RNS Number:5287D

Andrews Sykes Group PLC

30 September 2004

ANDREWS SYKES GROUP PLC

Interim Results for the 27 weeks ended 3 July 2004

Dear Shareholders

I have pleasure in presenting the results of our Group for the 27 weeks ended 3

July 2004.

Overview

Overall our Group's performance in the first half of 2004 has been satisfactory.

The salient features of the results for the 27 weeks ended 3 July 2004 compared

with the 26 weeks ended 28 June 2003 are as follows:

* Earnings before Interest, Taxation, Depreciation and Goodwill

Amortisation (EBITDA, as reconciled on the face of the profit and loss

account) derived from continuing operations increased by 2.5% from #8.6

million to #8.8 million.

* Profit on ordinary activities before tax has increased by 10.4% from

#5.6 million to #6.2 million.

* Basic earnings per share has increased by 14.2% from 6.46 pence to

7.38 pence.

* Gearing has been further reduced from 27.6% as at 27 December 2003 to

20.4% as at 3 July 2004 reflecting the Group's strong underlying cash

generative abilities.

Financial review

In previous statements I have reported to you that our Board has been following

two key financial strategies. Firstly costs have been set at levels allowing us

to respond to peaks in demand and yet achieve high levels of profitability in

medium and low demand times. Secondly focussed initiatives have been followed

to develop the specialist hire markets which the Board considers have the

highest potential for profit growth. I am pleased to be able to report that both

these initiatives have, yet again, proved to be effective in the first half of

2004.

Even though the UK had unusually dry weather conditions during the first half of

this year, the level of turnover achieved by our main UK trading company,

Andrews Sykes Hire, was approximately #0.8 million higher in 2004 than in 2003.

Our strategies have therefore proven to be beneficial and have been responsible

for the increase in the Group's profit on ordinary activities before tax of #0.6

million from #5.6 million to #6.2 million. This indicates the strong underlying

profitability of our Group and demonstrates that even in difficult weather

conditions an excellent level of profit can be maintained.

Cash flow and gearing

Our Group continues to generate strong cash flows with a net cash inflow from

operating activities of #6.6 million in the first half of 2004, an increase of

#0.4 million over the same period last year. Gearing has been reduced from 27.6%

at 27 December 2003 to 20.4% at 3 July 2004 despite the payment of the 2003

final dividend of #1.7 million.

Earnings per share, share buy back programme and interim dividend

Mainly due to improvements in the Group's profit after taxation, the basic

earnings per share has increased from 6.46 pence in the first half of 2003 to

7.38 pence in the same period this year. Whilst the share buy back programme has

been very beneficial to the company in the past, the Board now believes that it

a dividend payment policy is now in the best interest of shareholders.

Accordingly I am pleased to announce that the Board has declared an interim

dividend of 1.0 pence per ordinary share. This will be paid on 4 November 2004

to shareholders on the register on 8 October 2004. The shares will go ex

dividend on 6 October 2004.

Prospects

The results for the third quarter of 2004 have been affected by the unusually

cold weather conditions in July and August which didn't stimulate the demand for

temperature control equipment.

September trading is in line with expectations and with the return of normal

weather conditions the Group is well positioned to benefit in the future from

the commercial strategies implemented since the beginning of the year.

JG Murray

Chairman

29 September 2004

Consolidated Profit and Loss Account for the 27 weeks ended 3 July 2004

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

(as restated*)

Continuing Continuing Continuing

activities activities activities

#'000 #'000 #'000

Turnover 31,407 32,371 68,252

Cost of sales -15,291 -16,810 -34,084

Gross profit 16,116 15,561 34,168

Distribution costs -4,745 -4,641 -9,647

Administrative expenses -4,949 -5,020 -10,080

Other operating income 18 - 5

Operating profit 6,440 5,900 14,446

EBITDA ** 8,773 8,556 19,666

Depreciation and asset disposals -2,326 -2,649 -5,206

Operating profit before goodwill amortisation 6,447 5,907 14,460

Goodwill amortisation -7 -7 -14

Operating profit 6,440 5,900 14,446

Profit on the disposal of a business - discontinued - - 598

Net interest payable -225 -272 -470

Profit on ordinary activities before taxation 6,215 5,628 14,574

Tax on profit on ordinary activities -1,938 -1,778 -4,617

Profit on ordinary activities after taxation being profit 4,277 3,850 9,957

for the financial period

Dividends proposed on equity shares -580 - -1,740

Retained profit for the financial period attributable to 3,697 3,850 8,217

ordinary shareholders

Basic earnings per ordinary share (pence) 7.38p 6.46p 16.82p

Diluted earnings per ordinary share (pence) 7.08p 6.25p 16.25p

Goodwill amortisation (pence) 0.01p 0.01p 0.02p

Exceptional items (pence) - - -0.97p

Adjusted diluted earnings per ordinary share (pence) 7.09p 6.26p 15.30p

Equity dividend per share (pence) 1.00p - 3.00p

* The comparative figures for the 26 weeks ended 28 June 2003 have been

restated (i) to comply with UITF 38 - Accounting for ESOP Trusts - which was

issued in December 2003, (ii) the reclassification of certain property and

salary expenses out of administration to distribution costs as this more

appropriately reflects the nature of the expense and the reclassification of

certain overseas costs to ensure consistency with 2003.

** Earnings Before Interest, Taxation, Depreciation and Amortisation.

There were no material acquisitions in any period.

Consolidated Balance Sheet as at 3 July 2004

3 July 28 June 27 December

2004 2003 2003

(as restated*)

#'000 #'000 #'000

Fixed assets

Intangible assets: Goodwill 52 66 59

Tangible assets 16,755 16,196 18,015

Investments 164 164 164

16,971 16,426 18,238

Current assets

Stocks 4,950 5,507 5,616

Debtors 15,999 16,988 14,953

Cash at bank and in hand 10,904 9,482 11,251

31,853 31,977 31,820

Creditors falling due within one year

Loans and overdrafts -3,119 -3,740 -3,749

Other creditors -9,197 -10,879 -10,715

Purchase of own shares - -47 -458

Corporation and overseas tax -2,680 -2,832 -3,191

Dividends -580 - -1,740

-15,576 -17,498 -19,853

Net current assets 16,277 14,479 11,967

Receivable within one year 16,277 13,260 11,967

Due after more than one year - 1,219 -

16,277 14,479 11,967

Total assets less current liabilities 33,248 30,905 30,205

Creditors falling due after more than one year

Loans -11,980 -14,470 -12,225

Provisions for liabilities and charges -725 -1,480 -869

Net assets 20,543 14,955 17,111

Capital and reserves

Called up share capital 11,598 11,836 11,615

Share premium account 10,678 10,476 10,678

Revaluation reserve 749 754 752

Other reserves 7,392 7,113 7,378

Profit and loss account -9,859 -15,077 -13,284

ESOP reserve -25 -157 -38

Equity shareholders' funds 20,533 14,945 17,101

Minority interests (equity) 10 10 10

20,543 14,955 17,111

* The comparative figures for the 26 weeks ended 28 June 2003 have been

restated to comply with UITF 38 - Accounting for ESOP Trusts - which was issued

in December 2003.

Consolidated Cash Flow Statement for the 27 weeks ended 3 July 2004

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

#'000 #'000 #'000

Net cash inflow from operating activities 6,555 6,224 17,329

Returns on investments and servicing of finance

Interest received 173 163 335

Interest paid -396 -371 -828

Net cash outflow for returns on investments and servicing of -223 -208 -493

finance

Cash outflow for taxation -2,175 -1,143 -3,214

Capital expenditure

Purchase of tangible fixed assets -2,002 -2,348 -7,405

Purchase of shares held in ESOP - -88 -88

Sale of tangible fixed assets 818 273 868

Sale of shares held in ESOP 12 82 176

Net cash outflow for capital expenditure -1,172 -2,081 -6,449

Acquisitions and disposals

Cash received following the disposal of a business - - 1,500

Net cash inflow for acquisitions and disposals - - 1,500

Equity dividends paid -1,740 - -

Cash inflow before the use of liquid resources and financing 1,245 2,792 8,673

Management of liquid resources

Movement in bank deposits 476 -2,493 3,862

Financing

Issue of ordinary share capital net of issue costs - - 252

New loans drawn down - - 1,259

Loan repayments -875 -245 -3,740

Purchase of own shares -630 -1,802 -3,883

Net cash outflow from financing -1,505 -2,047 -6,112

Increase / (decrease) in cash in the period 216 -1,748 6,423

Analysis of net debt

Bank current and deposit accounts and cash in hand 10,904 9,482 11,251

Total loans and overdrafts -15,099 -18,210 -15,974

Net debt -4,195 -8,728 -4,723

Net debt as a percentage of shareholders' funds (as -20.4% -58.4% -27.6%

restated)

Consolidated Statement of Total Recognised Gains and Losses for the 27 weeks

ended 3 July 2004

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

(as restated)

#'000 #'000 #'000

Profit for the financial period 4,277 3,850 9,957

Currency translation differences on foreign currency net -105 36 -18

investments

Total recognised gains and losses in the period 4,172 3,886 9,939

Notes to the accounts for the 27 weeks ended 3 July 2004

1. Basis of preparation

The interim report for the 27 weeks ended 3 July 2004 was approved by the Board

on 29 September 2004. The financial information contained in this interim report

does not constitute statutory accounts for the Group for the relevant periods.

The interim report is neither audited nor reviewed. The results for the 52 weeks

ended 27 December 2003 have been extracted from the audited financial statements

that have been filed with the Registrar of Companies. The report of the auditors

was unqualified and did not contain a statement under section 237(2) or (3) of

the Companies Act 1985.

The financial information has been prepared in accordance with the accounting

policies adopted within the financial statements for the 52 weeks ended 27

December 2003.

2. Segmental analysis

The Group's turnover may be analysed between the following principal activities:

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

#'000 #'000 #'000

Activity:

Hire 20,195 20,549 43,537

Sales 6,135 6,737 13,990

Installation 5,077 5,085 10,725

Total 31,407 32,371 68,252

The geographical analysis of the Group's turnover was as follows:

By origination: 27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

#'000 #'000 #'000

United Kingdom 28,419 29,249 61,925

Rest of Europe 1,212 1,602 3,239

Middle East and Africa 1,776 1,520 3,088

31,407 32,371 68,252

By destination: 27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

#'000 #'000 #'000

United Kingdom 27,892 28,454 60,196

Rest of Europe 1,317 2,067 4,388

Middle East and Africa 1,832 1,570 3,153

Rest of World 366 280 515

31,407 32,371 68,252

The analysis of profit before interest and tax and net assets by geographical

origin was as follows:

Profit before interest and tax Net assets

27 weeks to 26 weeks to 52 weeks to As at As at As at

3 July 28 June 27 December 3 July 28 June 27 December

2004 2003 2003 2004 2003 2003

#'000 #'000 #'000 #'000 #'000 #'000

United Kingdom 5,694 5,360 13,983 24,541 23,668 24,211

Rest of Europe 469 388 771 1,528 1,263 1,155

Middle East and Africa 277 152 290 1,929 1,584 1,399

6,440 5,900 15,044 27,998 26,515 26,765

Net debt -4,195 -8,728 -4,723

Taxation and dividends payable -3,260 -2,832 -4,931

20,543 14,955 17,111

3. Reconciliation of operating profit to net cash inflow from operating activities

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

(as restated)

#'000 #'000 #'000

Operating profit 6,440 5,900 14,446

Goodwill amortisation 7 7 14

Depreciation 2,847 2,709 5,575

Profit on sale of fixed assets -521 -60 -369

Decrease /(increase) in stocks 666 -815 -924

Increase in debtors -1,266 -1,223 -847

Decrease in creditors and provisions -1,618 -294 -566

Net cash inflow from operating activities 6,555 6,224 17,329

4. Earnings per share

The basic figures have been calculated by reference to the weighted average

number of 20p ordinary shares in issue, excluding those in the ESOP reserve,

during the period of 57,968,589 (26 weeks ended 28 June 2003: 59,605,878).

The calculation of the diluted earnings per ordinary share is based on the

profits as set out in the table below and on 60,421,720 (26 weeks ended 28 June

2003: 61,557,328) ordinary shares. The share options have a dilutive effect for

the period calculated as follows:

27 weeks to 3 July 2004 26 weeks to 28 June

2003

(as restated)

Total Number of Total Number of

earnings shares earnings shares

#'000 #'000

Basic earnings/weighted average number of shares 4,277 57,968,589 3,850 59,605,878

Weighted average number of shares under option 4,362,604 4,710,057

No. of shares that would have been issued at fair -1,909,473 -2,758,607

value

Earnings/ diluted weighted average number of shares 4,277 60,421,720 3,850 61,557,328

Diluted earnings per ordinary share (pence) 7.08p 6.25p

The adjusted diluted earnings per share excluding goodwill amortisation is based

upon the weighted average number of ordinary shares as set out in the table

above. The earnings can be reconciled to the adjusted earnings as follows:

27 weeks to 3 26 weeks to

July 2004 28 June 2003

(as

restated)

#'000 #'000

Earnings 4,277 3,850

Goodwill amortisation 7 7

Adjusted earnings 4,284 3,857

Adjusted diluted earnings per ordinary share (pence) 7.09p 6.26p

5. Reconciliation of movements in Group shareholders' funds

27 weeks to 26 weeks to 52 weeks to

3 July 28 June 27 December

2004 2003 2003

(as restated)

#'000 #'000 #'000

Profit for the financial period 4,277 3,850 9,957

Dividends -580 - -1,740

Other recognised gains and losses -105 36 -18

Proceeds from ordinary shares issued - - 252

Consideration for the purchase of own shares -172 -1,849 -4,341

Sale of own shares by the ESOP trust 12 93 176

Purchase of own shares by the ESOP trust - -88 -88

Net increase in shareholders' funds 3,432 2,042 4,198

Shareholders' funds at the beginning of the period 17,101 12,903 12,903

Shareholders' funds at the end of the period 20,533 14,945 17,101

6. Distribution of Interim Statement

A copy of this statement will be posted to all shareholders and is available

from the Company's registered office at Premier House, Darlington Street,

Wolverhampton, WV1 4JJ.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFVLARIIVIS

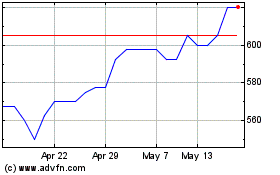

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024