Current Report Filing (8-k)

February 06 2023 - 6:02AM

Edgar (US Regulatory)

0001119190

false

0001119190

2023-01-31

2023-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 31, 2023

HUMBL,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-31267

|

|

91-2948019 |

| (State

of other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 600

B Street |

|

|

| Suite

300 |

|

|

| San

Diego, CA |

|

92101 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (786) 738-9012

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HMBL | | OTCQB

|

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On January 31, 2023, HUMBL,

Inc. (“HUMBL”) entered into a Settlement Agreement (the “Settlement Agreement”) with Javier Gonzalez and Juan

Luis Gonzalez. Under the terms of the Settlement Agreement, Tickeri, Inc. (“Tickeri”), a wholly-owned subsidiary of HUMBL,

was transferred back to Javier Gonzalez and Juan Luis Gonzalez, free of any encumbrances and including all of Tickeri’s

intellectual property, other assets and associated debt. The parties entered into the Settlement Agreement because HUMBL was in default

of the promissory notes for $5,000,000 issued to both Javier Gonzalez and Juan Luis Gonzalez (the “Notes”)

as a portion of the consideration paid by HUMBL under the agreement to acquire Tickeri. Javier Gonzalez and Juan Luis Gonzalez

will receive the 4,672,897 restricted shares of HUMBL’s common stock owed to them under the acquisition agreement. Under the

terms of the Settlement Agreement, the Notes were cancelled with all related accrued penalties and interest and the parties agreed to

a mutual release of all claims. The foregoing description of the Settlement Agreement does not purport to be complete and is qualified

in its entirety by reference to the Settlement Agreement which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

February 3, 2023 |

HUMBL,

Inc. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

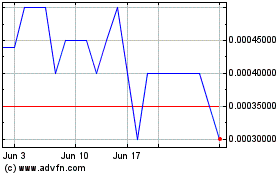

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2024 to May 2024

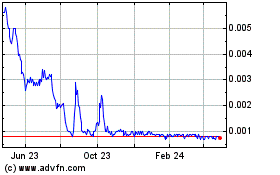

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From May 2023 to May 2024