UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of the Commission Only (as permitted by Rule 14z-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

PCS EDVENTURES!.COM, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computer on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date File:

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No

Page 2 of 22

PCS EDVENTURES!.COM, INC.

345 Bobwhite Court, Suite 200

Boise, Idaho 83706

(208) 343-3110

NOTICE OF ANNUAL MEETING TO SHAREHOLDERS

To the Shareholders of PCS Edventures!.com, Inc.:

The 2010 Annual Meeting of Shareholders of PCS Edventures!.com, Inc. will be held at the Company’s offices located at 345 Bobwhite Court, Suite 200 Boise, Idaho 83706, on Wednesday, August 25, 2010, at 10:00 a.m. MDT. At this year’s meeting, we plan to conduct the following business items:

1)

Re-elect the current members of our Board of Directors;

2)

Ratify the election of M&K CPAs, PLLC as our independent registered public accounting firm for our fiscal year ending March 31, 2011.

3)

Transact such other business as may properly come before the Annual Meeting (and any adjournment thereof), all in accordance with the accompanying Proxy Statement.

Shareholders of record at the close of business on Thursday, July 15, 2010, are entitled to notice of and vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to participate by completing, dating, and signing the accompanying proxy card and returning it to our offices as soon as possible in the enclosed self-addressed, stamped envelope provided for your convenience. If you send your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

Should any shareholder wish to submit a proposal for consideration at the Annual Meeting, the deadline is Monday, August 16, 2010. Notice of a shareholder proposal submitted outside the processes of Rule 14a-8 of the Securities and Exchange Commission shall be considered untimely.

The fiscal year 2011 Annual Meeting will be held on or about August 25, 2011. Should any shareholder wish to submit a proposal for consideration at the fiscal year 2011 Annual Meeting, the proposal should be submitted by July 5, 2011, in accordance with Rule 14a-8 of the Securities and Exchange Commission. Any proposal submitted after the deadline shall be considered untimely.

By the Order of the Board of Directors,

/s/Donald J. Farley/

Donald J. Farley,

Secretary

Page 3 of 22

PCS EDVENTURES!.COM, INC.

345 Bobwhite Court, Suite 200

Boise, Idaho 83706

PROXY STATEMENT

Annual Meeting and Proxy Solicitation Information.

This Proxy Statement is furnished by the Board of Directors of PCS Edventures!.com, Inc. (the “Company,” “PCS,” “us,” or “our”) for the solicitation of proxies from the holders of our common stock in connection with the Annual Meeting of shareholders to be held at our offices located at 345 Bobwhite Court, Suite 200 Boise, Idaho 83706, on Wednesday, August 25, 2010, at 10:00 a.m. MDT, and at any recess or adjournment thereof. It is expected that the Notice of Annual Meeting of Shareholders, our Annual Report on Form 10K of the Securities and Exchange Commission for fiscal year ended March 31, 2010, which is incorporated herein by reference, this Proxy Statement, and the accompanying proxy card will be mailed to shareholders starting on or about July 30, 2010.

Voting Procedures.

The presence in person or by proxy of a majority of the voting power at the Annual Meeting is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be considered represented at the Annual Meeting for the purpose of determining a quorum. The shares represented by each proxy will be voted in accordance with the instructions given therein. Where no instructions are indicated, the proxy will be voted in favor of all matters to be voted on as set forth in the proxy and, at the discretion of the persons named in the proxy, on any other business that may properly come before the Annual Meeting. Each shareholder will be entitled to one vote for each share of common stock held and will not be entitled to cumulate votes in the election of Directors. Shares that are authorized but not yet issued will not be entitled to vote at the Annual Meeting.

Shareholders can ensure that their shares are voted at the Annual Meeting by signing, dating, and returning the accompanying proxy card in the self-addressed, stamped envelope provided. The submission of a signed proxy will not affect a shareholder’s right to attend the Annual Meeting and vote in person. Shareholders who execute proxies retain the right to revoke them at any time before they are voted by filing with the Secretary of the Company a written revocation or a proxy bearing a later date at the corporate address. The presence at the Annual Meeting of a shareholder who has signed a proxy does not, by itself, revoke that proxy unless the shareholder attending the Annual Meeting files a written notice of revocation of the proxy with the Secretary of the Company at any time prior to the voting of the proxy at the meeting.

Proxies will be voted as specified by the shareholders. Where specific choices are not indicated, proxies will be voted FOR the election of each item so presented.

The Board of Directors knows of no other matters to be presented for shareholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote on such matters in their discretion.

Page 4 of 22

The expense of printing and mailing proxy materials, including expenses involved in forwarding proxy materials to beneficial owners of common stock held in the name of another person, will be paid by us. No solicitation, other than by mail, is currently planned.

Only shareholders of record at the close of business on Thursday, July 15, 2010 (this date is referred to as the “record date”), are entitled to receive notice of and to vote the shares of common stock registered in their name at the Annual Meeting. As of the record date, we had approximately 39,956,717 shares of our common stock outstanding. Each share of common stock entitles its holder to cast one vote on each matter to be voted upon at the Annual Meeting.

The Idaho Business Corporation Act requires the presence of a quorum to conduct business at the Annual Meeting. A quorum is defined as the presence, either in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting. The shares represented at the Annual Meeting by proxies that are marked “withhold authority” will be counted as shares present for the purpose of determining whether a quorum is present. Broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from beneficial owners to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will also be counted as shares present for purposes of determining a quorum.

Directors are elected by the affirmative vote of a plurality of the shares of common stock present, either in person or by proxy, at the Annual Meeting and entitled to vote. For this purpose, “plurality” means that the individuals receiving the largest number of votes are elected as Directors, up to the maximum number of Directors to be chosen at the election. In the election of Directors, votes may be cast in favor or withheld. Votes that are withheld and broker non-votes will have no effect on the outcome of the election of Directors.

A majority of the outstanding shares of the Company entitled to vote, represented in person or by proxy, constitute a quorum at the Annual Meeting of shareholders.

Effective Dates

.

The election of Directors, if approved by the shareholders, will be effective immediately following the Annual Meeting.

Security Ownership of Management and Certain Beneficial Owners.

The following table outlines information provided to the Company as of March 31, 2010 regarding beneficial ownership of PCS Common Stock by the Company’s Directors, executive management, and any 5% beneficial owners.

Page 5 of 22

DIRECTORS AND EXECUTIVE OFFICERS

|

|

|

|

|

|

|

|

|

Amount and Nature of Beneficial Ownership (1)

|

|

Name and Address of Beneficial Owner

|

Shares Owned

|

Shares Issuable Upon Exercise of Options

|

Shares Issuable Upon Receipt of Restricted Stock Units

|

|

|

|

|

|

|

|

Percentage Owned (2)

|

|

(3)

|

|

|

Total

|

|

|

Anthony A. Maher, Chairman of the Board, CEO, and Acting CFO (4)

|

2,190,809

|

0

|

0

|

2,190,809

|

5.52%

|

|

345 Bobwhite Court, Suite 200

|

|

Boise, Idaho 83706

|

|

Cecil D. Andrus, Director

|

716,438

|

461,040

|

|

1,177,478

|

2.97%

|

|

345 Bobwhite Court, Suite 200

|

|

|

Boise, Idaho 83706 (resigned effective March 1, 2010)

|

|

|

Dehryl A. Dennis, Director

|

34,670

|

20,971

|

35,294

|

90,935

|

0.23%

|

|

345 Bobwhite Court, Suite 200

|

|

|

Boise, Idaho 83706

|

|

|

Donald J. Farley, Secretary and Director

|

723,999

|

580,313

|

35,294

|

1,339,606

|

3.37%

|

|

345 Bobwhite Court, Suite 200

|

|

|

Boise, Idaho 83706

|

|

|

Michael K. McMurray, Director

|

261,888

|

74,466

|

35,294

|

371,648

|

Less than 1.0%

|

|

345 Bobwhite Court, Suite 200

|

|

|

Boise, Idaho 83706

|

|

|

Robert O. Grover, President, COO, and CTO

|

304,707

|

50,000

|

0

|

354,707

|

Less than 1.0%

|

|

345 Bobwhite Court, Suite 200

|

|

Boise, Idaho 83706

|

|

All officers and Directors as a group

|

4,232,511

|

1,186,790

|

105,882

|

5,525,183

|

13.92%

|

|

(six persons)

|

|

(1)

Unless otherwise noted above, we believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them. For purposes hereof, a person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from the date hereof upon the exercise of warrants or options or the conversion of convertible securities. Each beneficial owner's percentage of ownership is determined by assuming that any warrants, options or convertible securities that are held by such person (but not those held by any other person) and which are exercisable within 60 days from the date hereof, have been exercised. There are currently no beneficial owners, as defined by the Securities Exchange Commission as owners with greater than 10% ownership, other than our Directors and executive officers.

(2)

Based upon 39,700,831 shares issued and outstanding as of the first date listed in this section.

(3)

This is the amount exercisable by the Directors and executive officers as of March 31, 2010.

Page 6 of 22

(4)

Includes (i) 2,116,309 shares owned of record by Mr. Maher; (ii) 9,500 shares which are beneficially owned by Sullivan Maher, LLC, for which Mr. Maher acts as a manager; (iii) 35,000 shares owned by the Nick Maher Foundation, of which Mr. Maher is a trustee; (iv) 30,000 shares owned by the Maher Family Partnership LLP.

Proposal No. 1

Election of Directors

The nominees for election as Directors are the four members of our current Board of Directors: Anthony A. Maher, Donald J. Farley, Dehryl A. Dennis, and Michael K. McMurray. Each Director is to serve until the next Annual Meeting of our shareholders or until the Director’s death, resignation or termination and the appointment and qualification of a successor.

Nominees for Director.

|

|

|

|

|

|

Name

|

Age

|

Position

|

Held Position Since

|

|

Anthony A. Maher

|

62

|

Chairman, CEO, and acting CFO

|

1989

|

|

Donald J. Farley

|

62

|

Secretary and Director

|

1994

|

|

Dehryl A. Dennis

|

69

|

Director

|

2006

|

|

Michael K. McMurray

|

64

|

Director

|

1989-1994, 2004-Present

|

Anthony A. Maher.

Mr. Maher is CEO and Chairman of the Board. Mr. Maher was recruited to PCS at its inception as Chairman of the Board, President and Chief Executive Officer and structured the purchase of PCS Schools, Inc. and PCS LabMentors, Under Mr. Maher‘s leadership, the Company has developed curriculum from an initial four core areas to over 60; developed the distance developer database; and created web-based publishing expertise. From 1982 to 1989 he was founder and Chairman of the Board of National Manufacturing Company, Inc. and its subsidiary, National Medical Industries, Inc. From 1979 to 1982, Mr. Maher was Executive Vice President for Littletree Inns, a hotel company based in Boise, Idaho with properties throughout the Northwest. Mr. Maher graduated from Boise State University in 1970 with a Bachelor of Arts degree in Political Science. Mr. Maher has not held a directorship position nor was he a directorship nominee for any other public company or investment company in the past five (5) years.

Donald J. Farley

. Mr. Farley is the Secretary of the Company and acted as the Company's legal counsel from 1994 until 2005. Mr. Farley is a founding partner of the law firm of Hall, Farley, Oberrecht & Blanton, P.A. His legal practice emphasizes litigation and representation of closely held businesses. He has been in private practice since 1975, after serving a two-year judicial clerkship with former United States District Judge J. Blaine Anderson. Mr. Farley is admitted to practice before all state and federal courts in Idaho and has also been admitted to practice before the United States Supreme Court. He is a member of the American Bar Association, the International Association of Defense Counsel, Defense Research Institute, the Idaho State Bar Association and the Association of Trial lawyers of America. Mr. Farley graduated from the University of Idaho in 1970 with a Bachelor of Arts degree in Economics and from the University of Idaho College of Law in 1973. Mr. Farley has

Page 7 of 22

not held a directorship position nor was he a directorship nominee for any other public company or investment company in the past five (5) years.

Dehryl A. Dennis, Ed.D.

Dr. Dennis has had a 36-year career that took him from teaching in small public schools in southwest Idaho to Puerto Rico and Illinois, and then returned him to his native state as a district administrator in Boise, Idaho. During his entire professional career, Dr. Dennis was an outspoken advocate for programs that emphasized applied learning. Because of his strong belief that most people learn by “doing rather than thinking about doing,”he supported and helped implement off-school site classrooms in malls and hospitals; partnerships with trade unions, small business, and industry; and cooperative agreements with institutions of higher learning. The success of these programs culminated in the construction of the Dehryl A. Dennis Professional Technical Center, which opened in 1999 and presently serves approximately 900 students from 16 area high schools. Appointed in 1976 as Director of Personnel of the Boise School District, he later served as Assistant Superintendent and then Deputy Superintendent until he was appointed District Superintendent in 1994. He remained as Superintendent until his retirement in July 1999. Dr. Dennis has not held a directorship position nor was he a directorship nominee for any other public company or investment company in the past five (5) years.

Michael K. McMurray.

Mr. McMurray returned to the PCS Board in 2004 after having served on the Board from 1989 through 1994. He retired as a financial executive from Boise Cascade Corporation in 2001. Mike has served on a number of company and not-for-profit boards. Mike is currently on the PCS Edventures!.com, Inc and Tenxsys Boards. Mike also serves as a director for the non-public company Regence Blue Shield of Idaho and on the public not-for-profit Finance Committee of the Board of the Idaho Community Foundation. Mike has worked as a consultant primarily engaged in financing growth for a broad range of companies including the Titcomb Family Trust and Paksense. Community boards include past Board Chairman of Idaho Housing and Finance Association and Board Chairman of the Idaho Housing Company. He is a past board member of Farmers and Merchants Bank, the Downtown Boise Association, Hillcrest Country Club and the Boise Family YMCA. Mike is a graduate of the University of Idaho with a finance degree and the Harvard Business School Executive MBA program. Other than the items mentioned above, Mr. McMurray has not held a directorship position in any other publicly held company or investment company in the past five (5) years.

Director Qualifications

.

In evaluating potential Directors, Mr. Maher and the Board consider the following factors:

·

the appropriate size of our Board of Directors;

·

our needs with respect to the particular talents and experience of our Directors;

·

the knowledge, skills and experience of nominees, including experience in finance, administration, or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

·

familiarity with the educational industry;

Page 8 of 22

·

experience with accounting rules and practices; and

·

the desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board members.

Our goal is to assemble a Board of Directors that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, Mr. Maher and the Board will also consider candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for Director nominees, although Mr. Maher and the Board of Directors may also consider such other factors as they may believe are in the best interests of PCS and its shareholders.

Mr. Maher and the Board of Directors identify nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-election. If any member of the Board does not wish to continue in service or if we decide not to re-nominate a member for re-election, we then identify the desired skills and experience of a new nominee in light of the criteria above. Current members of the Board of Directors are polled for suggestions as to individuals meeting the criteria described above. The Board may also engage in research to identify qualified individuals. To date, we have not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in the future to retain a third party search firm, if necessary.

The Company has chosen to combine the Chairman of the Board and Chief Executive Officer positions. The CEO is actively involved in the day-to-day operations of the Company and provides the best conduit of information to the Board. This allows for greater communication and transparency between the Company’s activities and the Board’s responsibilities and oversight.

Role of Board in Risk Oversight

.

One of the functions of our Board of Directors is informed oversight of our risk management process. The Board does not have a standing risk management committee but oversee this function through the Board as a whole, as well as through the audit committee, which is responsible for discussing guidelines and policies to govern the process by which risk assessment and management is undertaken.

Our Board oversees risk, including operational risk, liquidity risk and credit risk in various ways. Board meetings generally include discussions among Board members, management and outside consultants, when practical, regarding material risks we face, including operational and financial risk. Our management provides information to the Board regarding our approach to material risks, both at meetings and on a regular basis during informal discussion. In addition, the Board generally reviews the disclosures in our Annual Report on Form 10-K, including the risk factors. The Board’s discussions with management include whether all material risks and concerns have been identified and the manner in which management will address the issues.

Page 9 of 22

Potential Conflicts of Interests of Compensation Consultants.

None.

Committees.

Audit Committee:

We chartered an audit committee in 2001 for the purpose of engaging accounting firm(s), which is currently M&K CPAs, PLLC, for the annual audit. The audit committee currently consists of Board members Michael K. McMurray and Dehryl A. Dennis. Mr. McMurray is considered an audit committee financial expert based on his previous work experience and the definition contained in Reg. 228.401 Instructions to paragraph (e)(1) of Item 401 of the Sarbanes-Oxley Act. The audit committee continued to implement the formal policy regarding the scope, responsibilities and length of service for the audit committee adopted in fiscal year 2005, as revised in fiscal year 2010. A copy of this policy can be accessed on our website at www.edventures.com/ac. The audit committee meets with M&K CPAs, PLLC via telephone on a quarterly basis. In connection with the Annual meeting on August 27, 2009, the audit committee held one (1) formal meeting with the Board of Directors. In addition, the audit committee discusses as needed auditing issues via telephone conference and during regularly scheduled Board meetings, after which time the conversations are incorporated into the Company’s minutes.

The audit committee is currently responsible for (i) appointing or replacing our auditing firm, (ii) reviewing the scope, reports, costs, and other items related to the quarterly reviews and annual audit conducted by our auditors, (iii) reviewing the qualifications, expertise, and suitability of our auditors, (iv) speaking with and approving all actions to be undertaken by our auditors, and (v) reviewing and providing feedback for our internal control reports.

Nominating or Governance Committee:

PCS does not have a standing nominating or governance committee or a charter with respect to the process for nominations to our Board of Directors. Currently, our Directors submit nominations for election to fill vacancies on the Board to the entire Board for its consideration.

Our Bylaws do not contain any provision addressing the process by which a shareholder may nominate an individual to stand for election to the Board of Directors, and we do not have any formal policy concerning shareholder recommendations to the Board of Directors. To date, we have not received any recommendations from non-affiliate shareholders requesting that the Board consider a candidate for election to the Board. However, the absence of such a policy does not mean that the Board of Directors would not consider any such recommendation, if one is received. The Board would consider any candidate proposed in good faith by a shareholder. To do so, a shareholder should send the candidate’s name, credentials, contact information and his or her consent to be considered as a candidate to the Chairman of the Board, Anthony A. Maher at 345 Bobwhite Court, Suite 200, Boise, Idaho 83706. The proposing shareholder should also include his or her contact information and a statement of his or her share ownership in the Company (how many shares owned and for how long).

Our Board of Directors does not have a formal process for shareholders to send communications to the Board. However, our Directors take great interests in the concerns of

Page 10 of 22

shareholders. In addition, our Directors review and give careful consideration to any and all shareholder communications. Shareholder communications may be sent to: Board of Directors, PCS Edventures!.com, Inc., 345 Bobwhite Court, Suite 200, Boise, Idaho 83706. Communications may also be sent to any individual Director at our address.

Compensation Committee:

We adopted a compensation committee during fiscal year 2004 for the purpose of regulating management’s compensation, as well as any incentive plans proposed by the Company. The compensation committee currently consists of Board Members Donald J. Farley and Michael K. McMurray. Mr. McMurray replaced Cecil D. Andrus upon his resignation on March 1, 2010. None of the members of the committee is now or was previously an officer or employee of the Company or any of its subsidiaries. Compensation for each member of the compensation committee is included in the table titled Director Compensation for fiscal year 2010.

Compensation Committee Report.

This report is being submitted by the compensation committee members, Mr. Farley and Mr. McMurray. This report addresses what the compensation committee is responsible for and how the Company currently decides on compensation of its executive officers.

The compensation committee is currently responsible for (i) reviewing and monitoring the appropriateness of the Company’s executive compensation procedures, (ii) reviewing and approving, where necessary, compensation and benefits to executives, (iii) evaluating the performance of the executive officers, (iv) monitoring the benefit plan(s) offered to employees of the Company, and (v) evaluating and making recommendations for the stock incentive plan(s).

The compensation committee did not hold any meetings during fiscal year 2010. However, compensation was discussed during regularly scheduled Board meetings, after which time the discussions were incorporated into the Company’s minutes. Within these discussions, the compensation committee discussed topics including, but not limited to compensation awarded to, earned by, or paid to the executive officers of the Company; current and long-term compensation for executive officers; and proposed incentive compensation plans. The compensation committee sets all levels of compensation for the executive officers. For executive officers other than the CEO, the committee reviews, analyzes, and makes a determination of compensation based on recommendations from the CEO. The CEO’s compensation is determined by the compensation committee each year after open discussions with other Board members, excluding the Chairman, who is the CEO. The key components of our compensation strategy is to link performance and shareholder value to salaries, stock bonus awards, and stock option awards to recognize the contribution of each individual executive officer, as well as to recognize the business results as demonstrated by the executive officers as a whole.

The Compensation Committee of

the Board of Directors

Donald J. Farley, Chairman

Michael K. McMurray

Page 11 of 22

Executive Compensation:

Summary Compensation Table For Fiscal Years 2007-2010.

The following table provides information relative to compensation paid to our executive officers for the fiscal years ended March 31, 2007 through March 31, 2010. During the fiscal year ended March 31, 2010, Mr. Grover’s salary comprised 7.36% of the total compensation paid to all employees, while Mr. Maher’s salary comprised 8.84% of the total compensation paid to all employees.

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

Year

|

Salary ($)

|

Bonus ($)

|

Stock Awards

($)

|

Option Awards

($)

|

Non-Equity Incentive Plan Compensation

($)

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings

($)

|

All Other Comp.

($)

|

Total ($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

|

Anthony A. Maher Chairman, CEO, and Acting CFO

|

03/31/10

|

106,000

|

0

|

14,000

|

0

|

0

|

0

|

*

|

120,000

|

|

03/31/09

|

120,000

|

0

|

0

|

0

|

0

|

0

|

*

|

120,000

|

|

03/31/08

|

120,000

|

0

|

0

|

0

|

0

|

0

|

*

|

120,000

|

|

Robert O. Grover, President, COO, and CTO

|

03/31/10

|

81,667

|

0

|

18.333

|

0

|

0

|

0

|

*

|

100,000

|

|

03/31/09

|

100,000

|

0

|

15,000

|

0

|

0

|

0

|

*

|

115,000

|

|

03/31/08

|

100,000

|

0

|

0

|

0

|

0

|

0

|

*

|

100,000

|

*Aggregate amount of other compensation is less than $50,000or 10% of the total annual salary and bonus reported.

Page 12 of 22

Grants of Plan-Based Awards For Fiscal Year 2010.

The following table outlines the equity-based awards granted to our executive officers for the fiscal year ended March 31, 2010. The Company does not currently provide for any incentive plan awards.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Grant Date

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards

|

Estimated Future Payouts Under Equity Incentive Plan Awards

|

All Other Stock Awards: Number of Shares of Stock or Units (#)

|

All Other Option Awards: Number of Securities Underlying Options (#)

|

Exercise or Base Price of Option Awards ($/Sh)

|

|

|

|

Threshold ($)

|

Target ($)

|

Max-imum ($)

|

Thres-

Hold

(#)

|

Target (#)

|

Max-imum (#)

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

(k)

|

|

Anthony A Maher, Chairman, CEO and Acting CFO

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Robert O Grover, President, COO, and CTO

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Page 13 of 22

Outstanding Equity Awards at Fiscal Year-End 2010.

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards

|

Stock Awards

|

|

Name

|

Number of Securities Underlying Unexercised Options (#) Exercisable

|

Number of Securities Underlying Unexercised Options (#) Unexercisable

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)

|

Option Exercise Price ($)

|

Option Expiration Date

|

Number of Shares of Units of Stock That Have Not Vested (#)

|

Market Value of Shares or Units of Stock That Have Not Vested ($)

|

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)

|

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

|

Anthony Maher

|

0

|

0

|

N/A

|

N/A

|

N/A

|

0

|

0

|

N/A

|

N/A

|

|

Robert Grover

|

30,000

|

20,000

|

N/A

|

$1.70

|

12/11/2011

|

0

|

0

|

N/A

|

N/A

|

Effective May 2009, in an effort to reduce cash outflow the officers assumed a 20% cash compensation reduction and receive the 20% in Restricted Rule 144 common stock. Currently, the Company is paying the officers the following annual salaries: Anthony A. Maher - $96,000 in cash and 24,000 shares of Restricted Rule 144 common stock; Robert O. Grover - $80,000 in cash and 20,000 shares of Restricted Rule 144 common stock. The Company also makes available medical and dental insurance coverage for its officers and other U.S. employees.

Option Exercises and Stock Vested for Fiscal Year 2010.

The following table provides information related to stock option exercises by executive officers of the Company, as well as any stock awards vesting during the Fiscal Year Ended March 31, 2010.

|

|

|

|

|

|

|

|

Option Awards

|

Stock Awards

|

|

Name

|

Number of Shares Acquired on Exercise (#)

|

Value Realized on Exercised ($)

|

Number of Shares Acquired on Vesting (#)

|

Value Realized on Vesting ($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

|

Anthony Maher

|

47,411

|

$14,223

|

N/A

|

N/A

|

|

Robert Grover

|

270,703

|

100,530

|

N/A

|

N/A

|

Page 14 of 22

Director Independence.

We believe that all members of our Board of Directors, except for Mr. Maher are independent based on the following definition of NASDAQ, which is quoted below from Rule 5605(a)(2). Our Board of Directors has adopted this definition of an “independent director” even though we are not required to have independent directors.

(2) ”Independent Director” means a person other than an Executive Officer or employee of the Company or any other individual having a relationship, which, in the opinion of the Company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. For purposes of this rule, “Family Member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home. The following persons shall not be considered independent:

(A) a director who is, or at any time during the past three years was, employed by the Company;

(B) a director who accepted or who has a Family Member who accepted any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following:

(i)

compensation for board or board committee service;

(ii)

compensation paid to a Family Member who is an employee (other than an Executive Officer) of the Company; or

(iii)

benefits under a tax-qualified retirement plan, or non-discretionary compensation.

Provided, however, that in addition to the requirements contained in this paragraph (B), audit committee members are also subject to additional, more stringent requirements under Rule 5605(c)(2).

(C) a director who is a Family Member of an individual who is, or at any time during the past three years was, employed by the company as an Executive Officer;

(D) a director who is, or has a Family Member who is, a partner in, or a controlling Shareholder or an Executive Officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than the following:

Page 15 of 22

(i)

payments arising solely from investments in the Company’s securities; or

(ii)

payments under non-discretionary charitable contribution matching programs.

(E) a director of the Company who is, or has a Family Member who is, employed as an Executive Officer of another entity where at any time during the past three years any of the Executive Officers of the Company serve on the compensation committee of such other entity; or

(F) a director who is, or has a Family Member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years.

(G) in the case of an investment company, in lieu of paragraphs (A)-(F), a director who is an “interested person” of the Company as defined in Section 2(a)(19) of the Investment Company Act of 1940, other than in his or her capacity as a member of the board of directors or any board committee.

Director Compensation For Fiscal Year 2010.

Each fiscal year, the Board of Directors sets the dollar amount for the compensation of outside Directors for their services. As of August 31, 2009, PCS had accrued approximately $115,000 of director fees pending review and implementation of the PCS 2009 Equity Incentive Plan. The accrued compensation was paid to the Directors with PCS common stock on March 17, 2010, at the per share closing price of $0.88. on March 16, 2010.

Effective October 1, 2009, the Board resolved and adopted the annual fees to be paid to outside Directors of the Board at $30,000 annually and paid in the form of Restricted Stock Units, or other form authorized under the PCS 2009 Equity Incentive Plan as the Board determines. Restricted Stock Units are subject to forfeiture as described in the 2009 Plan. As of March 31, 2010 the Company had accrued $17,500 of director fees. The current CEO is excluded from receiving additional compensation as a Board member beginning the second fiscal quarter of 2006 by unanimous consent of the Board and his own request.

The Board of Directors granted additional compensation to Michael K. McMurray for his additional work on behalf of the Company during the absence of Mr. Anthony A. Maher, CEO and Acting Chief Financial Officer. Common stock in the amount of 33,333 shares was issued to Mr. McMurray on March 8, 2010. The price per share was $0.90, for a total valuation of $30,000. The price per share was based on the closing price from the preceding day.

As of March 31, 2010, the Company expensed $15,000 in director fees for Cecil D. Andrus for meritorious service as a member of the Board of Directors for his term beginning from his election as a member of the Board in August 2009, to March 1, 2010, the effective date of his resignation. As of March 31, 2010, said compensation was accrued as stock payable.

Page 16 of 22

The following table shows awards and payments to members of our Board for fiscal year 2010 as compensation in accordance with the Board approved director compensation. The table excludes our Chairman, who is also an executive officer. The Chairman’s compensation is fully reflected in the Summary Compensation Table for Fiscal Year 2007-2010, above.

|

|

|

|

|

|

|

|

|

|

Name

|

Fees Earned or Paid in Cash ($)

|

Stock Awards ($)

|

Option Awards ($)

|

Non-Equity Incentive Plan Compensation ($)

|

Change in Pension value and Nonqualified Deferred Compensation Earnings

|

All Other Compensation ($)

|

Total ($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

|

Cecil Andrus (resigned effective March 1, 2010)

|

0

|

43,750

|

0

|

0

|

0

|

0

|

43,750

|

|

Dehryl Dennis

|

0

|

28,750

|

0

|

0

|

0

|

0

|

28,720

|

|

Donald Farley

|

0

|

28,750

|

0

|

0

|

0

|

0

|

28,750

|

|

Michael McMurray

|

0

|

58,750

|

0

|

0

|

0

|

0

|

58,750

|

Certain Relationships and Related Transactions.

During the last two fiscal years ended March 31, 2010 and 2009, we have granted common stock to members of our management.

During the month of March 2010, we issued 32,670 shares of common stock to each of our four Board Members for a total issuance of 130,680 shares at an exercise price of $0.88 per share. These shares were issued for compensation for the Board for services for the period October 2007 through August 2009. These services had previously been accrued, in the period earned, pending the review and implementation of the PCS 2009 Equity Incentive Plan

During the month of March 2010, we issued 33,333 shares of common stock at a price per share of $0.90 to one of our Board Members for additional services rendered during the absence of Mr. Maher due to medical reasons.

As of March 31, 2010 the Company expensed $15,000 in director fees for Cecil D. Andrus for meritorious service as a member of the Board of Directors for his term beginning from his election as a member of the Board in August 2009, to March 1, 2010, the effective date of his resignation. As of March 31, 2010 said compensation was accrued as stock payable.

Family Relationships.

There are no family relationships between any of our Directors or executive officers.

Page 17 of 22

Involvement In Certain Legal Proceedings.

During the past ten years, none of our present or former Directors, executive officers, promoters, control persons or persons nominated to become Directors or executive officers:

1)

Filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

2)

Was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

3)

Was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities;

4)

Was found by a court of competent jurisdiction in a civil action, by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated any federal or state securities law, and the judgment in such civil action or finding by the Securities and Exchange Commission or the Commodity Futures Trading Commission has not been subsequently reversed, suspended, or vacated.

5)

Was subject to any judicial or administrative proceedings resulting from involvement in mail or wire fraud, or fraud in connection with any business entity.

6)

Was subject to any judicial or administrative proceedings based on violations of federal or state securities, commodities, banking or insurance laws and regulations, or any settlement to such actions.

7)

Did not receive any disciplinary sanctions or orders imposed by stock, commodities or derivatives exchanges or other self-regulatory organizations.

Transactions with Related Persons.

See Certain Relationships and Related Transactions.

Parents.

None, not applicable.

Promoters and Control Persons.

None, not applicable.

Code of Ethics.

We have adopted a Code of Ethics and it was attached as Exhibit 14 to our 2004 Annual Report on Form 10-KSB of the Securities and Exchange Commission and was reviewed and updated in FY2010. This policy can be accessed in our website at www.edventures.com/cg. If any shareholder does not have Internet access, a copy of the Code of Ethics will be provided on request to us at no cost.

Page 18 of 22

Section 16(a) Beneficial Ownership Reporting Compliance.

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and Directors and persons who own more than ten percent (10%) of our common stock to file initial reports of ownership (Form 3) and reports of changes in ownership (Form 4) with the Securities and Exchange Commission. Executive officers, Directors, and greater than 10% owners are required by the Securities and Exchange Commission’s regulations to furnish us with copies of all Section 16(a) forms that they file.

Based solely on review of the copies of such forms furnished to us, we believe that all Section 16(a) filing requirements applicable to our executive officers and Directors were timely filed during fiscal year 2010, with the exception of our President, COO, and CTO, Robert O. Grover, who filed the following: Form 4 on July 6, 2009 for the cashless purchase of options granted for net shares received of 153,726 with a transaction date of June 12, 2009, Form 4 filed July 6, 2009 for 2,368 common shares granted in lieu of cash compensation for the period June 16, 2009 through June 30, 2009, Form 4 filed January 6, 2010 for the sale of 10,000 shares of common stock on December 30, 2009, and Form 4 filed January 22, 2010 for the sale of 6,000 shares of common stock on January 19, 2010

PROPOSAL No. 1

Election of Directors

Board Members for Re-election

.

Anthony A. Maher has been with the organization since its inception as Chairman of the Board and CEO. He is also the Acting CFO. During his tenure, he has made countless contributions, including overseeing growth in curriculum from an initial four core areas to over 60; the development of the distance developer database; and the creation of web-based publishing expertise. Mr. Maher was instrumental in bringing PCS into the international light with offices and affiliations in Canada, Mexico, and the Middle East. We feel he is more than qualified to be re-elected to the Board because of his long tenure and knowledge of the Company, his business acumen, and his consensus building skills that continue to move the Company closer to profitability.

Donald J. Farley was previously corporate counsel from 1994 until 2002, during which time he guided the Company in merger and acquisition activities, as well as all agreements between the company and its vendors and customers. In 1988 he co-founded one of the larger legal firms in Boise and has been the firm’s managing shareholder for the past 15 years. He has been active in the Boise and Idaho legal and business communities throughout his 35 years as a practicing attorney. We feel he is more than qualified to be re-elected to the Board because of his long tenure and knowledge of the Company, his legal experience and general business experience. Mr. Farley currently acts as the Corporate Secretary and is our gateway to the legal community.

Derhyl A. Dennis was previously the Superintendent of the Boise School District and served in that capacity for over 10 years after having been Chief Deputy Superintendent for 10 years. During

Page 19 of 22

that time, he brought the Boise School District from an under-performing school system to the best performing in the State of Idaho. During his tenure the District started the Derhyl A. Dennis Technical Center, a 40,000 square foot technical school within the Boise District. We feel Dr. Dennis, a Board Member since 2000, is more than qualified to sit on our Board, as he is the technical advisor to our in-house instructional designers and curriculum writers for all products developed for the classroom. He is our sounding board for product and program development.

Michael K. McMurray was previously the Assistant Treasurer of Boise Cascade Corporation, a $4.0B forest products and paper Company. Mr. McMurray returned to our Board in 2004 after serving on the Board from 1989 through 1994. He is familiar with our Company and personnel. He provides financial expertise that is useful to our company. Mr. McMurray currently acts as the Chairman of our Audit Committee. He also serves on our Compensation Committee and is generally in our offices weekly staying in close contact with developments. He acted as a sounding board for our employees when our CEO was absent recovering from a heart attack. We feel Mr. McMurray is a considerable asset to PCS.

We feel that the individual members of our Board of Directors are of the highest quality and frankly, we feel fortunate to have gathered what we consider a Blue Ribbon Board of Directors for our Company. Each of these gentlemen is active, engaged and committed to our Company.

The Board of Directors recommends that shareholders vote FOR Proposal No. 1

to Re-Elect All Members of the Company’s Board of Directors.

PROPOSAL No. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The audit committee of our Board of Directors has selected to M&K CPAs, PLLC as our independent registered public accounting firm for the fiscal year ending March 31, 2011, and has further directed that management submit the selection of an independent registered public accounting firm for ratification by the shareholders at the Annual Meeting

Neither our bylaws nor other governing documents or law require shareholder ratification of the selection of M&K CPAs, PLLC as our independent registered public accounting firm. However, the audit committee is submitting the selection of M&K CPAs, PLLC to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the audit committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the company and our shareholders.

Representatives of M&K CPAs, PLLC are not expected to be present at the shareholders’ meeting for the fiscal year ending March 31, 2010. Accordingly, they will not have the opportunity to make a statement nor will they be available to respond to appropriate questions.

Page 20 of 22

Ratification of the selection of M&K CPAs, PLLC requires the affirmative vote of a of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the shareholders.

Independent Registered Public Accounting Firm Fee Information.

In connection with the audit of our 2010 financial statements, we entered into an engagement agreement with M&K CPAs, PLLC that set forth the terms by which M&K CPAs, PLLC would perform audit services for us, including responsibilities of M&K CPAs, PLLC and management in the conduct of the audit and estimated fees. That agreement is subject to alternative dispute resolution procedures.

The following paragraph summarizes aggregate fees billed or to be billed to us for services performed for the fiscal years ended March 31, 2010 and 2009, by M&K CPAs, PLLC, our independent registered public accounting firm.

The total fees paid to M&K CPAs, PLLC for professional services performed in connection with the audit of our financial statements for the fiscal year ended March 31, 2010 and for review of our financial statements in connection with our 1

st

, 2

nd

and 3

rd

Quarterly Reports on Form 10-Q, were approximately $40,000. The Company paid $44,961 in fees during fiscal year ended March 31, 2009, which included review of our financial statements for our Quarterly Reports and other reviews related to regulatory filings required by the SEC. The total fees paid to M&K CPAs, PLLC were approximately $37,000. The total fees paid HJ & Associates were approximately $7,961 for fiscal years 2010 and 2009, respectively.

All services provided by M&K CPAs, PLLC for the fiscal years ended March 31, 2010 and 2009 were approved by the audit committee.

The Board of Directors recommends that shareholders vote FOR Proposal No. 2

to Ratify the Election of M&K CPAs, PLLC.

Proposal No. 3

OTHER MATTERS

The Board of Directors is not aware of any business other than the aforementioned matters that will be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, it is the intention of the person named in the enclosed proxy to vote thereon in accordance with his best judgment.

A copy of our annual report 10K for the fiscal year ending March 31, 2010 and filed July 1, 2010 is attached. Should additional copies be required they may be obtained by one of the following means:

1)

E-mailing

jconaway@pcsedu.com

;

2)

Calling Investor Relations at (208) 343-3110;

3)

Visiting www.edventures.com/ir;

4)

Writing Investor Relations PCS Edventures!.com, Inc. 345 Bobwhite Court, Suite 200 Boise, Idaho 83706

Page 21 of 22

We look forward to seeing many of our shareholders at our Annual Meeting on August 25, 2010. If you are unable to attend, please do not forget to submit your proxy to have your shares voted according to your wishes.

Sincerely,

/s/Anthony A. Maher

Anthony A. Maher

Chairman & CEO

Page 22 of 22

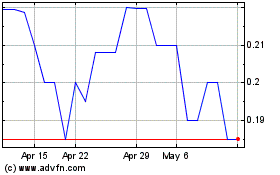

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Jun 2024 to Jul 2024

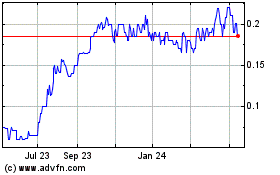

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Jul 2023 to Jul 2024