TIDMALFA

RNS Number : 3710D

EQT Fund Management S.à r.l.

21 June 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.4 OF THE CITY CODE

ON TAKEOVERS AND MERGERS (THE "CODE") AND DOES NOT CONSTITUTE AN

ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF

THE CODE. THERE CAN BE NO CERTAINTY THAT ANY FIRM OFFER WILL BE

MADE NOR AS TO THE TERMS ON WHICH ANY FIRM OFFER MIGHT BE MADE.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

21 June 2023

Statement regarding possible offer for Alfa Financial Software

Holdings plc ("Alfa" or "the Company")

CHP Software and Consulting Limited enters into irrevocable

undertaking

Irrevocable Commitment

Further to the announcement made by the Company on 9 June 2023

in response to press speculation (the "Possible Offer

Announcement") in respect of the possible offer for the Company by

EQT X EUR SCSp and EQT X USD SCSp each represented by its manager

(gérant), EQT Fund Management S.à r.l. (collectively referred to as

"EQT"), EQT announces that it has entered into an irrevocable

undertaking with CHP Software and Consulting Limited ("CHP") (which

is ultimately controlled by Andrew Page, the Chairman and founder

of the Company) in respect of a possible offer by EQT for the

entire issued and to be issued share capital of the Company at a

price of 208 pence per ordinary share of the Company, to be

implemented by means of a recommended scheme of arrangement under

Part 26 of the Companies Act 2006 and including a customary right

to switch from the Scheme to a takeover offer and the proposed

Share Alternative, as further described below (the "Possible

Offer").

The irrevocable undertaking is in respect of CHP's entire

current holding of 175,905,649 ordinary shares in the capital of

the Company representing approximately 59.5 per cent. of the

Company's total issued ordinary share capital.

The irrevocable undertaking provides that CHP will, if a firm

offer is made, vote in favour of all resolutions to approve any

scheme of arrangement under Part 26 of the Companies Act 2006 in

respect of the Possible Offer (the "Scheme") (or, to accept a

takeover offer in the event that EQT were to exercise its right to

switch from the Scheme to a takeover offer provided that the

acceptance condition for such offer is set at not less than 75 per

cent. of the fully diluted share capital of the Company).

CHP has also undertaken to vote against any competing proposal,

so long as the irrevocable undertaking continues to be binding.

Prior to the release by EQT of an announcement of a firm

intention to make an offer for the Company for the purposes of Rule

2.7 of the Code, the irrevocable undertaking will terminate and

cease to be binding if:

a. EQT releases an announcement that it does not intend to

proceed with the Possible Offer (for the purposes of Rule 2.8 of

the Code); or

b. EQT has otherwise not released announcement of a firm

intention to make an offer for the Company, for the purposes Rule

2.7 of the Code, by 31 August 2023; or

c. a third party announces a firm intention to make an offer for

the Company for the purposes of Rule 2.7 of the Code at a price per

ordinary share of the Company equal to or greater than 239 pence (a

"Competing Offer") and EQT does not announce a firm intention to

make an offer for the Company under Rule 2.7 of the Code at a price

per share of the Company equal to or greater than the price of such

Competing Offer within ten business days of the announcement of

such Competing Offer.

Following the release by EQT of an announcement of a firm

intention announcement to make an offer for the Company for the

purposes of Rule 2.7 of the Code, the irrevocable undertaking will

remain binding in the event of a Competing Offer and will only

terminate and cease to be binding in certain limited circumstances,

specified in the irrevocable undertaking, including if: the Scheme

lapses or is withdrawn for the purposes of the Code, and the

relevant bid vehicle formed for the purposes of the offer and

ultimately controlled by EQT publicly confirms that it does not

intend to to implement the offer by way of a takeover offer, or has

otherwise not become effective by 6.00 p.m. on the long stop date

specified in the relevant announcement of a firm intention to make

an offer for the Company, if and when made by EQT.

Further details regarding the irrevocable undertaking are set

out in Appendix 1.

Share Alternative

As stated above and referred to in the Possible Offer

Announcement, it is currently expected as an alternative (the

"Share Alternative") to the cash offer of 208 pence per ordinary

share of the Company (the "Cash Offer"), that an eligible Alfa

shareholder would be entitled to elect to receive rollover ordinary

and preference shares in a holding company ("Holdco") ultimately

controlled by EQT (the "Rollover Securities") in exchange for their

holding of Company shares in respect of up to 33 per cent. of their

shareholding in the Company (with the remaining percentage of such

Alfa shareholder's shareholding being settled by way of the Cash

Offer) and at a ratio to be specified in the relevant offer

documentation.

CHP has further undertaken to elect for the proposed Share

Alternative, up to the maximum amount of 33 per cent. of its

holding in the Company; provided that if CHP, acting in good faith,

determines that the detailed terms of the Share Alternative do not

accurately reflect the term sheet appended to the irrevocable

undertaking, CHP may elect to receive cash at a price of 208 pence

per ordinary share in respect of all of its holding in the

Company.

The maximum number of Rollover Securities available to Alfa

shareholders under the Share Alternative would be limited to 20 per

cent. of the issued ordinary share capital of Holdco as at

completion of the Possible Offer (the "Alternative Offer

Maximum").

If valid elections were to be made from eligible Alfa

shareholders that would require the issue of Rollover Securities

exceeding the Alternative Offer Maximum, the number of Rollover

Securities to be issued in respect of each Alfa share would be

rounded down on a pro rata basis, and the balance of the

consideration for each Alfa Share would be paid in cash in

accordance with the terms of the Cash Offer.

The availability of the Share Alternative would also be

conditional upon valid elections being made for such number of

Rollover Securities as represent at least 7.5 per cent. of the

issued ordinary share capital of Holdco at completion of the

Possible Offer, failing which the Share Alternative would lapse and

no Rollover Securities would be issued.

Unless otherwise determined by EQT and permitted by applicable

law and regulation, the Share Alternative would not be offered,

sold or delivered, directly or indirectly, in or into any

jurisdiction where local laws or regulations may result in a

significant risk of civil, regulatory or criminal exposure if

information concerning the Possible Offer is sent or made available

to Alfa shareholders in that jurisdiction or where to do so would

result in compliance requirements or formalities which EQT regards

as unduly onerous. In addition, individual acceptances of the Share

Alternative would only be valid if all regulatory approvals (if

any) required by the relevant Alfa shareholder to acquire the

Rollover Securities had been obtained.

If a firm offer were to be made, for the purposes of Rule 24.11

of the Code, Goldman Sachs, as financial adviser to EQT would

provide an estimate of the value of a Rollover Security, together

with the assumptions, qualifications and caveats forming the basis

of its estimate of value, in a letter to be included in the

relevant offer documentation.

Further details on the terms of the Share Alternative are set

out in Appendix 2.

Further information

Discussions between the parties remain ongoing. There can be no

certainty that any offer will be made for the Company by EQT.

Further announcements may be made as and when appropriate.

In accordance with Rule 2.6(a) of the Code, EQT is required, by

no later than 5.00pm (London time) on 7 July 2023 either to

announce a firm intention to make an offer for the Company in

accordance with Rule 2.7 of the Code or to announce that it does

not intend to make an offer, in which case the announcement will be

treated as a statement to which Rule 2.8 of the Code applies. This

deadline can be extended with the consent of the Panel in

accordance with Rule 2.6(c) of the Code.

In accordance with Rule 2.5 of the Code, EQT reserves the right

to vary the form and/or mix of the consideration described in this

announcement or implement the transaction by means of a takeover

offer as opposed to a scheme of arrangement. EQT also reserves the

right to make an offer for the Company on less favourable terms

than those described in this announcement: (i) with the agreement

or recommendation of the board of the Company; (ii) if a third

party announces a firm intention to make an offer for Company

which, at that date, is of a value less than the value of the

Possible Offer; or (iii) following the announcement by the Company

of a Rule 9 waiver transaction. If Alfa announces, declares or pays

any new dividend or any other distribution or return of value to

shareholders after the date of this announcement (other than the

final dividend of 1.2 pence per share payable on 26 June 2023), EQT

reserves the right to make an equivalent reduction to the Possible

Offer.

Enquiries:

EQT

Finn McLaughlan +44 77 1534 1608

Goldman Sachs, Financial Advisor to EQT

Nicholas van den Arend

Owain Evans

Cara Pazdon +44 20 7774 1000

Greenbrook Advisory, PR Advisor to EQT +44 20 7952 2000

eqt@greenbrookadvisory.com

James Madsen

Matthew Goodman

Kirkland & Ellis International LLP is acting

as legal adviser to EQT

About EQT

EQT is a purpose-driven global investment organization with EUR

119 billion in assets under management within two business segments

- Private Capital and Real Assets.

Funds managed by EQT own portfolio companies and assets in

Europe, Asia-Pacific and the Americas and supports them in

achieving sustainable growth, operational excellence and market

leadership.

More information is available at www.eqtgroup.com

Important Notices

Goldman Sachs International ("Goldman Sachs"), which is

authorised by the Prudential Regulation Authority and regulated in

the United Kingdom by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting exclusively for EQT and

no one else in connection with the Possible Offer or any other

matter referred to in this announcement and will not be responsible

to anyone other than EQT for providing the protections offered to

clients of Goldman Sachs or for providing advice in relation to the

contents of this announcement or any matters referred to herein

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities, or the solicitation of any

vote or approval in any jurisdiction, whether pursuant to this

announcement or otherwise. Any offer, if made, will be made solely

by certain offer documentation which will contain the full terms

and conditions of any offer, including details of how it may be

accepted.

The release, distribution or publication of this announcement in

whole or in part, directly or indirectly in, into or from

jurisdictions outside the United Kingdom may be restricted by law

and therefore persons into whose possession this announcement comes

should inform themselves about, and observe, such restrictions. Any

failure to comply with the restrictions may constitute a violation

of the securities law of any such jurisdiction.

EQT is not aware of any dealings in Alfa ordinary shares that

would require a minimum level, or particular form, of consideration

that it would be obliged to offer under Rule 6 or Rule 11 of the

Code (as appropriate). However, it has not been practicable to make

such enquiries of all persons presumed to be acting in concert with

EQT. Enquiries of such parties will be made as soon as practicable

following the date of this announcement and, to the extent that any

further disclosure is required, EQT will make an announcement as

soon as practicable, and in any event by the time it is required to

make its Opening Position Disclosure pursuant to Rule 8.1 of the

Code.

Rule 26.1 Disclosure

In accordance with Rule 26.1 of the Code, a copy of this

announcement and the irrevocable referred to in it will be

available at www.alfasystems.com and www.

publication-documents.co.uk , by no later than 12 noon (London

time) on 22 June 2023. The content of the website referred to in

this announcement is not incorporated into and does not form part

of this announcement.

Note to US Shareholders

In accordance with normal UK practice and pursuant to Rule

14e-5(b) of the US Exchange Act, EQT or its nominees or brokers

(acting as agents), may from time to time make certain purchases

of, or arrangements to purchase, Alfa ordinary shares outside the

United States, other than pursuant to the possible offer, before or

during the period in which the possible offer, if made, remains

open for acceptance. Also, in accordance with Rule 14e-5(b) of the

US Exchange Act, Goldman Sachs International will continue to act

as exempt principal traders in Alfa ordinary shares on the London

Stock Exchange. These purchases may occur either in the open market

at prevailing prices or in private transactions at negotiated

prices. Any information about such purchases will be disclosed as

required in the United Kingdom, will be reported to a Regulatory

Information Service and will be available on the London Stock

Exchange website, www.londonstockexchange.com .

MAR

The information contained within this announcement is deemed by

EQT to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No.596/2014 (as applicable in the UK and as

amended from time to time). Upon the publication of this

announcement via a Regulatory Information Service, such information

is now considered to be in the public domain.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at https://www.thetakeoverpanel.org.uk

, including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Takeover Panel's Market

Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as

to whether you are required to make an Opening Position Disclosure

or a Dealing Disclosure.

Bases and Sources

In this announcement, unless otherwise stated or the context

otherwise requires, the following bases and sources have been

used:

-- References to percentage ownership of the Company have been

based on Company's total voting rights last publicly announced

before at the date of this announcement, being: 295,469,376.

-- Certain figures included in this announcement have been subject to rounding adjustments.

Disclaimer

The information contained herein does not constitute an offer to

sell, nor a solicitation of an offer to buy, any security, and may

not be used or relied upon in connection with any offer or

solicitation. Any offer or solicitation in respect of EQT X will be

made only through a confidential private placement memorandum and

related documents which will be furnished to qualified investors on

a confidential basis in accordance with applicable laws and

regulations. The information contained herein is not for

publication or distribution to persons in the United States of

America. Any securities referred to herein have not been and will

not be registered under the U.S. Securities Act of 1933, as amended

(the "Securities Act"), and may not be offered or sold without

registration thereunder or pursuant to an available exemption

therefrom. Any offering of securities to be made in the United

States would have to be made by means of an offering document that

would be obtainable from the issuer or its agents and would contain

detailed information about the issuer of the securities and its

management, as well as financial information. The securities may

not be offered or sold in the United States absent registration or

an exemption from registration.

Appendix 1

Irrevocable Undertaking

CHP has given an irrevocable undertaking to vote in favour of

all resolutions to approve the Scheme (or, to accept a takeover

offer in the event that EQT were to exercise its right to switch

from the Scheme to a takeover offer provided that the acceptance

condition for such takeover offer is set at not less than 75 per

cent. of the fully diluted share capital), as summarised in the

text of this announcement..

Name Total number of shares Percentage of existing

of the Company issued share capital

CHP 175,905,649 59.5

Appendix 2 - Indicative terms of Rollover Securities

Set out below are the indicative terms of the Rollover

Securities, subject to tax structuring

1. Voting Rights

Each ordinary share comprising a Rollover Security will carry

one vote, while each preference share comprising a Rollover

Security would not carry any general voting rights at general

meetings of Holdco.

2. Significant Shareholder

Any holder of Rollover Securities who at Completion holds more

than 8 per cent. of the total number of ordinary shares in Holdco

(a "Significant Shareholder") would be entitled to appoint (and

remove/replace), in good faith consultation with EQT X EUR SCSp and

EQT X USD SCSp, each represented by its manager (gérant), EQT Fund

Management S.à r.l. ("EQT"), a director to the board of Holdco (the

"Board") and also appoint (and remove/replace) an observer to

attend, by teleconference or videoconference only, (but not vote

at) meetings of the Board.

A Significant Shareholder would also have a consent right over

certain matters, including certain amendments to Holdco's

organisations or constitutional documents, reorganisations,

reductions in capital or distributions of Holdco (other than on a

pro rata basis), any material change to the nature of the business,

and any transactions between Holdco or its subsidiaries and EQT or

its affiliates.

In the event that the Significant Shareholder ceases to hold 8

per cent. of the issued ordinary share capital of Holdco (other

than as a result of any issuance by Holdco of new equity

securities), such appointment rights and consent rights shall no

longer apply.

A Significant Shareholder would have the right to receive annual

audited accounts, business plan and budget, monthly management

accounts and all information packs provided to the Board. In the

event that the Significant Shareholder ceases to hold 5 per cent.

of the issued ordinary share capital of Holdco at completion, or

makes an investment in any business considered by the Board (acting

reasonably and in good faith) to be a competitor, in any material

respect, of the business of the Holdco group, such information

rights shall no longer apply.

Such Board appointment, consent and information rights are

personal to the relevant Significant Shareholder and will not

transfer along with any transfer of Rollover Securities.

EQT and any Significant Shareholder would each agree to a

non-solicitation covenant (subject to customary carve-outs) such

that, each party, for up to one year from the date on which such

party ceases to hold any Holdco securities and for as long as the

other party continues to hold securities in Holdco, will not

solicit any member of senior management of Alfa Financial Software

Holdings plc.

3. Unlisted

The Rollover Securities would be unlisted.

4. Transfers of the Rollover Securities

Rollover Securities would not be transferable (directly or

indirectly) during an initial five-year lock-up period (the

"Lock-up Period") without the prior written consent of EQT except

to its affiliates or pursuant to the drag and tag rights described

below.

Following the expiration of the Lock-up Period, a holder of

Rollover Securities (a "Rollover Shareholder") would be entitled to

transfer its Rollover Securities (provided that any such transfer

is for all (but not part) of the Rollover Securities held by such

Rollover Shareholder), subject to a customary right of first offer

on the part of EQT and to certain other restrictions in respect of

the identity of the proposed transferee. Any proposed transferee of

Rollover Securities after the Lock-up Period:

-- would be required to adhere to the relevant shareholders' agreement relating to Holdco;

-- would be required to complete any applicable anti-money

laundering, anti-bribery and corruption, anti-sanctions and "know

your client" checks reasonably required by EQT and/or any antitrust

or regulatory change in control approvals required by any

regulator; and

-- must not be considered by EQT to be a competitor of the

business of the Holdco group or a person whose investment is likely

to result in reputational harm to the Holdco group, EQT or their

respective affiliates.

5. Additional Rollover Security Issues

The Rollover Shareholders would be entitled to participate pro

rata in securities issues after completion (other than debt

financing provided by a third-party lender and subject to customary

exceptions).

6. Exit Arrangements

Any future share sale, asset sale, IPO, winding-up or other form

of liquidity event relating to the group (an "Exit") would occur at

the absolute discretion of EQT (in good faith consultation with the

Board).

Each holder of Rollover Securities will be entitled to pro rata

pre-emption and sell-down rights on any IPO. Each holder of

Rollover Securities will be required to enter into customary

lock-up undertakings and reasonable and customary provisions

designed to result in an orderly disposal of securities, but on no

more onerous or lengthy terms than EQT (and, for the avoidance of

doubt, each holder of Rollover Securities will be offered the same

liquidity opportunities as EQT at the same time and on a pro-rata

basis).

On any sale of all or substantially all of the business of the

Holdco Group, the Board shall seek to distribute the proceeds of

such sale to Holdco shareholders as soon as reasonably practicable

thereafter (subject to Holdco having sufficient distributable

reserves and withholding such amounts as are considered reasonably

necessary by EQT in good faith to meet any current or future

obligations, liabilities or contingencies of the Group).

7. Drag along and tag along

EQT shall have a customary drag right (i.e. force a sale) on the

same terms (including implied price and form of consideration) on

any transfers of direct or indirect shareholdings which would

result in a change of control. EQT will not be able to exercise its

drag along transfer rights such that any drag transfer would

complete within 12 months of completion of the Possible Offer

without prior written consent of the relevant Significant

Shareholder(s).

Rollover Shareholders shall have a customary pro rata tag right

on the same terms (including implied price and form of

consideration) on any transfer of direct or indirect shareholdings

by EQT(other than in respect of certain excluded instances

including, but not limited to, customary permitted transfers to

affiliates, any current or prospective director, officer, employee

or consultant of the group, reorganisation, IPO, where a drag right

has been exercised, and/or any syndication to limited partners

and/or co-investors). A transfer by EQT of its securities to a

continuation fund will constitute an exit event entitling any

Significant Shareholder to tag along all of their Rollover

Securities.

On any drag or tag transfer, any dragged or tagging shareholder

will be required to give the same warranties and indemnities as are

given by EQT.

8. Risk factors

If a firm offer is made, a more detailed set of risk factors

will be set out in any firm intention announcement under Rule 2.7

of the Code but will include, among other things, the

following:

-- the Rollover Securities will comprise securities in a private

and unquoted company, and there is no current expectation that they

will be listed or admitted to trading on any exchange or market for

the trading of securities, and will therefore be illiquid;

-- the value of the Rollover Securities will at all times be

uncertain and there can be no assurance that any such securities

will be capable of being sold in the future or that they will be

capable of being sold at the value to be estimated by Goldman Sachs

in any offer documentation;

-- the holders of Rollover Securities, apart from any

Significant Shareholder, will not enjoy any minority protections or

other rights save for those rights prescribed by applicable law;

and

-- the holders of Rollover Securities, apart from any

Significant Shareholder, will not be afforded the same level of

protections and disclosure of information that they currently

benefit from as shareholders in the Company as a listed

company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OFDZZGZVFGFGFZZ

(END) Dow Jones Newswires

June 21, 2023 02:00 ET (06:00 GMT)

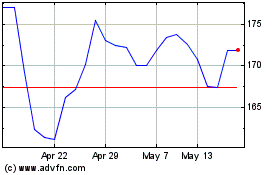

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From Jun 2024 to Jul 2024

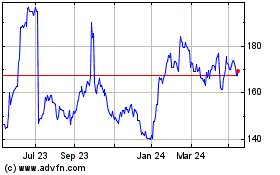

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From Jul 2023 to Jul 2024