- Current report filing (8-K)

April 08 2009 - 6:01AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC

20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15

(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): March 31, 2009

LIVE CURRENT MEDIA

INC.

(Exact

name of Registrant as specified in charter)

|

|

|

|

|

|

|

Nevada

(State

or other jurisdiction

of

incorporation)

|

|

000-29929

(Commission

File Number)

|

|

88-0346310

(IRS

Employer

Identification

Number)

|

375 Water

Street, Suite 645

Vancouver,

British Columbia V6B 5C6

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (604) 453-4870

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following

provisions (see General Instruction A.2 below).

|

|

|

|

|

o

|

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

|

|

|

o

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17

CFR240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b)).

|

|

|

|

|

|

o

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13(e)-4(c))

|

This

Form 8-K and other reports filed by the Company from time to time with the

Securities and Exchange Commission (collectively the “Filings”) contain forward

looking statements and information that are based upon beliefs of, and

information currently available to, the Company’s management as well as

estimates and assumptions made by the Company’s management. When used in the

Filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”,

“intend”, “plan” or the negative of these terms and similar expressions as they

relate to the Company or the Company’s management identify forward looking

statements. Such statements reflect the current view of the Company with respect

to future events

and are subject to risks, uncertainties,

assumptions and other factors relating to the Company’s industry, operations and

results of operations and any businesses that may be acquired by the Company.

Should one or more of these risks or uncertainties materialize, or should the

underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or

planned.

The

following discussion provides only a brief description of the documents

described below. The full text of the agreements is attached to this

Current Report as exhibits. The discussion below is qualified in its

entirety by the full text of the agreements.

ITEM 1.01

Entry

into a Material Definitive Agreement

On March

31, 2009, Live Current Media Inc. (the “Company”), Global Cricket Ventures Pte.

Ltd. (“GCV”), an entity which is partially owned by the Company, and the Board

of Control for Cricket in India (“BCCI”) entered into a Novation Agreement (the

“Novation”) pursuant to which GCV was granted all of the Company’s rights,

and assumed all of the Company’s obligations, under that certain Memorandum of

Understanding that had been executed by the Company and the

BCCI, acting for and on behalf of its separate subcommittee unit known as

the Indian Premiere League (“BCCI-IPL”), on April 16, 2008 (the “Original

Agreement”). The purpose of the Original Agreement was to grant to

the Company the right to be the exclusive online provider of the official

website for the IPL (the “IPL Website”). On April 16, 2008 the

Company had also entered into a separate Memorandum of Understanding with the

BCCI to become the exclusive online provider of the BCCI’s website (the “BCCI

MOU”). While the BCCI MOU was terminated on March 31, 2009 (see Item

1.02 below), certain payments due to the BCCI under the BCCI MOU were assumed by

GCV, as described below.

Pursuant

to the Novation,

|

|

·

|

GCV,

rather than the Company, will be the party to the Original

Agreement;

|

|

|

·

|

the

term of the Original Agreement will begin on April 1, 2008 and end on

December 31, 2017;

|

|

|

·

|

the

minimum payments due on October 1, 2008 to the BCCI and the BCCI-IPL of

$625,000 and $375,000, respectively, as well as any other payments owed to

the BCCI and the IPL through March 31, 2009, are assumed by GCV and

will be paid on July 1, 2009;

|

|

|

·

|

a

right to terminate the Original Agreement due to a material breach or on

the insolvency of either party has been added;

and

|

|

|

·

|

the

“Minimum Annual Fee Payment Schedule” (Schedule 2 to the Original

Agreement) has been revised. The first payment of $2,250,000 is

due on July 1, 2009.

|

ITEM

1.02 Termination of a Material Definitive Agreement

On March

31, 2009, the Company and the BCCI entered into a Mutual Termination Agreement

pursuant to which the BCCI MOU was terminated and the parties released from any

further obligations thereunder.

ITEM 9.01

FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits.

|

Exhibit

No

|

Item

|

|

|

|

|

10.1

|

Memorandum

of Understanding dated April 16, 2008 between the Company and the Board of

Control for Cricket in India

|

|

10.2

|

Memorandum

of Understanding dated April 16, 2008 between the Company and the Board of

Control for Cricket in India for and on behalf of Indian Premiere

League

|

|

10.3

|

Novation

Agreement

|

|

10.4

|

Mutual

Termination

Agreement

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

LIVE

CURRENT MEDIA INC.

|

|

|

|

|

|

|

By:

|

|

/s/

C. Geoffrey

Hampson

|

|

|

|

|

|

|

|

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

Dated:

April 7, 2009

|

|

|

3

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From May 2024 to Jun 2024

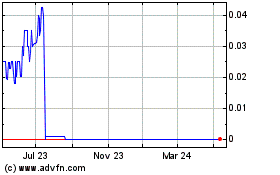

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Jun 2023 to Jun 2024