false

0001006028

0001006028

2023-10-30

2023-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 30, 2023

PURE

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-14468 |

|

33-0530289 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

771

Jamacha Rd., #512

El

Cajon, California |

|

92019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

9669

Hermosa Avenue

Rancho

Cucamonga, California |

|

91730 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(Former

name or former address, if changed since last report)

Registrant’s

telephone number, including area code: (619) 596-8600

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

October 30, 2023, PURE Bioscience, Inc. (the “Company”) issued a press release announcing financial results for the fiscal

year ended July 30, 2023 and related information. A copy of the press release is attached as Exhibit 99.1.

The

information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated

by reference into any registration statement or other document filed with the Securities and Exchange Commission.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

| * |

Exhibit

99.1 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934 or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference into any registration

statement or other document filed with the Securities and Exchange Commission. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PURE

BIOSCIENCE, INC. |

| |

|

|

| Dated:

October 30, 2023 |

By:

|

/s/

Robert F. Bartlett |

| |

|

Robert

F. Bartlett |

| |

|

Chief

Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

PURE

Bioscience Reports Fiscal 2023

Financial

Results

Update

on Business and PURE’s SDC-Based Antimicrobial Food Safety Solutions

El

CAJON, CA (October 30, 2023) – PURE Bioscience, Inc. (OTCQB: PURE) (“PURE,” the “Company” or “we”),

creator of the patented non-toxic silver dihydrogen citrate (SDC) antimicrobial, today reported financial results for the fiscal

year ended July 31, 2023.

Summary

of Results – Year-End Operations

| ● | Net

product sales were $1,871,000 and $1,813,000 for the fiscal year ended July 31, 2023 and

2022, respectively. The increase of $58,000 was attributable to increased sales across our

end-user network servicing the food processing industry. |

| ● | Net

loss for the fiscal year ended July 31, 2023 was ($4.0 million), compared to ($3.5 million)

for the fiscal year ended July 31, 2022. |

| ● | Net

loss, excluding share-based compensation, for the fiscal year ended July 31, 2023 was ($3.6

million), compared to ($2.9 million) for the fiscal year ended July 31, 2022. |

| ● | Net

loss per share was ($0.04) for the fiscal year ended July 31, 2023 and 2022. |

| ● | Net

cash used in operations for the fiscal year ended July 31, 2023 was ($3.3 million), compared

to ($2.5 million) for the fiscal year ended July 31, 2022. |

Business

Update

Customer

acceptance of our revolutionary SDC solutions in the food processing industry has increased dramatically over the last year, due in part

to following reasons:

| ● | Customer

Innovation - Our customer-first focus has led to exciting new applications for PURE Hard

Surface (PHS). Our technical service team, working in tandem with our customers, has developed

a new application technology to treat produce field harvest equipment. This mitigating sanitation

step was developed in response to new FDA field testing protocols for the leafy green industry.

In addition, our technical team has developed a new program to sanitize produce field harvest

bins. Our new automated bin solution has the potential to treat thousands of bins per day.

We view the bin solution as a game changer for the produce industry as our chemistry replaces

the current use of plastic liners. Not only is our chemistry cheaper than plastic liners,

it’s more environmentally sustainable. The current plastic liner solution has resulted

in hundreds of thousands of pounds of plastic either recycled or taken to the landfill annually. |

| | | |

| ● | In

the past year PURE has been focusing on the expansion of our SDC solutions for the food industry.

Many of our solutions have been adopted by our current customers and new customers alike,

as the industry is seeking new solutions for a safe food supply. Our engineers and sales

team continue to develop and expand our comprehensive cleaning programs, using SDC formulated

cleaners and disinfectants. When combined with our innovative application technologies, our

customers experience repeatable cleaning processes resulting in decreased downtime and water

usage. |

| ● | Professional

Conferences and Trade Show Attendance – Over the course of the last fiscal year PURE

has attended numerous conferences and trade shows. In July 2023, we attended the International

Association for Food Protection (IAFP) conference in Toronto, Canada where we introduced

our “PURE GENIUS” food safety solution. The initial response to PURE GENIUS has

been very favorable and the program shows great promise as our technology has now been implemented

into numerous food processing facilities and is currently under evaluation at various locations

throughout North America. In addition to the IAFP, our team has led research symposiums at

trade shows and universities focused on PURE’s user-friendly product options for plant

sanitation and environmental controls. Our attendance at conferences and trade shows has

increased the Company’s brand awareness across the food processing industry. |

| | | |

| ● | Marketing

Materials – Our team is working closely with contracted professionals to modify our

website to be utilized as a sales tool. In addition, our team has developed targeted marketing

materials specific to use-case solutions of SDC. Technical bulletins and sell sheets have

been created outlining the benefits of using SDC in the food service, food processing, healthcare,

and personal care industries. Furthermore, we have been increasing our presence on LinkedIn,

YouTube, and other social media platforms. For more information on PUREs solutions, please

visit www.purebio.com/solutions/ |

Robert

Bartlett, Chief Executive Officer and President, said, “Our customer driven focus is beginning to pay off. Q4 revenue increased

both versus the prior year, as well as our previous quarter. Pure’s overall ending revenue for fiscal year 2023 showed a slight

increase over fiscal year 2022, and while not substantial on its own, it is important to note that Q4 revenue 2023 vs. Q4 revenue 2022

experienced a 49% increase. A quarter does not make a year, but I see this increase as a turning point and confirmation of our team’s

implementation of ‘new customer driven programs.’ These programs were initiated during the Q3 and Q4 of fiscal year 2023.

With that said, the Team’s focus and continuation of these programs is paramount to our future success,” concluded Bartlett.

All-remote

Work Environment

Since

2019, when PURE closed its El Cajon offices / warehouse facility, the Company moved almost entirely to a work-from-home model with a

few people working at the underutilized corporate office / warehouse location in Rancho Cucamonga. Over the course of FYQ4, PURE has

relocated all remaining assets held at the Rancho Cucamonga location to new third-partly facilities throughout the United States. This

decision was made, in part, to better service our customers by reducing lead times and costs associated with logistics and for the following

key points:

| ● | Reduced

Operating Costs - Eliminating costs associated with leasing commercial space, including triple

net, electricity, insurance, and security costs. |

| | | |

| ● | Focus

on Sustainability - Evaluating sustainability through the environmental, social and corporate

governance initiatives, an all-remote model, which reduces PURE’s overall carbon footprint,

further plays into its corporate responsibility and business model. |

| | | |

| ● | Increased

Hiring Options - A remote workforce allows PURE the ability to hire from a much larger pool

of talented candidates as it grows, benefiting our customers and increasing shareholder value.

Strategically hiring in geographic locations ensures PURE can better support its customers’

unique needs across the country. |

| | | |

| ● | Increased

Employee Productivity and Job Satisfaction - PURE has benefited from increased employee productivity

and efficiency, meanwhile allowing employees more time to spend with their families and invest

in their community. PURE believes the benefits of an all-remote job for its employees are

not just eliminating the commute, but also gives our employees a sense of work-life balance,

helping prevent employee burnout and increasing job satisfaction. |

“When

the pandemic forced people to stay at home, our remote workforce was already prepared to manage our customers’ needs without having

to scramble to develop remote workflows. Our success during this demanding time led us to evaluate the benefits of a virtual workplace

as a long-term model. We believe having employees working all-remote directly supports our vision as we design the future of PURE. We

will continue to evaluate and align the needs of our business and evolve with our workforce to better serve our customer needs,”

said Jeff Kitchell, VP of Operations and Corporate Secretary.

About

PURE Bioscience, Inc.

PURE

is focused on developing and commercializing our proprietary antimicrobial products primarily in the food safety arena. We provide solutions

to combat the health and environmental challenges of pathogen and hygienic control. Our technology platform is based on patented, stabilized

ionic silver, and our initial products contain silver dihydrogen citrate, better known as SDC. This is a broad-spectrum, non-toxic antimicrobial

agent, and formulates well with other compounds. As a platform technology, SDC is distinguished from existing products in the marketplace

because of its superior efficacy, reduced toxicity and mitigation of bacterial resistance. PURE’s mailing address located in El

Cajon, California (San Diego County area) serves as its official address for all business requirements. Additional information on PURE

is available at www.purebio.com.

Forward-looking

Statements: Any statements contained in this press release that do not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Statements in this press release, including

quotes from management, concerning the Company’s expectations, plans, business outlook, future performance, future potential revenues,

expected results of the Company’s marketing efforts, the execution of contracts under negotiation and any other statements concerning

assumptions made or expectations as to any future events, conditions, performance or other matters, are “forward-looking statements.”

Forward-looking statements inherently involve risks and uncertainties that could cause our actual results to differ materially from any

forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the Company’s

failure to implement or otherwise achieve the benefits of its proposed business initiatives and plans; acceptance of the Company’s

current and future products and services in the marketplace, including the Company’s ability to convert successful evaluations

and tests for PURE Control and PURE Hard Surface into customer orders and customers continuing to place product orders as expected and

to expand their use of the Company’s products; the Company’s ability to maintain relationships with its partners and other

counterparties; the Company’s ability to generate sufficient revenues and reduce its operating expenses in order to reach profitability;

the Company’s ability to raise the funding required to support its continued operations and the implementation of its business

plan; the ability of the Company to develop effective new products and receive required regulatory approvals for such products, including

the required data and regulatory approvals required to use its SDC-based technology as a direct food contact processing aid in raw meat

processing and to expand its use in OLR poultry processing; competitive factors, including customer acceptance of the Company’s

SDC-based products that are typically more expensive than existing treatment chemicals; dependence upon third-party vendors, including

to manufacture its products; and other risks detailed in the Company’s periodic report filings with the Securities and Exchange

Commission (the SEC), including its Form 10-K for the fiscal year ended July 31, 2023. You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release. By making these forward-looking statements, the Company undertakes

no obligation to update these statements for revisions or changes after the date of this release.

Contact:

Mark

Elliott, VP Finance

PURE

Bioscience, Inc.

Phone:

619-596-8600 ext.: 116

PURE

Bioscience, Inc.

Consolidated

Balance Sheets

| | |

July 31, 2023 | | |

July 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,095,000 | | |

$ | 3,391,000 | |

| Accounts receivable | |

| 285,000 | | |

| 201,000 | |

| Inventories, net | |

| 88,000 | | |

| 179,000 | |

| Restricted cash | |

| 75,000 | | |

| 75,000 | |

| Prepaid expenses | |

| 61,000 | | |

| 18,000 | |

| Total current assets | |

| 1,604,000 | | |

| 3,864,000 | |

| Property, plant and equipment, net | |

| 221,000 | | |

| 620,000 | |

| Total assets | |

$ | 1,825,000 | | |

$ | 4,484,000 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 422,000 | | |

$ | 488,000 | |

| Accrued liabilities | |

| 110,000 | | |

| 87,000 | |

| Total current liabilities | |

| 532,000 | | |

| 575,000 | |

| Long-term liabilities | |

| | | |

| | |

| Note payable to related parties | |

| 1,021,000 | | |

| — | |

| Total long-term liabilities | |

| 1,021,000 | | |

| — | |

| Total liabilities | |

| 1,553,000 | | |

| 575,000 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.01 par value: 5,000,000 shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.01 par value: 150,000,000 shares authorized, 111,856,473 shares issued and outstanding at July 31, 2023, and 111,356,473 shares issued and outstanding at July 31, 2022 | |

| 1,119,000 | | |

| 1,114,000 | |

| Additional paid-in capital | |

| 132,398,000 | | |

| 132,079,000 | |

| Accumulated deficit | |

| (133,245,000 | ) | |

| (129,284,000 | ) |

| Total stockholders’ equity | |

| 272,000 | | |

| 3,909,000 | |

| Total liabilities and stockholders’ equity | |

$ | 1,825,000 | | |

$ | 4,484,000 | |

PURE

Bioscience, Inc.

Consolidated

Statements of Operations

| | |

Year ended | |

| | |

July 31, | |

| | |

2023 | | |

2022 | |

| Net product sales | |

$ | 1,871,000 | | |

$ | 1,813,000 | |

| Royalty revenue | |

| 6,000 | | |

| 40,000 | |

| Total revenue | |

| 1,877,000 | | |

| 1,853,000 | |

| Cost of goods sold | |

| 906,000 | | |

| 853,000 | |

| Gross Profit | |

| 971,000 | | |

| 1,000,000 | |

| Operating costs and expenses | |

| | | |

| | |

| Selling, general and administrative | |

| 4,302,000 | | |

| 4,051,000 | |

| Research and development | |

| 297,000 | | |

| 319,000 | |

| Impairment of fixed assets | |

| 315,000 | | |

| 55,000 | |

| Impairment of intangibles | |

| — | | |

| 299,000 | |

| Total operating costs and expenses | |

| 4,914,000 | | |

| 4,724,000 | |

| Loss from operations | |

| (3,943,000 | ) | |

| (3,724,000 | ) |

| Other income (expense) | |

| | | |

| | |

| Interest expense, net | |

| (14,000 | ) | |

| (6,000 | ) |

| Other income (expense), net | |

| (4,000 | ) | |

| — | |

| Gain on extinguishment of indebtedness, net | |

| — | | |

| 239,000 | |

| Total other income (expense) | |

| (18,000 | ) | |

| 233,000 | |

| Net loss | |

$ | (3,961,000 | ) | |

$ | (3,491,000 | ) |

| Basic and diluted net loss per share | |

$ | (0.04 | ) | |

$ | (0.04 | ) |

| Shares used in computing basic and diluted net loss per share | |

| 111,404,418 | | |

| 88,835,424 | |

PURE

Bioscience, Inc.

Consolidated

Statements of Stockholders’ Equity

| | |

Common Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance July 31, 2021 | |

| 87,223,141 | | |

$ | 873,000 | | |

$ | 128,253,000 | | |

$ | (125,793,000 | ) | |

$ | 3,333,000 | |

| Issuance of common stock in private placements to related parties, net | |

| 23,333,332 | | |

| 233,000 | | |

| 3,267,000 | | |

| | | |

| 3,500,000 | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 465,000 | | |

| — | | |

| 465,000 | |

| Share-based compensation expense - restricted stock units | |

| — | | |

| — | | |

| 102,000 | | |

| — | | |

| 102,000 | |

| Issuance of common stock for vested restricted stock units | |

| 800,000 | | |

| 8,000 | | |

| (8,000 | ) | |

| — | | |

| — | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (3,491,000 | ) | |

| (3,491,000 | ) |

| Balance July 31, 2022 | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,079,000 | | |

$ | (129,284,000 | ) | |

$ | 3,909,000 | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 262,000 | | |

| — | | |

| 262,000 | |

| Share-based compensation expense - restricted stock units | |

| — | | |

| — | | |

| 62,000 | | |

| — | | |

| 62,000 | |

| Issuance of common stock for vested restricted stock units | |

| 500,000 | | |

| 5,000 | | |

| (5,000 | ) | |

| — | | |

| — | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (3,961,000 | ) | |

| (3,961,000 | ) |

| Balance July 31, 2023 | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,398,000 | | |

$ | (133,245,000 | ) | |

$ | 272,000 | |

PURE

Bioscience, Inc.

Consolidated

Statements of Cash Flows

| | |

Year Ended | |

| | |

July 31, | |

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (3,961,000 | ) | |

$ | (3,491,000 | ) |

| Adjustments to reconcile loss to net cash used in operating activities: | |

| | | |

| | |

| Share-based compensation | |

| 324,000 | | |

| 567,000 | |

| Impairment of fixed assets | |

| 315,000 | | |

| 55,000 | |

| Depreciation and amortization | |

| 117,000 | | |

| 213,000 | |

| Reserve for inventory obsolescence | |

| 34,000 | | |

| 75,000 | |

| Impairment of intangibles | |

| — | | |

| 299,000 | |

| Gain on extinguishment of indebtedness | |

| — | | |

| (239,000 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (84,000 | ) | |

| 167,000 | |

| Inventories | |

| 57,000 | | |

| 78,000 | |

| Prepaid expenses | |

| (43,000 | ) | |

| 14,000 | |

| Accounts payable and accrued liabilities | |

| (43,000 | ) | |

| (156,000 | ) |

| Interest on note payable | |

| 6,000 | | |

| — | |

| Net cash used in operating activities | |

| (3,278,000 | ) | |

| (2,418,000 | ) |

| Investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (33,000 | ) | |

| (81,000 | ) |

| Net cash used in investing activities | |

| (33,000 | ) | |

| (81,000 | ) |

| Financing activities | |

| | | |

| | |

| Net proceeds from note payable to related parties | |

| 1,015,000 | | |

| — | |

| Net proceeds from the sale of common stock | |

| — | | |

| 3,500,000 | |

| Net cash provided by financing activities | |

| 1,015,000 | | |

| 3,500,000 | |

| Net (decrease) and increase in cash, cash equivalents, and restricted cash | |

| (2,296,000 | ) | |

| 1,001,000 | |

| Cash, cash equivalents, and restricted cash at beginning of year | |

| 3,466,000 | | |

| 2,465,000 | |

| Cash, cash equivalents, and restricted cash at end of year | |

$ | 1,170,000 | | |

$ | 3,466,000 | |

| | |

| | | |

| | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,095,000 | | |

$ | 3,391,000 | |

| Restricted cash | |

| 75,000 | | |

| 75,000 | |

| Total cash, cash equivalents and restricted cash | |

$ | 1,170,000 | | |

$ | 3,466,000 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for taxes | |

$ | 5,000 | | |

$ | 2,000 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

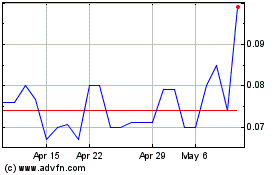

PURE Bioscience (PK) (USOTC:PURE)

Historical Stock Chart

From Dec 2024 to Jan 2025

PURE Bioscience (PK) (USOTC:PURE)

Historical Stock Chart

From Jan 2024 to Jan 2025