RNS Number:6790W

H&T Group PLC

16 May 2007

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE IN OR INTO JURISDICTIONS OTHER THAN

THE UNITED KINGDOM

This announcement does not constitute or form part of any offer or invitation to

sell or issue, or any solicitation of any offer to subscribe for, any ordinary

shares or any other securities, nor shall it (or any part of it), or the fact of

its distribution, form the basis of, or be relied on in connection with, any

contract relating thereto.

This summary should be read in conjunction with the full text of the following

announcement.

H&T Group plc

"H&T" or "the Group"

Proposed placing and Notice of EGM

H&T, the UK's leading pawnbroking business by size of pledge book, is pleased to

announce a conditional placing of in aggregate 3,600,000 new ordinary shares at

a price of 204 pence per share, raising #7 million, net of expenses for the

Company.

The proceeds will be used to finance the expansion of the Group's store estate,

in particular to fund acquisitions. To this end, the Company has recently

completed the acquisition of two stores and has agreed terms and exclusivity to

acquire a further four stores. In addition, terms are being progressed in

respect of four more stores.

A circular, which will include a Notice of EGM to be held at 10 a.m. on 11 June

2007, is expected to be posted to shareholders later today.

It is expected that the Placing Shares will be admitted to trading on AIM on 12

June 2007. The Placing is conditional upon:

* the approval of the Resolutions at the EGM;

* the Placing Agreement becoming unconditional in all respects and not

having been terminated in accordance with its terms; and

* Admission.

John Nichols, H&T Group CEO commented:

"H&T Group delivered a strong financial performance in 2006, with underlying

gross profit increasing by 18 per cent. The pawnbroking industry remains a very

fragmented market and the proposed fundraising will allow us to participate in

the consolidation process. This forms a key part of our current growth

strategy."

16 May 2007

For further information please contact:

H&T Group plc 0870 9022 600

John Nichols, Chief Executive

Hawkpoint Partners Limited 020 7665 4500

Lawrence Guthrie / Sunil Duggal

Numis Securities Limited 020 7260 1000

Oliver Hemsley / Charles Farquhar

College Hill Associates 020 7457 2020

Gareth David / Paddy Blewer

About H&T Group

H&T Group is the UK's leading pawnbroking business by size of pledge book. The

business was founded in 1897 and now has 78 outlets across the UK and

approximately 350 employees.

H&T Group's outlets offer a range of services including pawnbroking, prepaid

debit cards, cheque cashing and unsecured loans. H&T Group is also a retailer

of jewellery, both second-hand items sourced from its pawnbroking operations and

a relatively small number of new products brought in for re-sale.

H&T Group provides lending solutions designed to meet the financing needs of

individuals who may not satisfy the lending criteria of high street banks. As

these individuals are not adequately serviced by mainstream lenders, the

Directors believe that this represents an attractive niche market. The

Directors believe that H&T Group has developed strong client relationships

founded on its ability to reach lending decisions quickly and the emphasis on

customer service, evidenced by repeat business where a single item may be pawned

more than once. New customers are typically sourced through passing trade at

the Company's high street and shopping mall locations, introductions from

existing clients and advertising.

H&T Group's admission to AIM in May 2006 was accompanied by a #49 million

institutional placing of Ordinary Shares at 172 pence per share.

The Board of H&T wishes to draw the market's attention to the following letter

to shareholders from the Chairman of H&T Group plc, which is included in the

shareholder circular that will be sent today. Copies of this document will be

available free of charge until 11 June 2007 on the Company's website and at the

Company's registered office, which is located at Times House, Throwley Way,

Sutton, Surrey SM1 4AF, during normal business hours.

Definitions

The following definitions apply throughout this document and in the accompanying

form of proxy unless the context requires otherwise:

"Act" the Companies Act 1985, as amended;

"Admission" admission of the Placing Shares to trading on AIM

becoming effective in accordance with the AIM Rules;

"AIM" AIM, a market operated by the London Stock Exchange;

"AIM Rules" the rules for AIM companies and their nominated

advisers published by the London Stock Exchange

governing admission to, and the operation of, AIM (as

amended from time to time);

"Board or Directors" the directors of H&T Group whose names are set out on

page 5 of this document and "Director" shall mean any

one of them;

"Company" or "H&T" or "H&T Group" H&T Group plc;

"CREST" the computerised settlement system operated by CRESTCo

Limited which facilitates the transfer of shares;

"EGM" or "Extraordinary the extraordinary general meeting of H&T Group to be

held at" the offices of Numis at the London Stock

General Meeting Exchange Building,10 Paternoster Square, London EC4M

7LT at 10 a.m. on 11 June 2007, notice of which is set

out at the end of this document;

"Group" the Company and its subsidiaries;

"HMRC" HM Revenue and Customs;

"London Stock Exchange" London Stock Exchange plc;

"Option Schemes" the H&T Group plc Company Share Option Scheme and the H

&T Group plc 2006 Unapproved Share Option Scheme;

"Ordinary Shares" the ordinary shares of 5p each in the capital of the

Company;

"Placing" the proposed placing by Numis of the Placing Shares on

behalf of the Company at the Placing Price and on the

terms of the Placing Agreement;

"Placing Agreement" the conditional agreement dated 16 May 2007 between

Numis and the Company relating to the Placing, a

summary of which is set out in paragraph 4 of the

letter from the Chairman;

"Placing Price" 204p per Placing Share;

"Placing Shares" 3,600,000 new Ordinary Shares to be allotted pursuant

to the Placing;

"Resolutions" the resolutions to be proposed at the EGM, as set out

in the notice of EGM at the end of this document; and

"Shareholders" the holders of Ordinary Shares.

Letter from the Chairman H&T Group plc

(Incorporated and registered in England and Wales under the Companies Act 1985

with registered number 5188117)

Peter Middleton (Non-Executive Chairman) Registered Office:

John Nichols (Chief Executive) Times House

Laurent Genthialon (Finance Director) Throwley Way

Stephen Fenerty (Commercial Director) Sutton

Andrew Brown (Non-Executive Director) Surrey SM1 4AF

Peter McNamara (Non-Executive Director)

To Shareholders and, for information only, to holders of options under the

Option Schemes

16 May 2007

Dear Shareholder,

PROPOSED PLACING OF 3,600,000 NEW ORDINARY SHARES AND NOTICE OF EXTRAORDINARY

GENERAL MEETING

1. Introduction

H&T Group announced today a conditional placing of in aggregate 3,600,000 new

Ordinary Shares at a price of 204 pence per share. The Placing will raise

approximately #7 million, net of expenses, for the Company.

The Company intends to use the proceeds of the Placing to finance the expansion

of its store estate, in particular to fund the cash element of acquisitions and

the working capital required to grow these businesses. To this end, the Company

has recently completed the acquisition of two stores, has agreed key terms and

exclusivity to acquire a further four stores and terms are being progressed in

respect of an additional four stores.

Further details of the Placing and the other matters referred to above are set

out below.

The Placing Shares have been conditionally placed with institutions. Dealings in

these Placing Shares are expected to commence on AIM at 8 a.m. on 12 June 2007.

The Placing Shares are equivalent to approximately 11.43 per cent. of the

Company's existing issued share capital and will, when issued, represent

approximately 10.26 per cent. of the enlarged issued share capital.

Approval of the necessary authorities required for the allotment of the Placing

Shares pursuant to the Placing will be sought at an Extraordinary General

Meeting convened for 10 a.m. on 11 June 2007. The purpose of this document is to

provide shareholders with information on the Placing, and to convene the EGM at

which shareholders' approval will be sought for the Resolutions, as set out in

the notice of EGM at the end of this document.

2. Background to and reasons for the Placing

The National Pawnbroking Association estimates that there are approximately 800

pawnbroking stores in the UK. The market is highly fragmented with the four

largest chains only accounting for just over 200 stores. The Directors believe

the structure of the market and the Company's position within it mean that the

Company is well placed to make acquisitions to expand its geographical

footprint.

The Company maintains a list of potential store acquisitions and plans to

acquire at least ten stores during 2007. The Company's acquisition strategy is

principally asset driven, with assets consisting of a combination of pledgebook,

Pay Day Advance book and retail jewellery stock together with store fixtures and

fittings.

The Company seeks acquisitions which:

* are earnings accretive;

* are supportable by the Company's existing infrastructure; and

* do not adversely impact the financial performance of existing stores.

Following the acquisition of a store, the Company either continues trading from

the acquired premises or relocates to an alternative nearby site, which may be

one of the Company's existing stores.

So far during 2007, the Company has acquired two stores. The Company has agreed

key terms and exclusivity to acquire a further four stores. Terms are also being

progressed in respect of an additional four stores which are part of the

Company's wider target list of stores for acquisition

The Company intends to use the funds raised pursuant to the Placing to expand

its store estate and, in particular, to finance the cash consideration of the

acquisition opportunities and the working capital required to grow these

businesses.

3. Information on H&T Group

3.1 Overview

H&T Group is the UK's leading pawnbroking business by size of pledge book. The

business was founded in 1897 and now has 78 outlets across the UK and

approximately 350 employees.

H&T Group's outlets offer a range of services including pawnbroking, prepaid

debit cards, cheque cashing and unsecured loans. H&T Group is also a retailer of

jewellery, both second-hand items sourced from its pawnbroking operations and a

relatively small number of new products brought in for re-sale.

H&T Group provides lending solutions designed to meet the financing needs of

individuals who may not satisfy the lending criteria of high street banks. As

these individuals are not adequately serviced by mainstream lenders, the

Directors believe that this represents an attractive niche market. The Directors

believe that H&T Group has developed strong client relationships founded on its

emphasis on customer service, evidenced by repeat business where a single item

may be pawned more than once. New customers are typically sourced through

passing trade at the Company's high street and shopping mall locations,

introductions from existing clients and advertising.

H&T Group's admission to AIM in May 2006 was accompanied by a #49 million

institutional placing of Ordinary Shares at 172 pence per share.

3.2 Strategy

H&T Group's objective is to capitalise on its position as one of the UK's

largest pawnbrokers. It intends to continue growing the business through:

* expanding its geographical footprint through greenfield sites and store

acquisitions;

* establishing recently introduced products and services. The Directors believe

that H&T Group is well placed to capitalise on the growing awareness of prepaid

cards in the UK. The Company also intends to expand its portfolio of unsecured

products, using the Pay Day Advance and KwikLoan models to their best advantage.

In addition, the Company is continuing to appraise the trial of its secondary

brand, Get>Go; and

* developing new products and services. H&T Group has a track record for

developing new products and the Company intends to introduce new products to

attract new customers and provide additional services to the existing customer

base.

3.3 Current trading

The current financial year has started well and trading is in line with

management's expectations.

4. The Placing

The Company announced today that it was raising approximately #7 million, net of

expenses, through the placing of the Placing Shares. The Placing Price

represents a discount of approximately 2.63 per cent. to the closing mid-market

price of 2091/2p per Ordinary Share as at 14 May 2007, the latest

practicable date prior to the announcement of the Placing. The Placing Shares

will rank in full for all dividends and otherwise pari passu with the existing

Ordinary Shares.

It is expected that the Placing Shares will be admitted to trading on AIM on 12

June 2007. The Placing is conditional upon:

* the approval of the Resolutions at the EGM;

* the Placing Agreement becoming unconditional in all respects and not having

been terminated in accordance with its terms; and

* Admission.

The Placing is to be effected on behalf of the Company by Numis on the terms of

the Placing Agreement. The Placing Agreement provides for Numis to use its

reasonable endeavours to procure subscribers for the Placing Shares and to the

extent that it does not procure such subscribers, to subscribe for such Placing

Shares itself. These obligations are subject to certain conditions including

those listed above.

In consideration of their services in connection with the Placing, the Company

will pay to Numis a commission of an amount equal to 2 per cent. of the

aggregate value, at the Placing Price, of the Placing Shares. The Placing

Agreement contains warranties given by the Company with respect to its business

and the Group and certain matters connected with the Placing. In addition, the

Company has given indemnities to Numis in connection with the Placing and Numis'

performance of services in relation to the Placing. Numis is entitled to

terminate the Placing Agreement in specified circumstances.

The Placing Shares represent approximately 10.26 per cent. of the enlarged

issued ordinary share capital of the Company following the Placing.

5. Directors' Shareholdings

The Directors will not be subscribing for any shares pursuant the Placing. The

beneficial and non-beneficial interests of the Directors (not including

unexercised options over the Ordinary Shares) on the date of this document and

following the Placing are set out below:

Director Current number of Ordinary Shares Interests after the Placing as a

percentage of the enlarged issued

share capital

Peter Middleton 12,000 0.03

John Nichols* 1,400,000 3.99

Laurent Genthialon** 800,000 2.28

Stephen Fenerty*** 400,000 1.14

Andrew Brown 12,000 0.03

Peter McNamara 12,000 0.03

* John Nichols has a beneficial interest in options granted over 87,397 Ordinary

Shares under the Option Schemes

** Laurent Genthialon has a beneficial interest in options granted over 63,287

Ordinary Shares under the Option Schemes

*** Stephen Fenerty has a beneficial interest in options granted over 51,233

Ordinary Shares under the Option Schemes

6. Extraordinary General Meeting and action to be taken

A notice convening the EGM to be held at the offices of Numis at the London

Stock Exchange Building, 10 Paternoster Square, London EC4M 7LT at 10 a.m. on 11

June 2007 is set out at the end of this document. The Resolutions to be proposed

at the EGM are to empower the Directors to allot equity securities for cash and

to do so otherwise than in accordance with the Shareholders' statutory

pre-emptory provisions, as set out in the Act, in connection with the Placing.

The authority given to the Directors to allot further shares in the capital of

the Company requires the prior authorisation of the Shareholders at a general

meeting under section 80 of the Act. Upon the passing of Resolution 1 the

Directors will have authority to allot certain of the unissued ordinary share

capital of the Company up to an aggregate nominal amount of #524,214.70,

representing approximately 29.88 per cent. of the issued ordinary share capital

of the Company as enlarged by the issue of the Placing Shares. This authority

will expire immediately following the annual general meeting of the Company in

2008 or on 11 September 2008, whichever is the earliest.

Upon the passing of Resolution 2, the Directors will have the power under

section 95 of the Act. to allot, for cash, Ordinary Shares up to a maximum

aggregate nominal amount of #87,714.25, representing approximately 5 per cent.

of the issued ordinary share capital of the Company as enlarged by the issue of

the Placing Shares, without being required first to offer such securities to

Shareholders in accordance with statutory pre-emption rights. This authority

will expire immediately following the annual general meeting of the Company in

2008 or on 11 September 2008, whichever is the earliest.

While the Directors have no present intention to allot any Ordinary Shares

pursuant to the authorities proposed to be granted to them at the EGM, save for

the allotment of the Placing Shares, the rights described above would provide

flexibility for raising additional funds or making acquisitions should further

suitable opportunities arise.

A form of proxy for use by Shareholders in connection with the EGM is enclosed

with this document. Whether or not you propose to attend the EGM in person, you

are requested to complete the form of proxy in accordance with the instructions

printed on it and to return it to the Company's registrars, Lloyds TSB

Registrars, The Causeway, Worthing, West Sussex, BN99 6ZL, as soon as possible

and in any event so as to arrive no later than 10 a.m. on 9 June 2007.

Completion and return of the form of proxy will not preclude you from attending

the EGM and voting in person should you so wish.

7. Responsibility

The Directors of the Company, whose names appear on page 5, accept

responsibility for the information contained in this document including

individual and collective responsibility for compliance with the AIM Rules. To

the best of the knowledge and belief of the Directors (who have taken all

reasonable care to ensure that such is the case), the information contained in

this document is in accordance with the facts and does not omit anything likely

to affect the import of such information.

8. Recommendation

The Directors consider the terms of the Placing to be fair and reasonable

insofar as the Shareholders are concerned and in the best interests of the

Company and accordingly unanimously recommend that you vote in favour of the

Resolutions at the EGM as they intend to do in respect of their own holding of

Ordinary Shares, representing 2,636,000 Ordinary Shares, being approximately

8.37 per cent. of the Company's current issued ordinary share capital.

Yours faithfully,

Peter Middleton

Chairman

This announcement is not for release, publication or distribution, in whole or

in part, in or into jurisdictions other than the United Kingdom (the "Prohibited

Territories"). The new ordinary shares have not been and will not be registered

under the applicable securities laws of any of the Prohibited Territories and,

unless an exemption under such laws is available, may not be offered for sale or

subscription or sold or subscribed directly or indirectly within the Prohibited

Territories or for the account or benefit of any national, resident or citizen

of any of the Prohibited Territories.

Hawkpoint Partners Limited ("Hawkpoint"), which is authorised in the United

Kingdom by the Financial Services Authority, is the Company's nominated adviser

and is acting exclusively for the Company in respect of the Placing and

Admission. Hawkpoint is not acting for any other person in relation to the

matters referred to in this document and will not be responsible to anyone other

than the Company for providing the protections afforded to clients of the

Company or for giving advice in relation to the matters referred to in this

document.

Numis Securities Limited ("Numis"), which is authorised and regulated in the

United Kingdom by the Financial Services Authority is the Company's broker and

is acting exclusively for the Company in relation to the Placing. Numis is not

acting for any other person in connection with the matters referred to in this

document and will not be responsible to anyone other than the Company for

providing the protections afforded to clients of the Company or for giving

advice in relation to the matters referred to in this document.

This announcement does not constitute an offer of, or the solicitation of any

offer to subscribe for or buy, any of the new ordinary shares to any person in

any jurisdiction to whom or in which such offer or solicitation is unlawful.

The distribution of this announcement in certain jurisdictions may be restricted

by law and therefore persons into whose possession this announcement comes

should inform themselves about and observe any such restrictions. Any failure

to comply with these restrictions may constitute a violation of the securities

laws of such jurisdictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEIIFIDEIIRLID

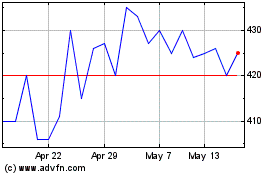

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jul 2023 to Jul 2024