TIDMASY

RNS Number : 8603F

Andrews Sykes Group PLC

04 May 2011

Andrew Sykes Group plc

4 May 2011

Preliminary Results

For the 12 months ended 31 December 2010

Summary of Results

12 months 12 months

ended ended

31 December 31 December

2010 2009

GBP'000 GBP'000

Revenue from continuing operations 55,951 54,358

Normalised EBITDA* from continuing

operations 17,721 17,368

Normalised operating profit** 13,942 12,937

Profit after tax for the financial

period 10,562 11,643

Basic earnings per share from

continuing operations (pence) 24.19p 26.30p

Dividend paid per equity share

(pence) 11.10p -

Net cash inflow from operating

activities 13,863 14,334

Total dividends paid 4,800 -

Net funds / (debt) 4,905 (2,808)

* Earnings Before Interest, Taxation, Depreciation, profit on

sale of property, plant and equipment, Amortisation and

non-recurring costs as reconciled on the consolidated income

statement.

** Normalised operating profit, being operating profit before

non-recurring costs as reconciled on the consolidated

income statement.

For further information, please contact:

Andrews Sykes Group plc

J-C Pillois 01902 328700

Brewin Dolphin

Sandy Fraser/Iain Marlow 0845 213 4730

Chairman's Statement

Overview and Financial Highlights

I am pleased to be able to report that the normalised operating

profit* has increased by GBP1 million from GBP12.9 million in 2009

to GBP13.9 million in the current year.

The group continues to generate strong cash flows. Net cash

inflow from operating activities was GBP13.9 million which, due to

higher tax payments, was down a little compared with GBP14.3

million last year. As at 31 December 2010 the group had net funds

of GBP4.9 million compared with net debt of GBP2.8 million last

year despite shareholder related cash outflows of GBP6 million on

dividends and the purchase of own shares. External bank borrowings

have been reduced by GBP9 million from GBP29 million at the start

of the year to GBP20 million by the year-end.

Ongoing cost control, cash and working capital management

continue to be priorities for the group. In total working capital

has been reduced by GBP0.2 million thereby consolidating the

significant reductions of GBP2.2 million made last year. Capital

expenditure is carefully controlled and directed to assets that

will yield the best returns. Hire fleet utilisation, the fleet's

condition and availability have all been maximised.

*Operating profit before non-recurring items as reconciled on

the Consolidated Income Statement.

Operating performance

Our main hire and sales business in the UK and Northern Europe

(the Netherlands and Belgium) returned a strong performance in the

year. The operating profit from this business sector increased by

GBP2.9 million from GBP11.1 million in 2009 to GBP14.0 million in

the current year. The performance was in part attributable to the

cold weather in December which assisted the performance of our

heating division. In addition management continue to develop

non-weather dependent niche markets which has benefited the

performance of the specialist hire division. We will continue to

invest in and develop this business as well as our traditional core

products and services.

As predicted in my Interim Statement, our business in the Middle

East continues to suffer from the economic downturn in the region,

particularly in Dubai, and we anticipate that this will continue

for some time. The business does continue to make a return on

reduced levels of turnover and management are taking action to

ensure that the cost base reflects the reduced activity levels. On

a more positive note, our business in Abu Dhabi continues to grow

year on year.

The UK fixed installation business improved its operating profit

by GBP0.1 million to GBP0.2 million and we look forward to further

improvements next year.

The ongoing strategy of cost control through efficiency savings

has resulted in reduced overhead costs which have also contributed

to the overall increase in normalised operating profit during the

year.

A more detailed review of this year's operating performance is

given in the Operations Review within the Directors' report in the

2010 Annual Report and Financial Statements.

Profit for the financial year

Profit before tax increased by GBP1.1 million from GBP13.3

million in 2009 to GBP14.4 million in the current year. However,

the profit after tax for the financial year was GBP10.6 million

(2009: GBP11.6 million) due to a normal tax charge of GBP3.8

million this year compared with GBP1.7 million in 2009. This is

mainly due to a deferred tax release of GBP1.2 million last year

and a change in the group's profit mix away from the Middle East

towards the UK and Northern Europe.

A more detailed review of the profit for the financial year is

given in the Operations and Financial Review within the Directors'

report in the 2010 Annual Report and Financial Statements.

Net funds / (debt)

As at 31 December 2010 the group had net funds of GBP4.9 million

compared with net debt of GBP2.8 million last year: a positive

increase of GBP7.7 million despite a dividend of GBP4.8 million and

cash outflows on share buybacks of GBP1.2 million.

Equity dividends paid

The company declared an interim dividend of GBP4.8 million on 9

November 2010 and this was paid on 10 December 2010. The Board

continues the policy of returning value to shareholders whenever

possible and accordingly the decision regarding an interim dividend

for 2011 will be taken later in the year in the light of

profitability and available cash resources.

Share buyback programme

During the current year the company purchased 1,152,561 ordinary

shares for cancellation for a total consideration of GBP1,371,000

of which GBP187,000 remained unpaid at the year-end. So far during

2011 the company has purchased a further 402,716 ordinary shares

for cancellation for a total consideration of GBP867,000. These

purchases enhanced earnings per share and were for the benefit of

all shareholders.

As previously reported, the directors intend to continue to

actively pursue the buyback programme provided the necessary funds

are available. Shares will only be bought back for cancellation

provided they enhance earnings per share. Any shareholder who is

considering taking advantage of the share buyback programme is

invited, after taking the appropriate independent financial advice,

to contact their stockbroker, bank manager, solicitor, accountant

or other independent financial advisor authorised under the

Financial Services and Markets Act 2000, in order to contact Brewin

Dolphin Limited who are operating the buyback programme on behalf

of the company. Accordingly at the next Annual General Meeting

shareholders will be asked to vote in favour of a resolution to

renew the general authority to make market purchases of up to 12.5%

of the ordinary share capital in issue.

Outlook

The group's continuing strategy of investing in its traditional

core products and services, the increase in non-seasonal business

and investment in new technically advanced and environmentally

friendly products yet again proved to be beneficial in 2010 and

will therefore be continued into 2011.

The group continues to face challenges in all of its

geographical markets. Nevertheless our business is strong, cash

generative and well developed with positive net funds. All these

factors help us to be able to take advantage of opportunities

wherever and whenever they arise and the Board is therefore

optimistic for further success in 2011.

JG Murray

Chairman

3 May 2011

Consolidated Income Statement

For the 12 months ended 31 December 2010

12 months 12 months

ended ended

31 December 31 December

2010 2009

GBP'000 GBP'000

Continuing operations

Revenue 55,951 54,358

Cost of sales (24,015) (23,218)

----------------- -----------------

Gross profit 31,936 31,140

Distribution costs (9,219) (9,367)

Administrative expenses - Recurring (8,775) (8,836)

- Non-recurring 164 273

---------------------------------------- ----------------- -----------------

Total administrative expenses (8,611) (8,563)

Operating profit 14,106 13,210

Normalised EBITDA* Depreciation and 17,721 17,368

impairment losses Profit on the (4,239) (4,964)

sale of plant and equipment 460 533

----------------- -----------------

Normalised operating profit 13,942 12,937

Profit on the sale of property 164 273

----------------- -----------------

Operating profit 14,106 13,210

----------------- -----------------

Income from other participating

interests 400 980

Finance income 2,012 1,944

Finance costs (2,144) (2,843)

----------------- -----------------

Profit before taxation 14,374 13,291

Taxation (3,812) (1,648)

Profit for the financial period

attributable to equity holders of the

parent 10,562 11,643

----------------- -----------------

There were no discounted operations in either

of the above periods.

Earnings per share from continuing and total

operations

Basic (pence) 24.19p 26.30p

Diluted (pence) 24.18p 26.30p

Dividends paid per equity share 11.10p 0.00p

(pence)

** Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-recurring costs.

Consolidated Statement of Comprehensive Total Income

For the 12 months ended 31 December 2010

12 months 12 months

ended ended

31 December 31 December

2010 2009

GBP'000 GBP'000

Profit for the financial period 10,562 11,643

Other comprehensive income:

Currency translation differences on

foreign currency net investments (99) (1,602)

Defined benefit plan actuarial

gains and losses 1,964 (1,308)

Deferred tax on other comprehensive

income (530) 366

----------------- -----------------

Other comprehensive income for the

period net of tax 1,335 (2,544)

----------------- -----------------

Total comprehensive income for the

period 11,897 9,099

----------------- -----------------

Consolidated Balance Sheet

As at 31 December 2010

31 December 2010 31 December 2009

---------------------------- ----------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Non-current

assets

Property,

plant and

equipment 11,817 13,697

Lease

prepayments 58 59

Trade

investments 164 164

Deferred tax

asset 721 1,042

Retirement

benefit

pension

surplus 1,990 -

Other

financial

assets -

cash held on

deposit - 3,000

------------- -------------

14,750 17,962

Current assets

Stocks 4,032 4,865

Trade and

other

receivables 15,917 13,295

Other

financial

assets -

cash held on

deposit - 6,000

Cash and cash

equivalents 25,709 18,150

Assets held

for sale - 238

45,658 42,548

------------- -------------

Current

liabilities

Trade and

other

payables (10,143) (7,408)

Current tax

liabilities (2,274) (1,670)

Bank loans (6,000) (6,000)

Obligations

under

finance

leases (203) (203)

Provisions (13) (13)

Derivative

financial

instruments (7) (23)

------------- -------------

(18,640) (15,317)

------------- -------------

Net current

assets 27,018 27,231

Total assets

less current

liabilities 41,768 45,193

Non-current

liabilities

Bank loans (14,000) (23,000)

Obligations

under

finance

leases (553) (700)

Provisions (47) (60)

Derivative

financial

instruments (41) (32)

------------- -------------

(14,641) (23,792)

Net assets 27,127 21,401

------------- -------------

Equity

Called-up

share

capital 431 443

Retained

earnings 23,607 17,828

Translation

reserve 2,842 2,895

Other

reserves 237 225

Surplus

attributable

to equity

holders of

the parent 27,117 21,391

Minority

interest 10 10

Total equity 27,127 21,401

------------- -------------

Consolidated Cash Flow Statement

For the 12 months ended 31 December 2010

12 months 12 months

ended ended

31 December 31 December

2010 2009

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 17,763 18,081

Interest paid (503) (1,653)

Net UK corporation tax paid (2,113) (1,586)

Withholding tax paid (119) (329)

Overseas tax paid (1,165) (179)

Net cash flow from operating activities 13,863 14,334

----------------- -----------------

Investing activities

Dividends received from

participating interests (trade

investments) 400 980

Movements in ring fenced bank

deposit accounts 9,000 (9,000)

Sale of assets held for sale 390 439

Sale of plant and equipment 643 813

Purchase of property, plant and

equipment (1,745) (1,661)

Interest received 168 208

Net cash flow from investing activities 8,856 (8,221)

----------------- -----------------

Financing activities

Loan repayments (9,000) (5,000)

Finance lease capital repayments (263) (150)

Equity dividends paid (4,800) -

Purchase of own shares (1,184) -

Net cash flow from financing activities (15,247) (5,150)

----------------- -----------------

Net increase in cash and cash

equivalents 7,472 963

Cash and cash equivalents at the

beginning of the period 18,150 18,233

Effect of foreign exchange rate

changes 87 (1,046)

Cash and cash equivalents at end of

the period 25,709 18,150

----------------- -----------------

Reconciliation of net cash flow to movement in net

debt in the period

Net increase in cash and cash

equivalents 7,472 963

Cash outflow from the decrease in

debt 9,263 5,150

Movements in ring fenced bank

deposit accounts (9,000) 9,000

Non-cash movements in respect of

new finance leases (116) -

Non-cash movements in the fair value

of derivative instruments 7 53

----------------- -----------------

Movement in net funds/(debt) during the

period 7,626 15,166

Opening net debt at the beginning

of the period (2,808) (16,928)

Effect of foreign exchange rate

changes 87 (1,046)

----------------- -----------------

Closing net funds/(debt) at the end

of the period 4,905 (2,808)

----------------- -----------------

Consolidated Statement of Changes in Equity

For the 12 months ended 31 December 2010

Attributable to equity holders of Minority Total

the parent company interest equity

---------------------------------------------------------------------------

Share Retained Translation Other

Capital earnings reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2008 443 7,127 4,497 225 12,292 10 12,302

Profit for the

financial

period - 11,643 - - 11,643 - 11,643

Other comprehensive income:

Currency

translation

differences

on foreign

currency net

investments - - (1,602) - (1,602) - (1,602)

Defined

benefit plan

actuarial

gains and

losses net of

tax - (942) - - (942) - (942)

Total other

comprehensive

income - (942) (1,602) - (2,544) - (2,544)

------------ ------------- ---------------- ------------- ------------- ------------- ------------

At 31 December

2009 443 17,828 2,895 225 21,391 10 21,401

Profit for the

financial

period - 10,562 - - 10,562 - 10,562

Other comprehensive income: - -

Transfer on

closure of

overseas

subsidiary - (46) 46 - - - -

Currency

translation

differences

on foreign

currency net

investments - - (99) - (99) - (99)

Defined

benefit plan

actuarial

gains and

losses net of

tax - 1,434 - - 1,434 - 1,434

Total other

comprehensive

income - 1,388 (53) - 1,335 - 1,335

------------ ------------- ---------------- ------------- ------------- ------------- ------------

Transactions

with owners

recorded

directly in

equity:

Purchase of

own shares (12) (1,371) - 12 (1,371) - (1,371)

Dividends paid - (4,800) - - (4,800) - (4,800)

Total

transactions

with owners (12) (6,171) - 12 (6,171) - (6,171)

------------ ------------- ---------------- ------------- ------------- ------------- ------------

At 31 December

2010 431 23,607 2,842 237 27,117 10 27,127

------------ ------------- ---------------- ------------- ------------- ------------- ------------

There were no transactions with owners recorded directly in

equity during the 12 months ended 31 December 2009.

Notes

1. Basis of preparation

Whilst the information included in this preliminary announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs. Therefore the financial

information set out above does not constitute the company's

financial statements for the 12 months ended 31 December 2010 or 31

December 2009 but it is derived from those financial

statements.

2. Going concern

The Board remains satisfied with the group's funding and

liquidity position. The group has external bank loans of GBP20

million and has operated both throughout the period under review

and subsequently within its financial covenants. Consequently the

loans have been analysed between current and non-current

liabilities in accordance with the agreed repayment profile.

The group has substantial cash resources which at 31 December

2010 amounted to GBP25.7 million. Net funds at 31 December 2010

were GBP4.9 million. Profit and cash flow projections for 2011 and

2012, which have been prepared on a conservative basis taking into

account reasonably possible changes in trading performance,

indicate that the group will be profitable and generate positive

cash flows after loan repayments. These forecasts and projections

indicate that the group should be able to operate within the

current bank facility and associated covenants.

The Board considers that the group has considerable financial

resources and a wide operational base. As a consequence, the Board

believes that the group is well placed to manage its business risks

successfully, as demonstrated by the current year's result, despite

the current uncertain economic outlook.

After making enquiries, the Board has a reasonable expectation

that the group have adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Board

continues to adopt the going concern basis when preparing this

Annual Report and Financial Statements and this preliminary

announcement.

3. Distribution of Annual Report and Financial Statements

The group expects to distribute copies of the full Annual Report

and Financial Statements that comply with IFRSs by 12 May 2011

following which copies will be available either from the registered

office of the company; Premier House, Darlington Street,

Wolverhampton, WV1 4JJ; or from the company's website;

www.andrews-sykes.com. The Annual Report and Financial Statements

for the 12 months ended 31 December 2009 have been delivered to the

Registrar of Companies and those for the 12 months ended 31

December 2010 will be filed at Companies House following the

company's Annual General Meeting. The auditors have reported on

those financial statements; their report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain details of any matters on which

they are required to report by exception.

4. Date of Annual General Meeting

The group's Annual General Meeting will be held at 10.30 a.m. on

Tuesday 7(th) June 2011 at Floor 5, 10 Bruton Street, London, W1J

6PX.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UGUGWAUPGGQW

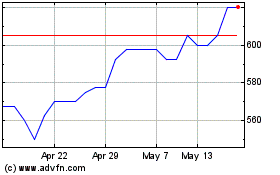

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024