Interim Management Statement (8377P)

October 10 2011 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 8377P

Baker Steel Resources Trust Ltd

10 October 2011

BAKER STEEL RESOURCES TRUST LTD

www.bakersteelresourcestrust.com

September 2011 Quarterly Factsheet

% Change

At 30 September Price/Index % Change om % Change in from

2011 Level Quarter Year Inception

------------------ ------------- ------------- ------------- -------------

Net Asset Value

(pence/share) 118.7 +1.5% +14.8% +18.7%*

------------------ ------------- ------------- ------------- -------------

Diluted Net

Asset Value

(pence/share) 115.6 +1.3% +12.4% n/a

------------------ ------------- ------------- ------------- -------------

Ordinary Share

Price

(pence/share) 98.5 -5.0% +25.5% -1.5%**

------------------ ------------- ------------- ------------- -------------

Subscription

Share Price

(pence/share) 17.5 -22.2% +12.9% n/a

------------------ ------------- ------------- ------------- -------------

MSCI World

Index 280.64 -17.9% -15.1% -9.0%

------------------ ------------- ------------- ------------- -------------

HSBC Global

Mining Index 1143.83 -25.6% -29.4% -12.0%

------------------ ------------- ------------- ------------- -------------

CRB Index 298.15 -11.8% -10.4% +9.1%

------------------ ------------- ------------- ------------- -------------

Chinese

Domestic Iron

Ore -

Hebei/Tangshan

(US$/t) 230 +10.0% +7.0% +19.8%

------------------ ------------- ------------- ------------- -------------

Copper (US$/t) 6998 -25.7% -27.5% -6.1%

------------------ ------------- ------------- ------------- -------------

Gold (US$/oz) 1623.97 +8.2% +14.3% +39.1%

------------------ ------------- ------------- ------------- -------------

Source: Bloomberg closing 27/4/10, **Issue price 28/4/10, * NAV

30/4/10

This document constitutes an interim management statement for

the period from 1 June 2011 to 10 October 2011 (the "Period").

Financial information has been drawn up as at 30/09/2011. There

have been no material changes since that date.

Review At the end of June 2011, Baker Steel Investment Objective

Resources Trust Limited ("BSRT" or "the To seek capital growth

Company") was 99.5% invested. During the over the long term through

quarter the realisation of the Company's a focused global portfolio

interest in First Coal Corporation ("First consisting principally

Coal") resulted in the percentage invested of the equities, or related

falling to 92.8% of net asset value ("NAV"). instruments, of natural

Since the period end the Company has resources companies.

returned to being close to fully invested Investment Strategy

following a further investment in October Investing predominantly

2011. During the quarter NAV per share rose in attractively valued

1.5% with the profit on the sale of First private companies with

Coal being partially offset by the fall in strong development projects

the share prices in the listed investments and focused management

in the portfolio. Following a mixed first and also in listed securities

half of 2011, markets for mining equities to exploit value inherent

fell sharply in the third quarter with the in market inefficiencies.

HSBC Global Mining Index falling 25.6%. The Asset Allocation

performance of commodities themselves was Unlisted Equities GBP65.3

mixed with iron ore and gold holding up well M 83.3 %

and base metals such as copper falling Listed Equities GBP 7.5

heavily. The emphasis of markets generally M 9.5 %

has been one of de-risking as investors Net Cash & GBP 5.6 M 7.2

continue to be concerned by debt levels in %

the western economies and the crisis of Equivalents

confidence in the Eurozone. For example, as Net Assets GBP78.4 M

the gold price has risen, the margins of Gearing: NIL

gold producers have generally widened but Shares in Issue

the market's lack of appetite for risk and Trading: The London Stock

equities in general has resulted in gold Exchange Ordinary: 66,033,061

share prices falling rather than rising, as Code: BSRT

might be expected with enhanced ISIN GG00B6686L20

profitability. During the quarter the Subscription: 13,194,622

Company made one significant addition to its Code: BSRW

portfolio, investing GBP3.75 million in ISIN GG00B64WLC23

Metals Exploration plc, an AIM listed Financial Calendar

company, as part of a larger strategic stake Listing Date: 28 April

alongside other funds managed by Baker 2010

Steel. Metals Exploration plc holds the Year End: 31 December

Runruno gold project in the Philippines Interims: August

where a feasibility study has been completed Finals April

into a mine producing approximately 100,000

ounces of gold per annum. During the

quarter, the Company made its first major

realisation following the takeover of First

Coal Corporation by Xstrata Coal in an all

cash offer. After taking into account

Canadian tax payable, the Company made a

gain of C$6.75 million on its investment

representing a return of 129%. Outlook One

of the main avenues for realisations of the

Company's investments is through IPOs on

relevant stock exchanges. Several of the

companies in the portfolio had been planning

IPO's during the second half of 2011. These

plans have been disrupted by the recent

turbulent markets but they are well

positioned for when market conditions

normalise. The Company's strategy has been

to invest in projects with sufficient

quality and scale that they would be

attractive to major mining companies. The

balance sheets of the majors are currently

very strong and this, in the meantime,

remains a route for realisations as was

demonstrated by the First Coal sale.

--------------------------------------------- -------------------------------

Largest Investments (at 30 September Investment Manager Baker Steel

2011) Ivanhoe Nickel and Platinum Capital Managers LLP Investment

Limited 27.9% NAV A private company Advisers AWR Lloyd Capital Ltd Rock

with a major copper project in the Capital Partners Ltd Management Fees

Democratic Republic of Congo and a Monthly: 1/12 of 1.75% of Market

platinum/nickel project in South Capitalisation Performance: 15% of

Africa. Ferrous Resources Limited NAV growth (if over 8% p.a. compound

14.0% NAV A private company with five hurdle rate, with high watermark)

iron ore projects in Brazil, Board Howard Myles (Chairman) Ed

containing Joint Ore Resource Flood Charles Hansard Clive Newall

Committee ("JORC") resources of 5.1 Chris Sherwell Joint Brokers RBC

billion tonnes of iron ore. Gobi Coal Capital Markets +44(0)20 7653 4253

& Energy Limited 13.9% NAV A private Winterflood Investment Trusts

company with three coking coal +44(0)20 3100 0000 Contact: Baker

projects in Mongolia with a JORC Steel Capital Managers LLP 86 Jermyn

compliant resource of 322 million Street, London SW1Y 6JD +44 (0) 20

tonnes. Ironstone Resources Limited 7389 8237

6.5% NAV A private company with an enquiries@bakersteelresourcestrust.co

iron ore/vanadium project in Canada. m Baker Steel Resources Trust Ltd is

It has a NI-43-101 compliant resource incorporated in Guernsey Registration

of 203 million tonnes of iron ore. Number: 51576 Arnold House, St

Silver China 5.6% NAV A private Julian's Avenue, St Peter Port,

company with a producing Guernsey

silver/lead/zinc mine and other

development opportunities in China.

Metals Exploration plc 4.9% NAV A

company listed on the AIM market of

the London Stock Exchange whose main

asset is the Runruno gold project in

the Philippines. Bilboes Holdings

(Pvt) Limited 4.9% NAV A private

company which owns four previously

producing gold mines in Zimbabwe.

Copperbelt Minerals Limited 4.4% NAV

A private company with a 68% interest

in the Deziwa Copper-Cobalt Project

in the Democratic Republic of Congo.

Polar Silver 4.4% NAV A private

company which holds a 50% interest in

the Prognoz silver project in Russia

which has JORC resources containing

293 million ounces of silver. The

remainder of the Portfolio (excluding

cash) comprises six holdings totaling

6.3% NAV. Further information is

available on BSRT's website:

www.bakersteelresourcestrust.com

-------------------------------------- --------------------------------------

Important Information This document is issued and approved by Baker Steel

Capital Managers LLP (authorised and regulated by the Financial Services

Authority). The information contained in this document is not intended to and

does not constitute an offer, solicitation, inducement, invitation or

commitment to purchase, subscribe to, provide or sell any securities, service

or product or to provide any recommendations which should be relied upon for

financial, securities, investment or other advice or to take any decision

based on such information. Individual advice should be sought from legal,

financial, personal and other advisors before making any investment or

financial decision or purchasing any financial, securities or

investment-related service or product. As a registered collective investment

scheme, shares in Baker Steel Resources Trust Ltd are not permitted to be

directly offered to the public in Guernsey but may be offered to regulated

entities in Guernsey or offered to the public by entities appropriately

licensed under the Protection of Investors (Bailiwick of Guernsey) Law 1987

as amended.

------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSFMMGGGRNGMZM

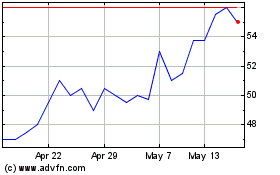

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024