TIDMCRV

RNS Number : 3825E

Craven House Capital PLC

03 July 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Craven House Capital plc

("Craven House" or the "Company")

Year-end Update and Financial Calendar

Craven House Capital (AIM:CRV) is pleased to announce the

following unaudited year-end investment update covering the year

ending 31 May 2019.

Highlights

-- Directors estimate that Net Asset Value ("NAV") per share has

increased by 17% to $9.99 per share in the six-month period from

November 2018 to May 2019.

-- Changes in valuations reflect the previously announced

repositioning of capital allocation and current investment focus in

North America.

The table below sets out the latest estimate of the appropriate

carrying value of the Company's investments as at 31 May 2019 in

comparison to the values as of the latest published financial

statements of the Company.

Investment Estimated value at Value at 30 Nov

31 May 19 18 (unaudited)

(unaudited)

Shares in Craven Industrial

Holdings Plc $27,605,161 $23,892,006

Comprising:

Shares in DLC Holdings Corp. $8,757,041 $6,491,893

Shares in Qeton Ltd $650,206 $1,551,814

Shares in Craven House Angola

LDA $7,921,212 $8,903,150

Shares in Craven House Capital

North America LLC $7,907,782 $4,528,396

Shares in Kwikbuild Corporation

Ltd $2,368,919 $2,416,753

Portfolio update

The valuation of the Company's shareholding in Craven Industrial

Holdings Plc ("CIH"), its principal wholly-owned investment holding

company, has increased from $23.9m to $27.6m. This reflects the

change in the respective value of subsidiary holdings as

follows;

DLC Holdings Corp. (TSXV:DLC) - 68% owned by CRV

DLC is a Toronto Stock Exchange listed agricultural investment

company with holdings in Brazil and South Africa. The valuation

ascribed to CIH's shareholding in DLC in CRV's financial statements

reflects the latest published share price of DLC's shares as of 31

May multiplied by the number of shares owned by CIH.

The valuation of DLC has increased due to an increase in the

share price of DLC between Nov 18 and May 19.

Qeton Ltd ("Qeton") - 50% owned by CRV.

Qeton Ltd is a joint venture company focusing on the

distribution of mobile phones, tablet computers and accessories

into emerging markets.

The valuation of Qeton during the past six-month period has

reduced from $1.55m to $0.650m reflecting a reduction in the

earnings of Qeton during the period, with shares in Qeton valued at

a multiple to net earnings based on the prior 12 months of trading.

Whilst earnings have reduced, Qeton remains profitable and has a

positive trading outlook.

Craven House Angola LDA ("CHA") - 100% owned by CRV.

Craven House Angola continued to provide local currency

financing to Angolan subsidiaries of US and European companies in

the consumer electronic and energy sectors. The carrying value of

CHA's loan portfolio reduced from $8.9m to $7.9m during the

six-month period to May 2019, reflecting the repayment of a portion

of the outstanding loan facilities, in accordance with the terms of

repayment. The proceeds of the repayments were passed to the parent

company and utilized for general working capital purposes and for

investment into Craven House's North American subsidiary.

Craven House Capital North America LLC ("CHNA") - 100% owned by

CRV

The valuation of Craven's US investment holding company, CHNA,

increased from $4.5m to $7.9m during the six months to May 2019.

The majority of this increase reflects the successful sale of

CHNA's wholly owned insurance business to LM Funding America Inc.

("LMFA") a NASDAQ listed entity as announced in January 2019. As of

May 2019, CHNA owns c.25% of the common shares of LMFA and holds

c.$3.6m in convertible notes in LMFA. CHNA also benefits from an

equity portfolio valued at c.$3.5m, on a mark-to-market basis, as

of May 2019.

Kwikbuild Corporation Ltd. - 97% owned by CRV

There was little change in the valuation of Kwikbuild during the

six-month period to the end of May 2019. The slight reduction in

carrying value is the result of exchange rate movements and

operating costs; the valuation of the underlying South African

assets remained unchanged during this period. We continue with the

process of liquidating our remaining holdings in South Africa.

Net Asset Value

As of the end of May 2019 the Directors estimate that the

combined value of the other assets and liabilities of the Company

represent a total liability of c.$2.6m. Of total liabilities of

c.$3.6m, the majority (c.$2.4m) comprise intercompany loans or are

due to related parties.

The approximate Net Asset Value of the Company therefore stood

at c.$25.0m as of May 2019, equating to an NAV per share of $9.99

(vs. $8.57 as of November 2018). This estimate is prior to

calculation of any performance fees due to the Investment Manager,

which will be finalized following completion of the year-end

audit.

Share buyback Update

The High Court has approved the reduction in share capital which

is now subject to final formalities before being completed.

Financial Calendar

In order to provide shareholders with more regular information

regarding the Company's investments, the Directors have decided to

amend Craven House's reporting cycle to include, in addition to its

interim and preliminary results, two further portfolio updates.

These portfolio updates will occur shortly after the May year-end

and November interim period in July and December respectively. This

RNS forms the first of these new portfolio updates.

Going forward, the Company intends to follow the below financial

timetable:

Anticipated

date

Portfolio and NAV update July

Preliminary financial results (for previous financial

year) Sept / Oct

Portfolio and NAV update December

Interim Results March

In addition to the above financial reporting calendar the

Company will, in accordance with its obligations under the AIM

Rules for Companies, make additional updates of matters which it

considers appropriate. This may or may not include additional NAV

updates.

Ends

For further information please contact:

Craven House Capital Plc Tel: 0203 286 8130

Mark Pajak

www.Cravenhousecapital.com

SI Capital Tel: 01483 413500

Broker

Nick Emerson

www.sicapital.co.uk

SPARK Advisory Partners Limited Tel: 0203 368 3550

Nominated Adviser

Matt Davis/Mark Brady

www.Sparkadvisorypartners.com

About Craven House Capital:

The Company's Investing Policy is to invest in or acquire a

portfolio of companies, partnerships, joint ventures, businesses or

other assets globally in any geographic jurisdiction. The company

will invest in both developed and developing markets providing long

term patient capital and is often involved in special situations,

restructuring, expansion and turn around investments in crisis and

transitioning economies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUGUUPMUPBGGW

(END) Dow Jones Newswires

July 03, 2019 07:24 ET (11:24 GMT)

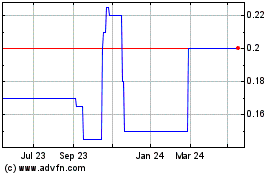

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

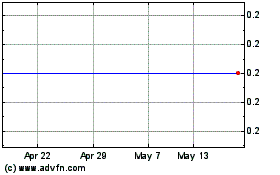

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jul 2023 to Jul 2024