Filed Pursuant to Rule 424(b)(2)

Registration Statement

Nos. 333-273353

333-273353-01

The information in this preliminary pricing supplement

is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

|

| |

Subject

to Completion. Dated January 3, 2025 |

|

|

Nomura America Finance,

LLC

$

Callable Contingent Coupon

Index-Linked Notes due 2027

guaranteed by

Nomura Holdings, Inc. |

|

Payment at Maturity: The amount that you will be paid on your

notes at maturity, if they have not been redeemed by us, in addition to the final coupon, if any, is based on the performance of the

underlier with the lowest underlier return. You could lose your entire investment in the notes.

Coupon Payments: The notes will pay a contingent monthly coupon

on a coupon payment date if the closing level of each underlier is greater than or equal to its coupon trigger level on

the related coupon observation date.

Company’s Redemption Right: Prior to the stated maturity

date, we may redeem your notes at our option on any coupon payment date commencing in May 2025.

The terms included in the “Key Terms” table below are

expected to be as indicated, but such terms will be set on the trade date. You should read the disclosure herein to better understand

the terms and risks of your investment, including the credit risk of Nomura America Finance, LLC and Nomura Holdings, Inc. See page PS-9.

| Key

Terms |

|

| Issuer

/ Guarantor: |

Nomura

America Finance, LLC / Nomura Holdings, Inc. |

| Aggregate

face amount: |

$ |

| Cash

settlement amount: |

subject

to the early redemption feature, on the stated maturity date, in addition to any coupon then due, the issuer will pay, for each $1,000

face amount of the notes, an amount in cash equal to: |

| |

· if

the final underlier level of each underlier is greater than or equal to its trigger buffer level: $1,000; or |

| |

· if

the final underlier level of any underlier is less than its trigger buffer level: |

| |

$1,000

+ ($1,000 × the least performing underlier return) |

| Underliers: |

the

S&P 500® Index (current Bloomberg symbol: “SPX Index”), the Russell 2000® Index (current

Bloomberg symbol: “RTY Index”), and the NASDAQ-100 Index® (current Bloomberg symbol: “NDX Index”) |

| Coupon

trigger level: |

for

each underlier, 70% of its initial underlier level (rounded to two decimal places with respect to SPX and NDX, and three decimal

places with respect to RTY) |

| Trigger

buffer level: |

for

each underlier, 70% of its initial underlier level (rounded to two decimal places with respect to SPX and NDX, and three decimal

places with respect to RTY) |

| Initial

underlier level: |

with

respect to an underlier, an intra-day level or the closing level of such underlier on the trade date |

| Final

underlier level: |

with

respect to an underlier, the closing level of such underlier on the determination date* |

| Underlier

return: |

with

respect to an underlier: (its final underlier level - its initial underlier level) / its initial underlier level |

| Least

performing underlier return: |

the

underlier return of the least performing underlier (the underlier with the lowest underlier return) |

| Calculation

agent: |

Nomura

Securities International, Inc. |

| CUSIP

/ ISIN: |

65541KAQ7

/ US65541KAQ76 |

* subject to adjustment as described in the accompanying

product prospectus supplement

Investing in the notes involves significant risks, including

Nomura America Finance, LLC and Nomura Holdings, Inc.’s credit risk. You should carefully consider the risk factors under

“Selected Risk Factors” beginning on page PS-9 of this pricing supplement, under “Additional Risk Factors Specific

to the Notes” beginning on page PS-18 of the accompanying product prospectus supplement, under “Risk Factors”

beginning on page 6 in the accompanying prospectus and any risk factors incorporated by reference into the accompanying prospectus

before you invest in the notes.

The estimated value of your notes at the time the terms of your notes

are set on the trade date (as determined by reference to pricing models used by Nomura Securities International, Inc.) is expected

to be between $920.00 and $970.00 per $1,000 face amount, which is expected to be less than the original issue price.

The expected delivery of the notes will be made against payment therefor

on or about the original issue date.

The notes will be unsecured obligations of Nomura America Finance,

LLC. Nomura America Finance, LLC is not a bank, and the notes will not constitute deposits insured by the U.S. Federal Deposit Insurance

Corporation or any other governmental agency or instrumentality.

| |

Original

issue price |

Underwriting

discount(1) |

Net

proceeds to the issuer |

| Per

Note |

100.00%

of the face amount |

Up

to 0.75% |

At

least 99.25% |

| Total |

$ |

$ |

$ |

(1) See “Supplemental Plan of Distribution.”

Neither the Securities and Exchange Commission nor any other regulatory

body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement. Any representation

to the contrary is a criminal offense.

January

, 2025

| Key

Terms (continued) |

|

| Coupon: |

subject to the early redemption feature, on each coupon payment

date, the issuer will pay, for each $1,000 of the outstanding face amount, an amount in cash equal to:

· if

the closing level of each underlier on the related coupon observation date is greater than or equal to its coupon trigger level:

$7.50 (0.75% monthly, or the potential for up to 9.00% per annum); or

· if

the closing level of any underlier on the related coupon observation date is less than its coupon trigger level: $0 |

| Early

redemption feature: |

The notes may be redeemed by the issuer at its option, in whole

but not in part, on each coupon payment date commencing in May 2025 and ending in January 2027, for an amount in cash for

each $1,000 of the outstanding face amount on the redemption date equal to $1,000 (along with the coupon then due).

If the issuer chooses to exercise the issuer’s redemption

right, it will notify the holder of this note (The Depository Trust Company) and the trustee by giving at least three business days’

prior notice. We will have no independent obligation to notify you directly. The day the issuer gives the notice, which will be a

business day, will be the redemption notice date and the immediately following coupon payment date, which the company will state

in the redemption notice, will be the redemption date.

The company will not give a redemption notice that results in

a redemption date later than the January 2027 coupon payment date. A redemption notice, once given, shall be irrevocable. |

| Trade

date: |

expected

to be January 31, 2025 |

| Original

issue date: |

expected

to be February 5, 2025 |

| Determination

date: |

the

last coupon observation date, expected to be February 1, 2027* |

| Stated

maturity date: |

expected

to be February 4, 2027* |

| Coupon

observation dates* |

Coupon

payment dates* |

| February 28,

2025 |

March 5,

2025 |

| March 31,

2025 |

April 3,

2025 |

| April 30,

2025 |

May 5,

2025 |

| June 2,

2025 |

June 5,

2025 |

| June 30,

2025 |

July 3,

2025 |

| July 31,

2025 |

August 5,

2025 |

| September 2,

2025 |

September 5,

2025 |

| September 30,

2025 |

October 3,

2025 |

| October 31,

2025 |

November 5,

2025 |

| December 1,

2025 |

December 4,

2025 |

| December 31,

2025 |

January 6,

2026 |

| February 2,

2026 |

February 5,

2026 |

| March 2,

2026 |

March 5,

2026 |

| March 31,

2026 |

April 3,

2026 |

| April 30,

2026 |

May 5,

2026 |

| June 1,

2026 |

June 4,

2026 |

| June 30,

2026 |

July 3,

2026 |

| July 31,

2026 |

August 5,

2026 |

| August 31,

2026 |

September 3,

2026 |

| September 30,

2026 |

October 5,

2026 |

| November 2,

2026 |

November 5,

2026 |

| November 30,

2026 |

December 3,

2026 |

| December 31,

2026 |

January 6,

2027 |

| February 1,

2027 |

February 4,

2027 |

* subject to adjustment as described in the accompanying

product prospectus supplement

| The issue

price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional

notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from

the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue

price you pay for such notes. |

| |

| Nomura America Finance,

LLC may use this prospectus in the initial sale of the notes. In addition, Nomura Securities International, Inc. or any other

affiliate of Nomura America Finance, LLC may use this prospectus in a market-making transaction in a note after its initial sale.

Unless Nomura America Finance, LLC or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus

is being used in a market-making transaction. |

| |

| ADDITIONAL

INFORMATION |

| You

should read this pricing supplement together with the prospectus, dated July 20, 2023 (the “prospectus”), and the

product prospectus supplement, dated February 29, 2024 (the “product prospectus supplement”), relating to our Senior

Global Medium-Term Notes, Series A, of which these notes are a part. In the event of any conflict between the terms of this

pricing supplement and the terms of the prospectus or the product prospectus supplement, the terms of this pricing supplement will

control. |

| |

| This

pricing supplement, together with the prospectus and the product prospectus supplement, contains the terms of the notes. You should

carefully consider, among other things, the matters set forth under “Risk Factors” in the accompanying prospectus, under

“Additional Risk Factors Specific to the Notes” in the accompanying product prospectus supplement, and under “Selected

Risk Factors” beginning on page PS-9 of this pricing supplement. We urge you to consult your investment, legal, tax, accounting

and other advisors before you invest in the notes. |

| |

| We

have not authorized anyone to provide any information or to make any representations other than those contained or incorporated by

reference in this pricing supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may provide. This pricing supplement is an offer to sell only the securities offered hereby, but only under

circumstances and in jurisdictions where it is lawful to do so. The information contained in this pricing supplement is current only

as of its date. |

| |

| You

may access the prospectus and the product prospectus supplement on the SEC website at www.sec.gov as follows: |

| |

| · Prospectus

dated July 20, 2023: |

| https://www.sec.gov/Archives/edgar/data/1383951/000110465923082805/tm2320650-3_424b3.htm |

| |

| · Product

Prospectus Supplement dated February 29, 2024: |

| https://www.sec.gov/Archives/edgar/data/1163653/000110465924029404/tm247408-1_424b3.htm |

| |

| Some

of the terms or features described in the listed documents may not apply to your notes. |

SUPPLEMENTAL TERMS OF THE NOTES

For purposes of the notes offered by this pricing

supplement, all references to each of the following terms used in the accompanying product prospectus supplement will be deemed to refer

to the corresponding term used in this pricing supplement, as set forth in the table below:

| Product Prospectus Supplement Term |

Pricing Supplement Term |

| redemption settlement

date |

redemption date |

| contingent coupon barrier |

coupon trigger level |

| final valuation date |

determination date |

| initial valuation date |

trade date |

| principal amount |

face amount |

| reference asset |

underlier |

| reference asset performance |

underlier return |

| reference asset sponsor |

underlier sponsor |

| scheduled

trading day |

trading day |

| closing

value |

closing

level |

| initial

value |

initial underlier level |

| final

value |

final underlier level |

| barrier percentage |

trigger buffer level |

Market Disruption Event

The following description supersedes the market disruption event disclosure

in “General Terms of the Notes — Market Disruption Events — Reference Assets Consisting of an Index” in the accompanying

product prospectus supplement:

Any of the following will be a market disruption event with respect

to any underlier:

| · | a

suspension, absence or material limitation of trading in the underlying securities of such

underlier constituting 20% or more, by weight, of the applicable underlier on their respective

primary markets, in each case for more than two hours of trading or during the one-half hour

before the close of trading in the relevant equity market or markets, as determined by the

calculation agent in its sole discretion; |

| | | |

| · | a

suspension, absence or material limitation of trading in options or futures contracts relating

to such underlier or to underlying securities constituting 20% or more, by weight, of such

underlier, if available, in the respective primary markets for those contracts, in each case

for more than two hours of trading or during the one-half hour before the close of trading

in that market, as determined by the calculation agent in its sole discretion; or |

| | | |

| · | underlying

securities constituting 20% or more, by weight, of such underlier, or options or futures

contracts relating to such underlier or to underlying securities constituting 20% or more,

by weight, of such underlier, if available, do not trade on what were the respective primary

markets for those underlying securities or contracts, as determined by the calculation agent

in its sole discretion; |

and, in the case of any of these events, the calculation agent determines

in its sole discretion that such event materially interferes with our ability or the ability of any of our affiliates to unwind all or

a portion of a hedge with respect to the notes. For more information about hedging by us or our affiliates, see “Use of Proceeds

and Hedging” in the accompanying product prospectus supplement.

The following events will not be market disruption events with respect

to any underlier:

| · | a

limitation on the hours or numbers of days of trading, but only if the limitation results

from an announced change in the regular business hours of the relevant market; or |

| | | |

| · | a

decision to permanently discontinue trading in the options or futures contracts relating

to such underlier or any underlying security. |

| HYPOTHETICAL

EXAMPLES |

| |

| The following examples

are provided for purposes of illustration only. The examples should not be taken as an indication or prediction of future investment

results and merely are intended to illustrate (i) the impact that the various hypothetical closing levels of the underliers

on a coupon observation date could have on the coupon payable, if any, on the related coupon payment date and (ii) the impact

that the various hypothetical closing levels of the least performing underlier on the determination date could have on the cash settlement

amount at maturity assuming all other variables remain constant and are not intended to predict the closing levels of the underliers. |

| |

| The information in the

following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue

date at the face amount and held to the stated maturity date or date of early redemption. If you sell your notes in a secondary market

prior to a the stated maturity date or date of early redemption, as the case may be, your return will depend upon the market value

of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below, such

as interest rates, the volatility of the underliers, the creditworthiness of Nomura America Finance, LLC, as issuer, and the creditworthiness

of Nomura Holdings, Inc., as guarantor. The information in the examples also reflects the key terms and assumptions in the box

below. |

| Key

Terms and Assumptions |

|

| Face

amount |

$1,000 |

| Coupon |

$7.50

(0.75% monthly, or the potential for up to 9.00% per annum) |

| Coupon

trigger level |

with

respect to each underlier, 70% of its initial underlier level |

| Trigger

buffer level |

with

respect to each underlier, 70% of its initial underlier level |

| The

notes are not redeemed, unless otherwise indicated below |

| Neither

a market disruption event nor a non-trading day occurs on any originally scheduled coupon observation date or the originally scheduled

determination date |

| No

change in or affecting any of the stocks comprising an underlier or the method by which the applicable underlier sponsor calculates

any underlier |

| Notes

purchased on original issue date at the face amount and held to the stated maturity date or date of early redemption |

| For these reasons, the actual performance

of the underliers over the life of your notes, the actual underlier levels on any coupon observation date, as well as the coupon

payable, if any, on each coupon payment date, may bear little relation to the hypothetical examples shown below or to the historical

underlier levels shown elsewhere in this pricing supplement. |

| |

| Also, the hypothetical examples shown below do

not take into account the effects of applicable taxes. |

| Hypothetical

Coupon Payments |

| |

| The examples below show

the hypothetical coupon, if any, that we would pay on each coupon payment date with respect to each $1,000 face amount of the notes

if the hypothetical closing level of each underlier on the applicable coupon observation date was the percentage of its initial underlier

level shown. |

Scenario 1

Coupon

Observation

Date |

Hypothetical

Closing

Level of the

NASDAQ-100 Index®

(as Percentage of

Initial Underlier Level) |

Hypothetical

Closing

Level of the Russell

2000® Index

(as

Percentage of Initial

Underlier Level) |

Hypothetical

Closing

Level of the S&P 500®

Index (as Percentage

of Initial Underlier

Level) |

Hypothetical

Coupon |

| 1 |

130.000% |

75.000% |

65.000% |

$0.00 |

| 2 |

69.000% |

130.000% |

135.000% |

$0.00 |

| 3 |

85.000% |

70.000% |

87.000% |

$7.50 |

| 4 |

65.000% |

60.000% |

65.000% |

$0.00 |

| 5 |

65.000% |

68.000% |

30.000% |

$0.00 |

| 6 |

90.000% |

55.000% |

95.000% |

$0.00 |

| 7 |

100.000% |

75.000% |

110.000% |

$7.50 |

| 8 |

110.000% |

105.000% |

50.000% |

$0.00 |

| 9 |

100.000% |

69.000% |

55.000% |

$0.00 |

| 10 |

90.000% |

65.000% |

65.000% |

$0.00 |

| 11 |

110.000% |

50.000% |

55.000% |

$0.00 |

| 12

- 24 |

65.000% |

65.000% |

68.000% |

$0.00 |

| |

|

|

Total

Hypothetical Coupons |

$15.00 |

| In Scenario 1, the hypothetical closing

level of each underlier has increased or decreased relative to the initial underlier level on each hypothetical coupon observation

date. On the coupon payment dates relating to coupon observation dates on which the hypothetical closing level of each underlier

is greater than or equal to its coupon trigger level, you will receive a coupon payment. However, on the coupon payment dates relating

to coupon observation dates on which the hypothetical closing level of at least one underlier is less than its coupon trigger level,

you will not receive a coupon payment. |

Scenario 2

Coupon

Observation

Date |

Hypothetical

Closing

Level of the

NASDAQ-100 Index®

(as Percentage of

Initial Underlier Level) |

Hypothetical

Closing

Level of the Russell

2000® Index (as

Percentage of Initial

Underlier Level) |

Hypothetical

Closing

Level of the S&P 500®

Index (as Percentage

of Initial Underlier

Level) |

Hypothetical

Coupon |

| 1 |

130.000% |

60.000% |

65.000% |

$0.00 |

| 2 |

90.000% |

65.000% |

125.000% |

$0.00 |

| 3 |

90.000% |

65.000% |

82.000% |

$0.00 |

| 4 |

90.000% |

135.000% |

65.000% |

$0.00 |

| 5 |

90.000% |

65.000% |

65.000% |

$0.00 |

| 6 |

90.000% |

70.000% |

65.000% |

$0.00 |

| 7 |

100.000% |

60.000% |

105.000% |

$0.00 |

| 8 |

110.000% |

50.000% |

83.000% |

$0.00 |

| 9 |

100.000% |

60.000% |

55.000% |

$0.00 |

| 10 |

90.000% |

69.000% |

75.000% |

$0.00 |

| 11 |

110.000% |

55.000% |

50.000% |

$0.00 |

| 12

- 24 |

65.000% |

65.000% |

65.000% |

$0.00 |

| |

|

|

Total

Hypothetical Coupons |

$0.00 |

| In Scenario 2, the hypothetical closing

level of each underlier has increased or decreased relative to the initial underlier level on each hypothetical coupon observation

date. However, you will not receive a coupon payment on any coupon payment date because in each case the hypothetical closing level

of at least one underlier on the related coupon observation date is less than its coupon trigger level. The overall return you earn

on your notes will be less than zero. |

Scenario 3

Coupon

Observation

Date |

Hypothetical

Closing

Level of the

NASDAQ-100 Index®

(as Percentage of

Initial Underlier Level) |

Hypothetical

Closing

Level of the Russell

2000® Index (as

Percentage of Initial

Underlier Level) |

Hypothetical

Closing

Level of the S&P 500®

Index (as Percentage

of Initial Underlier

Level) |

Hypothetical

Coupon |

| 1 |

40.000% |

50.000% |

50.000% |

$0.00 |

| 2 |

25.000% |

30.000% |

45.000% |

$0.00 |

| 3 |

110.000% |

105.000% |

105.000% |

$7.50 |

| |

|

|

Total

Hypothetical Coupons |

$7.50 |

| In Scenario 3, the hypothetical closing

level of each underlier is less than its coupon trigger level on the first two hypothetical coupon observation dates, but increases

to a level that is greater than its initial underlier level on the third hypothetical coupon observation date. Further, we also exercise

our early redemption right with respect to a redemption on the third hypothetical coupon payment date (which is also the first hypothetical

date with respect to which we could exercise such right). Therefore, on the third coupon payment date (the redemption date), in addition

to the coupon payment, you will receive an amount in cash equal to $1,000 for each $1,000 face amount of your notes. |

| |

| Hypothetical

Payment at Maturity |

| |

| If the notes are not

redeemed, the cash settlement amount that we would deliver for each $1,000 face amount of your notes on the stated maturity date

will depend on the performance of the least performing underlier on the determination date, as shown in the table below. The table

below assumes that the notes have not been redeemed and does not include the final coupon, if any. If the final underlier

level of the least performing underlier is less than its coupon trigger level, you will not be paid a final coupon at maturity. |

| |

| The levels in the left

column of the table below represent hypothetical final underlier levels of the least performing underlier and are expressed as percentages

of the initial underlier level of the least performing underlier. The amounts in the right column represent the hypothetical cash

settlement amounts, based on the corresponding hypothetical final underlier level of the least performing underlier, and are expressed

as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement

amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount

of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical

final underlier level of the least performing underlier and the assumptions noted above. |

| The

Notes Have Not Been Redeemed |

Hypothetical

Final Underlier Level

of

the Least Performing Underlier (as Percentage of

Its Initial Underlier Level) |

Hypothetical

Cash Settlement Amount

(as

Percentage of Face Amount) |

| 200.000% |

100.000%* |

| 175.000% |

100.000%* |

| 150.000% |

100.000%* |

| 125.000% |

100.000%* |

| 100.000% |

100.000%* |

| 90.000% |

100.000%* |

| 75.000% |

100.000%* |

| 70.000% |

100.000%* |

| 69.999% |

69.999% |

| 60.000% |

60.000% |

| 50.000% |

50.000% |

| 25.000% |

25.000% |

| 12.500% |

12.500% |

| 0.000% |

0.000% |

*Does not include the final coupon

| As shown in the table above, if the notes have not been

redeemed: |

| |

| · |

If the final underlier level of the least performing underlier

were determined to be 12.500% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity

would be 12.500% of the face amount of your notes. |

| |

|

| |

○ |

As a result, if you purchased your notes on the original

issue date at the face amount and held them to the stated maturity date, you would lose 87.500% of your investment (if you purchased

your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment). |

| |

|

|

| · |

If the final underlier level of the least performing underlier

were determined to be 200.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at

maturity would be limited to 100.000% of each $1,000 face amount of your notes. |

| |

|

| |

○ |

As a result, if you held your notes to the stated maturity date, you

would not benefit from any increase in the final underlier level of the least performing underlier over its initial underlier level. |

SELECTED RISK FACTORS

Risks Relating to the Structure or Features of the Notes

The Notes Do Not Guarantee Any Return of Principal

and You May Lose All of Your Face Amount.

The notes do not guarantee any return of principal. The notes differ

from ordinary debt securities in that we will not pay you 100% of the face amount of your notes if the notes are not redeemed and the

final underlier level of any underlier is less than its trigger buffer level. In this case, the payment at maturity you will be entitled

to receive will be less than the face amount and you will lose 1% for each 1% that the underlier performance of the least performing

underlier is less than -30.00%. You may lose up to 100% of your investment at maturity. Even with any contingent coupons received prior

to maturity, your return on the notes may be negative in this case.

The Return on Your Notes May Change Significantly Despite

Only a Small Change in the Level of the Least Performing Underlier

If your notes are not redeemed by us and the final underlier level

of the least performing underlier is less than its trigger buffer level, you will receive less than the face amount of your notes and

you could lose all or a substantial portion of your investment in the notes. This means that while a decrease in the final underlier

level of the least performing underlier to its trigger buffer level will not result in a loss of principal on the notes, a decrease in

the final underlier level of the least performing underlier to less than its trigger buffer level will result in a loss of a significant

portion of the face amount of the notes despite only a small change in the level of the least performing underlier.

The Amount Payable on the Notes Is Not Linked

to the Levels of the Underliers at Any Time Other Than the Coupon Observation Dates, Including the Determination Date.

The payments on the notes will be based on the closing level of each

underlier on the coupon observation dates, including the determination date, subject to postponement for non-trading days and certain

market disruption events. Even if the level of the least performing underlier is greater than or equal to its coupon trigger level during

the term of the notes other than on a coupon observation date but then decreases on a coupon observation date to a level that is less

than its coupon trigger level, the contingent coupon will not be payable for the relevant monthly period. Similarly, if the notes are

not redeemed, even if the level of the least performing underlier is greater than or equal to its trigger buffer level during the term

of the notes other than on the determination date but then decreases on the determination date to a level that is less than its trigger

buffer level, the payment at maturity will be less, possibly significantly less, than it would have been had the payment at maturity

been linked to the level of the least performing underlier prior to such decrease. Although the actual level of the least performing

underlier on the maturity date or at other times during the term of the notes may be higher than its level on the coupon observation

dates, whether each contingent coupon will be payable and the payment at maturity will be based solely on the closing level of the least

performing underlier on the applicable coupon observation dates.

You May Not Receive Any Contingent Coupons.

We will not necessarily make periodic coupon payments on the notes.

If the closing level of any underlier on a coupon observation date is less than its coupon trigger level, we will not pay you the contingent

coupon applicable to that coupon observation date. If on each of the coupon observation dates, the closing level of any underlier is

less than its coupon trigger level, we will not pay you any contingent coupons during the term of, and you will not receive a positive

return on, the notes. Generally, this non-payment of the contingent coupon coincides with a period of greater risk of principal loss

on the notes.

Your Return on the Notes Is Limited to the

Face Amount Plus the Contingent Coupons, If Any, Regardless of Any Appreciation in the Level of Any Underlier.

You will not participate in any appreciation of the underliers. In

addition to any contingent coupon payments received prior to maturity or early redemption, for each $1,000 face amount, at maturity or

upon early redemption, you will receive $1,000 plus the final contingent coupon if the closing level of the least performing underlier

on the relevant coupon observation date is equal to or greater than its coupon trigger level, regardless of any appreciation in the level

of any underlier, which may be significant. Accordingly, the return on the notes may be significantly less than the return on a security,

the return of which was directly linked to the performance of any underlier during the term of the notes.

We Are Able to Redeem Your Notes at Our Option.

On each coupon payment date commencing in May 2025 and ending

in January 2027, we will be permitted to redeem your notes at our option. Even if we do not exercise our option to redeem your notes,

our ability to do so may adversely affect the value of your notes. It is our sole option whether to redeem your notes prior to maturity

and we may or may not exercise this option for any reason. Because of this redemption option, the term of your notes could be reduced.

The Notes May Be Redeemed Prior to the

Maturity Date.

If the notes are redeemed early, the holding period over which you

may receive contingent coupon payments may be significantly reduced. It is more likely that we will redeem the notes prior to maturity

if we expect that the contingent

coupon payments are likely to be payable on most or all of the coupon

payment dates during the term of the notes, resulting in a return on the notes which is greater than the interest that would be payable

on other instruments issued by us of comparable maturity, terms and credit rating trading in the market. There is no guarantee that you

would be able to reinvest the proceeds from an investment in the notes at a comparable return for a similar level of risk in the event

the notes are redeemed prior to the maturity date.

The Coupon Does Not Reflect the Actual Performance of the Underliers

from the Trade Date to Any Coupon Observation Date or from Coupon Observation Date to Coupon Observation Date

The coupon for each coupon payment date is different from, and may

be less than, a coupon determined based on the percentage difference of the closing levels of the underliers between the trade date and

any coupon observation date or between two coupon observation dates. Accordingly, the coupons, if any, on the notes may be less than

the return you could earn on another instrument linked to the underliers that pays coupons based on the performance of the underliers

from the trade date to any coupon observation date or from coupon observation date to coupon observation date.

Since the Notes Are Linked to the Performance

of More Than One Underlier, You Will Be Fully Exposed to the Risk of Fluctuations in the Level of Each Underlier.

Since the notes are linked to the performance of more than one underlier,

the notes will be linked to the individual performance of each underlier. Because such notes are not linked to a basket, in which the

risk is mitigated and diversified among all of the components of a basket, you will be exposed to the risk of fluctuations in the level

of each underlier. For example, in the case of notes linked to a basket, the return would depend on the aggregate performance of the

basket components reflected as the basket return. Thus, the depreciation of any basket component could be mitigated by the appreciation

of another basket component. However, in the case of notes linked to the performance of more than one underlier, the individual performance

of each of the underliers would not be combined to calculate your return and the depreciation of any underlier would not be mitigated

by the appreciation of the other underliers. Instead, your return would depend on the least performing underlier.

Because the Notes Are Linked to the Performance

of the Least Performing Underlier, You are Exposed to Greater Risks of Sustaining a Significant Loss on Your Investment Than if the Notes

Were Linked to Just One Underlier.

The risk that you will suffer a significant loss on your investment

is greater if you invest in such notes as opposed to substantially similar securities that are linked to the performance of just one

underlier. With multiple underliers, it is more likely that the level of one of the underliers will be below its trigger buffer level

on the determination date, than if the notes were linked to only one underlier. Therefore, it is more likely that you will suffer a significant

loss on your investment.

Higher Contingent Coupon Rates or Lower Barrier

Levels Are Generally Associated With Underliers With Greater Expected Volatility and Therefore Can Indicate a Greater Risk of Loss.

"Volatility" refers to the frequency and magnitude of changes

in the level of an underlier. The greater the expected volatility with respect to an underlier on the trade date, the higher the expectation

as of the trade date that the level of the underlier could close below its coupon trigger level on a coupon observation date or its trigger

buffer level on the determination date, indicating a higher expected risk of non-payment of contingent coupons or loss on the notes.

This greater expected risk will generally be reflected in a higher contingent coupon rate than the yield payable on our conventional

debt securities with a similar maturity, or in more favorable terms (such as a lower trigger buffer level, a lower coupon trigger level

or a higher contingent coupon rate) than for similar securities linked to the performance of underliers with lower expected volatility

as of the trade date. You should therefore understand that a relatively higher contingent coupon rate may indicate an increased risk

of loss. Further, a relatively lower trigger buffer level may not necessarily indicate that the notes have a greater likelihood of a

repayment of principal at maturity. The volatility of any underlier can change significantly over the term of the notes. The level of

any underlier for your notes could fall sharply, which could result in a significant loss of principal. You should be willing to accept

the downside market risk of the underlier and the potential to lose some or all of your principal at maturity and to not receive any

contingent coupons.

General Risk Factors

You Are Subject to Nomura’s Credit Risk, and the Value of

Your Notes May Be Adversely Affected by Negative Changes in the Market’s Perception of Nomura’s Creditworthiness.

By purchasing the notes, you are making, in part, a decision about

Nomura’s ability to pay you the amounts you are owed pursuant to the terms of your notes. Substantially all of our assets consist

of loans to and other receivables from Nomura and its subsidiaries. Our obligations under your notes are guaranteed by Nomura. Therefore,

as a practical matter, our ability to pay you amounts we owe on the notes is directly or indirectly linked solely to Nomura’s creditworthiness.

In addition, the market’s perception of Nomura’s creditworthiness generally will directly impact the value of your notes.

If Nomura becomes or is perceived as becoming less creditworthy following your purchase of notes, you should expect that the notes will

decline in value in the secondary market, perhaps substantially. If you sell your notes in the secondary market in such an environment,

you may incur a substantial loss.

The Estimated Value of Your Notes at the Time

the Terms of Your Notes Are Set on the Trade Date (as Determined by Reference to Our Pricing Models) Will Be Less Than the Original Issue

Price of Your Notes.

The original issue price for your notes will exceed the estimated

value of your notes as of the time the terms of your notes are set on the trade date, as determined by reference to our pricing models.

Such estimated value will be set forth on the front cover of the final pricing supplement. After the trade date, the estimated value,

as determined by reference to these pricing models, may be affected by changes in market conditions, our and Nomura’s creditworthiness

and other relevant factors. If Nomura Securities International, Inc. buys or sells your notes, it will do so at prices that reflect

the estimated value determined by reference to such pricing models at that time. The price at which Nomura Securities International, Inc.

will buy or sell your notes at any time also will reflect, among other things, its then current bid and ask spread for similar sized

trades of structured notes.

In estimating the value of your notes as of the time the terms of

your notes are set on the trade date, as will be disclosed on the front cover of the final pricing supplement, our pricing models consider

certain variables, including principally Nomura’s internal funding rates, interest rates (forecasted, current and historical rates),

volatility, price-sensitivity analysis and the time to maturity of the notes. These pricing models are proprietary and rely in part on

certain assumptions about future events, which may prove to be incorrect. In addition, our internal funding rate used in our models generally

results in a higher estimated value of your notes than would result if we estimated the value using our credit spreads for our conventional

fixed rate debt. As a result, the actual value you would receive if you sold your notes in the secondary market may differ, possibly

even materially, from the estimated value of your notes that we will determine by reference to our pricing models as of the time the

terms of your notes are set on the trade date due to, among other things, any differences in pricing models, third-parties’ use

of our credit spreads in their models, or assumptions used by other market participants.

The difference between the estimated value of your notes as of the

time the terms of your notes are set on the trade date and the original issue price is a result of certain factors, including principally

the underwriting discount and commissions, the expenses incurred in creating, documenting and marketing the notes, and an estimate of

the difference between the amounts we pay to our affiliates and the amounts our affiliates pay to us in connection with their agreement

to hedge our obligations on your notes. These costs will be used or retained by us or one of our affiliates, except for underwriting

discounts paid to unaffiliated distributors.

If We Were to Repurchase Your Notes Immediately After the Original

Issue Date, the Price You Receive May Be Higher Than the Estimated Value of The Notes.

Assuming that all relevant factors remain constant after the original

issue date, the price at which we may initially buy or sell the notes in the secondary market, if any, and the value that may initially

be used for customer account statements, if any, may exceed the estimated value on the trade date for a temporary period expected to

be approximately 1 month after the original issue date. This temporary price difference may exist because, in our discretion, we may

elect to effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the notes and other costs

in connection with the notes that we will no longer expect to incur over the term of the notes. We will make such discretionary election

and determine this temporary reimbursement period on the basis of a number of factors, including the tenor of the notes and any agreement

we may have with the distributors of the notes. The amount of our estimated costs which we effectively reimburse to investors in this

way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise

the duration of the reimbursement period after the original issue date of the notes based on changes in market conditions and other factors

that cannot be predicted.

Because Nomura Is a Holding Company, Your Right to Receive Payments

on Nomura’s Guarantee of the Notes Is Subordinated to the Liabilities of Nomura’s Other Subsidiaries.

The ability of Nomura to make payments, as guarantor, on the notes,

depends upon Nomura’s receipt of dividends, loan payments and other funds from subsidiaries. In addition, if any of Nomura’s

subsidiaries becomes insolvent, the direct creditors of that subsidiary will have a prior claim on its assets, and Nomura’s rights

and the rights of Nomura’s creditors, including your rights as an owner of the notes, will be subject to that prior claim.

Nomura’s subsidiaries are subject to various laws and regulations

that may restrict Nomura’s ability to receive dividends, loan payments and other funds from subsidiaries. In particular, many of

Nomura’s subsidiaries, including its broker-dealer subsidiaries, are subject to laws and regulations, including regulatory capital

requirements, that authorize regulatory bodies to block or reduce the flow of funds to the parent holding company, or that prohibit such

transfers altogether in certain circumstances. For example, Nomura Securities Co., Ltd., Nomura Securities International, Inc.,

Nomura International plc and Nomura International (Hong Kong) Limited, Nomura’s main broker-dealer subsidiaries, are subject to

regulatory capital requirements that could limit the transfer of funds to Nomura. These laws and regulations may hinder Nomura’s

ability to access funds needed to make payments on Nomura’s obligations.

You Must Rely on Your Own Evaluation of the Merits of an Investment

Linked to the Underliers.

In the ordinary course of business, Nomura or any of its affiliates

may have expressed views on expected movements in the underliers, and may do so in the future. These views or reports may be communicated

to Nomura’s clients and clients of its affiliates. However, any such views are and will be subject to change from time to time.

Moreover, other

professionals who deal in markets relating to the underliers may at

any time have significantly different views from those of Nomura or its affiliates. For these reasons, you are encouraged to derive information

concerning the underliers from multiple sources, and you should not rely on any of the views that may have been expressed or that may

be expressed in the future by Nomura or any of its affiliates. Neither the offering of the notes nor any view which Nomura or any of

its affiliates from time to time may express in the ordinary course of business constitutes a recommendation as to the merits of an investment

in the notes or any of the component securities.

Your Return May Be Lower Than the Return on Other Debt Securities

of Comparable Maturity.

Any contingent coupons payable on your notes may represent a return

that is below the prevailing market rate for other debt securities of comparable maturity that are not linked to an underlier. Consequently,

unless the cash settlement amount you receive on the maturity date substantially exceeds the amount you paid for your notes, the overall

return you earn on your notes could be less than what you would have earned by investing in non–underlier-linked debt securities

that bear interest at prevailing market rates. For example, your return may be less than the return you would earn if you bought a traditional

interest-bearing debt security with the same maturity date. Your investment may not reflect the full opportunity cost to you when you

take into account factors that affect the time value of money.

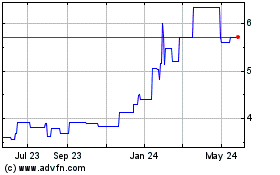

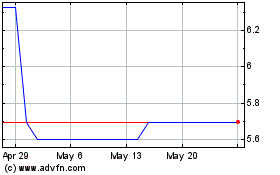

The Historical Performance of the Underliers Should Not Be Taken

as an Indication of Its Future Performance.

The historical levels of the underliers included in this pricing supplement

should not be taken as an indication of its future performance. Changes in the levels of the underliers will affect the market value

of the notes, but it is impossible to predict whether the levels of the underliers will rise or fall during the term of the notes. The

levels of the underliers will be influenced by complex and interrelated political, economic, financial and other factors.

Our or Our Affiliates’ Hedging and Trading Activities May Adversely

Affect the Market Value of the Notes.

As described under “Use of Proceeds and Hedging”

in the accompanying product prospectus supplement, we or one or more of our affiliates may hedge our obligations under the notes by entering

into transactions involving purchases of futures and/or other derivative instruments linked to the underliers. We also expect that we

or one or more of our affiliates will adjust these hedges by, among other things, purchasing or selling any of the foregoing, and perhaps

other instruments linked to any of the foregoing, at any time and from time to time, and unwind the hedge by selling any of the foregoing

on or before the determination date for the notes or in connection with the redemption of the notes. Our or our affiliates’ hedging

activities may result in our or our affiliates’ receiving a substantial return on these hedging activities even if your investment

in the notes results in a loss to you. These hedging activities could adversely affect the levels of the underliers and, therefore, the

market value of the notes and the cash settlement amount payable on the notes.

We or one or more of our affiliates may also issue or underwrite other

securities or financial or derivative instruments with returns linked or related to changes in the performance of the underliers. By

introducing competing products into the marketplace in this manner, we or one or more of our affiliates could adversely affect the market

value of the notes and the cash settlement amount payable on the notes.

We or one or more of our affiliates may also engage in business with

the component securities issuers or trading activities related to the component securities, which may present a conflict of interest

between us (or our affiliates) and you.

There Are Potential Conflicts of Interest between You and the Calculation

Agent and between You and Our Other Affiliates.

The calculation agent will make important determinations as to the

notes. Among other things, the calculation agent will determine the applicable closing levels of the underliers. We have initially appointed

our affiliate, Nomura Securities International, Inc., to act as the calculation agent. We may change the calculation agent after

the original issue date without notice to you. For a fuller description of the calculation agent’s role, see “General

Terms of the Notes— Role of Calculation Agent” in the accompanying product prospectus supplement. The calculation agent

will exercise its judgment when performing its functions and will make any determination required or permitted of it in its sole discretion.

For example, the calculation agent may have to determine whether a market disruption event affecting an underlier has occurred and may

also have to determine its closing level in such case. This determination may, in turn, depend on the calculation agent’s judgment

whether the event has materially interfered with our ability or the ability of one of our affiliates to unwind our hedge positions. The

calculation agent may also have to select a substitute index if an underlier is discontinued. All determinations by the calculation agent

are final and binding on you absent manifest error. Since this determination by the calculation agent will affect the cash settlement

amount payable on the notes, the calculation agent may have a conflict of interest if it needs to make a determination of this kind,

and the cash settlement amount payable on your notes may be adversely affected. In addition, if the calculation agent determines that

a market disruption event has occurred, it can postpone any relevant valuation date, which may have the effect of postponing the maturity

date. If this occurs, you will receive the cash settlement amount, if any, after the originally scheduled stated maturity date but will

not receive any additional payment or any interest on such postponed cash settlement amount.

We or our affiliates may have other conflicts of interest with holders

of the notes. See “Additional Risk Factors Specific to the Notes—Our or Our Affiliates’ Business Activities May Create

Conflicts of Interest” in the accompanying product prospectus supplement.

There May Not Be an Active Trading Market for the Notes—Sales

in the Secondary Market May Result in Significant Losses.

The notes will not be listed on any securities exchange, and there

may be little or no secondary market for the notes. Nomura Securities International, Inc. and other affiliates of ours currently

intend to make a market for the notes, although they are not required to do so. Nomura Securities International, Inc. or any other

affiliate of ours may stop any such market-making activities at any time. Even if a secondary market for the notes develops, it may not

provide significant liquidity and the notes may not trade at prices advantageous to you. We expect that transaction costs in any secondary

market would be high. As a result, the difference between bid and ask prices for your notes in any secondary market could be substantial.

Furthermore, if you sell your notes, you will likely be charged a

commission for secondary market transactions, or the price will likely reflect a dealer discount.

If you sell your notes before the maturity date, you may have to do

so at a substantial discount from the issue price and as a result you may suffer substantial losses.

You Have No Shareholder Rights or Rights to Receive Any Underlier

Stock.

Investing in your notes will not make you a holder of any of the underlier

stocks. Neither you nor any other holder or owner of your notes will have any rights with respect to the underlier stocks, including

any voting rights, any rights to receive dividends or other distributions, any rights to make a claim against the underlier stocks or

any other rights of a holder of the underlier stocks. Your notes will be paid in cash, as will any coupon payments, and you will have

no right to receive delivery of any underlier stocks.

Risks Relating to the Underliers

Except to the Extent The Goldman Sachs Group, Inc. Is One

of the Companies Whose Common Stock Comprises the S&P 500® Index, There Is No Affiliation Between the Underlier Stock

Issuers or the Underlier Sponsor and Us or Goldman Sachs & Co. LLC.

The common stock of The Goldman Sachs Group, Inc. is one of the

underlier stocks comprising the S&P 500® Index. Neither we nor Goldman Sachs & Co. LLC (GS&Co.) are not

otherwise affiliated with the issuers of the underlier stocks or the underlier sponsors. As we have told you above, however, we or our

affiliates may currently or from time to time in the future own securities of, or engage in business with, the underlier sponsors or

the underlier stock issuers. Neither we nor any of our affiliates have participated in the preparation of any publicly available information

or made any “due diligence” investigation or inquiry with respect to the underliers or the other underlier stock issuers.

You, as an investor in your notes, should make your own investigation into the underliers and the underlier stock issuers. See “The

Underliers” below for additional information about the underliers.

Neither the underlier sponsors nor any of the

other underlier stock issuers are involved in the offering of your notes in any way and none of them have any obligation of any sort

with respect to your notes. Thus, neither the underlier sponsors nor any of the other underlier stock issuers have any obligation to

take your interests into consideration for any reason, including in taking any corporate actions that might affect the market value of

your notes.

Changes That Affect the Underliers May Affect

the Level of the Underliers and the Market Value of the Notes and the Amount You Will Receive on the Notes and the Amount You Will Receive

at Maturity.

The policies of the underlier sponsors of the underliers concerning

additions, deletions and substitutions of the stocks included in the underliers, and the manner in which the reference sponsor takes

account of certain changes affecting those stocks, may affect the level of the underliers. The policies of the underlier sponsors with

respect to the calculation of the underliers could also affect the level of the underliers. The underlier sponsors may discontinue or

suspend calculation or dissemination of the underliers. Any such actions could affect the level of the underliers and the level of and

the return on the notes.

An Investment In the Notes Is Subject to Small-capitalization

Risks.

The RTY tracks companies that are considered small-capitalization.

These companies often have greater stock price volatility, lower trading volume and less liquidity than large-capitalization companies

and therefore the level of the RTY may be more volatile than an investment in stocks issued by large-capitalization companies. Stock

prices of small-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business and

economic developments, and the stocks of small-capitalization companies may be thinly traded, making it difficult for the RTY to track

them. In addition, small-capitalization companies are typically less stable financially than large-capitalization companies and may depend

on a small number of key personnel, making them more vulnerable to loss of personnel. Small-capitalization companies are often subject

to less analyst coverage and may be in early, and less predictable, periods of their corporate existences. Such companies tend to have

smaller revenues, less diverse product lines, smaller shares of their product or service markets, fewer financial resources and less

competitive strengths than large-capitalization companies and are more susceptible to adverse developments related to their products

or services. Any of these factors may adversely affect the performance of the RTY and consequently, the return on the notes.

Non-U.S. Securities Risk.

Some of the equity securities included in the NDX are issued by non-U.S.

companies. Investments in securities linked to the value of such non-U.S. equity securities, such as the notes, involve risks associated

with the home countries of the issuers of those non-U.S. equity securities. The prices of securities in non-U.S. markets may be affected

by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic

and fiscal policies and currency exchange laws.

As Compared to Other Index Sponsors, Nasdaq, Inc. Retains

Significant Control and Discretionary Decision-Making Over the Underlier, Which May Have an Adverse Effect on the Level of the Underlier

and on Your Notes.

Pursuant to the underlier methodology, Nasdaq, Inc. retains the

right, from time to time, to exercise reasonable discretion as it deems appropriate in order to ensure underlier integrity, including,

but not limited to, changes to quantitative inclusion criteria. Nasdaq, Inc. may also, due to special circumstances, apply discretionary

adjustments to ensure and maintain quality of the underlier. Although it is unclear how and to what extent this discretion could or would

be exercised, it is possible that it could be exercised by Nasdaq, Inc. in a manner that materially and adversely affects the level

of the underlier and therefore your notes. Nasdaq, Inc. is not obligated to, and will not, take account of your interests in exercising

the discretion described above.

Government Regulatory Action, Including Legislative Acts and

Executive Orders, Could Result in Material Changes to the Composition of an Underlier with Underlier Stocks from One or More Foreign

Securities Markets and Could Negatively Affect Your Investment in the Notes.

Government regulatory action, including legislative

acts and executive orders, could cause material changes to the composition of an underlier with underlier stocks from one or more foreign

securities markets and could negatively affect your investment in the notes in a variety of ways, depending on the nature of such government

regulatory action and the underlier stocks that are affected. For example, recent executive orders issued by the United States Government

prohibit United States persons from purchasing or selling publicly traded securities of certain companies that are determined to operate

or have operated in the defense and related materiel sector or the surveillance technology sector of the economy of the People’s

Republic of China, or publicly traded securities that are derivative of, or that are designed to provide investment exposure to, those

securities (including indexed notes). If the prohibitions in those executive orders (or prohibitions under other government regulatory

action) become applicable to underlier stocks that are currently included in an underlier or that in the future are included in an underlier,

such underlier stocks may be removed from an underlier. If government regulatory action results in the removal of underlier stocks that

have (or historically have had) significant weight in an underlier, such removal could have a material and negative effect on the level

of such underlier and, therefore, your investment in the notes. Similarly, if underlier stocks that are subject to those executive orders

or subject to other government regulatory action are not removed from an underlier, the value of the notes could be materially and negatively

affected, and transactions in, or holdings of, the notes may become prohibited under United States law. Any failure to remove such underlier

stocks from an underlier could result in the loss of a significant portion or all of your investment in the notes, including if you attempt

to divest the notes at a time when the value of the notes has declined.

THE UNDERLIERS

Description of the SPX

S&P Publishes the SPX

The SPX, which we also refer to in this description as the “index,”

was first launched on March 4, 1957 based on an initial value of 10 from 1941-1943, and it is sponsored by S&P. The SPX includes

a representative sample of 500 companies in leading industries of the U.S. economy. The 500 companies are not the 500 largest companies

listed on the NYSE and not all 500 companies are listed on the NYSE. S&P chooses companies for inclusion in the SPX with an aim of

achieving a distribution by broad industry groupings that approximates the distribution of these groupings in the common stock population

of the U.S. domiciled equity market. Although the SPX contains 500 constituent companies, at any one time it may contain greater

than 500 constituent trading lines since some companies included in the SPX prior to July 31, 2017 may be represented by multiple share

class lines in the SPX. The SPX is calculated, maintained and published by S&P and is part of the S&P Dow Jones Indices

family of indices. Additional information is available on the following websites: spglobal.com/spdji/en/indices/equity/sp-500 and spglobal.com.

We are not incorporating by reference the websites or any material they include in this pricing supplement.

S&P

intends for the SPX to provide a performance benchmark for the large-cap U.S. domiciled equity markets. Constituent changes are made

on an as-needed basis and there is no schedule for constituent reviews. Index additions and deletions are announced with at least three

business days advance notice. Less than three business days’ notice may be given at the discretion of the S&P Index Committee.

Relevant criteria for additions to the SPX that are employed by S&P include: the company proposed for addition should have an unadjusted

company market capitalization of $18.0 billion or more and a security level float-adjusted market capitalization of at least 50% of such

threshold (for spin-offs, eligibility is determined using when-issued prices, if available); the float-adjusted liquidity ratio of the

stock (defined as the annual dollar value traded divided by the float-adjusted market capitalization) should be greater than or equal

to 0.75 at the time of the addition to the S&P 500® Index and the stock should trade a minimum of 250,000 shares in

each of the six months leading up to the evaluation date (current constituents have

no minimum requirement), where the annual dollar value traded is calculated as the average closing price multiplied by the historical

volume over the 365 calendar days prior to the evaluation date (reduced to the available trading period for IPOs, spin-offs or public

companies considered to be U.S. domiciled for index purposes that do not have 365 calendar days of trading history on a U.S. exchange);

the company must be a U.S.-domiciled company (characterized as a company that satisfies U.S. Securities Exchange Act’s periodic

reporting obligations by filing certain required forms for domestic issuers (e.g., Form 10-K annual reports, Form 10-Q quarterly reports

and Form 8-K current reports, among others) and with a primary listing of the common stock on the NYSE, NYSE Arca, NYSE American, Nasdaq

Global Select Market, Nasdaq Global Market, Nasdaq Capital Market, Cboe BZX, Cboe BYX, Cboe EDGA or Cboe EDGX (each, an “eligible

exchange”)); the proposed constituent has an investable weight factor (“IWF”) of 10% or more; the inclusion of the

company will contribute to sector balance in the SPX relative to sector balance in the market in the relevant market capitalization range;

financial viability (the sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings

(net income excluding discontinued operations) should be positive as should the most recent quarter); and, for IPOs, the company must

be traded on an eligible exchange for at least twelve months (for former SPACs, S&P considers the de-SPAC transaction to be an event

equivalent to an IPO, and 12 months of trading post the de-SPAC event are required before a former SPAC can be considered for inclusion

in the S&P 500® Index; spin-offs or in-specie distributions from existing constituents do not need to be traded on

an eligible exchange for twelve months prior to their inclusion in the SPX). In addition, constituents of the S&P MidCap 400® Index

and the S&P SmallCap 600® Index can be added to the SPX provided they meet the unadjusted company level market

capitalization eligibility criteria for the SPX. Migrations from the S&P MidCap 400® Index or the S&P SmallCap

600® Index do not need to meet the financial viability, liquidity, or 50% of the SPX’s unadjusted company level

minimum market capitalization threshold criteria. Further, constituents of the S&P Total Market Index Ex S&P Composite 1500 (which

includes all eligible U.S. common equities except for those included in the SPX, the S&P MidCap 400® Index and

the S&P SmallCap 600® Index) that acquire a constituent of the SPX, the S&P MidCap 400® Index

or the S&P SmallCap 600® Index that do not fully meet the all of the eligibility criteria may still be added

to the SPX at the discretion of the Index Committee if the merger consideration includes the acquiring company issuing stock to target

company shareholders, and the Index Committee determines that the addition could minimize turnover and enhance the representativeness

of the SPX as a market benchmark. Certain types of organizational structures and securities are always excluded, including, but not limited

to, business development companies (BDCs), limited partnerships, master limited partnerships, limited liability companies (LLCs),

OTC bulletin board issues, closed-end funds, ETFs, ETNs, royalty trusts, tracking stocks, special purpose acquisition companies

(SPACs), preferred stock and convertible preferred stock, unit trusts, equity warrants, convertible bonds, investment trusts, rights

and American depositary receipts (ADRs). Stocks are deleted from the SPX when they are involved in mergers, acquisitions or significant

restructurings such that they no longer meet the inclusion criteria, and when they substantially violate one or more of the addition

criteria. Stocks that are delisted or moved to the pink sheets or the bulletin board are removed, and those that experience a trading

halt may be retained or removed in S&P’s discretion. S&P evaluates additions and deletions with a view to maintaining SPX

continuity.

For constituents included in the SPX prior to July 31, 2017, all publicly

listed multiple share class lines are included separately in the SPX, subject to, in the case of any such share class line, that share

class line satisfying the liquidity

and float criteria discussed above and subject to certain exceptions. It

is possible that one listed share class line of a company may be included in the SPX while a second listed share class line of the same

company is excluded. For companies that issue a second publicly traded share class to index share class holders, the newly issued

share class line is considered for inclusion if the event is mandatory and the market capitalization of the distributed class is not

considered to be de minimis.

As of July 31, 2017, companies with multiple share class lines are

no longer eligible for inclusion in the SPX. Only common shares are considered when determining whether a company has a multiple share

class structure. Constituents of the SPX prior to July 31, 2017 with multiple share class lines will be grandfathered in and continue

to be included in the SPX. If an SPX constituent reorganizes into a multiple share class line structure, that company will be reviewed

for continued inclusion in the SPX at the discretion of the S&P Index Committee.

Calculation of the SPX

The SPX is calculated using a base-weighted aggregative methodology.

This discussion describes the “price return” calculation of the SPX. The value of the SPX on any day for which an index value

is published is determined by a fraction, the numerator of which is the aggregate of the market price of each stock in the SPX times the

number of shares of such stock included in the SPX, and the denominator of which is the divisor, which is described more fully below.

The “market value” of any index stock is the product of the market price per share of that stock times the

number of the then-outstanding shares of such index stock that are then included in the SPX.

The SPX is also sometimes called a “base-weighted aggregative

index” because of its use of a divisor. The “divisor” is a value calculated by S&P that is intended to maintain

conformity in index values over time and is adjusted for all changes in the index stocks’ share capital after the “base date”

as described below. The level of the SPX reflects the total market value of all index stocks relative to the index’s base period

of 1941-1943.

In addition, the SPX is float-adjusted, meaning that the share counts

used in calculating the SPX reflect only those shares available to investors rather than all of a company’s outstanding shares.

S&P seeks to exclude shares held by long-term, strategic shareholders concerned with the control of a company, a group that generally

includes the following: officers and directors and related individuals whose holdings are publicly disclosed, private equity, venture

capital, special equity firms, asset managers and insurance companies with board of director representation, publicly traded companies

that hold shares in another company, holders of restricted shares (except for shares held as part of a lock-up agreement),

company-sponsored employee share plans/trusts, defined contribution plans/savings, investment plans, foundations or family trusts associated

with the company, government entities at all levels (except government retirement or pension funds), sovereign wealth funds and any individual

person listed as a 5% or greater stakeholder in a company as reported in regulatory filings (collectively, “strategic holders”).

To this end, S&P excludes all share-holdings (other than depositary banks, pension funds (including government pension and retirement

funds), mutual funds, exchange traded fund providers, investment funds, hedge funds, asset managers that do not have direct board of

director representation (including stakeholders who may have the right to appoint a board of director member but choose not to do so,

stakeholders who have exercised a right to appoint a board of director “observer” even if that observer is employed by the

stakeholder and stakeholders who have exercised a right to appoint an independent director who is not employed by the stakeholder), investment

funds of insurance companies and independent foundations not associated with the company) with a position greater than 5% of the outstanding

shares of a company from the float-adjusted share count to be used in SPX calculations.

The exclusion is accomplished by calculating an IWF for each stock

that is part of the numerator of the float-adjusted index fraction described above:

IWF = (available float shares)/(total shares outstanding)

where available float shares is defined as total shares outstanding

less shares held by strategic holders. In most cases, an IWF is reported to the nearest one percentage point. For companies with multiple

share class lines, a separate IWF is calculated for each share class line.

Maintenance of the SPX

In order to keep the SPX comparable over time S&P engages in an

index maintenance process. The SPX maintenance process involves changing the constituents as discussed above, and also involves maintaining

quality assurance processes and procedures, adjusting the number of shares used to calculate the SPX, monitoring and completing the adjustments

for company additions and deletions, adjusting for stock splits and stock dividends and adjusting for other corporate actions. In addition

to its daily governance of indices and maintenance of the SPX methodology, at least once within any 12 month period, the S&P Index

Committee reviews the SPX methodology to ensure the SPX continues to achieve the stated objective, and that the data and methodology

remain effective. The S&P Index Committee may at times consult with investors, market participants, security issuers included in

or potentially included in the SPX, or investment and financial experts.

Divisor Adjustments

The two types of adjustments primarily used by S&P are divisor

adjustments and adjustments to the number of shares (including float adjustments) used to calculate the SPX. Set forth below under “Adjustments

for Corporate Actions” is a table of certain corporate events and their resulting effect on the divisor and the share count. If

a corporate event requires an adjustment to the divisor, that event has the effect of altering the market value of the affected index

stock and consequently of altering the aggregate market value of the index stocks following the event. In order that the level of the