SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 15, 2014

| SKKYNET CLOUD SYSTEMS, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

|

Nevada

|

|

000-54747

|

|

45-3757848

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

2233 Argentia Road – Suite 306, Toronto, Ontario, Canada L5N 2X7

(Address of Principal Executive Office) (Zip Code)

Registrant’s telephone number, including area code: (888) 628-2028

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 Entry into a Material Definitive Agreement

On August 15, 2014, Skkynet Cloud Systems, Inc. (the “Company”) entered into common stock purchase agreements with various accredited investors for the sale of an aggregate of 798,500 shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”) with gross proceeds to the Company of $878,350.00. The proceeds from this offering will be used to further develop, promote and market the Company’s recently-launched real-time cloud service. The purchase price of each share of Common Stock was $1.10 per share. The Company expects the closing of all of the sales of the Common Stock to occur by August 29, 2014. All shares of Common Stock issued will be “restricted” securities as such term is defined by the Securities Act of 1933, as amended (the “Securities Act”).

The shares of Common Stock will be issued in reliance upon an exemption from registration provided by Rule 506 of Regulation D and Regulation S of the Securities Act since no general solicitation or advertising was conducted by us in connection with the offering of any of the shares, all shares to be purchased in the offering will be restricted in accordance with Rule 144 of the Securities Act and each of these shareholders are accredited as defined in Rule 501 (a) of Regulation D promulgated under the Securities Act.

ITEM 3.02 Unregistered Sales of Equity Securities

On August 15, 2014, Skkynet Cloud Systems, Inc. (the “Company”) entered into common stock purchase agreements with various accredited investors for the sale of an aggregate of 798,500 shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”) with gross proceeds to the Company of $878,350.00. The proceeds from this offering will be used to further develop, promote and market the Company’s recently-launched real-time cloud service. The purchase price of each share of Common Stock was $1.10 per share. The Company expects the closing of all of the sales of the Common Stock to occur by August 29, 2014. All shares of Common Stock issued will be “restricted” securities as such term is defined by the Securities Act of 1933, as amended (the “Securities Act”).

The shares of Common Stock will be issued in reliance upon an exemption from registration provided by Rule 506 of Regulation D and Regulation S of the Securities Act since no general solicitation or advertising was conducted by us in connection with the offering of any of the shares, all shares to be purchased in the offering will be restricted in accordance with Rule 144 of the Securities Act and each of these shareholders are accredited as defined in Rule 501 (a) of Regulation D promulgated under the Securities Act.

ITEM 7.01 Regulation FD Disclosure

The Company issued a press release on August 21, 2014, a copy of which is attached hereto as an exhibit.

The information contained in this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

|

Description of Exhibit

|

| |

|

|

|

99(i)*

|

|

August 21, 2014 Press Release

|

| |

|

|

|

10.1*

|

|

Form of Common Stock Purchase Agreement

|

__________

*filed herewith

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SKKYNET CLOUD SYSTEMS, INC.

|

|

| |

|

|

|

|

August 21, 2014

|

By:

|

/s/ Paul E. Thomas

|

|

| |

|

Paul E. Thomas

President and Secretary

|

|

4

EXHIBIT 10.1

COMMON STOCK PURCHASE AGREEMENT

THIS COMMON STOCK PURCHASE AGREEMENT is made and entered into as of August 15, 2014, by and between Skkynet Cloud Systems, Inc. (OTCQB: SKKY), a Nevada corporation with an address at 2233 Argentia Road, Suite 306, Mississauga, ON, L5N 2X7 Canada (the “Company”), and ____________, with an address at ______________ (the “Purchaser”):

WHEREAS, the Purchaser desires to purchase, and the Company desires to sell, an aggregate of __________ shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), upon the terms and conditions hereof;

NOW, THEREFORE, in consideration of the premises and the mutual agreements contained herein, the Purchaser and the Company hereby agree as follows;

Section 1. Sale and Purchase of Shares

1.1 Sale and Purchase of Shares. Subject to the terms and conditions hereof, the Company will sell and deliver to the Purchaser and the Purchaser will purchase from the Company, on the Closing (as defined below), the Shares for a purchase price as set forth in Section 2.3 below.

Section 2. Closing Date; Delivery; Consideration

2.1 Closing Date. The closing of the purchase and sale of the Shares hereunder (the “Closing”) shall be held within ten (10) business days immediately following the execution and delivery of this Agreement or unless otherwise agreed to by the Company and the Purchaser.

2.2 Delivery at Closing. At the Closing, the Company will deliver to the Purchaser a stock certificate registered in the Purchaser’s name, representing the number of Shares to be purchased by the Purchaser hereunder, against payment of the consideration as indicated herein.

2.3 Consideration. As consideration for the purchase of the Shares as set forth in Section 1 of this Agreement, Purchaser shall pay Seller the amount of ______________ U.S. Dollars ($________), to be paid in immediately available funds pursuant to the instructions of the Company.

Section 3. Representations and Warranties of Company

The Company hereby represents and warrants to the Purchaser as follows:

3.1 Valid Issuance of Shares. The Shares, when issued, sold and delivered in accordance with the terms and for the consideration set forth in this Agreement, will be validly issued, fully paid and nonassessable and free of restrictions on transfer other than restrictions described herein in this Agreement, applicable state and federal securities laws and liens or encumbrances created by or imposed by a Purchaser. Assuming the accuracy of the representations of the Purchasers in Section 4 of this Agreement and subject to the filings described in Section 3.2 below, the Shares will be issued in compliance with all applicable federal and state securities laws.

3.2 Government Consents and Filings. Assuming the accuracy of the representations made by the Purchasers in Section 4 of this Agreement, no consent, approval, order or authorization of, or registration, qualification, designation, declaration or filing with, any federal, state or local governmental authority is required on the part of the Company in connection with the consummation of the transactions contemplated by this Agreement, except for filings pursuant to Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and applicable state securities laws, which have been made or will be made in a timely manner.

Section 4. Representations and Warranties of Purchaser

The Purchaser hereby represents and warrants to the Company as follows:

4.1 Investment Experience. The Purchaser has such knowledge and experience in financial and business matters so that the Purchaser is capable of evaluating the merits and risks of its investment in the Company, whether by reason of the Purchaser’s own business and financial expertise, the business and financial expertise of certain professional advisors unaffiliated with the Company with whom the Purchaser has consulted, or the Purchaser’s preexisting business relationship with the Company or any of its officers, directors or controlling persons. The Purchaser acknowledges that the purchase of the Shares involves a high degree of risk, and that the Company’s future prospects are uncertain. The Purchaser is able to hold the Shares indefinitely if required and is able to bear the loss of its entire investment in the Shares.

4.2 Investment Intent. The Purchaser is acquiring the Shares for investment for its own account, not as a nominee or agent, and not with the view to, or for resale in connection with, any distribution thereof, and that the Purchaser has no present intention of selling, granting any participation in, or otherwise distributing the same. The Purchaser further represents that it does not have any contract, undertaking, agreement or arrangement with any person or entity to sell, transfer or grant participation to such person or entity or to any third person or entity with respect to any of the Shares.

4.3 Restricted Securities. The Purchaser understands that the Shares have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Purchaser’s representations as expressed herein. The Purchaser understands that the Shares are “restricted securities” under applicable U.S. federal and state securities laws and that, pursuant to these laws, the Purchaser must hold the Shares indefinitely unless they are registered with the Securities and Exchange Commission and qualified by state authorities, or an exemption from such registration and qualification requirements is available. The Purchaser acknowledges that the Company has no obligation to register or qualify the Shares. The Purchaser further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Shares, and on requirements relating to the Company which are outside of the Purchaser’s control, and which the Company is under no obligation and may not be able to satisfy.

4.4 Access to Data. The Purchaser is sufficiently aware of the Company’s business affairs and financial condition to reach an informed and knowledgeable decision to acquire the Shares. The Purchaser has had opportunity to discuss the plans, operations and financial condition of the Company with its officers, directors or controlling persons, and has received all information the Purchaser deems appropriate for assessing the risk of an investment in the Shares.

4.5 Authorization.

a. This Agreement, when executed and delivered by the Purchaser, will constitute valid and legally binding obligations of the Purchaser, enforceable in accordance with its terms except: (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally; and (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies or by general principles of equity.

b. The execution, delivery and performance by the Purchaser of this Agreement and compliance therewith and the purchase and sale of the Shares will not result in a violation of and will not conflict with, or result in a breach of, any of the terms of, or constitute a default under, any provision of state or Federal law to which Purchaser is subject, or any mortgage, indenture, agreement, instrument, judgment, decree, order, rule or regulation or other restriction to which the Purchaser is a party or by which the Purchaser is bound, or result in the creation of any mortgage, pledge, lien, encumbrance or charge upon any of the properties or assets of the Purchaser pursuant to any such term.

c. The Purchaser has all necessary power and authority to enter into and to perform its obligations under this Agreement, and the execution, delivery and performance by the Purchaser of this Agreement have been duly authorized by all necessary action on the part of the Purchaser and its management. No consent, approval, authorization, order, filing, registration or qualification of or with any court, governmental authority or third person is required to be obtained by the Purchaser in connection with the execution and delivery of this Agreement by the Purchaser or the performance of the Purchaser’s obligations hereunder.

4.6 Accredited Investor. The Purchaser is an “accredited investor” within the meaning of Regulation D, Rule 501, promulgated by the Securities and Exchange Commission under the Securities Act and shall submit to the Company such further assurances of such status as may be reasonably requested by the Company.

Section 5. Miscellaneous

5.1 Governing Law; Construction. This Agreement shall be governed in all respects by, and construed in accordance with, the laws of the State of Nevada, without regard to conflicts of laws principles thereof. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the parties hereto, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any of the provisions of this Agreement.

5.2 Survival. The terms, conditions and agreements made herein shall survive the Closing.

5.3 Successors and Assigns. Except as otherwise expressly provided herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto.

5.4 Entire Agreement; Amendment; Waiver. This Agreement constitutes the entire and full understanding and agreement between the parties with regard to the subject matter hereof. Neither this Agreement nor any term hereof may be amended, waived, discharged or terminated, except by a written instrument signed by all the parties hereto.

5.5 Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which together, shall constitute one instrument.

IN WITNESS WHEREOF, the undersigned have executed this Common Stock Purchase Agreement as of the day and year first above written.

| |

COMPANY

SKKYNET CLOUD SYSTEMS, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ |

|

| |

Name: |

|

|

| |

Title: |

|

|

| |

|

|

|

| |

PURCHASER |

|

| |

|

|

|

| |

By: |

/s/ |

|

| |

Name: |

|

|

EXHIBIT 99.1

Skkynet Cloud Systems, Inc. Enters Agreement for $878k Dollar Private Placement

Total private investment targeted for the acceleration of company growth now exceeds $1.2 million for this year.

Mississauga, Ontario, August 21, 2014 – Skkynet Cloud Systems, Inc. (“Skkynet” or “the Company”) (OTC.BB:SKKY), a global leader in real-time cloud information systems, is pleased to announce it has entered into an agreement with a group of accredited investors to invest $878,350 in a private placement of common stock.

Under the terms of the agreement, the investors will purchase $878,350 of Skkynet’s common stock at a price of $1.10 per share. The proceeds of the private placement will be used to further Skkynet’s growth strategy. With the private placement of January 2, 2014, Skkynet has raised in aggregate $1.24 Million in private placement proceeds this year.

“This investment represents an indication of confidence in our abilities to execute as a SaaS company and to increase shareholder value on an ongoing basis,” said Mr. Paul Thomas, President of Skkynet. “Such confidence has just been confirmed by the impact of Skkynet at the M2M show in Las Vegas, and our win at its Battle of the Platforms as the best new technology offering.”

Skkynet’s Secure Cloud Service launch received an enthusiastic reception from the press, business development executives, technology strategists, and cloud systems experts at the M2M Evolution Conference and Expo in Las Vegas last week. The service won the Battle of the Platforms category of Best Enabling Non-platform Technology or Offering, and dozens of companies have requested to participate in the trial beta period.

About Skkynet Cloud Systems, Inc.:

Skkynet Cloud Systems, Inc., through its wholly owned subsidiary Cogent Real-Time Systems Inc., is a leading developer of DataHub® and VINE™ software, Secure Cloud Service™ and related systems and facilities for collecting, processing and distributing real-time information over networks. This capability allows our clients to both locally and remotely manage, supervise and control industrial processes, embedded devices and financial information systems. Through their web-based assets, WebView™ enables data connectivity and visualization over the cloud, providing clients and their customers the necessary ability and tools to observe and interact with these processes and services in real time, empowering them to fully control their systems and analyze their data. DataHub® and WebView™ are trademarks used under license.

Safe Harbor:

This news release contains “forward-looking statements” as that term is defined in the United States Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended. Statements in this press release that are not purely historical are forward-looking statements, including beliefs, plans, expectations or intentions regarding the future, and results of new business opportunities. Actual results could differ from those projected in any forward-looking statements due to numerous factors, such as the inherent uncertainties associated with new business opportunities and development stage companies. We assume no obligation to update the forward-looking statements. Although we believe that any beliefs, plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate. Investors should refer to the risk factors disclosure outlined in our annual report on Form 10-K for the most recent fiscal year, our quarterly reports on Form 10-Q and other periodic reports filed from time-to-time with the Securities and Exchange Commission.

Contact:

Skkynet Cloud Systems, Inc.

Paul E. Thomas, President

Office: (888) 628-2028

Fax: (888) 705-5366

Web: http://skkynet.com

Email: ir@skkynet.com

Twitter: https://twitter.com/RealTimeCloud

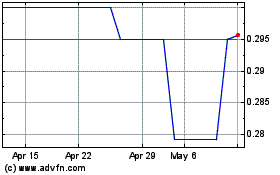

Skkynet Cloud Systems In (QB) (USOTC:SKKY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Skkynet Cloud Systems In (QB) (USOTC:SKKY)

Historical Stock Chart

From Jul 2023 to Jul 2024