TIDMCCP

RNS Number : 4854X

Celtic PLC

14 August 2009

CELTIC plc

Preliminary Results for the year ended 30 June 2009

SUMMARY OF THE RESULTS

Operational Highlights

* Winners of the Co-operative Insurance Cup

* Participation in the Group stages of the UEFA Champions League playing 3 home

European fixtures (2008: 5)

* Season ticket sales of 54,252 (2008: 53,517) following a price freeze and

introduction of low-priced concession tickets

* 26 home matches played at Celtic Park in the year (2008: 28)

* Appointment of Tony Mowbray as football manager.

* NIKE'S appointment as kit manufacturer extended for 5 years until 2015

Financial Highlights

* Group revenue reduced by 0.5% to GBP72.59m (2008: GBP72.95m)

* Operating expenses reduced by 4.3% to GBP61.36m (2008: GBP64.09m)

* Profit from trading before asset transactions and exceptional operating expenses

of GBP11.23m (2008: GBP8.86m)

* Exceptional operating expenses of GBP2.78m (2008: GBP3.19m)

* Gain on disposal of intangible assets of GBP1.55m (2008: GBP5.70m)

* Profit before taxation of GBP2.00m (2008: GBP4.44m)

* Year end bank debt of GBP1.51m (2008: GBP3.52m) net of cash

* Investment of GBP8.53m (2008: GBP5.11m) in the acquisition of football players.

For further information contact:

+-----------------------------------+------------------------------------+

| Dr John Reid, Celtic plc | Tel: 0141 551 4235 |

+-----------------------------------+------------------------------------+

| Peter Lawwell, Celtic plc | Tel: 0141 551 4235 |

+-----------------------------------+------------------------------------+

| Iain Jamieson, Celtic plc | Tel: 0141 551 4235 |

+-----------------------------------+------------------------------------+

| | |

+-----------------------------------+------------------------------------+

CHAIRMAN'S STATEMENT

I am pleased to report on the Company's performance in the year to 30 June 2009.

It was a year of great challenges, promise and expectation, both financially and

from a football perspective. The financial storm of 2008/2009 has been weathered

successfully, so far, but our objective of achieving four SPL championships in a

row was not fulfilled; once again we have seen just how closely fought the SPL

title can be. Losing the SPL title and the accompanying direct entry place to

this year's Champions League to our greatest rivals is not easy to accept; it is

not in our nature to be satisfied with second best.

It is a measure of how far we have come in recent years, and the high standards

that have been set, that our football fortunes in a year in which we won the CIS

Cup, participated once again in the Group Stages of the UEFA Champions League

and challenged until the very last for a fourth consecutive SPL title, could be

described as mixed. This highlights the contribution and achievements of Gordon

Strachan and his backroom staff in their time with the Club, for which we thank

them.

The new management team have much to live up to, but we firmly believe that Tony

Mowbray and his coaching staff are the right choice to take the Club forward.

From a financial perspective our results for the year continue to provide us

with a solid footing and remain highly creditable. Turnover, at GBP72.59m, was

on a par with the GBP72.95m of 2007/2008, despite playing only 26 home games

rather than the 28 of the year before. Merchandising sales improved and

multi-media sales increased. Operating expenses reduced by 4.3% in the year

(GBP2.74m) to GBP61.36m. Exceptional operating expenses of GBP2.78m were

incurred, mainly relating to player impairment values and costs from onerous

contracts and employment contract terminations. These are good results in the

present economic context.

Gains on player trading of GBP1.55m this year against GBP5.70m last time, and

higher amortisation costs from investment in players, offset by the savings in

operating expenses, result in our profit before tax of GBP2.00m compared with

GBP4.44m the year before. Our year end bank debt, net of cash, was GBP1.51m,

down from GBP3.52m the previous year.

Investment in players increased from GBP5.11m to GBP8.53m, reflecting our policy

of and commitment to strengthening the team within the parameters of a

sustainable financial model. Put simply, last year we brought in less from

selling players and spent more in bringing in new players than in the previous

year. At 53.4% the ratio of total labour cost to turnover has been maintained at

the same level as last year - reflecting a total outlay on labour of

GBP38.75m.

These results have been achieved in trying and often frustrating circumstances

and substantially in reliance upon the tremendous contribution of the Celtic

support. In football, at home and abroad, and in other fields, many

organisations are in financial difficulty. We have placed a premium on financial

prudence in order to safeguard this Club for future generations.

Unlike other sectors, the football transfer market has not been depressed by

recessionary influences; indeed wages for good quality players, as well as

transfer fees have increased, buoyed mainly by the broadcasting money available

in England. The Scottish broadcasting deal negotiated by the SPL with Setanta

last summer - although in no way as lucrative as that offered by SKY in England

- was held out as a substantial increase on the agreement then in place. Celtic

did not support that new agreement, preferring the SKY option. We believed that

in selecting Setanta instead of SKY in the competitive bid process, an

opportunity for the SPL to benefit from the greater status, stability, reach and

financial resources of one of the world's largest broadcasters was lost, as

became apparent when Setanta entered into administration just after the end of

the season. The recently agreed arrangements with SKY / ESPN are significantly

less than could have been the case had SKY's offer been accepted last year, and

are a hard lesson in what could and should have been a far more positive outcome

for all of the SPL clubs.

This only adds to the many challenges we face in the coming season: money is

tight for all of our customers; much of Scottish football is now edging along

the narrow line of solvency; we must continue to seek to ensure that supporters

are satisfied that they are receiving value for the money that they are asked to

spend; and, for ourselves, we face a difficult path to our initial goal of

Champions League Group Stage qualification.

We will face those challenges undaunted. As a result of a magnificent away

performance in Moscow earlier this month we are assured of further European

football this season. I believe that is of great importance to our fans.

I also believe that although we have a strong financial base, we cannot be

immune from the pressures that weigh on our supporters and their families.

Accordingly, Season Ticket prices have been frozen again this year and we have

retained the extensive concessionary schemes introduced last year, as part of

the family aspect of Celtic Football Club and our policy of attracting the

supporters of the future. A record 54,252 season tickets were sold last season,

up on 53,517 the year before. Our season ticket sales so far are encouraging but

we will have to work extremely hard to match our performance last year. Your

support in doing so will be vital.

The difficult economic circumstances are no reason for us to cut back on our

Foundation and Charity work. Indeed in many ways these become more important in

times of greater deprivation. That is why I am delighted that the Celtic

Foundation continues to tackle social inequality in many fields, with over 6,500

young people and adults participating in its programmes each week and a

staggering 1,250,000 young people and adults having been involved in some way

with its work since its activities began in May 2003. Celtic Charity Fund has

again had a major effect on the lives of many of the least fortunate in society,

both at home and abroad, with almost GBP446,500 donated in cash to good causes

in the year. As a sum equivalent to 0.61% of Group turnover this year, we are

well on our way to achieving the target of 0.7% I set for us at last year's AGM,

a commendable effort during an economic recession. I am proud that over the last

12 months the Club has been involved in more charitable, educational and

community work than it has at any other time in its history.

This coming year sets us further football challenges. We look forward very much

to working with our new manager Tony Mowbray and his team. Tony is in the

process of rebuilding the squad. In recent weeks we have been joined by new

faces on the playing staff, including Fortune, N'Guemo and Fox. We will continue

to seek to strengthen where we can and within our means, and to invest for the

longer term in youth development, scouting, and sports science as we have done

in previous years. The first full year of operations at Lennoxtown has been very

successful and we will be investing further sums in pitch facilities during the

year. Attractive, exciting and, importantly, winning football is something that

our fans expect, and we aim to provide.

My fellow director, Brian McBride will not be standing for re-election at this

year's AGM, after almost 5 years on the Board. I record my own and the Club's

appreciation to Brian.

I also express my personal thanks to our supporters, customers, shareholders and

staff for their continuing outstanding contribution to maintaining the

traditions, standards, success and vibrancy of this great Club.

Dr John Reid

Chairman

14 August 2009

INTRODUCTION

In another very eventful year we won the CIS Cup while narrowly missing out on

the Clydesdale Bank Scottish Premierleague and we participated in the UEFA

Champions League group stage, which greatly assisted the financial performance

of the Company.

Having promised much we disappointingly fell away at the final hurdle to concede

the title on the last day of the season, narrowly missing out on four in a row.

Failing to win the Clydesdale Bank Scottish Premierleague last season was

additionally disappointing as the title winners secured automatic direct

qualification to the group stage of the UEFA Champions League, whilst we as the

second placed club are required to negotiate two demanding qualifying rounds

before we can take a place in the group stage. Following victory over Dinamo

Moscow in the first of those rounds, we now require to overcome Arsenal to

progress in the Champions League, although failure to do so will see Celtic

participate in the new Europa League in season 2009/2010.

During the course of the 2008/9 season we had mixed fortunes in Europe's premier

club competition, beating Villarreal at Celtic Park and only conceding a late

equaliser to the holders Manchester United. However, a goalless draw at home to

the Danish side Aalborg eventually contributed to us missing out on progression

to the last 16.

At the end of the season Gordon Strachan resigned as manager after four

successful years in charge, during which we won three SPL titles, one Scottish

Cup, two League Cups and reached the last 16 of the UEFA Champions League on two

occasions. We are grateful for his contribution to the Club's success during his

tenure as manager.

Tony Mowbray, an ex-Celtic player and former manager of Hibernian and West

Bromwich Albion, has been appointed to succeed Gordon. Tony has a reputation for

playing open, attacking football and giving home grown players their chance, and

has been well received by the Celtic supporters. We believe he will continue to

bring success to the Club. Tony has been joined at Celtic by Mark Venus, Peter

Grant and Neil Lennon in the new Celtic football management team.

FINANCIAL PERFORMANCE

In general it is recognised that much of the football sector continues to be

challenged financially. A number of clubs remain heavily in debt and incurring

ongoing losses. This has been exacerbated in Scotland by the collapse of

Setanta, the most recent media rights holder for SPL football. Conversely the

lucrative television deals recently secured in England, particularly by the

English Premier League, have resulted in increased transfer values and much

higher wages at clubs in that league and fuelled wage and transfer fee inflation

around Europe.

The impact of the credit crunch on the world economy has been significant and

trading conditions have been and continue to be extremely difficult. But

Celtic's trading results for the year to 30 June 2009 are again strong,

benefiting dramatically from participation in the UEFA Champions League group

stage, tighter cost control and player trading.

In the year to 30 June 2009 turnover was GBP72.59m, which is a slight reduction

of GBP0.37m, 0.5% against the previous year having played 26 home matches in

comparison to 28 last year. Much of this net reduction is due to lower ticket

revenue with two fewer high value home European matches being played. This

reduction has been partially offset by an increase in multi-media, GBP0.59m, and

merchandise sales, GBP1.09m, largely as a result of there being three kit

launches in the current year as against one the previous.

In the year to 30 June 2009 total operating expenses reduced over the previous

year by approximately GBP2.74m, 4.3% to GBP61.36m. Much of this cost saving is

as a result of a reduction in cost of sales, labour, travel and accommodation

together with reduced match day costs from playing two fewer home games this

season.

During the financial year to 30 June 2009, GBP8.53m was invested in

strengthening the first team squad, which resulted in an amortisation charge of

GBP7.43m in comparison to GBP5.60m the previous year. In addition a gain on sale

of GBP1.55m resulted from the sales of Sno and Riordan and a contingent receipt

in respect of Petrov, this compared to GBP5.69m last year. Exceptional costs of

GBP2.78m were incurred in comparison to GBP3.19m last year. This in the main

relates to a provision for impairment to player values together with costs

arising from onerous contracts and the early termination of certain employment

contracts.

As a result of the above, and after various exceptional costs, the Company

announced a retained profit for the year to 30 June 2009 of GBP2.00m which

compares with the previous year's GBP4.44m. Further details can be found in the

Financial Director's Review.

FOOTBALL INVESTMENT

Planned trading of players and the development of younger players continue to be

integral parts of our longer-term strategy. As in recent seasons any new

signings and contract extensions must be at a financially viable level.

The playing squad was further enhanced during the 2008/9 season by the GBP8.53m

investment mentioned above. The funds achieved from the sale of players together

with the incremental contribution arising from participation in the group stage

of the UEFA Champions League helped fund the acquisition of new players. A

number of experienced players were brought in along with younger often locally

developed players who offer much potential.

For the 2008/9 season significant sums were invested to strengthen the playing

squad, with new signings including Marc Crosas from Barcelona, Georgios Samaras

from Manchester City, Shaun Maloney from Aston Villa, Glen Loovens from Cardiff

City, Milan Misun from IFK Pribram and both Paddy McCourt and Niall McGinn from

Derry City.

Important contract extensions were also secured for Scott McDonald and Aiden

McGeady, amongst others.

Of the senior players, Thomas Gravesen, Derek Riordan and Evander Sno left the

club in Summer 2008, whilst players loaned out during the year included John

Kennedy, Chris Killen and Cillian Sheridan. At the end of the season a number of

senior players' contracts came to an end, including those of Bobo Balde,

Shunsuke Nakamura, Jean-Joel Perrier-Doumbe, Jan Vennegoor of Hesselink and Paul

Hartley.

The Club plans to continue to build on the success achieved in recent years,

seeking to further strengthen the first team squad under Tony Mowbray, whilst

managing our financial resources responsibly. For season 2009/10 Lukasz Zaluska

has been secured from Dundee United, Daniel Fox has arrived from Coventry City

and both Marc-Antoine Fortune and Landry N'Guemo have joined Celtic from FC

Nancy in France, the latter on a 12 month loan.

In the coming year we plan to augment the infrastructure at Lennoxtown, with a

further pitch to be installed. Such investment is intended to provide our

football operation with the best possible resources, systems and facilities.

We are in the process of strengthening the scouting department to create a world

class scouting system which will enhance player identification and recruitment

at all levels, including the introduction of more sophisticated player

monitoring and assessment procedures.

FOOTBALL OPERATIONS

During season 2008/9 the Club played 51 competitive matches, winning 31 and

losing just 8, with 12 matches drawn. After a thrilling penalty shootout in the

semi-final against Dundee United, Celtic went on to beat Rangers in the final to

lift the CIS Cup. Furthermore, no less than eighteen Celtic players were called

up for senior International duty, spanning eleven different nations.

The reserve side under Willie McStay won the SPL Reserve Championship for the

eighth year in a row, losing just 2 of its 22 competitive matches. Willie has

since departed to take up a great managerial opportunity at Ujpest in Hungary.

YOUTH ACADEMY

Six new coaches joined the Academy in 2008/9, including Tommy McIntyre as Head

of Professional Academy and Stephen Frail as Under 19 Head Coach. Two new teams

were added at Under 9s and Under 10s in order to prepare players for

participating in the SFA Youth league at Under 11s. We now have squads from

Under 9s through to Under 19s.

The season started well for the Under 19s winning the Glasgow Cup by beating

Rangers 3-1 in the final. They then went on to record their highest ever

position in the prestigious Villarreal Tournament.

TICKET SALES

Season 2008/9 was another successful year. Standard season ticket sales

exceeded 51,000 with a value of circa GBP17m. The introduction of new

concessionary prices for kids' season tickets was very well received by

supporters, with nearly 10,000 taking advantage of the discounted tickets. Sales

were boosted by a highly successful half season ticket sale, which accounted for

2,100 season sales worth over GBP180,000. Taking into account Corporate and

Premium ticket sales the total number of seasonal tickets sold reached over

54,000, which is amongst the highest in the UK.

Match ticket sales of over 300,000, generated revenue in excess of GBP7million.

Nearly 160,000 UEFA Champions League tickets were sold at a value of GBP4.2m,

whilst many SPL games were sold out.

Given the current economic climate the Board took the decision to maintain

prices again for the new season.

CELTIC DEVELOPMENT

Approximately 2.3 million lottery chances were sold by Celtic Development Pools

Limited during the period July 2008 to June 2009. Around GBP840,000 was donated

to Celtic's Development Division for the purposes of youth development. Over

GBP900,000 in prize money was paid out to supporters from all over the country.

The weekly Celtic Pool lottery continues to out-perform most football club and

charitable lottery products; the Paradise Windfall match day lottery continues

to be very popular, with a top prize of GBP8,500 last season being the biggest

cash prize in UK football. Prize money of approximately GBP1.9 million has now

been paid out to Celtic supporters at Celtic Park since the start of the

Windfall in 1995.

CELTIC FOUNDATION

Through a number of projects the Celtic Foundation has again demonstrated its

ability to tackle the social inequalities that children, youths and adults

encounter living in Glasgow and elsewhere.

The Foundation has also strengthened its partnerships arrangements with the

private, public and voluntary sectors to deliver on key policy initiatives in

respect of young people and adults. These include improving health, social

well-being and educational attainment, promoting positive behaviour, increasing

confidence and raising self-worth, providing training and/or employment

opportunities and working with young people who are at risk of offending or who

have offended.

The Celtic Foundation has attracted over 1,250,000 young people and adults from

across Scotland, Ireland and beyond since the inception of the programme in May

2003. Currently over 6,500 young people and adults participate in the Celtic

Foundation's programmes each week.

Under the Play for Celtic programme, 36 Community Academy teams operate across

the country, with the aim of establishing a further 30 teams during season

2009/10. In recent years over 30 youngsters have graduated from our community

programmes into the Celtic Youth Academy.

The Girls Community / Youth Academy and Celtic Ladies Senior teams also continue

to make good progress with all Youth Academy sides winning their respective

Leagues and additional cup successes during season 2008/9.

Celtic Football Club is fully committed to the continuation of the Celtic

Foundation and its community work and has invested substantially in

infrastructure and programme delivery. The community aspect plays a key role in

the Club's social ethos and corporate social responsibilities. Over the past 12

months the Club has been involved in more charitable, educational and community

work than at any time in its history.

MERCHANDISING

Merchandising revenue for the year reached GBP17.18m, which was 6.8% up on the

previous year despite the challenging market place. The international away kit

released in June 2009 has also proved to be a success with initial sales ahead

of expectations. An additional away kit was launched in August 2009 and the

iconic 'bumble-bee' design has been well received.

The Club now operates fourteen stand-alone shops and licenses one franchise

store. Two temporary units were opened in Livingston and Braehead to benefit

from the Christmas trading period. The Argyle Street store was extensively

refurbished in February of this year in conjunction with NIKE.

Autumn 2008 also saw the successful release of the Club's Official History DVD

and in the Spring of 2009 a tribute DVD to Tommy Burns was issued. Both have

performed well.

MULTI MEDIA & MARKETING

The Multi Media Division now includes the Company's marketing function, a change

effected in February 2009 to ensure consistency in communicating the Club's

message.

Channel 67, the Club's online portal to view live matches, is now in its

eleventh year and continues to provide quality streams of Celtic matches to the

worldwide fan base. Going forward and subject to broadcasting rights, the

intention is to further develop the Channel 67 brand following the collapse of

the Setanta operation in the UK.

Celticfc.net and Celticfc.jp websites have seen new functionality and features

in the past year and development work continues in these areas.

Multi Media & Marketing had production and technical input into the successful

Tony Roper play the 'Celts in Seville' and is working with other writers and

producers with a view to staging more Celtic productions in future.

The department continues to produce high quality, sell-thru'DVD products to the

retail and wholesale markets. In the past financial year we have released The

Official History of Celtic Football Club as well as producing and successfully

releasing 'Faithful Through and Through - The Tommy Burns Story'.

Television advertisements and all video-related promotional material continue to

be produced by the Club's in-house team of production staff, editors and camera

operators. This service affords other parts of the business a cost-effective

solution to advertising and promotion on both internal and external media.

The department continued to provide a solution for cost-effectively producing

and presenting top-quality Club dinners and events. In the past year these have

included Player of the Year, the Joe McBride and Stevie Chalmers Tribute Nights,

and the Club's Annual Charity Dinner among others.

The commercial aspect of publishing also sits within the department with

oversight of the Celtic View, match day programme and various book titles.

PUBLIC RELATIONS

The level of media interest and activity around the Club was again extremely

high during the year, given the Club's UEFA Champions League participation and

involvement in domestic competitions.

The PR Department continued to manage a substantial level of media coverage for

a range of Club activities at a national level, including commercial, charitable

and community events. In addition, the Department plays an important role in

dealing with supporter enquiries, working closely with supporter organisations

and liaising directly with Glasgow City Council and other bodies to ensure the

Club maintains its important social dimension.

BRAND PROTECTION

Celtic protects its intellectual property rights internationally and seeks to

prevent unauthorised bodies from using the Celtic brand. This work ensures that

the Celtic brand remains a valuable asset of the Club and also assists in

raising the Club's global profile.

The Club continues to work closely with the enforcement authorities. Counterfeit

goods to the value of around GBP200,000 were removed from the marketplace, with

other investigative and enforcement work conducted on an ongoing basis.

PARTNER PROGRAMME

NIKE and Celtic agreed an extension of their relationship which is now in place

until 2015; the deal continues to support Celtic's global commercial strategy

and gives the Club an excellent platform to gain new partners. In 2008/9,

Emirates, Citylink, Konami, Wish Telecoms and Albert Bartlett became new Club

partners and with Powerade and Shields Autoparks already signed for the season

ahead, Celtic's partner portfolio continues to grow.

Key contract extensions have been agreed with Thomas Cook, BT and Seat Exchange.

The implementation of LED perimeter advertising boards at Celtic Park has given

partners a new way to advertise and the Club will strive to find further ways to

support our sponsors going forward. The focus for season 2009/10 will be to

continue to explore new revenue streams, both domestically and overseas, with an

emphasis on "Platinum" partnerships

STADIUM

Spectator safety remains of paramount importance for fans attending matches both

home and away. During the course of the year, Celtic Football Club continued to

enhance its close liaison and valuable partnership with the Glasgow City Council

Safety Team for Sports Grounds.

We continued to develop the training of colleagues responsible for public safety

duties. To meet the requirements of the Guide to Safety at Sports Grounds

(Edition Five), the year saw the successful completion of accredited training in

Spectator Safety Management and the introduction of training towards the SVQ

Level 2 qualification for Event Stewards. In addition, the Club was delighted to

be invited to provide an input to the Match Commanders Training Programme held

at the Scottish Police College and to UEFA Safety and Security Seminars held in

Amsterdam, Athens and Belarus.

The success of the travel stewarding arrangements continued. with Celtic travel

stewards accompanying our fans to assist in local operations, ensuring the

wellbeing of Celtic supporters who continue to attract praise from safety

authorities for their positive support of the team.

FACILITIES

The Facilities team undertook a number of maintenance and refurbishment projects

during a busy year, enhancing the environment for customers and colleagues

alike.

Streamlining of purchasing procedures and a focus on energy saving initiatives

resulted in improved efficiency and cost control.

We will strive to further improve service and upgrade facilities throughout the

Stadium and at the Training Ground in Lennoxtown, with Health and Safety

continuing to be of the utmost importance.

Celtic continues to invest in its Information, Communications and Technology

(ICT) systems to ensure it has a modern, robust and secure infrastructure to

support business operations going forward. Over the course of the next year, we

will be looking to drive efficiencies in our ICT infrastructure whilst looking

to provide improved services, communication and information to our customers.

CATERING AND CORPORATE HOSPITALITY

The Number 7 Restaurant has experienced an impressive level of sales growth over

last season, with our children's menu receiving a Gold Award from the Soil

Association. The presentation was made by HRH The Prince of Wales and this is

the highest accreditation that has ever been presented to a football club in the

UK.

Conference and Banqueting performed well in a difficult competitive climate. We

provided hospitality services for a number of prestigious events, including the

Young Scottish Muslim Awards, Player of the Year dinners in Glasgow and Ireland,

Celtic Supporters Club Annual Rally and various tribute dinners.

In terms of match day services, the strong partnership with Lindley Catering has

continued to grow, whilst food and beverage sales in the hospitality lounges

performed ahead of budget.

Corporate Hospitality also performed well, with excellent customer feedback.

Corporate and Premium seasonal sales were strong in all areas ending the season

ahead of budget.

The Visitor Centre beat its sales targets in another challenging market and

regularly welcomed visitors from Asia, North America and across the United

Kingdom.

SUPPORTER RELATIONS

Our Customer Relationship Management (CRM) system has continued to be developed

and enhanced over the past year. This system has allowed us to bring together

supporter information gathered from many business areas. By creating one central

database we can obtain a complete picture of each supporter's transactions with

the Club.

The number of supporters on the database has continued to grow, with a 14%

increase seen in the last year. Analysis of this data helps us to communicate

with and market to supporters in a more targeted and effective manner, reducing

costs and driving revenues for both the Club and for our partners and sponsors.

The use of lower cost communication channels such as e-mail and SMS messaging in

conjunction with the CRM system has been successful in reducing costs and

generating income, particularly in the promotion of ticket sales and events. But

communicating with our supporters is not just about marketing products; a new

weekly e-mail newsletter has been introduced to provide supporters with news,

videos, interviews, and competitions.

CELTIC CHARITY FUND

Celtic Charity Fund, the Club's charitable arm, again enjoyed a highly

successful year, donating over GBP446,000 to a range of worthy causes. A

detailed summary of its activities is set out in the Annual Report.

The Club's commitment to supporting worthy causes will continue in 2009/10 as we

look to increase the fundraising impetus and, in turn, our donations to

registered charities in Scotland, Ireland and across the globe.

HUMAN RESOURCES

Celtic remains the only SPL club to date to become an "Investor in People". This

prestigious award was gained in 2007 in recognition of attaining the national

standard for people management and development. We are now the only Scottish

club to hold this award, whilst in England there are just four clubs with full

or part-recognition.

Remuneration and benefits are regularly reviewed and benchmarked and employee

welfare remains an important consideration. Recruitment and induction processes

have been revised and updated, whilst all Celtic colleagues now have access to a

free Employee Assistance Programme and a comprehensive voluntary benefits

package called Celtic Choice.

In January 2009 Celtic was awarded the "Positive about Disabled People" symbol

by Job Centre Plus for the fourth successive year, reflecting the fact that we

continue to meet our commitments to colleagues and job applicants with a

disability.

Celtic also continues to hold "Tommy's" accreditation, which is recognition of

the Company's good-practice policies in respect of pregnant employees.

55 pupils from local schools enjoyed a week of structured work experience at

Celtic Park during the year. This is a highly successful ongoing programme open

to all, which has received plaudits from pupils, parents and the education

authorities.

The hard work and contribution of all colleagues in another exciting year is

greatly appreciated.

SUMMARY AND OUTLOOK

Football success continues to have a major effect on trading performance which,

in addition to the gains reported from player trading, has resulted in strong

financial results again for the year to 30 June 2009. However, our failure to

progress beyond the group stage of the Champions League has contributed to a

profit performance that fell short of last year.

The football sector remains financially difficult, particularly given recent

economic pressures. To some extent, football has been protected from the

harshest of these forces but overall attendances dipped a little and this had

knock-on consequences for our merchandise and hospitality businesses.

Furthermore, the collapse of the Setanta broadcasting contract for the SPL and

associated demise of Celtic TV had a negative impact on income at the end of the

financial year.

Revenues generated by progress in European competitions remain of major

significance and provide greater flexibility regarding player investment.

We continue to maximise revenues and develop the Celtic brand at home and abroad

and together with the ongoing management of costs we should maintain a

sustainable financial model.

Trading at the beginning of the new financial year has been quite encouraging in

a challenging marketplace. Celtic enjoys partnerships with several international

companies, which will continue to provide income streams going forward.

However, additional revenue generating opportunities continue to be sought.

It is imperative that we attain domestic success and compete successfully,

particularly in the Clydesdale Bank Scottish Premierleague. Wage and transfer

fee inflation at the highest level continues to rise. The gap with major

European nations widens and thus the cost of attracting quality new players

increases. As such the emphasis on careful and patient use of our financial

resources and development of talent will characterise our efforts to strengthen

the first team squad.

We will continue to invest strategically on our technical functions, talent

identification, Academy, Sports Science and performance analysis, with the

objective of achieving excellence and creating Champions League quality players.

Once again, the biggest challenge facing the Board is the management of salary

and transfer costs whilst achieving playing success in order to yield

satisfactory financial results. Clearly, European progression is key in enabling

the Club to achieve its financial objectives.

Peter T Lawwell14 August 2009

Chief Executive

CONSOLIDATED INCOME STATEMENT

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | 2009 | | 2008 |

+--------------------------------+-------+----------------------------------------+--+----------+

| |Notes | Operations | | Player | | Total | | Total |

| | | excluding | | trading | | GBP000 | | GBP000 |

| | | player | | GBP000 | | | | |

| | | trading | | | | | | |

| | | GBP000 | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Continuing operations: | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Revenue | 2 | 72,587 | | - | | 72,587 | | 72,953 |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Operating expenses | | (61,358) | | - | | (61,358) | | (64,095) |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit from trading before | | 11,229 |- | - | | 11,229 | | 8,858 |

| asset transactions and | | | | | | | | |

| exceptional items | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Exceptional operating expenses | 3 | (1,985) | | (797) | | (2,782) | | (3,189) |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Amortisation of intangible | | - | | (7,434) | | (7,434) | | (5,598) |

| assets | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit on disposal of | | | | 1,546 | | 1,546 | | 5,695 |

| intangible assets | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit / (loss) on disposal of | | 231 | | - | | 231 | | (268) |

| property plant and equipment | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit/(loss) before finance | | 9,475 | | (6,685) | | 2,790 | | 5,498 |

| costs and tax | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Finance costs: | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Bank loans and overdrafts | | | | | | (243) | | (519) |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Convertible Preference Shares | 4 | | | | | (544) | | (544) |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit before tax | | | | | | 2,003 | | 4,435 |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Taxation | 5 | | | | | - | | - |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit for the year from | | | | | | 2,003 | | 4,435 |

| continuing operations | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Profit for the year | | | | | | 2,003 | | 4,435 |

| attributable to equity holders | | | | | | | | |

| of the parent | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Basic earnings per Ordinary | 6 | | | | | 2.24p | | 5.09p |

| Share | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| | | | | | | | | |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

| Diluted earnings per share | 6 | | | | | 1.87p | | 3.70p |

+--------------------------------+-------+------------+--+----------+--+----------+--+----------+

CONSOLIDATED BALANCE SHEET

+----------------------------------------------+------+----------+---+----------+

| | | 2009 | | 2008 |

+----------------------------------------------+------+----------+---+----------+

| | | GBP000 | | GBP000 |

+----------------------------------------------+------+----------+---+----------+

| Assets | | | | |

+----------------------------------------------+------+----------+---+----------+

| Non-current assets | | | | |

+----------------------------------------------+------+----------+---+----------+

| Property, plant and equipment | | 56,689 | | 56,315 |

+----------------------------------------------+------+----------+---+----------+

| Intangible assets | | 12,145 | | 11,862 |

+----------------------------------------------+------+----------+---+----------+

| | | 68,834 | | 68,177 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Current assets | | | | |

+----------------------------------------------+------+----------+---+----------+

| Inventories | | 2,020 | | 2,410 |

+----------------------------------------------+------+----------+---+----------+

| Trade and other receivables | | 4,427 | | 6,063 |

+----------------------------------------------+------+----------+---+----------+

| Cash and cash equivalents | | 10,489 | | 8,475 |

+----------------------------------------------+------+----------+---+----------+

| | | 16,936 | | 16,948 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Total assets | | 85,770 | | 85,125 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Equity | | | | |

+----------------------------------------------+------+----------+---+----------+

| Issued share capital | | 24,204 | | 24,122 |

+----------------------------------------------+------+----------+---+----------+

| Share premium | | 14,309 | | 14,205 |

+----------------------------------------------+------+----------+---+----------+

| Other reserve | | 21,222 | | 21,222 |

+----------------------------------------------+------+----------+---+----------+

| Capital redemption reserve | | 2,686 | | 2,766 |

+----------------------------------------------+------+----------+---+----------+

| Accumulated losses | | (19,071) | | (21,074) |

+----------------------------------------------+------+----------+---+----------+

| Total equity | | 43,350 | | 41,241 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Non-current liabilities | | | | |

+----------------------------------------------+------+----------+---+----------+

| Interest-bearing liabilities/bank loan | | 12,000 | | 12,000 |

+----------------------------------------------+------+----------+---+----------+

| Debt element of Convertible Preference | | 3,027 | | 3,027 |

| Shares | | | | |

+----------------------------------------------+------+----------+---+----------+

| Deferred income | | 254 | | 820 |

+----------------------------------------------+------+----------+---+----------+

| | | 15,281 | | 15,847 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Current liabilities | | | | |

+----------------------------------------------+------+----------+---+----------+

| Trade and other payables | | 14,188 | | 16,224 |

+----------------------------------------------+------+----------+---+----------+

| Current borrowings | | 140 | | 154 |

+----------------------------------------------+------+----------+---+----------+

| Deferred income | | 12,811 | | 11,659 |

+----------------------------------------------+------+----------+---+----------+

| | | 27,139 | | 28,037 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Total liabilities | | 42,421 | | 43,884 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Total equity and liabilities | | 85,770 | | 85,125 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

Approved by the Board on 14 August 2009

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | Share | Share | Other | Capital | Retained | Total |

| | capital | premium | reserve |redemption | earnings | |

| | | | | reserve | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | GBP000 | | | | |

| | GBP000 | | GBP000 | GBP000 | GBP000 | GBP000 |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Equity shareholders' | 23,452 | 14,129 | 21,222 | 2,440 | (24,514) | 36,729 |

| funds | | | | | | |

| as at 1 July 2007 | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Share capital issued | 1 | 76 | - | - | - | 77 |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Transfer to Capital | 669 | - | - | 326 | (995) | - |

| Redemption | | | | | | |

| Reserve | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Profit for the period | | | | | 4,435 | 4,435 |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Equity shareholders' | 24,122 | 14,205 | 21,222 | 2,766 | (21,074) | 41,241 |

| funds | | | | | | |

| as at 30 June 2008 | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Share capital issued | 2 | 104 | - | - | - | 106 |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Transfer to Capital | 80 | - | - | (80) | - | - |

| Redemption | | | | | | |

| Reserve | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Profit for the period | - | - | - | - | 2,003 | 2,003 |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| Equity shareholders' | 24,204 | 14,309 | 21,222 | 2,686 | (19,071) | 43,350 |

| funds | | | | | | |

| as at 30 June 2009 | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

| | | | | | | |

+-----------------------+-----------+-----------+----------+------------+-----------+----------+

CONSOLIDATED CASH FLOW STATEMENT

+----------------------------------------------+------+----------+---+----------+

| | | 2009 | | 2008 |

+----------------------------------------------+------+----------+---+----------+

| | | GBP000 | | GBP000 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Cash flows from operating activities | | | | |

+----------------------------------------------+------+----------+---+----------+

| Profit for the year | | 2,003 | | 4,435 |

+----------------------------------------------+------+----------+---+----------+

| Depreciation | | 2,204 | | 1,925 |

+----------------------------------------------+------+----------+---+----------+

| Amortisation of intangible assets | | 7,434 | | 5,598 |

+----------------------------------------------+------+----------+---+----------+

| Impairment of intangible assets | | 797 | | 353 |

+----------------------------------------------+------+----------+---+----------+

| Profit on disposal of intangible assets | | (1,546) | | (5,695) |

+----------------------------------------------+------+----------+---+----------+

| (Profit) /loss on disposal of property, | | (231) | | 268 |

| plant and equipment | | | | |

+----------------------------------------------+------+----------+---+----------+

| Finance costs | | 787 | | 1,063 |

+----------------------------------------------+------+----------+---+----------+

| Sub total | | 11,448 | | 7,947 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Decrease in inventories | | 390 | | 973 |

+----------------------------------------------+------+----------+---+----------+

| (Increase)/decrease in receivables | | (406) | | (123) |

+----------------------------------------------+------+----------+---+----------+

| (Increase)/decrease in payables and deferred | | (2,415) | | 2,824 |

| income | | | | |

+----------------------------------------------+------+----------+---+----------+

| Cash generated from operations | | 9,017 | | 11,621 |

+----------------------------------------------+------+----------+---+----------+

| Interest paid | | (243) | | (519) |

+----------------------------------------------+------+----------+---+----------+

| Net cash flow from operating activities - A | | 8,774 | | 11,102 |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Cash flows from investing activities | | | | |

+----------------------------------------------+------+----------+---+----------+

| Purchase of property, plant and equipment | | (3,574) | | (3,605) |

+----------------------------------------------+------+----------+---+----------+

| Purchase of intangible assets | | (6,970) | | (12,254) |

+----------------------------------------------+------+----------+---+----------+

| Proceeds from sale of property, plant and | | 596 | | - |

| equipment | | | | |

+----------------------------------------------+------+----------+---+----------+

| Proceeds from sale of intangible assets | | 3,639 | | 8,048 |

+----------------------------------------------+------+----------+---+----------+

| Net cash used in investing activities - B | | (6,309) | | (7,811) |

+----------------------------------------------+------+----------+---+----------+

| | | | | |

+----------------------------------------------+------+----------+---+----------+

| Cash flows from financing activities | | | | |

+----------------------------------------------+------+----------+---+----------+

| Repayment of debt | | (14) | | (887) |

+----------------------------------------------+------+----------+---+----------+

| Dividends paid | | (437) | | (935) |

+----------------------------------------------+------+----------+---+----------+

| Net cash used in financing activities - C | | (451) | | (1,822) |

+----------------------------------------------+------+----------+---+----------+

| Net increase in cash equivalents A+B+C | | 2,014 | | 1,469 |

+----------------------------------------------+------+----------+---+----------+

| Cash and cash equivalents at 1 July | | 8,475 | | 7,006 |

+----------------------------------------------+------+----------+---+----------+

| Cash and cash equivalents at 30 June | | 10,489 | | 8,475 |

+----------------------------------------------+------+----------+---+----------+

NOTES TO THE ACCOUNTS

1.BASIS OF PREPARATION AND ACCOUNTING POLICIES

These Financial Statements have been prepared in accordance with IFRS as adopted

by the European Union, and with those parts of the Companies Act 2006 applicable

to companies reporting under IFRS. The accounting policies have been

consistently applied to both years presented.

The Group's Profit and Loss Account follows the Financial Reporting Guidance for

Football Clubs issued in February 2003 by The Football League, The FA Premier

League and the FA, although the revenue within Note 2 continues to be analysed

in accordance within the headings of the business operations of the Group.

2.REVENUE

+----------------------------------------------------+------------+--+------------+

| The Group's revenue comprises: | 2009 | | 2008 |

| | GBP000 | | GBP000 |

+----------------------------------------------------+------------+--+------------+

| | | | |

+----------------------------------------------------+------------+--+------------+

| | | | |

+----------------------------------------------------+------------+--+------------+

| Football and stadium operations | 36,534 | | 38,580 |

+----------------------------------------------------+------------+--+------------+

| Merchandising | 17,180 | | 16,092 |

+----------------------------------------------------+------------+--+------------+

| Multimedia and other commercial activities | 18,873 | | 18,281 |

+----------------------------------------------------+------------+--+------------+

| | | | |

+----------------------------------------------------+------------+--+------------+

| | 72,587 | | 72,953 |

+----------------------------------------------------+------------+--+------------+

3.EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP2.78m (2008: GBP3.19m) reflect GBP1.98m

(2008: GBP2.84m) in respect of labour and other ancillary costs largely arising

as a result of onerous contracts and the early termination of certain employment

contracts and GBP0.80m (2008: GBP0.35m) in respect of a provision for impairment

of intangible assets.

4.DIVIDENDS

A 6% (before tax credit deduction) non-equity dividend of GBP0.54m (2008:

GBP0.54m) is payable on 1 September 2009 to those holders of Convertible

Cumulative Preference Shares on the share register at 31 July 2009. On 31 August

2007 the entitlement to a dividend on the Convertible Preferred Ordinary Shares

ceased. A number of shareholders have elected to participate in the Company's

scrip dividend reinvestment scheme for this financial year. Those shareholders

will receive new Ordinary Shares in lieu of cash. The implementation of the

presentational aspects of IAS32 ("Financial Instruments: disclosure") in the

preparation of the annual results, requires that the Group's Preference Shares

and Convertible Preferred Ordinary Shares, as compound financial instruments,

are classified as a combination of debt and equity and the attributable

non-equity dividends are classified as finance costs. No dividends were payable

or proposed to be payable on the Company's Ordinary Shares.

5.TAXATION

No provision for corporation tax or deferred tax is required in respect of the

year ended 30 June 2009. Estimated tax losses available for set-off against

future trading profits amount to approximately GBP25m (2008: GBP27m). This

estimate is subject to the agreement of the current and prior years' corporation

tax computations with H M Revenue and Customs.

6.EARNINGS PER SHARE

+-----------------------------------------------+-----------+---+------------+

| | 2009 | | 2008 |

+-----------------------------------------------+-----------+---+------------+

| | | | GBP000 |

| | GBP000 | | |

+-----------------------------------------------+-----------+---+------------+

| Reconciliation of net profit to basic | | | |

| earnings: | | | |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Net profit attributable to equity holders of | 2,003 | | 4,435 |

| the parent | | | |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Basic earnings | 2,003 | | 4,435 |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Reconciliation of basic earnings to diluted | | | |

| earnings: | | | |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Basic earnings | 2,003 | | 4,435 |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Non-equity share dividend | 544 | | 544 |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| | 2,547 | | 4,979 |

+-----------------------------------------------+-----------+---+------------+

| | No.'000 | | No.'000 |

+-----------------------------------------------+-----------+---+------------+

| Reconciliation of basic weighted average | | | |

| number of ordinary shares to | | | |

| diluted weighted average number of ordinary | | | |

| shares: | | | |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Basic weighted average number of ordinary | 89,584 | | 87,171 |

| shares | | | |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Dilutive effect of share options | - | | - |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Dilutive effect of convertible shares | 46,346 | | 47,252 |

+-----------------------------------------------+-----------+---+------------+

| | | | |

+-----------------------------------------------+-----------+---+------------+

| Diluted weighted average number of ordinary | 135,930 | | 134,423 |

| shares | | | |

+-----------------------------------------------+-----------+---+------------+

Earnings per share has been calculated by dividing the profit for the period of

GBP2.00m (2008: GBP4.44m) by the weighted average number of Ordinary Shares of

89.58m (2008: 87.17 m) in issue during the year. Diluted earnings per share as

at 30 June 2009 has been calculated by dividing the earnings for the period by

the weighted average number of Ordinary Shares, Preference Shares and

Convertible Preferred Ordinary Shares in issue, assuming conversion at the

balance sheet date, and the full exercise of outstanding share purchase options,

if dilutive, in accordance with IAS33 Earnings Per Share. As at June 2008 and

June 2009 no account was taken of potential share purchase options, as these

potential Ordinary Shares were not considered to be dilutive under the

definitions of the applicable accounting standards.

7.ANNUAL REPORT & ACCOUNTS

Copies of the Annual Report & Accounts together with the notice and notes of the

2009 AGM are expected to be issued to all shareholders in due course.

The financial information set out above was approved by the Directors on 14

August 2009 and does not constitute the Company's statutory accounts for the

years ended 30 June 2009 or 30 June 2008. The auditors' opinion on the 2009

statutory accounts is unmodified and does not include a statement under Section

237 (2) or (3) of the Companies Act 1985. The statutory accounts for 2008 have

been filed and those for 2009 will be delivered to the Registrar of Companies in

due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFFFDLSUSELA

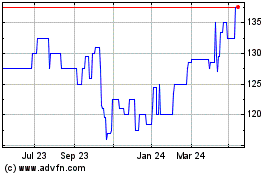

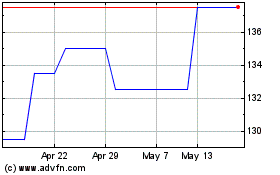

Celtic (LSE:CCP)

Historical Stock Chart

From Jul 2024 to Aug 2024

Celtic (LSE:CCP)

Historical Stock Chart

From Aug 2023 to Aug 2024