RNS Number:6354E

Andrews Sykes Group PLC

27 September 2007

Andrews Sykes Group plc

Interim Financial Statements

30 June 2007

Overview and financial highlights

I am pleased to be able to report that, despite unfavourable weather conditions,

the underlying Group trading profit has been maintained at a similar level

compared with the same period in 2006. This is due to our continuing cost

control and diversification strategies which ensure that satisfactory results

can be achieved even in the face of less than ideal trading conditions.

The financial highlights of this period compared with the first half of 2006 are

as follows:

2007 2006

#'000 #'000

Revenue 27,185 27,609

Trading profit before pension curtailment 5,665 5,442

charge

EBITDI* 6,635 7,211

Profit for the financial 2,857 3,340

period

Adjusted basic earnings per share from 7.88 7.50

continuing operations excluding pension pence pence

curtailment charge

Basic earnings per share from continuing 6.41 7.50

operations pence pence

Net cash inflow from operating 3,414 3,691

activities

* Earnings Before Interest, Taxation, Depreciation and Impairment provisions as

reconciled on the face of the income statement.

Operations review

Continued close and detailed operational, marketing and financial management

have delivered a very good result in the face of unhelpful climate conditions.

We regard good customer relations as key to maintaining and developing market

share in highly competitive markets. Thus the much lower temperatures in the UK

in the early summer compared with 2006, though reducing our comfort air

conditioning revenues, have not had a proportionate effect on our market share

which has held up in difficult times.

We have also started, very cautiously, using our group expertise and resources

to open new depots in Holland and Belgium as well as a company specialising in

air conditioning in Florida, USA. Initial results from these start ups are

encouraging.

Pension curtailment offer

During the financial period an offer was made to all deferred members of our

defined benefit pension scheme giving them the opportunity to transfer their

accrued pension rights to an alternative pension scheme provider. Whilst it will

take several months for this offer to be finalised, the anticipated financial

effects have been reflected in these interim financial statements.

In summary it is expected that the cash cost to the group will be approximately

#4.6 million, of which #0.1 million had been paid by the period end, and this

will be financed primarily by new bank borrowings. It is anticipated that the

offer will result in a reduction in the pension scheme deficit of approximately

#3.7 million and a charge to the income statement of #0.9 million.

Prospects

The continuation of unfavourable weather conditions in the UK and Northern

Europe has resulted in air conditioning revenues below those of the remarkable

summer of 2006. We have however held onto our market share but lower

temperatures have impacted on the opening months of the second half. Fortunately

the pump division continues to perform well, ahead of both last year and our

expectations.

Nevertheless, overall, I am confident that I will still be able to report a

reasonable result for the second half of 2007.

JG Murray

Chairman

27 September 2007

Andrews Sykes Group plc

Consolidated Income Statement

For the 26 weeks ended 30 June 2007 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Continuing operations

Revenue 27,185 27,609 59,768

Cost of sales -12,696 -13,434 -26,918

Gross profit 14,489 14,175 32,850

Distribution costs -4,250 -4,433 -9,471

Administrative expenses -4,574 -4,300 -8,107

Trading profit before pension curtailment charge 5,665 5,442 15,272

Pension curtailment charge (see note 5) -934 - -

Operating profit 4,731 5,442 15,272

EBITDI* 6,635 7,211 18,887

Depreciation and impairment losses -2,255 -2,012 -4,153

Profit on the sale of property, plant and 351 243 538

equipment

Operating profit 4,731 5,442 15,272

Finance income 1,480 1,197 2,277

Finance costs -1,910 -1,855 -3,549

Profit before taxation 4,301 4,784 14,000

Taxation -1,444 -1,444 -4,150

Profit for the period from continuing operations 2,857 3,340 9,850

Discontinued operations

Loss for the period from discontinued operations - - -142

Profit for the financial period 2,857 3,340 9,708

Earnings per share from continuing operations

Basic (pence) 6.41p 7.50p 22.11p

Diluted (pence) 6.41p 7.49p 22.10p

Earnings per share from total operations

Basic (pence) 6.41p 7.50p 21.79p

Diluted (pence) 6.41p 7.49p 21.79p

* Earnings Before Interest,

Taxation, Depreciation and

Impairment provisions

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 30 June 2007 (unaudited)

30 June 2007 1 July 2006 31 December

2006

#'000 #'000 #'000

Non-current assets

Property, plant and equipment 15,340 13,205 15,201

Goodwill - 31 31

Lease prepayments 224 234 229

Trade investments 164 164 164

Deferred tax asset 2,361 3,223 3,201

Derivative financial instruments 161 - 23

18,250 16,857 18,849

Current assets

Stocks 5,830 4,475 4,336

Trade and other receivables 15,318 14,528 16,217

Cash and cash equivalents 11,908 11,435 10,190

Assets held for sale - 188 -

33,056 30,626 30,743

Current liabilities

Trade and other payables -14,436 -8,560 -10,108

Current tax liabilities -1,343 -2,133 -2,292

Bank loans -5,000 -5,000 -5,000

Obligations under finance leases -233 -233 -233

Provisions -15 -495 -24

-21,027 -16,421 -17,657

Net current assets 12,029 14,205 13,086

Total assets less current liabilities 30,279 31,062 31,935

Non-current liabilities

Bank loans -20,000 -25,000 -20,000

Obligations under finance leases -1,078 -1,214 -1,147

Retirement benefit obligations -2,190 -5,633 -6,577

-23,268 -31,847 -27,724

Net assets / (liabilities) 7,011 -785 4,211

Equity

Share capital 446 446 446

Retained earnings 6,701 -1,366 3,854

Translation reserve -368 -97 -321

Other reserves 222 222 222

Surplus / (deficit) attributable to the parent's 7,001 -795 4,201

shareholders

Minority interest 10 10 10

Total equity 7,011 -785 4,211

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 26 weeks ended 30 June 2007 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Cash flows from operating activities

Cash generated from operations 5,259 5,356 15,935

Interest paid -211 -877 -1,591

Net UK Corporation tax paid -1,352 -600 -2,465

Withholding tax paid -69 -52 -52

Overseas tax paid -213 -136 -290

Net cash flow from operating 3,414 3,691 11,537

activities

Investing activities

Disposal costs paid less consideration received 295 -138 -183

on prior year disposals

Sale of property, plant and equipment 389 342 526

Purchase of property, plant & equipment -2,408 -2,804 -7,067

Interest received 136 164 476

Net cash flow from investing activities -1,588 -2,436 -6,248

Financing activities

Loan repayments - - -5,000

Finance lease capital repayments -69 -64 -131

Purchase of own shares - -16 -16

Sale of own shares by ESOP - 4 4

Net cash flow from financing activities -69 -76 -5,143

Net increase in cash and cash equivalents 1,757 1,179 146

Cash and cash equivalents at beginning of period 10,190 10,342 10,342

Effect of foreign exchange rate changes -39 -86 -298

Cash and cash equivalents at end of period 11,908 11,435 10,190

Reconciliation of net cash flow to movement in net debt in the period

Net increase in cash and cash equivalents 1,757 1,179 146

Cash outflow from the decrease in debt 69 64 5,131

Non cash movements in the fair value of 138 - 23

derivatives

Movement in net debt during the period 1,964 1,243 5,300

Opening net debt at the beginning of period -16,167 -21,169 -21,169

Effect of foreign exchange rate changes -39 -86 -298

Closing net debt at the end of period -14,242 -20,012 -16,167

Andrews Sykes Group plc

Consolidated Statement of Recognised Income and Expense

For the 26 weeks ended 30 June 2007 (unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Actual return less expected return on pension - - 636

scheme assets

Experience gains and losses arising on plan - - -340

obligation

Changes in demographic and financial assumptions

underlying the present value of - - -1,937

plan obligations

Currency translation differences on foreign -46 -97 -321

currency net investments

Deferred tax on items posted directly to equity -11 - 493

Net income recognised directly in equity -57 -97 -1,469

Profit for the period attributable to equity 2,857 3,340 9,708

shareholders

Total recognised income and expense for the

period attributable to equity shareholders 2,800 3,243 8,239

Andrews Sykes Group plc

Notes to the consolidated financial statements

For the 26 weeks ended 30 June 2007

(unaudited)

1. General information

Basis of preparation

These interim financial statements have been prepared in accordance with

International Accounting Standards (IAS) and International Financial Reporting

Standards (IFRS) as adopted by the European Union and with the Companies Act

1985. It complies with the requirements of IAS 34 - Interim Financial Reporting.

The information for the 52 weeks ended 31 December 2006 does not constitute the

Group's statutory accounts for 2006 as defined in Section 240 of the Companies

Act 1985. Statutory accounts for 2006 have been delivered to the Registrar of

Companies. The Auditors' report on those accounts was unqualified and did not

contain statements under Section 237(2) or (3) of the Companies Act 1985. These

interim Financial Statements, which were approved by the Board of Directors on

26 September 2007, have not been audited or reviewed by the Auditors.

These interim financial statements have been prepared using the historical cost

basis of accounting except for:

i) Properties held at the date of transition to IFRS which are stated at deemed

cost;

ii) Assets held for sale which are stated at the lower of fair value less

anticipated disposal costs and carrying value and

iii) Derivative financial instruments (including embedded derivatives) which are

valued at fair value.

Functional and presentational currency

The financial statements are presented in pounds sterling because that is the

functional currency of the primary economic environment in which the group

operates.

First time adoption of International Financial Reporting Standards

This is the Group's first interim statement that has been prepared in accordance

with IFRS. The Group's transition date for adoption of IFRS is 1 January 2006.

An explanation of how the transition to IFRS has affected the Group's financial

position at the date of transition, 1 July 2006 (the date of the last interim

report prepared in accordance with UK GAAP) and 31 December 2006 (the last

reporting date under UK GAAP) together with a reconciliation of the results for

the 26 weeks ended 1 July 2006 and 52 weeks ended 31 December 2006 under UK GAAP

to IFRS are given in note 11.

The Group has revised its accounting policies where applicable to conform with

IFRS and the significant policies having an effect on the interim statement are

set out below. These policies have been applied consistently to all the periods

presented across all group companies and in preparing the opening balance sheet

as at 1 January 2006 for the purpose of transition to IFRS.

The Group has taken advantage of the following exemptions on transition to IFRS

as permitted by paragraph 13 of IFRS 1:

* The requirements of IFRS 3 - Business Combinations - have not been applied

to business combinations that occurred before the date of transition to

IFRS.

* The carrying values of freehold and leasehold properties are based on

previously adopted UK GAAP valuations and these are now taken as deemed

cost on transition to IFRS.

2. Significant accounting policies

Basis of consolidation

The consolidated financial statements incorporate the financial statements of

the Company and entities controlled by the Company (its subsidiaries) made up to

30 June 2007. Control is achieved where the Company has the power to govern the

financial and operating policies of an investee so as to obtain benefits from

its activities.

Minority interests in the net assets of consolidated subsidiaries are identified

separately from the Group's equity therein. Minority interests consist of the

amount of those interests at the date of the original business combination (see

below) and the minority's share of changes in equity since the date of the

combination. Losses applicable to the minority in excess of the minority's

interest in the subsidiary's equity are allocated against the interests of the

Group except to the extent that the minority has a binding obligation and is

able to make an additional investment to cover the losses.

All intra-group transactions, balances, income and expenses are eliminated on

consolidation.

Business combinations and goodwill

Goodwill arising on consolidation represents the excess of consideration over

the group's interest in the fair value of assets acquired. Goodwill is

recognised as an asset and is not amortised. It is reviewed for impairment at

each reporting date as detailed in "impairment of non-financial assets" below.

In accordance with the options that are available under IFRS 1, the Group has

elected not to apply IFRS 3 retrospectively to past business combinations that

occurred before the date of transition to IFRS. Accordingly goodwill amounting

to #37,206,000 that had previously been offset against reserves under UK GAAP

has not been recognised in the opening IFRS balance sheet.

Trade investments

The results of entities over which the Group is not in a position to be able to

exercise significant influence despite holding a significant shareholding are

not accounted for as associates and therefore are not equity accounted. These

companies are classified as trade investments and are carried at cost within

non-current assets as they are held as long term investments. Dividend income is

recognised in the income statement on a cash basis when received.

Property, plant and equipment

Property is carried at deemed cost at the date of transition to IFRS based on

the previous UK GAAP valuations adopted in 1998. Plant and equipment held at the

date of transition and subsequent additions to property, plant and equipment are

stated at purchase cost including directly attributable costs. The Group does

not have a revaluation policy.

Freehold land is not depreciated. Depreciation of other property, plant and

equipment is provided on a straight line basis using rates calculated to write

down the cost of each asset to its estimated residual value over its estimated

useful life as follows:

Property:

Freehold buildings and long leasehold property 2%

Short leasehold buildings Period of the

lease

Equipment for hire:

Heating, air conditioning and other environmental control 20%

equipment

Pumping equipment 10% to 33%

Accessories 33%

Motor vehicles 20% to 25%

Plant and machinery 7.5% to 33%

Fixtures and fittings 20%

Annual reviews are made of estimated useful lives and material residual values.

Leased assets

Lessor accounting

The group does not hold any assets for hire under finance leases.

Assets held for use under operating leases are recorded as hire fleet assets

within property, plant and equipment and are depreciated over their useful lives

to their estimated residual value.

Lessee accounting

Property leases are split into two elements, land and buildings and each

considered in isolation. The land element is always classified as an operating

lease and the building element is reviewed to determine if it is operating or

finance in nature. Initial rental payments in respect of operating leases are

included in current and non-current assets as appropriate and amortised to the

income statement over the period of the lease. Ongoing rental payments are

charged as an expense in the income statement on a straight line basis until the

date of the next rent review. Finance leases are capitalised and depreciated in

accordance with the accounting policy for property, plant and equipment.

As permitted by IFRS 1 at the date of transition to IFRS, the carrying value of

long leasehold properties are based on the previous UK GAAP valuations adopted

in 1998 and this has been taken as deemed cost.

Immaterial peppercorn rentals and ground rents in respect of all properties are

expensed to the profit and loss account on an accruals basis.

The group does not have any items of plant and equipment financed by finance

leases or similar hire purchase agreements.

Rental costs arising from operating leases are charged as an expense in the

income statement on a straight line basis over the period of the lease.

Non-current assets held for sale

Non-current assets and disposal groups are reclassified as assets held for sale

if their carrying value will be recovered through a sale transaction which is

highly probable to be completed within 12 months of the initial classification.

Assets held for sale are valued at the lower of carrying amount at the date of

initial classification and fair value less costs to sell.

Impairment of non-financial assets

Goodwill is tested annually for impairment, or more frequently if there are any

changes in circumstances or events that indicate that a potential impairment may

exist. Goodwill impairments cannot be reversed.

Property, plant and equipment are reviewed for indications of impairment when

events or changes in circumstances indicate that the carrying amount may not be

recovered. If there are indications then a test is performed on the asset

affected to assess its recoverable amount against carrying value.

An asset impaired is written down to the higher of value in use or its fair

value less costs to sell.

Deferred and current taxation

The charge for taxation is based on the taxable profit or loss for the period

and takes into account taxation deferred because of differences between the

treatment of certain items for taxation and for accounting purposes. Full

provision is made for the tax effects of these differences. Deferred tax is

provided on unremitted earnings from overseas subsidiaries where it is probable

that these earnings will be remitted to the UK in the foreseeable future.

Deferred tax is measured using tax rates that have been enacted, or

substantively enacted, by the year end balance sheet date. Deferred tax assets

and liabilities are not discounted.

The carrying amount of deferred tax assets is reviewed at each reporting balance

sheet date to ensure that it is probable that sufficient taxable profits will be

available to allow the asset to be recovered. Assets and liabilities, in respect

of both deferred and current tax, are only offset when there is a legally

enforceable right to offset and the assets and liabilities relate to taxes

levied by the same taxation authority.

Deferred and current tax are charged or credited in the income statement except

when they relate to items charged directly to equity in which case the

associated tax is also dealt with in equity.

Stocks

Stocks are valued at the lower cost of purchase and net realisable value. Cost

comprises actual purchase price and where applicable associated direct costs

incurred bringing the stock to its present location and condition. Net

realisable value is based on estimated selling price less further costs expected

to be incurred to completion and disposal. Provision is made for obsolete, slow

moving or defective items where appropriate.

Financial instruments

Financial assets and financial liabilities are recognised on the consolidated

balance sheet when the group becomes a party to the contractual provisions of

the instrument.

Financial liabilities and equity instruments are classified according to the

substance of the contractual arrangements entered into. An equity instrument is

any contract that evidences a residual interest in the assets of the group after

deducting all of its liabilities.

Derivative financial instruments and hedge accounting

The Group's borrowings are subject to floating rates based on LIBOR plus a

margin of between 0.5% and 1.25%. The Group uses financial derivatives to cap

the term loan (#20 million at 30 June 2007) exposure to LIBOR to a maximum of

5.5% throughout its term.

The Group's policy is not to hedge its international assets with respect to

foreign currency balance sheet translation exposure, nor against foreign

currency transactions. The Group does not use financial instruments for

speculative purposes.

Derivatives embedded in other financial instruments or other host contracts are

treated as separate derivatives when their risks and characteristics are not

closely related to those of the host contracts.

Derivative financial instruments are initially measured at cost and are

remeasured at fair value at the balance sheet date. Changes in the fair value of

derivative financial instruments that are designated and are effective as hedges

of future cash flows are recognised directly in equity and the ineffective

portion is recognised immediately in the income statement. Changes in the fair

value of derivative financial instruments that do not qualify for hedge

accounting are recognised in the income statement as they arise.

Trade and other receivables

Trade and other receivables are measured at initial recognition at fair value

and are subsequently measured at amortised cost using the effective interest

rate method. Allowances for irrecoverable amounts, which are dealt with in the

income statement, are calculated based on the difference between the asset's

carrying amount and the present value of estimated future cash flows discounted

at the effective interest rate computed at initial recognition.

Cash and cash equivalents

Cash and cash equivalents includes cash-in-hand, cash-at-bank and short term

highly liquid investments that are readily convertible into known amounts of

cash within three months from the date of initial acquisition with an

insignificant risk of a change in value.

Trade and other payables

Trade and other payables are measured at initial recognition at fair value and

are subsequently measured at amortised cost using the effective interest rate

method.

Bank loans

Interest bearing bank loans are recorded at the proceeds received less capital

repayments made. Finance charges are accounted for on an accruals basis in the

profit and loss account using the effective interest rate method. They are

included within accruals to the extent that they are not settled in the period

in which they arise.

Provisions

Provisions are created where the group has a present obligation (legal or

constructive) as a result of a past event where it is probable that the group

will be required to settle that obligation. Provisions are measured at the

directors' best estimate of the expenditure required to settle the obligation at

the balance sheet date. Provisions are only discounted to present value where

the effect is material.

Defined benefit retirement benefit costs

The interest cost and the expected return on assets are included within finance

costs and finance income respectively within the income statement. Actuarial

gains and losses are recognised immediately in the consolidated Statement of

Recognised Income and Expense (SORIE).

The defined benefit scheme is funded with the assets of the scheme held

separately in trustee administered funds. Pension scheme assets are measured at

fair value and liabilities are measured on an actuarial basis using the

projected unit method and discounted at a rate equivalent to the current rate of

return on a high quality corporate bond of equivalent currency and term to the

scheme liabilities. Full actuarial valuations are obtained triennially and are

updated at each year end balance sheet date in accordance with IAS 19. The

assumptions used in the half year interim statements are normally consistent

with the previous year end unless the directors are aware of any significant

factors which would render these assumptions invalid.

Net defined benefit pension scheme deficits are presented separately on the

balance sheet within non-current liabilities before tax relief. The attributable

deferred tax asset is included within deferred tax and is subject to the

recognition criteria as set out in the accounting policy on deferred and current

taxation. Net defined benefit pension scheme surpluses are only recognised to

the extent of any refunds and reductions in future contributions to the scheme.

Net debt

Net debt is defined as cash and cash equivalents, bank and other loans including

finance lease obligations and derivative financial instruments stated at current

fair value.

Revenue recognition

Revenue

Revenue represents the fair value of the consideration received and receivable

for the hire, sale and installation of environmental control products after

deducting trade discounts and volume rebates. Revenue is recognised for sales on

despatch of goods and for short term hire items on a straight line basis over

the period of the hire. Installation revenue is recognised as the contract

progresses on the basis of work completed. Revenue excludes Value added Tax.

Investment and interest income

Dividend income is recognised in the income statement when the shareholder's

right to receive payment has been established.

Interest income from bank deposit accounts is accrued on a time basis calculated

by reference to the principal on deposit and the effective interest rate

applicable.

Foreign currencies

Transactions in foreign currencies are recorded at the rate of exchange at the

date of the transaction. Monetary assets and liabilities in foreign currencies

are translated into pounds sterling at the financial reporting period end rates.

The results of overseas subsidiary undertakings, associates and trade

investments are translated into pounds sterling at average rates for the period

unless exchange rates fluctuate significantly during that period in which case

exchange rates at the date of transactions are used. The closing balance sheets

are translated at the period end rates and the exchange differences arising are

transferred to the group's translation reserve as a separate component of equity

and are reported within the Statement of Other Recognised Income and Expense.

All other exchange differences are included within the Income Statement in the

period.

Operating profit

Operating profit is defined as the profit for the period from continuing

operations after all operating costs and income but before investment income,

income from other participating interests, finance income, finance costs, other

gains and losses and taxation. Operating profit is disclosed as a separate line

on the face of the income statement.

Finance costs

Finance costs are recognised in the income statement on an accruals basis in the

period in which they are incurred.

3 Revenue

An analysis of the Group's revenue is as follows:

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Continuing operations

Hire 19,693 19,151 43,088

Sales 4,084 4,539 8,762

Installations 3,408 3,919 7,918

Group consolidated revenue from the sale of goods and services 27,185 27,609 59,768

Finance income 1,480 1,197 2,277

Gross consolidated revenue 28,665 28,806 62,045

4 Business and Geographical Segmental Analysis

Explanation

The Group operates in the United Kingdom, Northern Europe, the United Arab

Emirates and America providing the hire and sale of a range of

environmental control equipment. It also installs fixed air conditioning

equipment within the United Kingdom.

The directors consider that the nature of the risks and returns within the

hire and sales market are comparable across the geographical sectors within

which the group operates. However different risks and returns are faced by

the fixed air conditioning installation business.

The Group hires and sells similar equipment to the same market from its

depot network.

The integrated nature of this operation does not permit a meaningful

analysis of profit, assets or liabilities between hire and sales.

Principal business segment are therefore as follows:

The hire and sale of environmental control equipment - Hire & sales

The installation and maintenance of fixed air conditioning equipment - Fixed

installation UK Direct costs are allocated to each segment, central costs

are included in unallocated overheads and expenses.

Principal geographical segments are:

United Kingdom

Rest of Europe

Middle East and Africa

The Group was also previously involved in the hire and sale of accommodation

units and the sale of light engineering products in the UK. There were no

sales of these products in either the current or preceding financial

periods, the discontinued activities relate to adjustments made following

the disposal of these businesses (see note 6 ).

Segmental information about these businesses is presented below. Inter

segment sales are charged at arms length prices.

Business Segments

Income statement analysis Hire & Fixed Sub Eliminations Consolidated

26 weeks ended 30 June 2007 sales installation total results

#'000 #'000 #'000 #'000 #'000

Revenue

External sales 23,777 3,408 27,185 - 27,185

Inter-segment sales 42 7 49 -49 -

Total revenue 23,819 3,415 27,234 -49 27,185

Segment result 5,813 160 5,973 -7 5,966

Unallocated overheads and expenses -301

Pension curtailment charge -934

Operating profit 4,731

Finance income 1,480

Finance costs -1,910

Profit before taxation 4,301

Taxation -1,444

Profit for the financial period 2,857

Balance sheet information Hire & Fixed Sub Eliminations Consolidated

As at 30 June 2007 sales installation total results

#'000 #'000 #'000 #'000 #'000

Segment assets 44,614 3,293 47,907 -42 47,865

Trade investments 164

Deferred tax asset 2,361

Derivative financial instruments 161

Unallocated corporate assets 755

Consolidated total assets 51,306

Segment liabilities -12,670 -1,147 -13,817 42 -13,775

Current tax liabilities -1,343

Bank loans -25,000

Obligations under finance leases -1,311

Provisions -15

Pensions -2,190

Unallocated corporate liabilities -661

Consolidated total liabilities -44,295

Other information Hire & Fixed Sub Eliminations Consolidated

26 weeks ended 30 June 2007 sales installation total results

#'000 #'000 #'000 #'000 #'000

Capital additions 2,380 28 2,408 - 2,408

Depreciation 2,156 68 2,224 - 2,224

Income statement analysis Hire & Fixed Sub Eliminations Consolidated

26 weeks ended 1 July sales installation total results

2006

#'000 #'000 #'000 #'000 #'000

Revenue

External sales 23,690 3,919 27,609 - 27,609

Inter-segment sales 47 12 59 -59 -

Total revenue 23,737 3,931 27,668 -59 27,609

Segment result 5,811 149 5,960 -9 5,951

Unallocated overheads and expenses -509

Operating profit 5,442

Finance income 1,197

Finance costs -1,855

Profit before taxation 4,784

Taxation -1,444

Profit for the financial period 3,340

Balance sheet information Hire & Fixed Sub Eliminations Consolidated

As at 1 July 2006 sales installation total results

#'000 #'000 #'000 #'000 #'000

Segment assets 38,893 3,110 42,003 -23 41,980

Trade investments 164

Deferred tax asset 3,223

Assets held for sale 188

Unallocated corporate 1,928

assets

Consolidated total assets 47,483

Segment liabilities -7,052 -1,168 -8,220 23 -8,197

Current tax liabilities -2,133

Bank loans -30,000

Obligations under finance leases -1,447

Provisions -495

Pensions -5,633

Unallocated corporate liabilities -363

Consolidated total liabilities -48,268

Other information Hire & Fixed Sub Eliminations Consolidated

26 weeks ended 1 July sales installation total results

2006

#'000 #'000 #'000 #'000 #'000

Capital additions 2,800 5 2,805 - 2,805

Depreciation 1,922 90 2,012 - 2,012

Income statement analysis Hire & Fixed Sub Eliminations Consolidated

52 weeks ended 31 December 2006 sales installation total results

#'000 #'000 #'000 #'000 #'000

Revenue

External sales 51,850 7,918 59,768 - 59,768

Inter-segment sales 109 16 125 -125 -

Total revenue 51,959 7,934 59,893 -125 59,768

Segment result 15,862 269 16,131 -19 16,112

Unallocated overheads and expenses -840

Operating profit 15,272

Finance income 2,277

Finance costs -3,549

Profit before taxation 14,000

Taxation -4,150

Profit for the period from continuing operations 9,850

Post tax profit for the period from discontinued operations -142

Profit for the financial period after taxation and discontinued operations 9,708

Balance sheet information Hire & Fixed Sub Eliminations Consolidated

As at 31 December 2006 sales installation total results

#'000 #'000 #'000 #'000 #'000

Segment assets 41,591 3,543 45,134 -345 44,789

Trade investments 164

Deferred tax asset 3,201

Derivative financial instruments 23

Unallocated corporate 1,415

assets

Consolidated total assets 49,592

Segment liabilities -8,724 -1,586 -10,310 345 -9,965

Current tax liabilities -2,292

Bank loans -25,000

Obligations under finance leases -1,380

Provisions -24

Pensions -6,577

Unallocated corporate liabilities -143

Consolidated total liabilities -45,381

Other information Hire & Fixed Sub Eliminations Consolidated

52 weeks ended 31 December 2006 sales installation total results

#'000 #'000 #'000 #'000 #'000

Capital additions 7,060 7 7,067 - 7,067

Depreciation 3,984 169 4,153 - 4,153

Geographical segments

The geographical analysis of the Group's revenue was as

follows:

By origin By destination

26 weeks 26 weeks 52 weeks 26 weeks 26 weeks 52 weeks

ended ended ended ended ended ended

30 June 1 July 31 December 30 June 1 July 31 December

2007 2006 2006 2007 2006 2006

#'000 #'000 #'000 #'000 #'000 #'000

United Kingdom 22,761 22,487 50,254 21,987 22,137 49,070

Rest of Europe 2,095 3,131 5,435 2,854 3,180 6,240

Middle East and Africa 2,172 1,991 4,079 2,173 2,027 4,116

Rest of the world 157 - - 171 265 342

27,185 27,609 59,768 27,185 27,609 59,768

The carrying amount of segment assets and additions to property, plant and equipment analysed by the

geographical area in which the assets are located are as

follows:

Additions to property,

Segment assets plant and equipment

26 weeks 26 weeks 52 weeks 26 weeks 26 weeks 52 weeks

ended ended ended ended ended ended

30 June 1 July 31 December 30 June 1 July 31 December

2007 2006 2006 2007 2006 2006

#'000 #'000 #'000 #'000 #'000 #'000

United Kingdom 41,769 36,532 39,265 2,050 2,484 6,374

Rest of Europe 2,979 2,734 2,767 163 182 487

Middle East and Africa 2,876 2,714 2,757 111 139 206

Rest of the world 241 - - 84 - -

47,865 41,980 44,789 2,408 2,805 7,067

5 Pension curtailment charge 26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Pension curtailment -934 - -

charge

During the financial period an offer was made to all deferred members of the

Andrews Sykes Group Pension Scheme (a closed defined benefit scheme) to

transfer their accrued pension rights to an alternative pension scheme

provider of their choice. Independent Financial Advice was made available

free of charge to all deferred members. In summary the offer was to increase

each individual member's transfer value by 40% compared with the amount

that was then available from the scheme, this bonus could be paid either as

a cash payment direct to the member or as an enhanced transfer value to the

member's new pension scheme provider.

These interim financial statements include estimated reserves of the likely

cost of this offer, including legal expenses, employment costs and

curtailment settlement gains and losses. However as the process of

transferring the member's pension rights was still in progress when these

interim financial statements were prepared, the estimated liabilities will

be recalculated in the year end financial statements.

It is currently estimated that the net cash outflow as a result of this

offer will be approximately #4,582,000 of which #66,000 had been spent at

30 June 2007. The movement in the Retirement benefit obligation during the

period is as follows:

#'000

Liability at the beginning of the period before 6,577

deferred tax

Ordinary contributions paid during the period -750

Expected return on assets -1,050

Interest on liabilities 1,061

Anticipated effect of transfer value -3,648

offer

Liability at the end of the period before deferred 2,190

tax

In accordance with the Group's accounting policies, the actuarial

assumptions used to calculate the above obligation are those applied in the

last annual report and financial statements. These assumptions will be

reviewed in detail at the end of the financial year.

6 Discontinued activities 26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Adjustments directly related to prior period

disposals

Provisions for onerous lease - - 115

commitments

Profit adjustments in respect of the sale of subsidiary - - 27

undertakings

Loss for the period before taxation - - 142

Attributable tax charge - - -

Loss for the period from discontinued operations - - 142

During the 52 weeks ended 31 December 2005 the Group sold two subsidiary

undertakings, Accommodation Hire Limited and Engineering Appliances Limited

realising a combined profit on disposal of #6,564,000 under UK GAAP.

During the 52 weeks ended 31 December 2006 certain adjustments were made to

both the deferred consideration receivable and legal costs payable which

resulted in the net charge of #27,000 under UK GAAP last year.

The Group has various onerous property lease commitments inherited from the

Cox Plant business which was sold during 2002. During the previous financial

years the directors re-assessed the level of provisions required in

respect of these commitments and have accordingly adjusted the onerous lease

provision. This resulted in a charge to the income statement of #115,000

under UK GAAP during the 52 weeks ended 31 December 2005.

Cash flows attributable to the above discontinued activities have been

included within the following categories in the cash flow statement:

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Investing activities 295 -138 -183

7 Earnings per share

Basic earnings per share

The basic figures have been calculated by reference to the weighted average

number of ordinary shares in issue, excluding those in the ESOP reserve, and

the earnings as set out below:

26 weeks to 30 June 2007

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 2,857 2,857 44,552,715

Basic earnings per ordinary share 6.41p 6.41p

(pence)

26 weeks to 1 July 2006

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 3,340 3,340 44,562,701

Basic earnings per ordinary share 7.50p 7.50p

(pence)

52 weeks to 31 December 2006

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 9,850 9,708 44,557,701

Basic earnings per ordinary share 22.11p 21.79p

(pence)

Adjusted basic earnings per share excluding pension curtailment charge

The basic figures excluding the pension curtailment charge have been

calculated by reference to the weighted average number of ordinary shares

in issue, excluding those in the ESOP reserve, and the earnings as set out

below:

26 weeks to 30 June 2007

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 2,857 2,857 44,552,715

Add back pension curtailment charge net of tax 654 654

Adjusted basic earnings/weighted average number of shares 3,511 3,511 44,552,715

Adjusted basic earnings per ordinary share (pence) excluding 7.88p 7.88p

pension curtailment charge

The pension curtailment charge has no impact on the calculation of the basic

earnings per ordinary share for either the 26 weeks ended 1 July 2006 or the

52 weeks ended 31 December 2006.

Diluted earnings per share

The calculation of the diluted earnings per ordinary share is based on the

profits and shares as set out in the tables below. The share options have a

dilutive effect for the period calculated as follows:

26 weeks to 30 June 2007

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 2,857 2,857 44,552,715

Weighted average number of shares under option 15,000

Number of shares that would have been issued at

fair value -8,001

Earnings/ diluted weighted average number of 2,857 2,857 44,559,714

shares

Diluted earnings per ordinary share (pence) 6.41p 6.41p

26 weeks to 1 July 2006

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 3,340 3,340 44,562,701

Weighted average number of shares under option 16,194

Number of shares that would have been issued at

fair value -13,369

Earnings/ diluted weighted average number of 3,340 3,340 44,565,526

shares

Diluted earnings per ordinary share (pence) 7.49p 7.49p

52 weeks to 31 December 2006

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 9,850 9,708 44,557,701

Weighted average number of shares under option 15,603

Number of shares that would have been issued at

fair value -11,132

Earnings/ diluted weighted average number of 9,850 9,708 44,562,172

shares

Diluted earnings per ordinary share (pence) 22.10p 21.79p

Adjusted diluted earnings per share excluding pension curtailment charge

The calculation of the diluted earnings per ordinary share excluding the

pension curtailment charge is based on the profits and shares as set out in

the table below. The share options have a dilutive effect for the

period calculated as follows:

26 weeks to 30 June 2007

Continuing Total Number

earnings earnings of shares

#'000 #'000

Basic earnings/weighted average number of shares 2,857 2,857 44,552,715

Add back pension curtailment charge net of tax 654 654

Weighted average number of shares under option 15,000

Number of shares that would have been issued at

fair value -8,001

Adjusted earnings/ diluted weighted average number of shares 3,511 3,511 44,559,714

Adjusted diluted earnings per ordinary share (pence) excluding 7.88p 7.88p

pension curtailment charge

The pension curtailment charge has no impact on the calculation of the

diluted earnings per ordinary share for either the 26 weeks ended 1 July

2006 or the 52 weeks ended 31 December 2006.

8 Share capital

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Authorised:

1,398,170,943 ordinary shares of one pence each 13,982 13,982 13,982

Issued and fully paid:

44,552,865 ordinary shares of one pence each

(1 July 2006: 44,552,865, 31 December: 44,552,865 ordinary 446 446 446

shares of one pence each)

During the period the company did not buy back any shares for cancellation

(26 weeks ended 1 July 2006: 15,000 shares).

The company has one class of ordinary shares which carry no right to fixed

income.

At 30 June 2007 cash options to subscribe for ordinary shares under the

executive share option scheme were held as follows:

Number of one pence

Date of Grant Date normally exercisable Subscription ordinary shares

price per 30 June 1 July 30 December

share 2007 2006 2006

November 2001 November 2004 to October 89.5 pence 15,000 15,000 15,000

2011

No share options were granted, forfeited or expired during either the

current or previous financial periods.

No share options were exercised during the period.

(26 weeks ended 1 July 2006: 5,000 share options on 16 February 2006 when

the average share price was #1.115).

9 Cash generated from operations

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Profit for the period attributable to equity 2,857 3,340 9,708

shareholders

Adjustments for:

Loss from discontinued operations - - 142

Taxation charge 1,444 1,444 4,150

Finance costs 1,910 1,855 3,549

Finance income -1,480 -1,197 -2,277

Profit on the sale of property, plant and -351 -243 -538

equipment

Depreciation and 2,224 2,012 4,153

amortisation

Impairment losses 31 - -

Excess of pension contributions compared with service cost -750 -750 -1,503

Cash generated from operations before movements in working 5,885 6,461 17,384

capital

(Increase) / decrease in stocks -1,493 57 196

Decrease / (increase) in trade and other 760 -1,247 -2,829

receivables

Increase in trade and other payables 116 59 1,544

(Decrease) / increase in provisions -9 26 -360

Cash generated from operations 5,259 5,356 15,935

10 Analysis of net debt

30 June 1 July 31 December

2007 2006 2006

#'000 #'000 #'000

Cash and cash equivalents per cash flow statement 11,908 11,435 10,190

Derivative financial instruments 161 - 23

Financial assets 161 - 23

Bank loans -25,000 -30,000 -25,000

Obligations under finance leases -1,311 -1,447 -1,380

Financial liabilities -26,311 -31,447 -26,380

Net debt -14,242 -20,012 -16,167

11 Explanation of transition to IFRS

This is the first period that the group has prepared its consolidated

financial statements under IFRS. The following disclosures are required in

the year of transition to explain the financial impact of adopting IFRS on

the group. The last financial statements under UK GAAP were for the 52 weeks

ended 31 December 2006 and the date of transition to IFRS was 1 January 2006.

Reconciliation of equity as at 1 January 2006 (date of transition to IFRS)

UK GAAP Reclas IFRS 1 IFRS 5 IAS 17 IAS 19 IAS 39 IFRS

sifi First time Non Leases Employee Fair value

cations adoption current benefits adjustments

assets

Note 1 Note 2 Note 3 Note 4 Note 5 Note 6

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

Non-current assets

Goodwill 31 - - - - - - 31

Property, plant & 12,011 - - - 699 - - 12,710

equipment

Lease prepayments - - - - 239 - - 239

Trade investments 164 - - - - - - 164

Deferred tax asset - 2,672 - - 169 17 - 2,858

12,206 2,672 - - 1,107 17 - 16,002

Current assets

Stocks 4,532 - - - - - - 4,532

Trade and other 13,929 -772 - - 10 - - 13,167

receivables

Cash and cash 10,342 - - - - - - 10,342

equivalents

28,803 -772 - - 10 - - 28,041

Current liabilities

Trade and other -14,687 6,060 - - - - - -8,627

payables

Current tax - -1,060 - - - - - -1,060

liabilities

Bank loans - -5,000 - - - - - -5,000

Obligations under

finance leases - - - - -233 - - -233

Provisions - -469 - - - - - -469

-14,687 -469 - - -233 - - -15,389

Net current assets 14,116 -1,241 - - -223 - - 12,652

Total assets less 26,322 1,431 - - 884 17 - 28,654

current liabilities

Non-current

liabilities

Bank loans -25,000 - - - - - - -25,000

Obligations - - - - -1,278 - - -1,278

under finance

leases

Pension -4,434 -1,900 - - - -58 - -6,392

liabilities

Provisions -469 469 - - - - - -

-29,903 -1,431 - - -1,278 -58 - -32,670

Net liabilities -3,581 - - - -394 -41 - -4,016

Equity

Called-up share 446 - - - - - - 446

capital

ESOP reserve -6 - - - - - - -6

Retained earnings -4,994 - 741 - -394 -41 - -4,688

Revaluation reserve 741 - -741 - - - - -

Other reserves 222 - - - - - - 222

Deficit -3,591 - - - -394 -41 - -4,026

attributable

to equity holders

of the parent

Minority interest 10 - - - - - - 10

Total equity -3,581 - - - -394 -41 - -4,016

Reconciliation of equity as at 1 July 2006 (date of last UK GAAP Interim Statement)

UK GAAP Reclass- IFRS 1 IFRS 3 IAS 17 IAS 19 IFRS 5 IFRS

ifications First time Business Leases Employee Asset held

adoption combinations benefits for sale

Note 1 Note 2 Note 3 Note 4 Note 5 Note 7

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

Non-current assets

Goodwill 24 - - 7 - - - 31

Property, plant & 12,741 - - - 652 - -188 13,205

equipment

Lease prepayments - - - - 234 - - 234

Trade investments 164 - - - - - - 164

Deferred tax asset - 3,041 - - 165 17 - 3,223

12,929 3,041 - 7 1,051 17 -188 16,857

Current assets

Stocks 4,475 - - - - - - 4,475

Trade and other 15,886 -1,368 - - 10 - - 14,528

receivables

Cash and cash 11,435 - - - - - - 11,435

equivalents

Assets held - - - - - - 188 188

for sale

31,796 -1,368 - - 10 - 188 30,626

Current liabilities

Trade and other -8,560 - - - - - - -8,560

payables

Current tax -2,133 - - - - - - -2,133

liabilities

Bank loans -5,000 - - - - - - -5,000

Obligations - - - -233 - - - -233

under finance

leases

Provisions - -495 - - - - - -495

-15,693 -495 - - -233 - - -16,421

Net current 16,103 -1,863 - - -223 - 188 14,205

assets

Total assets 29,032 1,178 - 7 828 17 - 31,062

less current

liabilities

Non-current

liabilities

Bank loans -25,000 -25,000

Obligations - -1,214 -1,214

under finance

leases

Pension -3,902 -1,673 -58 -5,633

liabilities

Provisions -495 495 -

-29,397 -1,178 - - -1,214 -58 - -31,847

Net assets -365 - - 7 -386 -41 - -785

Equity

Called-up share 446 446

capital

Retained earnings -1,776 92 738 7 -386 -41 -1,366

Translation reserve - -97 -97

Revaluation reserve 738 -738 -

Other reserves 217 5 222

Surplus -375 - - 7 -386 -41 - -795

attributable to

equity holders

of the parent

Minority interest 10 10

Total equity -365 - - 7 -386 -41 - -785

Reconciliation of equity as at 31 December 2006 (date of last UK GAAP Financial Statements)

UK GAAP Reclass- IFRS 1 IFRS 3 IAS 17 IAS 19 IAS 39 IFRS

ifications First time Business Leases Employee Fair value

adoption combinations benefits adjustments

Note 1 Note 2 Note 3 Note 4 Note 5 Note 6

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

Non-current assets

Goodwill 17 - - 14 - - - 31

Property, plant & 14,599 - - - 602 - - 15,201

equipment

Lease prepayments - - - - 229 - - 229

Trade investments 164 - - - - - - 164

Deferred tax asset - 3,046 - - 162 - -7 3,201

Derivative financial - - - - - - 23 23

instruments

14,780 3,046 - 14 993 - 16 18,849

Current assets

Stocks 4,336 - - - - - - 4,336

Trade and other 17,280 -1,073 - - 10 - - 16,217

receivables

Cash and cash 10,190 - - - - - - 10,190

equivalents

31,806 -1,073 - - 10 - - 30,743

Current liabilities

Trade and other -17,400 7,292 - - - - - -10,108

payables

Current tax - -2,292 - - - - - -2,292

liabilities

Bank loans - -5,000 - - - - - -5,000

Obligations - - - - -233 - - -233

under finance

leases

Provisions - -24 - - - - - -24

-17,400 -24 - - -233 - - -17,657

- - - - - - - -

Net current 14,406 -1,097 - - -223 - - 13,086

assets

Total assets 29,186 1,949 - 14 770 - 16 31,935

less current

liabilities

Non-current

liabilities

Bank loans -20,000 - - - - - - -20,000

Obligations - - - - -1,147 - - -1,147

under finance

leases

Pension -4,604 -1,973 - - - - - -6,577

liabilities

Provisions -24 24 - - - - - -

-24,628 -1,949 - - -1,147 - - -27,724

Net assets 4,558 - - 14 -377 - 16 4,211

Equity

Called-up share 446 - - - - - - 446

capital

Retained earnings 3,153 312 736 14 -377 - 16 3,854

Translation - -321 - - - - - -321

reserve

Revaluation 736 - -736 - - - - -

reserve

Other reserves 213 9 - - - - - 222

Surplus 4,548 - - 14 -377 - 16 4,201

attributable to

equity holders

of the parent

Minority interest 10 - - - - - - 10

Total equity 4,558 - - 14 -377 - 16 4,211

Reconciliation of profit for the 26 weeks ended 1 July 2006

UK GAAP Reclass- IFRS 3 IAS 17 IAS 19 IAS 39 IFRS

ifications Business Leases Employee Fair value

combinations benefits adjustments

Note 1 Note 3 Note 4 Note 5 Note 6

#'000 #'000 #'000 #'000 #'000 #'000 #'000

Revenue 27,609 27,609

Cost of sales -13,441 - 7 - - - -13,434

Gross profit 14,168 - 7 - - - 14,175

Distribution costs -4,433 - - - - - -4,433

Administrative -4,372 - - 72 - - -4,300

expenses

Operating profit 5,363 - 7 72 - - 5,442

Finance income 282 - - - 915 - 1,197

Finance costs -880 - - -60 -915 - -1,855

Profit before taxation 4,765 - 7 12 - - 4,784

Taxation -1,440 - - -4 - - -1,444

Profit for the financial 3,325 - 7 8 - - 3,340

period

Reconciliation of profit for the 52 weeks ended 31 December 2006

UK GAAP Reclass- IFRS 3 IAS 17 IAS 19 IAS 39 IFRS

ifications Business Leases Employee Fair value

combinations benefits adjustments

Note 1 Note 3 Note 4 Note 5 Note 6

#'000 #'000 #'000 #'000 #'000 #'000 #'000

Revenue 59,768 - - - - - 59,768

Cost of sales -26,932 - 14 - - - -26,918

Gross profit 32,836 - 14 - - - 32,850

Distribution costs -9,471 - - - - - -9,471

Administrative -8,458 206 - 145 - - -8,107

expenses

Operating profit 14,907 206 14 145 - - 15,272

Finance income 477 - - - 1,777 23 2,277

Finance costs -1,651 - - -121 -1,777 - -3,549

Profit on the sale of 206 -206 - - - - -

property

Loss on disposal -142 142 - - - - -

of business -

discontinued

Profit before taxation 13,797 142 14 24 - 23 14,000

Taxation -4,136 - - -7 - -7 -4,150

Profit for the period 9,661 142 14 17 - 16 9,850

from continuing

operations

Loss for the period - -142 - - - - -142

from discontinued

operations

Profit for the financial 9,661 - 14 17 - 16 9,708

period

Notes to the reconciliations of equity

and profit

1 Reclassifications are required as certain items are shown differently under

IFRS compared with UK GAAP. Reclassifications relate to

(i) disclosing the defined benefit pension obligation gross of deferred tax

under IFRS compared with net under UK GAAP, (ii) the disclosure of current

tax liabilities and financial liabilities as separate items on the face of

the balance sheet under IFRS,

( iii ) the split of provisions for liabilities between current and long

term creditors under IFRS, (iv) the reclassification of profit on sale

of property within administration expenses under IFRS and (v) the disclosure

of loss on disposal of business as a discontinued operation.

In addition the foreign exchange translation adjustments are disclosed as

a separate reserve under IFRS from the date of transition.

2 As permitted by IFRS 1 - First time adoption of IFRS, the group has elected

to treat the October 1998 revaluation of the UK freehold and long leasehold

properties as deemed cost at that date. The valuation was carried out by DTZ

Debenham Tie Leung, Chartered Surveyors, at open market value for existing

use in accordance with the RICS Statement of Asset Valuation Practice and

Guidance notes. The aggregate deemed gross cost included within property,

plant and equipment is #2,731,000. Although no adjustment is required to the

carrying value of property, plant and equipment; the revaluation reserve

carried under UK GAAP has been transferred to retained earnings as a

consequence of this election.

3 As required by IFRS 3 - Business Combinations, purchased goodwill is not

amortised and is stated at it's carrying value at the date of transition to

IFRS. Accordingly goodwill amortisation charged in accordance with UK GAAP

has been reversed.

4 IFRS requires property leases to be split into two elements, Land and

Buildings. Each element is then considered independently and treated as a

finance or operating lease as appropriate. This treatment differs to UK GAAP

which requires the wholeproperty lease to be considered in its entirety.

Consequently certain leasehold buildings have been brought onto the balance

sheet under IFRS and conversely certain leasehold land, that was previously

treated as a finance lease under UK GAAP, has been reclassified as an off

balance sheet operating lease. Lease premiums relating to land have been

reclassified as prepayments.

5 The calculation of the defined benefit pension scheme liability under IFRS

requires the schemes assets to be valued at the lower bid market value

compared with mid market value required by UK GAAP. In addition the

disclosure requirements under IAS 19 differ in certain respects to FRS 17

with interest charges being disclosed on a gross rather than net basis.

6 IAS 39 requires all derivative financial instruments to be valued and

brought onto the balance sheet. There was no equivalent requirement under

UK GAAP. During the second half of 2006 the group purchased an interest

rate cap and this has been brought onto the balance sheet at fair value at

31 December 2006.

7 At 30 June 2006 the group held certain assets whose carrying value was

recovered primarily through a sales transaction rather than by continuing

use. In accordance with IFRS 5 - Non-current assets held for sale and

discontinued operations - these have been reclassified as a separate

non-current asset and are carried at the lower of the previous accounts

written down value and the net anticipated sale proceeds.

Other than presentational differences, there are no material adjustments to

the previous cash flow statements presented under UK GAAP.

12 Distribution of interim

financial statement

A copy of these interim financial statements will be posted to all

shareholders and is available from the Company's registered office at

Premier House, Darlington Street, Wolverhampton, WV1 4JJ. A copy will also be

available on the Company's website, www.andrews-sykes.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFVVAIIDFID

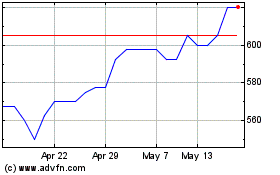

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024