UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Date of Report (Date of earliest event reported):

May 19, 2014

Commission File Number 000-8157

THE RESERVE PETROLEUM COMPANY

(Exact name of registrant as specified

in its charter)

| DELAWARE |

73-0237060 |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

6801 Broadway Ext., Suite 300

Oklahoma City, Oklahoma 73116-9037

(405) 848-7551

(Address and telephone number, including

area code, of registrant’s principal executive offices)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13c-4(c))

On May 19, 2014, The

Reserve Petroleum Company (the “Company”) became aware of a tender offer dated May 2014 for up to 5,700 shares of the

Company’s common stock at $350.00 per share (the “Tender Offer”) that is being made by Branzan Alternative Opportunities

Fund, L.L.L.P. (“Branzan”). The Company does not know whether or not the Tender Offer was sent to all stockholders

of the Company. A copy of the Tender Offer is attached to this Form 8-K as Exhibit 99.

On November 29, 2012,

Branzan sent a Demand for Inspection of Books and Records Pursuant to Section 220(b) of the Delaware General Corporation Law to

the Company (the “Demand Letter”). In the Demand Letter, Branzan requested the opportunity to inspect a current list

of the Company’s shareholders and their addresses and stated that it was making its request for the purposes of communicating

with the Company’s shareholders: (a) in order to solicit from other shareholders of the Company for the tender of stock,

and (b) in order to influence the policy of the Company’s management. On January 4, 2013, a representative of Branzan arrived

at the Company’s offices and was given a then current list of the Company’s stockholders pursuant to Section 220(b)

of the Delaware General Corporation Law.

In May 2013, Branzan

made a Tender Offer for up to 7,500 shares of the Company’s common stock at $230.00 per share (the “2013 Tender Offer”).

Based on the shares transferred to Branzan as a result of the 2013 Tender Offer, the Company believes that Branzan currently owns

approximately five hundred fifty nine (559) shares of the Company’s common stock. If Branzan purchases 5,700 shares in the

Tender Offer, the Company believes that Branzan will own approximately 3.9% of the Company’s outstanding common stock.

The Company expresses

no opinion and is remaining neutral toward the Tender Offer. The reasons for the Company’s position are as follows: (i) other

than related to the Demand Letter and the transfer of stock related to the 2013 Tender Offer, the Company has not had any contact

with Branzan and it does not know anything about Branzan, let alone how it intends to influence the policy of the Company’s

management, and (ii) due to the fact that the stock is so thinly traded, it is not possible to establish its value.

| Item 9.01 | | Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

THE RESERVE PETROLEUM COMPANY |

| |

|

| |

|

| |

By: |

/s/ Cameron McLain |

| |

Name: |

Cameron McLain |

| |

Title: |

Principal Executive Officer |

| |

|

| |

|

Date: May 22, 2014 |

The Reserve Petroleum Company 8-K

Exhibit 99

May 2014

Dear Reserve Petroleum Company Shareholder:

Branzan Alternative Opportunities Fund, L.L.L.P.

(Branzan) and its affiliates are offering to purchase up to 5,700 shares of The Reserve Petroleum Company (Reserve Petroleum) at

$350.00 per share.

This tender offer gives you an opportunity to

sell units of a relatively illiquid security without any brokerage or other costs.

Branzan has sufficient cash reserves to purchase

all of the shares tendered.

Reserve Petroleum purchased 79 shares in 2013

for $230.00 per share.

If you want to sell your shares, please complete

and sign the enclosed Stock Power and have your signature Medallion Guaranteed by a bank or a broker. Mail the Stock Power, together

with your certificate, to the address listed at the bottom of the page. We suggest you use registered mail. A check will be mailed

to you immediately upon our receiving confirmation from Reserve Petroleum that the shares have been successfully transferred to

Branzan or its assigns.

Unless extended, this offer will expire on June

30, 2014. Submissions postmarked after this date may not be accepted.

The offer price will be reduced by any distributions

made on the units after May 1, 2014.

You are under no obligation to accept this tender

offer. Branzan is not affiliated in any way with Reserve Petroleum.

If you have any questions, please do not hesitate

to contact us via telephone or e-mail.

| |

Very truly yours, |

| |

|

| |

C. Spencer Brant |

| |

|

| |

Branzan Alternative Opportunities Fund, L.L.L.P. |

| |

475 17th Street, Suite 570 |

| |

Denver, CO 80202 |

| |

Phone: |

(303) 292-9224 ext. 24 |

| |

Email: |

csb@branzanadvisors.com |

| |

|

|

| |

Enclosure |

475 Seventeenth

Street | Suite 570 | Denver Colorado 80202 | 303.292.9224 | www.branzanadvisors.com

IRREVOCABLE STOCK POWER FORM

| Date |

|

|

Contact Phone Number |

|

FOR VALUE RECEIVED, the Undersigned does (do)

hereby sell, assign and transfer the below listed shares of The Reserve Petroleum Company to Branzan Alternative Opportunities

Fund, L.L.L.P., Tax ID# __________________ (to be completed by Branzan)

| Name of Certificate Holder: |

|

| The Reserve Petroleum Company Certificate Number: |

|

| Number of Shares to be Transferred: |

|

The undersigned does (do) hereby irrevocably

constitute and appoint Branzan Alternative Opportunities Fund L.L.L.P. attorney to transfer the shares as the case may be,

on the books of said Company, with full power of substitution in the premises.

| |

|

| |

(Person executing this power signs here) |

| IMPORTANT - READ CAREFULLY |

|

| |

MEDALLION SIGNATURE GUARANTEED |

| |

|

The signature (s) to this Power

must correspond with the names(s) as written upon the face of the certificate(s), in every particular without

alteration or enlargement or any change whatever.

|

|

| |

|

| |

|

| |

|

| |

(Name of Bank, Trust Company or Broker) |

| |

|

| |

|

| |

|

| |

(Official Signature) |

| |

|

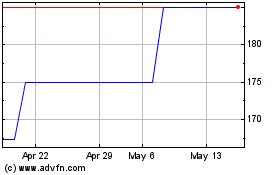

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From May 2024 to Jun 2024

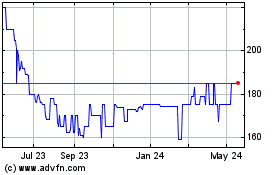

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jun 2023 to Jun 2024