RNS Number:9089R

Andrews Sykes Group PLC

29 September 2005

Andrews Sykes Group plc (the "Company")

29 September 2005

Interim Results for the 26 weeks to 2 July 2005

Chairman's Statement

Overview and financial highlights

Trading from continuing operations has been difficult across the UK operations

of the Group during the first half of 2005, due to a competitive market and low

demand caused by the unfavourable weather conditions of a mild, dry winter.

Nevertheless the Group has continued to generate cash and has successfully

disposed of a non-core subsidiary company, Accommodation Hire Limited, during

the first half of 2005. The initial net cash inflow from this disposal in the

first half year amounted to #9.2 million after costs.

The financial highlights for the first six months of 2005 were as follows:

* EBITDA (as reconciled on the face of the profit and loss account) derived

from continuing activities decreased from #8 million in 2004 to #5.5

million this period.

* Profit on ordinary activities before tax increased from #6.2 million in

2004 to #10.5 million after the exceptional profit on the sale of the

accommodation business of #6.8 million.

* After this exceptional profit, basic earnings per share from total

operations increased from 7.39 pence in 2004 to 16.70 pence this period.

* Despite the payment of the 2004 special final dividend of #8.1 million

during the period, at 2 July 2005 the Group has net funds of #1.3 million

compared with net debt of #2.9 million at 31 December 2004.

In common with many other UK companies, shareholders' funds have been adversely

impacted by the full adoption of a new accounting standard, FRS 17 - Retirement

benefits, which became effective from 1 January 2005. The net effect of this

adjustment has been to reduce shareholders' funds by approximately #6 million.

Capital reduction, tender offer and dividend policy

On 24 August 2005 the proposed capital reduction and tender offer, full details

of which were circulated to shareholders on 28 July 2005, was approved by the

members at an Extraordinary General Meeting. The offer was subsequently approved

by the High Court on 14 September 2005 and on 26 September 2005 payment of the

tender offer consideration of #23.8 million was despatched to those members who

accepted the offer. The Group's net debt subsequent to the tender offer is

approximately #24 million after taking into account a payment of #3 million into

the company's defined benefit pension scheme.

The Board has decided not to declare an interim dividend in respect of the

current financial period. As stated in the tender offer circular, the Board

intends to review its dividend policy next at the time of the announcement of

the preliminary results for the financial period ending 31 December 2005 at

which point it will communicate its decision to shareholders.

Prospects

The period of comparatively poor trading appears to have ended at the end of

May. The business performance for the month of June 2005 showed an improvement

compared with June 2004 and trading in the third quarter of 2005, to the date of

this statement, shows an improvement over the same period in 2004.

JG Murray

Chairman

29 September 2005

Andrews Sykes Group plc

Consolidated Profit and Loss Account

For the 26 weeks ended 2 July 2005

26 weeks to 2 July 2005 27 weeks to 3 July 2004 53 weeks to 31 December 2004

(as restated **) (as restated **)

Continuing Discontinued Total Continuing Discontinued Total Continuing Discontinued Total

activities activities activities activities activities activities

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

Turnover 24,342 2,416 26,758 27,614 3,793 31,407 54,982 7,698 62,680

Cost of sales (12,280) (1,381) (13,661) (13,096) (2,195) (15,291) (25,845) (4,441) (30,286)

Gross profit 12,062 1,035 13,097 14,518 1,598 16,116 29,137 3,257 32,394

Distribution costs (3,969) (430) (4,399) (4,145) (600) (4,745) (8,434) (1,248) (9,682)

Administrative (4,467) (271) (4,738) (4,257) (547) (4,804) (8,863) (1,127) (9,990)

expenses - ordinary

Administrative - - - - - - (4,872) - (4,872)

expenses -

exceptional (note 4)

Total administrative (4,467) (271) (4,738) (4,257) (547) (4,804) (13,735) (1,127) (14,862)

expenses

Other operating 2 - 2 18 - 18 39 - 39

income

Operating profit 3,628 334 3,962 6,134 451 6,585 7,007 882 7,889

EBITDA * 5,478 580 6,058 8,028 890 8,918 10,792 1,641 12,433

Depreciation and (1,843) (246) (2,089) (1,887) (439) (2,326) (3,771) (759) (4,530)

asset disposals

Operating profit 3,635 334 3,969 6,141 451 6,592 7,021 882 7,903

before goodwill

amortisation

Goodwill amortisation (7) - (7) (7) - (7) (14) - (14)

Operating profit 3,628 334 3,962 6,134 451 6,585 7,007 882 7,889

Income from other participating interests - - 304

Exceptional profit / (loss) on the 6,797 - (305)

disposal of a business

- discontinued (note 6)

Profit on ordinary activities before 10,759 6,585 7,888

interest and taxation

Net interest payable (211) (366) (718)

Profit on ordinary activities before 10,548 6,219 7,170

Tax on profit on ordinary activities (868) (1,938) (2,236)

taxation

Profit on ordinary activities after 9,680 4,281 4,934

taxation being profit for the financial

period

Earnings per share from continuing operations:

Basic (pence) 4.60p 6.92p 7.56p

Diluted (pence) 4.60p 6.64p 7.27p

Earnings per share from total operating results:

Basic (pence) 16.70p 7.39p 8.51p

Diluted (pence) 16.69p 7.09p 8.18p

Dividends paid per equity share (pence, as 14.0p 3.0p 4.0p

restated)

There were no material acquisitions in any period.

* Earnings Before Interest, Taxation, Depreciation and Amortisation.

** The comparative figures for the 27 weeks ended 3 July 2004 and the 53 weeks

ended 31 December 2004 have been restated due to both the full adoption of FRS

17 - Retirement Benefits and FRS 21 - Events after the Balance Sheet Date with

effect from 1 January 2005 as set out in note 8.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 2 July 2005

2 July 2005 3 July 2004 31 December 2004

(as restated*) (as restated*)

#'000 #'000 #'000

Fixed assets

Intangible assets: Goodwill 38 52 45

Tangible assets 11,940 16,755 15,876

Investments 164 164 164

12,142 16,971 16,085

Current assets

Stocks 4,801 4,950 4,942

Debtors 14,002 15,790 15,071

Cash at bank and in hand 12,308 10,904 9,295

31,111 31,644 29,308

Creditors falling due within one year

Loans and overdrafts (2,000) (3,119) (2,490)

Other creditors (7,738) (9,197) (9,989)

Corporation and overseas tax (1,267) (2,680) (1,099)

(11,005) (14,996) (13,578)

Net current assets 20,106 16,648 15,730

Total assets less current liabilities 32,248 33,619 31,815

Creditors falling due after more than one year

Loans (9,000) (11,980) (9,735)

Provisions for liabilities (339) (24) (310)

Net assets excluding pension liability 22,909 21,615 21,770

Pension Liability (6,050) (6,628) (6,660)

Net assets including pension liability 16,859 14,987 15,110

Capital and reserves

Called - up share capital 11,598 11,598 11,598

Share premium account 10,678 10,678 10,678

Revaluation reserve 743 749 746

Other reserves 7,395 7,392 7,389

Profit and loss account (13,559) (15,415) (15,292)

ESOP reserve (6) (25) (19)

Equity shareholders' funds 16,849 14,977 15,100

Minority interests 10 10 10

16,859 14,987 15,110

* The comparative figures as at 3 July 2004 and 31 December 2004 have been

restated due to both the full adoption of FRS 17 - Retirement Benefits and FRS

21 - Events after the Balance Sheet Date with effect from 1 January 2005 as set

out in note 8.

Andrews Sykes Group plc

Consolidated cash flow statement

For the 26 weeks ended 2 July 2005

26 weeks 27 weeks to 53 weeks to

to 2 July 3 July 31 December

2005 2004 2004

#'000 #'000 #'000

Net cash inflow from operating activities as reconciled in note 5 4,258 6,555 11,677

Dividend received from participating interests - - 139

Returns on investments and servicing of finance

Interest received 245 173 410

Interest paid (353) (396) (865)

Net cash outflow for returns on investments and servicing of finance (108) (223) (455)

Cash outflow for taxation (642) (2,175) (4,288)

Capital expenditure

Purchase of tangible fixed assets (1,856) (2,002) (3,936)

Sale of tangible fixed assets 395 818 1,483

Net cash outflow for capital expenditure (1,461) (1,184) (2,453)

Acquisitions and disposals

Cash received on the disposal of subsidiary undertakings as 9,614 - -

set out in note 6

Net cash balances disposed of with subsidiary (439) - -

Net cash inflow for acquisitions and disposals 9,175 - -

Equity dividends paid (8,119) (1,740) (2,320)

Cash inflow before the use of liquid resources and financing 3,103 1,233 2,300

Management of liquid resources

Movement in bank deposits (87) 476 (1)

Financing

Sale of shares held in ESOP 9 12 16

Loan repayments - (875) (3,749)

Purchase of own shares - (630) (630)

Net cash inflow / (outflow) from financing 9 (1,493) (4,363)

Increase / (decrease) in cash in the period 3,025 216 (2,064)

Analysis of net funds / (debt)

Bank current and deposit accounts and cash in hand 12,308 10,904 9,295

Total loans and overdrafts (11,000) (15,099) (12,225)

Net funds / (debt) as reconciled in note 7 1,308 (4,195) (2,930)

Net funds / (debt) as a percentage of shareholders' funds (as restated) 7.76% (28.01%) (19.40%)

Andrews Sykes Group plc

Other Consolidated Statements

For the 26 weeks ended 2 July 2005

Consolidated statement of total recognised gains and losses

26 weeks to 27 weeks to 53 weeks to 31

2 July 2005 3 July 2004 December 2004

(as restated*) (as restated*)

#'000 #'000 #'000

Profit for the financial period 9,680 4,281 4,934

Currency translation differences on foreign currency net investments (88) (105) 78

Actual return less expected return on pension scheme assets 419 (75) 354

Experience gains and losses arising on the pension scheme liabilities (38) 24 (601)

UK deferred tax attributable to the pension scheme asset (114) 15 74

and liability adjustments

Total recognised gains and losses relating to the year 9,859 4,140 4,839

FRS 17 prior year adjustment as set out in note 8 (6,288)

Total recognised gains and losses since the 2004 annual report and 3,571

financial statements

Reconciliation of movement in Group shareholders' funds

26 weeks to 2 27 weeks to 3 53 weeks to 31

July 2005 July 2004 December 2004

(as restated**) (as restated**)

#'000 #'000 #'000

Profit for the financial period 9,680 4,281 4,934

Dividends (8,119) (1,740) (2,320)

Consideration for the purchase of own shares - (172) (172)

Sale of own shares by the ESOP trust 9 12 16

Currency translation differences on foreign currency net investments (88) (105) 78

Actual return less expected return on pension scheme assets 419 (75) 354

Experience gains and losses arising on the pension scheme liabilities (38) 24 (601)

UK deferred tax attributable to the pension scheme asset and (114) 15 74

liability adjustments

Net increase in shareholders' funds 1,749 2,240 2,363

Shareholders funds at the beginning of the period as previously 13,269 17,101 17,101

stated

FRS 17 adjustment (6,288) (6,104) (6,104)

FRS 21 adjustment 8,119 1,740 1,740

Shareholders' funds at the beginning of the period as restated 15,100 12,737 12,737

Shareholders' funds at the end of the period 16,849 14,977 15,100

* The comparative figures for the 27 weeks ended 3 July 2004 and the 53 weeks

ended 31 December 2004 have been restated due to the full adoption of FRS 17 -

Retirement Benefits with effect from 1 January 2005.

** The comparative figures as at 3 July 2004 and 31 December 2004 have been

restated due to both the full adoption of FRS 17 - Retirement Benefits and FRS

21 - Events after the Balance Sheet Date with effect from 1 January 2005.

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 2 July 2005

1. Basis of preparation

The interim report for the 26 weeks ended 2 July 2005 was approved by the Board

on 28 September 2005. The financial information contained in this interim report

does not constitute statutory accounts for the Group for the relevant periods.

The interim report is neither audited nor reviewed. The results for the 53 weeks

ended 31 December 2004 have been extracted from the audited financial statements

that have been filed with the Registrar of Companies. The report of the auditors

was unqualified and did not contain a statement under section 237(2) or (3) of

the Companies Act 1985.

The interim statement has been prepared in accordance with the accounting

policies set out in the Group's 2004 Annual Report and Financial Statements with

the exception of the adoption of both FRS 17 - Retirement Benefits and FRS 21 -

Events after the Balance Sheet date. Both these standards are applicable for the

first time this period and have a prior year impact as detailed in note 8. FRS

22 - Earnings per Share and the relevant paragraphs of FRS 25 - Financial

Instruments, Presentation and Disclosure have also been applied but have no

impact.

2. Segmental analysis

The Group's turnover may be analysed between the following principal activities:

26 weeks to 27 weeks to 53 weeks to

2 July 3 July 31 December

2005 2004 2004

Activity: #'000 #'000 #'000

Hire 17,169 20,195 40,698

Sales 5,331 6,135 12,000

Installation 4,258 5,077 9,982

Total 26,758 31,407 62,680

The geographical analysis of the Group's turnover was as follows:

By origination: 26 weeks to 27 weeks to 53 weeks to

2 July 3 July 31 December

2005 2004 2004

#'000 #'000 #'000

United Kingdom 23,574 28,419 56,332

Rest of Europe 1,529 1,212 2,918

Middle East and Africa 1,655 1,776 3,430

26,758 31,407 62,680

By destination: 26 weeks to 27 weeks to 53 weeks to

2 July 3 July 31 December

2005 2004 2004

#'000 #'000 #'000

United Kingdom 23,190 27,892 55,571

Rest of Europe 1,561 1,317 3,154

Middle East and Africa 1,665 1,832 3,505

Rest of World 342 366 450

26,758 31,407 62,680

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 2 July 2005

2. Segmental analysis (continued)

The analysis of profit before interest and tax and net assets by geographical origin was as follows:

Profit before interest and tax Net assets including pension liability

26 weeks to 27 weeks to 53 weeks to As at As at As at

2 July 2005 3 July 2004 31 December 2 July 2005 3 July 2004 31 December

2004 2004

(as restated) (as restated) (as restated)(as restated)

#'000 #'000 #'000 #'000 #'000 #'000

United Kingdom 10,146 5,839 6,146 20,262 25,033 22,969

Rest of Europe 387 469 988 813 1,528 1,391

Middle East and Africa 226 277 754 1,793 1,929 1,439

10,759 6,585 7,888 22,868 28,490 25,799

Net cash / (debt) 1,308 (4,195) (2,930)

Taxation (1,267) (2,680) (1,099)

Pension liability (6,050) (6,628) (6,660)

16,859 14,987 15,110

3. Earnings per share

The basic figures have been calculated by reference to the weighted average

number of 20p ordinary shares in issue, excluding those in the ESOP reserve,

during the period of 57,976,672 (27 weeks ended 3 July 2004: 57,968,589).

The calculation of the diluted earnings per ordinary share is based on the

profits as set out in the table below and on 57,992,597 (27 weeks ended 3 July

2004: 60,421,720) ordinary shares. The share options have a dilutive effect for

the period calculated as follows:

26 weeks to 2 July 2005 27 weeks to 3 July 2004

(as restated)

Continuing Total No. of shares Continuing Total earnings No. of shares

earnings earnings earnings

#'000 #'000 #'000 #'000

Basic earnings/weighted 2,667 9,680 57,976,672 4,014 4,281 57,968,589

average number of shares

Weighted average number of shares under 30,000 4,362,604

option

Number of shares that would have been

issued at fair value (14,075) (1,909,473)

Earnings/ diluted weighted average 2,667 9,680 57,992,597 4,014 4,281 60,421,720

number of shares

Diluted earnings per ordinary share 4.60p 16.69p 6.64p 7.09p

(pence)

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 2 July 2005

4. Exceptional administrative expenses

The following item has been disclosed on the face of the profit and loss account

due to its size:

26 weeks to 27 weeks to 53 weeks to

2 July 3 July 31 December

2005 2004 2004

#'000 #'000 #'000

Exceptional costs of cash cancellation offer - - 4,872

On 18 November 2004 the Board of Andrews Sykes Group plc made a cash

cancellation offer to all of the Company's share option holders. The price

offered was #1.95 per share and the offer remained open for acceptance until 8

December 2004.

5. Reconciliation of operating profit to net cash inflow from operating

activities

26 weeks to 27 weeks to 53 weeks to

2 July 2005 3 July 2004 31 December 2004

(as restated) (as restated)

#'000 #'000 #'000

Operating profit 3,962 6,585 7,889

Goodwill amortisation 7 7 14

Depreciation 2,286 2,847 5,489

Profit on sale of fixed assets (197) (521) (959)

Decrease in stocks 141 666 674

Decrease /( increase) in debtors 20 (1,266) (29)

Decrease in creditors and provisions (1,961) (1,763) (1,401)

Net cash inflow from operating activities 4,258 6,555 11,677

6. Profit / (loss) and cash received on the disposal of subsidiary undertakings

On 6 May 2005 the Group sold its subsidiary undertaking, Accommodation Hire

Limited (AHL), to Wernick Hire Limited. AHL, which specialised in the hire and

sale of temporary accommodation units and toilet facilities, was managed as a

separate business operation and the net assets sold and consideration received

and receivable are as follows:

26 weeks to

2 July

2005

#'000

Tangible fixed assets 3,231

Debtors 1,479

Creditors (922)

Cash at bank 439

Corporation tax (29)

Deferred tax 118

Bank loans (1,225)

Net assets sold 3,091

Profit on disposal 6,797

Total net consideration 9,888

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 2 July 2005

Satisfied by:

Cash received net of disposal costs paid 9,614

Deferred consideration receivable less disposal costs payable 274

9,888

The exceptional charge of #305,000 in the 53 weeks ended 31 December 2004

relates to an adjustment to an onerous lease liability provision in respect of

the Cox Plant business that was sold by the Group during 2002.

7. Analysis of net funds / (debt)

As at Cash Disposal of Other non As at

2 July flow subsidiaries cash 31 December

2005 excluding movements 2004

cash

#'000 #'000 #'000 #'000 #'000

Cash 11,744 3,025 - (99) 8,818

Bank deposit 564 87 - - 477

Total cash at bank and in hand 12,308 3,112 - (99) 9,295

Debt due in one year (2,000) - 1,225 (735) (2,490)

Debt due after one year (9,000) - - 735 (9,735)

Gross debt (11,000) - 1,225 - (12,225)

Net funds / (debt) 1,308 3,112 1,225 (99) (2,930)

8. Prior year adjustment

The total of the prior year adjustments arising from the application of FRS 17 -

Retirement Benefits and FRS 21 - Events after the Balance Sheet date are

analysed as follows:

The opening equity shareholders' funds at 27 December 2003 were restated as

follows:

Equity shareholders' funds

#'000 #'000

Equity shareholders' funds at 27 December 2003 as previously stated 17,101

Adoption of FRS 17 as at 27 December 2003 (6,104)

Liability for 2003 final dividend not declared at 27 December 2003 1,740

Total prior period adjustments (4,364)

Equity shareholders' funds at 27 December 2003 as restated 12,737

The closing equity shareholders' funds at 31 December 2004 were restated as

follows:

Equity shareholders' funds

#'000 #'000

Equity shareholders' funds at 31 December 2004 as previously stated 13,269

Adoption of FRS 17 as at 31 December 2004 (6,288)

Liability for 2004 final dividend not declared at 31 December 2004 8,119

Total prior period adjustments 1,831

Equity shareholders' funds at 31 December 2004 as restated 15,100

The impact of adopting FRS 17 on the current period profit and loss account is a

credit of approximately #30,000. The impact of adopting FRS 21 on the current

period reserve movement is a charge of approximately #8.1 million.

9. Distribution of interim statement

A copy of this statement will be posted to all shareholders and is available

from the Company's registered office at Premier House, Darlington Street,

Wolverhampton, WV1 4JJ.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFIDASITFIE

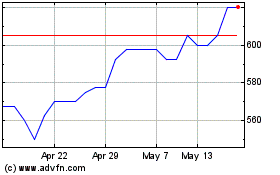

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024