How a Merger Between Deutsche Bank and Commerzbank Stacks Up

March 25 2019 - 5:59AM

Dow Jones News

By Patricia Kowsmann

FRANKFURT -- Despite spending billions of dollars to steady

their fortunes and try to remain independent, Deutsche Bank AG and

Commerzbank AG are now weighing a merger.

A spell of acute weakness across the sector means a reluctant

marriage could be the best result the struggling lenders can hope

for. That said, it is still possible -- some observers say even

likely -- that no deal happens.

If a deal is reached, it could do more than shore up the banks

themselves: The formation of a national banking champion would give

much-needed support to Germany's economy when the outlook is

bleak.

Here we lay out how the German banking industry and the two

banks stack up.

Germany's banking market is fragmented. At 1,600, the country

has more banks than the U.K., France, Italy and Spain combined.

The so-called "three-pillar" banking system comprises about 200

commercial banks, including Deutsche Bank and Commerzbank, some 400

state-owned local savings banks and more than 900 cooperative banks

owned by their 18 million account holders -- one in four Germans.

As a result, Deutsche Bank and Commerzbank each have a small market

share in domestic lending.

The stiff competition has added to pressure on the banks'

profitability.

Both banks are among the least profitable in the eurozone.

Commerzbank's return on tangible equity, a key measure of

profitability, is only slightly higher than that of beleaguered

Italian bank Monte dei Paschi di Siena SpA. Deutsche Bank's is

sharply lower.

Unlike Commerzbank, Deutsche Bank has a big investment-banking

business, which has been hit by volatility and has lost market

share to healthier U.S. competitors.

A combination of Deutsche Bank and Commerzbank would create the

eurozone's second-largest bank by assets, after France's BNP

Paribas SA. Their market share on domestic lending and deposits

would rise to between 10% and 15%, according to Fitch Ratings.

Deutsche Bank, whose funding costs have increased on low

investor confidence in its business, would also benefit from

Commerzbank's additional pool of retail deposits and cheaper

funding.

But skepticism about the benefits of the merger is widespread.

"In our view a combination of these two low return-on-equity

generating banks is unlikely to lead to improvement in earnings in

the short term, leading to a bigger balance sheet [and] higher

capital requirements," JPMorgan said in a recent note.

Just how much fresh capital the European Central Bank, which

supervises both lenders, would require to sustain such a big bank

is still unknown and will largely depend on what kind of bank were

created from any merger.

"If a merger is put forward to us, our sole focus is to access

the viability and the sustainability of the project," ECB banking

chief Andrea Enria told EU lawmakers Thursday. "It boils down to

making sure that the resulting entity is able to comply with the

supervisory requirements."

Deutsche Bank and Commerzbank would also have to convince their

shareholders that a tie-up, which would likely dilute their

holdings, would be good for them.

While Commerzbank has the blessing of its largest shareholder --

the German government -- Deutsche Bank must deal with Chinese

conglomerate HNA Group Co., which owns 6.3% of the bank, and the

Qatari royal family, which has a 6.1% stake through separate

Qatari-controlled vehicles.

Cerberus Capital Management LP, a top investor in both Deutsche

Bank and Commerzbank, has signaled it won't stand in the way of a

deal, according to a person familiar with the firm. BlackRock,

which also has stakes in both banks, is generally skeptical about

the benefits of combining the two banks, but like other investors

wants details of how a deal would look before making any decision,

according to a person briefed on the matter. Both have seen the

value of their stocks fall sharply overtime.

A vocal objector to a deal is services-sector labor union Verdi,

which has representatives in the supervisory board of both banks

and said up to 30,000 out of roughly 140,000 positions could

disappear under the merger.

"We reject a possible merger of both houses with a view to

endangering tens of thousands of jobs," said Jan Duscheck, a Verdi

representative.

While Berlin has signaled it would back job cuts, analysts are

skeptical that the banks will be able to deliver a leaner company

quickly. Germany's labor rules are notoriously stringent, making

layoffs difficult and costly. Both Deutsche Bank and Commerzbank

have struggled to absorb other banks they have bought in the

past.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

March 25, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

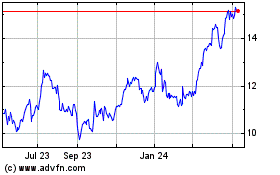

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jun 2024 to Jul 2024

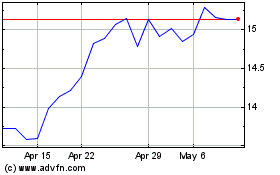

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Jul 2023 to Jul 2024