Current Report Filing (8-k)

February 12 2021 - 4:52PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 8, 2021

ELECTROMEDICAL TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified

in its Charter)

|

Delaware

|

Commission File Number

|

82-2619815

|

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

000-56192

|

(I.R.S. Employer

Identification Number)

|

16561 N. 92nd Street, Ste. 101

Scottsdale, AZ 85260

(Address of Principal Executive Offices

and Zip Code)

888-880-7888

(Issuer's telephone number)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

Trading

Symbols

|

Name

of Exchange on Which Registered

|

|

COMMON

|

EMED

|

NONE

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 1 - Registrant’s Business

and Operations Item

1.01 Entry into a Material Definitive

Agreement.

On February 8, 2021, the Registrant entered

into a material definitive agreement with YA II PN, Ltd., a Cayman Islands exempt company, comprised of a securities purchase

agreement, convertible debenture, warrant and registration rights agreement. Except than for the material definitive agreement,

no material relationship exists between the Registrant and YA II PN, Ltd.

Pursuant to the securities purchase agreement

and Section 4(2) and/or Rule 506 of Regulation D, under the Securities Act of 1933, the Registrant sold YA II PN, Ltd. debentures

in the aggregate principal amount of USD $1,000,000, in three separate closings, convertible into shares of the Company’s

common stock at the lower of the fixed price of $0.40 per share, or 70% of the lowest VWAP of the Company’s Common Stock

during the 20 Trading Days immediately preceding the Conversion Date. The first closing occurred upon the execution of the material

definitive agreement in the face amount of $500,000, for a purchase price of $475,000. The second closing is in the face amount

of $250,000 for a purchase price of $237,500 and the third closing in the face amount of $250,000 for a purchase price of $237,500.

To induce YA II PN, Ltd.to execute and

deliver the securities purchase agreement, the Company agreed to provide certain registration rights under the Securities Act

of 1933 for the shares registrable under the convertible debentures and warrants. The second closing is contingent upon the Registrant

filing a registration statement with the Securities and Exchange Commission by February 26, 2021. Upon effectiveness of the registration

statement, the third closing will be completed. The Registrant reserved an aggregate of 17,971,894 shares in anticipation of conversions

under the debentures and warrant.

Contemporaneously with the first closing

the Registrant sold to YA II PN, Ltd. a warrant to purchase 2,500,000 shares of the Registrant’s Common Stock at an exercise

price of $0.40 per share. The warrant expires February 8, 2026.

YA II PN, Ltd. shall not have the right

to convert any portion of the debentures or warrants, or receive shares of common stock as payment of interest hereunder to the

extent that after giving effect to such conversion or receipt of such interest payment, YA II PN, Ltd., together with any of its

affiliate, would beneficially own (as determined in accordance with Section 13(d) of the Exchange Act and the rules promulgated

thereunder) in excess of 4.99% of the number of shares of common stock outstanding immediately after giving effect to such conversion

or receipt of shares as payment of interest.

Section 2 - Financial Information

Item 2.01 Completion of Acquisition

or Disposition of Assets

On February 8, 2021, the securities purchase

agreement, convertible debenture, warrant and registration rights agreement were consummated. The disclosure included under Item

1.01 of this Current Report on Form 8-K is incorporated by reference herein.

Section 3 - Securities and Trading

Markets

Item 3.02 Unregistered Sales of Equity

Securities.

On February 8, 2021, the Company sold

YA II PN, Ltd. a warrant to purchase 2,500,000 shares of the Registrant’s common stock, par value $0.00001, equal in value

to $1,425,000 based on the closing price on February 8, 2021, in exchange for YA II PN, Ltd.’s execution of the material

definitive agreement and related transaction documents.

The warrant shares equal 8.95% of the

Registrant’s issued and outstanding shares as of February 10, 2021. The warrant agreement was sold pursuant to the exemption

from the registration requirements of the Securities Act of 1933, as amended, available to the Company by Section 4(a)(2) promulgated

thereunder due to the fact that it was an isolated issuance and did not involve a public offering of securities.

Section 9 – Financial Statement

and Exhibits

Item 9.01 Financial Statements and

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated February 12, 2021

|

|

|

|

|

|

ELECTROMEDICAL TECHNOLOGIES, INC.

|

|

|

|

|

|

By: /s/ Matthew Wolfson

|

|

|

Matthew Wolfson

|

|

|

Chief Executive Officer

|

|

|

(Principal Executive Officer)

|

|

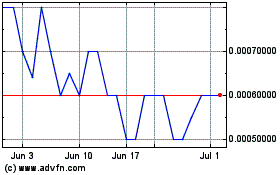

ElectroMedical Technolog... (PK) (USOTC:EMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

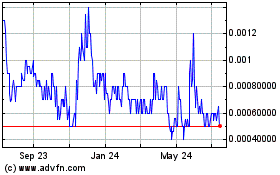

ElectroMedical Technolog... (PK) (USOTC:EMED)

Historical Stock Chart

From Apr 2023 to Apr 2024