TIDMFRES

RNS Number : 6507V

Fresnillo PLC

25 July 2018

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

25 July 2018

Production Report

for the three months ended 30 June 2018

Overview

-- Quarterly and first half silver production (including

Silverstream), up 5.7% and 9.7% respectively over the corresponding

periods in 2017 primarily due to the start up of operations at San

Julián JM (Phase II) in July 2017.

-- Quarterly gold production of 234 koz, up 4.6% vs. 2Q17 due to

the higher ore grade, throughput and recovery rate at Saucito and

the higher ore grades at Noche Buena, Herradura and Fresnillo.

-- First half gold production of 465 koz up 4.4% vs. 1H17, due

to the ongoing decrease in gold inventories and higher ore grade at

Herradura and higher volume of ore processed and ore grade at

Saucito.

-- Ongoing tests at the Herradura leaching pads have resulted in

an increase of 98.9 koz of gold in the inventory as of 1 January

2018.

-- Full year consolidated production guidance has been revised

marginally: total gold production to 900 - 930 koz (previously 870

- 900 koz) and total silver production to 64.5 - 67.5 moz

(previously 67 - 70 moz) including Silverstream.

Octavio Alvídrez, Chief Executive Officer, said:

"I am pleased to report a robust production performance in the

first half. In line with our strategy, we continue to actively

manage and strengthen our asset portfolio. In particular during the

period we have successfully ramped up our new San Julián JM mine to

full capacity which has made a significant contribution to overall

production. We have also made good progress with our development

pipeline, with our two main projects now complete. The Pyrites

Plant has been commissioned and final testing at the Second Dynamic

Leaching Plant is on track. Both projects will make a meaningful

contribution to overall 2018 production.

We have adjusted our full year production guidance to reflect a

better than anticipated gold performance due mainly to the ongoing

reduction of inventories at Herradura and slightly lower than

expected silver production due mainly to issues associated with

less availability of process water at San Julián. Overall however,

our full year consolidated guidance in silver equivalent ounces

remains unchanged".

Total Production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Silver (koz) 14,459 13,328 8.5 14,235 28,694 25,752 11.4

-------- -------- --------- -------- -------- -------- ---------

Silverstream

(koz) 884 1,188 -25.6 1,186 2,070 2,292 -9.7

-------------- -------- -------- --------- -------- -------- -------- ---------

Total Silver

(koz) 15,343 14,515 5.7 15,421 30,764 28,044 9.7

-------------- -------- -------- --------- -------- -------- -------- ---------

Gold (oz) 233,841 223,479 4.6 231,458 465,299 445,769 4.4

-------------- -------- -------- --------- -------- -------- -------- ---------

Lead (t) 13,223 11,385 16.1 11,629 24,853 22,846 8.8

-------------- -------- -------- --------- -------- -------- -------- ---------

Zinc (t) 22,014 14,919 47.6 19,040 41,054 28,725 42.9

-------------- -------- -------- --------- -------- -------- -------- ---------

Silver

Quarterly and first half silver production (including

Silverstream) increased 5.7% and 9.7% vs. the corresponding periods

in 2017 mainly as a result of the start of operations at San Julián

JM (Phase II) in July 2017. This was partially offset by lower ore

grades at Fresnillo and Saucito and the expected lower ore grade at

the San Julián Veins (Phase I).

The Silverstream contribution decreased as expected due to the

lower silver ore grade at the Sabinas mine.

Quarterly silver production increased 1.6% vs. 1Q18 as a result

of the higher volume of ore processed at Saucito and the higher

grades at Ciénega and San Julián JM (Phase II). These factors

compensated for the lower ore grades at the San Julián Veins (Phase

I) and at Fresnillo.

Gold

Quarterly gold production increased 4.6% vs. 2Q17 as a result of

the higher ore grade, volume of ore processed and recovery rate at

Saucito and the higher ore grades at Noche Buena, Herradura and

Fresnillo. These were partially offset by the lower ore grade at

Ciénega.

First half gold production increased 4.4% vs. 1H17 as a result

of the ongoing decrease of inventories and higher ore grade at

Herradura in addition to higher ore grade and volume of ore

processed at Saucito. These factors more than compensated for the

lower ore grade at Ciénega and San Julián Veins (Phase I).

Quarterly gold production remained broadly flat vs. 1Q18 (+1.0%)

as a result of the higher ore grade, volume of ore processed and

recovery at Saucito and the marginally higher volume of ore

processed and ore grade at Noche Buena which compensated for the

lower volume of ore processed and speed of recovery at

Herradura.

Outlook

2018 full year consolidated production guidance has been revised

marginally: total gold production guidance is now 900-930 thousand

ounces compared to our original guidance of 870-900 thousand ounces

and total silver production guidance (including Silverstream) is

64.5-67.5 million ounces compared to our original guidance of 67-70

million ounces. In the case of gold production, we are slightly

increasing our guidance to align production rates to the ongoing

reduction of inventories at Herradura's leaching pads. In the case

of silver production, we are marginally decreasing guidance to

reflect the now expected lower production from San Julián resulting

from a temporary re-sequencing of the production plan and higher

input of stockpile ore to deal with issues associated with less

availability of process water. The construction of the water

reservoir, aimed at providing a consistent source of water to

reduce this risk, has been delayed as a result of a longer than

expected permitting process. Full year consolidated production

guidance, in equivalent silver ounces, remains broadly the same as

our original guidance.

By-products

Quarterly by-product lead production increased 16.1% vs. 2Q17 as

a result of the start up of operations at San Julián JM (Phase II)

in July 2017 and the higher volume of ore processed and ore grade

at Saucito which compensated for the lower ore grade and recovery

rate at Ciénega.

Year to date by-product lead production increased 8.8% vs. 1H17

as a result of the start up of San Julián JM (Phase II) and the

higher ore grade at Fresnillo. These factors more than offset the

lower ore grade and recovery rate at Ciénega and the lower ore

grade at Saucito.

Quarterly by-product lead production increased 13.7% vs. 1Q18 as

a result of the higher volume of ore processed, ore grade and

recovery rate at Saucito which partially offset the lower ore grade

at Fresnillo.

Quarterly by-product zinc production increased 47.6% vs. 2Q17 as

a result of San Julián JM (phase II) commencing operations in July

2017, and a higher ore grade, recovery rate and volume of ore

processed at Saucito. These were partially offset by the lower ore

grade and recovery rate at Ciénega.

Half year by-product zinc production increased vs. 1H17 as a

result of the start up of operations at San Julián JM (Phase II),

the higher ore grade at Fresnillo and higher ore grade, recovery

rate and volume of ore processed at Saucito. These factors more

than compensated for the lower ore grade and recovery rate at

Ciénega.

Quarterly by-product zinc production increased 15.6% vs. 1Q18 as

a result of higher ore grade, volume of ore processed and recovery

rate at Saucito which more than compensated for the lower ore grade

at Fresnillo.

Fresnillo mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed

(t) 620,906 645,479 -3.8 637,410 1,258,316 1,258,492 -0.0

-------- -------- --------- -------- ---------- ---------- ---------

Production

-------- -------- --------- -------- ---------- ---------- ---------

Silver (koz) 3,793 4,491 -15.5 4,336 8,129 8,930 -9.0

-------- -------- --------- -------- ---------- ---------- ---------

Gold (oz) 10,953 9,403 16.5 10,431 21,384 20,728 3.2

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Lead (t) 5,052 4,982 1.4 5,783 10,835 10,153 6.7

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (t) 7,979 7,927 0.7 8,866 16,846 14,634 15.1

-------- -------- --------- -------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- ---------- ---------- ---------

Silver (g/t) 211 235 -10.1 232 222 240 -7.5

-------- -------- --------- -------- ---------- ---------- ---------

Gold (g/t) 0.70 0.59 19.3 0.66 0.68 0.66 2.6

-------- -------- --------- -------- ---------- ---------- ---------

Lead (%) 0.90 0.86 4.9 1.00 0.95 0.89 7.1

-------- -------- --------- -------- ---------- ---------- ---------

Zinc (%) 1.74 1.69 3.1 1.90 1.82 1.63 11.7

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Quarterly silver production decreased 15.5% and 12.5% vs. 2Q17

and 1Q18 respectively mainly due to the lower than expected ore

grades in certain areas and the temporary limited access to higher

ore grade areas at San Alberto, Candelaria and Santa Elena.

The temporary restricted access to higher grade areas of the

mine was a result of the delays in development and mine preparation

following lower than expected productivity from contractors. This

was due to a high turnover of contractor personnel which has a

knock-on effect of delaying the maintanance programme thereby

resulting in lower equipment availability. To mitigate this, the

Company is looking to: i) add a new contractor; ii) review, adapt

and improve the maintanance programme; and iii) purchase additional

equipment, to be operated by our own team alongside our

contractors, in order to provide us with higher degree of control

to increase development rates and mine preparation.

Silver production at the Fresnillo mine has shown a positive

trend increasing from 7,579 koz in the 2H16 to 8,129 in the 1H18, a

+7.2% increase. However, we have been below our production targets

which we are confident will be achieved in the near future once we

overcome the contractors productivity shortcomings.

The silver grade for the full year is expected to be 215-225 g/t

(previously 235 g/t) whilst going forward, the long term grade is

expected to remain approximately 260 g/t.

First half silver production decreased vs. 1H17 as a result of

the lower ore grade and, to a lesser extent, lower recovery

rate.

Quarterly by product gold production increased vs. 2Q17 and 1Q18

due to the higher ore grades which compensated for the lower

volumes of ore processed. Similarly, year to date by-product gold

production increased 3.2% vs. 1H17 mainly due to higher ore

grade.

Quarterly and first half by-product lead production increased

vs. 2Q17 and 1H17 as a result of higher ore grades.

Quarterly by-product lead and zinc production decreased 12.6%

and 10.0% vs. 1Q18 respectively, due to the lower ore grade and

volume of ore processed.

Quarterly by-product zinc production remained at a similar level

vs. 2Q17. First half by-product zinc production increased 15.1% vs.

1H17 as a result of higher ore grade and to a lesser extent,

improved recovery rate.

Saucito mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed

(t) 723,208 667,456 8.3 673,545 1,396,753 1,338,370 4.4

-------- -------- --------- -------- ---------- ---------- ---------

Production

-------- -------- --------- -------- ---------- ---------- ---------

Silver (koz) 5,235 5,674 -7.7 4,832 10,067 10,821 -7.0

-------- -------- --------- -------- ---------- ---------- ---------

Gold (oz) 22,908 15,896 44.1 16,880 39,788 33,859 17.5

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Lead (t) 5,327 4,688 13.6 3,183 8,510 9,442 -9.9

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (t) 7,549 4,923 53.3 3,916 11,465 10,062 13.9

-------- -------- --------- -------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- ---------- ---------- ---------

Silver (g/t) 263 306 -14.1 260 262 293 -10.6

-------- -------- --------- -------- ---------- ---------- ---------

Gold (g/t) 1.28 1.05 22.7 1.12 1.20 1.08 11.2

-------- -------- --------- -------- ---------- ---------- ---------

Lead (%) 0.86 0.81 6.2 0.57 0.72 0.84 -14.6

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (%) 1.64 1.26 30.1 0.96 1.31 1.26 4.0

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Quarterly and year to date silver production decreased 7.7% and

7.0% vs. 2Q17 and 1H17 respectively as a result of lower than

expected ore grades and increased dilution. We are now using

smaller sized equipment for the narrower veins in order to decrease

dilution in these areas.

Quarterly silver production however increased 8.3% vs. 1Q18 as a

result of the higher volume of ore processed.

The silver ore grade for the full year 2018 is now expected to

be 255-265 g/t (285 g/t previously guided) whilst going forward,

the long term silver grade is expected to be approximately 280

g/t.

Quarterly and first half by-product gold production increased

44.1%, 35.7% and 17.5% vs. 2Q17, 1Q18 and 1H17 respectively as a

result of higher ore grades, recovery rates and volumes of ore

processed.

Quarterly by-product lead production increased 13.6% vs. 2Q17 as

a result of higher volume of ore processed and a higher ore grade.

However, year to date by-product lead production decreased 9.9% vs.

1H17 as a result of a lower ore grade. Quarterly by-product lead

production increased 67.3% vs. 1Q18 as a result of a higher ore

grade, volume of ore processed and recovery rate.

Quarterly and year to date by-product zinc production increased

over the corresponding periods of 2017 and vs. the previous quarter

as a result of higher ore grades, recovery rates and volumes of ore

processed.

Ciénega mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed

(t) 330,879 322,760 2.5 320,006 650,885 636,680 2.2

--------------- -------- -------- --------- -------- -------- -------- ---------

Production

--------------- -------- -------- --------- -------- -------- -------- ---------

Gold (oz) 16,689 18,904 -11.7 16,377 33,066 36,358 -9.1

--------------- -------- -------- --------- -------- -------- -------- ---------

Silver (koz) 1,518 1,458 4.1 1,239 2,757 2,786 -1.0

-------- -------- --------- -------- -------- -------- ---------

Lead (t) 1,352 1,715 -21.2 1,335 2,687 3,251 -17.3

--------------- -------- -------- --------- -------- -------- -------- ---------

Zinc (t) 1,231 2,070 -40.5 1,006 2,237 4,030 -44.5

-------- -------- --------- -------- -------- -------- ---------

Ore Grades

-------- -------- --------- -------- -------- -------- ---------

Gold (g/t) 1.65 1.89 -12.7 1.66 1.66 1.89 -12.5

-------- -------- --------- -------- -------- -------- ---------

Silver (g/t) 166 161 3.5 141 154 161 -4.2

-------- -------- --------- -------- -------- -------- ---------

Lead (%) 0.67 0.78 -14.2 0.67 0.67 0.78 -14.3

-------- -------- --------- -------- -------- -------- ---------

Zinc (%) 0.77 1.10 -29.9 0.72 0.74 1.08 -31.4

--------------- -------- -------- --------- -------- -------- -------- ---------

Quarterly and year to date gold production decreased 11.7% and

9.1% respectively vs. their corresponding periods of 2017 primarily

due to the lower than expected ore grade following the depletion of

higher grade veins at Taspana, Las Casas and San Ramón. This was

mitigated by the higher volume of ore processed due to the

increased availability of equipment following improvements in the

maintenance programme. Quarterly gold production increased 1.9% vs.

1Q18 as a result of the higher volume of ore processed.

The expected gold grade for the full year 2018 is expected to

remain approximately 1.8 g/t.

Quarterly silver production increased 4.1% vs. 2Q17 and 22.4%

vs. 1Q18 due to increased access to higher silver ore grade areas

at Taspana and Rosario and increased volume of ore processed. Year

to date silver production was in line with 1H17.

The expected silver grade for the full year 2018 remains

unchanged at approximately 160 g/t.

Quarterly and first half by-product lead and zinc production

decreased when compared to the same periods of 2017 as a result of

lower ore grades and recovery rates, which were mitigated by the

higher volume of ore processed. Quarterly by-product lead

production was in line with 1Q18.

Quarterly by-product zinc production increased 22.4% vs. 1Q18 as

a result of a higher recovery rate, ore grade and volume of ore

processed.

San Julián mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed Phase

I Veins (t) 289,775 308,342 -6.0 310,742 600,517 614,423 -2.3

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Ore Processed Phase

II JM (t) 540,261 - N/A 531,459 1,071,720 - N/A

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Total production

at San Julián

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 20,097 20,912 -3.9 19,791 39,888 41,041 -2.8

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 3,533 1,592 121.9 3,568 7,100 2,979 138.3

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Production Phase

I Veins

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 19,584 20,912 -6.4 19,111 38,695 41,041 -5.7

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 1,263 1,592 -20.7 1,445 2,707 2,979 -9.1

-------- -------- --------- -------- ---------- -------- ---------

Production Phase

II

JM

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 513 - N/A 680 1,193 - N/A

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 2,270 - N/A 2,123 4,393 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Lead (t) 1,493 - N/A 1,328 2,821 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Zinc (t) 5,254 - N/A 5,252 10,507 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Ore Grades Phase

I Veins

-------- -------- --------- -------- ---------- -------- ---------

Gold (g/t) 2.12 2.19 -3.2 1.97 2.04 2.18 -6.6

-------- -------- --------- -------- ---------- -------- ---------

Silver (g/t) 144.58 171.58 -15.7 158.35 151.71 164.16 -7.6

-------- -------- --------- -------- ---------- -------- ---------

Ore Grades Phase

II

JM

-------- -------- --------- -------- ---------- -------- ---------

Gold (g/t) 0.07 - N/A 0.09 0.08 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Silver (g/t) 156.71 - N/A 146.64 151.72 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Lead (%) 0.42 - N/A 0.40 0.41 - N/A

-------- -------- --------- -------- ---------- -------- ---------

Zinc (%) 1.26 - N/A 1.31 1.28 - N/A

-------- -------- --------- -------- ---------- -------- ---------

San Julián Veins (Phase I)

Quarterly and first half silver production decreased 20.7%, 9.1%

and 12.6% vs. the same periods in 2017 and the previous quarter

respectively as a result of: i) the expected lower ore grade due to

less availability of the higher silver ore grade areas; and ii) a

lower volume of ore processed as a result of the low water

availability, restricting processing capacity. With the arrival of

the rainy season, full processing capacity has now been

restored.

The construction of the water reservoir, aimed at providing a

consistent source of water, has been delayed as a result of a

longer than expected permitting process delaying the grant of

environmental permits. The company is making efforts to accelerate

this process and is also looking for alternate sources of

water.

The expected silver grade for the full year 2018 is in the range

of 165-175 g/t.

Quarterly and year to date gold production decreased vs. their

corresponding periods in 2017 as a result of lower volumes of ore

processed and lower ore grades due to the previously mentioned

factors, however these were mitigated by the higher recovery

rates.

Quarterly gold production increased 2.5% vs. 1Q18 as a result of

increased access to areas with a higher gold ore grade and a higher

recovery rate which resulted from the appropriate operating

controls and the excellent response of the mineral at the leaching

stage.

The expected gold grade for the full year 2018 is expected to be

in the range of 1.9-2.1 g/t

San Julián (Phase II - JM disseminated ore body)

Quarterly silver production increased 6.9% vs. 1Q18 due to the

extraction from higher ore grade areas in line with the mining

sequence of the ore body. However, silver ore grade of 156.7 g/t

was below the guidance of 185 g/t for the full year.

The silver ore grade for the full year 2018 is expected to be in

the range of 145-155 g/t, lower than the previously guided ore

grade, due to the extraction of ore from lower grade areas of the

mine as well as processing ore from the development stockpile

instead of mining the orebody according to the original plan. This

was done as a temporary alternate production plan as stope

back-filling could not have been done at the normal pace due to

lower availability of water, which has now been restored with the

arrival of the rainy season.

Quarterly by-product gold production decreased 24.6% vs. 1Q18 as

a result of a lower ore grade and lower recovery rate.

Quarterly by-product lead production increased 12.4% vs. 1Q18 as

a result of a higher ore grade and recovery rate. Additionally

quarterly, by-product zinc production remained at similar levels

vs. 1Q18.

Herradura total mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed

(t) 5,605,427 6,551,791 -14.4 5,984,641 11,590,068 13,316,161 -13.0

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Total Volume

Hauled (t) 33,560,118 31,063,542 8.0 34,153,768 67,713,885 61,971,696 9.3

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Production

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (oz) 117,886 116,267 1.4 125,243 243,129 224,009 8.5

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (koz) 363 104 249.0 241 604 222 172.1

----------- ----------- --------- ----------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (g/t) 0.76 0.66 15.7 0.68 0.72 0.64 11.2

----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (g/t) 2.60 0.87 198.5 1.86 2.22 0.91 142.8

----------- ----------- --------- ----------- ----------- ----------- ---------

Quarterly and first half gold production increased vs. the

corresponding periods of 2017 as a result of: i) the ongoing

inventory reduction at the leaching pads; ii) an increase in the

ore grade at the Dynamic Leaching Plant as a higher volume of ore

was being processed from the higher grade Valles area; and iii) a

higher speed of recovery due to an intensive targeted irrigation

programme and better dilution. These factors more than compensated

for the lower volume of ore processed.

Quarterly gold production decreased 5.9% vs. 1Q18 as a result of

a decrease in the inventory reduction at the leaching pads and a

lower volume of ore processed. However, the previously mentioned

factors were mitigated by the higher ore grade in the mined

areas.

In 2017, as part of the future mine plan, Fresnillo decided to

construct a new leaching pad in a separate area of the Herradura

mine. To reduce the hauling distance from the pit to the new pad,

the Group constructed an access route through certain existing

leaching pads, removing and redepositing the ore in the process.

These works allowed the Group to perform assays and verify certain

characteristics of the ore, including the humidity of the ore

deposited and the grade of gold in solution. The testing of those

assays commenced in 2018 and is ongoing.

As a result of the information obtained to date, the Group

updated its estimate of the recoverable remaining gold content in

the inventories at the leaching pads resulting in an increase of

98.9 thousand ounces of gold as at 1 January 2018. This represents

1.7% of the total gold content deposited from the inception of the

mine to 31 December 2017.

Management expects to finalise the remaining testing by the year

end. The additional results may further increase management's

estimates.

Noche Buena total mine production

2Q 18 2Q 17 % change 1Q 18 1H 18 1H 17 % change

Ore Processed

(t) 4,550,915 4,399,136 3.5 4,414,790 8,965,705 9,012,820 -0.5

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Total Volume

Hauled (t) 22,073,319 22,436,979 -1.6 20,521,239 42,594,558 43,355,636 -1.8

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Production

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (oz) 45,308 42,097 7.6 42,735 88,043 89,774 -1.9

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (koz) 18 7 157.1 19 37 14 164.3

----------- ----------- --------- ----------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (g/t) 0.54 0.51 5.9 0.52 0.53 0.51 4.3

----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (g/t) 0.18 0.09 93.1 0.22 0.20 0.09 115.6

----------- ----------- --------- ----------- ----------- ----------- ---------

Quarterly gold production increased vs. the same period 2017 as

a result of higher ore grade and volume of ore processed. Year to

date gold production remained at a similar level when compared to

the same period of 2017.

Quarterly gold production increased 6.0% vs. 1Q18 as a result of

higher volume of ore processed and to a lesser extent, higher ore

grade.

Update on development projects

An update on our development projects and exploration programme

will be provided alongside our interim results, due to be announced

on 31 July 2018.

Safety Performance

We deeply regret to report that during 2Q18 there was a fatality

at the San Julián mine as a result of an accident that occurred

outside the mine operating areas but within the Company's property

limits. We continue to reinforce our safety measures throughout the

Company, with our management systems and organisational programmes

centered on personnel safety. We remain committed to our zero

fatalities target.

Interim Results

Fresnillo will announce its 2018 Interim Results on 31(st) of

July 2018.

For further information, please visit our website or

contact:

Fresnillo plc Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Patrick Chambers

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

Powerscourt Tel: +44 (0)20 7250 1446

Peter Ogden

About Fresnillo plc

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Ciénega (including the San Ramón satellite

mine), Herradura, Soledad-Dipolos(1) , Noche Buena and San Julián

(phase I and II), two development projects - the Pyrites Plant, and

second line of DLP at Herradura, and four advanced exploration

projects - Orisyvo, Juanicipio, Las Casas Rosario & Cluster

Cebollitas and Centauro Deep, as well as a number of other long

term exploration prospects. In total, Fresnillo plc has mining

concessions covering approximately 1.8 million hectares in

Mexico.

Fresnillo plc has a strong and long tradition of mining, a

proven track record of mine development, reserve replacement, and

production costs in the lowest quartile of the cost curve for

silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company, producing 65 million ounces

of silver per year by 2018, having already surpassed the gold

target of 750,000 ounces.

(1) Operations at Soledad-Dipolos are currently suspended.

Forward Looking Statements

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, commodity

prices, changes in regulation, currency fluctuations (including the

US dollar and Mexican Peso exchanges rates), the Fresnillo Group's

ability to recover its reserves or develop new reserves, including

its ability to convert its resources into reserves and its mineral

potential into resources or reserves, changes in its business

strategy and political and economic uncertainty.

LEI: 549300JXWH1UV5J0XV81

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLKZLFLVDFXBBL

(END) Dow Jones Newswires

July 25, 2018 02:01 ET (06:01 GMT)

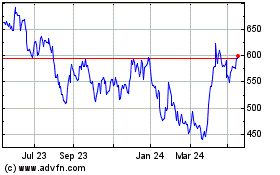

Fresnillo (LSE:FRES)

Historical Stock Chart

From Oct 2024 to Nov 2024

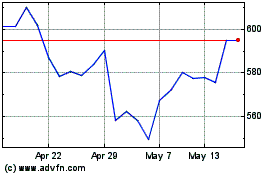

Fresnillo (LSE:FRES)

Historical Stock Chart

From Nov 2023 to Nov 2024