Avation PLC TURBO-PROP PORTFOLIO (6443Z)

March 16 2017 - 3:00AM

UK Regulatory

TIDMAVAP

RNS Number : 6443Z

Avation PLC

16 March 2017

AVATION PLC

TURBO-PROP PORTFOLIO

Avation PLC (LSE: AVAP, "Avation" or the "Company"), the

commercial passenger aircraft leasing company, announced on 26

October 2016 that it had received an expression of interest to

purchase a portfolio of 22 ATR 72 aircraft. With the assistance of

a financial adviser the Company ran a global process to consider

the proposal and benchmark alternative bids associated with the

potential sale of such a portfolio.

The Company carefully considered the process for the sale of the

portfolio. It was pleased to receive eight offers for all or parts

of the portfolio. In reviewing the offers, the Company considered

the consequential impact on revenues of the business, the impact to

the Company's credit ratings, lessee diversification and

concentration, the potential for redeployment of the sale proceeds

and other factors.

After due and careful consideration, the Company has decided

that the optimal commercial outcome is a sale of a smaller

portfolio of aircraft. The Company is currently in discussion with

a single commercial lessor for a proposed sale of six existing

leased ATR 72 aircraft. The Company has executed a conditional

letter of intent with the proposed purchaser which has made a $3

million cash deposit, refundable in the event of non-completion.

The transaction is expected to close prior to the end of June 2017

with an economic closing date of 7 of April 2017. The transaction

is subject to entering into definitive sale documentation and the

usual conditions of transactions of this type, including the

purchaser novating debt finance and technical inspections.

Assuming the transaction completes, as it remains conditional,

the outcome is at a price above the Company book value for these

aircraft and releases approximately $31 million in net proceeds to

the Company after transaction costs and debt repayment. The

Directors will carefully consider the redeployment of proceeds

through the acquisition of a diversified portfolio of leased

aircraft.

The Company may pay a dividend in the ordinary course of

business associated with the Company's year-end. There is no

special dividend under consideration in relation to this

transaction.

Executive Chairman Jeff Chatfield said "This was an extremely

positive process for the Company, eight existing and new lessors

were interested in part or all of the ATR portfolio. Many of these

bidders offered to pay cash above book value. But, in our view

selling such a large proportion of our fleet would reduce revenues

too dramatically. Aircraft valuations remain high, with a rush of

new liquidity into the aircraft lessor market. The efficient

redeployment of the proceeds from the sale of 22 aircraft would

therefore be challenging in the current aircraft pricing

environment. In our view the exercise did validate the Company

aircraft valuations and verified our business model.

"In electing to sell six aircraft, we expect to release

approximately $31 million in equity (before costs), which can then

be leveraged. We are confident the proceeds can be redeployed in a

sensible manner in the near term.

"The Company remains extremely confident in the ATR aircraft

which is the leading turboprop in the world with about 85% global

market share. The Company has three ATR-72s to place in 2017 and a

further six in future years with 27 additional options over new

aircraft. The Company plans to continue to invest in ATR-72s in

addition to jet aircraft. Avation PLC is in net growth mode in 2017

and is actively seeking airline sale and lease backs along with

secondary trade transactions with other lessors."

-ENDS-

More information on Avation can be seen at: www.avation.net

Enquiries:

Avation

Jeff Chatfield, Executive T: +65 6252 2077

Chairman

Notes to Editors:

Avation PLC is a commercial passenger aircraft leasing company,

owning and managing a fleet of 40 jet and turboprop aircraft which

it leases to airlines across the world. The Company's customers

include Air France, Air Berlin, Air India, Condor, Flybe, Fiji

Airways, Thomas Cook, Virgin Australia, UNI Air and Vietjet

Air.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISUNVNRBVAOARR

(END) Dow Jones Newswires

March 16, 2017 03:00 ET (07:00 GMT)

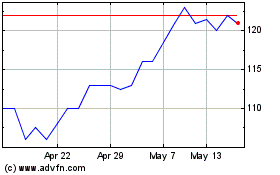

Avation (LSE:AVAP)

Historical Stock Chart

From Apr 2024 to May 2024

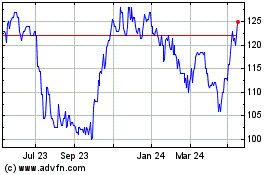

Avation (LSE:AVAP)

Historical Stock Chart

From May 2023 to May 2024