Pre-Close Trading Update

July 09 2009 - 2:00AM

UK Regulatory

TIDMCCC

RNS Number : 3698V

Computacenter PLC

09 July 2009

Computacenter plc

Pre-Close Trading Update

Computacenter is today holding an Investor and Analyst conference call to

provide an update on trading for the six months to 30 June 2009.

Overall profitability in the first half (pre-exceptional charges) will be ahead

of current market expectations.

The first half of 2009 has seen good growth in our Contractual Services across

the Group and significant cost reductions, both of which have driven our

increased profitability. Conversely, we have seen a significant negative impact

of the reduction in our customers' capital budgets in product sales and in

Professional Services which is involved with the implementation of new systems

and projects. Overall revenues reduced by 3% in the period, but were down by 8%

in constant currency.

Additionally, this combination of factors has not only improved the

profitability in this period but this continuing trend in business mix increases

our long term visibility and predictability of earnings.

As previously announced there is likely to be an exceptional charge

of circa GBP5m for the year as a whole, the majority of which has been expensed

in the first half.

Our continued focus on the rigorous management of working capital has resulted

in strong cash generation in the period. At the end of the period Group net

funds were circa GBP49 million before customer specific financing 'CSF' (net

debt before CSF at H1 2008 was GBP29.7 million). The cash position was flattered

on a one off basis by circa GBP10 million in the UK due to the timing of our

quarter end. CSF at the end of the period was circa GBP65 million (GBP66.2

million at 30 June 2008). In January 2009 we announced our decision to cease the

trade distribution of personal systems and expected a cash inflow of

approximately GBP15 million, this was implemented successfully with an actual

cash inflow of approximately GBP18 million.

We have realised the majority of our planned cost reductions in the UK. We

implemented the organisational change, enhanced our competitive positioning and

improved profitability as set out in our Pre-Close briefing on 13 January, 2009.

Contractual Services revenue increased by 10% in the period which bodes well for

profitability in the second half and years to come. Overall revenue in the UK

was down 8% excluding the impact of exiting the trade distribution of personal

systems. The combination of these factors in the UK together with the exiting of

trade distribution will have a positive effect on margins.

In Germany, we are continuing to see further progress with increased services

revenues of 4% in constant currency coupled with an increase in services margin.

German product revenue was down only 4% but has been a little weaker towards the

end of the period. Computacenter Germany has been successful in winning one of

its largest Managed Services contracts to date, which will commence in the

second half but will not make a significant contribution to the business until

2010.

Computacenter France has seen an improved performance against the first half of

last year driven by 12% service revenue growth in constant currency and improved

service margins combined with overhead cost reduction. These factors are

encouraging for the future of our French business, however the second half of

2009 as previously highlighted will be challenging due to the start-up of new

contracts with our largest customer in France.

At a Group level, our annual service contract base now stands in excess of

GBP510 million on 30 June 2009 representing a growth in excess of 11% over 30

June 2008 based on constant currency.

We are pleased with the progress achieved in the first six months and the

consistent improvement in Group performance that we have been able to deliver.

However, we are far from satisfied and much remains to be done to achieve the

long term performance we desire.

Looking particularly at the second half of 2009, we are unlikely to see a return

to growth in capital expenditure on IT equipment across our geography, however

we are confident of further progress in our contractual services business where

we save our customers money. We will also continue to be rigorous in the cost

management of our business. We are obviously not immune to the broader economic

environment but our performance to date gives us encouragement for the future.

Mike Norris, Chief Executive of Computacenter plc, commented:

"The trading environment remains very challenging and neither Computacenter nor

its customers are immune. It is therefore no surprise that our product sales

are down in the period. However the steps that we have taken to reduce our costs

and win new service contracts have meant that we are again able to deliver

another strong profit performance."

Computacenter will report its Interim results on 27 August 2009.

Enquiries:

Computacenter plc

Mike Norris, Chief Executive01707 631601

Tony Conophy, Finance Director01707 631515

Tessa Freeman, PR Manager01707 631514

Tulchan Communications 020 7353 4200

Andrew Grant

Stephen Malthouse

Note

The financial information contained within this announcement is sourced from

unaudited management accounts.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDGGGNVRZGLZM

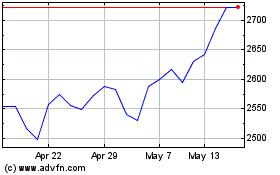

Computacenter (LSE:CCC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Nov 2023 to Nov 2024