UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

14C

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

☐

Preliminary information statement

☐

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

☒

Definitive information statement

Reviv3

Procare Company

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a–101) per Item 1 of this Schedule

and Exchange Act Rules 14c–5(g) and 0–11

THIS

INFORMATION STATEMENT IS BEING PROVIDED TO

YOU

BY THE BOARD OF DIRECTORS OF REVIV3 PROCARE COMPANY.

Reviv3

Procare Company

901

Fremont Avenue, Unit 158

Alhambra,

CA 91803

(888)

638-8883

NOTICE

OF ACTION TAKEN BY

WRITTEN

CONSENT OF A MAJORITY OF STOCKHOLDERS

Dear

Stockholders:

The

enclosed information statement (the “Information Statement”) is being provided to the stockholders of record on October 31,

2023 (the “Record Date”) of Reviv3 Procare Company, a Delaware corporation (the “Company,” “we,”

“our,” or “us”) to inform our stockholders of corporate actions taken by written consent of stockholders holding

at least a majority of our issued and outstanding shares of our common stock, par value $0.0001 per share (the “Common Stock”).

On

October 31, 2023, the board of directors of the Company (the “Board”) approved and submitted for the approval of our stockholders

the following:

| (i) | An

amendment to our Amended and Restated Certificate of Incorporation (the “Charter”)

to effect a name change of the Company from “Reviv3 Procare Company” to “AXIL

Brands, Inc.” (the “Name Change Amendment”); |

| (ii) | The

Company’s 2022 Equity Incentive Plan (the “Plan”) and an amendment to the

Plan to effect an increase in authorized shares for issuance under the Plan by an additional

15,000,000 shares (the “Equity Incentive Plan Increase”) to an aggregate of 25,000,000

shares available under the Plan; |

| (iii) | An

amendment to our Charter to effect a reverse stock split of the issued and outstanding shares

of our Common Stock in a range of not less than one-for-3 shares and not more than one-for-25

shares (the “Reverse Stock Split”), at the discretion of the Board (the “Reverse

Stock Split Amendment”); |

| (iv) | Amendments

to our Charter and to our Bylaws to increase the size of our Board and create three (3) classes

of directorships for the Board (the “Classified Board Amendment”); and |

| (v) | Amendments

to our Charter and to our Bylaws to vest the Board with authority to make, repeal, alter,

amend or rescind any or all of the Bylaws and to amend the Bylaws to add a provision relating

to notice of stockholder business and nominations (the “Bylaws Amendment”). |

Effective

on October 31, 2023, stockholders holding at least a majority of the voting power of the Company approved the Name Change Amendment,

the Plan, the Equity Incentive Plan Increase, Reverse Stock Split Amendment, the Classified Board Amendment, and the Bylaws Amendment

by written consent.

PLEASE

NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED

HEREIN PURSUANT TO SECTION 14(c) OF THE SECURITIES EXCHANGE ACT OF 1934 AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION

14C AND PURSUANT TO SECTION 228(E) OF THE DELAWARE GENERAL CORPORATION LAW.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No

action is required by you. Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the Name Change Amendment, the

Plan, the Equity Incentive Plan Increase, the Reverse Stock Split Amendment, the Classified Board Amendment, and the Bylaws Amendment

will not be effective until a date at least twenty (20) calendar days after the date that the enclosed Information Statement is filed

and mailed to our stockholders of record on the Record Date. Unless otherwise indicated, all share amounts and per share data are represented

without giving effect to the Reverse Stock Split.

The

enclosed Information Statement contains additional information pertaining to the matters acted upon.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

OF REVIV3 PROCARE COMPANY, |

| |

|

| |

/s/ Jeff Toghraie |

| |

Jeff Toghraie |

| |

Chief Executive Officer and Chairman of the Board of Directors

December 4, 2023 |

TABLE

OF CONTENTS

Reviv3 Procare

Company

901 Fremont

Avenue, Unit 158

Alhambra, CA

91803

(888) 638-8883

DEFINITIVE INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL INFORMATION

This information statement (the

“Information Statement”) is furnished to the stockholders of Reviv3 Procare Company, a Delaware corporation (the “Company,”

“we,” “our,” or “us”), at the close of business on October 31, 2023 (the “Record Date”),

in connection with actions taken by written consent of stockholders holding at least a majority of our issued and outstanding shares of

our common stock, par value $0.0001 per share (the “Common Stock”).

On October 31, 2023, the board

of directors of the Company (the “Board”) approved and submitted for the approval of our stockholders the following:

| |

(i) |

An amendment to our Amended and Restated Certificate of Incorporation (the “Charter”) to effect a name change of the Company from “Reviv3 Procare Company” to “AXIL Brands, Inc.” (the “Name Change Amendment”); |

| |

(ii) |

The Company’s 2022 Equity Incentive Plan (the “Plan”) and an amendment to the Plan to effect an increase in authorized shares for issuance under the Plan by an additional 15,000,000 shares (the “Equity Incentive Plan Increase”) to an aggregate of 25,000,000 shares available under the Plan; |

| |

(iii) |

An amendment to our Charter to effect a reverse stock split of the issued and outstanding shares of our Common Stock in a range of not less than one-for-3 shares and not more than one-for-25 shares (the “Reverse Stock Split”), at the discretion of the Board (the “Reverse Stock Split Amendment”); |

| |

(iv) |

Amendments to our Charter and to our Bylaws to increase the size of our Board and create three (3) classes of directorships for the Board (the “Classified Board Amendment”); and |

| |

(v) |

Amendments to our Charter and to our Bylaws to vest the Board with authority to make, repeal, alter, amend or rescind any or all of the Bylaws and to amend the Bylaws to add a provision relating to notice of stockholder business and nominations (the “Bylaws Amendment”). |

Effective October 31, 2023, stockholders

holding at least a majority of the voting power of the Company (the “Consenting Stockholders”) approved the Name Change Amendment,

the Plan, the Equity Incentive Plan Increase, the Reverse Stock Split Amendment, the Classified Board Amendment, and the Bylaws Amendment

(together, the “Corporate Actions”) by written consent in accordance with Section 228 of the Delaware General Corporation

Law (the “DGCL”). The Consenting Stockholders consist of stockholders owning and having authority to vote on 62,119,000

shares of our Common Stock representing approximately 53% of the issued and outstanding shares of Common Stock.

We believe the Name Change

Amendment and the adoption of “AXIL Brands, Inc.” as the Company’s name better reflects the nature of our business,

our operations, and our strategy.

We believe the Plan, as amended

by the Equity Incentive Plan Increase, and our continued ability to offer equity incentive awards under the Plan, are critical to our

ability to continue to attract, motivate, and retain highly qualified executives and employees.

The Company is in the process

of seeking to list its shares of Common Stock on the NYSE American Stock Exchange (the “NYSE American”). No assurance can

be given that the Company’s Common Stock will be accepted for listing on the NYSE American. We believe that the Reverse Stock Split

Amendment and the Reverse Stock Split, if any, will enhance the ability of the Company to list its shares on the NYSE American, thereby

providing the Company and its stockholders with, among other things: immediate access to much larger national financial markets; access

to institutional and other large scale investors; the ability to market and publicize performance and other relevant information to a

larger audience; and the ability to provide our stockholders with access to a national stock exchange wherein their shares will be available

to a much broader markets. Specifically, we believe the Reverse Stock Split will result in an increase in the price per share of

our Common Stock, allowing us to meet the initial listing requirements for NYSE American.

In connection with the proposed

listing on NYSE American, we propose to the increase the size of our Board and create three (3) classes of directorships for the Board.

We believed that the Classified Board Amendment promotes greater stability and better focus on long-term strategy for our Company.

We believe that the Bylaws Amendment

will clarify and confirm the Board’s authority to make, alter, or repeal the Bylaws, in whole or in part. Additionally, we believe

the Bylaws Amendment will provide clarity into how a stockholder may nominate a director or make a proposal and requirements for annual

meetings of stockholders and special meetings of stockholders.

Dissenting stockholders do not

have any statutory appraisal rights as a result of the Corporate Actions. The Board does not intend to solicit any proxies or consents

from any other stockholders in connection with the Corporate Actions, and your consent is not required and is not being solicited in connection

with the approval of the Corporate Actions. All necessary corporate approvals for the Corporate Actions have been obtained.

This Information Statement has

been filed with the Securities and Exchange Commission (the “SEC”) and is being furnished pursuant to Section 14 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) to inform our stockholders of the action taken by written

consent and shall serve as written notice thereof, pursuant to Section 228(e) of the DGCL.

Pursuant to Rule 14c-2 under the

Exchange Act, the Corporate Actions will not be effective until a date at least twenty (20) calendar days after the date that the enclosed

Information Statement is filed and mailed to our stockholders of record on the Record Date.

QUESTIONS AND ANSWERS ABOUT THE INFORMATION STATEMENT

What is the purpose of this Information Statement?

This Information Statement is being furnished to you

pursuant to Section 14 of the Exchange Act to inform our stockholders as of the close of business on the Record Date of the actions

taken by written consent. The Consenting Stockholders holding a majority of our outstanding voting capital stock have authorized by written

consent the Corporate Actions as outlined in this Information Statement, which actions will be effective on a date that is at least twenty

(20) calendar days after the mailing of this Information Statement.

Who is entitled to notice?

Each outstanding share of our Common Stock on the

close of business on the Record Date is entitled to notice of each matter voted on by the Consenting Stockholders. The Consenting Stockholders

as of the close of business on the Record Date held the authority to cast votes in excess of fifty percent (50%) of our outstanding voting

power and have authorized by written consent the Corporate Actions. Under Section 228 of the DGCL, stockholder approval may be taken by

obtaining the written consent and approval of more than 50% of the holders of voting stock in lieu of a meeting of the Company’s

stockholders.

What constitutes the voting shares of the Company?

The voting power entitled to vote on the Corporate

Actions consists of the vote of the holders of a majority of our voting securities as of the Record Date. As of the Record Date, our voting

securities consisted of 117,076,949 shares of Common Stock. As of the Record Date, our voting securities were entitled to cast a total

of 117,076,949 votes.

What corporate matters did the Consenting Stockholders vote for,

and how did they vote?

The Consenting Stockholders approved an amendment

to our Charter to effect a name change of the Company from “Reviv3 Procare Company” to “AXIL Brands, Inc.” Additionally,

the Consenting Stockholders approved the Plan and an amendment to the Plan to effect an increase in authorized shares for issuance under

the Plan by an additional 15,000,000 shares to an aggregate of 25,000,000 shares available under the Plan.

Furthermore, the Consenting Stockholders approved

an amendment to our Charter to effect a Reverse Stock Split, at the discretion of the Board, of the issued and outstanding shares of our

Common Stock, in a range of not less than one-for-3 shares and not more than one-for-25 shares. The Reverse Stock Split could be effected

at any time prior to October 31, 2024, at the exact ratio to be set at a whole number within the above range as determined by the Board

in its discretion. Further, the Board may, in its sole discretion, determine whether or not the Reverse Stock Split is effected.

Finally, the Consenting Stockholders approved amendments

to our Charter and our Bylaws to create three (3) classes of directorships for the Board, to vest the Board with authority to make, repeal,

alter, amend or rescind any or all of the Bylaws, and to add a provision to our Bylaws relating to notice of stockholder business and

nominations.

What vote is required to approve the Corporate Actions?

Pursuant to Section 242 of the DGCL, a majority in interest of our capital

stock entitled to vote thereon is required in order to approve the Corporate Actions. Other than the approval by the Consenting Stockholders,

which we have already obtained, no further vote is required for approval of the Corporate Actions.

Who is paying the cost of this Information Statement?

We will pay for the preparation, printing and mailing of this Information

Statement.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Information Statement

contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act. These forward-looking statements represent our expectations,

beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about

financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource

needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated

problems and our plans for future operations; the economy in general or the future of the beauty and hair care industry and the hearing

protection and ear bud business; the Reverse Stock Split Amendment and the Reverse Stock Split; and our ability to list our shares

on NYSE American, all of which were subject to various risks and uncertainties.

There

are a number of factors that could cause our actual results to differ from those indicated in the forward-looking statements, many of

which are outside of our control. They include: the impact of unstable market and general economic conditions on our business, financial

condition and stock price, including inflationary cost pressures, decreased discretionary consumer spending, supply chain disruptions

and constraints, labor shortages, ongoing economic disruption, including the effects of the Ukraine-Russia conflict, the effects of the

Israel-Hamas conflict, and other downturns in the business cycle or the economy; our financial performance and liquidity, including our

ability to successfully generate sufficient revenue to support our operations; our ability to repay our outstanding loans; if any; risks

related to our operations and international markets, such as fluctuations in currency exchange rates, different regulatory environments,

trade barriers and sanctions, exchange controls, and social and political instability; changes in the regulatory environment in which

we operate, including environmental, health and safety regulations, including those related to climate change; our ability to protect

and defend our intellectual property; continuity and security of information technology infrastructure and the potential impact of cybersecurity

breaches or disruptions to our management information systems; competition; our ability to retain our management and employees and the

potential impact of ongoing labor shortages; demands on management resources; availability and cost of the raw materials we use to manufacture

our products, including the impacts of inflationary cost pressures and ongoing supply chain disruptions and constraints, which have been,

and may continue to be, exacerbated by the Russia-Ukraine conflict; the Israel-Hamas conflict; additional tax expenses or exposures; product

liability claims; the potential outcome of any legal or regulatory proceedings; integrating acquisitions and achieving the expected savings

and synergies, including our recent acquisition of hearing protection and ear bud businesses; global or regional catastrophic events,

including the effects of natural disasters, which may be worsened by the impact of climate change; demand for and market acceptance of

our products, as well as our ability to successfully anticipate consumer trends; business divestitures; labor relations; the potential

impact of environmental, social and governance matters; implementation of environmental remediation matters; the risk that the Reverse

Stock Split won’t increase the price of our Common Stock and otherwise have its intended effect; and risks associated with listing

our shares on NYSE American.

When used in this Information

Statement, the words or phrases “believe,” “anticipate,” “predict,” “may,” “can,”

“will,” “should,” “expect,” “likely,” “intend,” “potential,” or

similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained

in this Information Statement that are not statements of historical fact may be deemed to be forward-looking statements. Furthermore,

such forward-looking statements speak only as of the date of this Information Statement. We caution that these statements by their nature

involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety

of important factors. These forward-looking statements are not guarantees of our future performance and involve risks, uncertainties,

estimates and assumptions that are difficult to predict.

We do not assume the obligation

to update any forward-looking statement, except as required by applicable law.

VOTES REQUIRED AND RELATED INFORMATION

Section 228 of the DGCL generally provides that any

action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting upon the written consent of the

holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Further, pursuant to Section

242 of the DGCL, a majority in interest of our capital stock entitled to vote thereon is required in order to approve the Corporate Actions.

In order to eliminate the costs and management time

involved in holding a special meeting, our Board determined that it was in the best interests of all of our stockholders that the Corporate

Actions be adopted by majority written consent and this Information Statement to be mailed to all stockholders as notice of the action

taken. Pursuant to Section 228(e) of the DGCL, we are required to promptly inform our stockholders of action taken by written consent

and this Information Statement serves as written notice thereof.

As of the Record Date, there were 117,076,949 shares

of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote. Accordingly, for the approval of each of the

Corporate Actions, the affirmative vote of a majority of the shares of Common Stock outstanding and entitled to vote at the Record Date,

or 58,538,475 votes, was required for approval. The Consenting Stockholders combine to account for an affirmative vote of 62,119,000

votes, which exceeds the required number of votes in favor of each of the Corporate Actions.

NO MEETING OF STOCKHOLDERS REQUIRED

The Board does not intend to solicit any proxies or

consents from any other stockholders in connection with the Corporate Actions, and your consent is not required and is not being solicited

in connection with the approval of the Corporate Actions. The Consenting Stockholders hold a majority of the Company’s outstanding

voting rights and, accordingly, such persons have sufficient voting rights to approve the Corporate Actions.

CONSENTING STOCKHOLDERS

On October 31, 2023, the Board unanimously adopted

resolutions approving the Corporate Actions. In connection with the adoption of these resolutions, the Board elected to seek the written

consent of the holders of a majority of the Company’s issued and outstanding shares of Common Stock in order to reduce the costs

and implement the proposal in a timely manner.

On October 31, 2023, the following Consenting Stockholders consented in

writing to the Corporate Actions:

| Name | |

Class of Shares Held | |

No. of Shares | |

No. of Votes | |

Percentage of Outstanding Votes |

| Intrepid Global Advisors, Inc. | |

Common Stock | |

| 50,534,000 | | |

| 50,434,000 | | |

| 43.16 | % |

| Shircoo, Inc. | |

Common Stock | |

| 11,685,000 | | |

| 11,685,000 | | |

| 9.98 | % |

| | |

| |

| Total: | | |

| 62,119,000 | | |

| 53.14 | % |

The Company is not seeking written consent from

any of our other stockholders, and stockholders other than the Consenting Stockholders will not be given an opportunity to vote with respect

to the Corporate Actions.

AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO

EFFECT A NAME CHANGE FROM “REVIV3 PROCARE COMPANY” TO “AXIL BRANDS, INC.”

General

On October 31, 2023, our Board approved the Name Change

Amendment to effect the change of the Company’s name to “AXIL Brands, Inc.” On October 31, 2023, the Consenting Stockholders,

acting by written consent, approved the Name Change Amendment. The Board will have the discretion to implement the Name Change Amendment

or to not effect the Name Change Amendment at all. The Board currently intends to effect the Name Change Amendment as soon as practicable

at a date at least twenty (20) calendar days after the date that the enclosed Information Statement is filed and mailed to our stockholders

of record on the Record Date.

If effected by the Board, the Name Change Amendment

will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware, in substantially

the form as attached hereto as Appendix A, which will occur as soon as reasonably practical.

Purposes and Effects of the Name Change Amendment

The adoption of “AXIL Brands, Inc.” as

the Company’s name better reflects the nature of our business, our operations, and our strategy. In June 2022, we completed the

acquisition of certain assets of Axil & Associated Brands Corp., which led to our hearing enhancement and protection business segment.

During our fiscal year ended May 31, 2023 and the three (3) months ended August 31, 2023, the hearing and protection business segment

accounted for approximately 93% and 95% of our net sales, respectively.

While the Name Change Amendment will cause us to incur

certain costs, the Board believes that any potential costs, and any potential confusion, associated with the Name Change Amendment will

be outweighed by the benefits of the change.

The Name Change Amendment will not affect the status

of the Company or the rights of any stockholders in any respect, or the validity or transferability of stock certificates presently outstanding.

The Company’s stockholders will not be required to exchange stock certificates in connection with the Name Change Amendment. Any

outstanding physical stock certificate that represents a stockholder’s shares of Common Stock will continue to represent such stockholder’s

ownership of such shares. If physical certificates are presented for transfer in the ordinary course, new certificates bearing the new

corporate name will be issued.

APPROVAL OF THE COMPANY’S 2022 EQUITY INCENTIVE

PLAN AND AN AMENDMENT TO THE COMPANY’S 2022 EQUITY INCENTIVE PLAN TO Effect an increase

in THE authorized shares AVAILABLE FOR ISSUANCE by an additional 15,000,000 shares.

General

On

March 21, 2022, our Board approved the Plan and on October 31, 2023, our Board approved an amendment to the Plan to effect an increase

in the number of shares available for issuance under the Plan by an additional 15,000,000 shares up to an aggregate of 25,000,000 shares

available under the Plan. On October 31, 2023, the Consenting Stockholders, acting by written consent, approved the Plan and the Equity

Incentive Plan Increase. The Board will have the discretion to implement the Equity Incentive Plan Increase or to not effect the Equity

Incentive Plan Increase at all. The Board currently intends to effect the Equity Incentive Plan Increase as soon as practicable at a date

at least twenty (20) calendar days after the date that the enclosed Information Statement is filed and mailed to our stockholders of record

on the Record Date.

We believe that our continued

ability to offer equity incentive awards under the Plan are critical to our ability to continue to attract, motivate, and retain highly

qualified executives and employees. We believe that the Plan has been an effective component of our compensation program and has heightened

our ability to attract, retain and motivate highly qualified executives and employees. We further believe that the awards granted under

the Plan have provided an effective inducement to incentivize plan participants to pursue our goals and objectives, including the creation

of long-term value for our stockholders. The Board has determined that the Plan as amended by the Equity Incentive Plan Increase is in

the best interests of the Company and its stockholders.

The following descriptions

of the Plan, as amended by the Equity Incentive Plan Increase, are qualified in their entirety by the terms of the Plan document, a copy

of which is attached to this Informational Statement as Appendix B, and the Equity Incentive Plan Increase, a copy of which is

attached to this Informational Statement as Appendix C.

References to the Plan in

the remainder of this discussion refer to the Plan, as amended by the Equity Incentive Plan Increase, unless otherwise specified or the

context otherwise references the Plan prior to it being amended by the Equity Incentive Plan Increase.

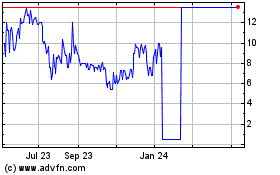

The closing price of our

common stock on November 20, 2023, was $0.32.

Why We Approved the Plan and the Equity Incentive Plan Increase Amendment

The Board and Consenting

Stockholders have determined that it is in the best interests of the Company and its stockholders to approve the Plan and the Equity Incentive

Plan Increase to increase the number of shares available for issuance under the Plan by an additional 15,000,000 shares up to an aggregate

of 25,000,000 shares available under the Plan. We believe the Plan and the Equity Incentive Plan Increase will allow us to continue to

utilize a broad array of equity incentives in order to attract and retain talent, and to continue to provide incentives that align the

interests of our employees and directors with the interests of our stockholders.

Before the Equity Incentive

Plan Increase, the number of shares available for issuance under the Plan would be too limited to effectively operate as an incentive

and retention tool for employees, officers, directors, non-employee directors and consultants of

the Company and its affiliates (as defined in the Plan). The Plan and the approved increase will enable us to continue our policy

of equity ownership by employees, officers, directors, non-employee directors and consultants of

the Company and its affiliates as an incentive to contribute to the creation of long-term value for our stockholders. Absent

sufficient equity incentives, we would need to consider additional cash-based incentives to provide a market-competitive total compensation

package necessary to attract, retain and motivate the talent that is critical to driving our success. Payment of cash incentives would

then reduce the cash available for product development, marketing, operations, and other corporate purposes.

The Plan

Our

Board approved the Plan on March 21, 2022. Under the Plan, equity-based awards may be made to employees, officers, directors, non-employee

directors and consultants of the Company and its affiliates in the form of (i) Incentive Stock Options (to eligible employees only);

(ii) Nonqualified Stock Options; (iii) Restricted Stock; (iv) Stock Awards; (v) Performance Shares; or (vi) any

combination of the foregoing. Prior to Equity Incentive Plan Increase, the Plan was to terminate upon the close of business on the day

next preceding March 21, 2032, unless terminated earlier in accordance with the terms of the Plan. The Board serves as the Plan administrator

and may amend or terminate the Plan without stockholder approval, subject to certain exceptions.

The

total number of shares initially authorized for issuance under the Plan was 10,000,000 shares. The Plan provides for an annual increase

on April 1st of each calendar year, beginning in 2022 and ending in 2031, subject to Board approval prior to such date. Such

increase may be equal to the lesser of (i) four percent (4%) of the total number of shares of the Company’s common stock outstanding

on May 31st of the immediately preceding fiscal year and (ii) such smaller number of shares as determined by the Board. The

number of shares authorized for issuance under the Plan will not change unless the Board affirmatively approves an increase in the number

of shares authorized for issuance prior to April 1st of the applicable year. The Board has not approved an increase in the

number of shares authorized for issuance under the Plan as of October 31, 2023. Shares surrendered or withheld to pay the exercise price

of a stock option or to satisfy tax withholding requirements will not be added back to the number of shares available under the Plan.

To the extent that any shares of Common Stock awarded or subject to issuance or purchase pursuant to awards under the Plan are not delivered

or purchased, or are reacquired by the Company, for any reason, including a forfeiture of restricted stock or failure to earn performance

shares, or the termination, expiration or cancellation of a stock option, or any other termination of an award without payment being made

in the form of shares of Common Stock will be added to the number of shares available for awards under the Plan. The number of shares

available for issuance under the Plan will be adjusted for any increase or decrease in the number of outstanding shares of Common Stock

resulting from payment of a stock dividend on Common Stock, a stock split or subdivision or combination of shares of Common Stock, or

a reorganization or reclassification of Common Stock, or any other change in the structure of shares of Common Stock, as determined by

the Board. Shares available for awards under the Plan will consist of authorized and unissued shares.

Two types of options may

be granted under the Plan: (1) Incentive Stock Options which may only be issued to eligible employees of the Company and are required

to have the exercise price of the option not less than the fair market value of the common stock on the grant date; or in the case of

an Incentive Stock Option granted to a Ten Percent Stockholder, one hundred ten percent (110%) of the fair market value of the Common

Stock at the grant date; and (2) Non-qualified Stock Options which may be issued to participants

under the Plan and which may have an exercise price less than the fair market value of the Common Stock on the grant date, but not less

than par value of the stock.

The Board may grant or sell

restricted stock to participants (i.e., shares that are subject to restrictions or limitations as to the participant’s ability to

sell, transfer, pledge or assign such shares) under the Plan. Except for these restrictions and any others imposed by the Board, upon

the grant of restricted stock, the recipient generally will have rights of a stockholder with respect to the restricted stock. During

the applicable restriction period, the recipient may not sell, exchange, transfer, pledge or otherwise dispose of the restricted stock.

The Board may also grant awards of Common Stock to participants under the Plan, as well as awards of performance shares, which are awards

for which the payout is subject to achievement of such performance objectives established by the Board. Performance shares may be settled

in cash.

Each equity-based award granted

under the Plan will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and

conditions as the Board may determine, consistent with the provisions of the Plan.

Upon the occurrence of a

change in control, unless otherwise provided in an award agreement: (i) all outstanding stock options will become immediately exercisable

in full; (ii) all outstanding performance shares will vest in full as if the applicable performance conditions were achieved in full,

subject to certain adjustments, and will be paid out as soon as practicable; and (iii) all restricted stock will immediately vest in full.

The Plan defines a change in control as (i) the adoption of a plan of merger or consolidation of the Company with any other corporation

or association as a result of which the holders of the voting capital stock of the Company as a group would receive less than fifty (50%)

of the voting capital stock of the surviving or resulting corporation; (ii) the approval by the Board of an agreement providing for the

sale or transfer (other than as security for obligations of the Company) of substantially all the assets of the Company; or (iii) in the

absence of prior Board approval, the acquisition of more than twenty (20%) of the Company’s voting capital stock by any person within

the meaning of Rule 13d-3 under the Exchange Act (other than the Company or a person that directly or indirectly controls, is controlled

by, or is under common control with, the Company).

Subject to the Plan’s

terms, the Board has full power and authority to determine whether, to what extent and under what circumstances any outstanding award

will be terminated, canceled, forfeited or suspended. Awards to that are subject to any restriction or have not been earned or exercised

in full by the recipient will be terminated and canceled if such recipient is terminated for cause, as determined by the Board in its

sole discretion.

Pursuant to the Plan, on

May 10, 2022, the Company issued to two executive officers non-statutory stock options to purchase, in the aggregate, up to 5,300,000 shares

of its Common Stock, at an exercise price of $0.09 per share and expiring on April 20, 2032. The market value of the shares underlying

the options was $0.32 per share as of November 20, 2023. The options vest over time with 25% of the options vesting on September 1, 2022

and thereafter vesting 1/24th on the 1st of every month.

Pursuant

to the Plan, on November 1, 2022, the Company issued non-statutory stock options to a former executive officer, to purchase, in the aggregate,

up to 300,000 shares of its Common Stock, at an exercise price of $0.20 per share and expiring on November 31, 2032. 75,000

shares vested as of January 29, 2023, and the remaining 225,000 options were forfeited in April 2023 when the executive officer left the

Company. The market value of the shares underlying the options was $0.32 per share as of November 20, 2023.

Upon effectiveness of the

Reverse Stock Split and the Company’s listing on a national securities exchange, the Company intends to grant an executive an equity

award equivalent to 30,000 shares of common stock (on a post-split basis), subject to certain performance and time vesting conditions.

Certain U.S. Federal Income Tax

Consequences of Awards

The

following discussion is intended to provide only a general outline of the U.S. federal income tax consequences of participation in the

Plan to participants and the Company. This discussion does not discuss the income tax laws of any city, state or foreign jurisdiction

in which a participant may reside.

Nonqualified

Stock Options

A

participant who exercises a nonqualified stock option recognizes taxable ordinary income in the year that the option is exercised in an

amount equal to the excess of the fair market value of the shares purchased on the exercise date over the exercise price (the “spread”).

Generally, subject to applicable provisions of the Code and regulations thereunder, the Company is entitled to a tax deduction in an amount

equal to the ordinary income recognized by the participant.

Incentive

Stock Options

A

participant who exercises an incentive stock option (an “ISO”) does not recognize ordinary income at the time of exercise

(although the participant may be subject to the alternative minimum tax on the spread), and the Company is not entitled to a tax deduction.

Upon the sale of shares obtained by exercising an ISO more than two years after grant and one year after exercise, the excess of the sale

price of the shares over the exercise price of the ISO is taxed as long-term capital gain. If the shares are sold within two years of

the grant date and/or one year of the date of exercise, the excess of the fair market value of the shares on the date of exercise (or

sale proceeds if less) over the exercise price is taxed as ordinary income and any remaining gain is taxed as capital gain.

Restricted

Stock

When

shares of restricted stock vest, the participant will recognize taxable ordinary income in an amount equal to the fair market value of

the shares at that time less the amount, if any, paid for the shares. A participant may elect, by filing a timely election under Section

83(b) of the Code, to recognize taxable ordinary income in the year shares of restricted stock are granted in an amount equal to the excess

of their fair market value at the grant date, determined without regard to certain restrictions, over the amount, if any, paid for the

shares. Generally, subject to applicable provisions of the Code and regulations thereunder, the Company is entitled to a tax deduction

at the time and in an amount equal to the ordinary income recognized by the participant.

Stock

Awards

When

stock awards are settled, the participant will recognize taxable ordinary income in an amount equal to the fair market value of the earned

shares at that time. Generally, subject to applicable provisions of the Code and regulations thereunder, the Company is entitled to a

tax deduction in an amount equal to the ordinary income recognized by the participant.

The

discussion set forth above does not purport to be a complete analysis of all potential tax consequences relevant to recipients of awards,

particular circumstances, or all awards available under the Plan. It is based on U.S. federal income tax law and interpretational authorities

as of the date of this Information Statement, which are subject to change at any time.

Authorized Shares

The

increase in shares available under the Plan pursuant to the Equity Incentive Plan Increase will be effected prior to the Reverse Stock

Split discussed below, if effected by our Board, and the number of shares available for grant and issuance under the Plan will decrease

by the Reverse Stock Split ratio approved by our Board.

New Plan Benefits

The

specific benefits or amounts to be received by or allocated to participants and the number of shares of Common Stock to be granted under

the Plan cannot be determined at this time because the amount and form of grants to be made to any eligible participant in any year is

determined at the discretion of the Board.

Aggregate Awards Granted

The following table sets forth information with respect

to the number of shares subject to awards previously granted under the Plan since its inception through the Record Date, to each named

executive officer, all current executive officers as a group, all current directors who are not executive officers as a group, and all

employees, including all current officers who are not executive officers, as a group. This table includes shares subject to awards that

may have been exercised, cancelled or forfeited.

| |

Number of Shares Underlying Options |

|

Jeff Toghraie

Chief Executive Officer and Chairman of

the Board |

3,100,000 |

| Jeff Brown |

2,200,000 |

| Chief Operating Officer |

|

| Monica Diaz Brickell |

|

| Chief Financial Officer |

— |

| Meenu Jain |

300,000* |

| Former Chief Financial Officer |

|

| All current executive officers as a group |

5,300,000 |

| All current directors who are not executive officers as a group |

— |

| All employees, including current officers who are not executive officers, as a group |

— |

| * |

|

Upon Ms. Jain’s departure, only 75,000 options had vested. The unvested portion of the award was forfeited. |

Equity Compensation Plan Information

The following table sets forth equity compensation plan information as

of May 31, 2023:

| Plan category | |

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a) | |

Weighted-average exercise price of outstanding options, warrants and rights

(b) | |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c) |

| Equity compensation plans approved by security holders | |

| — | | |

$ | — | | |

| — | |

| Equity compensation plans not approved by security holders | |

| | | |

| | | |

| | |

| 2022 Equity Incentive Plan | |

| 5,375,000 | | |

$ | 0.09 | | |

| 4,625,000 | |

| Total | |

| 5,375,000 | | |

$ | 0.09 | | |

| 4,625,000 | |

AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND OUTSTANDING SHARES OF OUR COMMON STOCK, IN A RANGE OF NOT LESS THAN

ONE-FOR-3 SHARES AND NOT MORE THAN ONE-FOR-25 SHARES.

General

On October 31, 2023, our Board approved the Reverse

Stock Split Amendment to effect the Reverse Stock Split, at the direction of the Board, in a range of not less than one-for-3 shares and

not more than one-for-25 shares. The Reverse Stock Split could be effected at any time prior to October 31, 2024, at the exact ratio to

be set at a whole number within the above range as determined by the Board in its discretion. Further, the Board may, in its sole

discretion, determine whether or not the Reverse Stock Split is effected and may choose to effect it, including immediately prior to or

concurrently with our anticipated listing on the NYSE American.

The Company currently has authorized 450,000,000 shares

of Common Stock. As of the Record Date, there were 117,076,949 shares issued and outstanding of Common Stock.

Purposes of the Reverse Stock Split

Satisfaction of Initial Listing Requirements of the NYSE American.

We have commenced the process of applying to list

on the NYSE American. Our Board submitted the Reverse Stock Split to our stockholders for approval with the primary intent of increasing

the price per share of our Common Stock to enhance our ability to meet the initial listing requirements of the NYSE American and to make

our Common Stock more attractive to a broader range of institutional and other investors. Accordingly, for these and other reasons discussed

below, we believe that effecting the Reverse Stock Split is in the Company’s and our stockholders’ best interests. There

can be no assurance that we will complete our application to list, or that we will be accepted to list on the NYSE American.

We believe that the Reverse Stock Split will enhance

our ability to obtain an initial listing on the NYSE American. The NYSE American requires, among other items, an initial bid price of

least $4.00 per share and following initial listing, maintenance of a continued price of at least $1.00 per share. Reducing the number

of outstanding shares of our Common Stock should, absent other factors, increase the per share market price of our Common Stock because

by condensing a number of pre-split shares into one (1) share of Common Stock, the market price of a post-split share should generally

be greater than the current market price of a pre-split share. However, we cannot provide any assurance that, following the Reverse Stock

Split, our minimum bid price would remain over the minimum bid price requirements of the NYSE American.

Increase Our Common Stock Price to a Level More Appealing for Investors.

We believe that the Reverse Stock Split could enhance

the appeal of our Common Stock to the financial community, including institutional investors, and the general investing public. Because

our Common Stock is not listed on a national securities exchange and presently trades at less than $1.00, trading in our Common Stock

is subject to the requirements of certain rules promulgated under the Exchange Act, which require additional disclosure by brokers or

dealers in connection with any trades involving a stock defined as a “penny stock.” Because our Common Stock is presently

classified as a “penny stock,” prior to effectuating any transaction in our Common Stock, a broker or dealer is required to

make a suitability determination as to the proposed purchaser of our Common Stock and to receive a written agreement, meeting certain

requirements. The additional burdens imposed upon brokers or dealers by such requirements may discourage brokers or dealers from effecting

transactions in our Common Stock, which limits the market liquidity of our Common Stock and the ability of investors to trade our Common

Stock.

We believe that a number of institutional investors

and investment funds are reluctant to invest in lower-priced securities and that brokerage firms may be reluctant to recommend lower priced

stock to their clients, which may be due in part to a perception that lower-priced securities are less promising as investments, are less

liquid in the event that an investor wishes to sell its shares, or are less likely to be followed by institutional securities research

firms and therefore to have less third-party analysis of the company available to investors. We believe that the anticipated increased

stock price immediately following and resulting from the Reverse Stock Split may encourage interest and trading in our Common Stock and

thus possibly promote greater liquidity for our stockholders, thereby resulting in a broader market for our Common Stock than that which

currently exists.

For the above reasons, the Board believes that the

Reverse Stock Split is in the best interests of the Company and its stockholders. However, there can be no assurances that the Reverse

Stock Split will have the desired consequences.

We cannot assure you that all or any of the anticipated

beneficial effects on the trading market for our Common Stock will occur. Our Board cannot predict with certainty what effect the

Reverse Stock Split will have on the market price of our Common Stock, particularly over the longer term. Some investors may view

the Reverse Stock Split negatively, which could result in a decrease in our market capitalization. Additionally, any improvement

in liquidity due to increased institutional or brokerage interest or lower trading commissions may be offset by the lower number of outstanding

shares.

Effect of Reverse Stock Split on our Common Stock

How a Reverse Stock Split Will Affect Securityholders.

The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership

interests in us, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share. No fractional

shares shall be issued. In lieu of issuing fractional shares, we will issue to any stockholder who otherwise would have been entitled

to receive a fractional share as a result of the Reverse Stock Split an additional full share of our Common Stock. New shares will remain

fully paid and non-assessable. The conversion provisions of our Series A Preferred Stock will also be proportionately adjusted in connection

with the Reverse Stock Split.

Depending on the ratio for the Reverse Stock Split

determined by the Board, a minimum of three (3) and a maximum of twenty-five (25) of existing shares of Common Stock will be combined

into one (1) new share of Common Stock. The table below shows, as of the October 31, 2023, the number of outstanding shares of Common

Stock that would result from the listed hypothetical Reverse Stock Split ratios (without giving effect to the treatment of fractional

shares):

| Reverse Stock Split Ratio |

|

Number of Outstanding Shares of Common Stock

Following the Reverse Stock Split |

Number of Shares of Common Stock Reserved for Future Issuance |

Number of Shares of Common Stock Authorized but not Outstanding or Reserved |

| 1-for-3 |

|

39,025,650 |

1,541,667 |

409,432,684 |

| 1-for-10 |

|

11,707,695 |

462,500 |

437,829,805 |

| 1-for-15 |

|

7,805,130 |

308,333 |

441,886,537 |

| 1-for-20 |

|

5,853,848 |

231,250 |

443,914,903 |

| 1-for-25 |

|

4,683,078 |

185,000 |

445,131,922 |

The actual number of shares issued after giving effect

to the Reverse Stock Split, if implemented, will depend on the Reverse Stock Split ratio that is ultimately determined by our Board.

Authorized Shares of Common Stock. The Reverse

Stock Split will not reduce or otherwise affect the number of authorized shares of our capital stock.

Fractional Shares. The Reverse Stock Split

will affect all of our stockholders uniformly and will not affect any stockholders percentage ownership interests in our Company, except

to the extent that the result of the Reverse Stock Split results in any of our stockholders owning a fractional share. If this occurs,

the fractional shares will be rounded up to the next whole share, including fractional shares that are less than one (1) share. In addition,

the Reverse Stock Split will not affect any stockholders percentage ownership or proportionate voting power. The Common Stock issued pursuant

to the Reverse Stock Split will remain fully paid and non-assessable.

Effect on Voting Rights of, and Dividends on, our

Common Stock. Proportionate voting rights and other rights of the holders of our Common Stock would not be affected by the Reverse

Stock Split. The percentage of outstanding shares owned by each stockholder prior to the split will remain the same, except for adjustment

as a consequence of rounding up any fractional shares created by the Reverse Stock Split to the next whole share, which is discussed in

more detail under “Fractional Shares,” above. For example, generally, a holder of two percent (2%) of the voting power

of the outstanding shares of Common Stock immediately prior to the effective time of the Reverse Stock Split would continue to hold two

percent (2%) of the voting power of the outstanding shares of Common Stock after a Reverse Stock Split.

We have never paid any cash dividends on our Common

Stock and we do not expect to pay cash dividends on our Common Stock in the foreseeable future. Any future determination to pay dividends

on our Common Stock will be at the discretion of our Board and will depend on our financial condition, results of operations, capital

requirements, applicable restrictions in our Charter, applicable restrictions in our Bylaws, contractual limitations, and other factors

that our Board deems relevant. Therefore, we do not believe that a Reverse Stock Split would have any effect with respect to future distributions,

if any, to our stockholders.

Effect on Registered and Beneficial Stockholders.

Upon the consummation of the Reverse Stock Split, we intend to treat stockholders holding stock in “street name”, through

a bank, broker or other nominee, in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers

or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders, holding the stock in “street

name.” However, such banks, brokers or other nominees may have different procedures than registered stockholders for processing

the Reverse Stock Split. If you hold your shares with such a bank, broker or other nominee and if you have any questions in this regard,

we encourage you to contact your nominee.

Effect on Registered “Book-entry” Stockholder. Our

registered stockholders may hold some or all of their shares electronically in book-entry form. These stockholders will not have stock

certificates evidencing their ownership of the stock. These stockholders are, however, provided with a statement reflecting the number

of shares registered in their accounts. If you hold shares in book-entry form, you do not need to take any action to receive your post-Reverse

Stock Split shares. A transaction statement will automatically be sent to your address of record indicating the number of shares you hold.

Effect on Registered Certificated Shares. Some

of our registered stockholders hold all their shares in certificate form or a combination of certificate and book-entry form. If any of

your shares are held in certificate form, you do not need to take any action to exchange your stock certificate. Stockholders

may continue to make sales or transfers using their old stock certificates. On request, we will issue new certificates to anyone who holds

old stock certificates in exchange therefor. Any request for new certificates into a name different from that of the registered holder

will be subject to normal stock transfer requirements and fees, including proper endorsement and signature guarantee, if required.

Effect on Liquidity. The decrease in the number

of shares of our Common Stock outstanding as a consequence of the Reverse Stock Split may decrease the liquidity in our Common Stock if

the anticipated beneficial effects on the trading market for our Common Stock do not occur. See “Purposes of the Reverse Stock Split,”

above.

Potential Anti-Takeover Effect. If the Reverse

Stock Split is effected, the increased proportion of authorized but unissued shares of our Common Stock to issued and outstanding shares

thereof could, under certain circumstances, have an anti-takeover effect. For example, such a change could permit future issuances of

our Common Stock that would dilute the stock ownership of a person seeking to effect a change in composition of our Board or contemplating

a tender offer or other transaction for the combination of our Company with another entity. The Reverse Stock Split, however, is not being

brought forth in response to any effort of which we are aware to accumulate shares of our Common Stock or to obtain control of us.

Effective Date of the Reverse Stock Split. If

effected by the Board, the Reverse Stock Split Amendment, will become effective upon the filing of a Certificate of Amendment with the

Secretary of State of the State of Delaware, in substantially the form as attached hereto as Appendix D, which we anticipate will

be effected in connection with our proposed listing on the NYSE American. In addition, our Board reserves the right, notwithstanding stockholder

approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to

filing the Certificate of Amendment, our Board, in its sole discretion, determines that it is no longer in our best interests and the

best interests of our stockholders to proceed with the Reverse Stock Split.

No Going Private Transaction. Notwithstanding

the decrease in the number of outstanding shares following the Reverse Stock Split, our Board does not intend for this transaction to

be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The Company not sought, and will not seek, a ruling

from the Internal Revenue Service regarding the U.S. federal income tax consequences of the Reverse Stock Split. The Company believes,

however, that because the Reverse Stock Split is not part of a plan to increase any stockholder’s proportionate interest in the

assets or earnings and profits of the Company, the Reverse Stock Split will have the following federal income tax effects on each holder

of our Common Stock and Series A Preferred Stock:

| |

1. |

The holder should not recognize any gain or loss for U.S. federal income tax purposes (except with respect to cash, if any, received in lieu of a fractional share of common stock); |

| |

2. |

The holder’s aggregate tax basis in the stock received pursuant to the Reverse Stock Split, including any fractional share of stock not actually received, should be equal to the aggregate tax basis of such holder’s stock surrendered in exchange therefor; |

| |

3. |

The holder’s holding period for the stock received pursuant to the Reverse Stock Split, including any fractional share of The stock not actually received, should include such holder’s holding period for the stock surrendered in exchange therefor; |

| |

4. |

Cash payments received by the holder for a fractional share of stock generally should be treated as if such fractional share had been issued pursuant to the Reverse Stock Split and then sold by such holder, and such holder generally should recognize capital gain or loss with respect to such payment, measured by the difference between the amount of cash received and such holder’s tax basis in such fractional share; |

| |

5. |

Any such capital gain or loss should be treated as a long-term or short-term capital gain or loss based on such holder’s holding period in such fractional share; and |

| |

6. |

The Company should not recognize gain or loss solely as a result of the Reverse Stock Split. |

The above summary does not discuss any state, local,

foreign or other tax consequences of the Reverse Stock Split. It is for general information only and does not discuss consequences which

may apply to special classes of taxpayers. The tax treatment of a stockholder may vary depending upon the particular facts and circumstances

of such stockholder. Accordingly, each holder of our Common Stock or Series A Preferred Stock should consult his, her or its tax advisor

with respect to the particular tax consequences of the Reverse Stock Split to such holder.

Accounting Consequences and Effect on Registration of Common Stock Under

the Exchange Act

The par value of our Common Stock would remain unchanged

at $0.0001 per share after the Reverse Stock Split. However, the Common Stock as designated on our balance sheet would be adjusted downward

in respect of the shares of the new Common Stock to be issued in the Reverse Stock Split such that the Common Stock would become an amount

equal to the aggregate par value of the shares of new Common Stock being issued in the Reverse Stock Split, and that the additional paid

in capital as designated on our balance sheet would be increased by an amount equal to the amount by which the Common Stock was decreased. Additionally,

net income (loss) per share would increase proportionately as a result of the Reverse Stock Split since there will be a lower number of

shares outstanding.

Our Common Stock is currently registered under the

Exchange Act. If the Reverse Stock Split is effected prior to our anticipated listing on the NYSE American, it would not affect the registration

of our Common Stock under the Exchange Act. After the Reverse Stock Split, our Common Stock would continue to be quoted on the OTCQB under

the symbol “RVIV”. If the Reverse Stock Split is effected concurrently with our anticipated listing on the NYSE American,

our Common Stock would be registered under Section 12(b) under the Exchange Act and listed on the NYSE American. After the Reverse Stock

Split is effected and we are listed on the NYSE American, our Common Stock would be quoted on the NYSE American under a new, to be determined,

symbol.

AMENDMENTS TO OUR AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION AND OUR BYLAWS TO INCREASE THE SIZE OF OUR BOARD CREATE THREE (3) CLASSES OF DIRECTORSHIPS.

General

On October 31, 2023, in connection with our anticipated

listing on the NYSE American, our Board approved the Classified Board Amendment to increase the size of our Board to three members and

to create three (3) classes of directorships of our Board. On October 31, 2023, the Consenting Stockholders, acting by written consent,

approved the Classified Board Amendment. The Board will have the discretion to implement the Classified Board Amendment or to not effect

the Classified Board Amendment at all. The Board currently intends to effect the Classified Board Amendment in connection with our anticipated

listing on the NYSE American at a date at least twenty (20) calendar days after the date that the enclosed Information Statement is filed

and mailed to our stockholders of record on the Record Date. The Board may choose to effect the Classified Board Amendment immediately

prior to or concurrently with our anticipated listing on the NYSE American. Additionally, the Board reserves the right to effect the Classified

Board Amendment even if we are not listed on the NYSE American.

If effected by the Board, the Classified Board Amendment

will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware, in substantially

the form as attached hereto as Appendix E, which will occur as soon as reasonably practical. Additionally, a corresponding amendment

will be made to our Bylaws, in substantially the form as attached hereto as Appendix E.

Purposes and Effects of the Classified Board Amendment

We believe the Classified Board Amendment promotes

greater stability and better focus on long-term strategy for our Company. By creating three (3) distinct classes of directors on our Board,

we believe we will be able to better attract and retain well-qualified individuals to commit the necessary time and resources to understand

the Company, its business affairs and operations.

Pursuant to Section 141(d) of the DGCL, stockholders

may, by amendment to the Certificate of Incorporation or by a Bylaw adopted by a vote of the stockholders, divide the directors of any

Delaware corporation, including the Company, into one, two or three classes.

The Board and the Consenting Stockholders

have approved the Classified Board Amendment, which establishes classified board of directors. The Board shall be divided into

three classes: Class I, Class II and Class III. The number of directors in each class shall be the whole number contained in the quotient

arrived at by dividing the authorized number of directors by three, and if a fraction is also contained in such quotient, then if such

fraction is one-third (1/3) the extra director shall be a member of Class III and if the fraction is two-thirds (2/3) one of the extra

directors shall be a member of Class III and the other shall be a member of Class II. Each director shall serve for a term ending on the

date of the third annual meeting following the annual meeting at which such director was elected.

In the event of any increase or decrease in the authorized

number of directors: (a) each director then serving as such shall nevertheless continue as a director of the class of which he is a member

until the expiration of his or her current term, or his or her prior death, resignation or removal, and (b) the newly created or eliminated

directorships resulting from such increase or decrease shall be apportioned by the Board to such class or classes as shall, so far as

possible, bring the number of directors in the respective classes into conformity with the formula described above, as applied to the

new authorized number of directors

Each director shall continue in office until the next

annual meeting at which such director’s class stands for election and his successor is elected and qualified, or until such director’s

earlier death, resignation, disqualification or removal from office.

Potential Anti-Takeover Effect. Upon effectiveness

of the Classified Board Amendment, it will take at least two (2) annual meetings of our stockholders for a majority of our issued and

outstanding shares of Common Stock to effect a change of control of the Board because only a minority of the Board will be elected at

each meeting. This delay is designed to reduce the vulnerability of the Company to unsolicited takeover attempts and attempts to compel

the Company’s restructuring or otherwise force it into an extraordinary transaction. The Board believes that this delay also serves

the best interests of the Company and its Stockholders by encouraging potential acquirors to negotiate with the Board rather than act

unilaterally. Without the ability to obtain control of the Board quickly, an unsolicited takeover bidder may be incapable of taking action

necessary to remove other impediments to its acquisition of the Company, even if that takeover bidder were to acquire a majority of our

outstanding shares of Common Stock. This situation may discourage unsolicited tender offers, perhaps including some tender offers that

Stockholders would conclude to be in their best interests if made. The Classified Board Amendment, however, is not being brought forth

in response to any effort of which we are aware to accumulate shares of our Common Stock or to obtain control of us.

The Classified Board Amendments that amend the Company’s

Bylaws also establish procedures for our stockholders to provide us with advance notice nominations of directors and proposals for matters

they intend to bring up at a stockholder meeting. Any stockholder wishing to nominate a candidate for election as a director or make a

proposal for new business at a stockholder meeting must submit written notice not less than thirty (30) or more than sixty (60) days in

advance of the meeting. This advance notice requirement may give management time to solicit its own proxies in an attempt to defeat any

dissident slate of nominations. Similarly, adequate advance notice of stockholder proposals will give management time to study such proposals

and to determine whether to recommend to the stockholders that such proposals be adopted. In certain instances, such provisions could

make it more difficult to oppose management’s nominees or proposals, even if the stockholders believe such nominees or proposals

are in their interests. These provisions may discourage persons from bringing up matters disclosed in the proxy materials furnished to

the stockholders and could inhibit the ability of stockholders to bring up new business in response to recent developments.

AMENDMENTS TO OUR AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION AND OUR BYLAWS TO VEST THE BOARD WITH AUTHORITY TO MAKE, REPEAL, ALTER, AMEND OR RESCIND ANY OR ALL OF THE BYLAWS AND

TO AMEND THE BYLAWS TO ADD A PROVISION RELATING TO NOTICE OF STOCKHOLDER BUSINESS AND NOMINATIONS.

General

On October 31, 2023, our Board approved the Bylaws

Amendment to vest the Board with authority to make, repeal, alter, amend or rescind any or all of the Bylaws and to amend the Bylaws to

add a provision relating to notice of stockholder business and nominations. On October 31, 2023, the Consenting Stockholders, acting by

written consent, approved the Bylaws Amendment. The Board will have the discretion to implement the Bylaws Amendment or to not effect

the Bylaws Amendment at all. The Board currently intends to effect the Bylaws Amendment as soon as practicable at a date at least twenty

(20) days after the date that the enclosed Information Statement is filed and mailed to our stockholders of record on the Record Date.

If effected by the Board, the Bylaws Amendment will

become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware, in substantially

the form as attached hereto as Appendix F, which will occur as soon as reasonably practical. Additionally, a corresponding amendment

will be made to our Bylaws, in substantially the form as attached hereto as Appendix F.

Purposes and Effects of the Bylaws Amendment

We believe that the Bylaws Amendment will clarify

and confirm the Board’s authority to make, alter, or repel the Bylaws, in whole or in part. Additionally, we believe the Bylaws

Amendment will provide clarity into how a stockholder may nominate a director or make a proposal and requirements for annual meetings

of stockholders and special meetings of stockholders. After the Bylaws Amendment is effected, our stockholders will have clearly defined

processes for stockholder meetings and nominations.

The Bylaws Amendment is not being brought forth in

response to any effort of which we are aware to accumulate shares of our Common Stock or to obtain control of us.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid

by us for the last two fiscal years ended May 31, 2023, and 2022, to our named executive officers (each, an “NEO”), who for

the fiscal year ended May 31, 2023 were Jeff Toghraie, our Chief Executive Officer and Chairman (Principal Executive Officer), Jeff Brown,

our Chief Operating Officer, Monica Diaz Brickell, our Chief Financial Officer, and Meenu Jain, our former Chief Financial Officer.

Summary Compensation Table

| Name and Principal Position | |

Year | |

Salary ($) | |

Bonus ($) | |

Stock Awards ($) | |

Option Awards ($)(1) | |

Non-Equity Incentive Plan Compensation ($) | |

Nonqualified Deferred Compensation Earnings ($) | |

All Other Compensation ($) | |

Totals ($) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Jeff Toghraie | |

| 2022 | | |

| — | | |

| — | | |

| — | | |

| 279,000 | | |

| — | | |

| — | | |

| — | | |

| 279,000 | |

| Chief Executive Officer and Chairman of the Board | |

| 2023 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeff Brown | |

| 2022 | | |

| 50,000 | | |

| — | | |

| — | | |

| 198,000 | | |

| — | | |

| — | | |

| — | | |

| 248,000 | |

| Chief Operating Officer | |

| 2023 | | |

| 98,000 | | |

| 35,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 133,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Meenu Jain(2) | |

| 2023 | | |

| 81,667 | | |

| — | | |

| — | | |

| 15,000 | | |

| — | | |

| — | | |

| — | | |

| 96,667 | |

| Former Chief Financial Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Monica Diaz Brickell(3) | |

| 2023 | | |

| 17,500 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 17,500 | |

| Chief Financial Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) |

|

The value of option awards in this table represents the fair value of such awards granted or modified during the fiscal year, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. The assumptions used to determine the valuation of the awards are discussed in Note 10—Stockholders’ Equity to our financial statements included herein. |

| (2) |

|

Ms. Jain became our Chief Financial Officer on November 1, 2022 and resigned as our Chief Financial Officer on April 21, 2023. |

| (3) |

|

Ms. Diaz Brickell became our Chief Financial Officer on April 24, 2023. |

Our Chief Executive Officer, Jeff Toghraie, and our

Chief Operating Officer, Jeff Brown, did not have formal employment agreements with the Company in place as of May 31, 2023. Mr. Toghraie

is entitled to an annual performance bonus, health benefits and equity awards at the discretion of the Board. Mr. Brown receives a base

salary of $98,000 per year and is entitled to annual performance bonus, paid vacation, optional health benefits and equity awards at the

discretion of the Board.

Monica Diaz Brickell joined the Company as Chief Financial

Officer in April 2023. Per her agreement with the Company, she receives a base salary of $140,000 per year and is entitled to paid vacation

and optional health benefits.

We did not pay any compensation to our non-employee

director during the fiscal years ended May 31, 2023 and 2022.

As of May 31, 2023, we did not have any retirement,

pension, or profit- sharing plans for the benefit of our executive officers and directors.

Outstanding Equity Awards at Fiscal Year-End

The

following table sets forth certain information regarding outstanding equity awards held by the named executive officers as of May 31,

2023:

| | |

| |

Option Awards |

| Name | |

Grant Date | |

Number of securities underlying unexercised options