UPDATE: Hungary's MOL Latest To Rethink Nabucco

April 24 2012 - 10:49AM

Dow Jones News

Hungary's oil and gas company MOL Nyrt (MOL.BU) Tuesday raised

serious concerns about the viability of the Nabucco pipeline

project, in yet another blow to an EU priority that's been hit by

high costs and uncertain gas supplies.

"There are many uncertainties around the Nabucco project that

would be hard to ignore. Both the financing background and the gas

source are uncertain," the company said in a statement. MOL still

supports diversification of suppliers but "we owe our shareholders

the highest possible economic justification as well," it added.

MOL is now the second major shareholder to publicly reconsider

its role in the Nabucco consortium, after Germany's RWE AG (RWE.XE)

Chief Executive said earlier this year that it could scrap its

plans for it. MOL and RWE are two of the main shareholders in the

consortium and their failure to support the project would put in

serious doubt its feasibility. Austria's OMV AG (OMV.VI) and three

other companies are also part of Nabucco.

The company's statement follows remarks by Hungary's Prime

Minister Viktor Orban Monday that MOL is leaving the project. A

Nabucco statement said the consortium has no indication of a change

in MOL's status.

"The Nabucco Pipeline project is based on a treaty that was

signed and ratified by the transit countries, including Hungary,"

said Nabucco spokesman Christian Dolezal, in a statement. "The

Nabucco shareholder in Hungary is FGSZ, a MOL subsidiary, and we

have not had any indication that this will change," he said.

Nabucco was originally designed as a 3,300 kilometer-long

pipeline project to bring Caspian gas to Austria across Turkey and

most of central Europe with the aim of easing the region's

dependence on Russian gas imports by opening up a "corridor" from

Central Asia to the European Union.

But uncertainty about the amount of gas effectively available in

the region for EU export by the end of the decade has dampened

those expectations and prompted the consortium to scale down the

project to roughly half its original size, ceding ground to

competing projects.

The European Commission, which has executive powers in the EU,

has strongly supported Nabucco as the best plan for such a

corridor, but has recently been open to accept other projects,

saying the priority is to get Caspian gas to Europe, rather than

the specific infrastructure to do that.

Marlene Holzner, a spokeswoman for European Energy Commissioner

Guenther Oettinger, said Tuesday the commission has no indication

about MOL dropping out of Nabucco, and didn't comment directly on

MOL's statement.

Azerbaijan and BP PLC --which has a leading role in the

consortium developing the Azeri field which would provide the gas

for the EU-- are working on two other, possibly complementary,

pipelines that are in direct competition with Nabucco as they would

follow a similar route.

The TANAP line would carry the gas across Turkey, while the

South East Europe Pipeline would then take proceed through central

Europe, possibly all the way to one of Europe's biggest gas hubs in

Austria. The capacity of these alternative lines is roughly half

that of Nabucco's.

Nabucco's prospects have also been challenged by the Russian-led

South Stream pipeline, whose partners include European giants like

Germany's BASF SE and France's Electricite de France SA. South

Stream would not rely on the same Azeri gas, but would provide the

commodity to the same end-markets in central Europe.

-By Alessandro Torello, Dow Jones Newswires; +32 2 741 14 88;

alessandro.torello@dowjones.com

(Gergo Racz and Veronika Gulyas in Budapest contributed to this

article.)

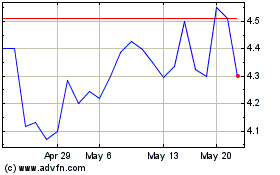

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jun 2024 to Jul 2024

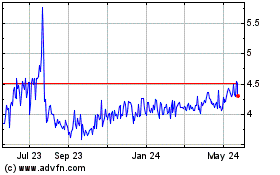

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jul 2023 to Jul 2024