Wi2Wi Corporation ("Wi2Wi" or the "Company")(TSX-V: YTY) is

pleased to announce its audited consolidated financial results for

the year ending December 31, 2013

Year

December 31, 2013

Year

December 31, 2012

(in thousands of US dollars) Statement of results

Revenue $3,748 $3,262 Gross Profit

1,470 1,109 Operating expenses Research and Development 1,000 1,166

Selling, general and administrative 4,762 3,897 Share Listing

expenses and interest paid 3,099 152 Net Loss and

Total Comprehensive Loss $(7,391) $(4,106) Net loss

per share, basic and diluted $(0.09) $(0.01)

Wi2Wi designs, manufactures and markets miniaturized embedded

wireless connectivity solutions (incorporating both hardware and

software) for premium industrial/medical, smart-home/smart

building and government markets worldwide. These products and value

added services provide highly integrated, multifunctional wireless

sub systems for mobile applications of all forms for mobile

devices.

RevenueRevenues for the

quarter ended December 31, 2013 and December 31, 2012 were $310 and

$665, respectively. Revenues decreased by 46% for the quarter ended

December 31, 2013, compared to the same period in 2012.

The Company is experiencing strong demand for its products

across multiple business segments and as of the date of this

release has record backlogs.

Gross ProfitGross profits

for the quarter ended December 31, 2013 and December 31, 2012 were

$109 and $246, respectively. Gross profits decreased by 44% for the

quarter ended December 31, 2013, compared to the same period in

2012. Gross margins for the quarter ended December 31, 2013 and

December 31, 2012 were 35% and 37%, respectively. This is slightly

lower than the results in previous quarters in 2013, due to some

inventory write downs and the impact that a large customer with

lower margins had on the total gross margins in the current

quarter.

EquityOn November 4, 2013, the Company entered into an

agreement with Paradigm Capital Inc. to act as lead agent and sole

book-runner on behalf of a syndicate, to complete a brokered

private placement of units (“Units”) for up to CDN$4,000,000 (the

“Offering”). The Offering will be made on a best efforts fully

marketed private placement basis. Each Unit shall be comprised of

one common share priced in the context of the market and one-half

of one common share purchase warrant (each whole common share

purchase warrant, a “Warrant”). Each whole Warrant shall entitle

the holder thereof to acquire one common share of the Company at a

price to be determined in the context of the market for a period of

24 months following the closing of the Offering. The agreement was

mutually terminated on January xx, 2014. On November 18, 2013 the

pricing of the Private Placement was approved by the Board at $0.20

per common share plus one half warrant per common share. The

exercise price of a full warrant is set at $0.25 and a term of two

years from the date of issuance.

The Company announced on February 27, 2014 closing of its first

tranche of its non brokered private placement Offering, issuing

2,175,000 Units at a price of CDN$0.20 per Unit. On April 30, 2014

the Company received acceptance for filing documents; the final

number of shares issued amounted to 2,961,452 along with 1, 480,726

warrants attached to those shares, for gross proceeds of

CDN$592.

The Company wishes to announce that Mr. James Wyant and Mr. John

Lokker have stepped down from the Wi2Wi Board of Directors, and Mr.

Lokker has resigned as the Company’s interim Chief Financial

Officer.

“Mr. Wyant and Mr. Lokker have held pivotal roles in Wi2Wi, Mr

Wyant as Chair of the Audit Committee, and Mr. Lokker who stepped

in as the Company’s interim CFO. We greatly appreciate the unique

perspectives and undeterred dedication both committed during their

time,” said Chairman Hans P. Black. “We would like to thank both

Mr. Wyant and Mr. Lokker for their invaluable contributions to the

Wi2Wi Board and wish them continued success in their future

endeavours.”

For further information, please contact:Prakash HariharanInterim

Chief Executive Officer(408) - 416-4221

Forward-Looking Statements: This news release contains certain

forward-looking statements, including management's assessment of

future plans and operations, and the timing thereof, that involve

substantial known and unknown risks and uncertainties, certain of

which are beyond the Company's control. Such risks and

uncertainties include, without limitation, risks associated with

oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of

commodity prices, currency fluctuations, imprecision of reserve

estimates, environmental risks, competition from other producers,

inability to retain drilling rigs and other services, delays

resulting from or inability to obtain required regulatory approvals

and ability to access sufficient capital from internal and external

sources, the impact of general economic conditions in Canada, the

United States and overseas, industry conditions, changes in laws

and regulations (including the adoption of new environmental laws

and regulations) and changes in how they are interpreted and

enforced, increased competition, the lack of availability of

qualified personnel or management, fluctuations in foreign exchange

or interest rates, stock market volatility and market valuations of

companies with respect to announced transactions and the final

valuations thereof, and obtaining required approvals of regulatory

authorities. The Company's actual results, performance or

achievements could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurances can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits, including the amount of proceeds, that

the Company will derive there from. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect the Company’s

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com).

This news release contains “forward-looking statements” within

the meaning of applicable securities laws relating to, among other

things, the Proposed Transaction. Readers are cautioned not to

place undue reliance on forward-looking statements. Actual results

and developments may differ materially from those contemplated by

these statements. Completion of the Proposed Transaction described

herein is dependent on a number of factors and is subject to a

number of risks and uncertainties, and it is not certain that the

Proposed Transaction will be completed. Factors that could cause

actual results to differ materially include, but are not limited

to, changes in the Com0pany`s or Wi2Wi’s business, general

business, economic and competitive uncertainties and delay or

failure to receive board, shareholder or regulatory approvals.

Forward-looking statements are made based on management’s

beliefs, estimates and opinions on the date the statements are made

and the Corporation undertakes no obligation to update

forward-looking statements and if these beliefs, estimates and

opinions or other circumstances should change, except as required

by applicable law. All subsequent forward-looking statements,

whether written or oral, attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these cautionary statements. Furthermore, the forward-looking

statements contained in this news release are made as at the date

of this news release and the Company does not undertake any

obligation to update publicly or to revise any of the included

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Wi2Wi CorporationPrakash Hariharan, 408-416-4221Interim Chief

Executive Officer

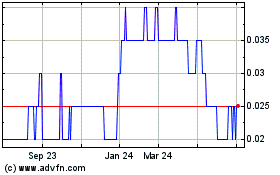

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

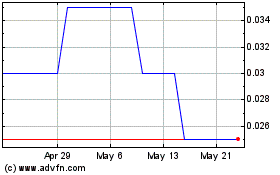

Wi2Wi (TSXV:YTY)

Historical Stock Chart

From Jan 2024 to Jan 2025