UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14F-1/A

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

|

XSUNX, INC.

|

|

(Exact name of registrant as specified in its corporate charter)

|

|

|

|

Commission File No.: 000-29621

|

|

Colorado

|

|

84-1384159

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

65 Enterprise, Aliso Viejo, CA 92656

|

|

(Address of principal executive offices)

|

|

|

|

(949) 330-8060

|

|

(Registrant’s telephone number, including area code)

|

|

Approximate Date of Mailing: May 15, 2020

|

XsunX, Inc.

Information Statement

Pursuant to Section 14(f) of the Securities Exchange Act of 1934

And Rule 14f-1 Thereunder

Notice of Change in the Majority of the Board of Directors

May 15, 2020

THIS INFORMATION STATEMENT IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS OF XSUNX, INC.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUIRED TO TAKE ANY ACTION.

Schedule 14f-1

We urge you to read this Information Statement carefully and in its entirety. However, you are not required to take any action in connection with this Information Statement. References throughout this Information Statement to “Company,” “we,” “us,” and “our” refer to XsunX, Inc.

Introduction

This Information Statement is being mailed on or about May 15, 2020 to the holders of record at the close of business on May 1, 2020 (the “Record Date”) of our common stock, no par value (the “Common Stock”). We are required to provide you with this Information Statement by Section 14(f) of the Securities Exchange Act of 1934 (the “Exchange Act”), and Exchange Act Rule 14f-1, in connection with an anticipated change in majority control of XsunX’s board of directors (the “Board”) other than at a meeting of shareholders. Exchange Act Section 14(f) and Rule 14f-1 require that we mail the information included in this Information Statement to our shareholders of record at least ten days before the date the proposed change in a majority of our directors occurs. Accordingly, the change in a majority of our directors pursuant to the transaction described below will not occur until at least ten days after we mail this Information Statement.

As previously disclosed in the Company’s Current Report on Form 8-K filed with the U.S. Securities Exchange Commission (“SEC”) on March 24, 2020, XsunX, Tom Djokovich, our President and Chief Executive Officer, and TN3, LLC, a limited liability company owned by Daniel G. Martin (“TN3”), entered into a Stock Purchase Agreement (the “Agreement”) on March 18, 2020. The Agreement is filed with the SEC as an exhibit to the Company’s March 31, 2020 Form 10-Q. Pursuant to the Agreement, Mr. Djokovich agreed to sell his 5,000 shares of Series A Preferred Stock of XsunX to TN3 (the “Preferred Stock”) for $50,000. In addition, TN3 has agreed to pay for certain expenses of the transaction incurred by Mr. Djokovich and XsunX totaling more than $50,000. The holder of the Preferred Stock may cast votes equal to not less than 60% of the total outstanding voting power of XsunX required to approve an action on all matters voted on by our shareholders. Daniel G. Martin is the President of TN3 and the Chairman of the Board and Chief Executive Officer of Innovest Global, Inc., a diversified industrial company (“Innovest”). Upon completion of the sale of the Preferred Stock to TN3, the current Board and officers of XsunX will resign and be replaced by a new Board and officers to be designated by Mr. Martin. In this Information Statement, we refer to the sale of Mr. Djokovich’s Preferred Stock to TN3 and the replacement of the Board and officers as required by the Agreement as the “Transaction.” We expect that the Transaction will close during the week of May 25, 2020, after the ten-day waiting period following the mailing of this Information Statement has expired.

After the Transaction closes, we plan to continue to market our current solar energy services while preparing to transition into a new business plan focused on commercializing developmental healthcare solutions in the biotechnology, medical, and health and wellness markets. Initially, we intend to acquire StemVax, LLC (“StemVax”) from Innovest. StemVax is a biotechnology company developing novel therapies for brain tumor patients and holds a related exclusive patent license from Cedars-Sinai Medical Center in Los Angeles, California known as StemVax Glioblast (SVX-GB). In preparation for the issuance of additional shares of our stock for the acquisition of biotechnology assets, including StemVax, we expect to effectuate a 1-for-1,000 reverse stock split of issued and outstanding Common Stock (the “Stock Split”). In connection with our new business focus, we also intend to change the name of the Company to “NovAccess Inc.”

Currently, XsunX continues to engage in the sale, design and installation of solar photovoltaic power generation and storage solutions. We cannot guaranty that the Transaction will close as expected or that we will successfully refocus our business on biotechnology.

THIS INFORMATION STATEMENT IS REQUIRED BY EXCHANGE ACT SECTION 14(F) AND RULE 14F-1 IN CONNECTION WITH THE APPOINTMENT OF DIRECTOR DESIGNEES TO THE BOARD. NO ACTION IS REQUIRED BY OUR SHAREHOLDERS IN CONNECTION WITH THIS INFORMATION STATEMENT.

Change in Majority of the Board of Directors

Pursuant to the Agreement, upon completion of the Transaction, the current members of the Board will resign and Daniel Martin will be appointed the sole member of our Board. For more information about Mr. Martin’s business experience and his plans for the Board, please refer to “Directors and Executive Officers — After the Transaction” below.

Mr. Martin does not currently own any securities of XsunX. Mr. Martin has never been a director of XsunX or held any previous position with XsunX, and Mr. Martin has not otherwise been involved in any transactions with XsunX or any of our directors, executive officers, affiliates or associates, other than the Agreement. During the past ten years, Mr. Martin has not been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations), been subject to any order, judgment or decree, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities, been found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law or been the subject of or a party to any sanction or order, of any self-regulatory organization, or any registered entity or equivalent organization that has disciplinary authority over its members or associated persons.

No action is required by our shareholders in connection with this Information Statement. However, Exchange Act Section 14(f) and Rule 14f-1 require that we mail the information included in this Information Statement to our shareholders of record at least ten days before the date the proposed change in a majority of our directors occurs.

Voting Securities

Our authorized capital stock consists of 2.0 billion shares of Common Stock, with no par value, and 50.0 million shares of preferred stock, par value of $0.01 per share. As of the Record Date, there were 1,601,887,744 shares of Common Stock issued and outstanding, which does not reflect our planned Stock Split. Holders of our Common Stock are entitled to one vote for each share on all matters voted on by our shareholders. As of the Record Date, 10,000 of our shares of preferred stock were designated as Series A Preferred Stock, of which 5,000 shares were issued and outstanding and held by Tom Djokovich, our President and Chief Executive Officer (the “Preferred Stock”). No other shares of our preferred stock are designated or issued and outstanding. As the holder of the Preferred Stock, Mr. Djokovich may cast votes equal to not less than 60% of the total outstanding voting power of XsunX required to approve an action on all matters voted on by our shareholders.

There is no cumulative voting in the election of directors, and our directors are elected by a plurality of the votes cast. Holders of our stock representing one-third of the voting power of our capital stock issued and outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our shareholders. A vote by the holders of a majority of the voting power of our capital stock issued and outstanding and entitled to vote is required to effectuate certain fundamental corporate changes.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, the number of shares of Common Stock owned of record and beneficially by executive officers, directors and persons who hold 5.0% or more of the outstanding Common Stock of the Company. Also included are the shares held by all executive officers and directors as a group. The information presented does not reflect our planned Stock Split. Unless otherwise indicated, the address of each beneficial owner listed below is c/o XsunX, Inc., 65 Enterprise, Aliso Viejo, California 92656. Each principal shareholder has sole investment power and sole voting power over the shares.

|

Shareholders/Beneficial Owners

|

|

Common Shares

|

|

|

Preferred Shares

|

|

|

Ownership

Percentage (1)

|

|

|

Tom Djokovich, President & Director (2)

|

|

|

13,000,000

|

|

|

|

5,000

|

|

|

|

60.8

|

%

|

|

Thomas Anderson, Chairman of the Board

|

|

|

4,433,333

|

|

|

|

0

|

|

|

|

<1

|

%

|

|

Oz Fundingsland, Director

|

|

|

2,666,667

|

|

|

|

0

|

|

|

|

<1

|

%

|

|

Mike Russak, Director

|

|

|

2,933,333

|

|

|

|

0

|

|

|

|

<1

|

%

|

|

All Officers & Directors as a Group (4 individuals)

|

|

|

23,033,333

|

|

|

|

0

|

|

|

|

61.4

|

%

|

|

(1)

|

Applicable percentage ownership is based on 1,601,887,744 shares of Common Stock issued and outstanding as of the Record Date. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of Common Stock that are currently exercisable or exercisable within 60 days of the Record Date are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

|

|

(2)

|

Includes 13,000,000 shares of Common Stock owned by Mr. Djokovich. Mr. Djokovich shares voting and dispositive power with respect to these shares with Mrs. Djokovich. The shares of Series A Preferred Stock have the voting equivalent of not less than 60% of the vote required to approve any action in which the shareholders of the Company’s Common Stock may vote. Mr. Djokovich held 5,000 shares of the Company’s Preferred Stock representing the combined voting equivalent of 974,132,646 shares of Common Stock or approximately 60.8% of the Company’s issued and outstanding voting stock.

|

Directors and Executive Officers

Before the Transaction

The following table and paragraphs provide information about each of our current directors and executive officers as of the date of this Information Statement.

|

Name

|

|

Age

|

|

Position Held

|

|

Tenure

|

|

Tom Djokovich

|

|

63

|

|

CEO, President, Director, Secretary, and acting Principal Accounting Officer

|

|

CEO and Director since October 2003, Secretary & PAO since September 2009, President since January 2013

|

|

Thomas Anderson

|

|

54

|

|

Director

|

|

Since August 2001

|

|

Oz Fundingsland

|

|

76

|

|

Director

|

|

Since November 2007

|

|

Michael Russak

|

|

73

|

|

Director

|

|

Since November 2007

|

Mr. Tom Djokovich, Chief Executive Officer and a director as of October 2003, acting Principal Accounting Officer as of September 2009, and President as of January 9, 2013. Mr. Djokovich was the founder and served from 1995 to 2002 as the Chief Executive Officer of Accesspoint Corporation, a vertically integrated provider of electronic transaction processing and e-business solutions for merchants. Under Mr. Djokovich’s guidance, Accesspoint became a member of the Visa/MasterCard association, the national check processing association NACHA, and developed one of the payment industry’s most diverse set of network-based transaction processing, business management and CRM systems for both Internet and conventional points of sale. Prior to Accesspoint, Mr. Djokovich founded TMD Construction and Development in 1979. TMD provided management for multimillion-dollar projects incorporating at times hundreds of employees, subcontractors and international material acquisitions for commercial, industrial and custom residential construction services as a licensed building and development firm in California. In 1995 Mr. Djokovich developed an internet-based business-to-business ordering system for the construction industry.

Mr. Thomas Anderson became a director of the Company in August 2001 and serves as our Chairman of the Board. Prior to co-founding PE/Q Energy, Tom served through October 2012 as Chief Operating and Development Officer for American Capital Energy (“ACE”), a large-scale commercial and small-scale utility solar PV developer and installer. While at ACE, he guided the development, installation, operation and maintenance of large-scale commercial and small utility rooftop and ground mount projects ranging in size from 200 kW to 6.16 MW; negotiated and secured dozens of MW of Power Purchase Agreements (“PPA”) with both commercial and utility clients; and served as project development lead for a fully developed 20 MW utility-PPA project to be constructed in 2014. He has served as Managing Director of the Environmental Science and Engineering Directorate of Qinetiq North America in Los Alamos, New Mexico. He was with Qinetiq North America, formerly Apogen Technologies, from January 2005 through September 2008. Mr. Anderson worked for 19 years in the environmental consulting field, providing consulting services in the areas of environmental compliance, characterization and remediation services to Department of Energy, Department of Defense, and industrial clients. He formerly worked as a Senior Environmental Scientist at Concurrent Technologies Corp. from November 2000 to December 2004. He earned his B.S. in Geology from Denison University and his M.S. in Environmental Science and Engineering from Colorado School of Mines.

Mr. Oz Fundingsland became a director of the Company in November 2007. Mr. Fundingsland brings over forty years of sales, marketing, executive business management, finance, and corporate governance experience to XsunX. His professional and business experience principally originated with his tenure, commencing in 1964, at Applied Magnetics Corp., a disk drive and data storage company. Prior to his retirement from Applied Magnetics in 1994, Mr. Fundingsland served as an Executive Officer and Vice President of Sales and Marketing of Applied Magnetics for 11 years directing sales growth from $50 million to over $550 million. Commencing in 1993 through 2003 Mr. Fundingsland served as a member of the board of directors for the International Disk Drive Equipment Manufacturers Association “IDEMA” where he retired emeritus. Mr. Fundingsland has provided consulting services assisting with sales, marketing, and management to a host of companies within the disk drive, optical, software, and LED industries.

Dr. Michael A. Russak became a director of the Company in November 2007. Dr. Michael A. Russak brings decades of business management, finance, and corporate governance experience to XsunX. His professional and business experience includes his tenure as Executive Vice President of Business Development with Intevac, Inc. in Santa Clara, CA. From 2001 to 2006 he was President and Chief Technical Officer of Komag, Inc., a manufacturer of hard magnetic recording disks for hard disk drive applications. From 1993 to 2001 he was Chief Technical Officer of HMT Technology, Inc. also a manufacturer of magnetic recording disks. From 1985 to 1993 he was a research staff member and program manager in the Research Division of the IBM Corporation. Dr. Russak has over thirty-five years of industrial experience progressing from a research scientist to senior executive officer of two public companies. He has expertise in thin film materials and devices for magnetic recording, photovoltaic, solar thermal applications, semiconductor devices as well as glass, glass-ceramic and ceramic materials. He also has over twelve years’ experience at the executive management level of public companies with significant offshore development and manufacturing functions. He received his B.S. in Ceramic Engineering in 1968 and Ph.D. in Materials Science in 1971, both from Rutgers University in New Brunswick, NJ. During his career, he has been a contributing scientist and program manager at the Grumman Aerospace Corporation, and a Research Staff Member and technical manager in the areas of thin film materials and processes at the Research Division of the IBM Corporation at the T.J. Watson Research Laboratories. In 1993, he joined HMT Technology, a manufacturer of thin film disks for magnetic storage, as Vice President of Research and Development. His responsibilities included new product design and introduction. Dr. Russak became Chief Technical Officer of HMT and held that position until 2000 when HMT merged with Komag Inc. Dr. Russak was appointed President and Chief Technical Officer of the combined company. He continued to set technical, operational and business direction for Komag until his retirement at the end of 2006. He has published over 90 technical papers and holds 23 U.S. patents.

None of the members of the Board or other executives has been involved in any bankruptcy proceedings, criminal proceedings, any proceeding involving any possibility of enjoining or suspending members of our Board or other executives from engaging in any business, securities or banking activities, and have not been found to have violated, nor been accused of having violated, any federal or state securities or commodities laws.

After the Transaction

Upon completion of the Transaction, Daniel Martin will be appointed the sole member of our Board and will serve as our Chairman of the Board, Chief Executive Officer and Acting Principal Financial and Accounting Officer. Assuming, XsunX acquires StemVax, Mr. Martin intends to expand the Board and add additional executive officers to the Company’s management team. Mr. Martin’s business experience is summarized below.

Daniel G. Martin, age 46, is a life-long entrepreneur and currently serves as the Chairman of the Board and Chief Executive Officer of Innovest Global, Inc. Since launching Innovest in August 2016, he has led the company through eight acquisitions, transforming Innovest into a diversified industrial company. Mr. Martin credits his business tenacity to growing up in his father’s drugstore which required managing very low margins and critically important services. From December 2014 to January 2016, Mr. Martin served as the Chief Financial Officer of global operations of Momentis International, where he was instrumental in stabilizing the company post-acquisition. In November 2015, he established TN3, LLC to pursue diverse investment opportunities, including the acquisition of preferred stock of Innovest. Mr. Martin has a Bachelor of Science in Business Administration from John Carrol University. Mr. Martin filed for bankruptcy as a result of his personal guarantee of the obligations of an unrelated company, and the bankruptcy was discharged in May 2015.

Corporate Governance

Director Independence

Directors Thomas Anderson, Oz Fundingsland and Dr. Michael Russak are independent. Our Chief Executive Officer, Tom Djokovich, is not considered an independent director. There is no family relationship between any of our directors.

Meetings of the Board of Directors

The Board met four times in fiscal 2019 and all of our directors attended every meeting. Our Chief Executive Officer, Tom Djokovich, is entitled to elect the members of our Board by voting his shares of XsunX Preferred Stock. As a result, we have not held an annual meeting of our shareholders and do not have a policy concerning our directors’ attendance at annual meetings.

Committees of the Board of Directors

XsunX is a small company with only four directors. As a result, our Board has not designated audit, nominating, compensation or other committees. Instead, these responsibilities are handled by the full Board. Assuming, the acquisition of StemVax, we expect our Board to form audit, nominating and compensation committees.

Director Nominations

The Board does not currently have a nominating committee. Instead, the Board believes it is in the best interests of XsunX to rely on the insight and expertise of all directors in the nominating process. Our directors will recommend qualified candidates for director to the full Board and nominees are subject to approval by a majority of our Board members. We do not have a formal policy for considering director candidates. Nominees are not required to possess specific skills or qualifications; however, nominees are recommended and approved based on various criteria including relevant skills and experience, personal integrity and ability and willingness to devote their time and efforts to the Company. Qualified nominees are considered without regard to age, race, color, sex, religion, disability or national origin. We do not use a third party to locate or evaluate potential candidates for director. The Board would consider nominees recommended by shareholders according to the same criteria.

Audit Process

The Board does not currently have an audit committee. Instead, the Board believes it is in the best interests of XsunX to rely on the insight and expertise of all directors in reviewing our audit process and audited financial statements for inclusion in the Company’s annual report on Form 10-K. Without an audit committee, we have not designated a director as an “audit committee financial expert” as defined by SEC rules.

Compensation Decisions

The Board does not currently have a compensation committee. Instead, the Board believes it is in the best interests of XsunX to rely on the insight and expertise of all directors in determining the compensation of Tom Djokovich, our only executive officer. Mr. Djokovich recuses himself and does not vote on Board decisions concerning his own compensation. The Board has not engaged a compensation consultant in making decisions concerning Mr. Djokovich’s compensation.

Board Leadership Structure

Currently, Thomas Anderson, who is not an officer of XsunX, serves as the Chairman of the Board, and Tom Djokovich serves as the President and Chief Executive Officer of the Company, which we believe is the appropriate leadership structure for XsunX prior to completing the Transaction.

Certain Relationships and Related Transactions

Except as described below with respect to the proposed transition services agreement, no officer, director, or related person of XsunX has or proposes to have any direct or indirect material interest in any asset proposed to be acquired by XsunX through securities holdings, contracts, options or otherwise, or to engage in any transaction with XsunX in which the amount involved exceeds the lesser of $120,000 or one percent of our total assets at year end.

We have adopted a policy under which any consulting or finder’s fee that may be paid to a third party for consulting services to assist management in evaluating a prospective business opportunity can be paid in stock, stock purchase options or in cash. Any such issuance of stock or stock purchase options would be made on an ad hoc basis. Accordingly, we are unable to predict whether or in what amount such a stock issuance might be made.

In connection with closing the Transaction, XsunX will enter into a transition services agreement (the “Services Agreement”) with Tom Djokovich, our current President and Chief Executive Officer, and Solar Energy Builders, Inc., a company controlled by Mr. Djokovich (“Solar Energy”). Pursuant to the Services Agreement, we will engage Solar Energy to service our solar business customers or refer those customers to Solar Energy on an exclusive basis. For referrals, Solar Energy will pay us a referral fee of 1% of the gross amount paid by the referred customer to Solar Energy. We intend to continue to market our solar services while preparing to transition into a new business plan focused on commercializing developmental healthcare solutions in the biotechnology, medical, and health and wellness markets.

If the Transaction closes, we will issue each of our current resigning directors warrants to purchase up to 500.0 million shares of XsunX Common Stock on a pre-Stock Split basis. These warrants will be exercisable on a cashless basis for a period of ten years from the effective date of the Stock Split at an exercise price of $0.00001 per share on a pre-Stock Split basis. The purpose of the warrants is to compensate our directors for serving on the Board without compensation in fiscal 2019. It is difficult to assess the value of the warrants given the highly limited trading in our Common Stock, the fact that the warrant shares have not been and are not expected to be registered for resale and will be restricted, and the speculative nature of the Company’s future business plans. However, we estimated the value of the services provided by each of our directors during 2019 to be $2,500 and believe that the value of the warrants to be issued to each of our resigning directors approximates that amount.

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and certain persons who own more than 10% of a registered class of the Company’s equity securities (collectively, “Reporting Persons”), to file reports of ownership and changes in ownership (“Section 16 Reports”) with the SEC. Reporting Persons are required by the SEC to furnish the Company with copies of all Section 16 Reports they file. Based on its review of filings, or representations from certain reporting persons, the Company believes that, during the fiscal year ended September 30, 2019, all filing requirements applicable to its officers, directors, and greater than ten-percent beneficial owners were complied with.

Legal Proceedings

There are no proceedings in which our current or incoming directors, officers or affiliates, or any record or beneficial holder of 5% or more of our Common Stock, is an adverse party or has a material interest adverse to our interest.

Compensation of Directors and Executive Officers

Overview

We are currently executing a business plan focused on the sale, design, installation, and servicing of commercial solar power, energy storage, and solar canopy systems. We rely on our board of directors to evaluate compensation and incentive offerings made by the Company as it applies to our executive officers. To date, our compensation policy has been conducted on a case by case basis with input from our chief executive officer, and focused on the following four primary areas: (a) first the Company’s commitment capabilities within the scope of objectives and capital capabilities, (b) salary compensatory with peer group companies and peer position, (c) cash bonuses tied to sales and revenue attainment, and (d) long term equity compensation tied to strategic objectives of establishing marketable solar technologies.

Executive Compensation

The following table sets forth information with respect to compensation earned by our chief executive officer and our president for the fiscal years ended September 30, 2019 and 2018.

|

Name and Principal Position

|

|

Year

|

|

Salary

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tom Djokovich, CEO *

|

|

2019

|

|

$

|

169,000

|

|

|

$

|

18,024

|

|

|

$

|

187,024

|

|

|

|

|

2018

|

|

$

|

169,000

|

|

|

$

|

16,132

|

|

|

$

|

183,747

|

|

|

*

|

In addition to Mr. Djokovich’s salary compensation the Company provided Mr. Djokovich with co-payments totaling $18,024 and $16,132 for health insurance premiums as part of the Company’s health insurance program in the fiscal periods ended 2019, and 2018 respectively.

|

Mr. Djokovich serves as our Chief Executive Officer, acting Principal Accounting Officer and President, and the qualifying person for the Company’s California State contractor’s license. We do not have an employment agreement with Mr. Djokovich and he currently works at the discretion of the board of directors. His total compensation is based solely on the annual base cash salary and we do not have any equity based, cash bonus, or special compensation agreements or understanding in place with Mr. Djokovich. No other compensation not described above was paid or distributed to the executive officers of the Company during the listed fiscal years.

Mr. Djokovich did not hold any outstanding equity awards at September 30, 2019 or 2018, did not exercise any options during the fiscal years ended September 30, 2019 and 2018, and is not entitled to any pension or other retirement benefits.

Director Compensation

In the fiscal year ended September 30, 2019, our directors did not receive compensation for their services on the Board. All directors were reimbursed for any expenses actually incurred in connection with attending meetings of the Board.

If the Transaction closes, we will issue each of our current resigning directors warrants to purchase up to 500.0 million shares of XsunX Common Stock on a pre-Stock Split basis. For more information about the director warrants, please refer to “Certain Relationships and Related Transactions” above.

Golden Parachute Compensation

None of our directors or executive officers is entitled to receive any compensation upon an acquisition, merger, consolidation, sale or other disposition of all or substantially all assets of the Company.

Shareholders Communications with the Board of Directors

Our website includes an “Investors” page on which we offer a toll-free phone number which is staffed 24/7 as well as an investor email link. Telephone and email messages from shareholders are received by our Secretary, Tom Djokovich, for review. Our policy is that all incoming communications related to the duties and responsibilities of the Board will be forwarded to the appropriate director(s). Communications that are determined to be primarily commercial in nature, product/service complaints or inquires, and comments or materials that are offensive or otherwise inappropriate, will not be forwarded to the Board, but will be addressed by our executive officer.

Any proposal submitted by a shareholder for submission to our shareholders, pursuant to Rule 14a-8 or otherwise, and director nominations, are not viewed as shareholder communications subject to this policy.

Signature

Pursuant to the requirements of the Securities Exchange Act, the Company has duly caused this information statement on Schedule 14f-1 to be signed on its behalf by the undersigned hereunto duly authorized.

XsunX, Inc.

/s/ Tom Djokovich

By Tom Djokovich

President and Chief Executive Officer

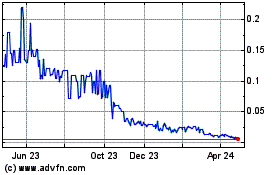

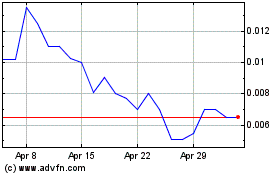

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Apr 2023 to Apr 2024