UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-Q

x

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For the

quarterly period ended March 31, 2009

or

o

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For the

transition period from ______ to ______

Commission

File Number 000-29929

LIVE

CURRENT MEDIA INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

88-0346310

|

|

(State or

other jurisdiction of

incorporation or

organization)

|

(IRS

Employer

Identification

Number)

|

375 Water Street, Suite 645,

Vancouver, British Columbia, V6B 5C6

(604)

453-4870

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

Yes

x

No

o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files.

o

Yes

o

No

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

o

|

Accelerated

filer

o

|

|

Non-accelerated

filer

o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

o

Yes

þ

No

APPLICABLE

ONLY TO CORPORATE ISSUERS

Indicate

the number of shares outstanding of each of the issuer's classes of common

stock, as of the latest practicable date.

|

|

Common

Stock

|

23,934,268 shares

outstanding

|

|

|

$.001 Par

Value

|

as of May 15,

2009

|

LIVE CURRENT MEDIA

INC.

REPORT

ON FORM 10-Q

QUARTER

ENDED MARCH 31, 2009

TABLE

OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

PART

I.

|

Financial

Information

|

4

|

|

|

|

|

|

Item

1.

|

Unaudited

Financial Statements

|

4

|

|

|

|

|

|

|

Consolidated

Balance Sheets as of March 31, 2009 and December 31, 2008

|

F-2

|

|

|

Consolidated

Statements of Operations for the periods ended March 31, 2009 and March

31, 2008

|

F-3

|

|

|

Consolidated

Statement of Stockholders’ Equity for the periods ended March 31, 2009 and

December 31, 2008

|

F-4

|

|

|

Consolidated

Statements of Cash Flows for the periods ended March 31, 2009 and March

31, 2008

|

F-5

|

|

|

Notes

to the Consolidated Financial Statements

|

F-6

|

|

|

|

|

|

Item

2.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

4

|

|

|

|

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

20

|

|

|

|

|

|

Item

4T.

|

Controls

and Procedures

|

20

|

|

|

|

|

|

|

|

|

|

PART

II.

|

Other

Information

|

21

|

|

|

|

|

|

Item

1.

|

Legal

Proceedings

|

21

|

|

|

|

|

|

Item

1A.

|

Risk

Factors

|

21

|

|

|

|

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds

|

21

|

|

|

|

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

21

|

|

|

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

21

|

|

|

|

|

|

Item

5.

|

Other

Information

|

21

|

|

|

|

|

|

Item

6.

|

Exhibits

|

22

|

|

|

|

|

|

Signatures

|

|

23

|

|

|

|

|

|

Certifications

|

|

|

PART I

– FINANCIAL INFORMATION

Item 1: Financial

Statements.

The

response to Item 1 has been submitted as a separate section of this Report

beginning on page F-1.

Item 2: Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

(a) Forward

Looking Statements

The

Company makes forward-looking statements in this report and may make such

statements in future filings with the Securities and Exchange Commission. The

Company may also make forward-looking statements in its press releases or other

public shareholder communications. Its forward-looking statements are subject to

risks and uncertainties and include information about its expectations and

possible or assumed future results of operations. When Management uses any of

the words “believes”, “expects”, “anticipates”, “estimates” or similar

expressions, it is making forward-looking statements.

While

Management believes that our forward-looking statements are reasonable, you

should not place undue reliance on any such forward-looking statements, which

speak only as of the date made. Because these forward-looking

statements are based on estimates and assumptions that are subject to

significant business, economic and competitive uncertainties, many of which are

beyond Management’s control or are subject to change, actual results could be

materially different. Factors that might cause such a difference include,

without limitation, the following: the Company’s inability to generate

sufficient cash flows to meet its current liabilities, its potential inability

to retain qualified management, sales and customer service personnel, the

potential for an extended decline in sales, the possible failure of revenues to

offset additional costs associated with any changes in business model, the

potential lack of website acceptance, its potential inability to introduce new

products to the market, the potential loss of customer or supplier

relationships, the extent to which competition may negatively affect prices and

sales volumes or necessitate increased sales or marketing expenses, and the

other risks and uncertainties set forth in this report.

Other

factors not currently anticipated by Management may also materially and

adversely affect our results of operations. Except as required by

applicable law, Management does not undertake any obligation to publicly release

any revisions which may be made to any forward-looking statements to reflect

events or circumstances occurring after the date of this report.

Readers

of this report should not rely solely on the forward-looking statements and

should consider all risks and uncertainties throughout this report, as well as

those discussed under “Item 1A Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2008.

The

following discussion should be read in conjunction with our interim consolidated

financial statements and their explanatory notes, which begin at page

F-1.

(b) Business

Overview

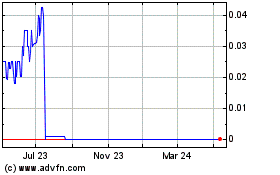

Live

Current Media Inc. was incorporated under the laws of the State of Nevada on

October 10, 1995 under the name “Troyden Corporation”. We changed our

name on August 21, 2000 from Troyden Corporation to “Communicate.com Inc.”, and

again on May 30, 2008 to Live Current Media Inc. Since August 4,

2008, our common stock has been quoted on the OTCBB under the symbol,

“LIVC”.

Our

corporate website is located at www.livecurrent.com. Information

included on the website is not a part of this Quarterly Report.

Subsidiaries

Our

principal operating subsidiary, Domain Holdings Inc. (“DHI”), was incorporated

under the laws of British Columbia on July 4, 1994 under the name “IMEDIAT

Digital Creations Inc.”. On April 14, 1999, IMEDIAT Digital

Creations, Inc. changed its name to “Communicate.com Inc.” and was redomiciled

from British Columbia to the jurisdiction of Alberta. On April 5,

2002, Communicate.com Inc. changed its name to Domain Holdings

Inc. DHI has 62,635,383 shares of common stock currently issued and

outstanding. 61,478,225 shares, or approximately 98.2% of the

outstanding shares, are held by Live Current.

On

December 31, 2005, DHI reorganized by transferring certain domain name assets

into its wholly owned subsidiary, Acadia Management Corp. (“Acadia”), a British

Columbia corporation incorporated on December 1, 2005. In October

2008, the assets and liabilities of Acadia were assigned to DHI and Acadia was

subsequently dissolved in January 2009. On December 31, 2006, DHI

transferred the domain name Importers.com to its wholly owned subsidiary 0778229

B.C. Ltd. (“Importers”), a British Columbia company incorporated on December 27,

2006. DHI also has a dormant wholly owned subsidiary, 612793 B.C.

Ltd. (“612793”), which was incorporated on August 21, 2000.

On March

13, 2008, the Company incorporated a wholly owned subsidiary in the state of

Delaware, Communicate.com Delaware, Inc. (“Delaware”). The new

subsidiary was incorporated to facilitate the merger with

Auctomatic.

On August

8, 2008, the Company formed a wholly-owned subsidiary in Singapore, LCM Cricket

Ventures Pte. Ltd. (“LCM Cricket Ventures”). This company holds

50.05% of Global Cricket Venture Pte. Ltd.

We

presently employ twenty-three full-time and one part-time employee, as well as

one consultant.

Our

principal office is located at #645-375 Water Street, Vancouver, British

Columbia V6B 5C6. We also lease an office at 12201 Tukwila Intl.

Blvd, Suite 200, Tukwila, WA 98168 for a nominal amount per month.

Operations

DHI, our

majority-owned subsidiary, owns more than 800 domain names. Through

DHI, we build consumer internet experiences around our large portfolio of

intuitive, easy to remember domain names. These domain names span

several consumer and business-to-business categories including health and beauty

(such as Perfume.com), sports and recreation (such as Cricket.com and

Boxing.com), travel (such as Brazil.com and Indonesia.com), and global trade

(Importers.com). We believe that we can develop and sustain

businesses based on these intuitive domain names in part because of the

significant amount of search and direct type-in traffic they

receive. We have begun to exploit this traffic through the

construction of consumer experiences online, which we call DestinationHubs

®

, at Perfume.com

and Cricket.com. DestinationHubs® tap into a large, passionate,

pre-existing community of interested users. From a technology and

product standpoint, a DestinationHub® is architected for discovery, meaning it

is built in such a way that it is found easily through search. One of

the best ways to ensure sites are found through search is to have a powerful

domain name asset as a low-cost customer acquisition vehicle that easily enables

ownership of that subject category. Over time, we will build out

additional DestinationHubs

®

at several of our

domain names. We may also choose to sell select domain names to

strategic buyers.

We also

own a number of .cn (China) domain names. We believe that the .cn

domain names could have significant value as the internet market in China

develops. We also have a number of non-core “bound.com” domain names

that we may choose to develop that cover expansive categories of interest such

as shoppingbound.com, pharmacybound.com and vietnambound.com.

We have

organized our operations into two principal segments: (1)

ECommerce Products

, which

currently consists of our “Health and Beauty” websites, and (2)

Advertising.

Our Health and

Beauty websites generate revenue by facilitating the sale of products direct to

consumers (eCommerce). Currently, our eCommerce revenues are

primarily derived from the sale of fragrance products to consumers at our

Perfume.com website. Our sports and recreation, travel, and global

trade websites generate revenues through the sale of online advertising space to

advertisers, derived by offering “pay per click” and display advertising on

various websites in our portfolio.

ECommerce

Revenues

We

currently generate almost all of our eCommerce revenues through product sales on

Perfume.com. We plan to continue to build Perfume.com eCommerce

revenues by expanding to more efficient distribution and fulfillment channels,

creating a more engaging consumer experience, and performing continued technical

improvements to the websites. We will also continue to explore other

product-related revenue streams across our domain name portfolio.

Health

and Beauty Products

Our

Perfume.com website sells discounted brand name fragrances, including women’s

perfume, men’s cologne, and designer hair care and skin care products direct to

consumers in the US and select international markets. Perfume.com

sells 100% authentic products and provides customers with a satisfaction

guarantee. We are not dependent on any single supplier for the

products that we sell. The products are supplied by various wholesale

suppliers located in the United States.

Our

products are described in detail on our website. The products are

offered through an easily navigated website experience within a transaction

secure environment accepting the usual modes of secure credit card payments,

PayPal and Google Checkout. Products can also be ordered using our

toll-free telephone number.

By way of

its intuitive domain name and through ongoing technical optimizations,

Perfume.com consistently ranks highly in organic, unpaid search results across

major search engines. Organic search traffic delivers the majority of

traffic and customers to Perfume.com. The site also realizes traffic

through direct navigation by visitors. Finally, we acquire internet

traffic through paid search, comparison shopping websites, and our robust email

marketing efforts as well as through affiliate sales.

We use affiliate

relationships whereby we pay our affiliates sales commissions if they deliver

traffic to Perfume.com that results in a successful

sale. Affiliates do not represent themselves as Perfume.com, and

through a rigorously enforced policy, are not allowed to use our

name. Affiliates place our advertisements on their

websites. We pay these affiliates a commission when visitors to their

sites click on our advertisements and make purchases on

Perfume.com.

Advertising

Revenues

Over

time, we expect to generate significant revenues by selling advertising either

directly to advertisers or in partnership with third party advertising

networks. During 2007 and early 2008, we had an arrangement with

Overture Services, Inc. (“Overture”) pursuant to which we were paid a fee for

referrals to sites with connections to Overture. We terminated our

relationship with Overture effective February 29, 2008, to give us more

flexibility to deploy advertising across our websites. Currently,

many of our websites are part of Google AdSense's network of publishers which

generates advertising revenues and monetizes our properties. Google

AdSense matches ads to our sites’ content and audiences, and depending on the

type of ad, we earn revenues from clicks or impressions.

The relationship with Google is a non-exclusive agreement and as

we develop our domain websites we may revisit direct relationships or other

third party advertising networks.

Sports

and Recreation

We

currently host one sports-related website, Cricket.com. Cricket.com

is a community website for cricket fans. The site includes

cricket-related news, schedules of games played worldwide, scores, photos and an

active fantasy cricket league. Cricket.com generates revenue through

paid advertisements on the website.

Travel

We

currently host two travel websites; Brazil.com and Indonesia.com, as Vietnam.com

was sold after March 31, 2009. These sites seek to provide much of

the information a traveler to these destinations might need. Aside

from information and access to flights and hotels, the sites provide basic facts

about the countries (history, language, maps and facts), information on tourist

attractions and major cities, weather, blogs from travelers and links to other

sites about the destination. We earn advertising revenues and

affiliate commission revenues for the referred sales of hotels, flights and

travel bookings from these websites.

Global

Trade

Importers.com

is a trade website that connects businesses around the world by providing tools

such as an email service and a searchable, online database which helps

facilitate communication between buyers and sellers. Businesses

register on the website for free. Once registered, buyers and

distributors can access information about manufacturers and wholesalers and vice

versa. The information is grouped in product categories or may be

found via a search bar included on the website. As long as both

parties are members, they may contact each other via e-mail. The

website also provides useful information concerning international trade-related

issues such as customs clearance, transportation providers and trade development

organizations. We earn advertising revenues from this

website.

Sale

and Lease of Domain Names

We own

more than 800 domain names. We believe that there is high value in

building businesses around the domain names we own, however we recognize that

there are opportunities whereby selling or leasing them may be more valuable

than exploiting the ownership value of the names. We also recognize

that selling some non-core domain names is an effective way to raise funds in a

non-dilutive manner, and have successfully sold or leased two domain names in

February 2009 with differing payment schedules, and another domain name

subsequent to our quarter end. We continue to evaluate any offers

received. In the future, we may buy domain names to complement our

existing businesses in the health and beauty, sports, travel and global trade

categories. In 2008, there was one outright sale and another sales-type lease of

domain name assets.

Karate.com

On

September 30, 2008, we signed a letter of intent with Domain Strategies, Inc., a

leading internet development and management company, to jointly establish a new

company (“Newco”) for the purpose of building, managing and monetizing the

Karate.com domain name we own. The partnership with Domain Strategies

will provide management focus and resources to efficiently monetize the domain

name. We will contribute the domain name Karate.com to Newco and will

receive a 50% interest of the new company, plus a distribution and liquidation

preference of $500,000. The Board of Directors of Newco will have

equal representation from both partners with Domain Strategies having primary

responsibility for the management of day-to-day operations including site

design, employment relationships, vendors, customer acquisition and maintenance

and relationships with potential strategic partners. If after three

years from the date of formation, Newco has not achieved the annual financial

goals as set by management and approved by the Board, we have the right to

terminate our participation in Newco and ownership of the domain name

www.karate.com

will

revert back to us. In the event that we are the terminating party, Domain

Strategies will have the right but not the obligation to purchase our interest

in Newco, including the domain name

www.karate.com

for $1

million within 60 days of termination.

Global

Cricket Venture

On April

17, 2008, we signed two Memoranda of Understanding (individually the “BCCI

Memorandum” and the “IPL Memorandum” and, together, the “Memoranda”) with each

of the Board of Control for Cricket in India (“BCCI”) and the DLF Indian Premier

League (“IPL”). The Memoranda, each of which had a term of 10 years,

granted to us the exclusive right to provide the official websites for the BCCI

and the IPL (the “Cricket Websites”). As consideration for the rights

conveyed, we agreed to pay a minimum annual fee to the BCCI of the greater of

50% of all revenues generated from the BCCI website or an average payment of $3

million per year and a minimum annual fee to the IPL of the greater of 50% of

all revenues generated from the IPL website or an average payment of $2 million

per year. In addition to the annual fee, we agreed to pay a total of

5% of the revenues generated by a third website, Cricket.com, to the BCCI and

the IPL. Revenues were defined as all revenues generated by the

Cricket Websites with the exception of revenues earned from the sale of tickets

to the matches. We agreed that the minimum annual fee would be paid

on a quarterly basis during the first 3 years of the term. The

payments, when made, may have been subject to certain withholding or other taxes

which we may have been required to gross up pursuant to the terms of the

Memoranda. The first payment to the BCCI of $625,000 was due on

October 1, 2008, with additional payments of $625,000 due on January 1, 2009,

April 1, 2009 and July 1, 2009. The first payment to the IPL of

$375,000 was due on October 1, 2008, with additional payments of $375,000 due on

January 1, 2009, April 1, 2009 and July 1, 2009. The payment due to

the BCCI was decreased to $125,000 pursuant to an agreement we reached with the

BCCI. We did not make any of the payments called for by the

Memoranda.

In

conjunction with our execution of the Memoranda, we signed an agreement (the

“Venture Agreement”) with Netlinkblue, the owner of the live streaming and

mobile rights to the BCCI and IPL cricket matches. Under the Venture

Agreement, we and Netlinkblue agreed to create a new company into which we would

transfer our rights under the Memoranda and Netlinkblue would transfer the

rights it acquired to live stream the matches. As contemplated by the

Venture Agreement, a company was incorporated in Singapore on June 10, 2008 and

named Global Cricket Venture Pte. Ltd. (“Global Cricket

Venture”). Our wholly-owned subsidiary, LCM Cricket Ventures,

currently owns 50.05% of the shares of Global Cricket

Venture. Pursuant to the Venture Agreement, once we and Netlinkblue

each transfer the rights we received from the BCCI and the IPL into Global

Cricket Venture, certain rights and obligations will arise, including the

obligation that each of us provides funding to Global Cricket

Venture. As described below, on March 31, 2009, we and the BCCI

jointly terminated the BCCI Memorandum and we assigned the IPL Memorandum to

Global Cricket Venture. To our knowledge, Netlinkblue has not

transferred the rights it received from the BCCI and the IPL to Global Cricket

Venture, therefore, as of March 31, 2009, we do not believe that we have an

obligation to provide funding to Global Cricket Venture. The Venture

Agreement also required that we and Netlinkblue negotiate and enter into

definitive agreements with further terms and conditions to govern our

relationship. To date, no definitive agreements have been

prepared.

On March

31, 2009, we and the BCCI entered into a Termination Agreement, pursuant to

which the BCCI Memorandum was terminated. On that same date, we,

Global Cricket Venture and the BCCI, on behalf of the IPL, entered into a

Novation Agreement (the “Novation”) with respect to the IPL

Memorandum. Pursuant to the Novation, Global Cricket Venture was

granted all of our rights, and assumed all of our obligations, under the IPL

Memorandum. Global Cricket Venture also assumed certain payments due

to the BCCI under the BCCI Memorandum.

As a

result of the Novation,

|

|

·

|

Global

Cricket Venture, a 50.05% owned subsidiary, rather than Live Current, is

the party to the IPL Memorandum;

|

|

|

·

|

the

term of the IPL Memorandum was modified, so that it began on April 1, 2008

and will end on December 31, 2017;

|

|

|

·

|

the

minimum payment due on October 1, 2008 to the BCCI of $125,000, reduced

from $625,000, and any other payments owed to the BCCI through March 31,

2009 were assumed by Global Cricket Venture and are to be paid on July 1,

2009. We will be fully released from these liabilities once

Global Cricket Venture makes these

payments;

|

|

|

·

|

the

minimum payment due on October 1, 2008 to the IPL of $375,000, and any

other payments owed to the IPL through March 31, 2009 were assumed by

Global Cricket Venture and are to be paid on July 1, 2009. We

have been fully released from these

liabilities;

|

|

|

·

|

a

right to terminate the IPL Memorandum due to a material breach or on the

insolvency of either party was added;

and

|

|

|

·

|

the

“Minimum Annual Fee Payment Schedule” (Schedule 2 to the IPL Memorandum)

was revised. The first payment of $2,250,000 is due on July 1,

2009.

|

The $375,000 owing to the

IPL for the October 1, 2008 minimum payment under the IPL Memorandum that was

accrued and expensed in 2008 was reversed on March 31, 2009. The

$625,000 owing to the BCCI for the October 1, 2008 minimum payment under the

BCCI Memorandum that was accrued and expensed in 2008 was renegotiated to

$125,000. Therefore $500,000 was reversed on March 31,

2009. The $625,000 owing to the BCCI for the January 1, 2009 minimum

payment under the BCCI Memorandum was accrued and expensed in the first quarter

of 2009. The two minimum payments of $125,000 and $625,000 owing to

the BCCI as at March 31, 2009 were assumed by Global Cricket Venture, however

the release of the Company's obligation to make the payments is contingent on

Global Cricket Venture making the payments on or before July 1,

2009.

During

the first quarter of 2009, the Company incurred $227,255 of costs relating to

initial performance of its obligations under the Memoranda with each of the BCCI

and the IPL and establishing Global Cricket Venture with

Netlinkblue. These costs relate to, but are not limited to,

expenditures for business development, travel, consulting, and

salaries.

Due to

the reversal of the $375,000 and $500,000 accrued liabilities at December 31,

2008, the recognition of $625,000 owing for the January 1, 2009 BCCI minimum

payment, and the costs incurred of $227,255 as noted above, there was a net

recovery of Global Cricket Venture expenses of $22,745 recorded during the

quarter.

(c) Selected

Financial Data

The

following selected financial data was derived from our unaudited interim

consolidated financial statements for the quarter ended March 31,

2009. The information set forth below should be read in conjunction

with our financial statements and related notes included elsewhere in this

report.

|

|

|

Three

Months Ended

|

|

|

|

|

March

31, 2009

|

|

|

March

31, 2008

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

SALES

|

|

|

|

|

|

|

|

Health

and beauty eCommerce

|

|

$

|

1,720,167

|

|

|

$

|

1,820,188

|

|

|

Other

eCommerce

|

|

|

-

|

|

|

|

455

|

|

|

Domain

name advertising

|

|

|

24,453

|

|

|

|

27,836

|

|

|

Miscellaneous

income

|

|

|

7,762

|

|

|

|

-

|

|

|

Total

Sales

|

|

|

1,752,382

|

|

|

|

1,848,479

|

|

|

|

|

|

|

|

|

|

|

|

|

COSTS

OF SALES

|

|

|

|

|

|

|

|

|

|

Health

and Beauty eCommerce

|

|

|

1,386,619

|

|

|

|

1,485,510

|

|

|

Other eCommerce

|

|

|

-

|

|

|

|

552

|

|

|

Total

Costs of Sales

|

|

|

1,386,619

|

|

|

|

1,486,062

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS

PROFIT

|

|

|

365,763

|

|

|

|

362,417

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

Amortization

and depreciation

|

|

|

98,166

|

|

|

|

15,266

|

|

|

Amortization of website development costs

|

|

|

32,562

|

|

|

|

-

|

|

|

Corporate

general and administrative

|

|

|

118,210

|

|

|

|

447,895

|

|

|

ECommerce

general and administrative

|

|

|

80,220

|

|

|

|

169,813

|

|

|

Management

fees and employee salaries

|

|

|

774,972

|

|

|

|

1,073,546

|

|

|

Corporate

marketing

|

|

|

2,454

|

|

|

|

26,459

|

|

|

ECommerce

marketing

|

|

|

111,422

|

|

|

|

149,187

|

|

|

Other expenses

|

|

|

346,564

|

|

|

|

629,856

|

|

|

Total

Expenses

|

|

|

1,564,570

|

|

|

|

2,512,022

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS

FROM OPERATIONS BEFORE OTHER ITEMS

|

|

|

(1,198,807

|

)

|

|

|

(2,149,605

|

)

|

|

|

|

|

|

|

|

|

-

|

|

|

Global

Cricket Venture recovery (expenses)

|

|

|

22,745

|

|

|

|

(55,317

|

)

|

|

Gain

from sales and sales-type lease of domain names

|

|

|

580,525

|

|

|

|

168,206

|

|

|

Accretion

expense

|

|

|

(40,000

|

)

|

|

|

-

|

|

|

Interest

and investment income

|

|

|

890

|

|

|

|

42,498

|

|

|

NET

LOSS AND COMPREHENSIVE LOSS FOR THE PERIOD

|

|

$

|

(634,647

|

)

|

|

$

|

(1,994,218

|

)

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

AND DILUTED LOSS PER SHARE

|

|

$

|

(0.03

|

)

|

|

$

|

(0.10

|

)

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED

AVERAGE NUMBER OF COMMON

|

|

|

|

|

|

|

|

|

|

SHARES

OUTSTANDING - BASIC AND DILUTED

|

|

|

22,509,120

|

|

|

|

19,970,334

|

|

|

BALANCE SHEET DATA

|

|

|

|

|

|

|

|

|

|

March

31, 2009

|

|

|

December

31, 2008

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

Assets

|

|

|

|

|

|

|

|

Current

Assets

|

|

|

835,612

|

|

|

|

2,133,150

|

|

|

Long-term

portion of investment in sales-type lease

|

|

|

-

|

|

|

|

23,423

|

|

|

Property

& equipment

|

|

|

947,389

|

|

|

|

1,042,851

|

|

|

Website

development costs

|

|

|

348,061

|

|

|

|

392,799

|

|

|

Intangible

assets

|

|

|

1,557,267

|

|

|

|

1,587,463

|

|

|

Goodwill

|

|

|

2,428,602

|

|

|

|

2,428,602

|

|

|

Total

Assets

|

|

$

|

6,116,931

|

|

|

$

|

7,608,288

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current

Liabilities

|

|

|

3,932,643

|

|

|

|

5,297,307

|

|

|

Deferred

lease inducements

|

|

|

50,345

|

|

|

|

55,380

|

|

|

Total

Liabilities

|

|

|

3,982,988

|

|

|

|

5,352,687

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders'

Equity

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

|

15,216

|

|

|

|

14,855

|

|

|

Additional

paid-in capital

|

|

|

15,285,508

|

|

|

|

14,772,880

|

|

|

Accumulated

deficit

|

|

|

(13,166,781

|

)

|

|

|

(12,532,134

|

)

|

|

Total

Stockholders' Equity

|

|

|

2,133,943

|

|

|

|

2,255,601

|

|

|

Total

Liabilities and Stockholders' Equity

|

|

$

|

6,116,931

|

|

|

$

|

7,608,288

|

|

(d) Results

of Operations

Sales

and Costs of Sales

Overall,

combined sales in Q1 of 2009 totaled $1,752,382 versus $1,848,479 in Q1 of 2008,

a decrease of 5.2%. Most of this decrease was driven by a decrease in sales on

Perfume.com as noted below. Overall, Health and Beauty eCommerce

product sales, consisting of Perfume.com sales, represented 98.2% of total

revenues in Q1 of 2009, compared to approximately 98.5% of total revenues in Q1

of 2008.

Costs of

sales were $1,386,619 in Q1 of 2009 compared to $1,486,062 during Q1 of 2008, a

decrease of 6.7%. The decrease of costs of sales in Q1 of 2009 over

Q1 of 2008 is in line with the decrease in Perfume.com sales for the

quarter.

Overall

gross margin in Q1 of 2009 was $365,763 or 20.9% compared to a gross margin of

$362,417 or 19.6% in Q1 of 2008. This increase in the overall gross

margin from Q1 of 2008 is due to efficient product merchandising efforts and a

decrease in exposing coupons and discounts.

Health

and Beauty eCommerce Sales

Our

Health and Beauty eCommerce sales result from the sale of fragrances, designer

skin care and hair care products to customers at Perfume.com. Our

results from the first quarter of 2008 include eCommerce monetization of

Body.com which ended in early 2008. Perfume.com accounted for nearly

all of our eCommerce sales in 2008 and 2009 and we expect that this will

continue in the short term.

The most

recent quarters have presented great challenges for all retailers including

eCommerce, due to the worldwide economic downturn. The industry has

seen a decrease in consumer spending on discretionary items. Such a

decrease will likely adversely affect the revenues from Perfume.com over the

short-term.

Perfume.com

revenues decreased 5.5% to $1,720,167 in Q1 of 2009 from $1,820,188 in Q1 of

2008. Daily sales averaged $19,113 per day in Q1 of 2009 compared to

$20,002 per day in Q1 of 2008. In Q4 of 2008, we began reflecting

revenues for orders that were in transit at quarter end as deferred revenues,

where these amounts were not material and therefore not recorded as such in

prior years. At the end of March, 2009, this represented

approximately $63,000 in deferred revenues. Without this effect in Q1

of 2009, the decrease in Perfume.com revenues year over year was only

2.0%. Revenue growth was challenged as a result of continued

softening of consumer discretionary spending in the US

market. Additionally, in Q1 2009 we did not publish as many

promotions with large product discounts that have historically driven top line

revenue and eroded margin. We also eliminated inefficient marketing

programs that drove revenue in 2008 but were not profitable.

Costs of

shipping and purchases totaled $1,386,619 in Q1 of 2009 versus $1,485,510 in Q1

of 2008. This produced a gross margin of $333,548 or 19.4% in Q1 of

2009 compared to $334,678 or 18.4% in Q1 of 2008. Gross profit margin

in Q1 2009 increased compared to Q1 of 2008 primarily due to nominal decreases

in our product discounting during the quarter, as well as a decrease in shipping

costs attributed to a slight decrease in oil prices. Management

anticipates that, subject to any further downturn in general economic

conditions, it will maintain this profit margin through 2008 and into

2009. Over the next several quarters, Management intends to explore

opportunities to introduce and implement more robust supply chain capability

which, if realized, should increase gross margins by the end of

2010.

Other

eCommerce Sales

In Q1 of

2008, we ceased offering goods or services for sale on any of our websites other

than Perfume.com and undertook to re-evaluate the business models around which

these websites were built. As a result, these websites generated no

revenue after the first quarter of the 2008 fiscal year. For the

first half of 2009 we will continue to allocate our resources to the

development of Perfume.com.

Advertising

In Q1 of

2009, we generated advertising revenues of $24,453 compared to $27,836 in Q1 of

2008, a decrease of 12.2%. Management has been able to establish new

advertising relationships that have increased quarterly advertising

revenues. In Q1 of 2009, advertising accounted for 1.4% of total

revenues, compared to 1.5% of total revenues in Q1 of

2008. Advertising revenues are expected to continue to account for a

small percentage of total revenues in the next few quarters as Management

continues to investigate new monetization opportunities with vendors, and

realigns to increase advertising options available on our properties. In the

medium-term, Management expects advertising revenues to be an important part of

overall revenue.

Domain

Name Leases and Sales

In 2008,

we entered into one agreement for a sales-type lease of one of our domain names

for CDN$200,000 and one agreement for an outright sale of another domain name

for CDN$500,000. The net gain on the disposal of these two domain

names was USD$498,829 as disclosed in the 2008 consolidated financial

statements

.

We have

announced our intention to sell six of our non-core but highly valuable dot.com

domain names from our portfolio in order to provide additional working capital

in a non-dilutive manner. We engaged the services of brokers to

assist us with sales of our domain names. As a result of these

relationships, we successfully sold or leased two domain names in February 2009,

as well as one additional domain name subsequent to the first quarter of

2009. We continue to evaluate any interest we receive from domain

name buyers, and continue to consider acquiring certain other domain names that

would complement either our advertising or eCommerce businesses.

General

and Administrative (G&A) Expenses

General

and administrative expenses consist of costs for general and corporate

functions, including facility fees, travel, telecommunications, investor

relations, insurance, merchant charges, and professional fees.

In Q1 of

2009, we incurred total general and administrative expense of $198,430 or 11.3%

of total sales as compared to $617,880 or 33.4% of total sales in Q1 of 2008, a

decrease of $419,450 or 67.9%. This total includes corporate and

eCommerce related general and administrative costs. Management

expected general and administrative expenses to decrease as a percentage of

revenue as the eCommerce business grows, and has been able to successfully

achieve this decrease in the first quarter of 2009.

Corporate

general and administrative costs of $118,210 have decreased over Q1 of 2008 by

$329,685. This was primarily due to a decrease in corporate legal of

approximately $151,000 compared to the same period last year due to the addition

of in-house legal counsel in May 2008. Other significant expenses

included a decrease of approximately $111,000 of corporate travel and

entertainment expenses and $25,000 in decreased rent and overhead due to

cost-cutting procedures implemented in late 2008 and early 2009. The

remainder of the difference is due to the declining value in the Canadian dollar

against the US dollar between the first quarter of 2009 and the first quarter of

2008. In total, these expenses accounted for 6.75% of total revenues

in Q1 of 2009, compared to 24.2% in Q1 of 2009.

We

anticipate that we may incur additional legal expenses to comply with new

disclosure and reporting requirements mandated by the British Columbia

Securities Commission for companies listed on the OTCBB with a presence in

British Columbia. These regulations were effective as of September

15, 2008.

ECommerce

general and administrative costs in Q1 of 2009 decreased by $89,765 over Q1 of

2008 primarily due to the fact that Q1 of 2008 included approximately $105,000

in expenses relating to our search for executive employees and additions to our

Perfume.com business. Some eCommerce general and administrative costs

that increased in Q1 of 2009 over Q1 of 2008 included $10,000 in Perfume.com

related travel. These expenses represented 6.5% of eCommerce sales in

Q1 of 2009, compared to 8.2% of eCommerce sales in Q1 of

2008. Management believes these expense ratios are reasonable given

the increasingly competitive environment for eCommerce sales in the United

States and Management’s continued focus on growing the eCommerce business

throughout 2008 and into 2009. Management expects to maintain

eCommerce general and administrative costs below 10% of eCommerce

sales.

Management

Fees and Employee Salaries

In Q1 of

2009, we incurred total management fees and staff salaries of $774,972 compared

to $1,073,546 in Q1 of 2008. This amount includes stock based

compensation of $386,512 in Q1 of 2009 and $482,144 in Q1 of

2008. Excluding these amounts, management fees and employee salaries

expense in Q1 of 2009 was $388,460 and in Q1 of 2008 was

$591,402. This produced a decrease of 34.3% in Q1 of 2009 over Q1 of

2008. This decrease was primarily due to the layoffs which occurred

in early 2009.

Management

fees and staff salaries, excluding stock-based compensation, represented 22.2%

of total revenues in Q1 of 2009 compared to 32.0% in Q1 of

2008. Since the end of the 2008 fiscal year, our staffing

requirements were restructured and a number of employees were terminated,

including our former President and COO. After severance payments have

been fully paid out, the reduced number of staff will contribute to a decrease

in management fees and salaries as a percentage of revenue. Given the

caliber of current management, employees and consultants, we anticipate

maintaining salary expense at approximately 20% of revenues.

On March

25, 2009, the Board of Directors approved a reduction of the exercise price of

stock option grants made prior to this date. As a result, all grants

issued prior to March 25, 2009 currently have an exercise price of

$0.65. The stock option grants included in the repricing initially

had exercise prices between $0.65 and $3.30. The incremental value of

$92,237 relating to the fair values at the date of the reduction in price has

been included in the stock compensation expense for the period.

Marketing

We

generate internet traffic through paid search, email and affiliate

marketing. We pay marketing costs related to these methods in order

to drive traffic to our various websites. We pay our affiliates sales

commissions if they deliver traffic to Perfume.com that result in a

successful sale. In Q1 of 2009, total marketing expenses were

$113,876 or 6.5% of total revenues, compared to $175,646 or 9.5% of total

revenues in Q1 of 2008. This resulted in a 35.2% decrease for the

period compared to the same period last year.

Expenses

related to corporate activity, which we classify as corporate marketing

expenditures totalled $2,454 in Q1 of 2009, compared to $26,459 in Q1 of

2008. These expenses consisted entirely of costs related to public

relations, which were higher in 2008 due to the repositioning of our business in

early 2008.

ECommerce

marketing expenses relate entirely to advertising costs incurred in our

eCommerce business, particularly email advertising, search engine marketing, and

affiliate marketing programs. ECommerce marketing expenses in Q1 of

2009 were $111,422 or 6.5% of eCommerce sales, compared to $149,187 or 8.2% of

eCommerce sales in Q1 of 2008. These expenses decreased steadily

during 2008 due to management’s decision to move key marketing efforts in-house,

thereby eliminating agency expenses, as well as to take steps to increase the

effectiveness of our search engine and email marketing campaigns for

Perfume.com. We believe that customer acquisition is the key to

accelerated growth, and deploying direct, measurable marketing vehicles like

search, email, and affiliate marketing account for the largest part of these

marketing expenditures.

Organic

search rankings for Perfume.com currently perform

adequately. However, we believe when these results are complemented

with targeted, paid keyword advertising at opportune times, it brings additional

traffic to Perfume.com. We believe that the more strategic and

measurable advertising expenditures implemented during the last fiscal year were

a contributing factor to increased revenues in 2008.

Marketing

costs coincide with revenue growth and are expected to be in the range of 10% of

gross product revenue. We have been able to maintain marketing costs below 10%

of revenues while aggressively marketing our products and services.

Other

Expenses

During Q1

of 2009, we incurred various restructuring costs of $346,564, consisting of

$264,904 in severance payments to the former President and Chief Operating

Officer and to other staff terminated in the first quarter as a result of

restructuring our staffing requirements, as well as $81,660 in signing bonuses

owing to our Chief Corporate Development Officer.

During Q1

of 2008, we incurred various restructuring costs of $629,856 relating to

establishing the new management team. These included approximately

$168,400 in severance payments and $25,700 in consulting fees for assistance

with the transition of the new management team, both of which were paid to our

former Chief Financial Officer, $317,100 in signing bonuses which were paid to

our new Chief Corporate Development Officer and our new Vice President Finance,

additional severance of $53,600 paid to one of our full time employees, $39,800

in costs related to changing our name and rebranding, and $25,300 in some final

windup costs related to the disposition of Frequent Traveler in late

2007.

(e) Liquidity

and Capital Resources

We

generate cash inflows from (i) the sale of third-party products over the

Internet; (2) "pay-per-click" advertising; (3) selling advertising on media rich

websites with relevant content; and (4) the sale or lease of domain name

assets. However, during the 2008 fiscal year and the first quarter of

2009, our cash inflows were not adequate to support our

operations. In order to conserve cash, we paid certain service

providers with shares of our common stock during, and subsequent to, the quarter

ended March 31, 2009.

As at

March 31, 2009, current liabilities were in excess of current assets resulting

in a working capital deficiency of $3,097,031, compared to a working capital

deficiency of $3,164,157 at the fiscal year ended December 31,

2008. During the three months ended March 31, 2009, we incurred a net

loss after other items of $634,647, compared to a net loss after other items of

$1,994,218 during the three months ended March 31, 2008. This

quarter’s net loss includes gains from sales and sales-type lease of domain

names of $580,525 compared to $168,206 during the same period last year, as well

as a recovery on the expenses for the Global Cricket Venture of $22,745 this

quarter compared to expenses of $55,317 in the same period last

year. We had a decrease in cash of $1,259,932 during the first

quarter of 2009 compared to a decrease in cash of $2,469,500 during the first

quarter of 2008. From the beginning of the fiscal year to

March 31, 2009, we increased our accumulated deficit to $13,166,781 from

$12,532,134 and have stockholders’ equity of $2,133,943.

The

decrease in cash for the three month period primarily included cash outlays to

pay off some large accounts payable that had been accrued at the December 31,

2008 fiscal year end, especially from our vendors relating to sales volume from

December 2008. Other payments that were either unusual or

non-operational in nature included $161,000 that was paid during the quarter

related to Global Cricket Venture expenses incurred to perform under the

agreements with BCCI, IPL and NLB.

Operating

Activities

Operating

activities in the three months ended March 31, 2009 resulted in cash outflows of

$1,903,550 after adjustments for non-cash items, the most significant of which

were the stock-based compensation expensed during the period of $386,513 and the

gain from the sales and sales-type lease of domain names of

$580,525. Operating activities also included a significant decrease

in accounts payable of $1,444,566. In the three months ended March

31, 2008, cash outflows of $1,959,299 were primarily due to the loss of the

period.

Investing

Activities

Investing

activities during the three months ended March 31, 2009 generated cash inflows

of $643,618, primarily due to proceeds received from the sale and sales-type

lease of domain names. During the three months ended March 31, 2008,

cash from investing activities used $510,201 primarily consisting of accrued

expenses relating to deferred acquisition costs of $111,265 as well as paid

deferred acquisition costs of $121,265, both pursuant to the Auctomatic

merger. Investing activities in the period also included purchases of

$154,069 for property and equipment and $147,025 spent in website development

costs.

Financing

Activities

There

were no financing activities in either the three months ended March 31, 2009 or

the three months ended March 31, 2008.

Future

Operations

At

quarter end, we had a working capital deficiency, and for over the past two

fiscal years we have experienced substantial losses. We expect to

continue to incur losses in the coming quarters even though costs have been

reduced through lay-offs and restructuring. We may also seek to

explore new business opportunities, including the partnering, building or

acquiring of a distribution center or warehouse in the United States to enhance

our fragrance fulfillment capability and improve gross margins. These

acquisitions may require additional cash beyond what is currently available and

such funds may be raised by future equity and/or debt financings, and through

the sale of non-core domain name assets.

We are

pursuing opportunities to increase cash flows, however there is no certainty

that these opportunities will generate sufficient cash flows to support our

activities in the future in view of changing market

conditions. During the 2009 fiscal year, we expect to expend

significant funds toward additional marketing costs, which we believe will

translate into higher revenue growth, as well as to fund costs related to the

Global Cricket Venture. There is no certainty that the profit margins

we may generate going forward, as well as any successful raising of working

capital, will be sufficient to offset the anticipated marketing costs, Global

Cricket Venture costs, and other expenditures and may result in net cash outflow

for the 2009 fiscal year.

We have

actively curtailed some operations and growth activities in an effort to reduce

costs and preserve cash on hand. We are also continuing to seek

opportunities to sell selected domain names in order to address short term

liquidity needs. As a result, we have entered into agreements with

brokers to sell several of our non-core but highly valuable dot-com domain names

from our portfolio of more than 800 domain names. Two domain names

were sold or leased during the first quarter of 2009 for $1.65

million. After the end of the quarter, we sold an additional domain

name for proceeds of $400,000. We anticipate that further strategic

sales of these domain names, if successful, will provide us with the required

cash to meet our working capital needs, to fund cricket related expenditures,

and to provide for general operating capital needs over the next 12 to 18

months. There can be no assurances that any future sales of domain

names on terms acceptable to us will occur.

The

interim consolidated financial statements have been prepared on a going concern

basis which assumes that we will be able to realize assets and discharge

liabilities in the normal course of business for the foreseeable

future. Our ability to continue as a going-concern is in substantial

doubt as it is dependent on continued financial support from our investors, our

ability to sell additional non-core domain names, our ability to raise future

debt or equity financings, and the attainment of profitable operations to meet

our liabilities as they become payable. The outcome of our operations

and fundraising efforts is dependent in part on factors and sources beyond our

direct control that cannot be predicted with certainty. Access to

future debt or equity financing is not assured and we may not be able to enter

into arrangements with financing sources on acceptable terms, if at

all. The financial statements do not include any adjustments relating

to the recoverability or classification of assets or the amounts or

classification of liabilities that might be necessary should we be unable to

continue as a going concern.

The first

payment due from Global Cricket Venture to the BCCI and the IPL is to be paid on

July 1, 2009. The amount of the payment is $2,250,000. If

Global Cricket Venture, a 50.05% owned subsidiary, is unable to make the

required payments to the BCCI or the IPL, and no extension or renegotiation of

the payment terms can be arranged, it may be exposed to a loss of rights and

opportunities, or potential liability for defaulting on its

payment. Such claims could include breach of contract, lack of

performance and other claims for damages. If these events were to

occur, they could have a negative effect on our overall anticipated results of

operations and performance.

We have

no current plans to purchase any significant property and

equipment.

Off-Balance

Sheet Arrangements

As of March 31, 2009, we did not have

any off-balance sheet arrangements, including any outstanding derivative

financial instruments, off-balance sheet guarantees, interest rate swap

transactions or foreign currency contracts. We do have

off-Balance Sheet commitments as disclosed in the notes to the interim

consolidated financial statements, included at page

F-1 to this

Report. We do not engage in trading activities involving non-exchange

traded contracts.

(f) Application

of Critical Accounting Policies

Our

interim consolidated financial statements and accompanying notes are prepared in

accordance with United States generally accepted accounting

principles. Preparing financial statements requires Management to

make estimates and assumptions that affect the reported amounts of assets,

liabilities, revenue, and expenses. These estimates and assumptions are affected

by Management's application of accounting policies. We believe that

understanding the basis and nature of the estimates and assumptions is critical

to an understanding of our operating results and financial

position.

Going

Concern

Our

consolidated financial statements have been prepared on a going concern basis

which assumes that we will be able to realize assets and discharge liabilities

in the normal course of business for the foreseeable future. We have

generated a consolidated net loss for the quarter ended March 31, 2009 of

$634,647 ($10,006,456 for the year ended December 31, 2008) and realized a

negative cash flow from operating activities of $1,903,550 for the quarter ended

March 31, 2009 ($4,854,260 for the year ended December 31,

2008). There is an accumulated deficit of $13,166,781 (December 31,

2008 - $12,532,134) and a working capital deficiency of $3,097,031 at March 31,

2009 ($3,164,157 at December 31, 2008).

Our

ability to continue as a going-concern is in substantial doubt as it is

dependent on continued financial support from our investors, our ability to

raise equity financing and the attainment of profitable operations and further

share issuances to meet our liabilities as they become payable,

including our commitments for Global Cricket Venture, if

any. The outcome of these matters is dependant on factors outside of

our control and cannot be predicted at this time.

The

accompanying consolidated financial statements have been prepared on a going

concern basis which assumes that we will be able to realize assets and discharge

liabilities in the normal course of business for the foreseeable

future. These financial statements do not include any adjustments

relating to the recoverability or classification of assets or the amounts or

classification of liabilities that might be necessary should we be unable to

continue as a going concern.

Principles

of consolidation

The

consolidated financial statements include our accounts, our wholly owned

subsidiary Delaware, our wholly-owned subsidiary LCM Cricket Ventures, our 98.2%

(December 31, 2007 - 94.9%) interest in our subsidiary DHI, DHI’s wholly owned

subsidiaries Importers and 612793, and LCM Cricket Ventures’ 50.05% interest in

Global Cricket Venture. All significant intercompany balances and

transactions are eliminated on consolidation.

Revenue

Recognition

Revenues,

and associated costs of goods sold, from the on-line sales of products,

currently consisting primarily of fragrances and other beauty products, are

recorded upon delivery of products and determination that collection is

reasonably assured. We record inventory as an asset for items in

transit as title does not pass until received by the customer. All

associated shipping and handling costs are recorded as cost of goods sold upon

delivery of products.

Web

advertising revenue consists primarily of commissions earned from the referral

of visitors to our websites from other parties. The amount and

collectibility of these referral commissions is subject to uncertainty;

accordingly, revenues are recognized when the amount can be determined and

collectibility can be reasonably assured. In accordance with Emerging

Issues Task Force (“EITF”) 99-19,

Reporting Revenue Gross as a

Principal versus Net as an Agent

, we record web advertising revenues on a

gross basis.

Revenue

from the sale of domain names, whose carrying values are recorded as intangible

assets, consists primarily of funds earned for the transfer of rights to domain

names that are currently in our control. Revenues have been

recognized when the sale agreement is signed and the collectibility of the

proceeds is reasonably assured. In the first quarter of 2009, there

was a sale of one domain name. Collectibility of the amounts owing on

this sale is reasonably assured and therefore accounted for as a sale in the

period the transaction occurred. In 2008, there was one sale of

a domain name. Collectibility of the amounts owing on this sale is

reasonably assured and therefore accounted for as a sale in the period the

transaction occurred.

Revenue

from the sales-type leases of domain names, whose carrying values are recorded

as intangible assets, consists primarily of funds earned over a period of time

for the transfer of rights to domain names that are currently in our

control. When collectibility of the proceeds on these transactions is

reasonably assured, the gain on sale is accounted for as a sales-type lease in

the period the transaction occurs.

Stock-Based

Compensation

During

the third quarter of 2007, we implemented the following new critical accounting

policy related to stock-based compensation. Beginning July 1, 2007, we began

accounting for stock options under the provisions of Financial Accounting

Standards No. 123 (revised 2004),

Share-Based Payment

(“FAS

123(R)”), which requires the recognition of the fair value of stock-based

compensation. Under the fair value recognition provisions for FAS 123(R),

stock-based compensation cost is estimated at the grant date based on the fair

value of the awards expected to vest and is recognized as expense ratably over

the requisite service period of the award. We have used the Black-Scholes

valuation model to estimate fair value of our stock-based awards which require

various judgmental assumptions including estimating price volatility and

expected life. Our computation of expected volatility is based on a combination

of historic and market-based implied volatility. In addition, we consider many

factors when estimating expected life, including types of awards and historical

experience. If any of these assumptions used in the Black-Scholes valuation

model change significantly, stock-based compensation expense may differ

materially in the future from what is recorded in the current

period.

In August

2007, our board of directors approved a Stock Incentive Plan to make available

5,000,000 shares of common stock to be awarded as restricted stock awards or

stock options, in the form of incentive stock options (“ISO”) or non-qualified

stock options to be granted to our employees, and other stock options to be

granted to our employees, officers, directors, consultants, independent

contractors and advisors, provided such consultants, independent contractors and

advisors render bona-fide services not in connection with the offer and sale of

securities in a capital-raising transaction or promotion of our

securities. Our shareholders approved the Stock Incentive Plan at the

2008 Annual General Meeting.

We

account for equity instruments issued in exchange for the receipt of goods or

services from other than employees in accordance with FAS No. 123(R) and the

conclusions reached by the EITF in Issue No. 96-18. Costs are measured at

the estimated fair market value of the consideration received or the estimated

fair value of the equity instruments issued, whichever is more reliably

measurable. The value of equity instruments issued for consideration other

than employee services is determined on the earliest of a performance commitment

or completion of performance by the provider of goods or services as defined by

EITF 96-18.

On March

25, 2009, our Board of Directors approved a reduction in the exercise price of

stock option grants previously made under the 2007 Incentive Stock Option

Plan. No other terms of the plan or the grants were

modified.

Inventory

Inventory

is recorded at the lower of cost or market using the first-in first-out (FIFO)

method. We maintain little or no inventory of perfume which is

shipped from the supplier directly to the customer. The inventory on

hand as at March 31, 2009 is recorded at cost of $47,421 (December 31, 2008 -

$74,082) and represents inventory in transit from the supplier to the

customer.

Website

Development Costs

We

adopted the provisions of EITF No. 00-2,

Accounting for Web Site Development

Costs

, whereby costs incurred in the preliminary project phase are

expensed as incurred; costs incurred in the application development phase are

capitalized; and costs incurred in the post-implementation operating phase are

expensed as incurred. Website development costs are stated at cost

less accumulated amortization and are amortized using the straight-line method

over its estimated useful life. Upgrades and enhancements are

capitalized if they result in added functionality which enables the software to

perform tasks it was previously incapable of performing.

Intangible

Assets

We

adopted the provision of FAS No. 142,

Goodwill and Intangible

Assets

, which revises the accounting for purchased goodwill and

intangible assets. Under FAS 142, goodwill and intangible assets with indefinite

lives are no longer amortized and are tested for impairment annually. The

determination of any impairment would include a comparison of estimated future

operating cash flows anticipated during the remaining life with the net carrying

value of the asset as well as a comparison of our fair value to book

value.

Our

intangible assets, which consist of its portfolio of generic domain names, have

been determined to have an indefinite life and as a result are not

amortized. Management has determined that there is no impairment of

the carrying value of intangible assets at March 31, 2009.

Goodwill

Goodwill

represents the excess of acquisition cost over the fair value of the net assets

of acquired entities.

In accordance with FAS

No. 142,

Accounting for

Goodwill and Other Intangible Assets,

we are required to assess the

carrying value of goodwill annually or whenever circumstances indicate that a

decline in value may have occurred, utilizing a fair value approach at the

reporting unit level.

A reporting unit is the

operating segment, or a business unit one level below that operating segment,

for which discrete financial information is prepared and regularly reviewed by

segment management.

The

goodwill impairment test is a two-step impairment test.

In the first step, we

compare the fair value of each reporting unit to its carrying value.

We determine the fair

value of our reporting units using a discounted cash flow approach.

If the fair value of the

reporting unit exceeds the carrying value of the net assets assigned to that

reporting unit, goodwill is not impaired and we are not required to perform

further testing.

If the carrying value of

the net assets assigned to the reporting unit exceeds the fair value of the

reporting unit, then we must perform the second step in order to determine the

implied fair value of the reporting unit’s goodwill and compare it to the

carrying value of the reporting unit’s goodwill.

The activities in the

second step include valuing the tangible and intangible assets and liabilities

of the impaired reporting unit based on their fair value and determining the

fair value of the impaired reporting unit’s goodwill based upon the residual of

the summed identified tangible and intangible assets and

liabilities.

We

assessed the carrying value of goodwill at the December 31, 2008 fiscal year

end, and there are no indications that a decline in value may have occurred to

March 31, 2009. At that date, the fair value of the Perfume.com

reporting unit exceeded the carrying value of the assigned net assets, therefore

no further testing was required and an impairment charge was not

required.

(g) Recent

Accounting Pronouncements

FAS

162

In May,

2008, the FASB issued FAS 162,

The Hierarchy of Generally Accepted

Accounting Principles.

The new standard is intended to improve financial

reporting by identifying a consistent framework, or hierarchy, for selecting

accounting principles to be used in preparing financial statements that are

presented in conformity with U.S. generally accepted accounting principles

(GAAP) for nongovernmental entities. This Statement is effective 60 days

following the SEC’s approval of the Public Company Accounting Oversight Board

amendments to AU Section 411,

The Meaning of

Present Fairly in Conformity With

Generally Accepted Accounting Principles

. We do not expect

that this Statement will result in a change in current practice.

Recently

Adopted Accounting Pronouncements

FAS

161

In

March 2008, the FASB issued FAS 161,

Disclosures about Derivative

Instruments and Hedging Activities

,

an amendment of FAS 133

. FAS

161 is intended to improve financial standards for derivative instruments and

hedging activities by requiring enhanced disclosures to enable investors to

better understand their effects on an entity's financial position, financial

performance and cash flows. Entities are required to provide enhanced

disclosures about: how and why an entity uses derivative instruments; how

derivative instruments and related hedged items are accounted for under FAS 133

and its related interpretations; and how derivative instruments and related

hedged items affect an entity's financial position, financial performance and

cash flows. FAS 161 was effective for financial statements issued for

fiscal years and interim periods beginning after November 15, 2008, which for us

was the fiscal year beginning January 1, 2009. We adopted FAS 161 at

January 1, 2009, however the adoption of this statement did not have a material

effect on our financial results.

FSP

FAS 142-3

In April

2008, the FASB issued FASB Staff Position ("FSP") FAS 142-3,

Determination of the Useful Life of

Intangible Assets

. FSP FAS 142-3 amends the factors that

should be considered in developing renewal or extension assumptions used to

determine the useful life of a recognized intangible asset under FAS 142,

Goodwill and Other Intangible

Assets