Ediston Property Inv Comp PLC Letting and lease restructure at St Philips Point (5126B)

June 17 2016 - 2:00AM

UK Regulatory

TIDMEPIC

RNS Number : 5126B

Ediston Property Inv Comp PLC

17 June 2016

Ediston Property Investment Company plc

Letting and lease restructure at St Philips Point,

Birmingham

Ediston Property Investment Company plc (LSE: EPIC) (the

"Company") announces that it has completed a lease restructure and

new letting at St Philips Point, Birmingham.

AXA Insurance UK plc ("AXA") has restructured its existing

leases over the fourth to sixth floors totalling 22,268 sq ft and

has increased its presence in the property by taking a new lease on

the previously vacant seventh floor of 5,399 sq ft. It now occupies

around 32% of the office accommodation at a total rent of

GBP664,008 per annum. Each lease is for a ten year term with a five

year tenant only break option.

This transaction follows the recent successful letting of the

lower ground floor to David's Bridal, results in the building being

approximately 95% let with only 5,328 sq ft available, and improves

the income stream and capital value of the asset.

Calum Bruce, Director of Investment at Ediston Properties

Limited, the Company's Investment Manager, said: "This letting

continues the successful asset management of the building following

the completion of the refurbishment. The transaction reaffirms

AXA's commitment to St Philips Point and underscores the quality of

the product on offer."

For further information:

Ediston Properties Limited (Investment Manager) 0131 225 5599

Calum Bruce

Canaccord Genuity Limited 020 7523 8000

Will Barnett

Neil Brierley

Dominic Waters

David Yovichic

Tavistock 020 7920 3150

Jeremy Carey (jeremy.carey@tavistock.co.uk)

James Whitmore (james.whitmore@tavistock.co.uk)

R&H Fund Services Limited (Company Secretary) 0131 550 3758

Gordon Humphries

Notes to editors:

Ediston Property Investment Company plc is a UK real estate

investment trust (REIT) with a premium listing on the Main Market

of the London Stock Exchange. The Company invests in UK commercial

real estate assets to achieve its objective of providing its

shareholders with an attractive level of income together with the

potential for capital and income growth. It invests principally in

three commercial property sectors: office, retail (including retail

warehouses) and industrial, without regard to a traditional

property market relative return benchmark. The Company launched in

October 2014 with the acquisition of an initial GBP76.7m

diversified portfolio of UK commercial properties. In July 2015 it

raised GBP35.9 million by way of a placing and offer of ordinary

shares as part of a placing programme. As at 31 March 2016, it

owned 13 properties with an aggregate value of GBP181.0

million.

Portfolio management services are undertaken by Ediston

Properties Limited, which currently manages property assets across

the UK for institutional investors.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEDLBFQQFEBBE

(END) Dow Jones Newswires

June 17, 2016 02:00 ET (06:00 GMT)

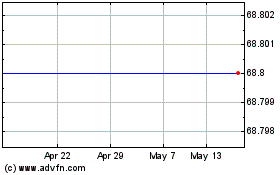

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Apr 2024 to May 2024

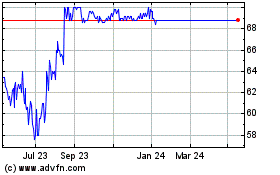

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From May 2023 to May 2024