J Sainsbury Agrees GBP3.5 Billion Financing Package For Asda Merger

July 04 2018 - 3:03AM

Dow Jones News

By Maryam Cockar

J Sainsbury PLC (SBRY.LN) said Wednesday that it has agreed to a

3.50 billion pounds ($4.61 billion) financing package for its

proposed merger with Asda, and that first-quarter sales rose.

Britain's second largest grocer by market share said that it

agreed to the financial package with its existing banks and new

institutions and that its current line of credit will increase to

GBP2 billion from GBP1.5 billion, providing further financial

flexibility to the combined group.

On April 30, Walmart Inc. (WMT) said it will sell its U.K.

business, Asda, to Sainsbury in a deal worth GBP7.30 billion. If

the tie-up is approved by Britain's Competition & Market

Authority it would create the largest grocer in the U.K.

For the 16 weeks to June 30, Sainsbury said like-for-like retail

sales rose 0.2%, while total retail sales increased 0.8%.

Grocery sales grew 0.5% with online and convenience store

grocery sales up 7.3% and 3.6%, respectively.

Sainsbury said general merchandise and clothing sales continued

to gain in the first quarter in a challenging market. General

merchandise sales rose 1.7% and clothing sales grew 0.8%.

Chief Executive Mike Coupe said first-quarter headline numbers

reflect price reductions the company made in key areas like fresh

meat, fruit and vegetables since March.

He said the market remains competitive, but the company has the

right strategy in place and the proposed merger will "create a

dynamic new player in U.K. retail".

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

July 04, 2018 02:48 ET (06:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

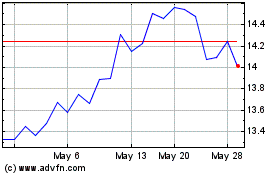

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jun 2024 to Jul 2024

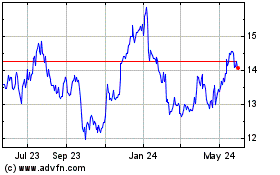

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jul 2023 to Jul 2024