U.K. Consumers Curb Spending in June After Vote to Leave EU

July 18 2016 - 9:00AM

Dow Jones News

LONDON—Consumers appear to be reining in shopping trips

following Britain's June 23 vote to leave the European Union,

reacting to the flagging pound and worries about economic

stability.

So-called footfall—or shopper visits—in the U.K. in June dropped

by 2.8% from a year earlier, the sharpest decline in more than two

years, according to data released Monday by the British Retail

Consortium and retail research firm Springboard. That compares with

a 0.3% rise in May from a year earlier.

"The results are shaped by a political and economic storm

against a backdrop of rain downpours and generally inclement

weather throughout the whole month," said Diane Wehrle, marketing

and insights director at Springboard.

While footfall climbed by 0.4% in the first week of June, it

fell by 4.6% during the week of the EU referendum, and declined by

3.4% in the weeks following despite summer sales by retailers. Ms.

Wehrle said cooler, rainier weather likely explained part of the

drop but at least some stemmed from weaker consumer confidence

after the referendum.

The declines were broad-based, with footfall dropping 2.3% at

enclosed malls, 1% in outdoor shopping centers and 3.7% on

Britain's high streets—the colloquial term for major shopping

arteries here. The last time all three locations reported a decline

was in December 2013.

Greater London, Scotland and the West Midlands saw the sharpest

footfall declines, reflecting that any consumer fallout from Brexit

is spread between both "remain" and "leave" camps. London and

Scotland were strongly in favor of Britain remaining in the EU

while the West Midlands reported the highest share of votes for

Britain to exit the bloc.

Also on Monday, commercial real-estate company British Land Co.

reported flat retail footfall for the first quarter, with retailer

sales up 0.2%. Chief Executive Chris Grigg said it was "too early

to properly assess the impact of the referendum result on the

markets in which we operate, but we do expect some occupiers and

investors to take a more cautious approach."

British retailers have so far shied away from quantifying the

impact of Brexit on footfall and spending. Department-store chain

Marks & Spencer Group PLC earlier this month said consumer

confidence had "weakened in the run up to the EU referendum" but

said it was "too early to quantify the implications of Brexit."

Still, Brexit is likely to hurt Britain's retailers as rattled

consumer confidence translates into less discretionary spending.

Additionally, sourcing costs for many retailers are incurred in

dollars, which will pressure margins once hedging effects wear off

given the slide of the pound against the U.S. dollar.

Halfords Group PLC—which sells car parts, bicycles and camping

equipment—last week said for every five cents the dollar

strengthens against the pound over the exchange rate the company

had baked into its plans, Halfords's pretax profit will fall by £ 3

million.

The FTSE 350 retail index—which consists of 29 retailers—is down

10% so far this year, compared with a 5.4% rise in the overall FTSE

350.

Most retailers' results for the quarter include only a few days

after June 23, but recent data is pointing to early signs that

consumers are curtailing spending. Visa Inc. last week reported a

0.9% increase in U.K. consumer spending in June from a year

earlier, making the second quarter the weakest for spending since

the first quarter of 2014.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 18, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

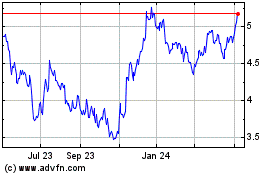

British Land (PK) (USOTC:BTLCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

British Land (PK) (USOTC:BTLCY)

Historical Stock Chart

From Jan 2024 to Jan 2025