Current Report Filing (8-k)

November 12 2021 - 10:01AM

Edgar (US Regulatory)

0001589150

false

0001589150

2021-11-11

2021-11-11

0001589150

2021-11-12

2021-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 11, 2021

REGEN

BIOPHARMA, INC.

(Exact

name of small business issuer as specified in its charter)

|

Nevada

|

45-5192997

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

Commission

File No. 333-191725

4700

Spring Street, St 304, La Mesa, California 91942

(Address

of Principal Executive Offices)

(619) 722

5505

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

|

None

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

November 11,2021 Regen Biopharma, Inc. (the “Company”) entered into a Letter of Intent ( “LOI”) with Canary Oncoceutics,

Inc (“Canary”) and Canary Oncoceutics Partners, LLC (“LLC”) whereby the Company shall acquire 95% of the share

capital and voting power of Canary ( “Canary Controlling Interest”) for consideration consisting of $1,000,000 and common

shares of the Company valued at the average share price of the common shares in the 2 weeks prior to the closing of a definitive agreement

between the parties (“RGBP Share Value”). The number of common shares to be issued shall be the number of common shares valued

at the RGBP share value which shall equal the value of the Canary Controlling Interest as determined by a mutually acceptable third-party

valuation expert.

No

definitive agreement between the parties for the acquisition by the Company of the Canary Controlling Interest shall close unless the

Company shall have raised the amount of $50,000,000 USD dedicated solely to the development and commercialization of Canary diagnostics

and products (“Canary Funds”).

It

is understood that the IP that will be licensed into Canary will originate from Cornell University. The final IP will be included in

the definitive agreement as an appendix. This IP allows for the creation of patient-derived tumor on vascular nets for in vitro testing

of therapeutic agents.

It

is contemplated by the parties that until the first commercial contract for use of the first Test Product, the Company shall pay to LLC

on each anniversary of the effective date of any definitive agreement the applicable fees listed below, with the last year pro-rated:

|

Date

|

PAYMENT

|

|

1st

- 3rd anniversary of Effective Date

|

$100,000

|

|

4th

anniversary of Effective Date

|

$150,000

|

|

5th

and each anniversary of Effective Date and each anniversary thereafter

|

$250,000

|

|

|

|

A.

Milestone Payments. The Company will pay LLC the following non-creditable milestone payments for each Test Product:

|

|

Milestone

|

AMOUNT

|

|

1.

Partnership with a genomics testing company

|

$1,000,000

|

|

2.

Partnership with a clinical laboratory equipment manufacturer

|

$1,000,000

|

|

3.

Submission to FDA of a Test Product Pre-Market Approval request

|

$500,000

|

|

4.

FDA (US) Approval of a Test Product

|

$3,000,000

|

|

5.

EMA (EU) Approval of a Test Product

|

$1,500,000

|

|

6.

PMDA (JPN) Approval of a Test Product

|

$1,000,000

|

|

7.

Cumulative Net Sales of Services for Test Products reach $100 Million

|

$2,000,000

|

|

|

|

|

Test

Product is defined within the LOI as a Patient-Derived Organoid on VascularNet (PDOV) for a specific tumor type. For example, a colon

tumor-derived PDOV is one Test Product, an ovarian tumor-derived PDOV is another Test Product.

It

is also contemplated that the Company shall pay LLC an earned royalty on Net Sales generated by use of the Test Products. Royalties are

payable on an annual worldwide Net Sales basis cumulative for each calendar year with an annual gross-up (if required) to reflect the

actual royalty tier achieved for the applicable calendar year.

|

|

CUMULATIVE

ANNUAL NET SALES

|

PERCENTAGE

|

|

|

Up

to $250 Million

|

2.5%

|

|

$250

Million to $500 Million

|

4%

|

|

Excess

above $500 Million

|

5%

|

It

is also contemplated that In the event of a Change in Control of Canary the Company shall pay to LLC a fee equal to 40% of the consideration

received by the Company as a result of the Change in Control net of expenses the Company has invested in Canary from date of acquisition,

including operational expenses and initial acquisition expenses. Change in Control is defined in the LOI as any transaction or series

of transactions, whether by merger or sale or transfer of more than fifty percent (50%) of the outstanding stock and voting power of

the relevant entity in which the members of the Board of Directors immediately preceding the closing of the Change of Control transaction

no longer constitute a majority of the Board of Directors of the surviving entity following the closing of such transaction.

Other

than as to confidentiality and goth faith provisions of the LOI the parties agree that the LOI does not constitute a binding commitment

by either party with respect to any transaction. The non-binding provisions of the LOI reflect only the parties’ current understanding

of the contemplated transaction, and a binding contract will not exist between the Parties unless and until they sign and deliver a mutually

acceptable definitive agreement. Other than to impose a duty to the parties to negotiate in good faith and to not disclose Confidential

Information, no obligations of one party to the other or liability of any kind shall arise from executing this Letter or its taking or

refraining from taking any actions relating to the proposed transaction.

The

management of the Company believes that the proposed acquisition of 95% of Canary would provide an opportunity for the Company to diversify

its intellectual property portfolio beyond the development of therapeutics into the development of in vitro diagnostics specifically

the development of complimentary functional precision medicine tests. In the event that intellectual property contemplated as being included

in any definitive agreement can be successfully developed cancer patients could receive both a genetic test and a functional test. This

combined test would provide their treating physician with information that will allow for the selection of the ideal drug/drug combination

for each patient.

The

transaction contemplated by the LOI is contingent upon the execution of one or more mutually acceptable definitive agreements between

the parties. No assurance can be given that any such agreements shall be executed or, if executed, shall not contain terms and conditions

materially different from the terms and conditions currently contemplated.

The

foregoing description of the abovementioned LOI is not complete and is qualified in its entirety by reference to the text of the abovementioned

LOI , which is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated in this Item 8.01 by reference.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

REGEN BIOPHARMA, INC.

|

|

|

|

|

Dated: November 11, 2021

|

By: /s/ David Koos

|

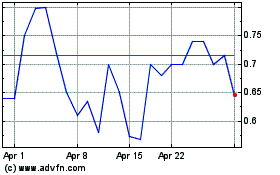

Regen Biopharma (PK) (USOTC:RGBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

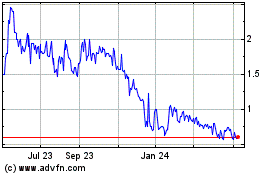

Regen Biopharma (PK) (USOTC:RGBP)

Historical Stock Chart

From Jul 2023 to Jul 2024