Baker Steel Resources Trust Ltd Interim Management Statement (0196Q)

October 09 2013 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 0196Q

Baker Steel Resources Trust Ltd

09 October 2013

BAKER STEEL RESOURCES TRUST LTD

www.bakersteelresourcestrust.com

September 2013 Quarterly Factsheet

At 30 September 2013 Price / Index Level % Change in Quarter % Change in Year % Change from Inception

----------------------------- -------------------- -------------------- ----------------- ------------------------

Net Asset Value

(pence/share) 70.3 +1.0% -35.6% -28.2%*

----------------------------- -------------------- -------------------- ----------------- ------------------------

Ordinary Share Price

(pence/share) 51.5 -6.4% -38.7% -48.5%**

----------------------------- -------------------- -------------------- ----------------- ------------------------

MSCI ACWI Index 382.07 +7.4% +12.5% +24.0%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Euromoney Global Mining

Index (Sterling) 543.35 +7.7% -23.4% -36.1%

----------------------------- -------------------- -------------------- ----------------- ------------------------

CRB Index 285.54 +3.6% -3.2% +4.5%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Chinese Domestic Iron Ore

- Hebei/Tangshan (US$/t) 170 +2.4% -1.7% -11.5%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Copper (US$/t) 7290.25 +8.3% -7.8% -2.2%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Gold (US$/oz) 1328.94 +7.6% -20.7% +13.8%

----------------------------- -------------------- -------------------- ----------------- ------------------------

Source: Bloomberg closing 27/4/10, **Issue price 28/4/10, * NAV

30/4/10

This document constitutes an interim management statement for

the period from 1 July 2013 to 9 October 2013 ("the Period").

Financial information has been drawn up as at 30/09/2013. There

have been no material changes since that date.

Review Investment Objective

At the end of September 2013, Baker Steel Resources To seek capital growth

Trust Limited ("BSRT" or "the Company") was fully over the long term through

invested. During the quarter there was little a focused global portfolio

change to the portfolio, with the Company selling consisting principally

some Ivanhoe Mines shares to finance its commitment of the equities, or related

to acquire a further interest in Metals Exploration instruments, of natural

to fund the development of its Runruno Gold Mine resources companies.

in the Philippines.

Following a weak first half of 2013, markets for Investment Strategy

mining equities stabilised during the third quarter

of 2013, with the Euromoney Global Mining Index Investing predominantly

rising 7.7%. This reflects the performance of in attractively valued

commodity prices themselves, which partially recovered private companies with

during the quarter. strong development projects

The net asset value of the Company likewise stabilised and focused management

after a weak first half, rising 1.0% during the and also in listed securities

quarter. The mining projects within the Company's to exploit value inherent

portfolio continue to progress up the development in market inefficiencies.

curve: Bilboes Gold has restarted production from

the oxide portion of its deposit whilst it undertakes Asset Allocation

the feasibility study on the underlying sulphides;

Black Pearl has moved into the commissioning phase Unlisted Equities GBP32.5

of its new iron sands project in Indonesia; and M 69.9 %

China Polymetallic Mining continues to ramp up Listed Equities GBP14.3

production at its Shizishan silver lead zinc mine M 30.7 %

in China. Good progress also continues to be made Net Cash & GBP -0.3 M -0.6

at the Company's largest investment, Ivanhoe Mines %

(previously Ivanplats), which has refocused the Equivalents

development strategy for its Kamoa Copper project Net Assets GBP46.5 M

in the Democratic Republic of Congo to require Gearing: 0.6%

lower capital costs and in October 2013 it raised

C$108 million to fund the ongoing feasibility Shares in Issue

work. Ivanplats also recently received approval

to commence the sinking of a shaft at its Platreef Trading: The London Stock

Platinum/Palladium/Nickel project in South Africa. Exchange Ordinary: 66,142,533

Outlook Code: BSRT

The outlook for commodities in the short term ISIN GG00B6686L20

remains difficult to call as exemplified by contrasting

forecasts on the iron ore market published recently

by Citigroup and Morgan Stanley. Clearly much Financial Calendar

will continue to depend on the growth of the Chinese

economy as the largest importer of raw materials. Year End: 31 December

During September McKinsey Global Institute published Interims: August

its first Resource Revolution trends survey which Finals: April

suggests that reports of the end of the so-called

resource price "super-cycle" appear to be premature

with commodity prices also driven by a combination

of geological issues and input cost inflation.

In the case of development projects in the mining

industry, analysis of discounted cashflows can

show enormous potential returns but this can realise

nothing if the project is not financed into production

so that these cashflows can be released. The Company

will continue to source projects which it considers

have a sufficiently strong future production and

cost profile such that they have the best likelihood

of attracting finance and make the leap into production

and positive cashflow.

------------------------------------------------------------ -----------------------------------------

Top 10 Investments (at 30 September 2013) Investment Manager

Baker Steel Capital Managers

Ivanhoe Mines Limited 22.0% NAV LLP

A company listed on the Toronto Stock Exchange

with major copper and zinc projects in the Democratic Investment Advisers

Republic of Congo and a platinum/nickel project AWR Lloyd Capital Ltd

in South Africa. Rock Capital Partners Ltd

Bilboes Gold Limited 12.1% NAV

A private company which owns four previously producing Management Fees

gold mines in Zimbabwe. Monthly: 1/12 of 1.75%

Ironstone Resources Limited 11.7% NAV of

A private company with an iron ore/vanadium project Market Capitalisation

in Canada. Performance: 15% of NAV

Black Pearl Limited Partnership 11.6% NAV growth (if over 8% p.a.

Black Pearl is the private vehicle through which compound hurdle rate, with

the investment in the Black Pearl beach placer high watermark)

iron sands project in West Java, Indonesia is

held. Board

Gobi Coal & Energy Limited 11.3% NAV Howard Myles (Chairman)

A private company with three coking coal projects Ed Flood

in Mongolia. Charles Hansard

China Polymetallic Mining Limited 8.0% NAV Clive Newall

A company listed on the Hong Kong Stock Exchange Chris Sherwell

with a producing silver/lead/zinc mine and other

development opportunities in China. Brokers

Polar Silver Resources Limited 7.9% NAV Numis Securities Limited

A private company which holds a 50% interest in +44(0)20 7260 1000

a silver project in Russia. David Benda (corporate)

Metals Exploration plc 6.6% NAV James Glass (sales)

A company listed on the AIM market of the London

Stock Exchange with a gold project in the Philippines. Contact:

Ferrous Resources Limited 5.7% NAV Baker Steel Capital Managers

A private company with two producing iron ore LLP

mines in Brazil. 86 Jermyn Street,

South American Ferro Metals Limited 1.3% NAV London SW1Y 6JD

A company listed on the Australian Stock Exchange +44 (0) 20 7389 8237

with a producing iron ore mine in Brazil.

enquiries@bakersteelresourcestrust.com

The remainder of the Portfolio (excluding cash)

comprises five holdings totalling 2.4% NAV. Baker Steel Resources Trust

Further information is available on BSRT's website: Limited is incorporated

www.bakersteelresourcestrust.com in Guernsey

Registration Number: 51576

Arnold House, St Julian's

Avenue,

St Peter Port, Guernsey

-------------------------------------------------------------- ------------------------------------------

Important Information

This document is issued by Baker Steel Capital Managers LLP (a Limited

Liability Partnership registered in England No OC301191 and authorised

and regulated by the Financial Services Authority). The information contained

in this document is not intended to and does not constitute an offer, solicitation,

inducement, invitation or commitment to purchase, subscribe to, provide

or sell any securities, service or product or to provide any recommendations

which should be relied upon for financial, securities, investment or other

advice or to take any decision based on such information. Individual advice

should be sought from legal, financial, personal and other advisors before

making any investment or financial decision or purchasing any financial,

securities or investment-related service or product. As a registered collective

investment scheme, shares in Baker Steel Resources Trust Ltd are not permitted

to be directly offered to the public in Guernsey but may be offered to

regulated entities in Guernsey or offered to the public by entities appropriately

licensed under the Protection of Investors (Bailiwick of Guernsey) Law

1987 as amended.

The Net Asset Value ("NAV") figures stated are based on unaudited estimated

valuations of the underlying investments and not necessarily based on observable

inputs. Such estimates are not subject to any independent verification

or other due diligence and may not comply with generally accepted accounting

practices or other generally accepted valuation principles. In addition,

some estimated valuations are based on the latest available information

which may relate to some time before the date set out above. Accordingly,

no reliance should be placed on such estimated valuations and they should

only be taken as an indicative guide. Other risk factors which may be relevant

to the NAV figures are set out in the Company's Prospectus dated 31 March

2010.

----------------------------------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSFMMGGFRDGFZM

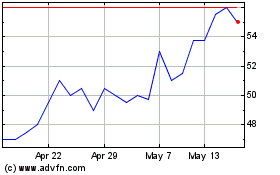

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024