RNS Number:5232T

Andrews Sykes Group PLC

01 May 2008

Andrews Sykes Group plc

1 May 2008

Final Results

Preliminary announcement

For the 52 weeks ended 29 December 2007

Summary of Results

52 weeks ended 52 weeks ended

29 December 2007 31 December 2006

#000 #000

Revenue from continuing operations 57,846 59,768

Normalised EBITDA* from continuing operations 18,173 18,887

Adjusted operating profit** 14,184 15,272

Profit for the financial period 8,549 9,708

Basic earnings per share from continuing operations (pence) 19.19p 22.11p

Adjusted basic earnings per share from continuing operations 20.62p 22.11p

excluding pension curtailment charge

Net Cash inflow from operating activities 7,067 11,537

Net Debt 12,344 16,167

* Earnings Before Interest, Taxation, Depreciation, profit on sale

of fixed assets, Amortisation and impairment charges as reconciled on the

consolidated income statement.

** Normalised operating profit before pension curtailment charge

Chairman's Statement

Overview and financial highlights

The group achieved an adjusted operating profit * of #14.2 million for 2007

which compares with #15.3 million in 2006, our record year. Therefore although

these profits are lower than 2006 I still consider that this is an extremely

good performance, particularly considering we did not experience the very hot

and favourable weather conditions of the summer of 2006 which contributed to a

#2 million decrease in revenue to #57.8 million.

More importantly, this result highlights the fact that the group is now less

weather dependent than ever before. It has been our strategy for some time to

move away from this dependency and our group now has a diverse range of income

streams thereby providing a solid base of revenue underpinning the business.

This, combined with our ongoing strict cost control policy, ensures that we are

able to deliver satisfactory results even in the face of less than favourable

climatic conditions.

Our main trading subsidiary, Andrews Sykes Hire continues to perform well. It

continues to expand its business in non-seasonal hire markets, particularly

through its specialist hire division. It has continued to expand its presence in

niche markets and these non-traditional businesses operate without undue

influence from seasonal weather patterns.

We have, of course, continued to support our traditional business roots. The

pumping division performed extremely well in 2007, taking advantage of the

opportunities presented. We will invest more in this business, as well as in our

profitable air conditioning and heating divisions, in order that we are well

placed to satisfy our customers' demands whenever they arise.

Pension curtailment offer

As I reported at the half year, an offer was made to all deferred members of our

defined benefit pension scheme giving them the opportunity to transfer their

accrued rights to an alternative pension provider.

The offer, which was substantially completed in 2007, has resulted in a

reduction of the pension scheme deficit of #3.5 million, a charge to the income

statement of #0.9 million and a cash outflow of #4.3 million. This was mainly

financed by an agreed reduction in the July 2007 loan repayment from #5 million

to #1 million.

Net Debt

Net debt has been reduced by #3.9 million from #16.2 million to #12.3 million

this year despite the following significant cash outflows:

#m

Capital expenditure net of disposal proceeds 4.6

Pension curtailment offer 4.3

Corporation tax payments 3.0

Regular defined benefit pension scheme payments 1.5

13.4

This reflects the strong cash generating ability of the group.

* Normalised operating profit before pension curtailment charge

Share buyback programme

The board continues to believe that shareholder value will be optimised by the

purchase, where appropriate, of our own shares. Consequently at the forthcoming

AGM, the board will request that shareholders vote in favour of a resolution to

renew the authority to purchase up to 12.5% of the ordinary shares in issue.

Subsequent events

Recognising the fact that no interim or final dividends were declared or paid

during either the current or previous financial period, I am pleased to report

that the board has announced two interim dividends for the 2008 financial year

amounting to approximately #15.0 million since the year-end. This continues the

board's policy of returning value to shareholders wherever possible.

Prior to the payment of the above dividends the company consulted with the

Andrews Sykes Defined Benefit Pension Scheme trustees and the pension regulator

and agreed to pay an additional one-off contribution of #1.7million into the

scheme as well as maintaining the regular monthly payment of #125,000.

The above payments will be mainly financed by additional borrowings of #10

million.

Outlook

The group's continuing strategy of investing in its traditional core products

and services, the increase in non-seasonal business and investment in new

technically advanced and environmentally friendly products proved to be

successful in 2007 and will therefore be continued into 2008. Overall trading in

the first quarter of 2008 was in line with expectations.

J G Murray

Chairman

30 April 2008

Andrews Sykes Group plc

Consolidated Income Statement

For the 52 weeks ended 29 December 2007

52 weeks ended 29 December 2007 52 weeks

Pension ended

curtailment 31 December

Normalised charge Total 2006

#'000 #'000 #'000 #'000

Continuing operations

Revenue 57,846 - 57,846 59,768

Cost of sales (25,816) - (25,816) (26,918)

Gross profit 32,030 - 32,030 32,850

Distribution costs (9,751) - (9,751) (9,471)

Administrative expenses (8,095) (911) (9,006) (8,107)

Operating profit 14,184 (911) 13,273 15,272

EBITDA* 18,173 (911) 17,262 18,887

Depreciation and impairment charges (4,463) - (4,463) (4,153)

Profit on the sale of property, plant and equipment 474 - 474 538

Operating profit 14,184 (911) 13,273 15,272

Income from other participating interests 209 -

Finance income 624 500

Finance costs (1,728) (1,772)

Profit before taxation 12,378 14,000

Taxation (3,829) (4,150)

Profit for the period from continuing operations 8,549 9,850

Discontinued operations

Loss for the period from discontinued operations - (142)

Profit for the financial period attributable to equity holders of 8,549 9,708

the parent

Earnings per share from continuing operations

Basic (pence) 19.19p 22.11p

Diluted (pence) 19.19p 22.10p

Earnings per share from total operations

Basic (pence) 19.19p 21.79p

Diluted (pence) 19.19p 21.79p

Dividends paid per equity share (pence) 0.0 p 0.0p

* Earnings Before Interest, Taxation, Depreciation, profit on sale of fixed

assets, Amortisation and impairment charges.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 29 December 2007

29 December 2007 31 December 2006

#'000 #'000 #'000 #'000

Non-current assets

Goodwill - 31

Property, plant and equipment 15,668 15,201

Lease prepayments 96 229

Trade investments 164 164

Deferred tax asset 1,404 3,201

Derivative financial instruments 13 23

17,345 18,849

Current assets

Stocks 5,742 4,336

Trade and other receivables 16,317 16,217

Cash and cash equivalents 13,102 10,190

Assets held for sale 494 -

35,655 30,743

Current liabilities

Trade and other payables (11,371) (10,108)

Current tax liabilities (1,370) (2,292)

Bank loans (5,000) (5,000)

Obligations under finance leases (415) (233)

Provisions (15) (24)

(18,171) (17,657)

Net current assets 17,484 13,086

Total assets less current liabilities 34,829 31,935

Non-current liabilities

Bank loans (19,000) (20,000)

Obligations under finance leases (1,006) (1,147)

Retirement benefit obligations (1,238) (6,577)

Derivative financial instruments (38) -

(21,282) (27,724)

Net assets 13,547 4,211

Equity

Called-up share capital 446 446

ESOP reserve - -

Retained earnings 12,595 3,854

Translation reserve 274 (321)

Other reserves 222 222

Surplus attributable to equity holders of the parent 13,537 4,201

Minority interest 10 10

Total equity 13,547 4,211

Andrews Sykes Group plc 52 weeks 52 weeks

Consolidated Cash Flow Statement ended ended

For the 52 weeks ended 29 December 2007 29 December 31 December

2007 2006

#'000 #'000

Cash flows from operating activities

Cash generated from operations 11,211 15,935

Interest paid (1,115) (1,591)

Net UK corporation tax paid (2,202) (2,465)

Withholding tax recovered / (paid) 50 (52)

Overseas tax paid (877) (290)

Net cash flow from operating activities 7,067 11,537

Investing activities

Dividends received from participating interests (trade investments) 209 -

Disposal costs paid less consideration received on prior year disposals 295 (183)

Sale of property, plant and equipment 778 526

Purchase of property, plant & equipment (5,346) (7,067)

Interest received 440 476

Net cash flow from investing activities (3,624) (6,248)

Financing activities

Loan repayments (1,000) (5,000)

Finance lease capital repayments (141) (131)

Purchase of own shares - (16)

Sale of own shares by ESOP - 4

Net cash flow from financing activities (1,141) (5,143)

Net increase in cash and cash equivalents 2,302 146

Cash and cash equivalents at the beginning of the year 10,190 10,342

Effect of foreign exchange rate changes 610 (298)

Cash and cash equivalents at end of the year 13,102 10,190

Reconciliation of net cash flow to movement in net debt in the period

Net increase in cash and cash equivalents 2,302 146

Cash outflow from the decrease in debt 1,141 5,131

Non cash movements in respect of new finance leases (182) -

Non cash movements in the fair value of derivative instruments (48) 23

Movement in net debt during the period 3,213 5,300

Opening net debt at the beginning of the year (16,167) (21,169)

Effect of foreign exchange rate changes 610 (298)

Closing net debt at the end of the year (12,344) (16,167)

Andrews Sykes Group plc

Consolidated Statement of Recognised Income and Expense

For the 52 weeks ended 29 December 2007

52 weeks 52 weeks

ended ended

29 December 31 December

2007 2006

#'000 #'000

Actual return less expected return on pension scheme 154 636

assets

Experience gains and losses arising on plan obligation 424 (340)

Changes in demographic and financial assumptions underlying the present

value of plan obligations (279) (1,937)

Currency translation differences on foreign currency net investments 595 (321)

Deferred tax on items posted directly to equity (107) 493

Net income / (expense) recognised directly in equity 787 (1,469)

Profit for the period attributable to parent's shareholders 8,549 9,708

Total recognised income and expense for the period attributable to equity

holders of the parent 9,336 8,239

Movement on share capital and reserves

Share ESOP Retained Translation Other Total

capital reserve earnings reserve reserves 0

#'000 #'000 #'000 #'000 #'000 #'000

At 1 January 2006 446 (6) (4,688) - 222 (4,026)

Total recognised income and expense - - 8,560 (321) - 8,239

Purchase of own shares - - (16) - - (16)

Sale of shares by the ESOP - 6 (2) - - 4

At 31 December 2006 446 - 3,854 (321) 222 4,201

Total recognised income and expense - - 8,741 595 - 9,336

At 29 December 2007 446 - 12,595 274 222 13,537

Notes

1. Whilst the financial information included in this preliminary

announcement has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards (IFRSs),

this announcement does not itself contain sufficient information to comply with

IFRSs. The group expects to distribute copies of the full Annual Report and

Financial Statements that comply with IFRSs by the middle of May 2008 following

which copies will be available from the registered office of the Company;

Premier House, Darlington Street, Wolverhampton, WV1 4JJ.

2. The Company's Annual General Meeting will be held at 10.30 a.m. on

Wednesday 11 June 2008 at Floor 5, 10 Bruton Street, London, W1J 6PX.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FKKKNFBKDFQN

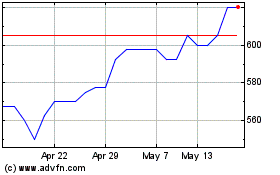

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024