UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

| | |

| Check the appropriate box: |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential — For Use of the Commission Only (as permitted by Rule 14a-5(d)(2)) |

| ☐ | Definitive Information Statement |

ZEUUS, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

ZEUUS, INC.

31 West 27th Street, 9th Floor

New York, NY 10001

(888) 469-3887

[•], 2022

TO THE STOCKHOLDERS OF ZEUUS, INC.:

THIS IS A NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTERS DESCRIBED HEREIN.

This notice and accompanying Information Statement is furnished to the holders of shares of common stock, par value $0.001 per share, of Zeuus, Inc., a Nevada corporation (the “Company”), pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C and Schedule 14C thereunder, in connection with the approval of the following actions taken by the Company’s Board of Directors (the “Board”) and by written consent of the holders of a majority of the voting power of the issued and outstanding capital stock of the Company:

| | | |

| | 1. | To amend our articles of incorporation, as amended (the “Articles”), to effect a forward stock split of the outstanding shares of common stock, by a ratio of 10-for-1 (the “Forward Stock Split”); and |

| | 2. | To amend our Articles to increase the number of authorized shares of common stock from 75,000,000 to 200,000,000 (the “Authorized Share Increase” and together with the Forward Stock Split, the “Corporate Actions”). |

The purpose of the Information Statement is to notify our stockholders that on March 8, 2022, a stockholder holding a majority of the voting power of our issued and outstanding shares of capital stock executed a written consent approving the Corporate Actions.

The written consent that we received constitutes the only stockholder approval required for the Corporate Actions under Nevada law and our Articles and bylaws. As a result, no further action by any other stockholder is required to approve the Corporate Actions and we have not solicited, and will not be soliciting, your approval of the Corporate Actions. Notwithstanding, the holders of our common stock of record at the close of business on March 3, 2022 are entitled to notice of the stockholder action by written consent.

This notice and the accompanying Information Statement are being mailed on or about [•], 2022 to our holders of common stock of record as of March 3, 2022. This notice and the accompanying Information Statement shall constitute notice to you of the action by written consent in accordance with Rule 14c-2 promulgated under the Exchange Act and in accordance with Nevada law and our bylaws.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THE ACCOMPANYING INFORMATION STATEMENT. WE ARE NOT ASKING FOR A PROXY AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

| | |

| [•], 2022 | By Order of the Board of Directors of |

| | ZEUUS, INC. |

| | |

| | /s/ Bassam A.I. Al-Mutawa |

| | Bassam A.I. Al-Mutawa |

| | President, Chief Executive Officer and Chief Financial Officer |

ZEUUS, INC.

31 West 27th Street, 9th Floor

New York, NY 10001

(888) 469-3887

Information Statement Pursuant to Section 14C

of the Securities Exchange Act of 1934

This Information Statement is being mailed on or about [•], 2022, to all holders of record on March 3, 2022 (the “Record Date”) of the common stock, $0.001 par value per share (the “Common Stock”), of ZEUUS, INC., a Nevada corporation (“Zeuus” or the “Company”), in connection with the approval of the following actions taken by the Board of Directors of the Company (the “Board”) and by written consent of the holder of a majority of the voting power of Zeuus’s issued and outstanding capital stock (the “Approving Stockholder”):

| | | |

| | 1. | To amend our articles of incorporation, as amended (the “Articles”), to effect a forward stock split of the outstanding shares of Common Stock, by a ratio of 10-for-1 (the “Forward Stock Split”); and |

| | 2. | To amend our Articles to increase the number of authorized shares of Common Stock from 75,000,000 to 200,000,000 (the “Authorized Share Increase” and together with the Forward Stock Split, the “Corporate Actions”). |

On March 8, 2022, our Board unanimously approved the Corporate Actions. In order to eliminate the costs and management time involved in holding a special meeting and in order to effect the actions disclosed herein as quickly as possible in order to accomplish the purposes of our Company, we chose to obtain the written consent of a majority of the Company’s voting power to approve the actions described in this Information Statement in accordance with Nevada law and our bylaws. On March 8, 2022, the Approving Stockholder approved, by written consent, the Corporate Actions. The Approving Stockholder, Fortis Business Holdings, Inc., is controlled by Bassam A.I. Al-Mutawa, the Company’s President, Chief Executive Officer, Chief Financial Officer and director. The Approving Stockholder holds 8,000,000 shares of Common Stock, representing 75.82% of the outstanding Common Stock.

Since the Board and the holder of a majority of the voting power of the Company’s issued and outstanding shares of capital stock have voted in favor of the Corporate Actions, all corporate actions necessary to authorize the Corporate Actions have been taken and you are not required to take any action. This Information Statement provides to you notice that the Corporate Actions have been approved. You will receive no further notice of the approval nor of the effective date of each of the Corporate Actions other than pursuant to reports which the Company will be required to file with the Securities and Exchange Commission (the “SEC”) in the future. We expect that each of the Corporate Actions will become effective on or about the 20th calendar day after the date on which this Information Statement and the accompanying notice are mailed to our stockholders. The Financial Industry Regulatory Authority (“FINRA”) must pre-clear the Forward Stock Split. Accordingly, we will not effect the Forward Stock Split prior to receipt of FINRA’s clearance. Our Board retains the authority to abandon either or both of the Corporate Actions for any reason at any time prior to the effective date of the respective Corporate Action.

The Company’s Common Stock is quoted on the OTC Pink market tier of the OTC Markets Group Inc. under the symbol “ZUUS.” The last sale price of our Common Stock as reported on the OTC Pink on December 17, 2021 was $90.00. No bids or sales of our Common Stock have been reported on the OTC Pink since December 17, 2021. Trading in securities quoted on the OTC Markets is often thin and characterized by wide fluctuations in trading prices. Any reported sale prices may not be a true market-based valuation of our Common Stock.

RECORD DATE AND VOTING SECURITIES

Only stockholders of record at the close of business on the Record Date are entitled to notice of the information disclosed in this Information Statement. As of the Record Date, our authorized securities consist of 75,000,000 shares of Common Stock, par value $0.001 per share. As of the Record Date, there were 10,550,616 shares of Common Stock issued and outstanding, held by approximately 56 holders of record. Holders of our Common Stock

1

are entitled to one vote per share. Accordingly, the Approving Stockholder holds 75.82% of the Company’s voting power.

EXPENSES

The costs of preparing, printing and mailing this Information Statement will be borne by the Company.

STOCKHOLDERS SHARING AN ADDRESS

We will deliver only one Information Statement to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. We undertake to deliver promptly, upon written or oral request, a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement is delivered. A stockholder can notify us that the stockholder wishes to receive a separate copy of the Information Statement by contacting us at the address or phone number set forth above. Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish to receive only one, such stockholders can notify us at the address or phone number set forth above.

STOCKHOLDERS’ RIGHTS

The elimination of the need for a special meeting of the stockholders to approve the actions described in this Information Statement is authorized by Section 78.320(2) of the Nevada Revised Statutes. Section 78.320(2) provides that any action required or permitted to be taken at a meeting of stockholders of a corporation may be taken without a meeting, before or after the action, if a written consent thereto is signed by the stockholders holding at least a majority of the voting power. In order to eliminate the costs and management time involved in holding a special meeting and in order to effect the Corporate Actions disclosed herein as quickly as possible in order to accomplish the purposes of our Company, we chose to obtain the written consent of a majority of the Company’s voting power to approve the Corporate Actions.

The Corporate Actions described in this Information Statement cannot be taken until at least 20 calendar days after this Information Statement has first been sent or given to our stockholders. In addition, FINRA must pre-clear the Forward Stock Split. Accordingly, we will not effect the Forward Stock Split prior to receipt of FINRA’s clearance. Our Board retains the authority to abandon the Corporate Actions for any reason at any time prior to the Effective Date.

INTEREST OF CERTAIN PERSONS IN THE CORPORATE ACTIONS

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in any of the Corporate Actions that is not shared by all of our other stockholders.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

ITEM 1—FORWARD STOCK SPLIT

Summary

Our Board of Directors’ primary reason for approving and recommending the Forward Stock Split is to decrease the per share price of our Common Stock. Our Board of Directors believes that attaining and maintaining the Company’s stock price at lower levels will enable the Company to permit better access to capital, which is in the best interests of our company and its stockholders. Our Board of Directors further believes that a decreased stock

2

price may encourage investor interest and improve the marketability of our Common Stock to a broader range of investors.

Description of the Forward Stock Split

The Forward Stock Split shall cause each share of pre-Forward Stock Split Common Stock to be converted into 10 shares of Common Stock.

Effect of the Forward Stock Split on the Company

The Forward Stock Split will increase the number of outstanding shares, which will in turn increase the Company’s administrative costs associated with the prior number of shares, and is expected to increase the per share price of our Common Stock. See “Background and Purpose of the Forward Stock Split.”

Approving Vote of the Board of Directors and Consenting Stockholders

The Company’s Board of Directors has determined that the Forward Stock Split is in the best interests of the Company. The Company has received the approving consent of the Approving Stockholder, who holds a majority of the voting power of the issued and outstanding capital stock of the Company entitled to vote on the Forward Stock Split. Accordingly, no additional vote of the Company’s stockholders is required to approve the Forward Stock Split.

Fairness of the Process

The Board of Directors did not obtain a report, opinion, or appraisal from an appraiser or financial advisor with respect to the Forward Stock Split and no representative or advisor was retained on behalf of the unaffiliated stockholders to review or negotiate the transaction. The Board of Directors concluded that the expense of these procedures was not reasonable in relation to the size of the transaction contemplated and concluded that the Board of Directors could adequately establish the fairness of the Forward Stock Split without such outside person.

Effective Date

The Forward Stock Split will become effective upon the later of (i) the filing of the Forward Stock Split Amendment (as hereinafter defined) with the Secretary of State of the State of Nevada, (ii) approval of the Forward Stock Split by FINRA, and (iii) the 20th calendar day after the date on which this Information Statement and the accompanying notice are mailed to our stockholders. In no event will the Forward Stock Split be effective sooner than 20 days after we mail this Information Statement and accompanying notice to our stockholders. Our Board retains the authority to abandon the Forward Stock Split for any reason at any time prior to the effective date of the Forward Stock Split.

Tax Consequences

The Forward Stock Split will be treated as a tax-free recapitalization for federal income tax purposes. Accordingly, stockholders will not recognize gain or loss, and their adjusted tax basis in their stock will not change. See “Certain Federal Income Tax Consequences of the Forward Stock Split.”

BACKGROUND AND PURPOSE OF THE FORWARD STOCK SPLIT

General

Our Board of Directors and the Approving Stockholder, who holds a majority of the voting power of the issued and outstanding capital stock, have taken action by written consent to authorize our Board of Directors to effect an amendment to the Articles to effect the Forward Stock Split of our issued and outstanding Common Stock by a ratio of 10-for-1 (the “Forward Stock Split Amendment”). The Board may (but is not required to) effect the Forward Stock Split at a ratio (the “Forward Stock Split Ratio”) of 10-for-1. Our Board of Directors has discretion to abandon the Forward Stock Split prior to its effectiveness.

3

Reasons for the Forward Stock Split

The purpose of the proposed Forward Stock Split is to increase the number of outstanding shares of Common Stock in order to increase the liquidity of the Common Stock. Immediately following the Forward Stock Split the per-share price of the Common Stock should generally decrease proportionately with the Forward Stock Split Ratio but the expectation is that the liquidity in the Common Stock will increase. In the longer term, however, depending upon market and industry conditions and the status of our Company, the Forward Stock Split may have no effect, a positive effect or a negative effect on the value of the post-Forward Stock Split Common Stock.

Increasing the number of outstanding shares of our Common Stock through the Forward Stock Split is intended, absent other factors, to increase the liquidity of our Common Stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the liquidity of our Common Stock. As a result, there can be no assurance that the Forward Stock Split, if completed, will result in the intended benefits described above, that the liquidity of our Common Stock will increase (proportionately to the increase in the number of shares of our Common Stock after the Forward Stock Split or otherwise) following the Forward Stock Split or that the market price of our Common Stock will not decrease in the future. Additionally, we cannot assure you that the liquidity in our Common Stock after the Forward Stock Split will increase in proportion to the increase in the number of shares of our Common Stock outstanding before the Forward Stock Split, or at all. Accordingly, the total market capitalization of our Common Stock after the Forward Stock Split could be lower or higher than the total market capitalization before the Forward Stock Split.

Effects of the Forward Stock Split

After giving effect to the Forward Stock Split, the 10,550,616 shares of pre-Forward Stock Split Common Stock issued and outstanding as of the Record Date will be recapitalized into approximately 105,606,160 shares of post-Forward Stock Split Common Stock. The practical effect of the Forward Stock Split will be to exceed the Company’s prior authorized but unissued shares of our post-Forward Stock Split Common Stock by 30,606,160. As such, the Forward Stock Split requires a change in the number of our authorized shares of Common Stock.

The following table presents information about our issued and outstanding Common Stock, shares reserved and shares available for future issuance, on a pre-Forward Stock Split and post-Forward Stock Split basis:

| | | | | |

| | | Number of Shares of Common Stock |

| | | Pre-Forward Stock Split | | Post-Forward Stock Split |

Total authorized shares of our Common Stock | | 75,000,000 | | 200,000,000 |

| Less: | | | | |

Issued and outstanding shares of Common Stock | | 10,550,616 | | 105,506,160 |

| Shares of Common Stock available for future issuance | | 64,449,384 | | 94,493,840 |

The Board and management believe that it is prudent and advisable for us to retain a sufficient number of authorized shares now to better position ourselves with added flexibility to raise additional capital through a variety of possible financing transactions and/or consummate mergers, acquisitions, combinations and various other strategic alternatives, and in order to avoid delays that might otherwise arise if we were required to solicit stockholder approval for additional shares at the time of a proposed transaction.

Our authorized but unissued Common Stock may be issued at the direction of the Board at such times, in such amounts and upon such terms as the Board may determine, without further approval of our stockholders unless, in any instance, such approval is expressly required by law.

The Common Stock that will be available for issuance following effectiveness of the Forward Stock Split (as well as any authorized but unissued preferred stock) could have material anti-takeover consequences, including the ability of the Board to issue additional Common Stock or new preferred stock without additional stockholder approval because unissued Common Stock could be issued by the Board in circumstances that may have the effect of delaying, deterring or preventing takeover bids. For example, without further stockholder approval, the Board could strategically sell Common Stock or preferred stock in a private transaction to purchasers who would oppose a

4

takeover. In addition, because stockholders do not have preemptive rights under our articles of incorporation, the rights of existing stockholders may (depending on the particular circumstances in which the additional capital stock is issued) be diluted by any such issuance and increase the potential cost to acquire control of our Company. The Company’s stockholders should be aware that approval of the Forward Stock Split Amendment could facilitate our efforts to deter or prevent changes of control in the future.

The Board does not intend to issue any additional shares of our capital stock except on terms that it deems to be in the best interest of our Company and our stockholders. It is not anticipated that our financial condition, the percentage ownership of management, the number of stockholders, or any aspect of our business will materially change as a result of the Forward Stock Split.

At the effective time of the Forward Stock Split, each lot of one pre-Forward Stock Split shares of our Common Stock (the “Old Shares”), as determined by the Board, issued and outstanding immediately prior to the effective time will, automatically and without any further action on the part of our stockholders, be split into and become 10 post-Forward Stock Split shares of our Common Stock (the “New Shares”), and each certificate which, immediately prior to the effective time, represented Old Shares will be deemed, for all corporate purposes, to evidence ownership of New Shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

The Forward Stock Split will be effected simultaneously for all of our then-existing Old Shares and the exchange ratio will be the same for all of our shares of outstanding our Common Stock. The Forward Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in us. The New Shares issued pursuant to the Forward Stock Split will be fully paid and non-assessable. All New Shares will have the same voting rights and other rights as the Old Shares.

A new CUSIP number will be assigned to our Common Stock following the Forward Stock Split.

Commencing upon effectiveness of the Forward Stock Split, to the extent there are any, all outstanding options, warrants and other convertible securities entitling holders thereof to purchase shares of our Common Stock would entitle such holders to receive, upon exercise of their securities, 10 of the number of shares of our Common Stock which such holders may purchase upon exercise or conversion of their securities. In addition, commencing at the effective time of the Forward Stock Split, the exercise or conversion price of all outstanding options, warrants and our other convertible securities will be increased 10 times, based on the exchange ratio of the Forward Stock Split.

Par Value Per Share of our Common Stock

The par value of our Common Stock will not change as a consequence of the Forward Stock Split. Accordingly, the par value of our Common Stock will remain at $0.001 per share.

Effect on Voting Rights of, and Dividends on, our Common Stock

Proportionate voting rights and other rights of the holders of our Common Stock will not be affected by the Forward Stock Split. The percentage of outstanding shares owned by each stockholder prior to the Forward Stock Split will remain the same.

We do not believe that the Forward Stock Split will have any effect with respect to future distributions, if any, to our stockholders.

Effect on Liquidity

We expect that the increase in the number of shares of our Common Stock outstanding as a consequence of the Forward Stock Split will increase liquidity in our Common Stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the liquidity of our Common Stock. We cannot assure you that the liquidity in our Common Stock after the Forward Stock Split will increase in proportion to the increase in the number of shares of our Common Stock outstanding before the Forward Stock Split, or at all.

5

Certain U.S. Federal Income Tax Consequences

The following summary of certain material federal income tax consequences of the Forward Stock Split does not purport to be a complete discussion of all of the possible federal income tax consequences and is included for general information only, is not intended as tax advice to any person and is not a comprehensive description of the tax consequences that may be relevant to each stockholder’s own particular circumstances. Further, it does not address any state, local, foreign or other income tax consequences, nor does it address the tax consequences to stockholders that are subject to special tax rules, such as stockholders who are subject to the alternative minimum tax, banks, insurance companies, regulated investment companies, personal holding companies, stockholders who are not “United States persons” as defined in section 7701(a)(30) of the Internal Revenue Code of 1986, as amended (the “Code”), broker-dealers and tax-exempt entities. This summary is based on the Code, the U.S. Treasury Department regulations thereunder and proposed regulations, court decisions and current administrative rulings and pronouncements of the Internal Revenue Service, all of which are subject to change, possibly with retroactive effect. This summary addresses only those stockholders who hold their Old Shares as “capital assets” as defined in the Code (generally, property held for investment), and will hold the New Shares as capital assets.

Holders of our Common Stock are advised to consult their own tax advisers regarding the federal income tax consequences of the Forward Stock Split in light of their personal circumstances and the consequences under state, local and foreign tax laws, and also as to any estate or gift tax considerations.

We are structuring the Forward Stock Split in an effort to obtain the following consequences:

●

the Forward Stock Split will qualify as a recapitalization under section 368(a)(1)(E) of the Code for U.S. federal income tax purposes;

●

stockholders should not recognize any gain or loss as a result of the Forward Stock Split;

●

the aggregate basis of a stockholder’s Old Shares will become the aggregate basis of the New Shares held by such stockholder immediately after the Forward Stock Split; and

●

the holding period of the New Shares will include the stockholder’s holding period for the Old Shares.

The above discussion is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. federal tax penalties. It was written solely in connection with the proposed Forward Stock Split of our Common Stock.

Regulatory Effects

The Common Stock is currently registered under Section 12(g) of the Exchange Act, and the Company is subject to the periodic reporting and other requirements of the Exchange Act. The proposed Forward Stock Split would not affect the registration of the Common Stock under the Exchange Act or the Company’s obligation to publicly file financial and other information with the SEC. If the proposed Forward Stock Split were implemented, the Common Stock would continue to trade on the OTC Pink (“OTC Pink”) tier of OTC Markets Group, Inc. under the symbol “ZUUS”, assuming the Company maintains compliance with its requirements; however, the Company would be required to obtain a new CUSIP number associated with post-Forward Stock Split shares of Common Stock.

FINRA Approval

Our Common Stock is currently quoted on OTC Pink. Accordingly, the Forward Stock Split must be processed and cleared by FINRA pursuant to Rule 10b-17 under the Exchange Act in order for it to be recognized for trading purposes. Accordingly, the Forward Stock Split, if implemented, will not be effective until it is processed by FINRA. In no event, however, will the Forward Stock Split be effective prior to the 20th calendar day after this Information Statement is mailed.

6

ITEM 2 — INCREASE IN AUTHORIZED SHARES OF COMMON STOCK TO 200,000,000 FROM 75,000,000

On March 8, 2022, our Board of Directors and the Approving Stockholder approved the Authorized Share Increase.

The effective date of the Authorized Share Increase will be determined at the sole discretion of the Board of Directors and will be publicly announced by us. The Authorized Share Increase will become effective upon the filing of a certificate of amendment to the Articles relating to the Authorized Share Increase with the Secretary of State of the State of Nevada. The Board of Directors may determine, in its sole discretion, not to effect the Authorized Share Increase and not to file any amendment to our Certificate.

Our Board believes it is in our best interests to increase the number of authorized shares of Common Stock in order to give us greater flexibility in considering and planning for future corporate needs, including, but not limited to, potential strategic transactions, including mergers, acquisitions and business combinations, stock dividends, grants under equity compensation plans, stock splits or financings, as well as other general corporate transactions. The Board believes that additional authorized shares of Common Stock will enable us to take timely advantage of acquisition opportunities that become available to us, as well as market conditions and favorable financing. We do not have any definitive plans, arrangements, understandings or agreements regarding the issuance of the additional shares of Common Stock that will result from adoption of Authorized Share Increase. Except as otherwise required by law, the newly authorized shares of Common Stock will be available for issuance at the discretion of our Board (without further action by our stockholders) for various future corporate needs, including those outlined above. While effecting the Authorized Share Increase would not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders, any future issuance of additional authorized shares of our Common Stock may, among other things, dilute the earnings per share of our Common Stock and the equity and voting rights of those holding equity at the time the additional shares are issued.

Any newly authorized shares of Common Stock will be identical to the shares of Common Stock now authorized and outstanding. The Authorized Share Increase will not affect the rights of current holders of our Common Stock, none of whom have preemptive or similar rights to acquire the newly authorized shares.

Board Discretion to Implement the Authorized Share Increase

The Board will implement the Authorized Share Increase only upon a determination that the Authorized Share Increase is in the best interests of the stockholders at that time. The Board of Directors may determine, in its sole discretion, not to effect the Authorized Share Increase and not to file any amendment to our Articles.

Effective Time

The Authorized Share Increase will become effective upon the later of (i) the filing of the Authorized Share Increase Amendment with the Secretary of State of the State of Nevada, and (ii) the 20th calendar day after the date on which this Information Statement and the accompanying notice are mailed to our stockholders. In no event will the Authorized Share Increase be effective sooner than 20 days after we mail this Information Statement and accompanying notice to our stockholders. Our Board retains the authority to abandon the Authorized Share Increase for any reason at any time prior to the effective date of the Authorized Share Increase.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the Record Date, below is information with respect to the securities holdings of (i) our named executive officers, (ii) our directors, (iii) our executive officers and directors as a group, and (iv) all persons which, pursuant to filings with the SEC and our stock transfer records, we have reason to believe may be deemed the beneficial owner of more than 5% of the shares of Common Stock.

The securities “beneficially owned” by an individual are determined in accordance with the definition of “beneficial ownership” set forth in the regulations promulgated under the Exchange Act and, accordingly, may include securities owned by or for, among others, the spouse and/or minor children of an individual and any other relative who resides in the same home as such individual, as well as other securities as to which the individual has or shares voting or investment power or which each person has the right to acquire within 60 days through the exercise of

7

options or otherwise. Beneficial ownership may be disclaimed as to certain of the securities. The following table is based on the number of shares of Common Stock outstanding totaling 10,550,616 as of the Record Date.

| | | | | | | | | |

| Name and Address | | Common Stock | | | Percentage of Class Beneficially Owned | |

| Executive Officers and Directors: | | | | | | | | |

| Bassam A.I. Al-Mutawa | | | 8,000,000 | | | | 75.8 | % |

| Tommy Dunehew | | | 1,255 | | | | * | |

| Khamis Buharoon Al Shamsi | | | 1,155 | | | | * | |

| All executive officers and directors as a group (3 persons) | | | 8,002,410 | | | | 75.9 | % |

MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Capital Stock

Our Certificate currently authorizes the issuance of up to 75,000,000 shares of Common Stock. As of the Record Date, there were 10,550,616 shares of Common Stock issued and outstanding, held by approximately 56 holders of record. The number of holders our Common Stock does not include beneficial owners of Common Stock whose shares are held in the names of broker-dealers and registered clearing agencies.

Market for Our Shares of Common Stock

Our common stock currently trades on OTC Pink under the symbol “ZUUS.” The market for our Common Stock is highly volatile. We cannot assure you that there will be a market in the future for our Common Stock. OTC Markets securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Markets securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTC Markets stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

The following table sets forth the high and low bid prices per share of our Common Stock by OTC Markets for the periods indicated. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions

| | | | | | | | | |

| For the year ended September 30, 2020 | | High | | | Low | |

| Fourth Quarter | | $ | 2.04 | | | $ | 2.04 | |

| Third Quarter | | $ | 3.00 | | | $ | 2.04 | |

| Second Quarter | | $ | 3.00 | | | $ | 2.71 | |

| First Quarter | | $ | 4.00 | | | $ | 2.91 | |

| | | | | | | | | |

| For the year ended September 30, 2021 | | High | | | Low | |

| Fourth Quarter | | $ | 65.00 | | | $ | 65.00 | |

| Third Quarter | | $ | 75.00 | | | $ | 14.00 | |

| Second Quarter | | $ | 16.00 | | | $ | 5.00 | |

| First Quarter | | $ | 5.00 | | | $ | 2.04 | |

| | | | | | | | | |

| For the year ending September 30, 2022 | | High | | | Low | |

| First Quarter (through December 31, 2021) | | $ | 60.00 | | | $ | 20.00 | |

As of December 17, 2021 (the most recent day on which a transaction in shares of our Common Stock was effective), the closing price of our Common Stock on the OTC Pink was $90.00.

Transfer Agent

Our transfer agent is Vstock Transfer, LLC and its phone number is (212) 828-8436.

8

Dividends

We have never declared or paid any cash dividends on our Common Stock. For the foreseeable future, we do not anticipate paying any cash dividends on our Common Stock. Any future determination to pay dividends will be at the discretion of our Board of Directors.

ADDITIONAL INFORMATION

We are subject to the disclosure requirements of the Exchange Act, and in accordance therewith, file reports, information statements and other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, DC 20549. Copies of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street, N.E., Washington, DC 20549 at prescribed rates. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, information statements and other information regarding issuers that file electronically with the SEC through the EDGAR (Electronic Data Gathering, Analysis and Retrieval) system.

You may request a copy of documents filed with or furnished to the SEC by us, at no cost, by writing to Zeuus, Inc., 31 West 27th Street, 9th Floor, New York, NY 10001, Attn: Corporate Secretary, or by calling the Company at (888) 469-3887.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to Zeuus, Inc., 31 West 27th Street, 9th Floor, New York, NY 10001, Attn: Corporate Secretary, or by calling the Company at (888) 469-3887.

If multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at, the address and phone number in the preceding paragraph. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to the address or phone number provided in the preceding paragraph.

MISCELLANEOUS

Additional copies of this Information Statement may be obtained at no charge by writing to us at c/o Zeuus, Inc., 31 West 27th Street, 9th Floor, New York, NY 10001, Attn: Corporate Secretary, or by calling the Company at (888) 469-3887.

NO ADDITIONAL ACTION IS REQUIRED BY OUR STOCKHOLDERS IN CONNECTION WITH THESE ACTIONS.

| | |

| | ZEUUS, INC. |

| | |

| [•], 2022 | /s/ Bassam A.I. Al-Mutawa |

| | Bassam A.I. Al-Mutawa |

| | President, Chief Executive Officer and Chief Financial Officer |

9

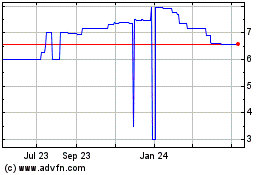

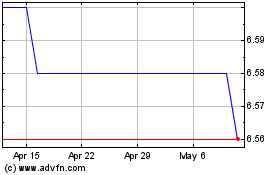

ZEUUS (PK) (USOTC:ZUUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

ZEUUS (PK) (USOTC:ZUUS)

Historical Stock Chart

From Jul 2023 to Jul 2024