RNS Number : 2486E

Andrews Sykes Group PLC

25 September 2008

Andrews Sykes Group plc

Interim Financial Statements for the six months to 30 June 2008

Chairman's Statement

Overview and financial highlights

I am pleased to be able to report that, despite a general economic slowdown in the UK, the group's results for the first half of 2008

show a marked improvement compared with the same period last year. Management continue to show initiative and sound judgement developing

markets that are not only less weather dependent than our traditional products and services but are also less reliant on the market sectors

most affected by the current UK slowdown.

The group's diverse base of operations predominantly across the UK, Northern Europe and the Middle East together with a low level of

imports into the UK from Europe mean that the current weakening of Sterling against, most notably, the Euro has not had a significant impact

on the group's profitability in the current period. In addition the group has the benefit of interest rate caps covering the majority of the

bank loans which have been effective in protecting it from the increase in the cost of borrowing seen by many over the past months.

The financial highlights of the period compared with the first half of 2007 are as follows:

2008 2007

�'000 �'000

Revenue 33,873 27,185

EBITDA* 10,550 7,569

Operating profit 9,019 4,731

Profit after tax for the financial period 6,169 2,857

Basic earnings per share 13.85 pence 6.41 pence

Net cash inflow from operating activities 5,854 3,414

Equity dividends paid 14,970 -

Closing net debt 22,182 14,242

* Earnings Before Interest, Taxation, Depreciation,

Amortisation, Impairment provisions and exceptional

items as reconciled on the face of the income

statement

Operations review

Our main UK trading subsidiary, Andrews Sykes Hire, continues to perform well. It continues to develop its business in non seasonal hire

markets, particularly through its specialist hire division. Its traditional products have also performed well, especially the pumping

division, which has benefited both from the deliberate decision to enter into longer term contracts guaranteeing revenue income as well as

unusually wet conditions and the opportunities so provided.

Our overseas operations in the Middle East and Northern Europe both continue to expand and further develop their market sectors. This is

particularly so in the case of the Middle East with management taking full advantage of the level of work currently being undertaken in this

region.

Dividend and pension scheme payments

During the current half year two interim dividends were paid that in total amounted to �15 million. Clearance was obtained both from the

pensions regulator and the pension scheme trustees and as part of this process a special one-off payment of �1.7 million was made to the

pension scheme. Further details of these payments are given in note 6 to these interim financial statements.

Prospects

The summer in the UK and Northern Europe has been very similar to 2007 with disappointing low average temperatures that have done little

to stimulate the demand for our air conditioning hire business. Nevertheless management initiatives and the move to less weather related

products continue to be effective and we currently anticipate that the second half of 2008 will be in line with last year.

JG Murray

Chairman

24 September 2008

Andrews Sykes Group plc

Consolidated Income Statement

For the 26 weeks ended 30 June 2008 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 30 June 29 December

2008 2007 2007

(as restated)**

�'000

�'000 �'000

Continuing operations

Revenue 33,873 27,185 57,846

Cost of sales (15,552) (12,696) (25,816)

Gross profit 18,321 14,489 32,030

Distribution costs (4,959) (4,250) (9,751)

Administrative expenses - (4,872) (4,574) (8,095)

Normal

- Exceptional 529 (934) (911)

- Total (4,343) (5,508) (9,006)

Operating profit 9,019 4,731 13,273

EBITDA* 10,550 7,569 18,173

Depreciation and impairment (2,551) (2,255) (4,463)

losses 491 351 474

Profit on the sale of plant

and equipment

Normalised operating profit 8,490 5,665 14,184

Profit on the sale of property 529 - -

Pension curtailment charge - (934) (911)

Operating profit 9,019 4,731 13,273

Income from other - - 209

participating interests 476 430 624

Finance income (1,025) (860) (1,728)

Finance costs

Profit before taxation 8,470 4,301 12,378

Taxation (2,301) (1,444) (3,829)

Profit after tax for the 6,169 2,857 8,549

financial period

There were no discontinued .

operations in any of the above

periods.

Earnings per share from

continuing operations

13.85p 6.41p 19.19p

13.85p 6.41p 19.19p

Basic (pence)

Diluted (pence)

Dividends paid per equity 33.60p -p -p

share (pence)

* Earnings Before Interest, Taxation, Depreciation, Amortisation, Impairment provisions and exceptional costs.

** Finance income and finance costs have been restated on a consistent basis with the 52 weeks ended 29 December 2007

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 30 June 2008 (unaudited)

30 June 2008 30 June 2007 29 December 2007

�'000 �'000 �'000

Non-current assets

Property, plant and equipment 15,489 15,340 15,668

Lease prepayments 93 224 96

Trade investments 164 164 164

Deferred tax asset 831 2,361 1,404

Derivative financial 100 161 13

instruments

16,677 18,250 17,345

Current assets

Stocks 5,904 5,830 5,742

Trade and other receivables 17,447 15,318 16,317

Cash and cash equivalents 12,870 11,908 13,102

Assets held for sale 405 - 494

36,626 33,056 35,655

Current liabilities

Trade and other payables

Current tax liabilities (11,899) (14,436) (11,371)

Bank loans (1,633) (1,343) (1,370)

Obligations under finance (5,000) (5,000) (5,000)

leases (252) (233) (415)

Provisions - (15) (15)

(18,784) (21,027) (18,171)

Net current assets 17,842 12,029 17,484

Total assets less current 34,519 30,279 34,829

liabilities

Non-current liabilities

Bank loans (29,000) (20,000) (19,000)

Obligations under finance (900) (1,078) (1,006)

leases (432) (2,190) (1,238)

Retirement benefit obligations - - (38)

Derivative financial

instruments

(30,332) (23,268) (21,282)

Net assets 4,187 7,011 13,547

Equity

Share capital 446 446 446

Retained earnings 2,675 6,701 12,595

Translation reserve 834 (368) 274

Other reserves 222 222 222

Surplus attributable to equity 4,177 7,001 13,537

holders of the parent

Minority interest 10 10 10

Total equity 4,187 7,011 13,547

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 26 weeks ended 30 June 2008 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Cash flows from operating

activities 7,821 5,259 11,211

Cash generated from operations (846) (211) (1,115)

Interest paid (802) (1,352) (2,202)

Net UK corporation tax paid (70) (69) 50

Net withholding tax (paid) / (249) (213) (877)

recovered

Overseas tax paid

Net cash inflow from operating 5,854 3,414 7,067

activities

Investing activities

Dividends received from -

participating interests (trade - - 209

investments) 295 295

Disposal costs paid less 636

consideration received on prior (2,458) 389 778

year disposals 405 (2,408) (5,346)

136 440

Sale of property, plant and

equipment

Purchase of property, plant &

equipment

Interest received

Net cash outflow from investing (1,417) (1,588) (3,624)

activities

Financing activities

Loan repayments (24,000)

New loans raised 34,000 - (1,000)

Finance lease capital repayments (195) - -

Equity dividends paid (14,970) (69) (141)

- -

Net cash outflow from financing (5,165) (69) (1,141)

activities

Net (decrease) / increase in cash (728) 1,757 2,302

and cash equivalents

13,102 10,190 10,190

Cash and cash equivalents at 496 (39) 610

beginning of period

Effect of foreign exchange rate

changes

Cash and cash equivalents at end 12,870 11,908 13,102

of period

Reconciliation of net cash flow

to movement in net debt in the

period

(728)

24,195 1,757 2,302

Net (decrease) / increase in cash (34,000) 69 1,141

and cash equivalents 74 - -

Cash outflow from loan and 125 - (182)

finance lease repayments 138 (48)

Cash inflow from the increase in

loans

Non cash movements re finance

leases

Non cash movements in the fair

value of derivative instruments

Movement in net debt during the (10,334) 1,964 3,213

period (12,344) (16,167) (16,167)

Opening net debt at the beginning 496 (39) 610

of period

Effect of foreign exchange rate

changes

Closing net debt at the end of (22,182) (14,242) (12,344)

period

Andrews Sykes Group plc

Consolidated Statement of Recognised Income and Expense

For the 26 weeks ended 30 June 2008 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Actual return less expected (1,759) - 154

return on pension scheme - - 424

assets

Experience gains and losses

arising on plan obligation 205 - (279)

Changes in demographic and 560 (46) 595

financial assumptions 435 (11) (107)

underlying the

present value of plan

obligations

Currency translation

differences on foreign

currency net investments

Deferred tax on items posted

directly to equity

Net (expense) / income (559) (57) 787

recognised directly in equity

8,549

6,169 2,857

Profit for the period

attributable to equity

shareholders

Total recognised income and

expense for the period 5,610 2,800 9,336

attributable to equity holders

of the parent

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 26 weeks ended 30 June 2008 (unaudited)

1 General information

Basis of preparation

These interim financial statements have been prepared in accordance with International Accounting Standards (IAS) and International

Financial Reporting Standards (IFRS) as adopted by the European Union and with the Companies Act 1985 to 2006.

The information for the 52 weeks ended 29 December 2007 does not constitute the group's statutory accounts for 2007 as defined in

Section 240 of the Companies Act 1985. Statutory accounts for 2007 have been delivered to the Registrar of Companies. The Auditor's report

on those accounts was unqualified and did not contain statements under Section 273(2) or (3) of the Companies Act 1985. These interim

financial statements, which were approved by the Board of Directors on 24 September 2008, have not been audited or reviewed by the

Auditors.

These interim financial statements have been prepared using the historical cost basis of accounting except for:

i) Properties held at the date of transition to IFRS which are stated at deemed cost;

ii) Assets held for sale which are stated at the lower of fair value less anticipated disposal costs and carrying value and

iii) Derivative financial instruments (including embedded derivatives) which are valued at fair value.

Functional and presentational currency

The financial statements are presented in pounds sterling because that is the functional currency of the primary economic environment in

which the group operates.

2 Accounting policies

These interim financial statements have been prepared on a consistent basis and in accordance with the accounting policies set out in

the group's Annual Report and Financial Statements 2007.

3 Revenue

An analysis of the group's revenue is as follows:

26 weeks ended 26 weeks ended 52 weeks ended

30 June 2008 30 June 2007 29 December

�'000 �'000 2007

�'000

Continuing Operations

Hire 26,311 19,693 43,579

Sales 4,926 4,084 8,043

Installations 2,636 3,408 6,224

Group consolidated revenue from 33,873 27,185 57,846

the sale of goods and services - - 209

Income from other participating

interests

Finance income 476 430 624

Gross consolidated revenue 34,349 27,615 58,679

4 Pension curtailment charge

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Pension curtailment charge - (934) (911)

Last year every member of the Andrews Sykes Group Defined Benefit Pension Scheme (ASGPS) was given the opportunity of transferring their

accrued rights to an independent pension provider of their choice. An incentive equal to 40% of the normally available transfer value was

offered and this could either be paid directly to the member, as a cash bonus, or to their new pension provider, via the ASGPS, as an

enhanced transfer value (ETV). As well as the presentations made by independent financial advisors, the group paid for independent financial

advice to be made available to each member.

5 Earnings per share

Basic earnings per share

The basic figures have been calculated by reference to the weighted average number of ordinary shares in issue and the earnings as set

out below. There are no discontinued operations in any period.

26 weeks to 30 June 2008

Continuing earnings �'000 Number of shares

Basic earnings/weighted average 6,169 44,552,865

number of shares

Basic earnings per ordinary 13.85p

share (pence)

26 weeks to 30 June 2007

Continuing earnings �'000 Number of shares

Basic earnings/weighted average 2,857 44,552,715

number of shares

Basic earnings per ordinary 6.41p

share (pence)

52 weeks to 29 December 2007

Continuing earnings �'000 Number of shares

Basic earnings/weighted average 8,549 44,552,790

number of shares

Basic earnings per ordinary 19.19p

share (pence)

Adjusted basic earnings per share excluding profit on sale of property and pension curtailment charge

The basic figures excluding the profit on sale of property and the pension curtailment charge have been calculated by reference to the

weighted average number of ordinary shares in issue and the earnings as set out below. There are no discontinued operations in any period.

26 weeks to 30 June 2008

Continuing earnings �'000 Number of shares

Basic earnings/weighted average 6,169 44,552,865

number of shares

Less profit on the sale of (517)

property net of tax

Adjusted basic earnings/weighted 5,652 44,552,865

average number of shares

Adjusted basic earnings per 12.69p

ordinary share (pence) excluding

profit on sale of property

Adjusted basic earnings per share excluding profit on sale of property and pension curtailment charge

26 weeks to 30 June 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted average 2,857 44,552,715

number of shares 654

Add back pension curtailment

charge net of tax

Adjusted basic earnings/weighted 3,511 44,552,715

average number of shares

Adjusted basic earnings per 7.88p

ordinary share (pence) excluding

pension curtailment charge

52 weeks to 29 December 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted 8,549 44,552,790

average number of shares

Add back pension curtailment 638

charge net of tax

Adjusted basic 9,187 44,552,790

earnings/weighted average

number of shares

Adjusted basic earnings per 20.62p

ordinary share (pence)

excluding pension curtailment

charge

Diluted earnings per share

The calculation of the diluted earnings per ordinary share is based on the profits and shares as set out in the tables below. There are

no discontinued operations in any period. The share options have a dilutive effect for the period calculated as follows:

26 weeks to 30 June 2008

Continuing earnings Number of shares

�'000

Basic earnings/weighted average 6,169 44,552,865

number of shares

15,000

Weighted average number of shares

under option

(11,966)

Number of shares that would be

issued at fair value to satisfy

above options

Earnings/diluted weighted average 6,169 44,555,899

number of shares

Diluted earnings per ordinary share 13.85p

(pence)

26 weeks to 30 June 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted average 2,857 44,552,715

number of shares

15,000

Weighted average number of shares

under option (8,001)

Number of shares that would be

issued at fair value to satisfy

above options

Earnings/diluted weighted average 2,857 44,559,714

number of shares

Diluted earnings per ordinary share 6.41p

(pence)

52 weeks to 29 December 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted average 8,549 44,552,790

number of shares

15,000

Weighted average number of shares

under option (8,065)

Number of shares that would be

issued at fair value to satisfy

above options

Earnings/diluted weighted average 8,549 44,559,725

number of shares

Diluted earnings per ordinary share 19.19p

(pence)

Adjusted diluted earnings per share excluding profit on sale of property and pension curtailment charge

The calculation of the diluted earnings per ordinary share excluding the profit on sale of property and the pension curtailment charge

is based on the profits and shares as set out in the table below. There are no discontinued operations in any period. The share options have

a dilutive effect for the period calculated as follows:

26 weeks to 30 June 2008

Continuing earnings Number of shares

�'000

Basic earnings/weighted 6,169 44,552,865

average number of shares (517)

Less profit on the sale of

property net of tax 15,000

Weighted average number of (11,966)

shares under option

Number of shares that would be

issued at fair value to

satisfy above options

Adjusted earnings/diluted 5,652 44,555,899

weighted average number of

shares

Adjusted diluted earnings per 12.69p

ordinary share (pence)

excluding profit on sale of

property

26 weeks to 30 June 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted 2,857 44,552,715

average number of shares 654

Add back pension curtailment

charge net of tax 15,000

Weighted average number of (8,001)

shares under option

Number of shares that would be

issued at fair value to

satisfy above options

Adjusted earnings/diluted 3,511 44,559,714

weighted average number of

shares

Adjusted diluted earnings per 7.88p

ordinary share (pence)

excluding pension curtailment

charge

52 weeks to 29 December 2007

Continuing earnings Number of shares

�'000

Basic earnings/weighted 8,549 44,552,790

average number of shares 638

Add back pension curtailment

charge net of tax 15,000

Weighted average number of (8,065)

shares under option

Number of shares that would be

issued at fair value to

satisfy above options

Adjusted earnings/diluted 9,187 44,559,725

weighted average number of

shares

Adjusted diluted earnings per 20.62p

ordinary share (pence)

excluding pension curtailment

charge

6 Dividend payments and loan restructuring

No interim dividends were declared or paid during either of the previous financial periods.

The directors declared and paid the following interim dividends in respect of the 52 weeks ending 31 December 2008 during the period

under review:

Pence per �'000

share

6.50p

2,896

27.10p

12,074

Interim dividend declared on 26 March 2008 and paid to

shareholders on the register as at 4 April 2008 on 18

April 2008

Interim dividend declared on 24 April 2008 and paid to

shareholders on the register as at 2 May 2008 on 16 May

2008

33.60p 14,970

The above interim dividends have been charged against retained earnings during the current period.

Clearance was obtained from the pensions regulator and trustees of the Andrews Sykes Group Defined Benefit Pension Scheme (ASGPS) prior

to the payment of the second interim dividend on 16 May 2008. As part of that process it was agreed that a special contribution of �1.7

million would be paid by the company to the ASGPS and this is shown in note 7 below.

The above dividend and pension scheme payments were mainly financed by net additional bank loans of �10 million comprising new loan

draw-downs of �34 million less loan repayments of �24 million. The interest rates and covenants on the new loans are similar to those in the

previous agreements and interest rate caps continue to be held to limit the group's exposure to increases in LIBOR.

7 Retirement benefit obligations - Defined benefit pension scheme

The group closed the UK group defined benefit pension scheme to future accrual as at 31 December 2002. The assets of the defined benefit

pension scheme continue to be held in a separate trustee administered fund.

The group are making additional contributions to remove the funding deficit in the group pension scheme. These contributions include

both one-off and regular monthly payments, �125,000 per month in the period under review, and are agreed in advance with the trustees of the

pension scheme.

Assumptions used to calculate the scheme deficit

A full actuarial valuation has been carried out as at 31 December 2007 and this was used as a basis for calculating the deficit as at 29

December 2007. In view of the significant changes in market conditions between the end of December 2007 and 30 June 2008, the valuation has

been further updated by a qualified independent actuary to take into account current market conditions.

The major assumptions used in this valuation to determine the present value of the scheme's defined benefit obligation were as follows:

30 June 30 June 29 December

2008 2007 2007

N/A N/A N/A

Rate of increase in pensionable salaries 4.00% 3.00% 3.40%

Rate of increase in pensions in payment 6.60% 5.40% 5.90%

Discount rate applied to scheme liabilities 4.10% 3.00% 3.40%

Inflation assumption

Assumptions regarding future mortality experience are set based on advice in accordance with published statistics. The current mortality

table used is PA92YOBMC+2 (29 December 2007: PA92YOBMC+2, 30 June 2007: PA92C2020)

The assumed average life expectancy in years of a pensioner retiring at the age of 65 given by the above tables is as follows:

30 June 30 June 29 December

2008 2007 2007

Male, current age 45 21.2 years 19.8 years 21.2 years

Female, current age 24.0 years 22.8 24.0 years

45 years

Valuations

The fair value of the scheme's assets, which are not intended to be realised in the short term and may be subject to significant change

before they are realised, and the present value of the scheme's liabilities which are derived from cash flow projections over long periods

and are inherently uncertain, were as follows:

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Total fair value of plan assets 26,794 24,557 25,913

Present value of defined benefit funded (27,151)

obligation (27,226) (26,747)

Deficit in the scheme - pension liability (432) (2,190) (1,238)

recognised in the balance sheet

The movements in the fair value of the scheme's assets over the reporting period are as follows:

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Fair value of plan assets at the 25,913 33,445 33,445

start of the period 692 1,050 1,926

Expected return on plan assets (1,759) - 154

Actuarial (losses)/gains 750 750 1,500

recognised in the SORIE 1,700 - -

Employer contributions - normal - 2,296 1,880

Employer contributions - special (502) (402) (1,269)

(note 6) - (11,723)

Employer contributions - transfer (12,582)

value exercise

Benefits paid

Settlements and curtailments

Fair value of plan assets at the 26,794 24,557 25,913

end of the period

Employer contributions in respect of the transfer value exercise and settlements and curtailments were both estimated at 30 June 2007

and finalised at 29 December 2007.

The movement in the present value of the defined benefit obligation during the period was as follows:

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Present value of defined benefit (27,151) (40,022) (40,022)

funded obligation at the beginning of (782) (1,061) (1,888)

the period 205 - 145

Interest on defined benefit obligation 502 402 1,269

Actuarial gain /(loss) recognised in - 13,934 13,345

the SORIE

Benefits paid

Settlements and curtailments

Present value of defined benefit (27,226) (26,747) (27,151)

funded obligation at the end of the

period

Amounts recognised in the income statement

The amounts (charged) / credited in the income statement were:

30 June 30 June 29 December

2008 2007 2007

�'000 �'000 �'000

Expected return on pension scheme assets 692 1,050 1,926

Interest on pension scheme liabilities (782) (1,888)

(1,061)

Net pension interest (charge) / income (90) (11) 38

Settlements and curtailments - 1,352 1,622

(90) 1,341 1,660

8 Share capital

30 June 2008 30 June 29 December

�'000 2007 2007

�'000 �'000

Authorised:

1,398,170,943 ordinary shares of one 13,982 13,982 13,982

pence each (30 June 2007 and 29

December 2007: 1,398,170,943 ordinary

shares of one pence each)

Issued and fully paid:

44,552,865 ordinary shares of one pence

each

(30 June 2007 and 29 December 2007:

44,552,865 ordinary shares of one pence 446 446 446

each)

During the period the company did not buy back any shares for cancellation (26 weeks ended 30 June 2007: Nil shares).

The company has one class of ordinary shares which carry no right to fixed income.

At 30 June 2008 cash options to subscribe for ordinary shares under the executive share option scheme were held as follows:

Number of one pence ordinary shares

Date of grant Date normally Subscription price 30 June 2008 30 June 29 December

exercisable per share 2007 2007

November 2001 November 2004 to 89.5 pence 15,000 15,000 15,000

October 2011

No share options were granted, forfeited or expired during either the current or previous financial periods.

No share options were exercised during the period (26 weeks ended 30 June 2007: Nil options).

9 Cash generated from operations

26 weeks ended 26 weeks ended 52 weeks ended

30 June 2008 30 June 2007 29 December

�'000 �'000 2007

�'000

Profit for the period 6,169 2,857 8,549

attributable to equity

shareholders

Adjustments for: 2,301 1,444 3,829

Taxation charge - 934 911

Pension curtailment charge 1,025 860 1,728

Finance costs (476) (430) (624)

Finance income - - (209)

Income from other (1,020) (351) (474)

participating interests 2,551 2,224 4,432

Profit on the sale of - 31 31

property, plant and equipment (750) (750) (1,500)

Depreciation and amortisation (1,700) (868) (4,279)

Impairment losses

Excess of normal pension

contributions compared with

service cost

Special pension contributions

Cash generated from operations 8,100 5,951 12,394

before movements in working

capital

(162) (1,493) (1,406)

(603) 760 (350)

Increase in stocks 501 50 582

(Increase) / decrease in trade (15) (9) (9)

and other receivables

Increase in trade and other

payables

Decrease in provisions

Cash generated from operations 7,821 5,259 11,211

10 Analysis of net debt

30 June 2008 30 June 2007 29 December 2007

�'000 �'000 �'000

Cash and cash equivalents per 12,870 11,908 13,102

cash flow statement

Derivative financial 100 161 13

instruments

Financial assets 100 161 13

Bank loans (34,000) (25,000) (24,000)

Obligations under finance (1,152) (1,311) (1,421)

leases

Derivative financial - - (38)

instruments

Financial liabilities (35,152) (26,311) (25,459)

Net debt (22,182) (14,242) (12,344)

11 Distribution of interim financial statements

Following a change in regulations, the company is no longer required to circulate this half year report to shareholders. This enables us

to reduce costs associated with printing and mailing and to minimise the impact of these activities on the environment. A copy of the

interim financial statements is available on the company's website, www.andrews-sykes.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFIRADISFIT

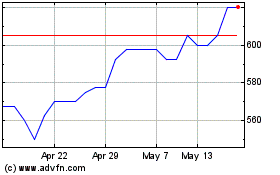

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024