TIDMART

RNS Number : 6861M

Artisanal Spirits Company PLC (The)

18 September 2023

18 September 2023

The Artisanal Spirits Company plc

('Artisanal Spirits', 'ASC' or 'the Group')

Interim Results for the Six Months to 30 June 2023

Continued positive progress towards our 2024 ambition

The Artisanal Spirits Company (AIM: ART), curators of the

world's favourite, single-cask and limited-edition whisky, and

owner of The Scotch Malt Whisky Society ("SMWS") which marks 40

years since its inception this year, is pleased to announce its

half year results for the six months ended 30 June 2023. The Group

has continued to deliver on its strategic plan and objectives -

progressing a disciplined investment programme and range of

operational initiatives to facilitate the Group's long term,

sustainable growth.

Performance highlights

Ongoing strategic progress maintaining consistency of delivery

-- against expectations.

Revenue of GBP10.2m representing +3% increase in H1-23,

-- with growth momentum gained in Q2-23, delivering +7% growth

following a relatively flat Q1.

SMWS membership growth of 9% vs H1-22, with double digit

-- growth in Europe, US, Japan and Franchises. China also

returned to membership growth through Q2, with membership

up +8% vs H1-22.

Europe online and UK Venues continued to achieve strong

-- outperformance with 21% and 23% growth respectively.

Adjusted EBITDA in H1-23 represents a loss of GBP1.8m against

-- a prior year EBITDA loss of GBP0.3m. Revenue growth and

profit delivery are weighted to the second half, and we

remain on track to deliver positive EBITDA in the full

year.

SMWS was again recognised in 2023 for the quality of its

-- spirits at awards from the top international competitions

including The International Spirits Challenge, Scotch Whisky

Masters, San Francisco World Spirits Competition and The

Tokyo Whisky and Spirits Competition.

Continued progress against strategic objectives

Continued successful international expansion;

-- * Post period-end launched a new Joint Venture

subsidiary in Taiwan (replacing a Franchise

agreement) in the world's 3rd biggest total

addressable whisky market.

* Successfully established the new franchise in South

Korea

* Signed new franchise agreements in Malaysia and

Singapore

Completed the final development phase of Masterton Bond:

-- e-fulfilment. The site is now completing all bottling and

despatch activities for the Group.

Re-opening of Vaults Members' room, the heart of the SMWS

-- brand home, due this month following refurbishment investment

of GBP0.5m.

In line with our strategy, realised value of our existing

-- spirit stock through private cask sales to members and

selected industry partners.

Continued to balance our cask spirit holding by also seeking

-- opportunities to acquire old and rare spirit.

Ongoing exploration of development opportunities in the

-- American Whiskey Market. Growth in American Whiskey sales

via SMWS USA ($120k in H1-23, up 50% on full year FY22)

and first shipment of JGT to the market in H1, with GBP130k

potential sales value.

Continued commitment to investment in digital transformation

-- and on track to launch a new Members' app by the end of

2023.

Further development of management, talent and expertise

-- within the business, with the promotion of Billy McCarter

to CFO, promotion of Rebecca Hamilton to Chief Marketing

& Experience Officer and the appointment of Chris Leggat

(former Chief Executive of Douglas Laing & Co) as new Business

Development Director.

Remain confident in delivering full year growth expectations

Like many other companies, we have felt the impact of the

-- changing macroeconomic conditions and cost of living pressures

during 2023, and we expect them to remain over the course

of the next 12-18 months. Our globally diversified footprint,

growing membership and pioneering model, combined with

the demographics of our loyal and engaged customers make

us better placed to continue to grow despite these wider

market conditions. We therefore remain confident that we

are on track to deliver growth in line with full year expectations,

including inaugural positive EBITDA.

We expect to see an acceleration in revenue growth during

-- H2-23 (full year consensus revenue expectation represents

c25% revenue growth vs H2-22), with positive impact of

the Taiwan & Korea launches, weaker comparatives in China

from H2-22, and further progress on cask sales.

The SMWS membership product offer is being broadened in

-- H2 with the introduction of private cask sales which allow

members to more actively participate in the whisky curation

process and which opens up a complementary revenue stream.

We also anticipate continued strong performance in UK venues

-- and the launch of the refurbished venue at the Vaults in

Leith at the end of September coupled with a Guinness World

Record attempt for the largest whisky tasting worldwide.

Alongside this, further progress on strategic objectives

-- will be made with the launch of a new SMWS App in the UK,

new membership & bottle product and first "prestige" 40-year-old

product designed to complement the existing Vaults Collection

range and further develop our prestige pricing.

GBP'm 6 months 6 months % change

N to 30 June to 30 June

ote 2023 2022

Revenue 6 10.2 9.9 3%

------ ------------ ------------ ---------

Gross profit 6.2 6.2 -

------ ------------ ------------ ---------

Gross margin 61% 63% (2ppt)

------ ------------ ------------ ---------

Adjusted EBITDA* 9 (1.8) (0.3) (500%)

------ ------------ ------------ ---------

EBITDA 9 (2.0) (0.3) (567%)

------ ------------ ------------ ---------

Loss before tax 9 (3.5) (1.1) (218%)

------ ------------ ------------ ---------

Loss after tax (3.6) (1.4) (157%)

------ ------------ ------------ ---------

Net Debt (18.8) (8.2) (128%)

------ ------------ ------------ ---------

Cask inventory 1 4 23.9 22.8 5%

------ ------------ ------------ ---------

Notional retail value

of cask inventory(+) 492 455 8%

------ ------------ ------------ ---------

* A djusted EBITDA is a non IFRS measure and is defined

as earnings before interest tax, depreciation, amortisation

and exceptional and restructure costs, details set

out in Note 9

+Notional retail value is a non IFRS measure and is

calculated as total litres of spirit in casks, converted

to bottle equivalent (based on 70cl) multiplied by

average net revenue per bottle in the period.

Operational highlights:

Global membership

'000s J une 2023 J une 2022 % change

--------------- ------------ ----------

UK 18.2 17.7 3%

--------------- ------------ ----------

US 6.3 5.5 15%

--------------- ------------ ----------

China 1.7 1.6 8%

--------------- ------------ ----------

Europe* 4.8 3.9 22%

--------------- ------------ ----------

Australia 1.5 1.5 -

--------------- ------------ ----------

Japan 1.9 1.6 20%

--------------- ------------ ----------

Rest of World 4.3 3.8 13%

--------------- ------------ ----------

Total members 38.7 35.6 9%

--------------- ------------ ----------

*Europe represents direct sales markets within continental

Europe, but excludes franchise markets in Denmark and

Switzerland which are shown within Rest of World

Notes

1. The Board of The Artisanal Spirits Company considers that

current consensus market expectations for the year ending 31

December 2023 are revenue of GBP25.2m (2022: GBP21.8m) and EBITDA

of GBP1.07m (2022: Adjusted EBITDA GBP0.4m)

Post-period highlights:

Continued growth in membership, now above 39,000.

--

Successful launch of newly established SMWS Taiwan subsidiary.

-- 500 members enrolled on the first day of trading. We now

plan to drive sales and engagement through the SMWS website,

in-person events and digital marketing, as well as social

media activity, building on launch activity for media,

whisky clubs, brand ambassadors and retailers.

Reopening of refurbished Vaults venue to reinforce members'

-- proposition and positive growth of venue revenue.

Andrew Dane, CEO of Artisanal Spirits Company, commented:

"We are pleased to have achieved year on year revenue growth,

particularly within the context of challenging macroeconomic

headwinds in some of our key markets and cost of living pressures,

with an increase of +7% in Q2 (following a relatively flat Q1) and

are proud to have also continued to deliver strong member growth,

+9% up on prior year, which is a leading indicator of future

revenue growth.

"We have also made continued progress against our strategic

objectives with Masterton Bond now fully operational, the

successful launches of the South Korea franchise and Taiwan

subsidiary and further strengthening of the Exec Team and talent

within the business.

"As we look ahead to trading in the balance of the year, despite

the ongoing macroeconomic backdrop, we remain focused on delivering

EBITDA at the consensus level, with the continued premiumisation

trend, our expanding, loyal and engaged membership base and

diversified global business model supporting our growth

ambitions.

"We also look forward to further delivery of our strategic

objectives for the year including continuance of the private cask

programme and launch of the new App all on track for this

year."

Sellside analyst presentation

Andrew Dane, CEO, and Billy McCarter, CFO, will host a physical,

in person presentation for sellside equity analysts, followed by

Q&A, at 09.00 hours BST today. Analysts wishing to join should

register their interest by

contacting: artisanalspirits@instinctif.com

Investor presentation

In addition, management will host a live online investor

presentation and Q&A at 11.30 hours BST on Wednesday 20th

September. The Group is committed to ensuring that there are

appropriate communication channels for all elements of its

shareholder base so that its strategy, business model and

performance are clearly understood.

The presentation is open to all existing and potential

shareholders. To register to attend, please use the link below:

https://www.equitydevelopment.co.uk/news-and-events/artisanal-results-presentation-20sept2023

A recording of the presentation will also be made available via

the Group's website following the webinar.

For further enquiries:

The Artisanal Spirits Company plc via Instinctif PR

Andrew Dane, Chief Executive Officer

Billy McCarter, Chief Financial Officer

Liberum Capital Limited (Nominated Tel: +44 (0) 20 3100 2222

Adviser and Broker)

Dru Danford

Edward Thomas

Miquela Bezuidenhoudt

Instinctif Partners (Financial PR) Tel: +44 (0)20 7457 2020

Justine Warren

Matthew Smallwood

Joe Quinlan

About The Artisanal Spirits Company

The Artisanal Spirits Company (ASC) are curators of the world's

favourite, single-cask and limited-edition whisky.

Based in Edinburgh, ASC owns The Scotch Malt Whisky Society

(SMWS) which was established in 1983 - marking its 40(th)

anniversary this year - and currently has a growing worldwide

membership of over 39,000 paying members.

SMWS provides members with inspiring experiences, content and

exclusive access to a vast and unique range of outstanding single

cask Scotch malt whiskies and other craft spirits, with current

stocks sourced from over 100 distilleries in 20 countries and

expertly curated with diligence and care.

Since producing the Society's very first cask, we have created

around 10,000 different whisky releases, producing a constant flow

of unique and exciting one-of-a-kind whiskies.

With proven e-commerce reach and new brands like J.G. Thomson,

ASC is building a portfolio of limited-edition and small-batch

spirits brands for a global movement of discerning consumers -

delivering c.GBP22 million in annual revenues with over 80% of

revenue generated online and over 65% from outside the UK, with a

growing presence in the key global whisky markets including UK,

China, USA and Europe.

ASC has a pioneering business model, a substantial and growing

addressable market presenting a long-term global growth opportunity

and a strong and resilient business primed to deliver growth.

Interim Statement

Introduction

The first half of 2023 was another period of progress against

our stated strategy with improved sales and membership growth. We

continue to believe that our pioneering model, long-term global

growth opportunity and robust business is well positioned to

deliver. Underpinning the Group's success remains our ability to

consistently deliver the very highest quality experiences to our

members with a range of exclusive and unique single malt Scotch

Whisky. The Artisanal Spirits Company ("ASC") has proven strategies

for growth around the world, further augmented by the combination

of the Group's online digital platform and exclusive membership

club venues/in person experiences which enable the maximisation of

our opportunity in both online and offline markets.

Our business fundamentals remain strong, and we achieved year on

year membership growth of +9% and member retention of 74%,

demonstrating the continued appeal of our membership proposition

and demand for our curated range of premium single malt whiskies.

Despite a relatively flat Q1, momentum was gained in Q2 achieving

+7% against Q2-2022, culminating in overall revenue increasing +3%

to GBP10.2 million in the six months to 30 June 2023, building on a

significantly strong H1-22 which delivered +25% year-on-year (2022:

GBP9.9 million). Our industry-leading gross margins were broadly

maintained vs H1-22, at 61%, (2022: 63%).

The Group has continued to invest in additional future whisky

stocks, infrastructure, systems and people to support ASC's future

growth, laying the foundations for delivery of significantly

enhanced shareholder value over time. In addition, and in line with

our strategy, we continue to enhance the value of our cask stock,

capitalising on the opportunity to further balance our cask spirit

holding, acquiring additional old and rare spirits to add to our

existing portfolio and recognise value from certain other

appreciating assets within our existing stock.

The Group incurred an adjusted EBITDA loss of GBP1.8 million

(2022: GBP0.3 million loss (adjusted and unadjusted EBITDA)) and a

loss before tax of GBP3.5 million (2022: GBP1.1 million loss).

However, the Board remains confident we remain on track to deliver

inaugural positive EBITDA, our strategic objectives delivery and

revenue diversification allowing us to manage the impact of the

evident macroeconomic headwinds suffered. We remain confident that

the investment we are making now will see margins continue to grow

over the longer term and deliver sustainable profits.

The Group is well positioned for the remainder of the year.

Whilst the wider challenging economic backdrop and general cost of

living concerns stubbornly remain, the global trend of growth in

spirits - particularly Scotch malt whisky, premiumisation,

digitalisation and consumer desire for experiences, underpins our

continued confidence in the future growth prospects for ASC. It is

anticipated that the full year performance will be in line with

market expectations and the Group remains on track to meet its aim

of doubling revenue between 2020 and 2024.

Operational progress and continued delivery of strategic

objectives

Group revenue in the period increased 3% overall, further

building on an exceptionally strong period of growth of 25% in the

prior year. Trading improved following a broadly flat Q1 and

although May and June were tougher months in the UK and China,

momentum increased with the result that the Group delivered +7%

growth in Q2-2023 versus Q2-2022. This performance evidenced strong

growth in Europe in the six-month period, with membership up 22%

and revenue up 21% versus 2022, as we continue to consolidate our

position in this key strategic growth area. There were encouraging

signs of recovery in China which delivered Q2-2023 revenue growth

of 50% on Q1-2023 and membership increased 6% year on year. The US,

Japan and Franchises also delivered double-digit membership growth

of 15%, 20% and 15% respectively.

UK Venues continued to achieve strong outperformance with 23%

revenue growth during H1-2023 against the same period in the prior

year - marking this division's strongest six-month performance on

record - as we see increase in member usage and spend per head.

Investment of GBP0.5 million in refurbishment of the Group's member

rooms at the Vaults in Edinburgh is due to complete at the end of

Q3 and we look forward to welcoming back our members for our busy

Christmas period.

A pioneering model relevant for today's consumer

ASC is a creator and curator of outstanding single cask and

limited-edition whisky, and, through its pioneering business model,

it combines a vertically integrated business; through its prowess

and expertise in acquiring and maturing limited edition whiskies,

with a horizontally integrated model; through its digital

e-commerce platform and four member venues in London, Glasgow,

Edinburgh and Leith. The Group has a robust and well-financed

business model which is arguably unique in combining the

attractions of direct-to-consumer attributes through membership of

The Scotch Malt Whisky Society ("SMWS"), with the benefits that

e-commerce brings, together with its physical member venues which

provide a rich source for recruitment and an additional level of

exclusivity for members.

SMWS benefits from a unique market position with its global

membership model which comprises an invested, loyal, growing and

high spending community, which is both scalable and geographically

diverse, with characteristically affluent members. An established

global brand with over 60% of revenues generated in international

markets across c.30 countries, SMWS continues to grow its presence

and standing in the world's key whisky markets such as the UK,

continental Europe, China and the US.

Loyal, valuable and growing global membership

Membership trends are a leading indicator of future revenue

growth, courtesy of SMWS' high member retention rates which, in

turn, deliver a stream of recurring annual revenue in the key

markets in which the Group operates. In addition, the breadth of

SMWS' international membership base diversifies the Group's risk,

and its affordable entry level membership fee delivers immediate

payback on average member acquisition cost.

Overall, membership grew by 9% in H1-2023 to 38,700 (30 June

2022: 35,600, 31 December 2022: 37,400). The Group experienced

strong growth in membership numbers in Europe, the US and Japan.

Following a slow start in China in Q1, due to significant levels of

Covid following the easing of lockdown and the macro-economic

challenges, encouragingly, Q2-23 saw improving momentum and both

revenue and membership have now returned to growth.

Lifetime member value reduced slightly to GBP1,261 - albeit this

remains up 35% since IPO, further demonstrating the intrinsic value

inherent within ASC's business model.

Continued international expansion

The period under review saw ASC continue to expand its

geographic footprint in additional key markets. The Group entered

into a new franchise operation in South Korea, achieving 300 new

members on initial launch in April 2023. We also signed new

franchise agreements in Malaysia and Singapore, where we expanded

our relationship with La Maison du Whisky.

Post the period end, a new Joint Venture subsidiary was

successfully launched in Taiwan in July 2023, a key strategic

objective for 2023. Taiwan is the third largest market for

Ultra-Premium Scotch Whisky globally based on value, with an

estimated total addressable market of $593 million (source: IWSR

2022) and our previous presence in this market had been limited to

a franchise agreement. The newly established SMWS Taiwan subsidiary

provides direct sales access to the Taiwanese market and marks the

next milestone in the Group's strategic expansion in Asia where

SMWS already has similar subsidiary operations in China and Japan

as well as franchise partners in a range of markets, including

those referenced above. ASC has 70% ownership of the new entity

which is led by an experienced management team of Murphy Chang,

former Brand Heritage Manager for Moët Hennessy Taiwan, as Country

Director who will oversee operations, supported by Eric Huang, the

former franchise partner and one of the foremost whisky experts in

Asia. Whilst still early days, this operation has got off to an

encouraging start with 500 members enrolling on launch day. We look

forward to building on this success over the coming months as we

continue to expand our representation within this important market

and in Asia more generally.

ASC now has an SMWS presence in the world's six largest markets

and our enlarged global footprint provides us with coverage of over

80% of the $8.1 billion Ultra-Premium Scotch Whisky Market (2022

IWSR) as we continue to grow our global reach.

International industry recognition

The limited-edition nature and outstanding reputation for the

quality of ASC's whisky continues to attract a growing number of

industry accolades, now totalling over 300 awards since 2018. This

third-party endorsement from prestigious awards globally, which are

judged by many of the most respected professionals in our industry,

further authenticate our credentials in producing outstandingly

high-quality single malt Scotch malt whiskies, thereby driving

demand and engendering a loyal, growing and high spending

membership of whisky-loving aficionados globally. ASC currently

sells over 1,000 different products per annum with an average

revenue per bottle of around GBP97.

Once again, H1 saw SMWS recognised for the quality of its

spirits at awards from the top competitions around the world,

including a record success in the International Spirits Challenge,

as well as achieving its best-ever result in the Scotch Whisky

Masters 2023. In addition, SMWS was recognised in the US at the

2023 San Francisco World Spirits Competition, as well as the 2023

The Tokyo Whisky & Spirits Competition (TWSC) in Japan. These

awards are testament to the outstanding quality of our single malt

Scotch whiskies which are appreciated around the world for their

unique flavours.

Investing to support long-term global growth

ASC remains on track to double sales between 2020 and 2024 and

with it sustainable profit delivery. It has made significant

investment for future growth with spirit and stocks acquired to

satisfy demand through to the end of FY28 and beyond, providing a

significant inflation hedge for the Group from a supply

perspective, with further potential upside from stock appreciation

over time. During the period under review, ASC invested GBP1.2

million in new spirit stock and wood, taking the total number of

casks to around 16,700 (31 December 2022: 16,500). During this

period the holding of New Make Spirit (NMS) casks rose to over 50%

of our total cask holding, over time feeding through to deliver

increases in gross margin.

As normal course of business, we continue to enhance the value

of our cask stock by taking advantage of the opportunities to grow

and realise value of this substantial and appreciated asset base in

line with our strategy. The flexibility of our model is such that

we proactively look to rebalance the Group's cask spirit holdings

from time to time (including cask swaps and sales) either by

acquiring additional old and rare spirits to add to our existing

portfolio or realising value from certain other appreciating assets

within our existing stock. An additional potential new revenue

stream currently under consideration includes the development of

member cask sales as part of the ongoing strategic development of

our membership offer to deliver additional value from our

appreciating asset base.

Embracing premiumisation and ecommerce growth

ASC is positioned at the forefront of key current structural

consumer trends such as premiumisation and experiential demand, as

consumers increasingly move away from mainstream brands to seek out

higher quality, crafted products which demonstrate premium

authenticity. These trends are particularly evident in the context

of artisanal whisky and other spirits. Today's consumer both values

- and demands - experience above all else, along with diversity of

choice, convenience of access, purchase and delivery, as well as

value for money.

ASC's relevance for today's consumer is further illustrated by

the way in which its ethos creates a sense of community, enabling

its members to socialise and connect in a variety of physical,

digital and virtual spaces through technology, data and its

membership venues. The Group is committed to continued investment

in digital transformation to further enhance member experience and

is on track to launch a new Members' app by the end of 2023.

In addition, SMWS is also a premier vehicle for investing in

outstanding cask whisky and accessing often rare and exclusive

whiskies. Through the provision of premium single cask whisky and

other spirits - each a limited edition by nature - ASC is able to

capitalise on the rarity value of its portfolio, creating the

desire for consumers to purchase each release before stocks run

out.

Significant and growing addressable market opportunity

Scotch Whisky remains a highly desirable global category. The

premium whisky sector in which we operate continues to grow and

prove its resilience in spite of the ongoing challenging economic

backdrop. Today, the Ultra-Premium and above whisky sector is

estimated to be worth $8.1 billion, of which ASC has a small but

growing share, achieving 12% CAGR since 2012 and grown by 52% by

2020.

Robust business characteristics

Whilst the macro-economic climate continues to be challenging,

and along with many other businesses the Group continues to face

certain inflationary pressures, the whisky category has

historically been highly robust, and stocks have typically

appreciated significantly through challenging periods protecting

gross margins and representing a natural inflation hedge.

Furthermore, our substantial stock holding not only provides

protection against supply side inflation but also potentially

delivers incremental value given the high degree of price

elasticity open to us as an 'ultra-premium' supplier and the

appreciating nature of our curated, finite spirits portfolio.

Further strengthening of Board and management team

The Group benefits from an experienced Board and management

team, with a proven track record of delivery. H1 saw further

strengthening of the Executive management team, talent and

expertise within the business with the promotion of Billy McCarter

to CFO and to the Board.

In addition, Chris Leggat (former Chief Executive of Douglas

Laing & Co) was appointed as the new Business Development

Director and Rebecca Hamilton as Chief Marketing & Experience

Officer (CXO).

Outlook and current trading

ASC continues to deliver against its stated strategy. The Group

enters H2 well positioned, and management remains confident in

continuing to progress the Group's strategic ambition of doubling

revenue between 2020 and 2024. We continue to face a challenging

economic landscape, noted by many within the spirits industry, but

remain on track to deliver positive EBITDA in 2023 and utilise our

loyal and growing membership base globally (now at over 39,000

members), diversified revenue portfolio and strategic delivery to

manage many of the challenges we currently face, and expected to

remain over the next 12-18 months.

Trading in the early weeks of H2 has been positive, with the

momentum evidenced in Q2 continuing into Q3, with performance

supported by growth in membership and robust demand for our

exclusive, curated and unique products and membership venues.

Europe and UK Venues are expected to continue to outperform the

prior year and momentum looks set to continue in China on strong Q2

membership growth of +8%.

Finalisation of the Vaults Member's Room refurbishment in

September following an investment of GBP0.5 million is on schedule

to plan and budget as we invest in the heart of the SMWS brand

home.

In terms of future developments, H2 will see further development

of our cask sales, building on the selective re-balancing of cask

spirit holdings initiatives undertaken in H1, as well as

development of private member cask sales as a new revenue driver as

part of the ongoing strategic development of our membership offer

to deliver additional value from our appreciating asset base. Our

new proprietary member app remains on course to go live later this

year bringing increased functionality and ease of engagement to our

loyal and growing members.

The Board remains confident in the future opportunity for ASC

and that market expectations for the year ended 31 December 2023

including inaugural positive EBITDA. Looking forward, the Group

looks increasingly well positioned to deliver significant future

value for shareholders.

Financial Review

The Group has delivered year-on-year sales growth of 3%,

trailing an H1-22 that was +25% vs prior year. Delivery of GBP10.2

million in the six months to June 2023 represents another period of

revenue growth.

Our H1-23 performance signifies strongly the diversified global

portfolio of our business. Despite a decline in China performance

given the particular economic conditions in that market, we have

successfully grown year on year. Some stand out performances

include;

1) The best six-month performance on record within our UK

Venues, achieving GBP2.0 million in H1-23, an increase of 16%

against H1-22;

2) Further growth in Europe, delivering 23% revenue growth,

driven by 22% increase in membership, against the prior year

3) Cask sales in the first half equating to GBP0.5 million,

H1-22 delivering GBP0.1m. This remains a strategic opportunity for

the business as we look at the potential of a cask sale offering to

members as a premium service and the opportunity to ensure we

continually balance our cask spirit holding portfolio, any sales

replaced with spirit that creates a better re-balance.

Within China, we have seen momentum as we exit H1 and sales in

Q2 were up more than 50% on Q1, however we recognise we won't

achieve the level of growth in year as was expected at the start of

the year as a result of the economic headwinds.

At a Gross Profit level, we are maintaining a strong return on

the costs of our product, delivering 61% in H1-23. This was

slightly lower than the prior year 63% as a result of Group level

margin mix from reduced sales in China, lower average selling

price, predominantly through re-pricing of some our premium Vaults

Collections and FX impacts relating to the Asia and US markets. The

expectation remains we will deliver in line with consensus margin

expectation, H2 trading margins and mix closing the current

gap.

The adjusted EBITDA loss of GBP1.8 million, and Loss before Tax

of GBP3.5m in the first half, down from a loss of GBP0.3 million

loss (adjusted and unadjusted EBITDA) and GBP1.1m respectively in

the same period of 2022, is a result of the continued investment in

systems and people, the second half delivering the greater

proportion of revenue and therefore EBITDA as our busiest trading

periods. EBITDA has been adjusted for two key items in 2023;

Masterton Bond costs, as we moved to our own self-sufficient supply

chain facility; GBP0.1m, which are exceptional by nature, and

restructuring costs that took place following the change of CEO,

GBP0.1m, non-recurring costs which have also been adjusted to

ensure we show representative underlying EBITDA (there were no

adjustment items in H1-22 EBITDA).

The Group's balance sheet retains a strong net asset value of

GBP18.7m, supported by continued investment in an appreciating cask

spirit asset held at cost value but with an external bank valuation

of +50% on holding value, and a retail value of almost

GBP0.5bn.

Within Cash, we continue to invest in cask wood and spirit

stock, per our strategy, GBP1.2m in the period, as well as the

final elements of investment in our Masterton Bond Supply Chain

facility, initial investment in the Vaults refurbishment and

restructuring costs within the business as a result of the change

in CEO.

The Artisanal Spirits Company

plc

Consolidated Statement of Comprehensive

Income

For the period ended 30 June 2023

6 months 6 months

to to Year Ended

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022 (Audited)

GBP'000 Notes

Continuing

operations

Revenue 6 10,226 9,933 21,781

Cost of sales (4,014) (3,719) (7,936)

------------------ ------------------ ----------------

Gross Profit 6,212 6,214 13,845

------------------ ------------------ ----------------

Selling &

Distribution

expenses (3,390) (1,819) (5,503)

Administrative

expenses (5,774) (5,316) (9,875)

Finance costs (629) (195) (576)

Other income 8 77 12 37

------------------ ------------------ ----------------

Loss on ordinary activities before

taxation 9 (3,504) (1,104) (2,072)

------------------ ------------------ ----------------

Taxation (8) (279) 359

------------------ ------------------ ----------------

Loss for the period (3,512) (1,383) (1,713)

------------------ ------------------ ----------------

Other comprehensive

income:

Item that will not be reclassified

to profit or loss

Movements in cash flow hedge reserve 0 31 31

Movements in translation reserve (127) 0 (59)

------------------ ------------------ ----------------

(127) 31 (28)

------------------ ------------------ ----------------

Total comprehensive loss for the

period (3,639) (1,353) (1,741)

------------------ ------------------ ----------------

Loss for the period attributable

to;

- Owners of parent

company (3,593) (1,562) (2,010)

- Non-controlling

interest 81 179 297

------------------ ------------------ ----------------

(3,512) (1,383) (1,713)

------------------ ------------------ ----------------

Total comprehensive loss for the period attributable

to;

- Owners of parent

company (3,720) (1,532) (2,038)

- Non-controlling

interest 81 179 297

------------------ ------------------ ----------------

(3,639) (1,353) (1,741)

------------------ ------------------ ----------------

Basic EPS (pence) 12 (5.3) (2.2) (2.9)

Diluted EPS (pence) 12 (5.3) (2.2) (2.9)

The Artisanal Spirits Company

plc

Consolidated Statement of Financial Position

As at 30 June 2023

As at As at

30 June 2023 31 December

(Unaudited) 2022 (Audited)

GBP'000 Notes

Non-current assets

Investment property 405 405

Property, plant and equipment 13 10,212 10,362

Intangible assets 2,139 2,249

-------------- ----------------

12,756 13,016

-------------- ----------------

Current assets

Inventories 14 29,780 28,303

Trade and other receivables 3,773 3,714

Cash and cash equivalents 1,506 2,331

-------------- ----------------

35,059 34,348

-------------- ----------------

Total assets 47,815 47,364

-------------- ----------------

Current liabilities

Trade and other payables 4,459 3,703

Current tax liabilities 327 405

Financial liabilities 15 281 357

Lease liability 15 360 360

Forward currency contracts - -

-------------- ----------------

5,427 4,825

-------------- ----------------

Net current assets 29,632 29,523

-------------- ----------------

Non-current liabilities

Financial liabilities 15 20,282 16,984

Lease liability 15 2,780 2,959

Deferred tax liabilities - -

Provisions 584 580

-------------- ----------------

23,646 20,523

-------------- ----------------

Total liabilities 29,073 25,348

-------------- ----------------

Net Assets 18,742 22,016

-------------- ----------------

Equity

Called up share capital 176 174

Share premium account 15,255 14,997

Translation reserve (196) (76)

Retained earnings 3,192 6,685

Cash flow hedge reserve 8 8

Equity attributable to parent

company 18,435 21,788

-------------- ----------------

Non-controlling interest 307 228

-------------- ----------------

Net assets 18,742 22,016

-------------- ----------------

The Artisanal Spirits Company plc

Consolidated Statement of Cash Flows

For the period ended 30

June 2023

Year

Ended

31 December

6 months to 6 months to 2022

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) (Audited)

GBP'000 Notes

Loss for the period after

tax (3,512) (1,383) (1,713)

Adjustments for:

Taxation charged 8 279 (359)

Finance costs 579 195 494

Interest receivable (2) - (4)

Movement in provisions 4 - 10

Share based payments 100 94 190

Investment in property

fair value movement - - (14)

Lease interest 50 - 82

Depreciation of tangible

assets 760 505 1,000

Amortisation of intangible

assets 124 133 259

Movement in working

capital:

(Increase)/decrease in

stocks (1,477) (3,005) (4,496)

(Increase)/decrease in

debtors (64) (627) (746)

Increase/(decrease) in

creditors 756 1,794 240

------------------------- ------------------------- -------------

Cash absorbed by

operations (2,674) (2,015) (5,057)

------------------------- ------------------------- -------------

Income taxes paid (86) (131)) (75)

Interest paid (579) (195) (494)

------------------------- ------------------------- -------------

Net cash outflow from

operating activities (3,339) (2,341) (5,626)

------------------------- ------------------------- -------------

Cash flow from investing

activities

Purchase of intangible

assets (14) (31) (88)

Purchase of property, plant

and equipment (610) (1,010) (2,911)

Purchase of JV China share - - (359)

Interest receivable 2 - 4

Net cash used in investing

activities (621) (1,041) (3,354)

------------------------- ------------------------- -------------

Cash flows from financing

activities

Asset backed lending drawn

down

Dividends paid (373)

Loan received

Repayment of loan (78) (148)

Share issue 252 59 59

Repayment of lease (230) (92) (354)

Inventory secured RCF

facility 3,221 5,650 10,300

Net cash from financing

activities 3,243 5,539 9,484

------------------------- ------------------------- -------------

Net (decrease)/increase in

cash and cash equivalents (718) 2,157 504

------------------------- ------------------------- -------------

Cash and cash equivalents at

beginning of period 2,331 2,012 2012

Reserve movements 120 31 -

Non controlling interest

movement (228) (185)

Cash and cash equivalents at

end of period 1,506 4,200 2,331

------------------------- ------------------------- -------------

The Artisanal

Spirits Company plc

Consolidated Statement of

Changes in Equity

For the period

ended 30 June 2022

Called Share Retained Cash Translation Total Non-controlling Total

up premium earnings flow reserve controlling interest equity

share account hedge interest

GBP'000 capital reserve

Balance at 31

December 2021 174 14,938 8,505 (23) (17) 23,577 304 23,881

Issue of share

capital 0 59 59 59

Share issue direct

costs

Loss for the

period (2,010) (2,010) 297 (1,713)

Adjustment to

non-controlling

interest

Share-based

compensation 190 190 190

Dividend paid (373) (373)

Investment in

subsidiary

Other

comprehensive

gain 31 (59) (28) (28)

-------- -------- --------- -------- ------------ ------------ ---------------- ---------

Balance at 31

December 2022 174 14,997 6,685 8 (76) 21,788 228 22,016

Issue of share

capital 2 258 260 260

Loss for the

period (3,593) (3,593) 79 (3,514)

Share-based

compensation 100 100 100

Other

comprehensive

gain (120) (120) (120)

-------- -------- --------- -------- ------------ ------------ ---------------- ---------

Balance at 30 June

2023 176 15,255 3,192 8 (196) 18,435 309 18,742

Notes to the unaudited interim financial information

1. Basis of preparation

The condensed interim financial information presents the

consolidated financial results of The Artisanal Spirits Company plc

and its wholly owned subsidiaries (together the "Group") for the

six months ended 30 June 2023 and the comparative figures for the

six months ended 30 June 2022 which are unaudited. This financial

information does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The condensed consolidated interim financial information, which

is neither audited nor reviewed, has been prepared in accordance

with the measurement and recognition criteria of adopted

International Financial Reporting Standards ("IFRS"). This

statement does not include all the information required for the

annual financial statements and should be read in conjunction with

the Group's the Company's Annual Report and Accounts for the 12

months ended 31 December 2022.

There are no new IFRS which apply to the condensed consolidated

interim financial information.

2. Accounting policies

The accounting policies applied in preparing the condensed

consolidated interim financial information are the same as those

applied in the preparation of the Group's HFI included within the

Company's Admission Document.

3. Going concern

The financial information has been prepared on the basis that

the Group will continue as a going concern. The directors have

considered relevant information, including annual budget

sensitivities, forecast future cash flows up until December 2024,

availability of financing and the impact of subsequent events in

making their assessment.

The directors have considered in detail both the impact

COVID-19, Brexit and the wider inflationary environment have had on

the Group's business to date and based on their forecasts and

sensitivity analysis including the potential impact of further

lockdown scenarios, are satisfied there is sufficient headroom in

their cashflow forecasts to continue to operate as a going

concern.

Based on this assessment and taking into account the Group's and

the Company's current position, the directors have a reasonable

expectation that the Group and the Company will be able to continue

in operation and meet its liabilities as they fall due over the

12-month period from the date of this announcement.

4. Principal risks and uncertainties

The principal risks and uncertainties affecting the Group are

unchanged from those set out in the Company's Annual Report and

Accounts for the 12 months ended 31 December 2022.

5. Dividends

No dividend was declared or paid during the period (prior period

GBPnil).

6. Revenue

An analysis of the Group

revenue is as follows:

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

GBP'000 (Audited)

Revenue from the sale

of Whisky 7,679 7,713 16,976

Membership Income 822 740 1,479

Revenue from the sale

of other spirits 56 74 149

Member rooms 1,091 910 2,025

Events & tastings 455 352 827

Other 123 144 325

------------------- ------------------- --------------

10,226 9,933 21,781

------------------- ------------------- --------------

An analysis of the Group revenue by geographical

areas is as follows:

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

GBP'000 (Audited)

UK 3,990 3,252 7,703

US 1,833 1,867 4,353

China 1,756 2,346 5,002

Europe 1,109 915 2,014

Rest of World 682 670 907

Australia 383 439 1,001

Japan 473 444 800

------------------- ------------------- --------------

10,226 9,933 21,781

------------------- ------------------- --------------

'Revenue from the Sale of Whisky' includes the revenue from sale

of cask whisky spirit, GBP502k (H1-22; GBP53k, 2022 GBP348k).

7. KPIs

LTM Period Average Retention Revenue/ Contribution(1) Expected LTV(3)

End / Years(2)

Revenue Members Members % Member Member (Avg

Members)

GBP'000 ('000s) ('000s)

UK 7,156 18.2 17.8 76% 402 217 4.2 910

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

United

States 4,370 6.3 5.9 68% 736 386 3.1 1,211

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

China 4,455 1.7 1.6 40% 2,739 1,931 1.7 3,210

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Europe(4) 2,388 4.8 4.3 73% 553 236 3.7 873

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Australia 945 1.5 1.6 75% 599 318 4.0 1,275

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Japan 829 1.9 1.8 85% 464 358 6.7 2,393

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Rest of

World 1,135 4.4 4.0 81% 1,034 620 7.9 2,047

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Total 21,278 38.8 37.1 74% 574 330 3.8 1,261

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

Change(5) 0% 4% 5% -4% -4% -3% -11% -13%

---------- ---------- ---------- ---------- --------- ---------------- ---------- -----------

1) Contribution is a non-IFRS measure, and is defined by

management as Gross Profit less Commission

2) Expected Years is a non-IFRS measure, and is defined by

Management as one divided by one minus retention 1/(1-r%)

3) Lifetime Value (LTV) is a non-IFRS measure, and is defined as

Annual Contribution per member, multiplied by expected years

4) Europe represents direct sales markets within continental

Europe, but excludes franchise markets in Denmark & Switzerland

which are shown within Rest of World

5) Change is shown versus the twelve-month period ended 30 December 2022

8. Other Operating Income

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

GBP'000 (Audited)

Other Income 74 10 37

------------------- ------------------- --------------

74 10 37

------------------- ------------------- --------------

Other income in the period relates to a refund from the Chinese

government to SMWS China in relation to previously overpaid

expenses.

9. Loss on ordinary activities before taxation

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

GBP'000 (Audited)

Presented as;

Adjusted EBITDA* (1,811) (313) 394

Depreciation of tangible

assets (760) (462) (1,000)

Amortisation of intangible

assets (124) (133) (259)

Finance costs (629) (195) (576)

Exceptional and restructure

costs (180) - (631)

------------------- ------------------- --------------

Loss on ordinary activities

before taxation (3,504) (1,104) (2,072)

------------------- ------------------- --------------

Loss on ordinary activities

before taxation (3,504) (1,104) (2,071)

Add back; Depreciation

of tangible assets 760 462 1,000

Add back; Amortisation

of intangible assets 124 133 259

Add back; Finance costs 629 195 576

EBITDA (1,991) (313) (236)

------------------- ------------------- --------------

Exceptional and restructure

costs 180 0 631

------------------- ------------------- --------------

Adjusted EBITDA* (1,811) (313) 395

------------------- ------------------- --------------

* Adjusted EBITDA is defined as earnings before interest,

tax, depreciation, amortisation and exceptional and

restructure costs

10. Exceptional and Restructure costs

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

GBP'000 (Audited)

Legal and professional

fees - - 1

Non underlying American

Whiskey pre operational

costs - - 288

Non underlying Masterton

pre-operational costs 91 342

Non recurring organisational 89 - -

restructuring costs

------------------- ------------------- --------------

180 - 631

------------------- ------------------- --------------

Costs in the period relate to GBP91k (2022; nil) relating to

final movement of Supply operations to our new Masterton Bond

Supply Chain facility and GBP89k (2022; nil) and restructure costs

relating to the change of CEO.

11. Taxation

The results include a tax charge against the profits of the

Group's Chinese subsidiary at the rate of 25% in both 2022 and

2023. There have been no corporation taxes due against other Group

companies due to carried forward trading losses.

12. Earnings Per Share (EPS)

6 months 6 months Year Ended

to to

30 June 30 June 31 December

2023 (Unaudited) 2022 (Unaudited) 2022

(Audited)

Earnings used in calculation

(GBP'000) (3,720) (1,532) (2,038)

Number of shares 69,807,454 69,638,840 69,708,374

Basic EPS (p) (5.3p) (2.2p) (2.9p)

Fully diluted number

of shares 74,995,461 74,673,842 74,746,138

Diluted EPS (p) (5.3p) (2.2p) (2.9p)

13. Property, Plant & Equipment

Land Land Leasehold Fixtures, Casks Right Total

and and improvements fittings GBP'000 of use GBP'000

buildings buildings GBP'000 and asset

freehold leasehold equipment 'GBP000

GBP'000 GBP'000 GBP'000

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

Cost or valuation

As at 1 January

2022 678 1,441 498 1,968 2,745 4,343 11,673

Additions - - 5 2,202 704 162 3,073

As at 31 December

2022 678 1,441 503 4,170 3,449 4,505 14,746

Additions - - - 287 322 - 609

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

As at 30 June 2023 678 1,441 503 2,651 3,070 4,343 12,686

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

Accumulated Depreciation

As at 1 January

2022 168 1,027 251 844 345 661 3,296

Charge for the year 13 70 55 328 148 474 1,088

As at 31 December

2022 181 1,097 306 1,172 493 1,135 4,384

Charge for the 6

months 18 24 27 407 73 210 759

As at 30 June 2023 199 1,121 333 1,579 566 1,345 5,142

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

Net book value

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

As at 31 December

2022 497 344 197 2,998 2,956 3,370 10,362

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

As at 30 June 2023 479 320 170 2,878 3,205 3,160 10,212

-------------------------- ----------- ----------- -------------- ----------- --------- --------- ---------

Investment in the period is driven by progression in the build

and fit-out of our new Supply Chain facility, Masterton Bond, and

continued investment in Cask Wood GBP322k; (2021; GBP199k).

14. Inventories

GBP'000 As at 30 As at 30 As at 31 December

June 2023 June 2022 2022

(Unaudited) (Unaudited) (Audited)

Cask whisky & other

spirits 23,926 22,804 23,034

------------- ------------- ------------------

Other inventory 5,844 3,921 5,269

------------- ------------- ------------------

Total inventory 29,780 26,725 28,303

------------- ------------- ------------------

The above balance contains no provision for aged stock (Jun-22:

GBP83k) as we have recognised write off costs direct to the income

statement in 2023, GBP100k relating to aged stock encountered as a

result of our move from third party supply chain support to sole

inhouse operations at our new Masterton bond supply chain

facility.

The movement in inventory is primarily driven by continued

investment in our cask stock inventory as we invest to meet future

demand, with net cask investment representing GBP0.9m in the

six-month period (H1-22: GBP2.4m).

15. Financial Liabilities

6 months Year Ended

to

30 June 31 December

2022 2022

(Unaudited)

GBP'000 (Audited)

Inventory secured revolving

credit facility 19,400 16,500

Bank loans 569 784

Other loans 45 57

-------------- --------------

Financial liabilities 20,014 17,341

Lease liability 3,139 3,319

-------------- --------------

23,153 20,660

-------------- --------------

The revolving credit facility (RCF) is secured by a bond and

floating charge over eligible inventory within the Group. The

availability of funds under the facility agreement is linked to a

calculation of eligible inventory, which is predominantly the

casked goods component of inventory assets.

In December 2022, the revolving credit facility was increased,

as part of the accordion element within the original contract, by

GBP3m, the total facility availability now GBP21.5m. The loan is

interest bearing and interest is due at a rate of 2.25% over the

Bank of England base rate.

The bank loan is secured by standard securities over the Ground

Floor Premises of the Leith property and a legal charge over the

Greville Street property. The loan is interest bearing and interest

is due at a rate of 2.25% over the Bank of England base rate.

16. Financial Instruments - accounting classifications and fair value

Financial assets

Trade and other receivables and cash and cash equivalents are

classified as financial assets at amortised cost.

Derivative assets are classified as financial assets measured at

fair value (level 2 - i.e. those that do not have regular market

pricing) through other comprehensive income.

Financial liabilities

Trade and other payables (excluding deferred income) are

classified as financial liabilities are measured at amortised

cost.

The fair value of both financial assets and financial

liabilities have been assessed and there is deemed to be no

material difference between fair value and carrying value.

Derivative liabilities are classified as financial liabilities

measured at fair value (level 2) through other comprehensive

income.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BDLLFXKLFBBK

(END) Dow Jones Newswires

September 18, 2023 02:00 ET (06:00 GMT)

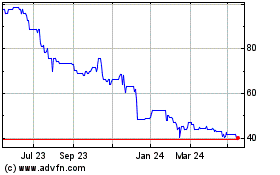

The Artisanal Spirits (LSE:ART)

Historical Stock Chart

From Oct 2024 to Nov 2024

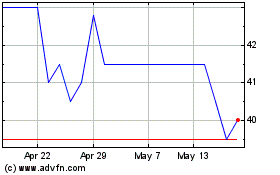

The Artisanal Spirits (LSE:ART)

Historical Stock Chart

From Nov 2023 to Nov 2024