false

0000822746

0000822746

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 1, 2023 (October 17, 2023)

American

Noble Gas, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-17204 |

|

87-3574612 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

15612

College Blvd, Lenexa, KS 66219

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (913) 955-0532

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| — |

|

— |

|

— |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

October 17, 2023, the Company and M3 Helium Corp. (“M3”) entered into a letter of understanding (the “Letter Agreement”)

and the related Assignment of Certain Contractual Rights and Interests that included the following provisions:

| |

● |

The

Company assigned all of its rights, title and interest in and to the 40% participation it had acquired on April 4, 2022 in a Farmout

Agreement by and between Sunflower Exploration, LLC as the Farmee and Scout Energy Partners as Farmor (“Scout”) with

regards to its oil and gas interests in the Hugoton Gas Field, located in Haskell and Finney Counties, Kansas. The Company assigned

such participation rights to M3 effective October 17, 2023. |

| |

|

|

| |

● |

The

assignment included all of its rights, title and interest in and to the Peyton 21-1 well which was drilled and completed in June

2022 pursuant to the participation agreement. In addition, M3 has agreed to assume all obligations and receivables for the sale of

oil and gas as of October 17, 2023. |

| |

|

|

| |

● |

The

parties agreed that the USNG Agreement dated November 9, 2021 is terminated effective October 17, 2023. |

| |

|

|

| |

● |

M3

has agreed to pay a total of $75,000 cash to the Company as consideration for the Letter Agreement including the assignments thereunder. |

The

foregoing description of the Letter Agreement and related Assignment of Certain Contractual Rights and Interests are not complete and

are qualified in its entirety by reference to the full text of the Letter Agreement, and related Assignment of Certain Contractual Rights

and Interests the forms of which are attached hereto as Exhibit 10.2 and 10.3 and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 1, 2023

| |

American

Noble Gas, Inc. |

| |

|

|

| |

By:

|

/s/Thomas

J. Heckman |

| |

Name: |

Thomas

J. Heckman |

| |

Title: |

Chief

Executive Officer and Chief Financial Officer |

EXHIBIT

10.2

October

__, 2023

Thomas

J. Heckman

c/o

American Noble Gas, Inc. (“AMGAS”)

15612

College Blvd.

Lenexa,

KS 66219

Mr.

Paul Mendell

c/o

M3 Helium Corp. (“M3”)

402

Oratino Dr.

Castle

Rock, CO 80108

| Re: | Letter of Understanding –

Sale

and Assignment of Hugoton Participation Agreement and the Peyton 21-1 well.

Termination of the Letter Agreement dated November 9,

2021 by and between AMGAS and USNG. |

Dear

Sirs:

Reference

is made to the various discussions and written correspondence by and among the parties hereto. The purpose of this Letter of Understanding

(this “Letter”) is to memorialize those discussions into a plan of agreement for the parties hereto.

As

of the date of this letter (the “Effective Date”), the parties agree as follows:

| a. | M3

shall pay $75,000 to AMGAS as consideration for entering into this Letter. The $75,000 payment

in verified funds will be due in full upon execution/closing of this Letter. AMGAS shall

not be bound by this Letter until such time as this payment made and verified. |

| b. | AMGAS

will sell/assign all of its rights, interests and obligations to M3 related to the Participation

Agreement dated April 4, 2022 by and between AMGAS and _______________, LLC, _________________,

_______________ and ______________, LLC which is attached as Exhibit A.

M3 will assume all current payables/receivables associated with the Participation Agreement

joint interest billings (“JIB”), including but not limited, to any extension

payments relative to the Participation Agreement. |

| | | |

| c. | AMGAS

will sell/assign all of its rights, interests and obligations to M3 related to the Peyton

21-1 Well (“Peyton Well”)as described in Exhibit B. M3 will assume

all current payables/receivables associated with the Peyton 21-1 well joint interest billings

(“JIB”) including but not limited to all net revenues/expenses due to/from Sunflower

Exploration, LLC currently existing. To clear any confusion, M3 will be entitled to any net

revenues due from Sunflower Exploration related to the sale of gas currently due and will

assume the payment of any JIB expenses currently due to the operation of the Peyton Well. |

| (a) | The

parties agree and understand that the USNG Letter Agreement (the “USNG Agreement”)

dated November 9, 2021 which is attached as Exhibit C, is terminated and rendered

null and void upon execution and fulfillment of all requirements/provisions of this Letter. |

This

Letter (a) shall be governed by and construed in accordance with the law of the State of Kansas, (b) is for the exclusive benefit of

the parties hereto, constitutes the entire agreement of such parties, superseding all prior agreements among them, with respect to the

subject matter hereof, (c) may be modified, waived or assigned only in writing and only to the extent such modification, waiver or assignment

would be permitted under this Letter (and any attempt to assign this Letter without such writing and approval by all parties hereto shall

be null and void, and (d) is a negotiated document, entered into freely among the parties upon advice of their own counsel, and it should

not be construed against any of its drafters. The fact that any term or provision of this Letter is held invalid, illegal or unenforceable

as to any person in any situation in any jurisdiction shall not affect the validity, enforceability or legality of the remaining terms

or provisions hereof or the validity, enforceability or legality of such offending term or provision in any other situation or jurisdiction

or as applied to any person.

The

parties’ obligations with respect to this Letter is expressly conditioned on the following conditions:

| (a) | AMGAS

shall receive verified funds totaling $75,000; |

| | | |

| (b) | AMGAS

will execute and render the Assignment Document attached as Exhibit D; and |

| | | |

| (c) | The

Company’s board of directors shall have duly approved, adopted and ratified this Letter

and all undertakings related thereto in all respects, shall have authorized an officer of

the Company to execute this Letter on its behalf. |

[Balance

of page intentionally left blank; signatures follow on next page]

Kindly

confirm your agreement with the above as of the Effective Date by signing in the space indicated below and by sending a partially executed

copy of this Letter to the undersigned, each of which shall be deemed an original but all of which shall constitute one and the same

agreement.

| |

|

Very

truly yours, |

| |

|

|

| |

|

American

Noble Gas, Inc |

| |

|

|

| |

By: |

/s/

Tom Heckman |

| |

|

Thomas

J. Heckman |

| |

|

Chief

Executive Officer & Chief Financial Officer |

| AGREED

AND ACCEPTED: |

|

| |

|

|

| |

/s/

Paul Mendell |

|

| Name: |

Paul

Mendell |

|

| Title: |

Secretary

& Authorized Agent |

|

Exhibit

10.3

ASSIGNMENT

OF CERTAIN CONTRACTUAL RIGHTS AND INTERESTS

ASSIGNMENT

OF CERTAIN CONTRACTUAL RIGHTS AND INTERESTS

Now

on this 17th day of October, 2023, American Noble Gas, Inc., (hereinafter “ANG”) 14001 Marshall Drive, Lenexa,

KS 66215 and M3 Helium Corp., a Delaware corporation (hereinafter “M3”) 4601 E Douglas Ave STE 150, Wichita, Kansas 67218

agree as follows:

WHEREAS,

___________, LLC (hereinafter “___________”) is the owner of certain rights arising under that certain Farmout Agreement

Between _______________ LP, et al., as farmor and _______________ as farmee made effective as of March 1, 2022, which Farmout Agreement

is by reference made a part hereof (hereinafter, the “Farmout Agreement”);

WHEREAS,

ANG did enter into that certain Participation Agreement with SunFlower and other parties made Effective as of April 4, 2022 whereby ANG

acquired certain undivided rights in and to all oil and gas wells and leases as and when earned by the farmee under the Farmout Agreement

together with an irrevocable first option to acquire any interest which may be earned pursuant to the Farmout Agreement (coliectively

the “Farmout Rights”), through the performance of their obligations set forth in said Participation Agreement;

WHEREAS,

____________ Revocable Trust, _________ and _________________, LLC did also enter into that certain Participation Agreement with

______________________made Effective April 4, 2022 whereby ________________ Revocable Trust, __________ and _______________, LLC

collectively conveyed a 3% carried working interest in and to the Farmout Rights to _____________ which burdened

_________________Revocable Trust, ____________ and __________________, LLC working interest in and to the Farmout Rights only and

did not burden any working interest owned by ANG

WHEREAS,

ANG did enter into a Joint Operating Agreement with ___________made Effective as of April 4, 2022 whereby __________ was designated as

the operator or all working interests obtained pursuant to the above referenced Farmout Agreement and Participation Agreements; and

WHEREAS,

ANG has agreed to convey all right, title, interest and future options or rights in and to the above referenced Agreements and the Farmout

Rights to M3.

Now

Therefore, for valuable and sufficient consideration the Parties agree as follows:

1

.. ANG does hereby assign all of its right, title and interest in and to Farmout Rights to M3, which represent not less than an undivided

Forty (40%) Percent interest in the Farmout Rights.

2.

ANG does hereby assign the interests described herein with special warranty by the ANG that nothing has encumbered the assigned interest

arising by, through or under ANG, but without any further representations or warranties of any kind. These assignments expressly disclaim

all other express or implied warranties, specifically including but not limited to implied warranties of merchantability and fitness

for a particular purpose.

3.

____________ and _______________Ill Revocable Trust do hereby consent to the transactions described herein, but are not conveying any

of their right, title or interest under the above referenced Farmout Agreement, Participation Agreements or Joint Operating Agreement.

4.

MISCELLANEOUS.

A.

SUCCESSORS AND ASSIGNS. This Agreement shall be binding upon, and inure to the benefit of, the Parties hereto and their respective

successors, heirs, administrator, and assigns.

B.

AMENDMENTS. This Agreement may be amended or modified only by a written instrument executed by the Parties.

C.

GOVERNING LAW. This Agreement shall be governed by, construed and enforced in accordance with the laws of Kansas. The venue of any action

shall be in Allen County, Kansas. Any party who breaches or fails to timely perform its obligations under this Agreement shall be liable

for the reasonable costs, expenses and attorney fees of the non-breaching party

D.

MERGER OF PRIOR AGREEMENTS. This Agreement, as may be amended, and the exhibits attached hereto constitute the entire Agreement between

the parties with respect to the subject matter hereof and supersede all prior Agreements and understandings between the Parties hereto

relating to the subject matter hereof.

E.

CONSENT OR WAIVER. No consent or waiver, express or implied, by either Party to or of any breach or default by the other Party in the

performance of this Agreement shall be constructed as a consent or waiver to or of any subsequent breach or default in the performance

by such other Party of the same or any other obligations hereunder.

F.

COUNTERPARTS. This Agreement may be executed in counterparts and all counterparts shall be considered part of one Agreement binding on

all parties hereto.

H.

SEVERABILITY. In the event that one or more of the provisions hereof shall be held to be illegal, invalid, or unenforceable, such provisions

shall be deemed severable and the remaining provisions hereof shall continue in full force and effect.

I.

JOINT DRAFTING. The Parties shall be considered joint drafters of this Agreement so as not to construe this contract against one Party

as drafter more than the other.

K.

SURVIVAL OF TERMS. The terms of this Agreement shall survive Closing and shall not merge with the Assignments referenced herein.

L.

EFFECTIVE DATE. This Agreement shall be effective as of 11/17/2023, regardless of the date on which it is actually executed by

the parties.

[Signature

Page Follows]

| |

American Noble Gas, Inc. |

| |

|

|

| |

By: |

/s/

Tom Heckman |

| |

|

CEO |

| |

|

|

| |

M3 Helium Corp., a Kansas corporation |

| |

|

|

| |

|

/s/

Anthony Melikhov |

| |

|

Anthony

Melikhov |

| |

|

CEO |

| |

|

,

LLC |

| |

|

|

| |

By: |

|

| |

|

Managing

Member |

| |

|

___________________

Revocable Trust |

| |

|

|

| |

|

/s/ |

| |

|

Trustee |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

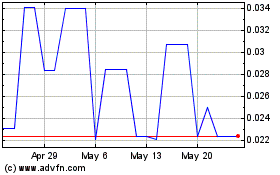

American Noble Gas (QB) (USOTC:AMNI)

Historical Stock Chart

From Apr 2024 to May 2024

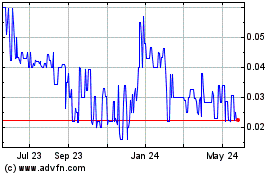

American Noble Gas (QB) (USOTC:AMNI)

Historical Stock Chart

From May 2023 to May 2024