Burford Capital Burford Opens in Singapore & Appoints Quentin Pak

October 03 2017 - 4:00AM

RNS Non-Regulatory

TIDMBUR

Burford Capital

03 October 2017

BURFORD CAPITAL OPENS IN SINGAPORE

AND APPOINTS QUENTIN PAK AS DIRECTOR

October 3, 2017 - Burford Capital ("Burford"), a leading global

finance firm focused on law, today announces that it is expanding

its business in Asia-Pacific with additional investment in

Singapore and the appointment of Quentin Pak as Director to lead

operations there. The development further cements Burford's status

as a leader in the emerging Asian market for commercial litigation

and arbitration finance. It also provides Burford with a platform

from which to continue to expand its presence in the region.

Burford's continued focus in Singapore follows increased demand

for legal capital in the wake of January 2017 amendments to

Singapore law permitting arbitration finance. In June 2017, Burford

announced that it had financed its first Singaporean arbitration

matter which, to Burford's knowledge, is the first Singapore-seated

arbitration funded by a third-party finance provider.

Mr. Pak, who joins Burford effective October 30, will run

Burford's office in Singapore and be responsible for expanding

Burford's presence in Asia and Australia. He joins Burford with 20

years of experience in finance and law, most recently as Head of

Commodities (Asia) at Commonwealth Bank of Australia in Singapore.

His previous experience includes senior positions at major global

financial institutions including Barclays, Goldman Sachs and

Deutsche Bank. Before entering the finance world, Mr. Pak practiced

law for a number of years with Allen & Overy in both London and

Singapore.

Christopher Bogart, Burford's CEO, commented:

"Burford sees significant potential in the Asia-Pacific market

following the passage this year of new laws in the region,

including Singapore, that support our business. With the addition

of a Singapore office and with Quentin's on-the-ground leadership

and vision, we're enthusiastic about meeting the increased demand

for third-party capital with smart and cost-effective

solutions."

END

Contact:

Asia-Pacific and EMEA: Neil McLeod, PHA Media, +44 20 7440 0811,

neilm@pha-media.com

N. America: Emma Murphy, The Neibart Group, +1 (718) 875-4545,

emurphy@neibartgroup.com

About Litigation Finance in Singapore and Hong Kong

In October 2016, the Hong Kong Law Reform Commission issued a

lengthy report in October 2016 that called for the expansion of the

use of litigation finance in Hong Kong. The Commission noted that

97% of the many submissions it received on the issue - from

essentially every kind of stakeholder in the dispute resolution

process - were in favour. Stakeholders commented that it is

"Pointless to try to hold back the tide" and that "We believe such

a positive clarification ... may well enhance Hong Kong's status as

a premium center for legal and dispute resolution services". In

step with Hong Kong, in November 2016, the Singapore Parliament

introduced legislation (now enacted) that would permit litigation

finance in arbitration and laid the groundwork for further

expansions.

About Burford Capital

Burford Capital is a leading global finance and investment

management firm focused on law. Its businesses include litigation

finance and risk management, asset recovery, and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the London Stock Exchange, and it works with law firms and

clients around the world from its principal offices in New York,

London and Chicago. For more information about Burford:

www.burfordcapital.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRALFFIIILLFIID

(END) Dow Jones Newswires

October 03, 2017 04:00 ET (08:00 GMT)

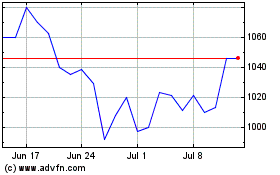

Burford Capital (LSE:BUR)

Historical Stock Chart

From Apr 2024 to May 2024

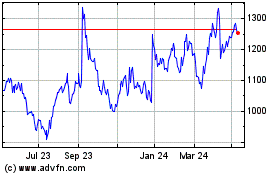

Burford Capital (LSE:BUR)

Historical Stock Chart

From May 2023 to May 2024