CEMEX

Cement Maker Set To Sell Ohio Assets

MEXICO CITY -- Mexican cement and building- materials company

Cemex SAB took another step toward meeting its asset-divestment

target with a pact to sell a cement plant and terminal in Ohio to

Eagle Materials Inc. for about $400 million.

The sale, which is expected to close in the fourth quarter,

includes a cement plant in Fairborn and a distribution terminal in

Columbus, Cemex said Monday. The assets are expected to generate

$79 million this year in revenue, and $33 million in operating cash

flow measured by earnings before interest, taxes, depreciation and

amortization, or Ebitda.

Cemex said it would use the money from the sale to pay down debt

and for other purposes.The Monterrey company, one of the world's

largest cement makers, is selling assets to reduce its heavy debt

load as it seeks to recover the investment-grade ratings that it

lost in the 2008-2009 global crisis.

Cemex aims to sell assets for $1.5 billion to $2 billion in

2016-2017. The sales are part of the company's plans to lower debt

by between $3 billion and $3.5 billion in that two-year period. It

recently agreed to sell plants in Texas and New Mexico to Grupo de

Cementos Chihuahua SAB for $306 million.

Dallas-based Eagle Materials said the Fairborn cement plant has

capacity to grind nearly one million tons a year of clinker, and

will increase its cement-making capacity by about 20%. Eagle said

the acquisition will contribute to earnings as soon as the deal

closes, and that it expects around $50 million in tax benefits from

the transaction.

"Our strategy has been to grow the cement side of our business.

The Fairborn plant extends our U.S. cement system and connects but

does not overlap with the market reach of our existing plants,"

said Dave Powers, Eagle's president and chief executive in a

statement from the company.

Eagle, which makes cement and other building materials, said it

would use cash and bank credit to finance the acquisition without

raising its debt-to-Ebitda ratio to more than two times.

The sale is positive for Cemex even though it is in one of its

biggest and currently fastest-growing markets, analysts at Mexico's

Intercam brokerage said in a note to clients.

The assets are far from Cemex's main areas of operations in the

U.S., and don't produce concrete or aggregates. "Besides, it's core

for Eagle Materials so they could pay a higher multiple," they

added.

--Anthony Harrup

SASOL

Slump in Oil Prices Weighs on Results

South African petrochemical and energy producer Sasol Ltd.

reported a steep drop in net profit and vowed to cut costs further

in the face of a sustained slump in oil prices.

Sasol said on Monday that net profit fell 55% to 13.22 billion

South African rand ($914.4 million) in the year to end-September

from 29.72 billion rand in the previous fiscal year despite cost

reductions and an increase in oil output. Revenue fell 6.6% to

172.9 billion rand. Headline earnings per share, the company's

preferred profit measure that strips out certain exceptional and

one-off items, fell 17% to 41.40 rand, in line with expectations.

The company reduced its dividend by more than a fifth to 9.10 rand

a share.

Sasol, one of South Africa's biggest industrial enterprises,

said it now expects sustainable cash cost savings of 2.5 billion

rand through 2019, a billion rand more than it had previously

targeted.

Management would continue to focus on preserving cash to better

respond to the prospect that oil prices would remain "lower for

much longer," the company said.

The fall in crude prices is putting pressure on Sasol as it

pushes ahead with a $8.9 billion investment in a petrochemical

project in Louisiana. Sasol has said it expects the project to come

online in 2018, tripling its chemical production capacity in the

U.S.

Sasol is also the biggest taxpayer in South Africa, whose

economy and currency have been rocked by political turmoil. The

company's ability to employ thousands of South Africans and pay

taxes, despite suffering from a lower rand on top of low oil

prices, is important for the country's future, not least for being

home to Africa's most advanced economy.

Sasol shares were down 2% on the Johannesburg Stock Exchange in

volatile early trading.

Sasol's operations include six coal mines which provide the raw

material for its fuel refining and chemicals activities, fuel for

power generation, and exports. Sasol also explores for oil and gas

in southern and central Africa, Australia and Canada.

--Matina Stevis

TELENOR

VimpelCom Stake To Be Whittled

Telenor ASA said Monday that it had started selling part of its

33% stake in VimpelCom Ltd., one of Russia's largest telecom

carriers, which was hit earlier this year with a hefty fine by U.S.

and Dutch authorities as part of a corruption case.

Telenor, which is majority-owned by the Norwegian state, said it

had commenced a public offering of nearly a fourth of its VimpelCom

shares, which are listed on Nasdaq in the U.S., adding price had

not yet been determined. The offer is part of Telenor's plan to

divest its entire stake in VimpelCom, for which it has been seeking

potential buyers since October 2015.

VimpelCom, which is registered in the Netherlands, in February

admitted to having paid more than $114 million in bribes to an

Uzbekistan official, and agreed to pay more than $795 million in

civil and criminal penalties to U.S. and Dutch authorities.

In April, two Telenor executives agreed to resign over the

company's handling of its ownership stake in VimpelCom after a

review by the law firm Deloitte. Telenor said the review hadn't

uncovered any corruption at the company but had pointed to

weaknesses in organizational structure, communication and

leadership relating to its role as VimpelCom owner.

In July, Telenor reported that its second-quarter net profit

fell by two-thirds compared with the year-earlier period, hit by a

2.5 billion Norwegian kroner ($303 million) impairment loss related

to its stake in VimpelCom, which has more than 200 million

subscribers and offers mobile services in 14 countries.

At the time, the company said, "VimpelCom will continue to be

classified as an associated company until it is highly probable

that a sale within 12 months will occur."

The news also comes just less than a week after former chief

executive of VimpelCom's Russia unit, Mikhail Slobodin, was put on

a federal wanted list after being declared a person of interest in

a bribery investigation.

Mr. Slobodin resigned late last Monday following the declaration

by Russia's Investigative Committee, the country's chief

investigative body. Being on a federal wanted list means that Mr.

Slobodin can be arrested if he is found on Russian territory. Mr.

Slobodin could not be reached for comment.

--Matthias Verbergt and Olga Razumovskaya

ASSOCIATED BRITISH FOODS

Pound's Tumble Makes Impact

LONDON -- The British pound's post-Brexit tumble benefited the

Primark discount fashion chain's recent results, but the

disadvantages resulting from the currency's fall also have

grown.

Associated British Foods PLC, the food and ingredients company

that owns Primark, said on Monday that the weaker pound after the

U.K.'s June 23 vote to leave the European Union would bolster its

results for fiscal 2016, ending Saturday. But it warned that the

currency move would hurt profit margins in fiscal 2017, because it

has many expenses in dollars and earns much of its revenue in

pounds and euros, and would turn its modest pension surplus into a

GBP200 million ($265.4 million) deficit.

AB Foods shares plunged in London trading on Monday, down 10.8%

to GBP28.15.

The London-based company blamed the pension deficit on a marked

decline in U.K. long-term bond yields following the EU referendum.

The company uses bond yields to value its pension obligations.

AB Foods Finance Director John Bason said the company's pension

plan is well funded and he expects several other U.K. companies to

report pension deficits due to falling bond yields.

The company vowed to maintain Primark's rock-bottom prices

despite the squeeze in margins and said the brand has been well

received in the world's largest clothing market, the U.S.

"All of our U.S. stores are growing in sales," Mr. Bason said,

adding that the stores are meeting sales expectations set by the

company. He declined to provide specific sales figures for the U.S.

stores.

Primark, popular in the U.K. and much of Europe, is expanding

gradually in the U.S. It opened its first store there a year ago,

in the former Boston location of the original Filene's Basement

discount store, and since has opened four more elsewhere in the

U.S. Northeast.

The chain now plans to expand selling space at the

77,000-square-foot Boston store by 20%, and it aims to have five

more U.S. stores in operation by fiscal 2018. That is a slower pace

than it planned a year ago, when it forecast nine U.S. stores by

the end of calendar 2016.

"There has been some slippage in phasing and delay in handling

over the stores" to Primark, Mr. Bason said. The company is poised

to open all of the U.S. stores as soon as it can, he added.

Kate Ormrod, an analyst at retail research agency Verdict

Retail, said a "more aggressive" expansion plan would be required

to fully seize Primark's U.S. potential and drive the volume

required for success.

"A Primark that trades well in the U.S. will have vast growth

potential, but if the brand fails to gain traction in the

notoriously competitive U.S. apparel sector, then a lot of hopes

will have been dashed," said George Salmon, an equity analyst at

Hargreaves Lansdown.

AB Foods said Primark's operating profit margin for fiscal 2016

would be close to the 11.7% it achieved in the first half. It said

it expects Primark's same-store sales to fall by 2%, citing adverse

weather conditions.

The company said the weak pound would help its sugar unit's

profit margins in the coming fiscal year, as well as delivering a

benefit on its profit earned outside the U.K.

--Tapan Panchal

(END) Dow Jones Newswires

September 13, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

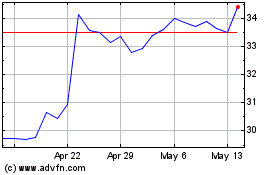

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From May 2024 to Jun 2024

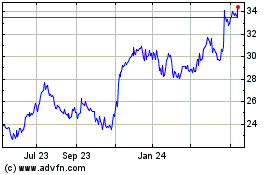

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2023 to Jun 2024