TIDMCLI

RNS Number : 1424I

CLS Holdings PLC

22 November 2018

Release date: 22 November 2018

Embargoed until: 07:00

CLS Holdings plc

("CLS", the "Company" or the "Group")

Trading Update for the period 1 July 2018 to 21 November

2018

Improving occupancy and strong operational performance across

the Group

Chief Executive of CLS, Fredrik Widlund, commented:

"In the second half of 2018 we have seen a robust performance

across each of our markets in the UK, Germany and France. We have

completed significant lettings including key properties acquired in

2017 where we identified asset management opportunities at the time

of purchase, and our Group vacancy level has fallen from 5.7% to

4.3%.

"We remain confident that our results will be in line with

market expectations for the full year, notwithstanding the current

political and economic uncertainties. Our cost of debt is at a

historical low, we have a strong balance sheet with substantial

liquid resources and are well positioned to take advantage of

opportunities as they arise."

Operational metrics

Vacancies being driven down across the Group.

-- Vacancy rate:

Group: 4.3% (30 June 2018: 5.7%)

UK: 4.2% (30 June 2018: 5.4%)

Germany: 5.1% (30 June 2018: 7.1%)

France: 3.2% (30 June 2018: 3.5%)

-- A net reduction in vacancies of 83,000 sq ft (7,711 sqm) since 30 June 2018:

o 323,961 sq ft (30,097 sqm) of new leases, lease renewals and

extensions completed

o 240,961 sq ft (22,386 sqm) vacated or expired

o Since 1 January 2018, 493,000 sq ft of new leases, lease

renewals and extensions completed at an average 4.3% above ervs at

31 December 2017

-- Included in the above, since 30 June 2018:

o In total 69 separate lettings

o 86% of UK expiries renewed

o Notable new leases included 75,390 sq ft (7,003 sqm) to four

tenants at East Gate, Munich, and 23,594 sq ft (2,192 sqm) to IWG

Group at One Elmfield Park, Bromley

Portfolio changes since 30 June 2018

Repositioning the portfolio for growth.

-- Disposals since 30 June 2018 comprised:

o Buspace Studios, 10 Conlan Street, London W10 for GBP13.5

million, 4.2% above the value at 31 December 2017 and at a net

initial yield of 4.5%

o Three smaller individual disposals for an aggregate value of

GBP6.6 million: Melita House, Chertsey; Units 3/5, Brooklands,

Plymouth; and Marler Stern, Marl, Germany, which were sold in

aggregate at 8.2% above their collective value at 31 December

2017

Developments and refurbishments

Completed developments will create value.

-- At Ateliers Victoires, 48 Rue Croix des Petits Champs, Paris,

the GBP8.2 million redevelopment completed in October 2018, and the

fit-out of the entire 21,500 sq ft (2,000 sqm) of space to our

tenant Epoka is under way

-- The development of 16 Tinworth Street SE11 (formerly known as

Phase 2 of Spring Mews), a 7-storey development of 9,181 sq ft (853

sqm) of office and student accommodation in Vauxhall, reached

practical completion in August

Financing

Low cost of debt and substantial liquid resources.

-- Redemption of GBP65 million 5.5% unsecured bonds due 2019 on

31 July 2018, 17 months early for GBP68.4 million

-- Weighted average cost of debt reduced to 2.43% (30 June 2018: 2.65%)

-- Balance sheet loan-to-value 38.1% (30 June 2018: 38.4%)

-- Corporate bond portfolio reduced through disposals to GBP34.3

million (30 June 2018: GBP46.5 million)

-- Current liquid resources of over GBP180 million, comprising

GBP89 million of cash, GBP34 million of corporate bonds, and

undrawn facilities in excess of GBP60 million

Portfolio statistics

A diversified, pan-European portfolio with strong

fundamentals.

-- Portfolio split by region:

UK: 52%

Germany: 32%

France: 16%

-- 49% of rent roll is subject to indexation increases

-- 27% of rent roll is derived from government tenants and 26% from major corporations

Stakeholder engagement

Enhancing the environment.

-- Listening to customers - in the UK and France, we completed

surveys of occupiers at 29% of the Group's portfolio as part of a

continual improvement process

-- Award-winning responsibility - we have been awarded a Green

Apple Award for best environmental practice on our recycling

campaign across our managed UK assets

-- Enhancing renewable energy - we have more than doubled our

on-site renewable generation capacity through 3 large solar PV

installations in 2018, taking our capacity to 304kW (2017: 128 kW)

and further reducing energy costs for our customers

-ends-

For further information, please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Fredrik Widlund, Chief Executive Officer

John Whiteley, Chief Financial Officer

Liberum Capital +44 (0)20 3100 2222

Richard Crawley

Jamie Richards

Whitman Howard +44 (0)20 7659 1261

Hugh Rich

Robin White

Elm Square Advisers +44 (0)20 7823 3695

Jonathan Gray

Smithfield Consultants (Financial PR) +44 (0)20 3047 2476

Alex Simmons

Forward-looking statements

This document may contain certain 'forward-looking statements'.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances.

Actual outcomes and results may differ materially from those

expressed or implied by such forward-looking statements. Any

forward-looking statements made by or on behalf of CLS speak only

as of the date they are made and no representation or warranty is

given in relation to them, including as to their completeness or

accuracy or the basis on which they were prepared. Except as

required by its legal or statutory obligations, the Company does

not undertake to update forward-looking statements to reflect any

changes in its expectations with regard thereto or any changes in

events, conditions or circumstances on which any such statement is

based. Information contained in this document relating to the

Company or its share price, or the yield on its shares, should not

be relied upon as an indicator of future performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFEIEFFFASEIF

(END) Dow Jones Newswires

November 22, 2018 02:01 ET (07:01 GMT)

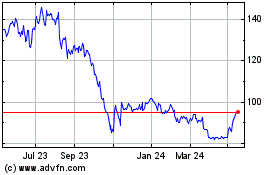

Cls (LSE:CLI)

Historical Stock Chart

From Jun 2024 to Jul 2024

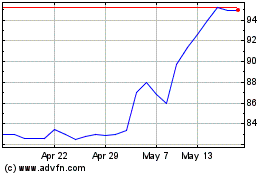

Cls (LSE:CLI)

Historical Stock Chart

From Jul 2023 to Jul 2024