TIDMFRES

RNS Number : 3562Q

Fresnillo PLC

27 October 2021

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

27 October 2021

THIRD QUARTER PRODUCTION REPORT

FOR THE THREE MONTHSED 30 SEPTEMBER 2021

Octavio Alvídrez, Chief Executive Officer, said:

"Silver production has remained in line with the first nine

months of last year with gold production over the same period ahead

of expectations as our Herradura gold mine continues to deliver

strong results. We have made good progress with our next flagship

mining project Juanicipio in the quarter and we are well set to

commission the plant before the end of the year subject to the

timely power connection by the national grid. We have seen some

limited short term disruption as a result of the new labour reforms

in Mexico which has impacted the performance of our Fresnillo and

Saucito mines in particular, due to the higher proportion of

contractors at those underground mines. However, the combination of

continued efficiency measures, the higher volume of ore processed

at Herradura, the ongoing contribution of development ore from our

Juanicipio project and an increase in silver ore grades at San

Julián Disseminated Ore Body, give us confidence in our full year

guidance."

HIGHLIGHTS

Silver

Year-to-date attributable silver production of 40.2 moz

(including Silverstream), in line with YTD20 due to a higher ore

grade at San Julián DOB and, to a lesser extent, the contribution

of development ore from Juanicipio, offset by a lower ore grade and

volume of ore processed at Saucito.

Quarterly attributable silver production of 12.7 moz (including

Silverstream), down 15.1% vs. 2Q21 mainly driven by the anticipated

lower ore grade at San Julián Disseminated Ore Body (DOB) following

the exceptional high grades in the previous quarter. The lower ore

grade and volume of ore processed at Fresnillo and Saucito also

contributed to the decrease in quarterly attributable silver

production.

Quarterly attributable silver production (including

Silverstream) decreased 4.7% vs. 3Q20 due to a lower volume of ore

processed and a lower ore grade at Saucito, mitigated by a higher

ore grade at San Julián DOB.

Gold

Year-to-date attributable gold production of 600.9 koz, up 8.5%

vs. YTD20, primarily due to the higher volume of ore processed at

Herradura following the lifting of Covid-19 restrictions which

resulted in lower volumes of ore deposited last year, partly offset

by a lower ore grade at Ciénega.

Quarterly attributable gold production of 172.5 koz, down 13.8%

vs. 2Q21, primarily due to lower volumes of ore processed and

recovery rates at Herradura and Noche Buena as well as a lower

volume of ore processed and ore grade at Saucito.

Quarterly attributable gold production in line with 3Q20 as a

result of a lower ore grade at Ciénega and San Julián Veins, offset

by the good performance at Herradura and Noche Buena.

By-Products

-- Year-to-date attributable by-product lead production remained

flat vs. YTD20 primarily due to lower ore grades at both Fresnillo

and Ciénega, compensated by higher ore grades at both Saucito and

San Julián DOB.

-- Year-to-date attributable by-product zinc production remained

flat vs. YTD20 due to a higher ore grade at Saucito, offset by a

lower ore grade at Ciénega.

-- Quarterly attributable by-product lead and zinc production

decreased 20.6% and 17.2% vs. 2Q21 respectively, driven primarily

by lower ore grades and decreased volumes of ore processed at

Saucito.

-- Quarterly attributable by-product lead production decreased

14.1% vs. 3Q20 due to a lower ore grade and volume of ore processed

at Saucito.

-- Quarterly attributable by-product zinc production decreased

12.9% vs. 3Q20 due to a lower ore grade and volume of ore processed

at Saucito, mitigated by a higher ore grade at Fresnillo.

Attributable 3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Silver (koz) 11,800 14,092 (16.3) 12,572 (6.1) 37,730 38,063 (0.9)

-------- -------- --------- --------------- --------- -------- -------- ---------

Silverstream

(koz) 851 803 6.0 709 20.2 2,451 2,037 20.3

-------- -------- --------- --------------- --------- -------- -------- ---------

Total Silver

(koz) 12,651 14,895 (15.1) 13,281 (4.7) 40,181 40,100 0.2

-------- -------- --------- --------------- --------- -------- -------- ---------

Gold (oz) 172,534 200,163 (13.8) 172,718 (0.1) 600,890 554,037 8.5

-------- -------- --------- --------------- --------- -------- -------- ---------

Lead (t) 13,010 16,386 (20.6) 15,144 (14.1) 44,736 45,229 (1.1)

-------- -------- --------- --------------- --------- -------- -------- ---------

Zinc (t) 22,930 27,687 (17.2) 26,320 (12.9) 76,498 75,701 1.1

-------- -------- --------- --------------- --------- -------- -------- ---------

DEVELOPMENT PROJECTS

The construction of the Juanicipio plant continued to progress.

Pre-commissioning testing has begun for key systems as we approach

mechanical completion. Our focus in the upcoming weeks will be to

progress from construction to no-load and water testing, with full

load commissioning with ore expected by year end.

NEW LABOUR REFORM IN MEXICO

The new labour reform in Mexico restricting the ability to

subcontract labour came into effect from 1st September 2021

resulting in the requirement to internalise a proportion of our

contractor workforce. While Fresnillo took significant steps to

prepare since the reform was announced in April, subsequent

contractor uptake has varied, with underground mines, in particular

in the Fresnillo District and at Cienega, more affected due to a

higher number of contractor workforces on site resulting in an

increased number of staff vacancies and a higher workforce

rotation. This in turn has affected equipment availability and

utilisation rates. We continue to take a series of actions to

mitigate this impact, including new recruitment campaigns, training

and investment in new equipment. These actions will continue in the

following months and we expect volumes to gradually return to a

normalised level during 2022. The transition has been largely

seamless in our open pit mines.

SAFETY PERFORMANCE

We are deeply saddened to confirm a fatal accident at the

Fresnillo mine during the quarter. A full independent investigation

was carried out in conjunction with relevant authorities and we are

providing support to the employee's family and colleagues. We

remain absolutely committed to a strong safety culture in our mines

and we will continue reinforcing our commitment to a safe operation

with stringent monitoring of safety implementation, a focus on

training, and emphasis on the follow up of critical controls as

well as technical key indicators. The importance of building a

healthy and safe working environment for all through our mines is

critical and we will continue encouraging safety procedures. The 'I

Care, We Care' programme continues to be rolled out across the

business and is a central aspect of all new development projects

and operations.

2021 OUTLOOK

We remain on track to meet our 2021 full year guidance of 53.5

to 59.5 moz of silver (including Silverstream) and 675 to 725 koz

of gold. We continue to monitor the possible impact of the labour

reform and general shortage of personnel, as well as potential

headwinds, in particular inflationary pressures and the average

revaluation of the Mexican peso vs US dollar, which may impact

costs.

For further information, please visit our website

www.fresnilloplc.com or contact:

FRESNILLO PLC Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Patrick Chambers

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

POWERSCOURT Tel: +44 (0)7793 858 211

Peter Ogden

MINING OPERATIONS

FRESNILLO MINE PRODUCTION

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Ore Processed

(t) 547,140 579,863 (5.7) 551,589 (0.8) 1,688,363 1,746,494 (3.3)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,722 3,348 (18.7) 3,085 (11.8) 9,331 9,841 (5.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 7,983 8,736 (8.6) 9,295 (14.1) 25,095 28,903 (13.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 4,904 4,875 0.6 4,588 6.9 14,271 16,065 (11.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 8,958 8,404 6.6 7,328 22.2 24,504 25,064 (2.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 170 201 (15.3) 193 (12.2) 191 195 (2.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.62 0.69 (9.8) 0.77 (18.5) 0.67 0.73 (9.0)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.07 0.99 8.2 0.95 12.6 1.00 1.08 (7.0)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.27 2.07 9.8 1.83 24.0 2.05 2.03 1.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production was down 18.7% vs. 2Q21 due to lower

ore grades resulting from the limited access to higher grade stopes

and to a lesser extent, a lower volume of ore processed. This was

caused by two key factors: i) an electrical outage which

temporarily limited the water pumping capacity and affected some

mining areas and haulage levels; and ii) the impact of the labour

reform in Mexico which resulted in a shortage of mining labour,

lower equipment availability and utilisation rates, restricting

operational flexibility and preventing access to higher ore grade

areas. As referred to above, with the deepest regret, we confirm

there was an incident at the Fresnillo mine resulting in an

employee fatality. The suspension of certain parts of the mine to

conduct a full investigation of the causes for the fatal accident

further contributed to the lower volumes processed.

Quarterly silver production was down 11.8% vs. 3Q20 due to a

lower ore grade resulting from the reasons mentioned above.

Year-to-date silver production decreased 5.2% vs. YTD20 due to a

margianlly lower volume of ore processed and ore grade due to the

issues mentioned above and as reported in prior quarters.

Mine development rates decreased quarter-on-quarter to an

average of 2,798 per month in 3Q21 (2Q21: 3,224m per month),

primarily driven by the uncertainty created by the new labour

reform as mentioned above, which impacted contractor performance as

well as a lower contribution from the tunnel boring machine (TBM)

as a result of equipment testing in a production area, which

resulted in fewer TBM development metres recorded. We expect to

regain the rate of 3,100 m per month on average during the final

quarter of the year.

Quarterly by-product gold production decreased 8.6% vs. 2Q21

driven by a lower ore grade and volume of ore processed, mitigated

by a higher recovery rate.

Quarterly and year-to-date by-product gold production decreased

14.1% and 13.2% vs. 3Q20 and YTD20 respectively due to lower ore

grade.

The silver ore grade in 2021 is expected to remain in the range

of 190-210 g/t, while the gold ore grade is expected to remain in

the range of 0.55-0.70 g/t.

SAUCITO MINE PRODUCTION

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Ore Processed (t) 565,425 660,039 (14.3) 710,618 (20.4) 1,876,348 2,096,003 (10.5)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,846 3,454 (17.6) 3,963 (28.2) 9,448 12,104 (21.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 19,143 24,760 (22.7) 20,105 (4.8) 70,721 61,679 14.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 4,853 7,650 (36.6) 7,267 (33.2) 20,344 19,239 5.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 7,226 11,722 (38.3) 10,993 (34.3) 30,797 28,736 7.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 178 190 (6.1) 207 (14.0) 182 209 (13.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.36 1.51 (9.7) 1.14 19.4 1.51 1.18 27.9

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.01 1.35 (25.2) 1.21 (16.2) 1.27 1.08 17.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.69 2.43 (30.3) 2.24 (24.6) 2.22 1.98 12.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 17.6% vs. 2Q21 due to a

lower volume of ore processed following the instability issues as

reported in 1Q21 and 2Q21, limiting access to higher ore grade

areas. To prioritise the safety of our people, during the quarter

we decided to limit mining in the affected area until additional

geomechanical monitoring equipment is installed and a safe mining

sequence is agreed. Production levels were also impacted by the

implementation of the aforementioned labour reforms which had a

particular effect at Saucito due to a less stable and greater

contractor base at this mine compared to our other sites. This has

limited equipment availability and lowered utilisation rates,

impacting volumes of ore hauled and decreasing development rates.

We have conducted additional recruitment campaigns to reach the

necessary staffing to operate the mine at full capacity.

Recruitment and training will continue over the next few months,

which will gradually see volumes return to a normalised level

during 2022.

Quarterly and year-to-date silver production decreased 28.2% and

21.9% vs. 3Q20 and YTD20 respectively due to the lower ore grade at

the Jarillas vein. Further, a lower volume of ore processed for the

reasons described above in addition to the previously mentioned

presence of high temperature water in an underground production

area earlier in the year, also impacted production.

Quarterly by-product gold production decreased 22.7% vs. 2Q21

driven by a lower volume of ore processed and lower ore grade.

Quarterly by-product gold production decreased 4.8% vs. 3Q20

driven by a lower volume of ore processed, mitigated by a higher

ore grade.

Year-to-date by-product gold production increased 14.7% vs.

YTD20, driven by higher ore grades and partially offset by lower

volumes of ore processed.

Full year 2021 silver ore grade is expected to decrease to

between 170-190 g/t, below the original estimate of 200-220 g/t,

while the gold ore grade is estimated to remain around 1.3-1.5

g/t.

PYRITES PLANT (PHASE I)

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Iron Concentrates

Processed (t) 37,376 48,523 (22.9) 43,871 (14.8) 127,659 124,373 2.7

------- ------- --------- ------- --------- -------- -------- ---------

Production

------- ------- --------- ------- --------- -------- -------- ---------

Silver (koz) 143 167 (14.8) 221 (35.6) 446 726 (38.5)

------- ------- --------- ------- --------- -------- -------- ---------

Gold (oz) 441 721 (38.9) 837 (47.3) 1,840 2,632 (30.1)

------- ------- --------- ------- --------- -------- -------- ---------

Ore Grades

------- ------- --------- ------- --------- -------- -------- ---------

Silver (g/t) 157 147 6.3 212 (26.3) 149 238 (37.7)

------- ------- --------- ------- --------- -------- -------- ---------

Gold (g/t) 1.35 1.56 (13.6) 1.87 (27.8) 1.53 2.02 (24.5)

------- ------- --------- ------- --------- -------- -------- ---------

Quarterly silver production decreased 14.8% vs. 2Q21 due to a

lower volume of ore processed, mitigated by a higher ore grade of

pyrite concentrates processed from the Saucito mine and increased

recovery rate.

Quarterly silver production decreased 35.6% vs. 3Q20 due to a

lower volume of pyrite concentrates processed and a lower ore grade

of pyrite concentrates processed from the Saucito mine.

Quarterly gold production decreased 38.9% and 47.3% vs. 2Q21 and

3Q20 respectively due to a decreased volume of pyrite concentrates

processed, a lower ore grade and recovery rate.

Year-to-date silver and gold production decreased 38.5% and

30.1% vs. YTD20 respectively due to lower ore grades from Saucito's

flotation plant, and to a lesser extent, lower recovery rates.

As a result of the lower volumes processed at Saucito, and the

lower tailings processed at the pyrites plant, we expect silver

production to be in the range of 550 to 600 koz for the year while

gold production is expected to be in the range of 2 to 2.5 koz.

As noted in previous reports, the Pyrites Plant (phase II) was

completed in 4Q20 but due to Covid-19 related delays and certain

additional technical requirements by the authorities, permits have

been delayed. Conversations with Comisión Federal de Electricidad

(CFE) and the regulatory authorities have now resumed and we expect

inspections to occur in 4Q21 followed by a six week period for

commissioning and testing before ramping up the plant.

CIENEGA MINE PRODUCTION

YTD

3Q21 2Q21 % Change 3Q20 % Change 21 YTD 20 % Change

Ore Processed (t) 320,277 333,959 (4.1) 325,392 (1.6) 980,399 983,285 (0.3)

-------- -------- --------- -------- --------- -------- -------- ---------

Production

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (oz) 11,528 12,406 (7.1) 18,122 (36.4) 38,223 50,496 (24.3)

-------- -------- --------- -------- --------- -------- -------- ---------

Silver (koz) 1,323 1,425 (7.1) 1,522 (13.1) 4,046 4,491 (9.9)

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (t) 985 964 2.1 1,536 (35.9) 3,175 4,772 (33.5)

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (t) 1,491 1,669 (10.7) 2,275 (34.5) 5,133 7,185 (28.6)

-------- -------- --------- -------- --------- -------- -------- ---------

Ore Grades

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (g/t) 1.21 1.24 (2.3) 1.85 (34.7) 1.30 1.72 (24.2)

-------- -------- --------- -------- --------- -------- -------- ---------

Silver (g/t) 150 154 (2.9) 169 (11.7) 150 165 (9.4)

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (%) 0.51 0.49 4.1 0.71 (29.2) 0.53 0.74 (28.2)

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (%) 0.85 0.91 (6.8) 1.18 (27.6) 0.94 1.22 (22.5)

-------- -------- --------- -------- --------- -------- -------- ---------

Quarterly gold and silver production both decreased 7.1% vs.

2Q21 due to a lower volume of ore processed given the impact of the

labour reform in Mexico leading to lower utilisation rates though

we expect this to be a temporary factor.

Quarterly and year-to-date gold and silver production decreased

vs. 3Q20 and YTD20 respectively due to the lower ore grades

year-on-year, in line with the mine sequence.

The gold and silver ore grades for 2021 are expected to remain

at the lower end of the given ranges of 1.30-1.40 g/t and 150-160

g/t respectively.

SAN JULIÁN MINE PRODUCTION

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Ore Processed Veins

(t) 302,987 302,475 0.2 317,134 (4.4) 894,135 939,107 (4.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Processed DOB

(t) 533,204 555,055 (3.9) 555,161 (4.0) 1,536,932 1,656,650 (7.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Total production

at San Julián

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 13,612 15,546 (12.4) 17,342 (21.5) 42,959 48,877 (12.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 4,156 5,219 (20.4) 3,298 26.0 12,805 9,576 33.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 12,550 14,320 (12.4) 16,426 (23.6) 39,698 46,667 (14.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 1,033 1,027 0.6 944 9.4 3,025 3,065 (1.3)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 1,062 1,226 (13.4) 917 15.8 3,261 2,209 47.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,123 4,192 (25.5) 2,355 32.6 9,780 6,511 50.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 2,122 2,813 (24.6) 1,676 26.6 6,629 5,076 30.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 5,039 5,751 (12.4) 5,627 (10.5) 15,572 14,618 6.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.36 1.56 (12.7) 1.71 (20.4) 1.46 1.62 (9.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 116 115 0.4 100 15.1 115 110 4.4

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.11 0.12 (5.1) 0.10 11.7 0.11 0.09 32.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 217 275 (20.9) 154 40.8 232 143 62.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.50 0.61 (17.9) 0.39 27.4 0.53 0.39 34.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.24 1.38 (10.4) 1.27 (2.9) 1.33 1.16 14.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

SAN JULIÁN VEINS

Quarterly gold production decreased 12.4% vs. 2Q21 due to a

lower ore grade due and depletion of high grade stopes at the Santa

Maria, Shalom and San Julián veins.

Quarterly silver production was flat vs. 2Q21 with all metrics

in line with the prior quarter, in spite of another electricity

outage by the Mexican state-owned utility Comisión Federal de

Electricidad (CFE) impacting volumes of ore processed during the

quarter.

Quarterly and year-to-date gold production decreased 23.6% and

14.9% vs. 3Q20 and YTD20 respectively due to a lower ore grade as a

result of the depletion of higher ore grade areas and, to a lesser

extent, lower volume of ore processed due to the electricity outage

as mentioned above.

Quarterly silver production increased 9.4% vs. 3Q20 due to a

higher ore grade, offset by a lower volume of ore processed.

Year-to-date silver production was flat vs. YTD20 due to a lower

volume of ore processed compensated for by a higher ore grade.

We continue to expect the 2021 silver and gold ore grades to

average 110-120 g/t and 1.30-1.50 g/t, respectively.

SAN JULIÁN DISSEMINATED ORE BODY (DOB)

Quarterly silver production decreased 25.5% vs. 2Q21 due to the

anticipated lower ore grade. Despite the quarter-on-quarter drop,

the grade remains higher than originally expected as a result of:

i) the positive variation with the geological model in the Central

area of the ore body; and ii) access to higher ore grade areas

following the mine resequencing in 2019, as mentioned in previous

quarters.

Quarterly silver production increased 32.6% vs. 3Q20 due to a

higher than expected ore grade, as explained above.

Year-to-date silver production increased 50.2% vs. YTD20 due to

a higher than expected ore grade as described above, partially

offset by a lower volume of ore processed driven by the temporary

impact in 1Q21 from the damage to the lead circuit housing at the

end of 2020 and the electricity outage by the CFE in February, as

reported in previous quarters, and once again in this quarter.

The review of the reconciliation of the actual silver grade with

the geological model announced last quarter was concluded,

following the higher than expected grades in recent months. This

review has increased the certainty of the geological model in

particular within the higher grade core of the ore body. Following

the review, we expect the 2021 silver ore grade to be at the lower

end of the revised 200-230 g/t range, as we continue to advance

towards the lower grade areas in the periphery of the ore body, in

line with the mine sequencing.

HERRADURA TOTAL MINE PRODUCTION

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Ore Processed

(t) 4,546,401 5,482,544 (17.1) 4,791,585 (5.1) 16,040,807 12,921,867 24.1

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Total Volume

Hauled (t) 33,068,512 33,153,978 (0.3) 28,017,785 18.0 99,723,666 80,801,385 23.4

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Production

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (oz) 94,193 108,990 (13.6) 85,102 10.7 352,358 290,848 21.1

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (koz) 228 227 0.3 251 (9.2) 757 1,075 (29.5)

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (g/t) 0.76 0.68 11.2 0.72 4.9 0.79 0.78 1.4

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (g/t) 2.24 1.74 28.7 2.18 2.5 2.09 3.21 (35.0)

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Quarterly gold production decreased 13.6% vs. 2Q21 due to a

lower volume of ore processed and lower recovery rates at the

leaching pads, caused by heavier than normal rainfall, which

resulted in increased silt restricting the filter capacity at the

plant. This has no impact on full year production as the gold in

the pregnant solution remains in the circuit and will be recovered

in the following months. Further, corrective maintenance to the SAG

mills in one of the dynamic leaching plants impacted the volumes of

ore processed during the quarter. This was mitigated by a higher

ore grade.

Quarterly gold production increased 10.7% vs. 3Q20 due to a

higher recovery rate as the effects of Covid-19 operational

restrictions in 2Q20 last year impacted the recovery cycles at the

leaching pads during 3Q20, and to a lesser extent, a higher ore

grade in the quarter.

Year-to-date gold production increased 21.1% vs. YTD20 due to a

higher volume of ore processed following the Covid-19 operational

restrictions last year, partially offset by a slower speed of

recovery on the leaching pads.

The gold ore grade in 2021 is expected to remain in the range of

0.70-0.75 g/t, despite the ore grade being above this guidance

YTD.

NOCHE BUENA TOTAL MINE PRODUCTION

3Q21 2Q21 % Change 3Q20 % Change YTD 21 YTD 20 % Change

Ore Processed

(t) 2,389,895 2,530,510 (5.6) 1,714,258 39.4 6,069,819 5,044,312 20.8

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Total Volume

Hauled (t) 6,222,974 6,585,098 (5.5) 9,937,248 (37.4) 19,471,184 25,654,647 (24.1)

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Production

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Gold (oz) 25,015 28,564 (12.4) 21,574 15.9 68,244 70,261 (2.9)

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Silver (koz) 8 8 0.0 11 (24.3) 21 30 (30.8)

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Ore Grades

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Gold (g/t) 0.59 0.53 11.5 0.49 20.4 0.55 0.52 4.6

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Silver (g/t) 0.19 0.17 6.4 1.25 (85.1) 0.19 0.68 (72.5)

---------- ---------- --------- ---------- --------- ----------- ----------- ---------

Quarterly gold production decreased 12.4% vs. 2Q21 due to a

lower recovery rate as a result of heavy rain storms diluting the

pregnant solution and a lower volume of ore processed due to longer

haulage distances. This was mitigated by a higher ore grade.

Quarterly gold production increased 15.9% vs. 3Q20 due to a

higher volume of ore deposited and higher ore grade following a

stability problem in the pit during 3Q20 as previously reported.

This led to an increase in the waste haulage last year in order to

regain access to the deeper areas of the mine. The higher gold

production in the quarter was partially offset by a lower recovery

rate in the quarter as 3Q20 benefitted from increased levels of

irrigation on the pads.

Year-to-date gold production decreased 2.9% vs. YTD20 due to a

lower recovery rate for the same reasons as described above. This

was mitigated by a higher volume of ore processed following the

Covid-19 operational restrictions last year.

The expected gold ore grade in 2021 is predicted to remain in

the range of 0.40-0.50 g/t.

JUANICIPIO

Development ore from Juanicipio continued to be processed in the

Fresnillo flotation plant. On an attributable basis, 374 koz of

silver and 620 oz of gold were produced in 3Q21.

Year-to-date, development ore from Juanicipio has contributed

876 koz of attributable silver production and 1,451 oz of

attributable gold production.

During the quarter, the Juanicipio plant construction continued

to progress. Pre-commissioning testing has begun for key process

plant systems as we approach mechanical completion. In the coming

weeks, our focus will be to move from construction to

pre-commissioning and commissioning activities. We expect to obtain

the authorisation to connect to the power grid on time, which will

allow us to start no-load testing and progress to water testing

during November and full load commissioning with ore by year end.

We anticipate our ongoing success in mitigating Covid-19 related

impacts will allow us to meet our planned start up schedule. We

continue to process development ore at the Fresnillo plant,

generating cash and simultaneously refining our metallurgy

understanding for a more efficient ramp up of the plant.

SILVERSTREAM

Quarterly Silverstream production increased 6.0% vs. 2Q21 mainly

due to a higher volume of ore processed and to a lesser extent,

higher ore grade.

Quarterly and year-to-date Silverstream production increased

20.2% and 20.3% vs. 3Q20 and YTD20 respectively due to a higher ore

grade and higher volume of ore processed.

Expected silver production in 2021 remains in the range of

2.5-3.5 moz.

ABOUT FRESNILLO PLC

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Ciénega (including Las Casas Rosario &

Cluster Cebollitas), Herradura, Soledad-Dipolos(1) , Noche Buena

and San Julián (Veins and Disseminated Ore Body), three development

projects - the Pyrites Plant at Fresnillo, the optimisation of the

beneficiation plant also at Fresnillo, and Juanicipio, and three

advanced exploration projects - Orisyvo, Rodeo and Guanajuato, as

well as a number of other long term exploration prospects.

Fresnillo plc has mining concessions and exploration projects in

Mexico, Peru and Chile.

Fresnillo plc has a strong and long tradition of exploring,

mining, a proven track record of mine development, reserve

replacement, and production costs in the lowest quartile of the

cost curve for silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company and Mexico's largest gold

producer.

(1) Operations at Soledad-Dipolos are currently suspended.

FORWARD-LOOKING STATEMENTS

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the

forward-looking statements including, without limitation,

general economic and business conditions, industry trends,

competition, commodity prices, changes in regulation, currency

fluctuations (including the US dollar and Mexican Peso exchanges

rates), the Fresnillo Group's ability to recover its reserves or

develop new reserves, including its ability to convert its

resources into reserves and its mineral potential into resources or

reserves, changes in its business strategy and political and

economic uncertainty.

LEI: 549300JXWH1UV5J0XV81

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLLQLLLFBLBFBK

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

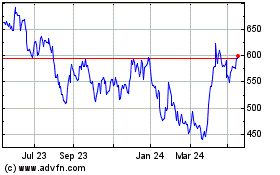

Fresnillo (LSE:FRES)

Historical Stock Chart

From Oct 2024 to Nov 2024

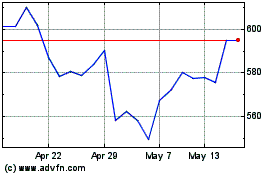

Fresnillo (LSE:FRES)

Historical Stock Chart

From Nov 2023 to Nov 2024