Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261530

PROSPECTUS

NaturalShrimp Incorporated

20,381,858 Shares

Common Stock

The selling stockholders named in this prospectus may offer and sell, from time to time, in one or more offerings, up to 20,381,858 shares of our common stock, par value $0.0001 per share. The shares of our common stock may be sold by the selling shareholders at prevailing market prices at the times of sale, prices related to the prevailing market prices or negotiated prices. The shares of common stock may be offered by the selling shareholders to or through underwriters, dealers or other agents, directly to investors or through any other manner permitted by law, on a continued or delayed basis. See “Plan of Distribution” beginning on page 73 of this prospectus.

We are not selling any shares of common stock in this offering, and we will not receive any proceeds from the sale of shares by the selling stockholders. The registration of the securities covered by this prospectus does not necessarily mean that any of these securities will be offered or sold by the selling stockholders. The timing and amount of any sale is within the respective selling stockholders’ sole discretion, subject to certain restrictions. To the extent that any selling stockholder resells any securities, the selling stockholder may be required to provide you with this prospectus identifying and containing specific information about the selling stockholder and the terms of the securities being offered.

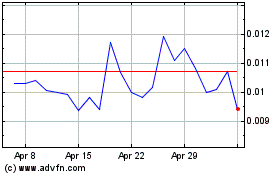

Shares of our common stock are quoted on the OTCQB of the OTC Markets Group Inc. under the symbol “SHMP.” On March 1, 2022, the closing price per share of our common stock as reported by OTC Markets Group Inc. was $0.246.

See “Risk Factors” beginning on page 17 of this prospectus for a discussion of risk factors that should be considered by prospective purchasers of the shares of common stock offered under this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 1, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We and the selling stockholders have not authorized anyone to provide any information or make any representations other than those contained in this Prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information in this Prospectus is current only as of its date.

The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus regardless of the time of delivery of this Prospectus or of any sale of the Common Stock. Neither the delivery of this Prospectus, nor any sale made hereunder, will under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information contained herein is correct as of any time subsequent to the date of such information.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our Common Stock, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is March 31 and our fiscal years ended March 31, 2021 and 2020 are sometimes referred to herein as fiscal years 2021 and 2020, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” or “NaturalShrimp” refer to NaturalShrimp Incorporated., a Nevada corporation, and each of our subsidiaries.

When used in this prospectus the following terms have the following meanings related to our subsidiaries.

| | · | “NSC” refers to NaturalShrimp USA Corporation, a company organized under the law of the state of Delaware. |

| | | |

| | · | “NS Global” refers to NaturalShrimp Global, Inc., a company organized under the law of the state of Delaware. |

| | | |

| | · | “NAS” refers to Natural Aquatic Systems, Inc., a company organized under the law of the state of Texas. |

Corporate History

We were incorporated in the State of Nevada on July 3, 2008 under the name “Multiplayer Online Dragon, Inc.” Effective November 5, 2010, we effected an 8-for-1 forward stock split, increasing the issued and outstanding shares of our common stock from 12,000,000 shares to 96,000,000 shares. On October 29, 2014, we effected a 1-for-10 reverse stock split, decreasing the issued and outstanding shares of our common stock from 97,000,000 to 9,700,000.

On November 26, 2014, we entered into an Asset Purchase Agreement (the “Agreement”) with NaturalShrimp Holdings, Inc. a Delaware corporation (“NSH”), pursuant to which we agreed to acquire substantially all of the assets of NSH which assets consisted primarily of all of the issued and outstanding shares of capital stock of NaturalShrimp Corporation (now known as NaturalShrimp USA Corporation) (“NSC”), a Delaware corporation, and NaturalShrimp Global, Inc. (“NS Global”), a Delaware corporation, and certain real property located outside of San Antonio, Texas (the “Assets”).

On January 30, 2015, we consummated the acquisition of the Assets pursuant to the Agreement. In accordance with the terms of the Agreement, we issued 75,520,240 shares of our common stock to NSH as consideration for the Assets. As a result of the transaction, NSH acquired 88.62% of our issued and outstanding shares of common stock; NSC and NS Global became our wholly owned subsidiaries; and we changed our principal business to a global shrimp farming company.

In connection with our receipt of approval from the Financial Industry Regulatory Authority (“FINRA”), effective March 3, 2015, we amended our Articles of Incorporation to change our name to “NaturalShrimp Incorporated.”

Business Overview

We are a biotechnology company and have developed a proprietary technology that allows us to grow Pacific White shrimp (Litopenaeus vannamei, formerly Penaeus vannamei) in an ecologically controlled, high-density, low-cost environment, and in fully contained and independent production facilities. Our system uses technology which allows us to produce a naturally grown shrimp “crop” weekly, and accomplishes this without the use of antibiotics or toxic chemicals. We have developed several proprietary technology assets, including a knowledge base that allows us to produce commercial quantities of shrimp in a closed system with a computer monitoring system that automates, monitors and maintains proper levels of oxygen, salinity and temperature for optimal shrimp production. The Company’s production facilities are located in La Coste, Texas and Webster City, Iowa.

NS Global, one of our wholly owned subsidiaries, owns less than 1% of NaturalShrimp International A.S. in Europe. Our European-based partner, NaturalShrimp International A.S., Oslo, Norway, was responsible for the construction cost of its facility and operating capital.

The first facility built in Spain for NaturalShrimp International A.S. is GambaNatural de España, S.L. The land for the first facility was purchased in Medina del Campo, Spain, and construction of the 75,000 sq. ft. facility was completed in 2016. Medina del Campo is approximately seventy-five miles northwest of Madrid, Spain.

On October 16, 2015, we formed Natural Aquatic Systems, Inc. (“NAS”). The purpose of NAS was to formalize the business relationship between our Company and F&T Water Solutions LLC (F&T) for the joint development of certain water technologies. On May 19, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”) with F&T. Prior to entering into the SPA, the Company owned fifty-one percent (51%) and F&T owned forty-nine percent (49%) of the issued and outstanding shares of common stock of NAS. Upon the closing of the SPA, the Company purchased the 980,000 shares of NAS’ common stock owned by F&T for a purchase price of $1,000,000 in cash and issued 3,960,396 shares of the Company’s common stock at a market value of $0.505 per share, for a total fair value of $2,000,000, for a total acquisition price of $3,000,000. The Company paid the cash purchase price on May 20, 2021 and the purchase of the NAS shares closed on May 25, 2021. After the SPA, NAS is a 100% owned subsidiary of the Company.

On May 19, 2021, the Company entered into a Patents Purchase Agreement (the “Patents Agreement”) with F&T. The Company and F&T had previously jointly developed and patented a water treatment technology used or useful in growing aquatic species in re-circulating and enclosed environments (the “Patent”) with each party owning a fifty percent (50%) interest. Upon the closing of the Patents Agreement, the Company would purchase F&T’s interest in the Patent, F&T’s 100% interest in a second patent associated with the first Patent issued to F&T in March 2018, and all other intellectual property rights owned by F&T for a purchase price of $2,000,000 in cash and issued 9,900,990 shares of the Company’s common stock with a market value of $0.505 per share for a total fair value of $5,000,000, for a total acquisition price of $7,000,000. The Company paid the cash purchase price on May 20, 2021 and the closing of the Patents Agreement took place on May 25, 2021.

On December 15, 2020, we entered into an Asset Purchase Agreement (“APA”) between VeroBlue Farms USA, Inc., a Nevada corporation (“VBF”), VBF Transport, Inc., a Delaware corporation (“Transport”), and Iowa’s First, Inc., an Iowa corporation (“Iowa’s First”) (each a “Seller” and collectively, “Sellers”). Transport and Iowa’s First were wholly-owned subsidiaries of VBF. The agreement called for us to purchase all of the tangible assets of VBF, the motor vehicles of Transport and the real property (together with all plants, buildings, structures, fixtures, fittings, systems, and other improvements located on such real property) of Iowa’s First. The consideration was $10,000,000, consisting of $5,000,000 in cash, paid at closing on December 17, 2020, (ii) $3,000,000 payable in 36 months with interest thereon at the rate of 5% per annuum, interest only payable quarterly on the first day of the quarter, with the remaining balance to be paid to VBF as a balloon payment on the maturity date, and (iii) $2,000,000 payable in 48 months with interest thereon at the rate of 5% per annuum, interest only payable quarterly on the first day of the quarter, with the remaining balance to be paid to VBF as a balloon payment on the maturity date. The Company also agreed to issue 500,000 shares of Common Stock as a finder’s fee, with a fair value of $135,000 based on the market value of the Common Stock as of the closing date of the acquisition. On December 23, 2021, the Company repaid the Notes fully with a payment of $4,556,164, of which $56,164 was interest. This included a $500,000 prepayment discount. The $500,000 was recognized as gain on settlement.

On August 25, 2021, the Company, through their 100% owned subsidiary NAS, entered into an Equipment Rights Agreements with Hydrenesis-Delta Systems, LLC (“Hydrenesis-Delta”), and a Technology Rights Agreement in a sub-license agreement with Hydrenesis Aquaculture LLC (“Hydrenesis-Aqua”). The Equipment Rights involve specialized and proprietary equipment used to produce and control, dose, and infuse Hydrogas® and RLS® into both water and other chemical species, while the Technology sublicense pertains to the rights to Hydrogas® and RLS®. Both Rights agreements are for a 10-year term, which shall automatically renew for ten-year successive terms. The term can be terminated by written notice by mutual consent or by either party upon a breach of contract, insolvency, or filing of bankruptcy. The agreements accord the exclusive rights to purchase or distribute the technology or buy or rent the equipment in the Industry Sector, which is the primary business and revenue stream generated from indoor aquaculture farming of any species in the Territory, defined as anywhere in the world except for the countries in the Gulf Corporation Council.

The Company has three wholly owned subsidiaries: NSC, NS Global, and NAS.

Recent Developments

Securities Purchase Agreement – Secured Promissory Note

The Company entered into a securities purchase agreement (the “SPA”) with an investor (the “Investor”) on December 15, 2021. Pursuant to the SPA, the Investor purchased a secured promissory note (the “Note”) in the aggregate principal amount totaling approximately $16,320,000 (the “Principal Amount”). The Note carried an original issue discount totaling $1,300,000 and a transaction expense amount of $20,000, both of which are included in the principal balance of the Note. The total purchase price of the Note was $15,000,000. The Note has an interest rate of 12% per annum. The maturity date of the Note is twenty-four (24) months from the issuance date of the Note (the “Maturity Date”). The Company also issued 3,000,000 warrants to Joseph Gunnar & Co., LLC (the placement agent) as placement agent fees, with a fair value of $940,000.

The Company used the proceeds from the Note, in part, to repay the amounts currently owing to VeroBlue Farms USA, Inc. On December 23, 2021, the Company fully repaid the Notes with a payment of $4,556,164, of which $56,164 was interest. This included a $500,000 prepayment discount. The $500,000 was recognized as gain on settlement.

Beginning on the date that is six (6) months from the issuance date of the Note, the Investor has the right to redeem up to $1,000,000 of the outstanding balance per month. Payments may be made by the Company, at the Company’s option, (a) in cash, or (b) by paying the redemption amount in the form of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), per the following formula: the number of redemption shares equals the portion of the applicable redemption amount divided by the Redemption Repayment Price. The “Redemption Repayment Price” equals 90% multiplied by the average of the two lowest volume weighted average price per share of the Common Stock during the ten (10) trading days immediately preceding the date that the Investor delivers notice electing to redeem a portion of the Note. The right to pay the redemption amount in the form of shares of Common Stock is subject to there not being any Equity Conditions Failure (as defined in the Note). The redemption amount shall include a premium of 15% of the portion of the outstanding balance being paid. In addition to the Investor’s right of redemption, the Company has the option to prepay the Notes at any time prior to the Maturity Date by paying a premium of 15% plus the principal, interest, and fees owed as of the prepayment date.

Within 180 days of the issuance date of the Note, the Company will obtain an effective registration statement or a supplement to any existing registration statement or prospectus with the SEC registering at least $15,000,000 in shares of Common Stock for the Investor’s benefit such that any redemption using shares of Common Stock could be done using registered Common Stock.

As soon as reasonably possible following the issuance of the Note, the Company will cause the Common Stock to be listed for trading on either of (a) NYSE, or (b) NASDAQ (in either event, an “Uplist”). In the event the Company has not effectuated the Uplist by March 1, 2022, the then-current outstanding balance will be increased by 10%. The Company will make a one-time payment to the Investor equal to 15% of the gross proceeds the Company receives from the offering expected to be effected in connection with the Uplist (whether from the sale of shares of its Common Stock and / or preferred stock) within ten (10) days of receiving such amount. In the event Borrower does not make this payment, the then-current outstanding balance will be increased by 10%.

The Company and the Investor entered into an amendment to the Note on February 7, 2022 extending the Uplist deadline to April 15, 2022 in consideration of the Company agreeing to add $249,079.47 to the outstanding balance of the Note. The Company did not receive any new funds from the Investor in connection with this amendment.

The Note is a secured obligation of the Company, to the extent provided for in the Security Agreement dated as of the date of the SPA (the “Security Agreement”) entered into by and among the Company and the Investor. The Note shall be senior in right of payment to all other Indebtedness (as defined in the Note) of the Company subject to the terms set forth in the Security Agreement. The Note is a direct obligation of the Company issued in accordance with the SPA. The Company granted a first priority security interest in and to all of the assets of the Company, provided, however, certain real property of the Company was to be secured in favor of the Investor within thirty (30) days of the issuance of the Note. Pursuant to the terms of the Note, for each day any third party outside of the Company’s control delays in permitting the Company to accomplish the securing of certain real property in favor of the Investor, a day shall be added to the foregoing thirty (30) day deadline. In such a situation, no increase in the Note’s outstanding balance will be assessed and the delay will not be considered a Trigger Event (as defined in the Note) which could lead to an event of default. While, as of March 1, 2022, the real property in question had not yet been secured in favor of the Investor, the Company expects to finalize this security interest prior to March 11, 2022. Pursuant to the terms of the Note, there has been no increase in the Note’s outstanding balance nor has there been a notification of a Trigger Event.

Securities Purchase Agreement - Series E Preferred Stock and Warrant

On November 22, 2021, NaturalShrimp Incorporated (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with one accredited investor (the “Purchaser”), for the offering (the “Offering”) of (i) one thousand five hundred (1,500) shares of the Company’s Series E Convertible Preferred stock, par value $0.0001 (the “Series E Preferred Stock”) at a price of one thousand dollars ($1,000.00) per share and (ii) a warrant to purchase up to one million five hundred thousand (1,500,000) shares of the Company’s common stock (the “Warrant”), with an exercise price equal to $0.75, subject to adjustment therein. Pursuant to the Purchase Agreement, the Purchaser is purchasing the one thousand five hundred (1,500) shares of Series E Preferred Stock (the “Purchased Shares”) and the Warrant for an aggregate purchase price of one million five hundred thousand dollars ($1,500,000.00). The Warrant expires on November 22, 2026, the five (5)-year anniversary of the issue date. The Offering was a private placement with the Purchaser. The Offering closed on November 23, 2021.

The Company received approximately one million three hundred fifty thousand dollars ($1,350,000.00) in net proceeds from the Offering before exercise of the Warrant and after deducting the commission of Joseph Gunnar & Co., LLC (the placement agent) and other estimated offering expenses payable by the Company. The Company issued 267,429 warrants as placement agent fees.

The Purchase Agreement contains customary representations, warranties and agreements by the Company and the other parties thereto, customary conditions to closing, indemnification obligations of the parties, including for liabilities under the Securities Act of 1933, as amended (the “Securities Act”) and other obligations of the parties.

Pursuant to the Purchase Agreement, from the date thereof until the date when the Purchaser no longer holds any of the Purchased Shares or the Warrant (the “Securities”), upon any issuance by the Company of its securities for cash consideration (a “Subsequent Financing”), the Purchaser may elect, in its sole discretion, to exchange (in lieu of conversion), if applicable, all or some of the Securities then held for any securities or units issued in a Subsequent Financing on a $1.00-for-$1.00 basis and under the same terms and conditions as provided for in the Subsequent Financing.

The shares of Series E Preferred Stock have a stated value of $1,200 per share (the “Series E Stated Value”) and are convertible into shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at the election of the holder of the Series E Preferred Stock at any time at a price of $0.35 per share, subject to adjustment (the “Conversion Price”). The Series E Preferred Stock is convertible into that number of shares of Common Stock determined by dividing the Series E Stated Value (plus any and all other amounts which may be owing in connection therewith) by the Conversion Price, subject to certain beneficial ownership limitations.

The Company has the right to redeem the Series E Preferred Stock shares by paying, in cash, a premium rate (with such rate ranging from 1.15 to 1.25) multiplied by the sum of (a) the Stated Value and (b) all amounts owed pursuant the Series E Preferred Stock Certificate of Designation (the “Certificate of Designation”) (included any accrued but unpaid dividends). The Company is required to redeem the Series E Preferred Stock shares on the one year anniversary of the date of issuance.

In addition, the Company shall, at the holder’s sole option, upon the occurrence of a Triggering Event and following a five (5) day opportunity to cure following written notice, to require the Company to redeem all of the Series E Preferred Stock shares for a redemption price, in cash, equal to the Triggering Redemption Amount ((a) 150% of the Stated Value and (b) all amounts owed pursuant the Certificate of Designation (included any accrued but unpaid dividends)). The Certificate of Designation defines Triggering Events as one of eleven (11) items including, a failure to deliver conversion shares, a failure to have a sufficient amount of authorized but unreserved shares available to issue to a holder upon a conversion, a bankruptcy event, a monetary judgment of over $500,000, and an event of default as defined in the Certificate of Designation.

Each holder of Series E Preferred Stock shall be entitled to receive, with respect to each share of Series E Preferred Stock then outstanding and held by such holder, dividends at the rate of twelve percent (12%) per annum, payable quarterly (the “Preferred Dividends”).

The holders of Series E Preferred Stock rank senior to the Common Stock and Common Stock Equivalents (as defined in the Certificate of Designation) with respect to payment of dividends and rights upon liquidation and will vote together with the holders of the Common Stock on an as-converted basis, subject to beneficial ownership limitations, on each matter submitted to a vote of holders of Common Stock (whether at a meeting of shareholders or by written consent).

Registration Rights Agreement

On November 22, 2021, in connection with the Purchase Agreement, the Company and the Purchaser entered into a registration rights agreement (the “Rights Agreement”) pursuant to which the Company agreed to, within fifteen (15) calendar days of November 22, 2021, the date of execution of the Rights Agreement, use its best efforts to file a registration statement or registration statements (as is necessary) with the SEC on Form S-1 (or, if such a form is unavailable, on such other form as is available for such registration) covering the resale of the Securities and the shares of Common Stock underlying the Securities, and pursuant to which the Company agreed that such registration statement will state, according to Rule 416 promulgated under the Securities Act, that such registration statement also covers such indeterminate number of additional shares of Common Stock as may become issuable upon stock splits, dividends, or similar transactions. The shares of Common Stock underlying the Securities are being registered in the registration statement of which this prospectus forms a part.

The Warrant’s cashless exercise provision will go into effect if the Company violates the Rights Agreement.

Waiver

On April 14, 2021, the Company entered into a securities purchase agreement (the “April SPA”) to sell: (a) 9,090,909 shares of Common Stock at a price per share of $0.55; (b) warrants to purchase up to 10,000,000 shares of Common Stock, at an exercise price of $0.75 per share (the “April Warrants”); and (c) 1,000,000 shares of Common Stock with a value (although no purchase price will be paid) of $0.65 per share, with GHS Investments LLC (“GHS”), an accredited investor. Pursuant to the April SPA, until April 14, 2022, GHS has a right to participate in any subsequent financing that the Company conducts.

On November 22, 2021, GHS entered into a Waiver (the “Waiver”) whereby GHS agreed to waive its right to participate in the Offering and to participate in a possible $16.32 million debt financing for which the Company is still negotiating definitive documentation. There is no guarantee the Company will be able to secure such debt financing at all or on favorable terms to the Company. GHS also agreed to waive its right, pursuant to the Certificate of Designation, to exchange shares of Series E Preferred Stock held by GHS for securities issued in the debt financing, if the Company enters into such financing.

In consideration for GHS entering into the Waiver, the Company agreed to lower the exercise price of the April Warrants to $0.35 per share (the Conversion Price) and to issue warrants to purchase 3,739,000 shares of Common Stock with an exercise price of $0.75 per share with such warrants being substantially in the form of the Warrants. The shares of Common Stock underlying the warrant issued to GHS are being registered in the registration statement of which this prospectus forms a part.

The foregoing descriptions of the Purchase Agreement, the Warrant, the Certificate of Designation, the Rights Agreement, and the Waiver are qualified in their entirety by reference to the full text of such Purchase Agreement, Warrant, Certificate of Designation, Rights Agreement, and Waiver, the forms of which are attached as exhibits to the registration statement of which this prospectus forms a part.

The shares of Series E Preferred Stock, the Warrants and the GHS warrant were not registered for sale under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements. The issuance and sale of the Securities was made in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated thereunder. No form of general solicitation or general advertising was conducted in connection with the issuance. The Securities contain (or will contain, where applicable) restrictive legends preventing the sale, transfer, or other disposition of such securities, unless registered under the Securities Act, or pursuant to an exemption therefrom.

Resolution of Gary Shover Litigation

A shareholder of NaturalShrimp Holdings, Inc. (“NSH”), Gary Shover, filed suit against the Company on August 11, 2020 in the Northern District of Texas, Dallas Division, alleging breach of contract for the Company’s failure to exchange common shares of the Company for shares Mr. Shover owns in NSH.

On November 15, 2021, a hearing was held before the US District Court for the Northern District of Texas, Dallas Division at which time Mr. Shover and the Company presented arguments as to why the Court should approve a joint motion for settlement. After considering the argument of counsel and taking questions from those NSH shareholders who were present through video conferencing link, the Court approved the motion of the parties to allow Mr. Shover and all like and similarly situated NSH shareholders to exchange each share of NSH held by a NSH shareholder for a share of the Company. A final Order was signed on December 6, 2021 and the case was closed by an Order of the Court of the same date. The Company is to issue approximately 93 million shares in settlement, which has been recognized as stock payable on the Company’s balance sheet, and its fair value of $29,388,000, based on the market value of the Company’s common shares of $0.316 on the date the case was closed, has been recognized in the Company’s statement of operations as legal settlement. As of March 1, 2022, the NSH shareholders have not yet received any shares of the Company.

Designation and Issuance of Series F Preferred Stock

On February 23, 2022, the Secretary of State of the State of Nevada delivered confirmation of the effective filing by the Company of its Certificate of Designation of Series F Convertible Preferred Stock (the “Series F Designation”). The Series F Designation authorized the issuance of up to 750,000 shares of the Company’s Series F Convertible Preferred Stock (“Series F Preferred Stock”), having such designations, rights and preferences as set forth therein.

The number of shares of Series F Preferred Stock authorized or outstanding shall not be affected by a subdivision of the Common Stock (by any forward stock split, stock dividend, recapitalization or otherwise) into a greater number of shares, or by a combination of the Common Stock (by combination, reverse stock split or otherwise) into a smaller number of shares.

On March 1, 2022, the Board of the Directors of the Company (the “Board”) issued 250,00 shares of Series F Preferred Stock to each of Gerald Easterling, William Delgado and Thomas Untermeyer in consideration for their past and future services as executive officers of the Company.

At any time after the three year anniversary of each respective date of the issuance of any share of Series F Preferred Stock (in each case, the “Issuance Date”), each individual holder shall have the right, at each individual holder’s sole option, to convert all of the shares of Series F Preferred Stock that such individual holds into shares of fully paid and nonassessable shares of Common Stock in an amount equal to 8% (eight percent) of the Company’s issued and outstanding shares of Common Stock as of the close of business on the day the Notice of Conversion (as defined in the Series F Designation) is sent to the Company. For the sake of clarity: (i) each individual holder cannot convert a portion of such holder’s shares of Series F Preferred Stock; rather, each individual holder must convert all of such holder’s holdings at the same time; and (ii) a reverse or forward stock split of the Common Stock will not affect the conversion rate.

Each individual holder of Series F Preferred Stock may only convert all of their shares of Series F Preferred Stock in one transaction. If the holder elects to convert all of its shares of the Series F Preferred Stock, it shall deliver three (3) days’ written notice thereof via email or overnight mail a notice of conversion (the “Notice of Conversion”) to the Company, listing the conversion date (the “Conversion Date”) which Notice of Conversion shall indicate (i) the holder is electing to convert all of their shares of Series F Preferred Stock, (ii) the Conversion Date, and (iii) the manner and the place designated for the surrender of the certificate or certificates representing the shares to be converted.

On any matter presented to the stockholders of the Company for their action or consideration at any meeting of stockholders of the Company (or by written consent of stockholders in lieu of meeting), the Series F Designation authorizes each holder of outstanding shares of Series F Preferred Stock to cast one thousand (1,000) votes per each share of Series F Preferred Stock held by such holder as of the record date for determining stockholders entitled to vote on such matter.

Other than a change in par value or as a result of a stock dividend or subdivision, forward stock split, reverse stock split, split-up or combination of shares, at any time after the Issuance Date, in the case of any capital reorganization, any reclassification of the stock of the Company, or a Change in Control (as defined in the Series F Designation), the shares of Series F Preferred Stock shall, at the effective time of such reorganization, reclassification, or Change in Control, be automatically converted into the kind and number of shares of stock or other securities or property of the Company or of the entity resulting from such reorganization, reclassification, or Change in Control to which such holder would have been entitled if immediately prior to such reorganization, reclassification, reorganization, reclassification, or Change in Control it had converted its shares of Series F Preferred Stock into Common Stock.

The Series F holders will not be entitled to dividends, nor any distribution rights in the event of any liquidation, dissolution, or winding up of the Company.

Evolution of Technology and Revenue Expectations

Historically, efforts to raise shrimp in a high-density, closed system at the commercial level have been met with either modest success or outright failure through “BioFloc Technology.” Infectious agents such as parasites, bacteria and viruses are the most damaging and most difficult to control. Bacterial infection can in some cases be combated through the use of antibiotics (although not always), and in general, the use of antibiotics is considered undesirable and counter to “green” cultivation practices. Viruses can be even worse, in that they are immune to antibiotics. Once introduced to a shrimp population, viruses can wipe out entire farms and shrimp populations, even with intense probiotic applications.

Our primary solution against infectious agents is our “Vibrio Suppression Technology.” We believe this system creates higher sustainable densities, consistent production, improved growth and survival rates and improved food conversion without the use of antibiotics, probiotics or unhealthy anti-microbial chemicals. Vibrio Suppression Technology helps to exclude and suppress harmful organisms that usually destroy “BioFloc” and other enclosed technologies.

In 2001, we began research and development of a high density, natural aquaculture system that is not dependent on ocean water to provide quality, fresh shrimp every week, fifty-two weeks a year. The initial NaturalShrimp system was successful, but the Company determined that it would not be economically feasible due to high operating costs. Over the next several years, using the knowledge we gained from developing the first system, we developed a shrimp production system that eliminated the high costs associated with the previous system. We have continued to refine this technology, eliminating bacteria and other problems that affect enclosed systems, and now have a successful shrimp growing process. We have produced thousands of pounds of shrimp over the last few years in order to develop a design that will consistently produce quality shrimp that grow to a large size at a specific rate of growth. This included experimenting with various types of natural live and synthesized feed supplies before selecting the most appropriate nutritious and reliable combination. It also included utilizing monitoring and control automation equipment to minimize labor costs and to provide the necessary oversight for proper regulation of the shrimp environment. However, there were further enhancements needed to our process and technology in order to begin production of shrimp on a commercially viable scale and to generate revenues.

Our current system consists of a nursery tank where the shrimp are acclimated and then moved to a larger grow-out tank for the rest of the twenty-four-week cycle. During 2016, we engaged in additional engineering projects with third parties to further enhance our indoor production capabilities. For example, through our relationship with Trane, Inc., a division of Ingersoll-Rand Plc (“Trane”), Trane provided a detailed audit to use data to build and verify the capabilities of then initial Phase 1 prototype of a Trane-proposed three tank system at our La Coste, Texas facility. The Company working with F&T Water Solutions contracted RGA Labs, Inc. (“RGA Labs”), to build the initial NaturalShrimp patented Electrocoagulation system for the grow-out, harvesting, and processing of fully mature, antibiotic-free Pacific White Leg shrimp. The design provided a viable pathway to begin generating revenue and producing shrimp on a commercially viable scale. The equipment was installed in early June 2018 by RGA Labs, and final financing for the system was provided by one of the Company’s institutional investors. The first post larvae (PL) arrived from the hatchery on July 3, 2018. The Company used the shrimp for sampling to key potential customers and special events such as the Texas Restaurant Association trade show. The Company also received two production PL lots from Global Blue Technologies on March 21, 2019, and April 17, 2019, and from American Penaeid, Inc., on August 7, 2019. Because the shrimp displayed growth that was slower than normal, the Company had a batch tested by an independent lab at the University of Arizona. The shrimp tested positive for Infectious hypodermal and hematopoietic necrosis (“IHHNV”) and the Texas Parks and Wildlife Department was notified that the facility was under quarantine. On August 26, 2019, the Company was forced to terminate all lots due to the infection. On August 30, 2019, the Company received notice that it was in compliance again and the quarantine had been lifted and the Company began restocking shrimp in the refurbished facility sections. During the aforementioned quarantine, the Company decided to begin an approximately $2,000,000 facility renovation demolishing the interior 16 wood structure lined tanks (720,000 gallons). The Company began replacing the previous tanks with 40 new fiberglass tanks (600,000 gallons) at a cost of approximately $400,000 allowing complete production flexibility with more smaller tanks.

On March 18, 2020, our research and development plant in La Coste, Texas, was destroyed by a fire. The Company believed that it was caused by a natural gas leak, but the fire was so extensive that the cause was undetermined. No one was injured as a result of the fire. The majority of the damage was to our pilot production plant, which comprised approximately 35,000 square feet of the total size of all facilities at the La Coste location of approximately 53,000 square feet, but the fire did not impact the separate greenhouse, reservoirs, or utility buildings. We received total insurance proceeds in the amount of $917,210, the full amount of our claim. These funds were utilized to rebuild a 40,000 square foot production facility at the La Coste facility and to repurchase the equipment needed to replace what was lost in the fire. As of the date of this prospectus, this facility is production-ready and, while we have experienced supply chain issues due to COVID-19, we expect the combined output from the La Coste, Texas, and Webster City, Iowa should result in a total of 25,000 pounds of shrimp production for the calendar quarter that will end on March 31, 2022. Also, the Company is expecting to break ground on an 80,000 square foot expansion in La Coste prior to March 31, 2022.

Overview of Industry

Shrimp is a well-known and globally-consumed commodity, constituting one of the most important types of seafood and a staple protein source for much of the world. According to the USDA Foreign Agricultural Service, the world consumes approximately 9 billion pounds of shrimp annually with over 1.7 billion pounds consumed in the United States alone. Approximately 65% of the global supply of shrimp is caught by ocean trawlers and the other 35% is produced by open-air shrimp farms, mostly in developing countries.

Shrimp boats catch shrimp through the use of large, boat-towed nets. These nets are quite toxic to the undersea environment as they disturb and destroy ocean-bottom ecosystems. These nets also catch a variety of non-shrimp sea life, which is typically killed and discarded as part of the shrimp harvesting process. Additionally, the world’s oceans can only supply a finite amount of shrimp each year, and in fact, single-boat shrimp yields have fallen by approximately 20% since 2010 and continue to decrease. The shrimping industry’s answer to this problem has been to deploy more (and larger) boats that deploy ever-larger nets, which has in the short-term been successful at maintaining global shrimp yields. However, this benefit cannot continue forever, as eventually global demand has the potential of outstripping the oceans’ ability to maintain the natural ecosystem’s balance, resulting in a permanent decline in yields. When taken in light of global population growth and the ever-increasing demand for nutrient-rich foods such as shrimp, this is clearly an unsustainable production paradigm.

Shrimp farming, known in the industry as “aquaculture,” has ostensibly stepped in to fill this demand/supply imbalance. Shrimp farming is typically done in open-air lagoons and man-made shrimp ponds connected to the open ocean. Because these ponds constantly exchange water with the adjacent sea, the farmers are able to maintain the water chemistry that allows the shrimp to prosper. However, this method of cultivating shrimp also carries severe ecological peril. First of all, most shrimp farming is primarily conducted in developing countries, where poor shrimp farmers have little regard for the global ecosystem. Because of this, these farmers use large quantities of antibiotics and other chemicals that maximize each farm’s chance of producing a crop, putting the entire system at risk. For example, a viral infection that crops up in one farm can spread to all nearby farms, quite literally wiping out an entire region’s production. In 1999, the White Spot virus invaded shrimp farms in at least five Latin American countries: Honduras, Nicaragua, Guatemala, Panama and Ecuador and in 2013-14 EMS (Early Mortality Syndrome) wiped out most of the Asia Pacific region and Mexico. Secondly, there is also a finite amount of coastline that can be used for shrimp production - eventually shrimp farms that are dependent on the open ocean will have nowhere to expand. Again, this is an ecologically damaging and ultimately unsustainable system for producing shrimp.

In both the cases, the current method of shrimp production is unsustainable. As global populations rise and the demand for shrimp continues to grow, the current system is bound to fall short. Shrimp trawling cannot continue to increase production without completely depleting the oceans’ natural shrimp population. Trends in per-boat yield confirm that this industry has already crossed the overfishing threshold, putting the global open-ocean shrimp population in decline. While open-air shrimp aquaculture may seem to address this problem, it is also an unsustainable system that destroys coastal ecological systems and produces shrimp with very high chemical contamination levels. Closed-system shrimp farming is clearly a superior alternative, but its unique challenges have prevented it from becoming a widely-available alternative - until now.

Of the 1.7 billion pounds of shrimp consumed annually in the United States, over 1.3 billion pounds are imported - much of this from developing countries’ shrimp farms. These farms are typically located in developing countries and use high levels of antibiotics and pesticides that are not allowed under USDA regulations. As a result, these shrimp farms produce chemical-laden shrimp in an ecologically unsustainable way.

Unfortunately, most consumers here in the United States are not aware of the origin of their store-bought shrimp or worse, that which they consume in restaurants. This is due to a USDA rule that states that only bulk-packaged shrimp must state the shrimp’s country of origin; any “prepared” shrimp, which includes arrangements sold in grocery stores and seafood markets, as well as all shrimp served in restaurants, can simply be sold “as is.” Essentially, this means that most U.S. consumers may be eating shrimp laden with chemicals and antibiotics. NaturalShrimp’s product is free of pesticide chemicals and antibiotics, a fact that we believe is highly attractive and beneficial in terms of our eventual marketing success.

Technology

Intensive, Indoor, Closed-System Shrimp Production Technology

Historically, efforts to raise shrimp in a high-density, closed system at the commercial level have been met with either modest success or outright failure through “BioFloc Technology”. Infectious agents such as parasites, bacteria and viruses are the most damaging and most difficult to control. Bacterial infection can in some cases be combated through the use of antibiotics (although not always), and in general, the use of antibiotics is considered undesirable and counter to “green” cultivation practices. Viruses can be even worse, in that they are immune to antibiotics. Once introduced to a shrimp population, viruses can wipe out entire farms and shrimp populations, even with intense probiotic applications.

Our primary solution against infectious agents is our “Vibrio Suppression Technology”. We believe this system creates higher sustainable densities, consistent production, improved growth and survival rates and improved food conversion without the use of antibiotics, probiotics or unhealthy anti-microbial chemicals. Vibrio Suppression Technology helps to exclude and suppress harmful organisms that usually destroy “BioFloc” and other enclosed technologies.

Automated Monitoring and Control System

The Company’s “Automated Monitoring and Control System” uses individual tank monitors to automatically control the feeding, oxygenation, and temperature of each of the facility tanks independently. In addition, a facility computer running custom software communicates with each of the controllers and performs additional data acquisition functions that can report back to a supervisory computer from anywhere in the world. These computer-automated water controls optimize the growing conditions for the shrimp as they mature to harvest size, providing a disease-resistant production environment.

The principal theories behind the Company’s system are characterized as:

| | · | High-density shrimp production |

| | | |

| | · | Weekly production |

| | | |

| | · | Natural ecology system |

| | | |

| | · | Regional production |

| | | |

| | · | Regional distribution |

These principles form the foundation for the Company and our potential distributors so that consumers can be provided with continuous volumes of live and fresh shrimp at competitive prices.

Target Markets and Sales Price

Our goal is to establish production systems and distribution centers in metropolitan areas of the United States, as well as international distribution networks through joint venture partnerships throughout the world. This should allow the Company to capture a significant portion of world shrimp sales by offering locally grown, environmentally “green,” naturally grown, fresh shrimp at competitive wholesale prices.

The United States population is approximately 325 million people with an annual shrimp consumption of 1.7 billion pounds, of which less than 400 million pounds are domestically produced. According to IndexMundi.com, the wholesale price for frozen, commodity grade shrimp has risen 15% since January 2015 (shell-on headless, 26-30 count; which is comparable to our target growth size). With world shrimp problems, this price is expected to rise more in the next few years.

We strive to build a profitable global shrimp production company. We believe our foundational advantage is that we can deliver fresh, organically grown, gourmet-grade shrimp, 52 weeks a year to retail and wholesale buyers in major market areas at competitive, yet premium prices. By locating regional production and distribution centers in close proximity to consumer demand, we can provide a fresh product to customers within 24 hours after harvest, which is unique in the shrimp industry. We can be the “first to market” and perhaps “sole weekly provider” of fresh shrimp and capture as much market share as production capacity can support.

For those customers that want a frozen product, we may be able to provide this in the near future and the product will still be differentiated as a “naturally grown, sustainable seafood” that will meet the increasing demand of socially conscious consumers.

Our patent-pending technology and eco-friendly, bio-secure production processes enable the delivery of a chemical and antibiotic free, locally grown product that lives up to the Company’s mantra: “Always Fresh, Always Natural,” thereby solving the issue of “unsafe” imported seafood.

Product Description

Nearly all of the shrimp consumed today are shipped frozen. Shrimp are typically frozen from six to twenty-four months before consumption. Our system is designed to harvest a different tank each week, which provides for fresh shrimp throughout the year. We strive to create a niche market of “Always Fresh, Always Natural” shrimp. As opposed to many of the foreign shrimp farms, we can also claim that our product is 100% free of antibiotics. The ability to grow shrimp locally, year-round allows us to provide this high-end product to specialty grocery stores and upscale restaurants throughout the world. We rotate the stocking and harvesting of our tanks each week, which allows for weekly shrimp harvests. Our product is free of all pollutants and is fed only all-natural feeds.

The seafood industry lacks a consistent “Source Verification” method to track seafood products as they move through countries and customs procedures. With worldwide overfishing leading to declining shrimp freshness and sustainability around the world, it is vital for shrimp providers to be able to realistically identify the source of their product. We have well-managed, sustainable facilities that are able to track shrimp from hatchery to plate using environmentally responsible methods.

Distribution and Marketing

We plan to build these environmentally “green” production systems near major metropolitan areas of the United States. Today, we have one pilot production facility in La Coste, Texas (near San Antonio) and plan to begin construction of a full-scale production facility in La Coste and plans for Nevada and New York. Over the next five years, our plan is to increase construction of new facilities each year. In the fifth year, we plan for a new system to be completed each month, expanding first into the largest shrimp consumption markets of the United States.

Harvesting, Packaging and Shipment

Each location is projected to include production, harvesting/processing and a general shipping and receiving area, in addition to warehousing space for storage of necessary supplies and products required to grow, harvest, package and otherwise make ready for delivery, a fresh shrimp crop on a weekly basis to consumers in each individual market area within 24 hours following harvest.

The seafood industry lacks a consistent source verification method to track seafood products as they move through countries and customs procedures. With worldwide overfishing leading to declining shrimp freshness and sustainability around the world, it is vital for shrimp providers to be able to realistically identify the source of their product. Our future facilities will be designed to track shrimp from hatchery to plate using environmentally responsible methods.

We have sold product to restaurants up to $12.00 per pound and to retail consumers at $16.50 to $21.00 per pound, depending on size, which helps to validate our pricing strategy. Additionally, from 2011 to 2013, we had two successful North Texas test markets which distributed thousands of pounds of fresh product to customers within 24 hours following harvest. The fresh product was priced from $8.40 to $12.00 per pound wholesale, heads on, net price to the Company.

Competition

There are a number of companies conducting research and development projects in their attempt to develop closed-system technologies in the U.S., some with reported production and sales. Florida Organic Aquaculture uses a Bio-Floc Raceway System to intensify shrimp growth, while Marvesta Shrimp Farms tanks in water from the Atlantic to use in their indoor system. Since these are privately held companies, it is not possible to know, with certainty, their state of technical development, production capacity, need for water exchange, location requirements, financial status and other matters. To the best of our knowledge, none are producing significant quantities of shrimp relative to their local markets, and such fresh shrimp sales are likely confined to an area near the production facility.

Additionally, any new competitor would face significant barriers for entry into the market and would likely need years of research and development to develop the proprietary technology necessary to produce similar shrimp at a commercially viable level. We believe our technology and business model sets us apart from any current competition. It is possible that additional competitors will arise in the future, but with the size and growth of the worldwide shrimp market, many competitors could co-exist and thrive in the fresh shrimp industry.

Intellectual Property

We intend to take appropriate steps to protect our intellectual property. We have applied for the trademark “NATURALSHRIMP” which is being reviewed by the U.S. Patent and Trademark Office. As of the date of this filing this trademark has not been approved for registration. There are potential technical processes for which the Company may be able to file a patent. However, there are no assurances that such applications, if filed, would be issued and no right of enforcement is granted to a patent application. Therefore, the Company has filed a provisional patent with the U.S. Patent Office and plans to use a variety of other methods, including copyright registrations as appropriate, trade secret protection, and confidentiality and non-compete agreements to protect its intellectual property portfolio.

Government Approvals and Regulations

We are subject to government regulation and require certain licenses. The following list includes regulations to which we are subject and/or the permits and licenses we currently hold:

| | · | Texas Parks and Wildlife Department (TPWD) (renewed annually) - “Exotic species permit” to raise exotic shrimp (non-native to Texas). The La Coste facility is north of the coastal shrimp exclusion zone (east and south of H-35, where it intersects Hwy 21 down to Laredo) and therefore outside of TPWD’s major area of concern for exotic shrimp. This license is currently active, expiring on December 31, 2022. |

| | | |

| | · | Texas Department of Agriculture (TDA) (renewed every two years) - “Aquaculture License” for aquaculture production facilities. License to “operate a fish farm or cultured fish processing plant.” This license is currently active, expiring on June 30, 2022. |

| | | |

| | · | Texas Commission on Environmental Quality (TCEQ) (renewed annually) - Regulates facility wastewater discharge. According to the TCEQ permit classification system, we are rated Level 1 - Recirculation system with no discharge. This license is currently active, with no set expiration date. |

We are subject to certain regulations regarding the need for field employees to be certified. We strictly adhere to these regulations. The cost of certification is an accepted part of expenses. Regulations may change and become a cost burden, but compliance and safety are our main concern.

Market Advantages and Corporate Drivers

The following are what we consider to be our advantages in the marketplace:

| | · | Early-mover Advantage: Commercialized technology in a large growing market with no significant competition yet identified. Most are early stage start-ups or early stage companies with limited production and distribution. |

| | | |

| | · | Farm-to-Market: This has significant advantages including reduced transportation costs and a product that is more attractive to local consumers. |

| | | |

| | · | Bio-secured Building: Our process is a re-circulating, highly-filtered water technology in an indoor-regulated environment. External pathogens are excluded. |

| | | |

| | · | Eco-friendly “Green” Technology: Our closed-loop, re-circulating system has no ocean water exchange requirements, does not use chemical or antibiotics and therefore is sustainable, eco-friendly, environmentally sound and produces a superior quality shrimp that is totally natural. |

| | | |

| | · | Availability of Weekly Fresh Shrimp: Assures consumers of optimal freshness, taste, and texture of product which will command premium prices. |

| | | |

| | · | Sustainability: Our naturally grown product does not deplete wild supplies, has no by-catch kill of marine life, does not damage sensitive ecological environments and avoids potential risks of imported seafood. |

Subsidiaries

The Company has three wholly owned subsidiaries including NaturalShrimp USA Corporation, NaturalShrimp Global, Inc. and Natural Aquatic Systems, Inc.

Employees

As of February 22, 2021, we 20 full-time employees. We intend to hire additional staff and to engage consultants in general administration on an as-needed basis. We also may engage experts in general business to advise us in various capacities. None of our employees are subject to a collective bargaining agreement, and we believe that our relationship with our employees is good.

Website

Our corporate website address is http://www.naturalshrimp.com.

The Offering

This prospectus relates to the offer and sale from time to time of up to an aggregate of 20,381,858 shares of the Company’s common stock by the selling stockholders.

Under the terms of the Rights Agreement entered into with the selling stockholder in connection with the Purchase Agreement, we agreed to register with the Securities and Exchange Commission, or SEC, 5,142,858 shares of common stock issuable upon the conversion of the Series E Convertible Preferred Shares and 1,500,000 shares of common stock issuable upon exercise of the Warrants. We have also agreed to register with the SEC: (a) 3,739,000 shares of our common stock issuable upon exercise of the additional warrant issued to GHS in exchange for the Waiver; and (b) the 10,000,000 shares of our common stock issuable upon exercise of the April Warrants whose exercise price was lowered to $0.35 per share in November 2021 in connection with the signing of the Waiver.

The number of shares ultimately offered for resale by the selling stockholders depends upon how many of the Preferred Shares, Warrants and additional warrants the selling stockholders elect to convert and exercise, respectively, and the liquidity and market price of shares of our common stock.

| Issuer | | NaturalShrimp Incorporated. |

| | | |

| Common stock to be offered by the selling stockholders | | The selling stockholders are offering up to 20,381,858 shares of the Company’s common stock, par value $0.0001 per share. |

| | | |

| Common stock outstanding prior to this offering (1) Common stock to be outstanding after the offering (1) | | 645,856,919 shares of common stock 666,238,777 shares of common stock if all Warrants (including the warrant issued to GHS in November 2021 and April Warrants whose exercise price was lowered in November 2021) are exercised in full and all of the Series E Preferred Shares are converted in full. |

| | | |

| Use of proceeds | | We will not receive any proceeds from the sale of common stock by the selling stockholders. All of the net proceeds from the sale of shares of our common stock will go to the selling stockholders as described below in the sections entitled “Selling Stockholders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the shares of common stock for the selling stockholders. |

| | | |

| Risk factors | | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 17 before deciding to invest in our securities. |

| (1) | The number of shares of our common stock outstanding prior to and to be outstanding immediately after this offering, as set forth in the table above, is based on 645,856,919 shares outstanding as of March 1, 2022. |

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this document that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. Moreover, additional risks not presently known to us or that we currently deem less significant also may impact our business, financial condition or results of operations, perhaps materially. For additional information regarding risk factors, see “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

The market for our product may be limited, and as a result our business may be adversely affected.

The feasibility of marketing our product has been assumed to this point and there can be no assurance that such assumptions are correct. It is possible that the costs of development and implementation of our shrimp production technology may be too expensive to market our shrimp at a competitive price. It is likewise possible that competing technologies will be introduced into the marketplace before or after the introduction of our product to the market, which may affect our ability to market our product at a competitive price.

Furthermore, there can be no assurance that the prices we determine to charge for our product will be commercially acceptable or that the prices that may be dictated by the market will be sufficient to provide to us sufficient revenues to profitably operate and provide a financial return to our investors.

Our business and operations are affected by the volatility of prices for shrimp.

Our business, prospects, revenues, profitability and future growth are highly dependent upon the prices of and demand for shrimp. Our ability to borrow and to obtain additional capital on attractive terms is also substantially dependent upon shrimp prices. These prices have been and are likely to continue to be extremely volatile for seasonal, cyclical and other reasons. Any substantial or extended decline in the price of shrimp will have a material adverse effect on our financing capacity and our prospects for commencing and sustaining any economic commercial production. In addition, increased availability of imported shrimp can affect our business by lowering commodity prices. This could reduce the value of inventories, held both by us and by our customers, and cause many of our customers to reduce their orders for new products until they can dispose of their higher cost inventories.

Market demand for our products may decrease.

We face competition from other producers of seafood as well as from other protein sources, such as pork, beef, and poultry. The bases on which we expect to compete include, but may not be limited to:

| | · | Price. |

| | | |

| | · | Product quality. |

| | | |

| | · | Brand identification. |

| | | |

| | · | Customer service. |

Demand for our products will be affected by our competitors’ promotional spending. We may be unable to compete successfully on any or all of these bases in the future, which may have a material adverse effect on our revenues and results of operations.

Moreover, although historically the logistics and perishability of seafood has led to regionalized competition, the market for fresh and frozen seafood is becoming increasingly globalized as a result of improved delivery logistics and improved preservation of the products. Increased competition, consolidation, and overcapacity may lead to lower product pricing of competing products that could reduce demand for our products and have a material adverse effect on our revenues and results of operations.

Competition and unforeseen limited sources of supplies in the industry may result in occasional spot shortages of equipment, supplies and materials. In particular, we may experience possible unavailability of post-larvae and materials and services used in our shrimp production facilities. Such unavailability could result in increased costs and delays to our operations. If we cannot find the products, equipment, supplies and materials that we need on a timely basis, we may have to suspend our production plans until we find the products, equipment and materials that we need.

If we lose our key management and technical personnel, our business may be adversely affected.

In carrying out our operations, we will rely upon a small group of key management and technical personnel including our Chief Executive Officer, Chief Operating Officer and Chief Financial Officer. We do not currently maintain any key man insurance. An unexpected partial or total loss of the services of these key individuals could be detrimental to our business.

Our expansion plans for our shrimp production facilities reflects our current intent and is subject to change.

Our current plans regarding the rebuilding of our La Coste production facilities, as well as its expansion are subject to change. Whether we ultimately undertake our expansion plans will depend on the following factors, among others:

| | · | Availability and cost of capital. |

| | | |

| | · | Current and future shrimp prices. |

| | | |

| | · | Costs and availability of post-larvae shrimp, equipment, supplies, and personnel necessary to conduct these operations. |

| | | |

| | · | Success or failure of system design and activities in similar areas. |

| | | |

| | · | Changes in the estimates of the costs to complete production facilities. |

| | | |

| | · | Decisions of operators and future joint venture partners. |

We will continue to gather data about our production facilities, and it is possible that additional information may cause us to alter our schedule or determine that a certain facility should not be pursued at all.

Our product is subject to regulatory approvals and if we fail to obtain such approvals, our business may be adversely affected.

Most of the jurisdictions in which we operate will require us to obtain a license for each facility owned and operate in that jurisdiction. We have obtained and currently hold a license to own and operate each of our facilities where a license is required. In order to maintain the licenses, we have to operate our current farms and, if we pursue acquisitions or construction of new farms, we will need to obtain additional licenses to operate those farms, where required. We are also exposed to dilution of the value of our licenses where a government issues new licenses to fish farmers other than us, thereby reducing the current value of our fish farming licenses. Governments may change the way licenses are distributed or otherwise dilute or invalidate our licenses. If we are unable to maintain or obtain new fish farming licenses or if new licensing regulations dilute the value of our licenses, this may have a material adverse effect on our business.

It is possible that regulatory authorities could make changes in regulatory rules and policies and we would not be able to market or commercialize our product in the intended manner and/or the changes could adversely impact the realization of our technology or market potential.

Failure to ensure food safety and compliance with food safety standards could result in serious adverse consequences for us.

As our end products are for human consumption, food safety issues (both actual and perceived) may have a negative impact on the reputation of and demand for our products. In addition to the need to comply with relevant food safety regulations, it is of critical importance that our products are safe and perceived as safe and healthy in all relevant markets.

Our products may be subject to contamination by food-borne pathogens, such as Listeria monocytogenes, Clostridia, Salmonella and E. Coli or contaminants. These pathogens and substances are found in the environment; therefore, there is a risk that one or more of these organisms and pathogens can be introduced into our products as a result of improper handling, poor processing hygiene or cross-contamination by us, the ultimate consumer or any intermediary. We have little, if any, control over handling procedures once we ship our products for distribution. Furthermore, we may not be able to prevent contamination of our shrimp by pollutants such as polychlorinated biphenyls, or PCBs, dioxins or heavy metals.

An inadvertent shipment of contaminated products may be a violation of law and may lead to product liability claims, product recalls (which may not entirely mitigate the risk of product liability claims), increased scrutiny and penalties, including injunctive relief and plant closings, by regulatory agencies, and adverse publicity.

Increased quality demands from authorities in the future relating to food safety may have a material adverse effect on our business, financial condition, results of operations or cash flow. Legislation and guidelines with tougher requirements are expected and may imply higher costs for the food industry. In particular, the ability to trace products through all stages of development, certification and documentation is becoming increasingly required under food safety regulations. Further, limitations on additives and use of medical products in the farmed shrimp industry may be imposed, which could result in higher costs for us.

The food industry, in general, experiences high levels of customer awareness with respect to food safety and product quality, information and traceability. We may fail to meet new and exacting customer requirements, which could reduce demand for our products.

Our success is dependent upon our ability to commercialize our shrimp production technology.

Prior to fiscal year 2020, we had been engaged principally in the research and development of our technology. Therefore, we have a limited operating history upon which an evaluation of our prospects can be made. Our prospects must be considered in light of the risk, uncertainties, expenses, delays and difficulties associated with the establishment of a business in the evolving food industry, as well as those risks encountered in the shift from development to commercialization of new technology and products or services based upon such technology.

We have developed our first commercial system that employs our technology but additional work is required to incorporate that technology into a system capable of accommodating thousands of customers, which is the minimum capability we believe is necessary to compete in the marketplace.

Our shrimp production technology may not operate as intended.

Although we have successfully tested our technology, our approach, which is still fairly new in the industry, may not operate as intended or may be subject to other factors that we have not yet considered. These may include the impact of new pathogens or other biological risks, low oxygen levels, algal blooms, fluctuating seawater temperatures, predation or escapes. Any of the foregoing may result in physical deformities to our shrimp or affect our ability to increase shrimp production, which may have a material adverse effect on our operations. Furthermore, even if we are able to successfully manage these factors, our ability to grow healthy shrimp at a commercially scalable rate may be limited,

Our success is dependent upon our ability to protect our intellectual property.

Our success will depend in part on our ability to obtain and enforce protection for our intellectual property in the United States and other countries. It is possible that our intellectual property protection could fail. It is possible that the claims for patents or other intellectual property protections could be denied or invalidated or that our protections will not be sufficiently broad to protect our technology. It is also possible that our intellectual property will not provide protection against competitive products, or will not otherwise be commercially viable.