UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment

No. 2)

|

☒

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For

the fiscal year ended December 31, 2016

|

☐

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE EXCHANGE ACT

|

For

the transition period from _________ to ________

Commission

File No.

000-55127

|

Blue

Sphere Corporation

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

Nevada

|

98-0550257

|

(State

or other jurisdiction of

incorporation or organization)

|

(I.R.S.

Employer

Identification No.)

|

|

|

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

|

|

(Address

of principal executive offices) (zip code)

|

|

|

|

704-909-2806

|

|

(Registrant’s

telephone number, including area code)

|

|

|

|

(Former

name, former address and former fiscal year, if changed since last report)

|

Securities

registered pursuant to Section 12(b) of the Exchange Act of 1934: None.

Securities

registered pursuant to Section 12(g) of the Exchange Act of 1934: Common Stock, $0.001 per share.

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act of

1934.

Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ☐ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

☐

|

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

|

☒

|

|

Emerging

Growth Company

|

☒

|

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The

aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $8,670,232,

based on the closing sales price of the registrant’s common stock as of the last business day of its most recently completed

second fiscal quarter. For purposes of calculating the aggregate market value of shares of our common stock held by non-affiliates

as set forth on the cover page of this Annual Report on Form 10-K, we have assumed that all outstanding shares are held by non-affiliates,

except for shares held by each of our executive officers, directors and 10% or greater stockholders. These assumptions should

not be deemed to constitute an admission that all executive officers, directors and 10% or greater stockholders are, in fact,

affiliates of our company, or that there are not other persons who may be deemed to be affiliates of our company. Further information

concerning shareholdings of our officers, directors and principal stockholders is included or incorporated by reference in Part

III, Item 12 of this Annual Report on Form 10-K.

As

of February 14, 2017, there were 279,913,848 shares of the Registrant’s common stock, par value $0.001 per share (“Common

Stock”), issued and outstanding.

EXPLANATORY

NOTE

Blue

Sphere Corporation (the “Company”) is filing this Amendment No. 2 on Form 10-K/A (the “Amendment No. 2”)

to its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission on February

15, 2017 (the “Form 10-K”), to incorporate its Amendment No. 1 on Form 10-K/A, filed with the Securities and Exchange

Commission on June 8, 2017, into the full text of the Form 10-K as originally filed. Therefore, the sole purpose of this Amendment

No. 2 is to amend Part II, Item 9A, Controls and Procedures, due to an inadvertent omission of the subsection “Management’s

Report on Evaluation of Internal Controls Over Financial Reporting” on the Form 10-K.

In

connection with the foregoing, and pursuant to the rules of the SEC, we are including with this Amendment No. 2 new certifications

by our principal executive officer and principal financial officer. Accordingly, Part IV, Item 15 of the Form 10-K is being amended

to reflect the filing of a new Exhibits 31.1, 31.2, 32.1 and 32.2.

Other

than with respect to the foregoing, this Amendment No. 2 does not modify or update in any way the disclosures made in the Form

10-K. This Amendment No. 2 speaks as of the original filing date of the Form 10-K and does not reflect events that may have occurred

subsequent to such original filing date.

TABLE

OF CONTENTS

Our

audited financial statements are stated in United States dollars (“U.S. $”, “$” or “USD”)

and are prepared in accordance with United States Generally Accepted Accounting Principles (“GAAP”). In this annual

report, unless otherwise specified, all dollar amounts are expressed in United States Dollars.

As

used in this report, the terms “we”, “us”, “our”, “Blue Sphere” or the “Company”

mean Blue Sphere Corp. and its subsidiaries, unless the context clearly requires otherwise.

Note

Regarding Forward-Looking Statements

This

report contains forward-looking statements. Forward-looking statements are projections in respect of future events or our future

financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”,

“expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”,

“potential” or “continue” or the negative of these terms or other comparable terminology. These statements

are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks set out below,

any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. These risks include, without limitation, (i) uncertainties regarding our ability to obtain adequate financing on a

timely basis including financing for specific projects, (ii) the financial and operating performance of our projects, (iii) uncertainties

regarding the market for and value of carbon credits, renewable energy credits and other environmental attributes, (iv) political

and governmental risks associated with the countries in which we may operate, (v) unanticipated delays associated with project

implementation including designing, constructing and equipping projects, as well as delays in obtaining required government permits

and approvals, (vi) the development stage of our business and (vii) our lack of operating history.

This

list is not an exhaustive list of the factors that may affect an of our forward-looking statements. These and other factors should

be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws

of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PART

I

Item

1.

Business

Company

Overview

We

are an international Independent Power Producer (“IPP”) that is active in the global clean energy production and waste-to-energy

markets. We aspire to become a key player in these rapidly growing markets by developing or acquiring projects with clean energy

technologies, including but not limited to waste-to-energy facilities that generate clean energy, such as electricity, natural

gas, heat, soil amendment and other by-products. These markets provide tremendous opportunity, insofar as we believe there is

a virtually endless supply of waste and organic material that can be used to generate power and valuable by-products. In particular,

the disposal of organic material to landfills in most parts of the world is a costly problem with environmentally-damaging consequences.

We seek to offer a cost-effective, environmentally-safe alternative.

We

are currently developing, constructing or operating, as applicable, fourteen (14) projects related to our strategy of acquisition,

development or operations of waste-to-energy facilities, which includes developing projects for which we have entered into nonbinding

letters of intent to acquire additional biogas facilities in Italy and to develop and construct waste-to-energy facilities in

the United States, the Netherlands, the United Kingdom and Israel. We continue to evaluate a pipeline of similar projects in the

pre-development phase in the above listed countries and we are also evaluating projects in other countries such as the Czech Republic,

Poland, Canada and Mexico.

We

are currently developing, constructing or operating, as indicated below, the following projects:

United

States (under construction)

|

|

●

|

Johnston,

RI Waste to Energy Anaerobic Digester 3.2 MW Plant

|

United

States (operating)

|

|

●

|

Charlotte,

NC Waste to Energy Anaerobic Digester 5.2 MW Plant

|

United

States (developing)

|

|

●

|

Red

Springs, NC. New Construction waste-to-energy Anaerobic Digester 3.0 MW Plant

|

|

|

●

|

Wallace,

NC. New Construction waste-to-energy Anaerobic Digester 3.0 MW Plant

|

Italy

(operating)

|

|

●

|

Soc.

agr. AGRICERERE srl – Tromello (Blue Sphere Pavia) 999 KW Plant

|

|

|

●

|

Soc.

agr. AGRIELEKTRA srl – Alagna (Blue Sphere Pavia) 999 KW Plant

|

|

|

●

|

Soc.

agr. AGRISORSE srl – Garlasco (Blue Sphere Pavia) 999 KW Plant

|

|

|

●

|

Soc.

agr. GEFA srl – Dorno (Blue Sphere Pavia) 999 KW Plant

|

Italy

(developing)

|

|

●

|

Cortona,

Italy. Acquisition of fully operating 1.28MW Clean Energy Plants from Pronto-Verde, A.G.

|

|

|

●

|

Cantu,

Italy. Acquisition of fully operating 1MW Clean Energy Plant from Pronto-Verde, A.G.

|

|

|

●

|

Udine,

Italy. Acquisition of fully operating 1MW Clean Energy Plant from Pronto-Verde, A.G.

|

|

|

●

|

Ostellato,

Italy. New Construction of two 1MW Anaerobic Digester Plants with Energy Lab, S.p.A

|

The

Netherlands (developing)

|

|

●

|

Sterksel,

NL. New Construction waste-to-energy Anaerobic Digester 10.0 MW Plant *

|

|

|

●

|

Terramass,

NL. New Construction waste-to-energy Anaerobic Digester 2.5 MW Plant

|

|

|

*

|

On

December 8, 2016, Blue Sphere Brabant B.V., a wholly owned subsidiary of the Company in the Netherlands, won a grant to sell

renewable gas on a per MWg basis to Rijksdienst voor Ondernemend Nederland (“RVO”) under the Renewable Energy

Production Incentive Scheme. The grant provides for the sale of up to 234,466.589 MWh per year, for a maximum total

value of the grant equal to €151,934,350.00 (approximately USD $161,642,955) paid over twelve (12) years,

from the date the facility begins production. The grant is conditioned upon the following: (1) the construction

must be assigned to a supplier (EPC) within one (1) year, with RVO receiving a copy of the assignment; (2) the facility must begin

production within four (4) years; (3) notice of any material changes (i.e., in location, receiver, power, required dates,

etc.) must be given to RVO; and (4) RVO is entitled to receive an annual progress report of the realization of the facility

|

The

United Kingdom (developing)

|

|

●

|

Carlton

Forest, GB. New Construction waste-to-energy Pyrolysis Plant 7.5MW (electricity) + 10MW (thermal)

|

|

|

●

|

Hull,

GB. New Construction waste-to-energy Pyrolysis Plant 15MW (electricity) + 15MW (thermal)

|

|

|

●

|

Hartlepool,

GB. New Construction waste-to-energy Pyrolysis Plant 4.5MW (electricity) + 8MW (thermal)

|

|

|

●

|

Seal

Sands, GB. New Construction waste-to-energy Pyrolysis Plant 16MW (electricity) + 23MW (thermal)

|

Israel

(developing)

|

|

●

|

Rishon,

IL. New Construction of a MRF (Materials Recycling Facility) + a 2.5MW Anaerobic Digester Plant

|

Our

strategy is to continue to expand in the future, including through acquisition of additional projects. From time to time we enter

into nonbinding letters of intent for projects that we are evaluating. However, until the negotiations are finalized and the parties

have executed a definitive agreement, there can be no assurance that we will be able to enter into any development or acquisition

transaction, on the terms in the applicable letter of intent or at all, or any other similar arrangements. Furthermore, any such

transactions that we do enter into would be subject to the uncertainties regarding our existing projects described in the “Risk

Factors” section.

Our

United States Projects

On

October 19, 2012, we entered into definitive project agreements in respect of both the North Carolina and Rhode Island sites with

Orbit Energy, Inc. (“Orbit”), pursuant to which we would be entitled to full ownership of each of the entities that

owns the rights to implement the respective projects (Orbit Energy Charlotte, LLC in the case of the North Carolina project (“OEC”)

and Orbit Energy Rhode Island, LLC in the case of the Rhode Island project (“OERI”)), subject to the satisfaction

of certain conditions.

Our

North Carolina Project

The

Amended OEC Purchase Agreement

On

November 19, 2014, we signed an amended and restated purchase agreement with Orbit for the North Carolina project (the “Amended

OEC Purchase Agreement”). Subject to the terms of the Amended OEC Purchase Agreement, Orbit transferred full ownership of

OEC to us in exchange for our agreeing to pay Orbit a development fee of $900,000, reimbursement of $17,764 of Orbit’s expenses,

and an amount equal to 30% of the distributable cash flow from the North Carolina project after the project achieves a post-recoupment

30% internal rate of return computed on the basis of any and all benefits from tax credits, depreciation and other incentives

of any nature. We also agreed to use high solid anaerobic digester units designed by Orbit (the “HSAD Units”) and

to retain Orbit to implement and operate the HSAD Units for an annual management fee of $187,500 (the “OEC Management Fee”),

subject to certain conditions. The Amended OEC Purchase Agreement provided that we had until December 15, 2014 to pay Orbit the

development fee and reimbursement amount, which was extended to January 15, 2015 upon payment by us to Orbit of $75,000. We did

not subsequently pay Orbit the development fee and reimbursement amount and, pursuant to the terms of the Amended OEC Purchase

Agreement, ownership of OEC reverted back to Orbit on January 15, 2015.

Concord

Energy Partners, LLC

On

January 30, 2015, (i) the Company, Concord Energy Partners, LLC, a Delaware limited liability company (“Concord”)

and York Renewable Energy Partners LLC (“York”) entered into a development and indemnification agreement (the “Concord

Development and Indemnification Agreement”), pursuant to which in 2015 York funded Concord’s payment to us of $1,250,000

in development fees, and Concord issued us 250 Series B units of Concord (“Concord Series B Units”) and issued 750

Series A units of Concord (“Concord Series A Units”) to York, and (ii) we and York entered into an amended and restated

limited liability company operating agreement (the “Concord LLC Agreement”) to establish the Concord Series A Units

and Concord Series B Units and admit us and York as 25% and 75% members of

Concord, respectively.

Purs

uant to the foregoing agreements, York also agreed to pay us two equal installments of $587,500 upon (a) mechanical

completion of the North Carolina project and (b) commercial operation of the North Carolina project. We have received payment

of the first installment.

Pursuant

to the Concord LLC Agreement, our right to receive distributions from Concord are subject to certain priorities in favor of York,

as follows:

|

|

(a)

|

The

unpaid rate of return, equal to nine percent (9%) per annum and compounded annually, of unrecovered capital contributions

outstanding, will be paid to York;

|

|

|

(b)

|

The

unpaid and unrecovered capital contributions outstanding will be paid to York;

|

|

|

(c)

|

The

amount of any excess profits from “feedstock tipping fees” shall be distributed with twenty percent (20%) going

to York, and eighty percent (80%) going to us;

|

|

|

(d)

|

The

amount of any excess profits from “thermal energy” shall be distributed equally between us and York; and

|

|

|

(e)

|

Any

amount remaining will be distributed

pro-rata

to us and York in proportion to York and our respective ownership of

Concord.

|

In

addition, our right to receive distributions upon a liquidation event of Concord are subject to certain priorities in favor of

York, as follows:

|

|

(a)

|

The

unpaid rate of return, equal to nine percent (9%) per annum and compounded annually, of unrecovered capital contributions

outstanding, will be paid to York;

|

|

|

(b)

|

The

unpaid and unrecovered capital contributions outstanding will be paid to York; and

|

|

|

(c)

|

Any

amount remaining will be distributed

pro-rata

to us and York in proportion to York and our respective ownership of

Concord.

|

Pursuant

to the Concord LLC Agreement, Concord is managed by a board of managers initially consisting of three managers (the “Concord

Board”). So long as York owns more than 50% of the membership interests of Concord, York is entitled to appoint two of the

Concord Board’s three managers. So long as we own no less than 50% of the membership interests of Concord that we acquired

pursuant to the Concord Development and Indemnification Agreement, we are entitled to appoint one manager of the Concord Board.

In the event that the Concord Board determines in good faith that additional equity capital is needed by Concord and is in the

best interests of the North Carolina project, the Concord Board may determine the amount of additional capital needed and issue

new units to raise the necessary funds. In this case, if we do not exercise our pre-emptive right with respect to such units,

our percentage interest in Concord would be reduced accordingly. The Concord LLC Agreement also contains certain restrictions

on our right to transfer our membership interests in Concord to third parties.

The

New OEC Purchase Agreement

On

January 30, 2015, we entered into the Orbit Energy Charlotte, LLC Membership Interest Purchase Agreement by and among the Company,

Orbit, Concord, and OEC (the “New OEC Purchase Agreement”), pursuant to which (i) Concord purchased all of Orbit’s

right, title and interest in and to the membership interests of OEC (the “OEC Interests”), (ii) Orbit abandoned all

economic and ownership interest in the OEC Interests in favor of Concord, (iii) Orbit ceased to be a member of OEC and (iv) Concord

was admitted as the sole member of OEC.

Under

the Amended OEC Purchase Agreement and the New OEC Purchase Agreement, we had agreed to pay to Orbit the costs of evaluating and

incorporating into the North Carolina project Orbit’s high solids anaerobic digestion technology and two HSAD Units designed

by Orbit. Orbit was unable to design and install this technology into the North Carolina project, and we never paid or became

obligated to pay any costs pursuant thereto. Instead, digesters designed and provided by Auspark LLC, the project’s engineering,

procurement, construction and technology provider, have been incorporated into the North Carolina project.

The

New OEC Purchase Agreement also carries forward from the Amended OEC Purchase Agreement our obligation to pay Orbit an amount

equal to thirty percent (30%) of the North Carolina project’s distributable cash flow after we and the other equity investors

in the North Carolina project fully recoup their respective investments in the North Carolina project (such investments to be

calculated solely as amounts expended in and for the construction of the North Carolina project) and the North Carolina project

achieves a thirty percent (30%) internal rate of return. The calculation of the project’s internal rate of return would

take into account and be computed on the basis of any and all benefits from tax credits, depreciation and other incentives of

any nature, as well as the OEC Management Fee.

On

January 23, 2017, the Company and Orbit entered into an agreement to reduce certain of the Company’s obligations to Orbit

under the Amended OEC Purchase Agreement and the New OEC Purchase Agreement, as set forth above (please refer to the above descriptions).

The

Operations of the North Carolina project

OEC

and Duke Energy Carolinas, LLC (“Duke Energy”) are parties to an Amended and Restated Renewable Energy Purchase Agreement,

dated October 12, 2012 and amended on April 25, 2013, January 31, 2014, January 20, 2015 and September 30, 2016 (as amended, the

“Duke PPA”), pursuant to which OEC has agreed to sell, and Duke has agreed to purchase, the energy output of OEC’s

facility, subject to the terms and conditions of the Duke PPA. Among other things, the Duke PPA required OEC to commence commercial

operations by December 31, 2015 or, if not operational within 60 days of such date, pay Duke Energy $500,000 of liquidated damages,

which would then extend the deadline for commercial operation to March 30, 2016. Since the commercial operations had not been

commenced within 60 days of December 31, 2015, OEC was required to pay $500,000 of liquidated damages to Duke Energy pursuant

to the Duke PPA during the first quarter of 2016, and York contributed these funds to OEC. The deadline for commercial operation

was thereafter extended to November 23, 2016 by amendment to the Duke PPA. The Duke PPA is effective until August 21, 2030. The

loss of Duke Energy as a customer of OEC could have a material adverse effect on the Company.

OEC

is projected to require about 424 tons of organic feedstock on a daily basis and is working with organic waste suppliers to arrange

supplies of feedstock. As of today, we have all definitive agreements signed to supply all feedstock needed for operation of the

North Carolina project.

On

November 18, 2016, the North Carolina project connected to the grid, commenced commercial operations and started to provide output

to Duke Energy pursuant to the Duke PPA. The North Carolina facility is currently in the mechanical completion and ramp-up phase

of the project. Commencement of the commercial operations includes the gradual intake of waste from the facility’s feedstock

suppliers, increasing the parasitic load to the digesters, completing the waste-water-treatment resources and completing all other

mechanical features needed for the facility to operate at full capacity. The Company estimates that the North Carolina project

will be fully completed by the end of the second quarter of 2017.

As

of December 31, 2016 equity earnings in the amount of $5,960,946 and Revenue from Services in the amount of $587,500 in 2016 with

respect of the North Carolina project.

Our

Rhode Island Project

The

Amended OEC Purchase Agreement

On

January 7, 2015, we signed an amended and restated purchase agreement with Orbit for the Rhode Island project (the “Amended

OERI Purchase Agreement”). Subject to the terms of the Amended OERI Purchase Agreement, Orbit transferred full ownership

of OERI to us in exchange for our agreeing to pay Orbit a development fee of $300,000, reimbursement of $86,432 of Orbit’s

expenses, and an amount equal to 30% of the distributable cash flow from the Rhode Island project after the project achieves a

post-recoupment 30% internal rate of return computed on the basis of any and all benefits from tax credits, depreciation and other

incentives of any nature. We also agreed to use HSAD Units designed by Orbit and to retain Orbit to implement and operate the

HSAD Units for an annual management fee of $187,500 (the “OERI Management Fee”), subject to certain conditions. The

Amended OERI Purchase Agreement provided that we had until January 22, 2015 to pay Orbit the development fee and reimbursement

amount, which was extended to February 28, 2015 in exchange for payment by us to Orbit of $31,000. We did not subsequently pay

Orbit the development fee and reimbursement amount and, pursuant to the terms of the Amended OERI Purchase Agreement, ownership

of OERI reverted back to Orbit.

Rhode

Island Energy Partners, LLC

On

April 8, 2015, (i) the Company, Rhode Island Energy Partners, LLC, a Delaware limited liability company (“Rhode Island”)

and York entered into a development and indemnification agreement (the “Rhode Island Development and Indemnification Agreement”),

pursuant to which Rhode Island paid us development fees of $1,541,900, issued us 2,275 Series B units of Rhode Island (“Rhode

Island Series B Units), and issued 7,725 Series A units of Rhode Island (“Rhode Island Series A Units”) to York, and

(ii) we and York entered into an amended and restated limited liability company operating agreement (the “Rhode Island LLC

Agreement”) to establish the Rhode Island Series A Units and Rhode Island Series B Units and admit us and York as 22.75%

and 77.25% members of Rhode Island, respectively. Pursuant to the foregoing agreements, York also agreed to fund Concord’s

payment to us of us three equal installments of $562,500 upon (a) signing of the Rhode Island Development and Indemnification

Agreement, (b) the later of (x) the date of mechanical completion of the Rhode Island project and (y) the date on which an executed

interconnection agreement between OERI and National Grid, including receipt of any regulatory approvals from the Rhode Island

Public Utility Commission, is delivered by OERI, and (c) commercial operation of the Rhode Island project. To date, York has made

payment of the first $562,500 installment.

Pursuant

to the Rhode Island LLC Agreement, our right to receive distributions from OERI are subject to certain priorities in favor of

York, as follows:

|

|

(a)

|

The

amount of any excess profits from “feedstock tipping fees” shall be distributed with twenty percent (20%) going

to York, and eighty percent (80%) going to us;

|

|

|

(b)

|

The

amount of any excess profits from “thermal energy” shall be distributed equally between us and York; and

|

|

|

(c)

|

Any

amount remaining will be distributed

pro-rata

to us and York in proportion to York and our respective ownership in

Rhode Island.

|

In

addition, our right to receive distributions upon a liquidation event of Rhode Island are subject to certain priorities in favor

of York, as follows:

|

|

(a)

|

The

unpaid guaranteed obligation return will be paid to York;

|

|

|

(b)

|

The

unpaid rate of return, equal to nine percent (9%) per annum and compounded annually, of unrecovered capital contributions

outstanding, will be paid to York;

|

|

|

(c)

|

The

unpaid and unrecovered capital contributions outstanding will be paid to York; and

|

|

|

(d)

|

Any

amount remaining will be distributed

pro-rata

to us and York in proportion to York and our respective ownership in

Rhode Island.

|

Pursuant

to the Rhode Island LLC Agreement, Rhode Island is managed by a board of managers initially consisting of three managers (the

“Rhode Island Board”). So long as York owns more than 50% of the membership interests of Rhode Island, York is entitled

to appoint two of the Rhode Island Board’s three managers. So long as we own no less than 50% of the membership interests

of Rhode Island that we acquired pursuant to the Concord Development and Indemnification Agreement, we are entitled to appoint

one manager of the Rhode Island Board. In the event that the Rhode Island Board determines in good faith that additional equity

capital is needed by Rhode Island and is in the best interests of the Rhode Island project, the Rhode Island Board may determine

the amount of additional capital needed and issue new units to raise the necessary funds. In this case, if we do not exercise

our pre-emptive right with respect to such units, our percentage interest in Rhode Island would be reduced accordingly. The Rhode

Island LLC Agreement also contains certain restrictions on our right to transfer our membership interests in Rhode Island to third

parties.

The

New OERI Purchase Agreement

On

April 8, 2015, we entered into the Orbit Energy Rhode Island, LLC Membership Interest Purchase Agreement by and among the Company,

Orbit, Rhode Island and OERI (the “New OERI Purchase Agreement”), pursuant to which (i) Rhode Island purchased all

of Orbit’s right, title and interest in and to the membership interests of OERI (the “OERI Interests”), (ii)

Orbit abandoned all economic and ownership interest in the OERI Interests in favor of Rhode Island, (iii) Orbit ceased to me a

member of OERI and (iv) Rhode Island was admitted as the sole member of OERI.

Under

the Amended OERI Purchase Agreement and the New OERI Purchase Agreement, we had agreed to pay to Orbit the costs of evaluating

and incorporating into the Rhode Island project Orbit’s high solids anaerobic digestion technology and two HSAD Units designed

by Orbit. Orbit was unable to design and install this technology into the Rhode Island project, and we never paid or became obligated

to pay any costs pursuant thereto. Instead, digesters designed and provided by Auspark LLC, the project’s engineering, procurement,

construction and technology provider, have been incorporated into the Rhode Island project.

The

New OERI Purchase Agreement also carries forward from the Amended OERI Purchase Agreement our obligation to pay Orbit an amount

equal to thirty percent (30%) of the Rhode Island project’s distributable cash flow after we and the other equity investors

in the Rhode Island project fully recoup our respective investments in the Rhode Island project (such investments to be calculated

solely as amounts expended in and for the construction of the Rhode Island project) and the Rhode Island project achieves a thirty

percent (30%) internal rate of return. The calculation of the project’s internal rate of return would take into account

and be computed on the basis of any and all benefits from tax credits, depreciation and other incentives of any nature, as well

as the OERI Management Fee.

On

January 23, 2017, the Company and Orbit entered into an agreement to reduce certain of the Company’s obligations to Orbit

under the Amended OERI Purchase Agreement and the New OERI Purchase Agreement, as set forth above (please refer to the above descriptions).

The

Operations of the Rhode Island project

OERI

and The Narragansett Electric Company d/b/a National Grid (“National Grid”) are parties to a Power Purchase Agreement,

dated May 26, 2011 and amended on April 11, 2013, December 9, 2013, January 9, 2015 and May 27, 2016 (as amended, the “National

Grid PPA”), pursuant to which OERI has agreed to sell, and National Grid has agreed to purchase, the energy output of OERI’s

facility, subject to the terms and conditions of the National Grid PPA. Among other things, the National Grid PPA required OERI

to commence commercial operations by December 31, 2015, which could be extended up to six months by OERI upon deposit of $22,500

of collateral. Since commercial operations were not commenced by December 31, 2015, OERI paid an additional “Development

Period Security” of $22,500 pursuant to the National Grid PPA, such funds having been contributed to OERI by York. On May

27 2016, National Grid agreed to modify the date to commence commercial operations to June 30, 2017. As an incentive and evidence

of good faith to achieve commercial operation, OERI posted additional collateral in the amount of $22,500, such funds having been

contributed to OERI by York. The National Grid PPA is effective for 15 years from the date commercial operations are commenced,

which may be extended by 6 years at the option of National Grid. The loss of National Grid as a customer of OERI could have a

material adverse effect on the Company.

OERI

has obtained all the required permits, except for the operating permit, to achieve commercial operation. Although no assurances

can be given, we expect the Rhode Island project to commence commercial operations on or before the modified date to commence

commercial operations, or June 30, 2017.

OERI

and Renewable Organics Management LLC are parties to an Organic Waste Delivery Agreement, dated October 13, 2016, in respect of

80,000 tons per year of organic feedstock. This agreement has a five-year term, subject to renewal, and begins upon commencement

of operations, at which time feedstock will be supplied to the Rhode Island project. OERI is projected to require 80,000 tons

per year of organic feedstock on a daily basis, so the quantity represented by this agreement is expected to satisfy 100% of facility’s

feedstock requirements for operations.

As

of December 31, 2016, we have recorded deferred revenue Deferred revenues from nonconsolidated affiliates in the amount of $5,658,169

with respect to our project in the Rhode Island project (which will be recorded as revenue upon the commencement of its commercial

operations.

Our

Italy Projects

The

Acquisition of Our Italy Projects

On

May 14, 2015, we entered into a Share Purchase Agreement (the “Italy Projects Agreement”) with Volteo Energie S.p.A.,

Agriholding S.r.l., and Overland S.r.l. (each, a “Seller” and collectively, the “Sellers”) through our

indirect, wholly-owned subsidiary, Bluesphere Italy S.r.l. (we subsequently changed the name of Bluesphere Italy S.r.l to Bluesphere

Pavia S.r.l (“Blue Sphere Pavia”), which is the name we use herein). Pursuant to the Italy Projects Agreement, we

agreed to purchase one hundred percent (100%) of the share capital of Agricerere S.r.l., Agrielektra S.r.l., Agrisorse S.r.l.

and Gefa S.r.l (each, an “SPV” and collectively, the “SPVs”) from the Sellers, who collectively held all

of the outstanding share capital of each SPV. Each SPV is engaged in the owning and operating of an anaerobic digestion biogas

plant for the production and sale of electricity to Gestore del Servizi Energetici GSE, S.p.A., a state-owned company, pursuant

to a power purchase agreement. All references to, and descriptions of, the Italy Projects Agreement incorporate the terms of an

amendment to the same entered into by the parties on December 14, 2015.

Pursuant

to the Italy Projects Agreement, the we agreed to pay an aggregate purchase price of €5,600,000 for all of the SPVs, which,

less certain credits applied, has adjusted to $5,646,628 (€5,200,000) (the “Purchase Price”). Fifty percent (50%)

of the Purchase Price, less certain credits, was due to the Sellers on the Closing Date and the remaining balance along with annual

interest rate of two percent (2%) (“the deferred payment”), less certain credits, is due to the Sellers on the third

anniversary of the Closing Date. The Purchase Price is subject to certain adjustments and to an adjustment based on the actual

EBITDA results in the 18 months following the Closing Date, per the following mechanism:

|

|

(a)

|

If

the actual EBITDA in the 18 months following the Closing Date divided by 1.5 is greater than € 934,519, then the deferred

payment shall be increased by the amount equal to fifty percent (50%) of the difference.

|

|

|

(b)

|

If

the actual EBITDA in the 18 months following the Closing Date divided by 1.5 is lesser than € 934,519, then the deferred

payment shall be reduced by the amount of the amount necessary to maintain a Purchase Price that yields an Equity IRR of twenty-five

percent (25%), but not more than 35% of the remaining balance.

|

Under

the Italy Projects agreement, EBITDA is defined as “total cash revenues received minus all cash expenditures made during

the relevant period excluding principle and interest payments due to the bank and taxes”.

Pursuant

to the Italy Projects Agreement, the Company will reimburse the Sellers the VAT amount that was requested and will be requested

by the SPVs for the fiscal year of 2014. The reimbursed amount will not exceed €1,160,425 and will be refunded to the Sellers

only after the amount is refunded to the Blue Sphere Pavia by the VAT authorities in Italy. Pursuant to the Italy Projects Agreement,

we also issued a corporate guarantee to the Sellers, whereby the Company will secure the obligations of Blue Sphere Pavia under

the Italy Projects Agreement.

On

December 14, 2015 (the “Closing Date”), pursuant to the Italy Projects Agreement, we completed the acquisitions of

one hundred percent (100%) of the share capital of the “SPVs. On the Closing Date, the Company paid an amount of $2,143,181

(€1,952,858), which represented fifty percent (50%) of the Purchase Price adjusted for certain post-closing adjustments and

closing costs. The remaining balance of of the Purchase Price (balance less the adjusted closing payment) is promised by a note

accruing interest at an annual rate of two percent (2%) to each Seller, with such principal and interest accrued due to each Seller

on or before the third anniversary of the Closing Date, subject to adjustment to the variation of EBITDA, as described above.

The portion of the Purchase Price and closing costs paid at closing was primarily financed by a loan of €2,900,000, obtained

pursuant to the Helios Loan Agreement.

The

closing of the Italy Projects Agreement was subject to certain conditions precedent including, but not limited to, obtaining consent

to the proposed sale and resulting change of control from Banca IMI S.p.A. (“the SVPs’ lender”) in connection

with a certain Financing Agreement, dated February 25, 2013, between the SPVs, Banca IMI S.p.A. and Intesa San Paolo S.p.A, as

well as from other counterparties to certain agreements to which the SVPs are a party. After the Closing Date, the SPV’s

paid a waiver fee of approximately $109,000 to the SVPs’ lender, such amount representing 50% of the fees and expenses charged

by the lenders in connection with obtaining these consents.

The

Operations of the Italy Projects

On

July 17, 2015, we entered into a Framework EBITDA Guarantee Agreement (the “Framework EBITDA Agreement”) with Austep

S.p.A. (“Austep”), an Italian corporation. Austep specializes in the design, construction, operation and servicing

of anaerobic digestion plants. The Framework EBITDA Agreement provides a framework pursuant to which Austep will perform technical

analyses of operating anaerobic digestion plants in Italy that we identify as potential acquisition targets. If and when we acquire

such anaerobic digestion plants in Italy, subject to the terms of the Framework EBITDA Agreement, we and Austep have agreed to

negotiate individual agreements pursuant to which Austep will operate, maintain and supervise each plant and guarantee agreed-upon

levels of EBITDA to us for a specified period. The Framework EBITDA Agreement will apply to the first fifteen anaerobic digestion

plants that we may acquire in Italy, including the plants subject to the Italy Projects Agreement.

On

the Closing Date, each SPV entered into Plant EBITDA Guarantee Agreement with Austep (collectively, the “Plant EBITDA Agreements”).

In accordance with the Plant EBITDA Agreements, Austep will operate, maintain and supervise each biogas plant owned by the SPVs.

In addition, the Plant EBITDA Agreements guaranteed a monthly aggregate EBITDA of $204,147 (€188,000) from the four SPVs,

collectively, for the initial six months following the Closing Date, and thereafter the Plant EBITDA Agreements guarantee an annual

aggregate EBITDA of $4,082,946 (€3,760,000) from the four SPVs, collectively. Pursuant to the terms of the Plant EBITDA Agreements,

the Company will receive the guaranteed levels of EBITDA, and Austep will receive ninety percent (90%) of the revenue in excess

of such levels.

The

Helios Loan Agreement

On

August 18, 2015, we and two of our wholly-owned subsidiaries, Eastern Sphere Ltd. (“Eastern Sphere”), the parent of

Blue Sphere Pavia, and Blue Sphere Pavia, entered into a Long Term Mezzanine Loan Agreement (the “Helios Loan Agreement”)

with Helios Italy Bio-Gas 1 L.P. (“Helios”) to finance the Italy Projects Agreement. Under the Helios Loan Agreement,

Helios made up to five million euros (€5,000,000) available to Blue Sphere Pavia (the “Helios Loan”) to finance

(a) ninety percent (90%) of the total required investment of the first four SPVs acquired, (b) seventy to eighty percent (70-80%)

of the total required investment of up to three SPVs subsequently acquired, if applicable, (c) certain broker fees incurred in

connection with the acquisitions, and (d) any taxes associated with registration of an equity pledge agreement (as described below).

Each financing of an SPV acquisition will be subject to specified conditions precedent and will constitute a separate loan under

the Helios Loan Agreement. Helios’s obligation to provide additional funds under the Helios Loan Agreement, in connection

with subsequently acquired SPVs, terminated on June 30, 2016.

As

of December 31, 2016, the outstanding balance under the Helios Loan was $2,607,000. Subject to specified terms, representations

and warranties, the Helios Loan Agreement provides that each loan thereunder will accrue interest at a rate of fourteen and one-half

percent (14.5%) per annum, and that Helios is entitled to an annual operation fee of one and one-half percent (1.5%) per annum.

Payments of principal, interest and the operation fee are due and payable quarterly. The final payment for each loan will become

due no later than the earlier of (a) thirteen and one half years from the date such loan was made available to Blue Sphere Pavia,

and (b) the date that the license to produce electricity granted to the relevant SVP expires. Pursuant to the Helios Loan Agreement

and an equity pledge agreement, We pledged all our shares in Blue Sphere Pavia to secure all loan amounts utilized under the Helios

Loan Agreement.

On

December 2015, we borrowed €2,900,000 ($3,149,000) under the Helios Loan Agreement to finance the purchase of the SPVs. No

additional funds have since been borrowed.

Fast

Charging Battery Technology

On

March 2016, we entered into a Share Sale and Purchase Agreement with Voltape Ltd., a company incorporated in Israel (“Voltape”).

Pursuant to the Share Sale and Purchase Agreement, we agreed to sell, and Voltape agreed to purchase, 6,860 ordinary shares of

Quickcharge Pte. Ltd., a company incorporated in Singapore (“Quickcharge”), such shares representing our entire interest

in Quickcharge. In consideration for the shares of Quickcharge, Voltape paid USD $100,000 to the Company. In satisfaction of a

condition precedent to the closing of the Share Sale and Purchase Agreement, on March 13, 2016, we entered into a License Termination

Agreement with Nanyang Technological University. The Termination Agreement terminates the License Agreement (the “License

Agreement”), dated October 30, 2014, between the Company and Nanyang Technological University. The Company has entered the

Agreements to divest its interests in this technology and focus on its core businesses.

Strategy

Our

main focus is providing tailored solutions internationally to produce clean energy primarily out of the treatment of waste. We

are focused on waste-to-energy projects in the United States, Italy, the Netherlands, the United Kingdom and Israel and are in

the process of developing a pipeline of similar projects. We believe there is a virtually endless supply of waste suitable for

such projects and the demand for energy (particularly from such projects) is growing consistently.

Our

model is to acquire or build, own and operate waste-to-energy facilities. We select projects with signed, long-term agreements

with waste producers or waste haulers for feedstock, with national governments or electricity corporations for energy output and

with private entities for the sale of other project by-products (such as renewable energy credits, heat, compost and fertilizer).

We are currently evaluating several types of projects: (i) anaerobic digestion to electricity, (ii) landfill gas to energy, (iii)

anaerobic digestion to renewable natural gas, (iv) biomass to electricity, (v) energy crop to electricity, (vi) pyrolysis to electricity

and thermal and (vii) incineration to electricity.

A

component of the clean energy and waste-to-energy industry in the United States is renewable energy credits (“RECs”).

A REC represents a MWh or KWh of clean energy. Many states, including North Carolina and Rhode Island, the sites of our two United

States projects, require their utilities to prove that a portion of the energy they sell is produced from clean or renewable sources.

A REC is used to demonstrate that the relevant unit of energy has a clean or renewable source. Consequently, utilities purchase

RECs from producers of clean and renewable energy. Our agreements with Duke Energy Carolinas, LLC (“Duke Energy”)

and The Narragansett Electric Company d/b/a National Grid (“National Grid”), for our North Carolina and Rhode Island

projects, respectively, provide for “bundled” pricing for the sale of electricity and RECs.

We

expect to generate revenue through sales of thermal and electrical energy, energy efficiency technologies and RECs, and by-products,

project development services, and tipping fees from accepting waste. On November 18, 2016, our project in the Charlotte, NC Waste

to Energy Anaerobic Digester 5.2 MW Plant commenced commercial operations and started to provide its output to Duke Energy pursuant

to the power purchase agreement with Duke Energy. The commencement of the commercial operations includes the gradual intake of

waste from the facility’s feedstock suppliers, increasing the parasitic load to the digesters, completing the waste-water-treatment

resources and completing all other mechanical features needed for the facility to operate at full capacity. As of December 31,

2016, the facility is in its mechanical completion and ramp-up phase of the project. We estimate that this project will be fully

completed by April 30, 2017.

Our

strategy is to integrate all activities and components that make up a waste-to-energy project and provide a turn-key, one-stop

shop solution for waste-to-energy development. We are also actively seeking to acquire facilities that are in various stages of

development. We work with and outsource key components of our projects to engineering, procurement and construction (“EPC”)

providers and other project participants that provide the most economically viable solution for each individual project. The EPC

providers may also be the provider of the technology used for each project. We The EPC providers may also be the provider of the

technology used for each project. We believe this provides us the flexibility and freedom to tailor the best solution for each

project. We expect that we will remain involved in managing and financing all aspects of our projects throughout their lifetimes

or until they are sold. We believe this assures all of the involved stakeholders, including waste producers, financing stakeholders,

EPC and technology providers, and customers, that there is long-term continuity and responsibility for each project.

We

aim to be distinctive and successful in the waste-to-energy market by:

|

|

●

|

providing

a one-stop, turn-key/build, own and operate/transfer solution;

|

|

|

●

|

identifying

and obtaining the rights to lucrative projects without incurring material expense;

|

|

|

●

|

delivering

seamless and professional project implementation through a combination of our own expertise and the use of third-party experts

with a track-record of success;

|

|

|

●

|

being

technology agnostic and using mature and well-known technologies and when necessary to tailor-make cost-efficient and effective

solutions for our projects;

|

|

|

●

|

leveraging

our management’s more than 30 years of experience in successful implementation of large and complex projects in the

developing world;

|

|

|

●

|

building

local and international teams to support each project;

|

|

|

●

|

obtaining

political, property, non-performance and insolvency insurance for our projects; and

|

|

|

●

|

receiving

almost all of our revenue in United States dollars or euros, whether operating in the United States, Europe or the developing

world.

|

Competition

There

are a number of other companies operating in the clean energy and waste-to-energy space, ranging from other project developers

to service or equipment providers, buyers and/or investors. Unlike the common market approach in this space (i.e., being solely

a project developer, service or equipment provider or a buyer or investor), we seek to provide a one-stop shop, turn-key solution

for project development and operation. As described above, our business model is to acquire or develop and manage all aspects

of project implementation and sales of the project’s clean energy and by-products. We believe this integrated approach is

attractive to project stakeholders and will differentiate us in a positive manner from our competition. We are aware of several

competitors in the United States, such as – Harvest Power, Neo Energy, Anaergia, Quasar, CH4 and others. We value these

companies, as they are helping to create awareness and credibility for the waste-to-energy space. However, companies in the waste-to-energy

industry tend to focus on new or singular technologies, whereas we believe that we have a competitive advantage in being technology

agnostic. By having our own technology experts, we are able to focus on finding the best locations where waste is abundant and

implementing the best technology for that particular waste stream.

The

clean energy and waste-to-energy space is intensely competitive and subject to rapid and significant technological change. Many

of our competitors and other companies operating in this space have greater financial and other resources than we have. As a result,

these companies may be more effective in developing and implementing a business model similar to ours and/or competing with us

in any aspect of project implementation and clean energy sales.

Government

Regulation

Permitting

Each

of our projects in development requires certain government approvals. In the United States, the standard required environmental

permits relate to solid waste composting and air quality. All construction and operational permits for our North Carolina and

Rhode Island projects have been obtained, except for the operating permit to achieve commercial operation for our Rhode Island

project. In Italy, all permits for operation of the projects have been received, and these projects are operational.

Effect

of Existing or Probable Government Regulations on Our Business

Our

business is affected by numerous laws and regulations on the international, federal, state and local levels, including energy,

environmental, conservation, tax and other laws and regulations relating to our industry. Failure to comply with any laws and

regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief

or both. Moreover, changes in any of these laws and regulations could have a material adverse effect on our business. In view

of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot

predict the overall effect of such laws and regulations on our future operations.

We

believe that our operations comply in all material respects with applicable laws and regulations and that the existence and enforcement

of such laws and regulations have no more restrictive an effect on our operations than on other similar companies in our industry.

We do not anticipate any material capital expenditures to comply with international, federal and state environmental requirements.

Employees

We

have eleven full-time basis professionals: our non-executive chairman, chief executive officer, two executive vice-presidents,

chief technical officer, chief financial officer, controller for European operations, vice president of strategy and business

development, vice president investor relations, operation manager for the United States market and vice president of business

development for the United States market. We also employ one part-time office manager. Our subsidiary, Eastern Sphere, has two

full-time employees, our vice president of business development for the European market and our executive vice president of mergers

and acquisitions.

Segments

and Geographic Information

We

have one reporting segment. For information regarding revenue and other information regarding our results of operations for each

of our last two fiscal years, please refer to our financial statements included in this Annual Report on Form 10-K and Management’s

Discussion and Analysis of Financial Condition and Results of Operations included in Item 7 of this Annual Report on Form 10-K.

Corporate

History

We

were incorporated in the state of Nevada on July 17, 2007 and were originally in the business of developing and promoting automotive

internet sites. In March 2010, we conducted a reverse merger, name change and forward split of our Common Stock, and current management

took over operations, at which point we changed our business focus to become a project integrator in the clean energy production

and waste to energy markets.

In

2013, we amended and restated our Articles of Incorporation to, among other things, (a) authorize the issuance of 500,000,000

shares of preferred stock, $0.001 par value, in one or more series and with such rights, preferences and privileges as our Board

of Directors may determine and (b) effect a 1 for 113 reverse stock split of our outstanding Common Stock.

Our

direct wholly-owned subsidiaries are Eastern Sphere, Binosphere LLC (“Binosphere”), Bluesphere Pavia and Blue Sphere

Brabant B.V. (“BSB”). Through our ownership of Blue Sphere Pavia, we own 100% of Agricerere S.r.l., Agrielekra S.r.l.,

Agrisorse S.r.l. and Gefa S.r.l. Through our ownership of Eastern Sphere, we own 50% of Sustainable Energy Ltd. (“SEL”)

and PureSphere Ltd. We also own a 25% interest in Concord (which owns OEC) and a 22.75% interest in Rhode Island (which owns OERI).

On January 31, 2017, we dissolved Johnstonsphere LLC, which had no operations.

Our

Corporate Information

Our

principal executive offices are located at 301 McCullough Drive, 4th Floor, Charlotte, North Carolina 28262 and our telephone

number is (704) 909-2806. Our web address is http://www.bluespherecorporate.com. The information on our website does not form

a part of this report.

Available

Information

We

also make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments,

available free of charge through our website at www.bluespherecorporate.com as soon as reasonably practicable after we electronically

file such material with (or furnish such material to) the Securities and Exchange Commission. The information contained on our

website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be part of this

Annual Report on Form 10-K.

Copies

of the reports and other information we file with the Securities and Exchange Commission may also be examined by the public without

charge at 100 F Street, N.E., Room 1580, Washington D.C., 20549, or on the internet at www.sec.gov. Copies of all or a portion

of such materials can be obtained from the SEC upon payment of prescribed fees. Please call the SEC at 1-800-SEC-0330 for further

information.

Item

1A. Risk Factors

As

a “smaller reporting company”, we are not required to provide the information required by this Item.

Item

1B

.

Unresolved

Staff Comments

Not

applicable.

Item

2.

Properties

Our

principal executive office is located in North Carolina at 301 McCullough Drive, 4th Floor, Charlotte, NC 28262. We lease office

space at this site for $196 per month. We also have office space located at 35 Asuta St. Even Yehuda, Israel 40500, for which

we pay the operating expenses but do not pay any rent. Each of the SPVs owned by Blue Sphere Pavia lease the property used for

the operation of the facilities. We intend to obtain additional working space near our projects if and when we believe this is

necessary for the development and operation of the projects. Until such time, we believe that our property is adequate for the

conduct of our business.

Item

3.

Legal Proceedings

From

time to time we and our subsidiaries may be parties to legal proceedings arising in the normal course of our business. Except

as noted below, we and our subsidiaries are currently not a party, nor is our property subject, to any material pending legal

proceedings. None of our directors, officers, affiliates, or any owner of record or beneficially of more than five percent of

our Common Stock, is involved in a material proceeding adverse to us or our subsidiaries or has a material interest adverse to

us or our subsidiaries.

On

October 22, 2016, the law firm of JS Barkats PLLC filed a complaint against us and Shlomo Palas, our Chief Executive Officer,

seeking allegedly unpaid legal fees for services rendered from June 9, 2011 through April 23, 2012 in the amount of USD $428,964.70,

plus interest for a total of USD $652,000 (the “Barkats Litigation”). The Barkats Litigation was filed as JS Barkats

PLLC v. Blue Sphere Corporation and Shlomo Palas with the Supreme Court of the State of New York for the County of New York (the

“New York Court”), Index No. 655600/2016. On October 26, 2016, without notice to us or Mr. Palas or an opportunity

to be heard, the New York Court issued a Temporary Restraining Order (the “TRO”) in favor JS Barkats PLLC, prohibiting

us and Mr. Palas from “transferring or dissipating their assets … to the extent of $652,000”, pending the return

date of JS Barkats PLLC’s asset attachment motion, due November 17, 2016. On October 28, 2016, we received notice of the

foregoing. On October 31, 2016, we removed the Barkats Litigation to federal court, filed as JS Barkats PLLC v. Blue Sphere Corporation

and Shlomo Palas with the United Stated District Court, Southern District Court of New York, Docket No. 1:16-cv-08404.

It

is the Company’s position that by operation of law, the TRO expired no later than November 15, 2016. On November 18, 2016,

the Company and Mr. Palas moved to compel mediation and arbitration of the dispute. Subsequently, on December 6, 2016, JS Barkats

PLLC filed a motion to remand the action to the New York Court and also filed a motion to hold the Company and Mr. Palas in contempt

for allegedly violating the TRO. The Company has opposed both motions. We terminated the services of JS Barkats LLC in 2012 and

believe the claims brought by JS Barkats PLLC are without merit, that the TRO was improvidently granted, and that JS Barkats PLLC

misrepresented, mischaracterized and omitted material facts and the law in seeking the TRO. We intend to vigorously defend against

the Barkats Litigation, the TRO and any other attempts to attach the assets of the Company.

Item

4.

Mine Safety

Disclosures

Not

applicable.

PART

II

Item

5.

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Recent

Sales of Unregistered Securities

The

following are sales of our unregistered securities during the fiscal year ended December 31, 2016 that have not otherwise been

reported in our periodic or current reports:

On

January 26, 2016, we issued 1,000,000 shares of our Common Stock in connection with a private offering, and pursuant to a subscription

agreement dated June 12, 2015.

On

February 1, 2016, we issued 540,000 shares of our Common Stock pursuant to a consulting agreement dated April 3, 2015, in consideration

for consulting services.

On

February 3, 2016, we issued 3-year warrants to purchase up to 1,500,000 shares of our Common Stock at an exercise price of $0.06

per share, in full satisfaction of certain obligations of the Company.

On

February 15, 2016, we completed a private offering representing aggregate gross proceeds to the Company of $1,925,000 (the “February

2016 Offering”), pursuant to which we issued (i) 35,000,000 shares of our Common Stock priced at $0.055 per share, the closing

price for our shares of Common Stock reported by the OTCQB Venture Marketplace on the trading day prior to the closing of the

February 2016 Offering, and (ii) 5-year warrants to purchase up to 17,500,000 shares of our Common Stock at an exercise price

of $0.10 per share, which was equal to 50% of the shares purchased in the offering. The Company engaged Maxim Group LLC to assist

in the offering, pursuant to which Maxim received 5-year warrants to purchase (a) up to 2,800,000 shares of our Common Stock at

an exercise price of $0.0605 per share and (b) up to 1,400,000 shares of our Common Stock at an exercise price of $0.11 per share.

The form and terms of the warrants issued to Maxim were substantially the same as the warrants issued to the February 15, 2016

investors.

On

March 15, 2016, we issued 85,000 shares of our Common Stock outstanding under a consulting agreement, dated February 22, 2015,

in consideration for consulting services.

On

April 13, 2016, we issued 1,000,000 shares of Common Stock of the Company to a consultant in consideration for corporate finance,

investor communications and financial and investor public relations services. On June 13, 2016, pursuant to the consulting agreement,

we issued an additional 1,000,000 shares of Common Stock as a service bonus since the agreement was not terminated prior to June

9, 2016.

On

April 13, 2016, we issued an aggregate of 875,000 shares of our Common Stock to a consultant, pursuant to consulting agreements

dated September 1, 2015 and March 1, 2016, in consideration for investor relations and communications services.

On

May 18, 2016, a 1.5-year warrant to purchase shares of Common Stock, dated May 4, 2015, was exercised into 700,000 shares of Common

Stock at an exercise price of $0.058 per share, for total consideration of $40,600.

On

June 2, 2016, the Company issued 13,930,742 shares of its Common Stock in consideration of $145,525 in proceeds pursuant to all

but one of the investors in a private placement of up to $250,000 of its Common Stock to finance a portion of the funds necessary

to complete the acquisitions of the projects by Blue Sphere Pavia closed on December 2, 2015. On or about December 13, 2016, the

Company issued the remaining 7,658,129 shares of its Common Stock, in consideration for $83,949 of proceeds.

On

June 13, 2016, we issued 7,103,467 shares of Common Stock of the Company to several officers, directors, employees and/or consultants

of the Company. All shares were issued pursuant to the Company’s Global Share and Options Incentive Enhancement Plan (2014)

and the Company’s Global Share Incentive Plan (2010).

On

June 26, 2016, we issued 500,000 shares of Common Stock of the Company in full satisfaction of certain obligations under a subscription

agreement.

In

June and July 2016, The Company conducted an offering (the “June 2016 Offering”) consisting of (a) up to USD $3,000,000

of shares of its Common Stock, priced at the closing price for shares of Common Stock, as reported on the OTCQB Venture Marketplace

on the trading day prior to each respective closing of the offering, and (b) five (5) year warrants to purchase shares of its

Common Stock in an amount equal to one hundred percent (100%) of the number of shares of Common Stock so purchased by the subscriber,

with an exercise price equal to the per share price of the Common Stock, or $0.011 per share, whichever is greater. On July 26,

2016, the Company completed closings of the June 2016 Offering, both such closings representing aggregate gross proceeds to the

Company of $1,370,000. In connection with both closings, the Company and subscribers entered into (i) subscription agreements

and issued 18,266,668 shares of Common Stock at $0.075 per share, and (ii) warrants to purchase up to 18,266,668 shares of Common

Stock at an exercise price of $0.11 per share. The Company engaged Maxim Group LLC to assist in the offering, pursuant to which,

Maxim Group LLC received commissions equal to 4.44% of the gross proceeds raised, warrants to purchase up to 928,000 shares of

Common Stock at an exercise price of $0.0825 per share, and warrants to purchase up to 928,000 shares of Common Stock at an exercise

price of $0.121 per share.

On

August 7, 2016, we issued 143,000 shares of Common Stock, in consideration for past capital advisory services rendered to the

Company.

On

August 16, 2016, we issued 400,000 shares of Common Stock, in satisfaction of debt of $24,000.

On

September 15, 2016, we issued 500,000 shares of Common Stock to a consultant, pursuant to a consulting agreement dated March 1,

2016, in consideration for investor relations and communications services.

On

September 15, 2016, we issued 500,000 shares of Common Stock to a consultant, pursuant to a consulting agreement dated September

1, 2016, in consideration for investor relations and communications services.

On

October 25, 2016, we completed a private placement of our securities to JMJ Financial, an accredited investor (the “October

2016 Financing”). Pursuant to the October Financing, we entered into a Securities Purchase Agreement with the investor thereby

agreeing to issue shares of Common Stock, notes, and warrants to purchase shares of Common Stock, in exchange for USD $500,000

paid at closing and an additional USD $250,000 which were paid at December 20, 2016 after the achievement of certain milestones,

as well as up to an additional USD $250,000 in financing upon the mutual agreement with the Investor. Pursuant to the terms of

such October 2016 Financing, we agreed to issue to JMJ (i) restricted shares of Common Stock equal to twenty-five percent (25%)

of the note principal paid to us by JMJ, subject to certain adjustments, (ii) a six (6) month promissory note covering the note

principal plus an amount equal to approximately five percent (5%) of the actual note principal, in total USD $1,053,000, and (iii)

a five (5) year warrant to purchase 10,000,000 shares of Common Stock with an aggregate exercise amount of USD $750,000.

On

December 14, 2016, we issued 7,658,129 shares of our Common Stock in consideration of $83,949 pursuant to the July 2015 Offering

Subscription Agreement.

On

December 20, 2016, we issued 950,000 shares of Common Stock to the CEO of the Company and 850,000 shares of Common Stock to the

Chairman of the Board of We under their service agreements with the Company. We have estimated and recorded the fair value of

such shares as an expense of $50,025 which was recorded through the vesting periods.

On

December 30, 2016, we issued 850,000 shares of Common Stock to an EVP of the under his service agreement with the Company. We

have estimated and recorded the fair value of such shares as an expense of $23,623 which was recorded through the vesting period.

On

December 30, 2016, we issued 5,775,000 shares of Common Stock to several officers, directors, employees and/or consultants of

the Company. All shares were issued pursuant to the Company’s Global Share and Options Incentive Enhancement Plan (2014)

(the “2014 Incentive Plan and the Company’s Global Share Incentive Plan (2010). We has estimated and recorded the

fair value of such shares as an expense of $386,347 which was recorded through the vesting periods.

On

December 30, 2016, we issued 300,000 shares of Common Stock, in consideration for past services rendered a member of the Board

of Directors to the Company. We have estimated the fair value of such shares, and recorded an expense of $19,770.

On

January 31, 2017, we issued 404,167 shares of Common Stock to the Former Chief Financial Officer (Israel) of the Company and 350,000

shares of Common Stock to Former Chief Financial Officer (U.S.) of the Company under their departure settlement agreements with

the Company.

The

transactions described above were exempt from registration under the Securities Act as transactions not involving a public offering.

Market

Information

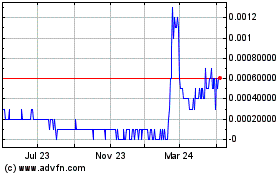

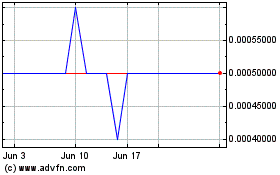

Our

Common Stock is quoted on the OTCQB under the symbol “BLSP”. The following quotations, which were obtained from nasdaq.com,

reflect the high and low bids for our Common Stock for the periods indicated, based on inter-dealer prices, without retail mark-up,

mark-down or commission and may not represent actual transactions. The first day on which our Common Stock traded under BLSP was

March 16, 2010. The high and low bid prices of our Common Stock for the periods indicated below are as follows:

|

Quarter

Ended

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2016

|

|

|

$

|

0.08

|

|

|

$

|

0.05

|

|

|

September

30, 2016

|

|

|

$

|

0.08

|

|

|

$

|

0.06

|

|

|

June

30, 2016

|

|

|

$

|

0.09

|

|

|

$

|

0.07

|

|

|

March

31, 2016

|

|

|

$

|

0.09

|

|

|

$

|

0.05

|

|

|

Quarter

Ended

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2015

|

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

September

30, 2015

|

|

|

$

|

0.04

|

|

|

$

|

0.01

|

|

|

June

30, 2015

|

|

|

$

|

0.07

|

|

|

$

|

0.02

|

|

|

March

31, 2015

|

|

|

$

|

0.23

|

|

|

$

|

0.04

|

|

Holders

As

of December 31, 2016, we had 136 holders of record of our Common Stock, per the listing of stockholders maintained by the Company’s

transfer agent, ClearTrust, LLC. This number does not include beneficial owners whose shares are held in the names of various

security brokers, dealers, and registered clearing agencies.

Dividends