RNS Number:1195Y

Andrews Sykes Group PLC

29 April 2004

Andrews Sykes Group plc

Preliminary Results for the 52 weeks ended 27 December 2003

FINANCIAL HIGHLIGHTS

* The basic earnings per share increased by 45.5% from 11.56 pence to

16.82 pence

* EBITDA* from continuing operations increased by #1.5 million from last

year at #19.7 million

* Profit on ordinary activities before taxation increased by #2.4 million

from last year to #14.6 million

* Net debt reduced by #5.1 million from last year at #4.7 million

representing 27.6% of equity shareholders' funds

SUMMARY OF RESULTS

52 weeks ended 52 weeks ended

27 December 2003 28 December 2002

#'000 #'000

Turnover from continuing operations 68,252 64,477

EBITDA* from continuing operations 19,666 18,204

Profit on ordinary activities before taxation 14,574 12,167

Basic earnings per share (pence) 16.82p 11.56p

Proposed final dividend per share (pence) 3.0p -

Net Debt 4,723 9,751

Gearing 27.6% 75.6%

* Earnings before interest, taxation, depreciation, exceptional items and

goodwill charges (as reconciled on the face of the consolidated profit and loss

account)

CHAIRMANS STATEMENT

Summary of results

I am pleased to be able to report that your Group has achieved another

satisfactory result in the year under review. The Group's profit on ordinary

activities before taxation was #14.6 million which, after a tax charge of #4.6

million, gives a profit for the financial period of #10.0 million. The basic

earnings per share has increased from 11.6 pence to 16.8 pence and I am pleased

to announce that the Board has proposed a final dividend of 3.0 pence per share.

As I reported to you last year we have reorganised the UK core businesses by

reducing the fixed costs and linking them to a sustainable level of turnover.

This has proved to be beneficial during 2003 although, in common with many other

companies, significant increases in liability insurance have masked these

benefits. Focussed initiatives to improve turnover have also lead to substantial

improvements in the Group's operating profit. The Board's strategy for

developing the specialist hire and rental markets, where the margins and the

potential for profit growth are considered to be the greatest, is proving to be

effective and will continue to be followed.

Even after cash outflows of #3.9 million attributable to the share buy back

programme, net debt has been significantly reduced by #5.1 million from #9.8

million last year to #4.7 million at 27 December 2003 thereby demonstrating our

Group's strong cash generative performance in the period.

I consider that the Group is in a strong financial position and is well placed

to be able to take advantage of commercial opportunities as and when they arise.

Overview of continuing operations

Turnover from continuing operations increased by #3.8 million from #64.5 million

to #68.3 million and operating profit from continuing operations increased by

#1.7 million from #12.7 million to #14.4 million in 2003. The majority of these

improvements are attributable to our main UK core business, Andrews Sykes Hire,

whose turnover increased by #3.3 million to #38.9 million. Due to focussed

initiatives to increase turnover the operating profit of this company increased

by #1.8 million to #11.5 million.

Weather was also a factor in the above results, but in different and opposing

ways. Whilst last year summer in the UK and Northern Europe was unusually hot

and dry, giving ideal conditions for our air conditioning hire business which

ran for several months at maximum utilisation, it also caused problems for our

pumping business which suffered because of the unusually low water table levels.

Overall, however, the results show a significant improvement compared with last

year and this underlines the benefits of a clear strategy and a diverse but

complementary product range which enables satisfactory profits to be achieved

whatever the weather conditions.

The UK fixed air conditioning installation business operated through Andrews Air

Conditioning & Refrigeration achieved an operating profit of #0.7 million, the

same as that achieved in 2002. Business activity grew by #1.4 million, or 16.7%,

compared with last year but downward pressure on margins and increases in

variable costs eliminated the volume gains achieved.

The Group's well established heating drying and air conditioning business in The

Netherlands also had another very successful year returning an operating profit

of #0.9 million compared with #0.8 million last year. Similarly our operation in

the Middle East, Khansaheb Sykes LLC, continues to perform well and it returned

an operating profit of #0.3 million which is unchanged from last year.

The above improvements in our core businesses were, however, partially eroded by

reduced profits in two of our smaller businesses.

Further details of the financial performance are given in the financial review

contained within the Annual report and financial statements. I remain confident

that our strategy of continuing to concentrate upon developing the UK specialist

hire and rental markets by organic growth, supplemented by niche market

acquisitions in the appropriate market sectors as and when opportunities arise,

offers the best opportunity for future profit growth and added shareholder

value. Therefore these policies will continue to be adopted.

Earnings per share and share buy back programme

As set out in note 6, the adjusted diluted earnings per share, which excludes

the exceptional gain of #0.6 million on the disposal of Cox Plant, is 15.3 pence

compared with 11.5 pence last year. The Board continues to believe that

shareholder value will be optimised by the purchase, when appropriate, of our

own shares coupled with investment in organic growth. Consequently the Board

will request that shareholders vote in favour of a resolution to renew the

authority to purchase up to 12.5% of the ordinary shares in issue.

Dividend

The Board is pleased to propose a final dividend of 3.0 pence per share. This

will be paid on 11 June 2004 to shareholders on the register on 14 May 2004.

Outlook

The results of the first quarter of 2004 are in line with both last year and

expectations. I expect that the Group will achieve another successful year.

JG Murray

Chairman

28 April 2004

Consolidated profit and loss account

For the 52 weeks ended 27 December 2003

52 weeks ended 52 weeks ended 28 December 2002

27 December 2003 (as restated)

Total Continuing Discontinued Total

operations operations

#'000 #'000 #'000 #'000

Turnover 68,252 64,477 6,067 70,544

Cost of sales (34,084) (33,043) (4,299) (37,342)

Gross profit 34,168 31,434 1,768 33,202

Distribution costs (9,647) (9,050) (1,033) (10,083)

Administrative expenses (10,080) (9,724) (885) (10,609)

Other operating income 5 21 - 21

Operating profit / (loss) 14,446 12,681 (150) 12,531

EBITDA * 19,666 18,204 1,028 19,232

Depreciation and asset disposals (5,206) (5,468) (1,178) (6,646)

Operating profit / (loss) before goodwill 14,460 12,736 (150) 12,586

amortisation

Goodwill amortisation (14) (55) - (55)

Operating profit / (loss) 14,446 12,681 (150) 12,531

Profit on the disposal of a business - discontinued 598 -

Profit before interest 15,044 12,531

Net interest payable (470) (364)

Profit on ordinary activities before taxation 14,574 12,167

Tax on profit on ordinary activities (4,617) (3,850)

Profit on ordinary activities after taxation being

profit for the financial period 9,957 8,317

Dividends proposed:

Equity shares (1,740) -

Retained profit for the financial period

attributable to ordinary shareholders 8,217 8,317

Basic earnings per ordinary share (pence) 16.82 11.56

Diluted earnings per share (pence) 16.25 11.42

Add back: Goodwill amortisation 0.02 0.08

Exceptional items (0.97) -

Adjusted diluted earnings per share (pence) 15.30 11.50

Dividends per share (pence):

Equity shares 3.00 -

Non equity shares - -

Activities in the current year derive from continuing operations. There were no

material acquisitions in either period.

* Earnings before interest, taxation, depreciation, and amortisation excluding

exceptional items.

The comparative figures have been restated to (i) comply with UITF 38 -

Accounting for ESOP Trusts - which was issued in December 2003, (ii) the

reclassification of certain property and salary expenses out of administration

to distribution costs as this more appropriately reflects the nature of the

expense and the reclassification of certain overseas costs to ensure consistency

with 2003.

Consolidated Balance Sheet

At 27 December 2003

27 December 28 December

2003 2002

As restated

#'000 #'000

Fixed assets

Intangible assets: Goodwill 59 73

Tangible fixed assets 18,015 16,638

Investments 164 164

18,238 16,875

Current assets

Stocks 5,616 4,692

Debtors 14,953 15,614

Cash at bank and in hand 11,251 8,704

31,820 29,010

Creditors: Amounts falling due within one year

Bank loans (3,749) (2,490)

Other creditors (11,173) (10,881)

Proposed dividends (1,740) -

Corporation and overseas tax (3,191) (2,018)

(19,853) (15,389)

Net current assets 11,967 13,621

Receivable within 1 year 11,967 11,292

Due after more than one year - 2,329

11,967 13,621

Total assets less current liabilities 30,205 30,496

Creditors: Amounts falling due after more than one year

Bank loans (12,225) (15,965)

Provisions for liabilities and charges (869) (1,618)

Net assets 17,111 12,913

Capital and reserves

Called up share capital 11,615 12,044

Share premium account 10,678 10,476

Revaluation reserve 752 757

Other reserves 7,378 6,907

Profit and loss account (13,284) (17,104)

ESOP reserve (38) (177)

Equity shareholders' funds 17,101 12,903

Minority interests (equity) 10 10

17,111 12,913

Analysis of net debt

Cash at bank and in hand 11,251 8,704

Bank loans (15,974) (18,455)

Net debt (4,723) (9,751)

As a percentage of equity shareholders' funds 27.6% 75.6%

The comparative figures have been restated to comply with UITF 38 - Accounting

for ESOP Trusts - issued in December 2003.

Consolidated cash flow statement

At 27 December 2003 52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

#'000 #'000

Net cash inflow from operating activities 17,329 18,866

Returns on investments and servicing of finance

Interest received 335 297

Interest paid (828) (724)

Net cash outflow for returns on investments and servicing of finance (493) (427)

Cash outflow for taxation (3,214) (3,373)

Capital expenditure and financial investment

Sale of own shares by ESOP 176 221

Purchase of own shares by ESOP (88) -

Purchase of tangible fixed assets (7,405) (6,020)

Sale of tangible fixed assets 868 1,076

Net cash outflow for capital expenditure and financial investment (6,449) (4,723)

Acquisitions and disposals

Cash received following the disposal of a business 1,500 7,205

Net cash inflow for acquisitions and disposals 1,500 7,205

Cash inflow before the use of liquid resources and financing 8,673 17,548

Management of liquid resources

Movement in bank deposits 3,862 (1,250)

Financing

Issue of ordinary share capital net of issue costs 252 90

Loans repaid (3,740) (17,595)

New loans drawn down 1,259 18,700

Purchase of own shares for cancellation (3,883) (17,819)

Net cash outflow from financing (6,112) (16,624)

Increase / (decrease) in cash in the period 6,423 (326)

Notes to the financial statements

For the 52 weeks ended 27 December 2003

1. Segmental analysis

The Group's turnover may be analysed between the following principal activities:

52 weeks ended 52 weeks ended 28 December 2002

27 December 2003

Total Continuing Discontinued Total

Continuing

#'000 #'000 #'000 #'000

Activity:

Hire 43,537 40,643 5,489 46,132

Sales 13,990 14,336 578 14,914

Installation 10,725 9,498 - 9,498

Total 68,252 64,477 6,067 70,544

The integrated nature of the Group's operations does not permit a meaningful

analysis of net assets by the above activities.

The results can be further analysed by class of business as follows:

52 weeks ended 27 December 2003:

Profit before Profit /(loss) Net assets

exceptionals Exceptionals before

& goodwill & goodwill interest

Turnover amortisation amortisation and tax

#'000 #'000 #'000 #'000 #'000

Pumps, heating, ventilation, air conditioning,

accommodation and other 68,252 14,460 (14) 14,446 26,765

General Plant - - 598 598 -

68,252 14,460 584 15,044 26,765

Net debt (4,723)

Taxation and dividends payable (4,931)

17,111

52 weeks ended 28 December 2002 (as restated):

Pumps, heating, ventilation, air conditioning,

accommodation and other 64,477 12,736 (55) 12,681 24,682

General Plant 6,067 (150) - (150) -

70,544 12,586 (55) 12,531 24,682

Net debt (9,751)

Taxation (2,018)

12,913

The geographical analysis of the Group's turnover was as follows:

By geographical By geographical

origin destination

52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended

27 December 28 December 27 December 28 December

2003 2002 2003 2002

#'000 #'000 #'000 #'000

United Kingdom 61,925 64,396 60,196 63,650

Rest of Europe 3,239 3,174 4,388 3,809

Middle East and Africa 3,088 2,974 3,153 3,069

Rest of World - - 515 16

68,252 70,544 68,252 70,544

The analysis of profit before interest and tax and net assets by geographical

origin was as follows:

Profit before interest Net assets Net assets

and tax

52 weeks 52 weeks

ended ended

27 December 28 December 27 December 28 December

2003 2002 2003 2002

(as restated) (as restated)

#'000 #'000 #'000 #'000

United Kingdom 13,983 11,538 24,211 22,504

Rest of Europe 771 720 1,155 943

Middle East and Africa 290 273 1,399 1,235

15,044 12,531 26,765 24,682

Net debt (4,723) (9,751)

Taxation and dividends payable (4,931) (2,018)

17,111 12,913

2. Reconciliation of operating profit to net cash inflow from operating

activities

52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

(as restated)

#'000 #'000

Operating profit 14,446 12,531

Goodwill amortisation 14 55

Depreciation 5,575 6,841

Profit on sale of tangible fixed assets (369) (195)

Increase in stocks (924) (425)

Increase in debtors (847) (989)

(Decrease) / increase in creditors and provisions (566) 1,048

Net cash inflow from operating activities 17,329 18,866

3. Reconciliation of net cash flow to movement in net debt

52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

#'000 #'000

Increase / (decrease) in cash in the period 6,423 (326)

Cash outflow / (inflow) from movement in net debt 2,481 (1,105)

Cash (inflow) / outflow from movement in liquid resources (3,862) 1,250

Change in net debt resulting from cash flows 5,042 (181)

Translation differences (14) (41)

Movement in period 5,028 (222)

Opening net debt (9,751) (9,529)

Closing net debt (4,723) (9,751)

4. Consolidated statement of total recognised gains and losses

52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

#'000 #'000

Profit for the financial period 9,957 8,317

Currency translation differences on foreign currency net investments (18) (64)

Total gains and losses in the period 9,939 8,253

Note on prior period adjustment

Total recognised gains and losses relating to the year as above 9,939

Prior period adjustment 43

Total gains and losses recognised since the last Annual Report 9,982

5. Reconciliation of movements in Group shareholders' funds

52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

(as restated*)

#'000 #'000

Profit for the financial period 9,957 8,317

Dividends (1,740) -

Other recognised gains and losses (18) (64)

Issue of ordinary shares 252 90

Purchase of own shares for cancellation (4,341) (17,819)

Sale of own shares by the ESOP trust 176 221

Purchase of own shares by the ESOP trust (88) -

Net increase / (decrease) in shareholders' funds 4,198 (9,255)

Shareholders' funds at the beginning of the period (as restated) 12,903 22,158

Shareholders' funds at the end of the period 17,101 12,903

*The opening shareholders' funds at 29 December 2002 as previously reported

amounted to #13,080,000 before the prior year adjustment of #177,000 that was

required in order to comply with UITF 38 - Accounting for ESOP Trusts - that was

issued in December 2003.

6. Earnings per ordinary share

The basic figures have been calculated by reference to the weighted average

number of ordinary 20 pence shares in issue during the period of 59,186,675

(52 weeks ended 28 December 2002: 71,949,134).

The calculation of the diluted earnings per ordinary share is based on a profit

of #9,957,000 (52 weeks ended 28 December 2002 as restated: #8,317,000) and on

61,255,953 (52 weeks ended 28 December 2002: 72,815,175) ordinary shares. The

share options have a dilutive effect for the period ended 27 December 2003

calculated as follows:

52 weeks ended 52 weeks ended 28

27 December 2003 December 2002

(as restated)

Earnings Number of Earnings Number of

#'000 shares #'000 shares

Basic earnings / weighted average number of shares 9,957 59,186,675 8,317 71,949,134

Weighted average number of shares under option 4,372,604 4,717,604

Number of shares that would have been issued at fair value (2,303,326) (3,851,563)

Earnings / diluted weighted average number of shares

9,957 61,255,953 8,317 72,815,175

Diluted earnings per ordinary share (pence) 16.25 11.42

The adjusted diluted earnings per share excluding goodwill amortisation and

exceptional items is based upon the weighted average number of ordinary shares

as set out in the table above. The earnings can be reconciled to the adjusted

earnings as follows:

52 weeks 52 weeks

ended ended

27 December 28 December

2003 2002

(as restated)

#'000 #'000

Earnings 9,957 8,317

Goodwill amortisation 14 55

Exceptional items (598) -

Adjusted earnings 9,373 8,372

Adjusted diluted earnings per share (pence) 15.30 11.50

The above figures have been disclosed to demonstrate maintainable earnings.

7. The financial information set out above has been prepared using accounting

policies that are consistent with those adopted in the statutory accounts for

the 52 weeks ended 28 December 2002 as amended for (i) the adoption of UITF 38

"Accounting for ESOP Trusts", (ii) the reclassification of certain property and

salary expenses out of administration to distribution costs as this more

appropriately reflects the nature of the expenses and the reclassification of

certain overseas costs to ensure consistency with 2003.

As a result of these changes in accounting policies the comparative figures have

been restated. This results in an increase in operating profit of #43,000 and a

transfer of #3,950,000 to distribution costs from administrative expenses for

the 52 weeks ended 28 December 2002. The effect of the changes on the current

year is similar to the effect on the prior year. The net assets as at 28

December 2002 have been reduced by #177,000.

8. The financial information set out above does not constitute the Group's

statutory accounts for the 52 weeks ended 27 December 2003 or the 52 weeks ended

28 December 2002 but it is derived from those accounts. The financial statements

for the 52 weeks ended 28 December 2002 have been filed and those for the 52

weeks ended 27 December 2003 will be filed with the Registrar of Companies. The

Company's auditors gave unqualified reports on the accounts for both these

periods and the reports did not contain a statement under section 237 (2) or (3)

of the Companies Act 1985.

9. Copies of the Annual Report and Financial Statements will be circulated to

shareholders shortly and will be available from the Registered office of the

Company; Premier House, Darlington Street, Wolverhampton, WV1 4JJ.

10. The Company's Annual General Meeting will be held at 10.30 a.m. on 9 June

2004 at Floor 5, 10 Bruton Street, London, W1J 6PX.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR QKFKBOBKDFQB

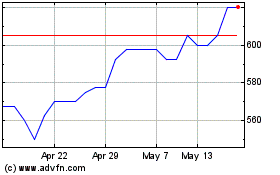

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024