As

filed with the Securities and Exchange Commission on April _____, 2021.

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DSG

GLOBAL INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

7373

|

|

26-1134956

|

|

(State

of

Incorporation)

|

|

(Primary

Standard Industrial

Classification

Number)

|

|

(IRS

Employer

Identification

Number)

|

207-15272

Croydon Drive

Surrey,

British Columbia, V3Z 0Z5, Canada

(604)

575-3848

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Please

send copies of all communications to:

|

Chase

Chandler, Esq.

Brunson

Chandler & Jones, PLLC

175

South Main Street, Suite 1410

Salt

Lake City, Utah 84111

801-303-5772

|

|

Melissa

Frayer, Esq.

Andrew

Thorpe, Esq.

Jeffrey

D. Cohan, Esq.

Mintz,

Levin, Cohn, Ferris, Glovsky & Popeo P.C.

44

Montgomery Street, 36th Floor

San

Francisco, California 94104

415-432-6000

|

|

Robert

Galletti, Esq.

Watson

Goepel LLP

1200-1075

West Georgia St.

Vancouver,

British Columbia

Canada

V6E 3C9

|

(Address,

including zip code, and telephone, including area code)

Approximate

date of proposed sale to the public: From time to time after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

Large

accelerated filer

|

[ ]

|

|

Accelerated

filer

|

[ ]

|

|

|

Non-accelerated

filer

|

[ ]

|

|

Smaller

reporting company

|

[X]

|

|

|

|

|

Emerging

Growth Company

|

[ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered (1)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration

Fee

|

|

|

Units, each consisting of one share of common stock, par value $0.001 per share, and one warrant (2)

|

|

$

|

15,000,000

|

|

|

$

|

1,636.50

|

|

|

Shares of common stock

included as part of the Units (3)

|

|

|

—

|

|

|

|

—

|

|

|

Warrants to purchase shares of common stock included as part of the Units (3)(4)

|

|

|

—

|

|

|

|

—

|

|

|

Shares of common stock issuable upon exercise of the Warrants (5)

|

|

$

|

15,000,000

|

|

|

$

|

1,636.50

|

|

|

Underwriter Warrants(6)

|

|

|

-

|

|

|

|

-

|

|

|

Shares of Common Stock issuable

upon exercise of the underwriter’s

|

|

|

|

|

|

|

|

|

|

Warrants (7)

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

30,000,000

|

|

|

$

|

3,273.00

|

|

|

(1)

|

In

the event of a stock split, stock dividend, or similar transaction involving our common stock, the number of shares registered

shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities

Act of 1933, as amended (the “Securities Act”).

|

|

|

|

|

(2)

|

Includes

shares of common stock and/or warrants that may be issued upon exercise of a 45-day option granted to the underwriter to cover

over-allotments, if any.

|

|

|

|

|

(3)

|

No

additional fee is payable pursuant to Rule 457(g) under the Securities Act.

|

|

|

|

|

(4)

|

There

will be issued warrants to purchase one share of common stock for every one share of common stock offered. The warrants are

exercisable at a per share price of 100% of the common stock public offering price.

|

|

|

|

|

(5)

|

In

accordance with Rule 457(i) under the Securities Act, because the shares of the Registrant’s common stock underlying

the warrants are hereby registered, no separate registration fee is required with respect to the warrants hereby

registered.

|

|

|

|

|

(6)

|

No additional registration fee is payable pursuant

to Rule 457(g) under the Securities Act.

|

|

|

|

|

(7)

|

The underwriter’s warrants are exercisable

into a number of shares of common stock equal to [____]% of the number of shares of common stock sold in this offering, excluding

upon exercise the option to purchase additional securities, at an exercise price equal to [____]% of the public offering price

per Unit.

|

We

hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant

shall file a further amendment which specifically states that this registration statement shall, thereafter, become effective

in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such

date as the Securities and Exchange Commission, acting pursuant to Section 8(a) may determine.

SUBJECT

TO COMPLETION DATED APRIL ____, 2021

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary

Prospectus

DSG

Global Inc.

[________]

Units

This

is a firm commitment underwritten public offering of [______] units (the “Units”), based on a public offering price

of $[______] per Unit, of DSG Global, Inc., a Nevada corporation (the “Company”, “we”, “us”,

“our”). We anticipate a public offering price between $[ ] and $[ ] per Unit. Each Unit consists of one share of common

stock, $0.001 par value per share, and one warrant (each, a “Warrant” and collectively, the “Warrants”)

to purchase one share of common stock at an exercise price of $[______] per share, constituting 100% of the price of each Unit

sold in this offering based on a public offering price of $[______] per Unit. The Units have no stand-alone rights and will not

be certificated or issued as stand-alone securities. The shares of common stock and the Warrants comprising the Units must be

purchased together in this offering as Units and are immediately separable and will be issued separately in this offering. Each

Warrant offered hereby is immediately exercisable on the date of issuance and will expire five years from the date of issuance.

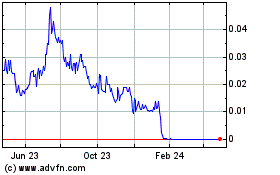

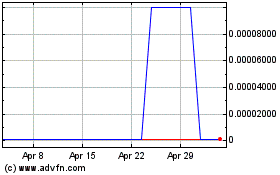

Our

common stock is presently traded on the over-the-counter market and quoted on the OTCQB market under the symbol “DSGT.”

On [ ], 2021, the last reported sale price of our common stock was $[______] per share ($[______] per share assuming

a reverse stock split of [_________]). We have applied to list our common stock and warrants on the Nasdaq Capital Market

under the symbols “DSGT” and “DSGTW”. No assurance can be given that our application will be approved

or that the trading prices of our common stock on the OTCQB market will be indicative of the prices of our common stock if our

common stock were traded on the Nasdaq Capital Market. If our listing application is not approved by the Nasdaq Stock Market,

we will not be able to consummate the offering and will terminate this offering.

The

offering price of the Units will be determined between the underwriter and us at the time of pricing, considering our historical

performance and capital structure, prevailing market conditions, and overall assessment of our business, and may be at a discount

to the current market price. Therefore, the recent market price used throughout this prospectus may not be indicative of the actual

public offering price for our common stock and the warrants.

Unless otherwise noted and other than in

our financial statements and the notes thereto, the share and per share information in this prospectus reflects a proposed reverse

stock split of the outstanding common stock at an assumed [_________] ratio to occur following the effective date but prior

to the closing of this offering.

This

offering is highly speculative, and these securities involve a high degree of risk and should be considered only by persons who

can afford the loss of their entire investment. See “Risk Factors” beginning on page 13. Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Per Unit

|

|

|

Total

|

|

|

Offering price

|

|

$

|

|

|

|

$

|

-

|

|

|

Underwriting discount and commissions (1)

|

|

$

|

-

|

|

|

$

|

|

|

|

Proceeds

to us before offering expenses (2)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

(1)

|

We

have agreed to issue warrants to purchase shares of our common stock to the underwriter and to reimburse the underwriter for

certain expenses. See “Underwriting” for additional information regarding total underwriter compensation.

|

|

|

(2)

|

The

amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment

option we have granted to the underwriter as described below and (ii) warrants being issued to the underwriter in this

offering.

|

We

have granted a 45-day option to the underwriter, exercisable one or more times in whole or in part, to purchase up to an additional

shares of common stock and/or additional warrants

at a price from us in any combination thereof at the public offering price per share of common stock and per warrant, respectively.

The

underwriter expects to deliver the securities against payment to the investors in this offering on or about ,

2021.

Sole

Book-Running Manager

Maxim

Group, LLC

The

date of this prospectus is ________________, 2021.

ABOUT

THIS PROSPECTUS

We

are responsible for the information contained in this prospectus. You should rely only on information contained in this prospectus.

We have not, and the underwriter has not, authorized anyone to provide you with additional information or information different

from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the

information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell

or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful,

or in any state or other jurisdiction where the offer is not permitted.

Neither

we nor the underwriter have taken any action that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States

who come into possession of this prospectus must inform themselves about, and observe, any restrictions relating to the offering

of the securities hereby covered or to the distribution of this prospectus outside of the United States.

The

information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial

condition, results of operations and prospects may have changed since those dates.

No

person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities

hereby offered, or any matter discussed in this prospectus, other than the information and representations contained in this prospectus.

If any other information or representation is given or made, such information or representation may not be relied upon as having

been authorized by us.

Neither

we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself

about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

Table

of Contents

The

following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read

the entire prospectus.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts.

Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,”

“believe,” “estimate,” “intend,” “could,” “should,” “would,”

“may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,”

“predict,” “project,” “forecast,” “potential,” “continue” negatives

thereof or similar expressions that convey uncertainty or future events or outcomes. Forward-looking statements are based on our

assumptions, estimates, analysis, and opinions made in light of our experience and our perception of market trends, current conditions

and expected developments, as well as other factors that we believe to be relevant and reasonable in the circumstances at the

date that such statements are made, but which are subject to known and unknown risks, and may prove to be incorrect. Such risks

are discussed in the section of this prospectus entitled “Risk Factors”. In particular, without limiting the generality

of the foregoing disclosure, the forward-looking statements contained in this prospectus and which are inherently subject to a

variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly include

but are not limited to:

|

|

●

|

our

ability to successfully homologate our electric vehicles offerings;

|

|

|

●

|

anticipated

timelines for product deliveries;

|

|

|

●

|

the

production capacity of our manufacturing partners and suppliers;

|

|

|

●

|

the

stability, availability and cost of international shipping services;

|

|

|

●

|

our

ability to establish and maintain dealership network for our electric vehicles;

|

|

|

●

|

our

ability to attract and retain customers;

|

|

|

●

|

the

availability of adequate manufacturing facilities for our PACER golf carts;

|

|

|

●

|

the

consistency of current labor and material costs;

|

|

|

●

|

the

availability of current government economic incentives for electric vehicles;

|

|

|

●

|

the

expansion of our business in our core golf market as well as in new markets like electric vehicles, commercial fleet management

and agriculture;

|

|

|

●

|

the

stability of general economic and business conditions, including changes in interest rates;

|

|

|

●

|

the

Company’s ability to obtain financing to execute our business plans, as and when required and on reasonable terms;

|

|

|

●

|

our

ability to accurately assess and respond to market demand in the electric vehicle and golf industries;

|

|

|

●

|

our

ability to compete effectively in our chosen markets;

|

|

|

●

|

consumer

willingness to accept and adopt the use of our products;

|

|

|

●

|

the

anticipated reliability and performance of our product offerings;

|

|

|

●

|

our

ability to attract and retain qualified employees and key personnel;

|

|

|

●

|

our

ability to maintain, protect and enhance our intellectual property;

|

|

|

●

|

our

ability to comply with evolving legal standards and regulations, particularly concerning requirements for being a public company.

|

|

|

●

|

the ability of our Chairman, President and Chief

Executive Officer to control a significant number of shares of our voting capital;

|

|

|

●

|

the immediate and substantial dilution of the

net tangible book value of our common stock;

|

|

|

●

|

he speculative nature of Warrants;

|

|

|

●

|

provisions in the Warrants may discourage a third-party

from acquiring us;

|

|

|

●

|

our ability to meet the initial or continuing

listing requirements of the Nasdaq Capital Market; and

|

|

|

●

|

we intend to effect a reverse stock split of

our outstanding common stock immediately following the effective date but prior to the closing of the offering; however, the

reverse stock split may not increase our stock price sufficiently and we may not be able to list our common stock on the Nasdaq

Capital Market in which case this offering may not be completed.

|

Readers

are cautioned that the foregoing list is not exhaustive of all factors and assumptions, which may have been used.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance

or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any

other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements

to actual results or to changes in our expectations, except as required by law.

You

should read this prospectus and the documents that we have filed with the Securities and Exchange Commission as exhibits hereto,

with the understanding that our actual future results and circumstances may be materially different from what we expect.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that

you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire

prospectus, including our consolidated financial statements and the notes thereto and the information set forth under the “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections

of this prospectus. In this prospectus, “DSG Global”, “DSG,” the “Company,” “we,”

“us,” and “our” refer to DSG Global Inc., a Nevada corporation, and as applicable, to our Nevada subsidiaries

Vantage Tag Systems Inc. (“Vantage TAG”), DSG Tag Systems Inc., and Imperium Motor Corp. (dba Imperium Motor Company

and Imperium Motors (“Imperium”)).

About

DSG Global Inc.

DSG

Global Inc. is a technology development, manufacturing and distribution company based in British Columbia, Canada and Fairfield,

California. DSG stands for “Digital Security Guard”, our first fleet management technology and primary value statement.

Through Vantage TAG, our golf and fleet management division, we are engaged in the design, manufacture, and sale of fleet and

player experience management solutions for the golf industry, and for commercial, government and military applications. More recently,

Vantage TAG has introduced a range of innovative single player and luxury golf carts. In 2020, we established an electric vehicle

division, Imperium Motor Company, headquartered at our Imperium Experience Centre in Fairfield, California. Imperium Motors is

engaged in the importation, marketing and distribution of a wide range a low-speed and high-speed electric passenger vehicles

for commuter, family, commercial, and public use.

We

were founded by a group of individuals who have dedicated their careers to fleet management technologies and have been at the

forefront of the industry’s most innovative developments. Our executive team has over 50 years of experience in the design

and manufacture of wireless, GPS, and fleet tracking solutions, and over 40 years of experience in automotive retail, wholesale,

distribution, and manufacturing. Powered by patented analytics and an extraordinary depth of industry knowledge, DSG’s mandate

is to improve lives and businesses with intelligent, affordable, adaptable and environmentally responsible transportation technologies

and electric vehicles.

Our

Products and Technologies

Vantage

TAG Fleet Management and Golf Products

Vantage

TAG Systems has developed a patented combination of hardware and software which we believe is the first completely modular and

scalable fleet management solution for the golf industry and beyond. Marketed around the world, the TAG System and suite of products

are deployed to help golf course operators manage their fleets of golf carts, turf equipment, and utility vehicles, providing

real time vehicle global positioning, geofencing, remote control, and remote vehicle lockdown security features. The TAG System

optimizes course efficiencies and pace of play, all while integrating a customizable array of player experience features such

as player messaging, course mapping and 3d flyover, course & tournament marshalling, pro tips, food & beverage ordering,

and ad streaming, among others.

The

TAG system fills a void in the marketplace by offering a modular structure that allows the customer to customize their system

to meet desired functionality and budget constraints. In addition to the core TAG Vehicle Control Unit functionality, which can

operate independently, we offer two golfer information display systems — the alphanumeric INFINITY 7” and high-definition

INFINITY XL 12” — providing the operator with two display options which is unique in the industry.

Pictured

clockwise from left: INFINITY XL 12” HD Touch Display, TAG GOLF CONTROL UNIT Monitor, TAG TEXT Alpha Numeric Display,

and TAG Vehicle Control Module.

The

primary market for our TAG system is the estimated 40,000 golf operations in over 200 countries worldwide. We have a direct sales

force in North America, which comprises the most significant portion of the golf fleet market, and have developed key relationships

with distributors and golf equipment manufacturers such as E-Z-GO, Yamaha, and Ransomes Jacobsen to help drive sales for the North

American and worldwide markets. The TAG Suite of products is currently sold and installed around the world in golf facilities,

and in commercial settings, through a network of established distributors and in partnership with some of the most notable brands

in fleet and equipment manufacture. We are a leader in the category of fleet management in the golf industry and were awarded

“Best Technology of the Year” in 2010 by Boardroom magazine, a publication of the National Golf Course Owners Association.

To date the TAG system is installed on over 8,000 vehicles and has been used to monitor over 6,000,000 rounds of golf.

While

the golf industry remains the primary focus of our sales and marketing efforts, we have completed several successful pilots of

the TAG System in other markets such as agriculture, commercial and government & military fleet operations. DSG aims to expand

our sales and marketing efforts into these new markets, where the customizable TAG System Control Tool Set can be leveraged to

control vehicle operating costs, reduce labor efforts, monitor production and increase workforce safety and communication.

Vantage

TAG Golf Carts

In

2021, after rigorous testing and consultation with industry leaders and partners, DSG has introduced the PACER Single Rider Golf

Cart. The PACER furthers Vantage TAG’s mandate to optimize the game for players and operators alike, increasing pace of

play, comfort, accessibility, and performance. The PACER can complete up to six rounds of golf on a single charge, is factory

equipped with the TAG Control Unit, and upgradable to the TAG Infinity Display at any time. DSG’s PACER program allows operators

to buy, lease, or install a PACER fleet on a zero overhead, revenue-sharing basis, making it accessible to the widest range of

golf courses, venues, campuses and communities.

Most

recently, Vantage TAG has also introduced the premium 100E Golf Cart, built for serious and casual riders seeking a luxury experience.

Available for sale or lease, the 100E combines real world range, performance, and safety into a premium Low Speed Vehicle that

only Vantage Tag can offer. Our first low speed, street legal vehicle, the 100E achieves a 90 mile range per charge, is Department

of Transportation certified, and comes equipped with a whole package of premium options starting at under $9,998 before discounts

and incentives. Available in a range of colors, the 100E brings style, performance, sustainability and fun, from the golf course

to town and everywhere in between.

The

Vantage TAG PACER Golf Cart (left) and 100E Golf Car (right).

Imperium

Motor Company®—Making Green Transportation Available to Everyone

In

2019, DSG Global founded Imperium Motor Company with a mission to bring the worlds most effective and cost-efficient electric

vehicles to North America and beyond. Our range of commuter, family, and commercial vehicles offer a lower cost alternative to

competitive offerings, with an emphasis on great design, performance, and functionality. Through our exclusive North American

manufacturing partnership with Zhejiang Jonway Group Co., Ltd. (“Jonway Group”), and Skywell New Energy Automobile

Group (“Skywell”), two of the world’s most prolific manufacturers of electric vehicles and components, Imperium

now offers one of the largest selections of electric vehicles in North America, including ebikes and scooters, e-rickshaws, low

speed cars, trucks, vans and scooters, high speed SUVs and pickups, as well as buses, cargo trucks, and sanitation vehicles.

Above:

The Imperium ET5 by Skywell, and Imperium W Coupe by Jonway

Below:

Imperium Transit Bus by Jonway and Imperium K-15 Box Truck by Skywell

Imperium®

EV Experience Center

The

hub of our electric vehicle operations is the Imperium® EV Experience Center in Fairfield, California, located

midway between Silicon Valley and Sacramento, and within arm’s reach of North America’s largest EV markets which account

for approximately 50% of EV sales in the United States. There customers and dealers can test our vehicle lineup, and receive product

training, education, parts supply and support. In addition to direct sales, Imperium is rapidly establishing a network of established

authorized automotive dealers across our distribution territory in the United States, Mexico, Canada, the Caribbean and South

America.

The

Imperium EV Experience Center in Fairfield, California.

Listing

on the Nasdaq Capital Market

Our

common stock is currently quoted on the OTCQB Market. In connection with this offering, we have applied to list our common stock

and the Warrants on the Nasdaq Capital Market (“Nasdaq”) under the symbols “DSGT” and “DSGTW,”

respectively. If our listing application is approved, we expect to list our common stock and the Warrants on Nasdaq upon consummation

of the offering, at which point our common stock will cease to be traded on the OTCQB Market. No assurance can be given that our

listing application will be approved. This offering will occur only if Nasdaq approves the listing of our common stock and Warrants.

Nasdaq listing requirements include, among other things, a stock price threshold. As a result, prior to the effectiveness of the

registration statement of which this prospectus forms a part, we will need to take the necessary steps to meet Nasdaq listing

requirements, including, but not limited to a reverse split of our outstanding common stock (as further discussed below). If Nasdaq

does not approve the listing of our common stock, we will not proceed with this offering. There can be no assurance that our common

stock will be listed on the Nasdaq.

Reverse

Stock Split

We

will effect a reverse stock split of our issued and outstanding common shares in the range of one for two (1:2) to one for thirty

(1:30), whereby every two to thirty (2 to 30) shares of the Company’s issued and outstanding common shares will be combined

into one (1) issued and outstanding common share (the “Reverse Stock Split”), and the number of authorized

common shares of the Company will remain 350,000,000. Unless otherwise noted and other than in our financial statements and the

notes thereto, the share and per share information in this prospectus reflects a proposed reverse stock split of the outstanding

common stock at an assumed [____________] ratio to occur following the effective date but prior to the closing of this offering.

Recent

Transactions

On

December 23, 2020, we entered into a redeemable stock purchase agreement with GHS Investments, LLC (“GHS”) pursuant

to which GHS purchased 1,500 shares of our Series F Preferred Stock having a stated value $1,200 per share, at a price of $1,000

per share or $1,500,000 in the aggregate. As additional consideration to GHS, we issued warrants to purchase 3,000,000 shares

of common stock at a price of $0.50 per share. The Warrants are not eligible for cashless exercise and may only be exercised in exchange

for cash payment.

On

January 29, 2021, pursuant to the terms of the stock purchase agreement, GHS purchased an additional 1,500 shares of Series F

Preferred upon the filing by the Company of a registration statement with the Securities and Exchange Commission (the “Resale

Registration Statement”) registering the shares underlying the Series F Preferred and underlying the Warrants. At the Company’s

request, GHS agreed to purchase an additional 1,000 shares of Series F Preferred every thirty (30) days (an “Additional

Closing”) as long the Resale Registration Statement remains effective and the Company’s average daily trading volume

for the thirty (30) trading days prior an Additional Closing is at least $500,000 per day. The Company has the option to buy back

any outstanding shares of Series F Preferred for six (6) months from the date of issuance at their stated value. No shares of

Series F Preferred shall be purchased under the share purchase agreement after the two (2) year anniversary of the date of the

share purchase agreement. The Company shall pay a dividend of 10% per annum on any purchased Series F Preferred shares, for as

long as the relevant Preferred Shares have not been redeemed or converted. Dividends shall be paid quarterly, and at the Company’s

discretion, in cash or Preferred Stock.

Following

completion of an underwritten offering of the Company’s common stock with gross proceeds of at least $10,000,000 (a “Qualified

Offering”) GHS, at is election, must either: (a) convert 50% of all purchased Preferred Shares into the Qualified Offering

at a twenty percent (20%) discount to the price of such offering (subject to any lock ups or leak outs) or (b) upon ten days written

notice to the Company and its underwriter in connection with a Qualified Offering, demand early redemption of up to 50% of all

purchased Preferred Shares at a premium of 1.10, multiplied by the sum of $1,200, all accrued but unpaid dividends and all other

amounts due pursuant to the Certificate of Designation.

Corporate

Information

DSG

Global Inc. (formerly Boreal Productions Inc.) was incorporated under the laws of the State of Nevada on September 24, 2007. On

April 13, 2015, we entered into a share exchange agreement with Vantage Tag Systems Inc. (formerly DSG Tag Systems Inc.) (“Vantage

Tag”) and the shareholders of Vantage Tag, pursuant to which we acquired 100% of the issued and outstanding shares of Vantage

Tag in exchange for the issuance by our Company of 15,365,698 common shares to the shareholders of Vantage Tag. Upon closing of

the share exchange agreement with Vantage Tag, we adopted its business and operations.

Our principal executive office is located

at 207 - 15272 Croydon Drive Surrey, British Columbia, V3Z 0Z5, Canada. The telephone number at our principal executive office

is 1 (877) 589-8806. Our electric vehicle division, Imperium Motor Company, is headquartered at our Imperium Experience Center,

located at 4670 Central Way, Suite D, Fairfield, CA 95605. Imperium’s telephone number is 1 (707) 266-7575.

Our

common stock first became quoted on the Over-the-Counter Bulletin Board electronic quotation system at the opening of trading

on February 23, 2015 under the symbol “BRPOD”. Effective March 19, 2015 our stock symbol changed to “DSGT”.

The first trade of our common shares occurred on March 25, 2015.

Summary

of the Offering

|

Securities

being offered by us:

|

|

[______]

Units, each Unit consisting of one share of our common stock and one warrant to purchase one share of our common stock. Each

warrant will have an exercise price of $[______] per share (100% of the assumed public offering price of one Unit), is exercisable

immediately and will expire five (5) years from the date of issuance. The Units will not be certificated or issued in stand-alone

form. The shares of our common stock and the warrants comprising the Units are immediately separable upon issuance and will

be issued separately in this offering.

|

|

|

|

|

|

Number

of shares of common stock offered by us:

|

|

[______]

|

|

|

|

|

|

Number

of Warrants offered by us:

|

|

[______]

|

|

|

|

|

|

Public

offering price:

|

|

$[______]

per Unit, based on the closing price of our common stock on April [_], 2021(1)

|

|

|

|

|

|

Shares

of common stock outstanding before the offering:

|

|

106,449,471(2)

|

|

|

|

|

|

Shares

of common stock outstanding after the offering:

|

|

[______](2)(3)

|

|

|

|

|

|

Over-allotment

option:

|

|

We

have granted a 45-day option to the underwriter to purchase up to additional

shares of common stock at a price of $ per

share (based on an assumed offering price of $ per

Unit) and/or additional warrants

at a price of $ per warrant

less, in each case, the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any.

If the underwriter exercises the option in full, the total underwriting discounts and commissions payable by us will be $ and

the total proceeds to us, before expenses, will be $ .

|

|

|

|

|

|

Use

of Proceeds:

|

|

We

estimate that we will receive net proceeds of approximately $[______] from our sale of Units in this offering, after deducting

underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering for

research and development; debt repayment; engineering, operations, quality inspection, information technology and sales force

expansion; marketing and sales and working capital. See “Use of Proceeds.”

|

|

|

|

|

|

Description

of the Warrants:

|

|

The

exercise price of the Warrants is $[______] per share (100% of the assumed public offering price of one Unit). Each Warrant is exercisable

for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications,

reorganizations or similar events affecting our common stock as described herein. A holder may not exercise any portion of a Warrant

to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99%

of the outstanding common stock after exercise, as such percentage ownership is determined in accordance with the terms of the Warrants,

except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. Each

Warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the Warrants

will be governed by a Warrant Agreement, dated as of the effective date of this offering, between us and Manhattan Transfer Registrar

Co, as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of common stock

issuable upon exercise of the Warrants. For more information regarding the warrants, you should carefully read the section titled “Description

of Securities—Warrants” in this prospectus.

|

|

|

|

|

|

Underwriter’s

Warrants:

|

|

The

registration statement of which this prospectus is a part also registers for sale warrants (the “Underwriter’s

Warrants”) to purchase [______] shares of our common stock (based on an offering price of $[______] per share) to Maxim

Group LLC (the “underwriter”), as a portion of the underwriting compensation in connection with this offering.

The Underwriter’s Warrants will be exercisable at any time, and from time to time, in whole or in part, during the period

commencing 180 days following the closing date of this offering and expiring 5 years from the effective date of the offering

at an exercise price of $[__] (110% of the assumed public offering price per Unit). Please see “Underwriting—Underwriter’s

Warrants” for a description of these warrants.

|

|

|

|

|

|

Trading symbol and Listing Application:

|

|

Our common stock is presently

quoted on the OTCQB under the symbol “DSGT.” We have filed an application to have our common stock and the Warrants

offered in the offering listed on the Nasdaq Capital Market under the symbols “DSGT” and “DSGTW,”

respectively. If Nasdaq does not approve the listing of our common stock and the Warrants, we will not proceed with this offering.

There can be no assurance that our common stock or Warrants will be listed on the Nasdaq.

|

|

|

|

|

|

Risk factors:

|

|

Investing

in our securities involves a high degree of risk and purchasers of our securities may

lose their entire investment. See “Risk Factors” and the other information

included and incorporated by reference into this prospectus for a discussion of risk

factors you should carefully consider before deciding to invest in our securities.

|

|

(1)

|

The

actual number of Units we will offer will be determined based on the actual public offering

price and the reverse split ratio will be determined based on the stock price.

|

|

(2)

|

Does not include:

|

|

|

●

|

12,939,813 common shares underlying outstanding warrants. As of December

31, 2020 the warrants had a weighted average remaining contractual life of 3.20 years and weighted average exercise price

of $0.60 per common share;

|

|

|

●

|

15,527,556 common shares issuable upon conversion, at the election

of the holders, of: (i) 131 shares of Series B preferred stock convertible on a 1 for 100,000 basis into common shares; (ii)

48,206 shares of Series D preferred stock convertible on a 1 for 5 basis into common shares; (iii) 3,000 shares of Series

E preferred stock convertible on a 1 for 4 basis into common shares; and (iv) 552 Series C Common Shares convertible on a

1 for 10 basis into common shares; and

|

|

|

●

|

an indeterminate number of common shares issuable upon conversion,

at the election of the holders, of 3,000 Series F Preferred shares having a stated value of $1,200 per share and convertible

into common shares at a price per share equal to the lesser of (a) the lowest traded price of the common shares for the fifteen

trading days prior to the conversion date.

|

(3) Does not include:

|

|

●

|

common shares issuable

upon exercise of the Underwriter’s Warrants; or

|

|

|

●

|

common shares issuable

upon exercise of the underwriter’s option to purchase additional shares and/or warrants from us in this offering.

|

|

|

●

|

common shares

issuable upon completion of this offering pursuant to mandatory conversion or redemption

of issued and outstanding Series F Preferred shares. Following the offering, the holder

of the Series F Preferred shares, at is election shall either: a) convert fifty percent

(50%) of all Series F Preferred shares into common shares at a twenty percent (20%) discount

to the price of the offering (subject to any lock ups or leak outs) or (b) upon ten (10)

days’ notice to the Company and its underwriter in connection with the offering,

demand early redemption of up to fifty percent (50%) of all purchased Series F Preferred

shares at a premium of 1.10, multiplied by the sum of $1,200 per share, all accrued but

unpaid dividends and all other amounts due pursuant to the Certificate of Designation.

|

|

Underwriter

compensation:

|

|

In

connection with this offering, the underwriter will receive an underwriting discount equal to 7% of the gross proceeds from

the sale of Units in the offering. We will also reimburse the underwriter for certain out-of-pocket actual expenses related

to the offering See “Underwriting.

|

|

|

|

|

|

Trading

Symbol:

|

|

Our

common stock is presently quoted on the OTCQB under the symbol “DSGT.” We have filed an application to have our

common stock and the Warrants offered in the offering listed on the Nasdaq Capital Market under the symbols “DSGT”

and “DSGTW,” respectively.

|

|

|

|

|

|

Dividend

Policy for common stock

|

|

We

have never declared or paid cash dividends on our common stock. So long as any shares

of our senior ranking Series A, B, C, D, or E Preferred Stock are outstanding, the Company

may not declare, pay or set apart for payment any dividend or make any distribution on

the common stock. Furthermore, each share of the 3,000 shares of Series F Preferred Stock

(stated valued of $1,200 per share) outstanding as of the date of this prospectus is

entitled, until converted or redeemed, to receive cumulative dividends of 10% per annum,

payable quarterly, in cash or Preferred shares. For additional information about the

redemption, conversion and dividend entitlements of our Preferred Stock please see the

section of this prospectus entitled “Description of Securities”.

We

currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate

paying any non-compulsory dividends on our preferred stock or common stock in the foreseeable future, if at all. Any future determination

to declare dividends will be made at the discretion of our Board of Directors and will depend on our financial condition, results of

operations, capital requirements, general business conditions and other factors that our Board of Directors may deem relevant.

|

|

|

|

|

|

Risk

Factors:

|

|

See

“Risk Factors” beginning on page 13 and the other information in this prospectus for a discussion

of the factors you should consider before deciding to invest in shares of our common stock.

|

RISK

FACTORS

This

investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below

and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and

financial condition could be harmed, and the value of our stock could go down. This means you could lose all or a part of your

investment.

RISKS

RELATED TO OUR COMPANY

Our

limited operating history in key areas of our business may not serve as an adequate basis to judge our future prospects and results

of operations.

DSG

Global and our subsidiaries, Vantage Tag and Imperium Motors, have a relatively limited operating history in the business golf

cart manufacturing and electric vehicle marketing and distribution. Our limited operating history and the unpredictability of

the golf and electric vehicle industries make it difficult for investors to evaluate our business. An investor in our securities

must consider the risks, uncertainties and difficulties frequently encountered by companies in rapidly evolving markets.

We

do not currently have all arrangements in place that are required to fully execute our business plan.

To

sell our electric vehicles and PACER golf carts as envisioned we must enter into certain additional agreements and arrangements

that are not currently in place. These include entering into agreements with distributors, arranging for the transportation and

storage for our planned electric vehicles, arranging for a facility for the assembly of our electric vehicles, and obtaining battery

and other essential supplies in the quantities that we require. If we are unable to enter into such agreements or are only able

to do so on terms that are unfavorable to us, we may not be able to fully carry out our business plans.

We

have limited cash on hand and we will require a significant amount of capital to carry out our proposed business plan to import,

market and sell electric vehicles, to continue to expand our fleet management technology sales and service operations, and to

manufacture, market and sell our new line of PACER golf carts. There is no assurance that we will raise sufficient capital to

execute our business plan or to continue to fund operations of our Company. There is substantial doubt as to the ability of our

Company to continue as a going concern.

We

incurred a comprehensive loss of $6,297,312 and $3,171,164 during the years ended December 31, 2020, and 2019, respectively. Although

we had cash of $1,372,016 as of December 31, 2020, our working capital deficit was $746,341. As of December 31, 2019 we

had cash of $25,494 and a working capital deficit of $8,376,433. We believe that we will need significant additional equity financing

to execute our business plan and to continue as a going concern, given that, among other things:

|

|

●

|

we

have begun the importation and homologation of our range of electric vehicles, and we expect to incur significant ramp-up

in costs and expenses through the establishment and supply of our dealership network and the fulfillment of anticipated product

orders;

|

|

|

|

|

|

|

●

|

we

have endeavored to manufacture and assemble our new line of PACER golf carts in North America, and we anticipate significant

ramp-up costs and expenses through the establishment of a manufacturing facility;

|

|

|

|

|

|

|

●

|

we

anticipate that the gross profit generated from the sale of our electric vehicle and golf cart offerings will not be sufficient

to cover our operating expenses until we achieve a high volume of sales, and our achieving profitability will depend, in part,

on our ability to materially reduce the bill of materials and per unit manufacturing cost of our products; and

|

|

|

|

|

|

|

●

|

we

do not anticipate that we will be eligible to obtain bank loans, or other forms of debt financing on terms that would be acceptable

to us.

|

We

anticipate generating a significant loss for the current fiscal year. The report of independent registered public accounting firm

on our audited financial statements includes an explanatory paragraph relating to our ability to continue as a going concern.

We

expect significant increases in costs and expenses to forestall profits for the foreseeable future, even if we generate increased

revenues in the near term. Our recently introduced and planned products might not become commercially successful. If we are to

ever achieve profitability, we must have a successful introduction and acceptance of our electric vehicles and golf carts, which

may not occur. We expect that our operating losses will increase substantially in 2021, and thereafter, and we also expect to

continue to incur operating losses and to experience negative cash flows for the next several years.

There

is no assurance that any amount raised through this offering will be sufficient to continue to fund the operations of our Company.

We

will need additional financing to implement our business plan.

The

Company will need additional financing to fully implement its business plan in a manner that not only continues to expand an already

established direct-to-consumer approach, but also allows the Company to establish a stronger brand name in all the areas in which

it operates. In particular, the Company will need additional financing to:

|

|

●

|

Effectuate

its business plan and further develop its golf products and service division, and its electric vehicle marketing and distribution

division;

|

|

|

|

|

|

|

●

|

Expand

its facilities, human resources, and infrastructure; and

|

|

|

|

|

|

|

●

|

Increase

its marketing efforts and lead generation.

|

There

are no assurances that additional financing will be available on favorable terms, or at all. If additional financing is not available,

the Company will need to reduce, defer or cancel development programs, planned initiatives and overhead expenditures. The failure

to adequately fund our capital requirements could have a material adverse effect on the Company’s business, financial condition

and results of operations. Moreover, the sale of additional equity securities to raise financing will result in additional dilution

to the Company’s stockholders and incurring additional indebtedness could involve the imposition of covenants that restrict

the Company’s operations.

We

currently have negative operating cash flows, and if we are unable to generate positive operating cash flows in the future our

viability as an operating business will be adversely affected.

We

have made significant up-front investments in research and development, sales and marketing, and general and administrative expenses

to rapidly develop and expand our business. We are currently incurring expenditures related to our operations that have generated

a negative operating cash flow. Operating cash flow may decline in certain circumstances, many of which are beyond our control.

We might not generate sufficient revenues in the near future. Because we continue to incur such significant future expenditures

for research and development, sales, marketing, general, and administrative expenses, we may continue to experience negative cash

flow until we reach a sufficient level of sales with positive gross margins to cover operating expenses. An inability to generate

positive cash flow until we reach a sufficient level of sales with positive gross margins to cover operating expenses or raise

additional capital on reasonable terms will adversely affect our viability as an operating business.

To

carry out our proposed business plan for the next 12 months to develop, manufacture, sell and service electric vehicles we will

require additional capital.

To

carry out our proposed business plan for the next 12 months, we estimate that we will need approximately $19.6 million in addition

to cash on hand at December 31, 2021. If cash on hand, revenue from the sale of our cars, if any, and cash received upon the exercise

of outstanding warrants, if any are exercised, are not sufficient to cover our cash requirements, we will need to raise additional

funds through the sale of our equity securities, in either private placements or registered offerings and/or shareholder loans.

If we are unsuccessful in raising enough funds through such capital-raising efforts we may review other financing possibilities

such as bank loans. Financing might not be available to us or, if available, may not be available on terms that are acceptable

to us.

Our

ability to obtain the necessary financing to carry out our business plan is subject to a number of factors, including general

market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions

of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly

reduce our spending, delay or cancel our planned activities or substantially change our current corporate structure. We might

not be able to obtain any funding, and we might not have sufficient resources to conduct our business as projected, either of

which could mean that we would be forced to curtail or discontinue our operations.

Terms

of future financings may adversely impact your investment.

We

may have to engage in common equity, debt or preferred stock financing in the future. Your rights and the value of your investment

in our securities could be reduced. Interest on debt securities could increase costs and negatively impacts operating results.

Preferred stock could be issued in series from time to time with such designation, rights, preferences and limitations as needed

to raise capital. The terms of preferred stock could be more advantageous to those investors than to the holders of common shares.

In addition, if we need to raise equity capital from the sale of common shares, institutional or other investors may negotiate

terms at least as, and possibly more, favorable than the terms of your investment. Common shares which we sell could be sold into

any market which develops, which could adversely affect the market price.

Our

future growth depends upon consumers’ willingness to adopt our range of electric vehicles.

Our

growth highly depends upon the adoption by consumers of, and we are subject to an elevated risk of, any reduced demand for alternative

fuel vehicles in general and electric vehicles in particular. If the market for low speed or for high speed electric vehicles

does not develop as we expect, or develops more slowly than we expect, our business, prospects, financial condition and operating

results will be negatively impacted. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized

by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards,

frequent new vehicle announcements and changing consumer demands and behaviors. Factors that may influence the adoption of alternative

fuel vehicles, and specifically electric vehicles, include:

|

|

●

|

perceptions

about electric vehicle quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost,

especially if adverse events or accidents occur that are linked to the quality or safety of electric vehicles;

|

|

|

|

|

|

|

●

|

the

limited range over which electric vehicles may be driven on a single battery charge;

|

|

|

|

|

|

|

●

|

the

decline of an electric vehicle’s range resulting from deterioration over time in the battery’s ability to hold

a charge;

|

|

|

●

|

concerns

about electric grid capacity and reliability, which could derail our efforts to promote electric vehicles as a practical solution

to vehicles which require gasoline;

|

|

|

|

|

|

|

●

|

the

availability of alternative fuel vehicles, including plug-in hybrid electric vehicles;

|

|

|

|

|

|

|

●

|

the

availability of service for electric vehicles;

|

|

|

|

|

|

|

●

|

volatility

in the cost of oil and gasoline;

|

|

|

|

|

|

|

●

|

government

regulations and economic incentives promoting fuel efficiency and alternate forms of energy;

|

|

|

|

|

|

|

●

|

access

to charging stations, standardization of electric vehicle charging systems and consumers’ perceptions about convenience

and cost to charge an electric vehicle;

|

The

influence of any of the factors described above may cause current or potential customers not to purchase our electric vehicles,

which would materially adversely affect our business, operating results, financial condition and prospects.

The

range of our electric vehicles on a single charge declines over time which may negatively influence potential customers’

decisions whether to purchase our vehicles.

The

range of our electric vehicles on a single charge declines principally as a function of usage, time and charging patterns. For

example, a customer’s use of their vehicle as well as the frequency with which they charge the battery of their vehicle

can result in additional deterioration of the battery’s ability to hold a charge. Battery deterioration will be variable

as between our various offered vehicles. Such battery deterioration and the related decrease in range may negatively influence

potential customer decisions whether to purchase our vehicles, which may harm our ability to market and sell our vehicles.

If

we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

We

may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive

position. Any failure to keep up with advances in electric vehicle technology would result in a decline in our competitive position

which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and

development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change, we plan

to upgrade or adapt our vehicles and introduce new models to continue to provide vehicles with the latest technology, and particularly

battery cell technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source

and integrate the latest technology into our vehicles. For example, we do not manufacture battery cells which makes us depend

upon other suppliers of battery cell technology for our battery packs.

Demand

in the vehicle industry is highly volatile.

Volatility

of demand in the vehicle industry may materially and adversely affect our business, prospects, operating results and financial

condition. The markets in which we will be competing have been subject to considerable volatility in demand in recent periods.

Demand for automobile sales depends to a large extent on general, economic, political and social conditions in a given market

and the introduction of new vehicles and technologies. As a new start-up manufacturer, we will have fewer financial resources than

more established vehicle manufacturers to withstand changes in the market and disruptions in demand.

We

depend on third parties for our electric vehicle manufacturing needs.

The

delivery of our licensed vehicles to future customers and the revenue derived therefrom depends on the ability of our suppliers,

including Jonway and Skywell, to fulfil their obligations under their respective license and distribution agreement with our company.

Fulfilment of these obligations is outside of our control and depends on a variety of factors, including their respective operations,

financial condition and geopolitical and economic risks that could affect China. The novel coronavirus (COVID-19) pandemic or

measures taken by the Chinese government relating thereto may also result in non-performance by our suppliers. If they are unable

to fulfil their obligations or are only able to partially fulfil their obligations under our existing agreements with them, or

if they are forced to terminate our agreements with them, either as a result of the coronavirus outbreak, the Chinese government’s

measures relating thereto or otherwise, we will not be able to produce or sell our licensed vehicles in the volumes anticipated

and on the timetable that we anticipate, if at all.

The

impact of the novel coronavirus (COVID-19) pandemic on the global economy and our operations remains uncertain, which could have

a material adverse impact on our business, results of operations and financial condition and on the market price of our common

shares.

In

December 2019, a strain of novel coronavirus (now commonly known as COVID-19) was reported to have surfaced in Wuhan, China. COVID-19

has since spread rapidly throughout many countries, and, on March 11, 2020, the World Health Organization declared COVID-19 to

be a pandemic. In an effort to contain and mitigate the spread of COVID-19, many countries, including the United States, Canada

and China, have imposed unprecedented restrictions on travel, and there have been business closures and a substantial reduction

in economic activity in countries that have had significant outbreaks of COVID-19. Although our manufacturing partners now report

that their operations have largely recovered, significant uncertainty remains as to the potential impact of the COVID-19 pandemic

on our and our partners’ operations (including, without limitation, staffing levels), supply chains for parts and sales

channels for our products, and on the global economy as a whole. It is currently not possible to predict how long the pandemic

will last or the time that it will take for economic activity to return to prior levels. The COVID-19 pandemic has resulted in

significant financial market volatility and uncertainty in recent weeks. A continuation or worsening of the levels of market disruption

and volatility seen in the recent past could have an adverse effect on our ability to access capital, on our business, results

of operations and financial condition, and on the market price of our common shares.

We

are subject to order and shipment uncertainties. Inaccuracies in our estimates of customer demand and product mix could negatively

affect our inventory levels, sales and operating results.

We

derive revenue primarily from customer purchase orders rather than long-term purchase commitments. To ensure availability of our

products, in some cases we may start manufacturing based on forecasts provided by customers in advance of receiving purchase orders

from them. In some cases, our supply chain has been affected by both tariffs or cost premiums imposed by national governments

or as a result of the COVID-19 pandemic. Our customers can cancel purchase orders or defer the shipments of our products under

certain circumstances with little or no advance notice to us. Some of our products are manufactured according to our estimates

of customer demand, which requires us to make demand forecast assumptions for every customer, and which may introduce significant

variability into our aggregate estimate. We typically sell to distributors and end users, and we consequently have limited visibility

into future end-user demand, which could adversely affect our revenue forecasts and operating margins. Additionally, we sometimes

receive soft commitments for larger order sizes which do not materialize. If we manufacture more products than we are able to

sell to our customers or distributors, we will incur losses and our results of operation and financial condition will be harmed.

Our

sales and marketing efforts may be unsuccessful in maintaining and expanding existing sales channels, developing new sales channels

and increasing the sales of our products.

To

grow our business, we must add new customers for our products in addition to retaining and increasing sales to our current customers.

Our ability to attract new customers will depend in part on the success of our sales and marketing efforts. There can be no guarantee

that we will be successful in implementing our sales and marketing strategy. If suitable sales channels do not develop, we may

not be able to sell certain of our products in significant volumes and our operating results, business and prospects may be harmed.

We

are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect

on our business and operating results.

We

are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements.

These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous

substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and

odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality.

These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such

laws and/or requirements would have a material adverse effect on our Company and its operating results.

Our

vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material

adverse effect on our business and operating results.

All

vehicles sold must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States

vehicles that meet or exceed all federally mandated safety standards are certified under the federal regulations. In this regard,

Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials

and equipment are among the requirements for achieving federal certification. Failure by us to have the SOLO, the Tofino or any

future model EV satisfy motor vehicle standards would have a material adverse effect on our business and operating results.

If

we are unable to reduce and adequately control the costs associated with operating our business, including our costs of manufacturing,

sales and materials, our business, financial condition, operating results and prospects will suffer.

If

we are unable to reduce and/or maintain a sufficiently low level of costs for designing, manufacturing, marketing, selling and

distributing and servicing our electric vehicles relative to their selling prices, our operating results, gross margins, business

and prospects could be materially and adversely impacted.

We

have very limited experience servicing our vehicles. If we are unable to address the service and warranty requirements of our

future customers our business will be materially and adversely affected.

If

we are unable to address the service requirements of our future customers our business and prospects will be materially and adversely

affected. In addition, we anticipate the level and quality of the service we will provide our customers will have a direct impact

on the success of our future vehicles. If we are unable to offer satisfactory service to our customers, our ability to generate

customer loyalty, grow our business and sell additional vehicles could be impaired.

We

will continue to encounter substantial competition in our business.

The

Company believes that existing and new competitors will continue to improve their products and services, as well as introduce

new products and services with competitive price and performance characteristics. The Company expects that it must continue to

innovate, and to invest in product development and productivity improvements, to compete effectively in the several markets in

which the Company participates. The Company’s competitors could develop a more efficient product or service or undertake

more aggressive and costly marketing campaigns than those implemented by the Company, which could adversely affect the Company’s

marketing strategies and have an adverse effect on the Company’s business, financial condition and results of operations.

Important

factors affecting the Company’s current ability to compete successfully include:

|

|

●

|

lead

generation and marketing costs;

|

|

|

|

|

|

|

●

|

service

delivery protocols;

|

|

|

|

|

|

|

●

|

branded

name advertising; and

|

|

|

|

|

|

|

●

|

product

and service pricing.

|

In

periods of reduced demand for the Company’s products and services, the Company can either choose to maintain market share

by reducing product and service pricing to meet the competition, or maintain its product and service pricing, which would likely

sacrifice market share. Sales and overall profitability may be reduced in either case. In addition, there can be no assurance

that additional competitors will not enter the Company’s existing markets, or that the Company will be able to continue

to compete successfully against its competition.

The

unavailability, reduction or elimination of government and economic incentives could have a material adverse effect on our business,

financial condition, operating results and prospects.

Any

reduction, elimination or discriminatory application of government subsidies and economic incentives that are offered to purchasers

of EVs or persons installing home charging stations, the reduced need for such subsidies and incentives due to the perceived success

of the electric vehicle, fiscal tightening or other reasons may result in the diminished competitiveness of the alternative fuel

vehicle industry generally or our electric vehicles in particular. This could materially and adversely affect the growth of the

alternative fuel automobile markets and our business, prospects, financial condition and operating results.

If

we fail to manage future growth effectively, we may not be able to market and sell our vehicles successfully.

Any

failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and

financial condition. We plan to expand our operations in the near future in connection with the planned marketing and sale of