UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 10,

2010

WOLVERINE EXPLORATION

INC.

(Exact name of registrant as specified in its

charter)

Nevada

(State or other jurisdiction of

incorporation)

000-53767

(Commission File Number)

98-0569013

(IRS Employer Identification

No.)

4055 McLean Road, Quesnel, British Columbia, Canada V2J

6V5

(Address of principal executive offices and Zip Code)

Registrant's telephone number, including area code

(250)

992-6972

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e -4(c))

- 2 -

Item 3.02 Unregistered Sales of Equity Securities

Effective May 10, 2010, we issued 5,850,000 shares of our

common stock pursuant to debt settlement agreements with twenty individuals. The

deemed price of the shares issued was $0.03 per share. We have issued all of the

shares to non-US persons (as that term is defined in Regulation S of the

Securities Act of 1933) in an offshore transaction relying on Regulation S

and/or Section 4(2) of the Securities Act of 1933.

Effective March 31, 2010, we issued 100,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $3,000. We have issued all of the shares to one non-US person (as

that term is defined in Regulation S of the Securities Act of 1933) in an

offshore transaction relying on Regulation S and/or Section 4(2) of the

Securities Act of 1933.

Effective April 15, 2010, we issued 2,000,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $60,000. We have issued all of the shares to one non-US person (as

that term is defined in Regulation S of the Securities Act of 1933) in an

offshore transaction relying on Regulation S and/or Section 4(2) of the

Securities Act of 1933.

Effective April 29, 2010, we issued 100,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $3,000. We have issued all of the shares to one non-US person (as

that term is defined in Regulation S of the Securities Act of 1933) in an

offshore transaction relying on Regulation S and/or Section 4(2) of the

Securities Act of 1933.

Effective May 14, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 17, 2010, we issued 600,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $18,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective May 19, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective May 21, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 24, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective May 25, 2010, we issued 800,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $24,000. We have issued all of the shares to three non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 25, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective May 26, 2010, we issued 600,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $18,000. We have issued all of the shares to three non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 26, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

- 3 -

Effective May 27, 2010, we issued 200,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $6,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective May 27, 2010, we issued 200,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $6,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 28, 2010, we issued 1,400,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $42,000. We have issued all of securities to one U.S. person (as

that term is defined in Regulation S of the Securities Act of 1933) relying upon

Rule 506 of Regulation D of the Securities Act of 1933.

Effective May 28, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of the shares to two non-US persons (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 29, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective May 31, 2010, we issued 200,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $6,000. We have issued all of the shares to two non-US persons (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 1, 2010, we issued 200,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $6,000. We have issued all of the shares to two non-US persons (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 2, 2010, we issued 500,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $15,000. We have issued all of the shares to four non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 3, 2010, we issued 700,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $21,000. We have issued all of the shares to three non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 4 2010, we issued 250,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $7,500. We have issued all of the shares to two non-US persons (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 4, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

- 4 -

Effective June 7, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 8, 2010, we issued 700,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $21,000. We have issued all of the shares to three non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 10, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 11, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 14, 2010, we issued 400,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $12,000. We have issued all of the shares to three non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 15, 2010, we issued 1,300,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $39,000. We have issued all of the shares to three non-US persons

(as that term is defined in Regulation S of the Securities Act of 1933) in an

offshore transaction relying on Regulation S and/or Section 4(2) of the

Securities Act of 1933.

Effective June 17, 2010, we issued 1,000,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $30,000. We have issued all of securities to one U.S. person (as

that term is defined in Regulation S of the Securities Act of 1933) relying upon

Rule 506 of Regulation D of the Securities Act of 1933.

Effective June 18, 2010, we issued 300,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $9,000. We have issued all of the shares to one non-US person (as that term

is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

Effective June 23, 2010, we issued 100,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $3,000. We have issued all of securities to one U.S. person (as that term is

defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of

Regulation D of the Securities Act of 1933.

Effective June 25, 2010, we issued 1,200,000 shares of our

common stock in a private placement at a purchase price of $0.03 raising gross

proceeds of $36,000. We have issued all of the shares to five non-US persons (as

that term is defined in Regulation S of the Securities Act of 1933) in an

offshore transaction relying on Regulation S and/or Section 4(2) of the

Securities Act of 1933.

Effective June 30, 2010, we issued 600,000 shares of our common

stock in a private placement at a purchase price of $0.03 raising gross proceeds

of $18,000. We have issued all of the shares to four non-US persons (as that

term is defined in Regulation S of the Securities Act of 1933) in an offshore

transaction relying on Regulation S and/or Section 4(2) of the Securities Act of

1933.

- 5 -

Item 5.02 Appointment of Certain Officers and Directors;

Departure of Certain Officers and Directors

On June 14, 2010, we received a consent to act from Luke Rich.

The Company increased the number of directors to two (2) and appointed Mr. Rich

as a member to the board of directors. We also appointed Mr. Rich as vice

president of explorations and development of our company.

Luke Rich – Vice President of Explorations and

Development and Director

Mr. Rich is a member of the Innu Nation and Mushuau Innu First

Nations and is a former VP of the Innu Nation. Prior to joining our company, Mr.

Rich was also Co-CEO of the Innu Development Limited Partnership (“IDLP”) from

October 2007 to April 2010. IDLP participated in the construction of the mine

and mill for the Voisey Bay Nickel Project. Mr. Rich is also a board member of

various IDLP owned companies including Innu Mikun Airlines, Innu Keiwit

Constructor LP and the Innu/SNC Lavalin Partnership.

There are no family relationships among our directors or

executive officers. There have been no transactions between our company and Mr.

Rich since our last fiscal year which would be required to be reported

herein.

Our board of directors now consists of Lee Costerd and Luke

Rich.

Item 9.01

Financial Statements and

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

WOLVERINE EXPLORATION INC.

/s/ Lee Costerd

Lee Costerd

President

Date: July 6, 2010

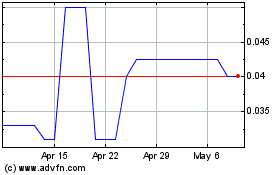

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

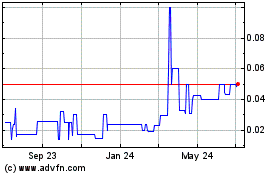

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Jul 2023 to Jul 2024