RNS Number:4434L

Andrews Sykes Group PLC

25 April 2005

Andrews Sykes Group plc (the "Company")

25 April 2005

Preliminary Results for the 53 weeks ended 31 December 2004

FINANCIAL HIGHLIGHTS

* EBITDA* from continuing operations #17.1 million.

* Profit on ordinary activities before exceptional items and taxation

#12.4million.**

* Net debt reduced by #1.8 million from last year at #2.9 million

representing 22.1% of equity shareholders' funds.

* Adjusted diluted earnings per share 14.23 pence.

SUMMARY OF RESULTS

53 weeks ended 52 weeks ended

31 December 2004 27 December 2003

#'000 #'000

Turnover from continuing operations 62,680 68,252

EBITDA* from continuing operations 17,060 19,666

Profit on ordinary activities before exceptional items and 12,364 13,976

taxation **

Operating profit 7,644 14,446

Profit on ordinary activities after taxation 4,945 9,957

Basic earnings per share (pence) 8.53p 16.82p

Adjusted diluted earnings per share (pence) 14.23p 15.30p

Interim dividend per share (pence) 1.0p -

Proposed dividend per share (pence) 14.0p 3.0p

Net debt 2,930 4,723

Gearing 22.1% 27.6%

* Earnings before interest, depreciation, exceptional items and goodwill charges (as reconciled on

the face of the consolidated profit and loss account).

** PBT #7,187,000 (2003: #14,574,000) add back adjustments following the sale of a business #305,000

(2003: less #598,000) and exceptional share option cash cancellation costs of #4,872,000 (2003:

#Nil).

Chairman's Statement

Summary of results

I am pleased to be able to report that your Group has achieved a satisfactory

result for the year 2004, despite unfavourable weather conditions. Compared with

2003 the Group's profit on ordinary activities before tax and exceptional

charges was #12.4m, compared with #14.0m last year (PBT #14.6m less #0.6m

exceptional credits). This is reduced to #7.2m after charging exceptional items

of #4.9m for the cash cancellation of employee share options and #0.3m lease

provisions on the disposal of Cox Plant. Profit after tax amounted to #4.9m.

Consequently the adjusted diluted earnings per share decreased from 15.3 pence

to 14.2 pence but the basic earnings per share reduced further from 16.8 pence

to 8.5 pence due to the effect of the exceptional items noted above.

2004 was a year of consolidation, reflecting a hiatus in the UK market place,

exacerbated by an unusual combination of weather conditions: a warm winter, an

extended period of low water tables caused by a year of low rainfall, and a cool

summer. We continue to focus on controlling costs and re-aligning the cost base

towards selling activity in order to be able to take advantage of any trading

opportunities that become available.

Despite the exceptional cash outflows of #4.9m for the cancellation of the

employee share options and #0.6m attributable to purchase of own shares, net

debt reduced from #4.7m last year to #2.9m at 31 December 2004.

I consider the Group has performed satisfactorily in a difficult trading

environment and is well placed to compete in a competitive market sector.

Overview of continuing operations

Turnover from continuing operations decreased from #68.3m to #62.7m and

operating profit before exceptional items from #14.4m to #12.5m in 2004

(operating profit of #7.6m add back #4.9m exceptional costs). The downturn

affected the UK core businesses especially Hire whose turnover decreased from

#38.9m to #36.5m. The operating profits of our main UK businesses fell from

#11.5m to #10.1m. Although all product ranges were affected due to adverse

weather conditions, the lack of prolonged summer conditions in 2004 compared to

the record temperatures of 2003 meant air conditioning was especially affected.

The UK fixed air conditioning company, Andrews Air Conditioning and

Refrigeration, achieved an operating profit of #0.6m compared to #0.7m in the

previous year. Although turnover decreased by #0.7m margins improved and the

value of gross margin was maintained.

Despite a #1.6m decrease in turnover, Accommodation Hire, our subsidiary that

specialises in the hire of temporary accommodation units and toilet facilities,

achieved an operating profit of a similar level to that in 2003.

Engineering Appliances, the specialist heating and ventilation business, saw

turnover fall by #0.9m from #3.8m to #2.9m.

The Group's well established heating and air conditioning business in The

Netherlands had a successful year achieving an operating profit of #1.1m

compared to #0.9m last year. Similarly our operation in the Middle East,

Khansaheb Sykes LLC, increased its profits to #0.4m from #0.3m last year.

I remain confident that our strategy of continuing to concentrate upon

developing the UK specialist hire and rental market by organic growth

supplemented by niche market acquisitions offers opportunity for further profit

growth and added shareholder value.

Earnings per share and buy back programme

As set out in the Note 9 of the Financial Statements, the adjusted diluted

earnings per share excluding exceptional items is 14.2 pence compared with 15.3

pence last year. Basic earnings per share was 8.5 pence compared with 16.8

pence last year.

The Board continues to believe that shareholder value will be optimised by the

purchase, when appropriate, of our own shares coupled with investment in organic

growth. Consequently, the Board will request that shareholders vote in favour of

a resolution to renew the authority to purchase up to 12.5% of the ordinary

shares in issue.

Dividend

As reported in my interim statement, the Board declared an interim dividend of

1.0 pence per ordinary share in respect of the year ended 31 December 2004 and

this was paid on 4 November 2004. The Board is now pleased to propose a final

special dividend of 14.0 pence per share, to return surplus cash to

shareholders. This will be paid on 15 June 2005 to shareholders on the register

on 13 May 2005.

Outlook

Expectations for the first quarter are broadly similar to the last quarter of

2004. With costs under control the business is well positioned to take

advantage of market opportunities as they arise. I would therefore expect the

Group to achieve a better year in 2005.

JG Murray

Chairman

22 April 2005

Andrews Sykes Group plc

Consolidated profit and loss account

For the 53 weeks ended 31 December 2004

53 weeks ended 31 December 2004 52 weeks ended

27 December

2003

Before Exceptional Total Total

exceptional items

items

#'000 #'000 #'000 #'000

Turnover 62,680 - 62,680 68,252

Cost of sales (30,286) - (30,286) (34,084)

Gross profit 32,394 - 32,394 34,168

Distribution costs (9,682) - (9,682) (9,647)

Administrative costs (10,235) (4,872) (15,107) (10,080)

Other operating income 39 - 39 5

Operating profit / (loss) 12,516 (4,872) 7,644 14,446

EBITDA* 17,060 - 17,060 19,666

Depreciation and asset (4,530) - (4,530) (5,206)

disposals

Operating profit before 12,530 - 12,530 14,460

goodwill

amortisation and exceptional

items

Exceptional items - (4,872) (4,872) -

Goodwill amortisation (14) - (14) (14)

Operating profit / (loss) 12,516 (4,872) 7,644 14,446

Income from other participating interests 304 -

Adjustments following the disposal of a business - (305) 598

discontinued

Profit before interest and 7,643 15,044

taxation

Net interest payable (456) (470)

Profit on ordinary activities before taxation 7,187 14,574

Tax on profit on ordinary (2,242) (4,617)

activities

Profit on ordinary activities after taxation

being profit for the financial period 4,945 9,957

Dividends paid and proposed on equity shares (8,699) (1,740)

Retained (loss) / profit for the financial (3,754) 8,217

period

attributable to equity

shareholders

Andrews Sykes Group plc

Consolidated profit and loss account

For the 53 weeks ended 31 December 2004 (continued)

Basic earnings per ordinary 8.53p 16.82p

share

Diluted earnings per share 8.20p 16.25p

Add back: Goodwill 0.02p 0.02p

amortisation

Exceptional items 6.01p (0.97)p

Adjusted diluted earnings per 14.23p 15.30p

share

Dividends per share:

Equity shares 15.0p 3.0p

Activities in both the current and preceding periods derive from continuing

operations.

*Earnings before interest, taxation, depreciation and amortisation excluding

exceptional items

Andrews Sykes Group plc

Consolidated Balance Sheet

At 31 December 2004

31 December 27 December

2004 2003

#'000 #'000

Fixed assets

Intangible assets: Goodwill 45 59

Tangible fixed assets 15,876 18,015

Investments 164 164

16,085 18,238

Current assets

Stocks 4,942 5,616

Debtors 15,230 14,953

Cash at bank and in hand 9,295 11,251

29,467 31,820

Creditors: Amounts falling due within one year

Bank loans (2,490) (3,749)

Other creditors (9,989) (11,173)

Proposed dividends (8,119) (1,740)

Corporation and overseas tax (1,099) (3,191)

(21,697) (19,853)

Net current assets 7,770 11,967

Total assets less current 23,855 30,205

liabilities

Creditors: Amounts falling due after more than one

year

Bank loans (9,735) (12,225)

Provisions for liabilities and charges (841) (869)

Net assets 13,279 17,111

Capital and reserves

Called-up share capital 11,598 11,615

Share premium account 10,678 10,678

Revaluation reserve 746 752

Other reserve 7,389 7,378

Profit and loss account (17,123) (13,284)

ESOP reserve (19) (38)

Equity shareholders' funds 13,269 17,101

Minority interests (equity) 10 10

Total capital employed 13,279 17,111

Analysis of net debt

Cash at bank and in hand 9,295 11,251

Bank loans (12,225) (15,974)

Net debt (2,930) (4,723)

As a percentage of equity shareholders' funds 22.1% 27.6%

Andrews Sykes Group plc

Consolidated cash flow statement

For the 53 weeks ended 31 December 2004

53 weeks ended 52 weeks ended

31 December 2004 27 December 2003

#'000 #'000

Net cash inflow from operating activities 11,677 17,329

Dividends received from participating 139 -

interests

Return on Investments and servicing of finance

Interest received 410 335

Interest paid (865) (828)

Net cash outflow returns on Investments and servicing of (455) (493)

finance

Cash outflow for taxation (4,288) (3,214)

Capital expenditure and financial investment

Purchase of tangible fixed (3,936) (7,405)

assets

Sale of tangible fixed assets 1,483 868

Net cash outflow for capital expenditure and financial (2,453) (6,537)

Investment

Acquisitions and disposals

Cash received following the disposal of a - 1,500

business

Equity dividends paid (2,320) -

Cash inflow before the use of liquid resources and 2,300 8,585

financing

Management of liquid resources

Movement in bank deposits (1) 3,862

Financing

Issue of ordinary share capital net of issue - 252

costs

Loans repaid (3,749) (3,740)

New loans drawn down - 1,259

Purchase of own shares for (630) (3,883)

cancellation

Sale of own shares by ESOP 16 176

Purchase of own shares by ESOP - (88)

Net cash outflow from (4,363) (6,024)

financing

(Decrease) / increase in cash in the period (2,064) 6,423

Andrews Sykes Group plc

Notes to the financial statements

For the 53 weeks ended 31 December 2004

1. Segmental analysis

The Group's turnover may be analysed between the following principal

activities:

53 weeks ended 52 weeks ended

31 December 2004 27 December 2003

Continuing Continuing

operations operations

#'000 #'000

Hire 40,698 43,537

Sales 12,000 13,990

Installation 9,982 10,725

Total 62,680 68,252

The Integrated nature of the Group's operations does not permit a meaningful analysis of profit

before interest and tax or net assets by the above activities.

The results and net assets are attributable to the Group's principal activity, the hire, sale and

installation of a range of equipment including portable heating, drying, ventilation, pumps and

temporary accommodation.

The geographical analysis of the Group's turnover was

as follows:

By geographical origin By geographical destination

53 weeks ended 52 weeks ended 53 weeks 52 weeks

27 December ended 31 ended 27

31 December 2003 December December

2004 2004 2003

#'000 #'000 #'000 #'000

United Kingdom 56,332 61,925 55,571 60,196

Rest of Europe 2,918 3,239 3,154 4,388

Middle East and 3,430 3,088 3,505 3,153

Africa

Rest of World - - 450 515

62,680 68,252 62,680 68,252

The analysis of profit before interest and tax and net assets by geographical origin

was as follows:

Profit before interest and tax Net assets Net assets

53 weeks ended 52 weeks ended 53 weeks 52 weeks

31 December 27 December ended 31 ended 27

2004 2003 December December

2004 2003

#'000 #'000 #'000 #'000

United Kingdom 5,901 13,983 22,597 24,211

Rest of Europe 988 771 1,391 1,155

Middle East and 754 290 1,439 1,399

Africa

7,643 15,044 25,427 26,765

Net debt (2,930) (4,723)

Taxation and dividends payable (9,218) (4,931)

13,279 17,111

Andrews Sykes Group plc

Notes to the financial statements

For the 53 weeks ended 31 December 2004

2. Reconciliation of operating profit to net cash inflow from operating

activities

53 weeks 52 weeks

ended 31 ended 27

December 2004 December

2003

#'000 #'000

Operating profit 7,644 14,446

Goodwill 14 14

amortisation

Depreciation 5,489 5,575

Profit on sale of tangible (959) (369)

fixed assets

Decrease / (increase) in 674 (924)

stocks

Increase in debtors (29) (847)

Decrease in creditors and (1,156) (566)

provisions

Net cash inflow from operating activities 11,677 17,329

3. Reconciliation of net cash flow to movement in net

debt

53 weeks 52 weeks

ended 31 ended 27

December 2004 December

2003

#'000 #'000

(Decrease) / increase in cash paid in the period (2,064) 6,423

Cash outflow from movement in net debt 3,749 2,481

Cash outflow / (inflow) from movement in liquid 1 (3,862)

resources

Change in net debt resulting from cash flows 1,686 5,042

Translation 107 (14)

differences

Movement in period 1,793 5,028

Opening net debt (4,723) (9,751)

Closing net debt (2,930) (4,723)

4. Consolidated statement of total recognised gains and loss

53 weeks 52 weeks

ended 31 ended 27

December 2004 December

2003

#'000 #'000

Profit for the financial 4,945 9,957

period

Currency translation differences on foreign currency net investments 78 (18)

Total recognised gains and losses in the period 5,023 9,939

Andrews Sykes Group plc

Notes to the financial statements

For the 53 weeks ended 31 December 2004

5. Reconciliation of movements in Group shareholders' funds

53 weeks 52 weeks

ended 31 ended 27

December 2004 December

2003

#'000 #'000

Profit for the financial 4,945 9,957

period

Dividends (8,699) (1,740)

Other recognised gains and 78 (18)

losses

Issue of ordinary - 252

shares

Purchase of own shares for cancellation (172) (4,341)

Sale of own shares by the ESOP trust 16 176

Purchase of own shares by the ESOP trust - (88)

Net (decrease) / increase in shareholders' (3,832) 4,198

funds

Shareholders' funds at the beginning of the 17,101 12,903

period

Shareholders' funds at the end of the period 13,269 17,101

6. Earnings per ordinary share

The basic figures have been calculated by reference to the weighted average

number of ordinary 20 pence shares in issue during the period of 57,967,089 (52

weeks ended 27 December 2003: 59,186,675).

The calculation of the diluted earnings share is based on a profit of #4,945,000

(52 weeks ended 27 December 2003: #9,957,000) and on 60,300,966 (52 weeks ended

27 December 2003: 61,255,953) ordinary shares. The share options have a dilutive

effect for the period ended 31 December 2004 calculated as follows:

53 weeks ended 31 52 weeks ended 27

December 2004 December 2003

Earnings Number of Earnings Number of

#'000 shares #'000 shares

Basic earnings / weighted average number of 4,945 57,967,089 9,957 59,186,675

shares

Weighted average number of share under 4,093,505 4,372,604

option

Number of shares that would have been issued of fair (1,759,628) (2,303,326)

value

Earnings / diluted weighted average 4,945 60,300,966 9,957 61,255,953

number of shares

Diluted earnings per ordinary share 8.20p 16.25p

(pence)

The adjusted diluted earnings per share excluding goodwill amortisation and

exceptional items is based upon the weighted average number of ordinary shares

as set out in the table above. The earnings can be reconciled to the adjusted

earnings as follows:

53 weeks ended 52 weeks ended

31 27

December 2004 December 2003

#'000 #'000

Earnings 4,945 9,957

Goodwill 14 14

amortisation

Exceptional items (net of tax)

Costs of cash cancellation offer 3,410 -

Provision for warranty and closure - (348)

provisions

Provision against doubtful debts - (250)

Provision for onerous lease 214 -

commitments

Adjusted earnings 8,583 9,373

Adjusted diluted earnings per share 14.23p 15.30p

(pence)

The above figures have been disclosed to demonstrate underlying performance .

Andrews Sykes Group plc

Notes to the financial statements

For the 53 weeks ended 31 December 2004

7. The tax charge for the year was #2,242,000 (52 weeks ended 27 December 2003: #4,617,000) which

represents an overall effective tax charge of 31.2% (52 weeks ended 27 December 2003: 31.7%).

The tax charge is higher than the standard 30% UK corporation tax rate primarily due to non

tax deductible items in the UK, withholding tax written off and the taxation of certain

overseas profits at different tax rates.

8. The financial information set out above has been prepared using accounting policies that are

consistent with those adopted in the statutory accounts for the 53 weeks ended 31 December

2004.

9. The financial information set out above does not constitute the Group's statutory accounts for

the 53 weeks ended 31 December 2004 or the 52 weeks ended 27 December 2003 but it is derived

from those accounts. The financial statements for the 52 weeks ended 27 December 2003 have

been filed and those for the 53 weeks ended 31 December 2004 will be filed with the Registrar

of Companies. The Company's auditors gave unqualified reports on the accounts for both these

periods and the reports did not contain a statement under section 237 (2) or (3) of the

Companies Act 1985.

10. Copies of the Annual Report and Financial Statements will be circulated to shareholders

shortly and will be available from the Registered office of the Company, Premier House,

Darlington Street, Wolverhampton, WV1 4JJ.

11. The Company's Annual General Meeting will be held at 11.00 am on 8 June 2005 at Floor 5, 10

Bruton Street, London, W1J 6PX.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKBKQFBKDOQB

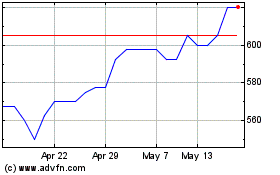

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024