RNS Number:2543I

H&T Group PLC

31 August 2006

H&T Group plc

"H&T" or "the Group"

H&T Group plc, which trades under the H&T Pawnbrokers and Get>Go brands, is the

UK's leading pawnbroking business by size of pledge book. The Group today

announces its Interim Results, for the period ended 30 June 2006.

Financial highlights

6 months 6 months

to 30 June to 30 June

2006 2005 Change

#m #m %

Gross profit 10.8 9.4 +14.1

Earnings before Interest, Tax, Depreciation, Amortisation (EBITDA) 3.9 3.4 +12.6

before exceptional items

Operating profit before exceptional items 2.9 2.4 21.0

Operating profit 1.0 2.4 -59.3

Pledge book 24.3 23.7 +2.3

Operational highlights

* Store expansion programme on track with one new store opened in H1 2006

and two further stores opened since the end of June 2006

* In-house cheque cashing & pay day advance underwriting and collecting

facilities

* Pre-paid debit cards now available in all stores

* Admission to AIM on 8 May 2006 with share price of 172 pence per share

Peter Middleton, Chairman said:

"I am very happy to present H&T's maiden Interim Results as a public company.

The period has included the major achievement of an initial public offering on

AIM which was well supported primarily by UK institutional investors. The

results announced today show continued progress and growth and provides a strong

foundation for the Group going forward. Overall, this has been an excellent

start for H&T as a public company."

John Nichols, CEO said

"Whilst pawnbroking will remain both the core of our business and a major growth

driver, we continue to develop new products within our financial services

offering. Pay Day Advance, Kwikloan, our pre-paid debit cards and Get>Go, our

alternative financial services outlet, are progressing well and I believe that

they offer valuable growth potential.

I look forward to the full year with confidence."

31 August 2006

For further information please contact:

H&T Group plc

John Nichols, Chief Executive 0870 9022 600

Hawkpoint Partners Limited (Nominated adviser)

Lawrence Guthrie/Sunil Duggal 020 7665 4500

Numis Securities Limited (Broker)

Oliver Hemsley/Charles Farquhar 020 7776 1500

College Hill Associates (PR)

Gareth David/Paddy Blewer 020 7457 2020

Notes to Editors

H&T is the UK's leading pawnbroking business by size of pledge book. The

business was founded in 1897 and now has 71 outlets across the UK and

approximately 300 employees.

H&T's outlets offer a range of services including pawnbroking, cheque cashing

and unsecured loans. H&T is also a retailer of jewellery, both second-hand

items sourced from its pawnbroking operations and a relatively small number of

new products brought in for re-sale.

H&T provides lending solutions designed to meet the financing needs of

individuals who may not satisfy the lending criteria of high street banks. As

these individuals are not adequately serviced by mainstream lenders, the

Directors believe that it is an attractive niche market. The Directors believe

that H&T has developed strong client relationships founded on its ability to

reach lending decisions quickly and the emphasis on customer service, evidenced

by repeat business where a single item may be pawned more than once. New

customers are typically sourced through passing trade at the Company's high

street and shopping mall locations, introductions from existing clients and

advertising.

In May 2006 H&T was admitted to AIM, placing shares worth #49 million, at 172

pence per share. The Daily Official List closing share price on 29 August 2006

was 182.5 pence giving the Group a market capitalisation of #57.5 million.

Report of the Chief Executive Officer and Finance Director

The first half of 2006 brought an exciting transformation for H&T, with the

successful admission to AIM in May which attracted investment from a number of

leading UK institutions. The Board is very pleased to be able to report a

positive trading performance which saw an increase in gross profit of 14.1% to

#10.8 million from #9.4 million in the equivalent period last year.

The pawnbroking segment of the business performed well with gross profit

increasing by 13.1% on the equivalent period last year, driven by strong cash

collections. Although there is evidence that consumer discretionary spend has

been under pressure, the Group has responded to the challenge with both revenue

and margin for H1 2006 ahead of the same period last year.

The financial services operation made further strong progress with an increase

in gross profit of 24.4% on the equivalent period last year, driven by growth

across the product range including cheque cashing, pay day advance and Kwikloan.

The Group has also brought the authorisations and collections "in house",

resulting in an improvement in margin.

In line with the Group's growth strategy, we have continued to grow our estate

with one new store opening in the first half of the year and two further new

store openings since 30 June. On the product side, we are continuing to invest

in our recently launched alternative financial products, such as Kwikloan and

our pre- paid debit card, as well as trialling new product initiatives.

OPERATIONAL REVIEW

Pawnbroking:

- Pawnbroking activities contributed #9.7 million (H1 2005: #8.6

million) or 91% of Group gross profit in H1 2006 (H1 2005: 91%).

- The pledge book totalled #24.3 million at 30 June 2006 compared with

#23.7 million at the same time in 2005. The current pledge book represents a

small decrease on the 31 December 2005 position (#24.4 million) due to seasonal

factors.

- Pawn Service Charge (PSC) rose by 8.3% to #7.6 million (2005: #7.0

million).

- Disposition combines contribution from retail and scrap. Difficult

high street trading conditions experienced in the sector in the second half of

2005 continued in the first half of 2006 and consequently retail gross revenues

were 2.3% down on prior year. However, the revision of the retail pricing policy

proved successful with the gross profit margin rising from 38.4% to 43.7%. As a

result, the retail gross profit increased by 11.1% to #1.6 million (2005: #1.4

million). Scrap sales benefited from the rise in the gold price showing an

increase of #0.4 million in gross margin.

Financial services:

- Financial services activities contributed #1.1 million (H1 2005: #0.9

million) or 9% of Group gross profit in H1 2006 (H1 2005: 9%).

- In January 2006, the arrangements for the underwriting of cheque

cashing and pay day advances with the The Money Shop were terminated. The

transition to in-house facilities has proved successful generating a positive

contribution from the outset.

- Kwikloan, the Group's unsecured loan product, was fully rolled out at

the end of 2005 and exhibited good growth in H1 2006. However, the Kwikloan

book remains small and the product's contribution to Group results remains

limited at present.

- The pre-paid debit card product has attracted new customers to the

stores although, as anticipated, it has made an immaterial direct financial

contribution to the H1 results. However, the Board believes there is

considerable potential for this product going forward.

STRATEGY REVIEW

H&T's admission document produced in connection with its admission to AIM,

presented the growth strategy on four main streams:

- Expand geographical footprint: The Group opened one new store in H1

2006 in Hastings. Two further new stores in Irvine and Basildon have been

opened since 30 June 2006, taking the current number of stores to 71. Leases

have been signed in respect of three further sites and subject to planning

consents these stores will be opened during the second half of 2006. The Board

also continues to review acquisition opportunities to expand the Group's estate

on an ongoing basis.

- Establish recently introduced products and services: The pre-paid

debit cards are attracting new customers to stores and the Group continues to

invest in the Kwikloan product.

- New store format Get>Go: The Group is planning to add a further store

in the Get>Go format, which focuses on cheque cashing and other financial

services. A pawnbroking offering presented as "cash lent on gold" is currently

being launched within this store format.

- New products: A trial of a new referral loans service is currently

planned for the second half of 2006.

Staff incentives

The Group has put in place both an approved and an unapproved share option

scheme. The approved scheme will enable share options to be granted to store

management as well as operational staff and should provide a strong incentive

for staff to contribute to the success of the Group.

Trading outlook

The Board is pleased with the overall trading performance of the Group which

remains in line with its expectations.

Seasonality within the business means that the second half of the year tends to

make a larger contribution to the full year result than the first half. The

extent of this is affected by retail sentiment, particularly during the

Christmas period. The business has good prospects for organic growth which will

be driven by further branch openings in the second half of the year.

FINANCIAL REVIEW

Turnover and gross profit

Turnover for the first six months of 2006 amounted to #14.5 million compared

with #13.6 million for the corresponding period in 2005. This 6.2% increase was

driven by strong PSC and scrap sales. The improvement in retail gross margin and

scrap gross profit resulted in an increase in total gross profit of 14.1% to

#10.8 million (2005: #9.4 million).

Administrative expenses

The Group's administrative expenses before exceptional items in the first six

months of 2006 were #7.9 million compared with #7.1 million for the same period

in 2005. This 11.9% increase was due to nine additional stores and the

introduction of the new cheque cashing authorisation and debt collection

facility. Exceptional expenses of #1.9 million were incurred as part of the

Initial Public Offer (IPO).

Operating profit

The Group recorded an operating profit before exceptional items of #2.9 million

for the period compared with #2.4 million in the previous period. Earnings

before interest, taxation, depreciation, amortisation and exceptional items

(EBITDA before exceptional items) increased by 12.6% to #3.9 million (2005: #3.4

million). After taking account of the exceptional items, operating profit was

#1.0 million in the six months ended 30 June 2006 compared with #2.4 million in

the same 2005 period.

Interest payable and similar charges

Interest payable before exceptional items decreased by #0.3 million from #2.6

million in the first six months of 2005 to #2.3 million in 2006. This reduction

has arisen as a result of the repayment of the Rutland loan notes and the

restructuring of bank facilities at the time of H&T's admission to AIM in May

2006. This restructuring incurred an exceptional charge of #0.8 million in the

period. Had this restructuring and IPO been effective as from the beginning of

the year, the Board estimates that the interest payable before exceptional items

would have been #1.6 million for H1 2006.

Profit/(loss) before taxation

The Group has recorded a loss before taxation of #2.3 million in H1 2006

compared with a profit before taxation of #0.4 million in H1 2005. The result in

H1 2006 was impacted by exceptional costs consisting of #1.9 million of

exceptional administrative expenses relating to H&T's admission to AIM and #0.8

million of debt restructuring costs. Profit before taxation and exceptional

items in H1 2006 was #0.4 million compared to a loss of #0.5 million in H1 2005.

(Loss)/Earnings per share

Basic loss per share for H1 2006 was 9.88 pence compared with basic earnings per

share of 0.83 pence in H1 2005. After adjusting for exceptional items, adjusted

basic loss per share for H1 2006 was 0.08 pence compared with adjusted basic

loss per share of 2.42 pence in H1 2005.

IPO/New debt structure

Following the IPO of H&T, a new debt structure was put in place. The mezzanine

debt (#5.2 million) and the Rutland loan notes (#18.3 million) were repaid with

the placing proceeds and an increase in other banking facilities provided by

Barclays Bank PLC. Net debt (before unamortised debt issue costs) was #35.8

million at 30 June 2006 compared with #52.7 million at 30 June 2005.

Hedging policy

The Group entered into a hedging agreement fixing the interest rate on #35.0

million of banking debt for a period of 3 years. This instrument was effective

from 30 June 2006.

Dividends

The Directors intend to pay a dividend of approximately 3 pence per ordinary

share in respect of the financial year ending 31 December 2006. The Directors

intend this to be declared as a final dividend and paid in April 2007.

J. G. Nichols L P Genthialon

Chief Executive Officer Finance Director

31 August 2006

H&T Group plc

Unaudited consolidated Profit and Loss Account

Six months Ended 30 June 2006

Before Exceptional Six months Before Exceptional Six months

Exceptional Items ended Exceptional Items ended

Items 30 June Items 30 June

2006 2005

Total Total

Note #'000 #'000 #'000 #'000 #'000 #'000

Turnover 14,478 - 14,478 13,636 - 13,636

Cost of sales (3,717) - (3,717) (4,208) - (4,208)

Gross profit 2 10,761 - 10,761 9,428 - 9,428

Administrative expenses 3 (7,904) (1,896) (9,800) (7,066) - (7,066)

Operating profit/(loss) 2,857 (1,896) 961 2,362 - 2,362

Profit on disposal of 4 - - - - 898 898

fixed assets

Interest receivable and 11 - 11 12 - 12

similar income

Interest payable and 5 (2,479) (800) (3,279) (2,909) - (2,909)

similar charges

Profit/(loss) on ordinary 389 (2,696) (2,307) (535) 898 363

activities before taxation

Tax on (loss)/profit on 6 (408) 400 (8) 52 (250) (198)

ordinary activities

(Loss)/profit for the 11 (19) (2,296) (2,315) (483) 648 165

period

(Loss)/earnings per share 7 (9.88) p 0.83 p

- basic

(Loss)/ earnings per 7 (9.88) p 0.79 p

share - diluted

Adjusted loss per share - 7 (0.08) p (2.42) p

basic

Adjusted loss per share - 7 (0.08) p (2.32) p

diluted

The consolidated Profit and Loss account for the 12 months ended 31 December 2005 is provided in note 1.

H&T Group plc

Unaudited consolidated Balance Sheet

As at 30 June 2006

30 June 2006 30 June 2005 31 December 2005

Note #'000 #'000 #'000

Fixed Assets

Intangible assets - goodwill 13,962 14,197 14,346

Tangible 5,437 4,920 5,144

19,399 19,117 19,490

Current Assets

Stock 4,277 4,534 3,373

Debtors 31,185 30,658 31,526

Cash at bank and in hand 1,220 2,101 1,434

36,682 37,293 36,333

Creditors: amounts falling due within 8 (4,589) (2,855) (3,569)

one year

Net Current Assets 32,093 34,438 32,764

Total Assets Less Current Liabilities 51,492 53,555 52,254

Creditors: amounts falling due after 9 (34,846) (52,409) (50,990)

more than one year

Provisions for liabilities & charges (143) (171) (133)

Net Assets 16,503 975 1,131

Capital and Reserves

Called up share capital 10,11 1,574 1,000 1,000

Share premium account 11 17,113 - -

Profit and loss account 11 (2,184) (25) 131

Shareholders' Funds 11 16,503 975 1,131

H&T Group plc

Unaudited consolidated Cash Flow Statement

Six months ended 30 June 2006

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2006 2005 2005

Note #'000 #'000 #'000

Net cash inflow from operating activities 12 3,020 686 5,421

Returns on investment and servicing of finance

Interest received 11 12 16

Debt restructuring cost (800) - -

Interest paid (1,299) (1,423) (2,850)

Net cash outflow from returns on investments and

servicing of finance

(2,088) (1,411) (2,834)

Taxation - corporation tax paid (150) (437) (806)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (1,462) (268) (910)

Sales of tangible fixed assets 42 999 1,074

Net cash (outflow)/inflow from capital

expenditure and financial investment

(1,420) 731 164

Acquisitions and disposals

Purchase of businesses - (390) (636)

Cash acquired with unincorporated businesses - - 3

Net cash outflow from acquisitions and disposals - (390) (633)

Financing

Issue of shares 18,364 - -

Expenses of share issue (677) - -

New borrowings 6,400 2,800 500

Repayment of borrowings (23,663) (500) (1,000)

Net cash inflow/(outflow) from financing 424 2,300 (500)

(Decrease)/increase in cash in the period (214) 1,479 812

H&T Group plc

Unaudited Notes to the Interim Statement

Six months ended 30 June 2006

Note 1 Consolidated profit and loss account for the 12 months ended 31 December

2005

Note Before Total

Exceptional Exceptional

Items Items

#'000 #'000 #'000

Turnover 29,638 - 29,638

Cost of sales (9,576) - (9,576)

Gross profit 2 20,062 - 20,062

Administrative expenses 3 (14,354) - (14,354)

Operating profit 5,708 - 5,708

Profit on disposal of fixed assets 4 - 898 898

Interest receivable and similar income 16 - 16

Interest payable and similar charges 5 (5,860) - (5,860)

(Loss)/profit on ordinary activities before (136) 898 762

taxation

Tax on (loss)/profit on ordinary activities 6 (191) (250) (441)

(Loss)/profit for the financial year 11 (327) 648 321

Earnings per share - basic 7 1.61 p

Earnings per share - diluted 7 1.54 p

Adjusted loss per share - basic 7 (1.64) p

Adjusted loss per share - diluted 7 (1.57) p

Note 2 Gross profit analysis

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2006 2005 2005

#'000 #'000 #'000

Pawn service charge (PSC) 7,615 7,029 14,258

Retail 1,552 1,397 3,561

Scrap 537 152 484

Disposition 2,089 1,549 4,045

Other financial services 1,057 850 1,759

Total gross profit 10,761 9,428 20,062

Pawn service charge principally comprises interest on loans, plus auction profit and loss, less any auction

commissions payable and less surplus payable to the customer.

Retail is the gross margin made on retail sales less direct costs.

Scrap is the proceeds from scrap less the pledge value of the item and associated disposition cost.

Other financial services includes cheque cashing commission, pay day advances commission, Kwikloan interest,

prepaid debit card commission, netted off with any bad debt write off or provision associated with any of

these products.

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 3 Administrative expenses

Six months ended Six months ended Year ended

30 June 30 June 31 December

2006 2005 2005

#'000 #'000 #'000

Other administrative expenses 6,900 6,000 12,217

Depreciation charge on owned tangible fixed 620 699 1,361

assets

Amortisation charge on intangible fixed 384 367 776

assets

Total administrative expenses before 7,904 7,066 14,354

exceptional items

Exceptional items (IPO expenses - note 13) 1,896 - -

Total administrative expenses 9,800 7,066 14,354

Note 4 Exceptional items for the six months ended 30 June 2005 and the year

ended 31 December 2005

During the first six months of 2005, the Group disposed of three freehold

properties, two of which were leased back under operating leases. The profit

arising on disposal amounted to #898,000.

Note 5 Interest payable and similar charges

Six months ended Six months ended Year ended

30 June 30 June 31 December

2006 2005 2005

#'000 #'000 #'000

Interest payable on bank loans and overdraft 1,360 1,521 3,023

On Rutland loan notes * 896 1,088 2,273

Other interest 15 3 29

Amortisation of debt issue costs 208 297 535

2,479 2,909 5,860

Exceptional items ** 800 - -

Total interest payable and similar charges 3,279 2,909 5,860

* The Rutland loan notes interest for the 2006 period ceased to accrue on 12 May

2006 when the loan notes were fully repaid.

** The #800k charge in the six month period ended 30 June 2006 relates to costs

expensed associated with the arrangement fees of the bank loan restructuring

disclosed in note 9.

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 6 Tax on (loss)/profit on ordinary activities

The taxation on profit/(loss) on ordinary activities before exceptional items

assessed for the 6 months ended 30 June 2006 is higher than that resulting from

applying the standard rate of corporation tax in the UK of 30% (2005 - 30%). The

differences are explained below:

Six months ended Six months ended Year ended

30 June 30 June 31 December

2006 2005 2005

#'000 #'000 #'000

Profit/(Loss) on ordinary activities before 389 (535) 762

taxation

Taxation on profit/(loss) on ordinary activities 117 (161) 229

before taxation

Effects of:

Disallowed expenses and non taxable income 99 140 348

Capital allowances and other timing differences 43 (48) (82)

Short term timing differences 139 4 9

Disposal of properties - - (23)

Adjustments to tax charge in respect of previous - - (104)

periods

Total actual amount of current tax 398 (65) 377

Deferred tax 10 13 64

Tax on profit/(loss) on ordinary activities 408 (52) 441

Tax on exceptional items

The #400k tax credit on exceptional items for the 6 month period ended 30 June

2006 is based on #160k available relief for IPO expenses and #240k available

relief for the debt restructuring costs. The #250k tax on exceptional items for

the 6 months ended 30 June 2005 and for the year ended 31 December 2005 is due

to the gain on the disposal of tangible fixed assets.

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 7 (Loss)/Earnings per share

Basic (loss)/earnings per share is calculated by dividing the profit on ordinary

activities after taxation by the weighted average number of ordinary shares in

issue during the period. For diluted (loss)/earnings per share, the weighted

average number of ordinary shares in issue is adjusted to assume the exercise of

warrants over shares.

Reconciliations of the (loss)/earnings per ordinary shares and weighted average

number of shares used in the calculations are set out below:

Six months ended Six months ended Year ended

30 June 30 June 31 December

2006 2005 2005

#'000 #'000 #'000

(Loss)/profit after taxation used for Basic and

Diluted (L)/EPS (2,315) 165 321

IPO costs 1,896 - -

Profit on fixed assets disposal - (898) (898)

Debt restructuring costs 800 - -

Tax relating to IPO costs, profit on fixed assets

disposal and debt restructuring costs (400) 250 250

Loss after taxation used for Adjusted Basic and (19) (483) (327)

Diluted (L)/EPS

Weighted average number of shares used for Basic

and Adjusted Basic (L)/EPS 23,426,675 20,000,000* 20,000,000*

Assumed conversion of warrants - 833,340* 833,340*

Diluted weighted average number of shares 23,426,675 20,833,340 20,833,340

* Reflects the subdivision of the ordinary shares from 100p to 5p

The Adjusted loss per share is presented as the directors consider that it

reflects the group results on a comparable basis once non recurring items are

taken into consideration. All the adjustments made to the non-adjusted (loss)/

earnings per share in arriving at adjusted (loss)/earnings per share are for

exceptional items disclosed separately on the face of the profit and loss

account.

Note 8 Creditors: Amounts falling due within one year

At 30 June At 30 June At 31 December

2006 2005 2005

#'000 #'000 #'000

Short term 1,250 1,250 1,500

portion of

bank loan

Unamortised (207) (577) (518)

debt issue

costs

Net 1,043 673 982

short-term

portion of

bank loans

Trade 1,034 579 859

creditors

Corporation - 377 73

tax

Other 967 133 239

taxation

and social

security

costs

Accruals 1,545 1,093 1,416

and

deferred

income

4,589 2,855 3,569

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 9 Creditors: Amounts falling due after more than one year

At 30 June 2006 At 30 June 2005 At 31 December

2005

#'000 #'000 #'000

Facility A 13,750 11,250 10,500

Facility B 22,000 20,900 18,600

Mezzanine debt - 5,164 5,265

Bank loans 35,750 37,314 34,365

Unamortised issue costs (904) (1,145) (801)

Rutland loan notes - 16,240 17,426

34,846 52,409 50,990

The Group restructured its banking arrangements at the time of the IPO. As a

result, the mezzanine debt was fully repaid, the Facility A loan was increased

to #15.0m, the Facility B was increased (enabling the Group to draw down to a

maximum amount of #29.0m based on the value of the Group's pledge book and a

#3.0m working capital facility was made available. The Group does not consider

these facilities as new debt but as a restructuring of its existing facilities

and accordingly the arrangement and associated fees incurred have been expensed

in the period. The proceeds to the Group from the IPO were used to repay in full

the #18.3m balance of Rutland loan notes.

Note 10 Called up share capital

At 30 June 2006 At 30 June 2005 At 31 December

2005

# # #

Authorised:

830,000 Ordinary A-class shares of #1 each - 830,000 830,000

110,000 Ordinary B-class shares of #1 each - 110,000 110,000

60,000 Ordinary C-class shares of #1 each - 60,000 60,000

41,667 Ordinary D-class shares of #1 each - 41,667 41,667

41,970,000 Ordinary shares of #0.05 each 2,098,500 - -

2,098,500 1,041,667 1,041,667

Allotted, called up and fully paid

830,000 Ordinary A-class shares of #1 each - 830,000 830,000

110,000 Ordinary B-class shares of #1 each - 110,000 110,000

60,000 Ordinary C-class shares of #1 each - 60,000 60,000

31,485,706 Ordinary shares of #0.05 each 1,574,285 - -

1,574,285 1,000,000 1,000,000

The cumulative authorised share capital as at 31 December 2005 of #1,041,667 has

been sub-divided during the six months ended 30 June 2006 into one class of

ordinary 5p share comprising 20,833,340 shares. 21,136,660 new ordinary shares

of 5p each have been authorised in the six months ended 30 June 2006 taking the

authorised ordinary share capital to 41,970,000 shares. Of these 21,136,660 new

ordinary shares, 10,652,366 were issued, called up and fully paid at the placing

price of #1.72 per share upon the admission of the Group to AIM on 8 May 2006.

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 11 Combined reconciliation of movement in shareholders' funds & statement

of movements on reserves

Share Share premium Profit and loss Total

capital account account

#'000 #'000 #'000 #'000

At 1 January 2005 1,000 - (190) 810

Retained profit for the period - - 165 165

At 30 June 2005 1,000 - (25) 975

Retained profit for the period - - 156 156

At 31 December 2005 1,000 - 131 1,131

Retained loss for the period - - (2,315) (2,315)

Issue of share capital 574 17,790 - 18,364

Issue expenses - (677) - (677)

At 30 June 2006 1,574 17,113 (2,184) 16,503

Note 12 Cash flow from operating activities

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2006 2005 2005

Continuing operations #'000 #'000 #'000

Operating profit 961 2,362 5,708

Amortisation of intangible assets 384 367 776

Profit on disposal of fixed assets (7) - (20)

Depreciation of tangible fixed assets 620 699 1,361

(Increase)/decrease in stock (904) (712) 456

Decrease/(increase) in debtors 431 (2,170) (3,429)

Increase in creditors 1,535 140 569

Net cash inflow from operating activities 3,020 686 5,421

Note 13 Initial Public Offer (IPO) costs

In the six months ended 30 June 2006, the Group incurred #3.4m of expenses

relating to the IPO and its debt restructuring. #0.8m was incurred for the

restructuring of its debt and accordingly was expensed to the profit and loss

account (note 5). #0.7m was directly allocated to the issue of new shares and

written off to the share premium account (note 11). The balance of #1.9m was

expensed to the profit and loss account (note 3).

H&T Group plc

Unaudited Notes to the Interim Statement (continued)

Six months ended 30 June 2006

Note 14 Reconciliation of the Earnings before Interest, Tax, Depreciation and

Amortisation (EBITDA) before exceptional items to Operating Profit before

exceptional items

Six months ended Six months ended Year ended

30 June 2006 30 June 2005 31 December 2005

#'000 #'000 #'000

Operating profit before exceptional items 2,857 2,362 5,708

Add depreciation 620 699 1,361

Add amortisation 384 367 776

EBITDA before exceptional items 3,861 3,428 7,845

Note 15 Statutory information

These results have been prepared on the basis of the UK generally accepted

accounting principles (GAAP) and accounting policies set out in the Group's 2005

audited statutory accounts. These results do not constitute the Group statutory

accounts for the periods ended 30 June 2006 or 30 June 2005 within the meaning

of section 240 of the Companies Act 1985. Financial information for the period

ended 31 December 2005 is extracted from the Group financial statements for the

year ended 31 December 2005, which was reported on by the Group's auditors,

Deloitte & Touche LLP, and have been filed with the Registrar of Companies. The

report of the auditors thereon was unqualified and did not contain a statement

under section 237(2) or (3) of the Companies Act 1985.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR WUUQGRUPQGAU

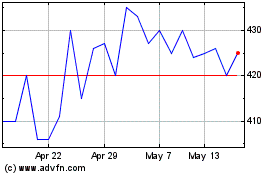

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jul 2023 to Jul 2024