By Joanne Chiu and Jing Yang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 7, 2020).

Successful listings of shares in Hong Kong by Alibaba Group

Holding Ltd. and smaller rival Meituan Dianping have burnished the

market's high-tech credentials. Now, bankers and investors expect

more Chinese technology companies to list in the city.

Having more fast-growth stocks like these could rejuvenate a

stock market dominated by less dynamic sectors such as banking and

property, which include many mainland Chinese enterprises. That

would likely boost trading volumes to the benefit of both brokers

and the stock exchange, which has been working to lure more

technology and health-care businesses.

In 2018, the operator of Hong Kong's stock exchange changed its

rules to admit companies with unequal voting rights -- luring

groups with existing U.S. listings, like Alibaba, and unlisted

startups, like Meituan.

Alibaba's stock sale here eventually raised nearly $13 billion,

after the banks underwriting the deal increased the deal's size in

December.

Johnson Chui, head of equity capital markets for Asia Pacific at

Credit Suisse -- one of the two sponsors, or most senior banks, on

the Alibaba offering -- said the secondary listing reaffirmed the

city's status as an important fundraising hub. It gives larger and

more well-known branded tech companies the confidence that Hong

Kong is another option, other than the U.S., he said.

Bankers and investors say a colder U.S. environment, caused by

the U.S.-China trade fight, could prompt other Chinese companies

with New York-traded American depositary receipts to follow suit.

Sen. Marco Rubio (R., Fla.) has proposed legislation that could

ultimately lead to the delisting of some U.S.-traded Chinese

companies.

More than 20 large Chinese technology companies with American

depositary receipts could qualify for secondary listings in Hong

Kong, Goldman Sachs analysts said recently. The largest include

JD.com Inc., Baidu Inc. and NetEase Inc. Baidu and NetEase had no

comment. A JD.com spokesperson said it had no plan for a secondary

listing but would continue to observe market sentiment.

The other prize would be to persuade more unlisted groups, such

as Bytedance Inc., owner of video-sharing app TikTok, to follow in

the footsteps of handset maker Xiaomi Corp. and app operator

Meituan in making their first market debut in Hong Kong.

Shares in Meituan soared 132% in 2019, as investors grew more

optimistic about the outlook for the group, whose app allows users

to book services such as food delivery and hotels. That has given

the company, which floated in September 2018, a market value of

roughly $76 billion and made it one of China's most valuable tech

firms.

While Hong Kong's rule change allows companies with unequal

voting rights such as Alibaba and Meituan to list, they aren't

currently allowed to be in the benchmark Hang Seng Index. The Hang

Seng lagged behind many global peers in 2019 because of U.S.-China

trade frictions and local civil unrest.

The index's sole tech constituent is Tencent Holdings Ltd.,

potentially limiting its appeal to investors seeking to benchmark

their performance against a gauge that represents China's changing,

increasingly consumer-driven economy. Hang Seng Indexes Co. will

consult early this year about adding companies with dual-class

shares to its flagship index, which would bring it into line with

rivals such as MSCI Inc. and FTSE Russell.

For executives, part of the city's appeal is that mainland

investors can buy Hong Kong securities through Stock Connect, a

trading link with Shanghai and Shenzhen.

That lets mainland insurers and pension funds, which can't trade

U.S.-listed stocks, buy into offshore-listed Chinese tech, said

Adrian Mowat, chief strategist at CLSA, a Hong Kong-based

securities house known for its research and investor forums.

"Chinese investors will push the valuation higher than we're seeing

in the U.S. market," he said.

Sean Taylor, chief investment officer for Asia Pacific at asset

manager DWS, said many U.S.-listed Chinese companies were

domestically focused e-commerce, education and travel groups.

Having a Hong Kong listing could make the shares less vulnerable to

indiscriminate selloffs related to the trade fight, he said.

To be sure, Hong Kong will face competition as a listing venue

for Chinese tech from both the U.S. and from mainland China,

particularly Shanghai's nascent STAR market. Bankers say the choice

depends on factors such as a company's business model, global

ambitions and funding needs.

In addition, secondary listings will only work for larger

companies with actively traded stocks, said Jwalant Nanavati, head

of technology, media and telecom, for Asia ex-Japan in the

investment banking division of Nomura. "Most companies still prefer

to have only one listing," he said.

Write to Joanne Chiu at joanne.chiu@wsj.com and Jing Yang at

Jing.Yang@wsj.com

(END) Dow Jones Newswires

January 07, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

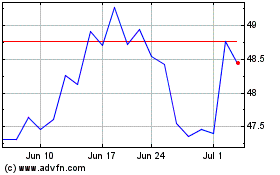

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

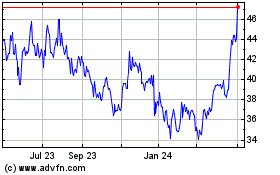

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Nov 2023 to Nov 2024