Pacific Exploration Reaches Forbearance Deal With Certain Noteholders -- Update

February 19 2016 - 3:04PM

Dow Jones News

By Carolyn King and Ben Dummett

Pacific Exploration & Production Corp. on Friday said it had

reached a forbearance agreement with holders of about 40% of its

$4.1 billion in senior notes, giving the troubled

Canadian-Colombian oil company until March 31 to restructure its

balance sheet.

The deal follows Pacific Exploration's decision not to make

scheduled interest payments due on the notes last month and to seek

restructuring alternatives. Analysts said that move was possibly a

sign the firm was running low on cash.

Washington, D.C.-based energy-investment firm EIG has made an

offer to Pacific Exploration's noteholders, offering 16 cents on

the U.S. dollar and saying it will overhaul the company's

management and sell off assets if its offer to noteholders is

successful.

Prices of the oil company's notes remain under pressure,

recently trading a few pennies below EIG's offer.

The extension deal with the noteholders "should allow the

company additional time to continue working with the independent

committee of the board of directors, the company's financial and

legal advisers as well as its lenders and the noteholders to come

to a consensual and comprehensive restructuring of the company's

balance sheet," Pacific Chief Executive Ronald Pantin said.

Pacific Exploration, which is listed on the Toronto Stock

Exchange but has most of its assets in Colombia, has been hit hard

by falling oil prices and a lack of new discoveries. After trading

around 34 Canadian dollars (about $25) in 2011, the company's

shares recently changed hands at 68 Canadian cents on the Toronto

Stock Exchange.

EIG and its subsidiary Harbour Energy first approached the

company's noteholders in January, offering 17.5 cents on the

dollar. EIG later lowered the offer, citing low oil prices and

Pacific Exploration's deteriorating financial condition.

Pacific Exploration has cut costs and tried to sell assets to

offset the blow from low oil prices, but even with the forbearance

agreement it isn't clear the company can survive if oil prices stay

at current levels of around $30 a barrel, said Klaus Spielkamp,

head of fixed-income sales at Bulltick Capital Markets, a

Miami-based investment bank focused on Latin America.

"I don't believe they have a plan for oil trading at $30 or

below $30 a barrel," he said. In New York, crude was recently at

$29.50 a barrel.

A Pacific Exploration spokesman declined to comment beyond the

company's statement.

In the statement, the company said it would use the extension

period to continue to work with its creditors and "to formulate a

comprehensive plan to address the current oil price environment and

ensure the long-term viability of its business." It said it

continues to operate normally and to pay its bills on time.

Write to Carolyn King at carolyn.king@wsj.com

(END) Dow Jones Newswires

February 19, 2016 14:49 ET (19:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

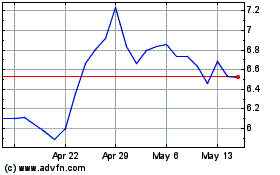

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From May 2024 to Jun 2024

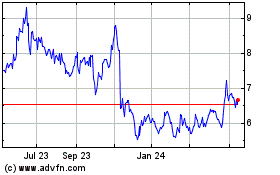

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From Jun 2023 to Jun 2024