UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): September 14, 2017 (September 11, 2017)

Blue Sphere Corporation

(Exact name of registrant as specified

in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

301 McCullough Drive, 4th Floor, Charlotte,

North Carolina 28262

(Address of principal executive offices)

(Zip Code)

704-909-2806

(Registrant’s telephone number,

including area code)

_____________________________________________________________

(Former Name or Former Address, if Changed

since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☒

Emerging

growth company

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

As used in this Current Report, all

references to the terms “we”, “us”, “our”, “Blue Sphere” or the “Company”

refer to Blue Sphere Corporation and its direct and indirect wholly-owned subsidiaries, unless the context clearly requires otherwise.

Explanatory Note

This Current Report on Form 8-K/A is

being filed to amend the Current Report on Form 8-K filed by the Company on July 6, 2017.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on Form 8-K/A includes

information that may constitute forward-looking statements. These forward-looking statements are based on the Company’s current

beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to the

Company. Such forward-looking statements include, but are not limited to, statements regarding the anticipated impact of certain

events on the Company’s financial statements. By their nature, forward-looking statements address matters that are subject

to risks and uncertainties. A variety of factors could cause actual events and results, as well as the Company’s expectations,

to differ materially from those expressed in or contemplated by the forward-looking statements. These factors include, without

limitation, the risk that additional information may become known prior to the expected filing of information or financial statements

with the Securities and Exchange Commission. Other risk factors affecting the Company are discussed in detail in the Company’s

filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable securities

laws.

Item 1.01

Entry Into a Material Definitive Agreement

Prior Related 8-K Filing

As reported by the Company on our Current

Report on Form 8-K filed on July 6, 2017, on June 29, 2017, we entered into a Share Purchase Agreement with Pronto Verde A.G.

(the “Share Purchase Agreement”), relating to the purchase of one hundred percent (100%) of the share capital of Energyeco

S.r.l., a limited liability company organized under the laws of Italy (the “Cantu SPV”), which owns and operates a

0.99 Kw plant for the production of electricity from vegetal oil located in Cantu, Italy. The closing in relation to the Cantu

SPV is scheduled to occur on or before September 27, 2017, subject to specified conditions precedent. We agreed to pay an aggregate

purchase price of €2,200,000 (approximately USD $2,490,000) for the Cantu SPV, subject to an adjustment formula to be calculated

at the closing.

Current Amendments to Prior Related 8-K Filing

In connection with Company’s purchase

of the Cantu SPV, on September 11, 2017, the Company entered into an agreement (the “Gain Agreement”) with Gain Solutions,

S.R.O., a company incorporated under the laws of the Czech Republic (“Gain”), pursuant to which Gain will purchase

thirty-eight and one-half percent (38.5%) of the capital stock of the Cantu SPV (the “Gain SPV Shares”) from the Company

for a purchase price of €1,100,000 (approximately USD $1,320,000), which included a €200,000 (approximately USD $240,000)

down payment paid by Gain (the “Down Payment”). The Gain Agreement is subject to Gain’s completion of due diligence

by September 18, 2017, and entry into definitive agreements to consummate the purchase and sale of the Gain SPV Shares.

The Down Payment will be applied toward the

purchase price, or in the event Gain does not proceed following due diligence, the parties do not enter into definitive agreements

or the Company does not ultimately acquire the Cantu SPV, the Down Payment will become repayable by the Company with ten percent

(10%) interest no later than December 13, 2017. Any amount of the Down Payment (including interest) that is not timely paid by

December 24, 2017 and through March 13, 2018 shall be subject to penalty interest equal to twenty percent (20%) per annum, and

any amounts (including penalty interest) not paid by March 13, 2018 shall be subject to penalty interest equal to twenty-five

percent (25%) per annum.

The Company provided to Gain an irrevocable

guarantee to repay the Down Payment and any interest or penalty interest that accrues thereon (the “Guarantee Letter”).

Also in connection with the secured Down Payment, the Company entered into a Security Agreement to register a lien and security

interest equal to 15% of the Company’s equity ownership of the Cantu SPV and all products and proceeds thereof pertaining

from the Company’s rights according to the closing of the Share Purchase Agreement (the “Security Agreement”).

The

foregoing descriptions of the Gain Agreement, Guarantee Letter and Security Agreement do not purport to be complete and are qualified

in their entirety by reference to the full text of the Gain Agreement, Guarantee Letter and Security Agreement as filed as Exhibits

10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K/A and incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

The following exhibits are furnished as part of this Current

Report on Form 8-K/A

(d) Exhibits.

|

|

10.01

|

Agreement, dated September 11, 2017, between Blue Sphere Corporation and Gain Solutions, S.R.O.

|

|

|

|

|

|

|

10.02

|

Letter from Blue Sphere Corporation to Gain Solutions, S.R.O. concerning an Irrevocable Guaranty of Down Payment, Interest and Penalty Interest, dated September 11, 2017.

|

|

|

|

|

|

|

10.03

|

Security Agreement, dated September 11, 2017, between Blue Sphere Corporation and Gain Solutions, S.R.O.

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Blue Sphere Corporation

|

|

|

|

|

|

Dated: September 14, 2017

|

By:

|

/s/ Shlomi Palas

|

|

|

|

Shlomi Palas

|

|

|

|

President and Chief Executive Officer

|

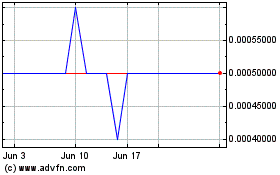

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

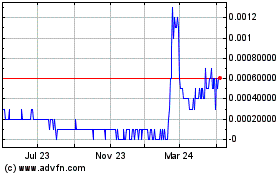

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Nov 2023 to Nov 2024